Professional Documents

Culture Documents

Dilip Sopan Khilare - 23-May-2019 - 480755800 PDF

Dilip Sopan Khilare - 23-May-2019 - 480755800 PDF

Uploaded by

Naziya TamboliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dilip Sopan Khilare - 23-May-2019 - 480755800 PDF

Dilip Sopan Khilare - 23-May-2019 - 480755800 PDF

Uploaded by

Naziya TamboliCopyright:

Available Formats

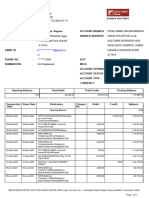

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2019-20

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

DILIP SOPAN KHILARE

PERSONAL INFORMATION AND THE

APJPK3348B

Flat/Door/Block No Name Of Premises/Building/Village

ACKNOWLEDGEMENT

Form Number ITR-1

S NO. Chinchwade Nagar Behind Panchavti

NUMBER

Road/Street/Post Office Area/Locality

Chinchwad

Status Individual

Town/City/District State Pin/ZipCode Filed u/s

Pune

MAHARASHTRA 411033 139(1)-On or before due date

Assessing Officer Details (Ward/Circle) WARD 8(5), PUNE

e-Filing Acknowledgement Number 480755800230519

1 Gross Total Income 1 440705

2 Total Deductions under Chapter-VI-A 2 145794

3 Total Income 3 294910

COMPUTATION OF INCOME

3a Deemed Total Income under AMT/MAT 3a 0

3b Current Year loss, if any 3b

AND TAX THEREON

0

4 Net Tax Payable 4 0

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 7900

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 7900

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 7900

Agriculture 0

10 Exempt Income 10 0

Others 0

VERIFICATION

I, DILIP SOPAN KHILARE son/ daughter of SOPAN KHILARE , solemnly declare that to the best of my knowledge and

belief, the information given in the return which has been submitted by me vide acknowledgement number 480755800230519 is

correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my capacity

as Self and I am also competent to make this return and verify it. I am holding permanent account number APJPK3348B .

Sign here

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Date of submission 23-05-2019 23:49:34

Source IP address 157.33.171.53

Seal and signature of APJPK3348B01480755800230519198F8A5C844DC5C511BCB60B07A13533B029C4ED

receiving official

Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru

560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from date of submission of ITR. Form ITR-V shall not

be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC

will be sent to the e-mail Id salaryreturn2017@gmail.com .

On successful verification, the acknowledgement can be downloaded from e-Filing portal as a proof of filing the return.

THIS IS NOT A PROOF FOR HAVING FILED THE RETURN

You might also like

- BRAC Bank Statement 10052023 PDFDocument7 pagesBRAC Bank Statement 10052023 PDFMd Mizanur Rahman100% (1)

- CMS Level II - Monetary Transaction ProcessingDocument41 pagesCMS Level II - Monetary Transaction ProcessingvaradhanrgNo ratings yet

- Invoice EB19316-2-1 - 05.03.2020 With LPODocument5 pagesInvoice EB19316-2-1 - 05.03.2020 With LPODumindu Chandana PunchihewaNo ratings yet

- Account Statement 241120 230421Document74 pagesAccount Statement 241120 230421vaibhav patilNo ratings yet

- Assignment 3 Mode Choice ModelsDocument4 pagesAssignment 3 Mode Choice ModelsSesay Alieu100% (2)

- Invoice 1605-23-S-726Document1 pageInvoice 1605-23-S-726Chintada Netaji PraneethNo ratings yet

- Isb PTCL Bill March 2020Document1 pageIsb PTCL Bill March 2020Umar FarooqNo ratings yet

- Sep MNTH InvoiceDocument10 pagesSep MNTH InvoiceSravani NNo ratings yet

- Ref - No. 2203166-16309213-4: Prashant KaushikDocument4 pagesRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- Account Statement-1603759922693Document3 pagesAccount Statement-1603759922693Fanny Ardhitunggal HakimNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/06/2021Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/06/2021Hem NathNo ratings yet

- Internet Bill Format PDFDocument2 pagesInternet Bill Format PDFmayank singhNo ratings yet

- MahalakmiDocument1 pageMahalakmiJeyaselan JeyaseelanNo ratings yet

- Inv TN B1 39515781 103417948939 October 20202Document2 pagesInv TN B1 39515781 103417948939 October 20202IndiaNo ratings yet

