Professional Documents

Culture Documents

Obillos Vs Cir

Obillos Vs Cir

Uploaded by

Ludy Jane FelicianoCopyright:

Available Formats

You might also like

- Contract To SellDocument3 pagesContract To SellChamp041850% (2)

- Course Overview: Venture Capital-FIN 9895Document9 pagesCourse Overview: Venture Capital-FIN 9895Maheen MahmoodNo ratings yet

- Case 2: Vs - Sandiganbayan (Fourth Division), Jose LDocument3 pagesCase 2: Vs - Sandiganbayan (Fourth Division), Jose Lidmu bcpo100% (1)

- Berkshire Hathaway Dividend Policy ParadigmDocument12 pagesBerkshire Hathaway Dividend Policy ParadigmsdNo ratings yet

- Ic 26 Practice Test 1 PDFDocument33 pagesIc 26 Practice Test 1 PDFLaxminarayana Madavi0% (1)

- Leviste vs. CADocument16 pagesLeviste vs. CAnathNo ratings yet

- Cir vs. Marubeni Corp., 372 Scra 577 - VelosoDocument1 pageCir vs. Marubeni Corp., 372 Scra 577 - VelosoAlan GultiaNo ratings yet

- Obillos vs. CIRDocument1 pageObillos vs. CIRElleNo ratings yet

- 2019 - Sample Articles of Incorporation Natural PersonDocument3 pages2019 - Sample Articles of Incorporation Natural PersonRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Heirs of Lorilla Vs CA c.8Document3 pagesHeirs of Lorilla Vs CA c.8sitty hannan mangotaraNo ratings yet

- Lagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFDocument22 pagesLagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFhenzencameroNo ratings yet

- Batch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Document55 pagesBatch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Jc RobredilloNo ratings yet

- Copiaco v. Luzon Brokerage - DigestDocument2 pagesCopiaco v. Luzon Brokerage - DigestMel Kenneth MabuteNo ratings yet

- Philippine Revised Penal Code Book 2 Midterm ReviewerDocument20 pagesPhilippine Revised Penal Code Book 2 Midterm ReviewerArnold ArizaNo ratings yet

- Labor Law Arbitration 2016Document168 pagesLabor Law Arbitration 2016Ck Bongalos AdolfoNo ratings yet

- Logical Reasoning 2Document2 pagesLogical Reasoning 2luigimanzanaresNo ratings yet

- Manungas vs. Loreto. G.R No. 193161. 22 August 2011Document6 pagesManungas vs. Loreto. G.R No. 193161. 22 August 2011Jay CruzNo ratings yet

- Dennis Subscribed To 10,000 Shares of XYZ Corporation With A Par Value ofDocument1 pageDennis Subscribed To 10,000 Shares of XYZ Corporation With A Par Value ofSara LeeNo ratings yet

- Fortich V CADocument2 pagesFortich V CABananaNo ratings yet

- Ledesma v. Enriquez (1949)Document5 pagesLedesma v. Enriquez (1949)Reinerr NuestroNo ratings yet

- AGENCY Obligations of The AgentDocument11 pagesAGENCY Obligations of The AgentALEXANDRIA RABANESNo ratings yet

- French Oil Machinery Company Vs CADocument1 pageFrench Oil Machinery Company Vs CAMoon BeamsNo ratings yet

- Tuazon Labor RevDocument78 pagesTuazon Labor RevianlaynoNo ratings yet

- 04 - Bartolome v. IACDocument1 page04 - Bartolome v. IACElise Rozel DimaunahanNo ratings yet

- Republic vs. Rayos Del SolDocument4 pagesRepublic vs. Rayos Del SolAnjNo ratings yet

- 3 Case Digest - People v. SamontañezDocument2 pages3 Case Digest - People v. SamontañezJoyce AllenNo ratings yet

- CHua-Burce Vs CADocument1 pageCHua-Burce Vs CAAJMordenoNo ratings yet

- Fernando v. CA 208 Scra 714Document10 pagesFernando v. CA 208 Scra 714Deb BieNo ratings yet

- SILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUEDocument4 pagesSILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUETrishaNo ratings yet

- Case Digest - Transpo - 2 PDFDocument11 pagesCase Digest - Transpo - 2 PDFAngemeir Chloe FranciscoNo ratings yet

- Grace PoeDocument7 pagesGrace PoeDanny CastilloNo ratings yet

- Zuelling Freight and Cargo Systems vs. National Labor Relations CommissionDocument6 pagesZuelling Freight and Cargo Systems vs. National Labor Relations CommissionRam Migue SaintNo ratings yet

- Given To Messrs. Kuenzle and Streiff."Document2 pagesGiven To Messrs. Kuenzle and Streiff."Mickey RodentNo ratings yet

- Labor Law Review Assignment CBA 2017Document2 pagesLabor Law Review Assignment CBA 2017KM MacNo ratings yet

- Gordoland Devt. Corp. Vs RepublicDocument2 pagesGordoland Devt. Corp. Vs RepublicBarrrMaidenNo ratings yet

- Agbayani v. Lupa Realty Holding CorporationDocument13 pagesAgbayani v. Lupa Realty Holding CorporationAnonymousNo ratings yet

- Salvador Escano v. Rafael OrtigasDocument9 pagesSalvador Escano v. Rafael OrtigasHv EstokNo ratings yet

- LCD Digest For Rem 1 Session 4 (Super Fortified) PDFDocument25 pagesLCD Digest For Rem 1 Session 4 (Super Fortified) PDFLance Cedric Egay DadorNo ratings yet