- Notice of Assessment OriginalDocument1 pageNotice of Assessment OriginalWawan SaidNo ratings yet

- Passbookstmt PDFDocument3 pagesPassbookstmt PDFRohitSinghBishtNo ratings yet

- Updated Online Iec CertificateDocument2 pagesUpdated Online Iec CertificateKartik WadhwaNo ratings yet

- InvoicedfgvnhbjnmDocument1 pageInvoicedfgvnhbjnmJay VayedaNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- View-Bill Dhaliywas PDFDocument1 pageView-Bill Dhaliywas PDFGourav RaoNo ratings yet

- View BillDocument1 pageView BillParvezNo ratings yet

- Gold InvoiceDocument1 pageGold Invoice8w7m4ffsx4No ratings yet

- Current Account December-18Document2 pagesCurrent Account December-18Er Rohit VermaNo ratings yet

- Invoice OD111025894559836000Document1 pageInvoice OD111025894559836000Husen GhoriNo ratings yet

- Raju Bhai PDFDocument1 pageRaju Bhai PDFbsnlquotesNo ratings yet

- Chandrakant G Tandel PDFDocument2 pagesChandrakant G Tandel PDFKarina TandelNo ratings yet

- IDFCFIRSTBankstatement 10154021420 194312985Document3 pagesIDFCFIRSTBankstatement 10154021420 194312985pradnyabagave101No ratings yet

- COMPUTATION ReadingDocument4 pagesCOMPUTATION ReadingSankalp BhardwajNo ratings yet

- Computation Sheet of Taxable Income & Income TaxDocument2 pagesComputation Sheet of Taxable Income & Income TaxPandu DoradlaNo ratings yet

- Postpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-229587980332Document3 pagesPostpay Bill: VAT Registration Number VAT: 0113241A PIN Number: P051129820X 1-229587980332Chrispus MutabuuzaNo ratings yet

- B S Technologies - Sky-177-22-23 (30-6-22)Document3 pagesB S Technologies - Sky-177-22-23 (30-6-22)Srikanth GNPNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- PDFDocument2 pagesPDFMehwish YusraNo ratings yet

- Tax Invoice: Mathru Indane Gas SERVICE (0000273708)Document2 pagesTax Invoice: Mathru Indane Gas SERVICE (0000273708)Shashi KiranNo ratings yet

- 31 May 2023 - 33AAACC6168L1ZJ - Invoice - 2305TNINANS00029 (442948)Document2 pages31 May 2023 - 33AAACC6168L1ZJ - Invoice - 2305TNINANS00029 (442948)Lokesh ANo ratings yet

- Invoice NF29188202112850Document3 pagesInvoice NF29188202112850Prem KumarNo ratings yet

- Procap Financial Services Pvt. LTDDocument9 pagesProcap Financial Services Pvt. LTDDekrouf SysNo ratings yet

- Bill of Supply For Electricity Due Date: - : BSES Yamuna Power LTDDocument1 pageBill of Supply For Electricity Due Date: - : BSES Yamuna Power LTDgstreturns88517100% (1)

- DaasdasddDocument2 pagesDaasdasddHarDik PatelNo ratings yet

- Tax Invoice: Bill Amount: 3300.00Document1 pageTax Invoice: Bill Amount: 3300.00Akshay SaneparaNo ratings yet

- 17286987Document2 pages17286987Ghazanfar AliNo ratings yet

- Bhitar Gaon PDFDocument1 pageBhitar Gaon PDFNeha SinghNo ratings yet

- 06 June 2023.07.01Document5 pages06 June 2023.07.01MD. ZAHIDUR RAHMANNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLohit MataniNo ratings yet

- 8 March 2022 To 7 April 2022: Account Statement ForDocument3 pages8 March 2022 To 7 April 2022: Account Statement ForLakshaywaveNo ratings yet

- BillDocument1 pageBillAskari NaqviNo ratings yet

- Pangan LestariDocument1 pagePangan LestariKurnia RiasmaNo ratings yet

- LT E-Bill Shop 7 17sept 2019Document2 pagesLT E-Bill Shop 7 17sept 2019John Smith0% (1)

- Invoice PDFDocument1 pageInvoice PDFRoshan AttavarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)diruNo ratings yet

- InvoiceDocument1 pageInvoiceAkhil Patel BandariNo ratings yet

- PSG TECH Online Fee ReceiptDocument1 pagePSG TECH Online Fee ReceiptVishalSelvanNo ratings yet

- 771621769Document2 pages771621769mahfuzurkhanNo ratings yet

- Excitel PDFDocument1 pageExcitel PDFPankaj AzadNo ratings yet

- LT Bill 57000406406 201907Document2 pagesLT Bill 57000406406 201907Faku RikiNo ratings yet

- 9011496693Document3 pages9011496693RITVIK ARORANo ratings yet

- ProductDocument1 pageProductAbhijitChandraNo ratings yet

- Madhyanchal Vidyut Vitran Nigam Limited: NON-TOD Bill PreviewDocument2 pagesMadhyanchal Vidyut Vitran Nigam Limited: NON-TOD Bill Previewabhishek singhNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsMurugan AyyaswamyNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ruloans VaishaliNo ratings yet

- Kajal Devi Itr 19-20 PDFDocument1 pageKajal Devi Itr 19-20 PDFShakeeb HashmiNo ratings yet

- International Payment Methods UoSDocument2 pagesInternational Payment Methods UoSJusticeNo ratings yet

- Portable Power Systems 2890 Market Loop Southlake, TX 76092 QuoteDocument1 pagePortable Power Systems 2890 Market Loop Southlake, TX 76092 Quotediogenes amaroNo ratings yet

- Ibs Mib Kuala Terengganu 1 CBS160630163064161024Document3 pagesIbs Mib Kuala Terengganu 1 CBS160630163064161024Ahmad ZubirNo ratings yet

- Ebs Upload As Per Bai FormatDocument11 pagesEbs Upload As Per Bai FormatLavanya Basa100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Subcontracting by SiteDocument12 pagesSubcontracting by SiteKenneth LippNo ratings yet

- 2022 Academic Calendar DetailedDocument2 pages2022 Academic Calendar DetailedXia AiNo ratings yet

- Cta 1D CV 08726 D 2017sep14 AssDocument115 pagesCta 1D CV 08726 D 2017sep14 AssdoookaNo ratings yet

- Bil Air Nov 2019Document1 pageBil Air Nov 2019Mohd ShyazaliNo ratings yet

- Accounts Test No. 1 MorningDocument1 pageAccounts Test No. 1 MorningAMIN BUHARI ABDUL KHADERNo ratings yet

- Invoice (1604 13478)Document6 pagesInvoice (1604 13478)Thomas RisingNo ratings yet

- Account StatementDocument2 pagesAccount Statementricusroux4No ratings yet

- Jurnal PT Anggrek Motor+PenyesuaianDocument4 pagesJurnal PT Anggrek Motor+PenyesuaianFanny HastiNo ratings yet

- V Yd JGD WMD8 ROg SJSDocument15 pagesV Yd JGD WMD8 ROg SJSOmprakash BanshiwalNo ratings yet

- Healthcare GeneralDocument2 pagesHealthcare GeneralkrisluidhardtNo ratings yet

- Tax Bill Example PDFDocument4 pagesTax Bill Example PDFrafael castilloNo ratings yet

- SRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionDocument93 pagesSRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionmnasirmehmoodNo ratings yet

- Incoterms 2000Document3 pagesIncoterms 2000Harvinder SinghNo ratings yet

- BCS 062 Solved Assignments 2016Document10 pagesBCS 062 Solved Assignments 2016Mess KNo ratings yet

- Maintain Financial Management Area in SapDocument5 pagesMaintain Financial Management Area in SapWaseem AnwarNo ratings yet

- Automated Teller MachineDocument8 pagesAutomated Teller MachineEigra EmliuqerNo ratings yet

- Account Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuryakiran kallaNo ratings yet

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- Union BankDocument14 pagesUnion BankRahul E ChoudharyNo ratings yet

- Igcse Accounting Essential 2e Answers 23Document12 pagesIgcse Accounting Essential 2e Answers 23Shruti D MishraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- 2022 Uber 1099-KDocument2 pages2022 Uber 1099-Kelklote89No ratings yet