- 1 Digest Harden V Benguet Conso MiningDocument2 pages1 Digest Harden V Benguet Conso MiningSharon G. BalingitNo ratings yet

- 8 Gilda C. Lim vs. Patricia Lim-YuDocument2 pages8 Gilda C. Lim vs. Patricia Lim-YuIraNo ratings yet

- Nera Vs Rimando: G.R. L-5971 February 27, 1911 Ponente: Carson, J.Document4 pagesNera Vs Rimando: G.R. L-5971 February 27, 1911 Ponente: Carson, J.Lyndon OliverosNo ratings yet

- Digest 2Document27 pagesDigest 2Vianice BaroroNo ratings yet

- Taxation Law 1 CasesDocument4 pagesTaxation Law 1 CasesAna RobinNo ratings yet

- Spouses Tirso Vintola and Loreta Dy Vs Insular Bank of Asia AndamericaDocument3 pagesSpouses Tirso Vintola and Loreta Dy Vs Insular Bank of Asia Andamericaangelsu04No ratings yet

- 107 108 112 Fisher V TrinidadDocument4 pages107 108 112 Fisher V TrinidadBeata CarolinoNo ratings yet

- Agency 1 Rallos vs. Felix Go ChanDocument19 pagesAgency 1 Rallos vs. Felix Go ChanAnonymous fnlSh4KHIgNo ratings yet

- Meralco V CtaDocument40 pagesMeralco V Ctajb13_ruiz4200No ratings yet

- Challenges of Intercountry AdoptionDocument16 pagesChallenges of Intercountry Adoptionlex librisNo ratings yet

- 07 CIR Vs Algue INCDocument3 pages07 CIR Vs Algue INCjamNo ratings yet

- Eurotech Vs Erwin Cuizon and Edwin Cuizon FactsDocument1 pageEurotech Vs Erwin Cuizon and Edwin Cuizon Factsroland deschainNo ratings yet

- Corpo Full CasesDocument105 pagesCorpo Full CasesGGT InteriorsNo ratings yet

- Incitti v. FerranteDocument1 pageIncitti v. FerranteJullianne Micaell CarlayNo ratings yet

- Baluyut v. PanoDocument1 pageBaluyut v. PanoCarlo MarcaidaNo ratings yet

- Agustin vs. InocencioDocument2 pagesAgustin vs. InocencioJose IbarraNo ratings yet

- 32aznar V Garcia DigestDocument1 page32aznar V Garcia DigestXing Keet LuNo ratings yet

- Philex Mining Vs CIRDocument6 pagesPhilex Mining Vs CIRArjay PuyotNo ratings yet

- Modesto Leoveras vs. Casimero ValdezDocument4 pagesModesto Leoveras vs. Casimero ValdezMitchi BarrancoNo ratings yet

- 216428-2018-Andrino v. Top Services Inc.20210424-12-GzqkjnDocument2 pages216428-2018-Andrino v. Top Services Inc.20210424-12-GzqkjnGina RothNo ratings yet

- DBP Vs CapulongDocument2 pagesDBP Vs CapulongRepolyo Ket CabbageNo ratings yet

- 03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990Document4 pages03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990kram.erri2012No ratings yet

- Obillos, Jr. vs. CIRDocument5 pagesObillos, Jr. vs. CIRAaron CariñoNo ratings yet

- Jose P. Obillos, JR., Et - Al vs. CIRDocument1 pageJose P. Obillos, JR., Et - Al vs. CIRVel JuneNo ratings yet

- Obillos v. Cir, 139 Scra 436Document1 pageObillos v. Cir, 139 Scra 436Juby D. CucalNo ratings yet

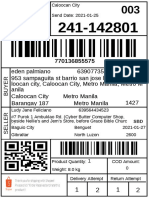

- Christie S. Dela Cruz 639289455929 Loboc Lapuz La Paz, Iloilo City, Iloilo City, Iloilo, Vi Sayas Iloilo City Iloilo Visayas 5000Document2 pagesChristie S. Dela Cruz 639289455929 Loboc Lapuz La Paz, Iloilo City, Iloilo City, Iloilo, Vi Sayas Iloilo City Iloilo Visayas 5000Ludy Jane FelicianoNo ratings yet

- 012521Document35 pages012521Ludy Jane FelicianoNo ratings yet

- Mark Harold Petrache 639637389003 #163 Cocohills Banlat Road Tandang Sora Quezo N City, Quezon City, Metro Manila, Metro Manila Quezon City Metro Manila Metro Manila 1116Document13 pagesMark Harold Petrache 639637389003 #163 Cocohills Banlat Road Tandang Sora Quezo N City, Quezon City, Metro Manila, Metro Manila Quezon City Metro Manila Metro Manila 1116Ludy Jane FelicianoNo ratings yet

- 011821Document41 pages011821Ludy Jane FelicianoNo ratings yet

- CERTIFICATIONDocument1 pageCERTIFICATIONLudy Jane FelicianoNo ratings yet

- CERTIFICATIONDocument1 pageCERTIFICATIONLudy Jane FelicianoNo ratings yet

- Collector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonDocument2 pagesCollector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonLudy Jane FelicianoNo ratings yet

- Office of The City Prosecutor PM Real Estate Corp. As Represented by Philip MendozaDocument3 pagesOffice of The City Prosecutor PM Real Estate Corp. As Represented by Philip MendozaLudy Jane FelicianoNo ratings yet

- Mu BuildDocument1 pageMu BuildLudy Jane FelicianoNo ratings yet

- AFFIDAVITDocument3 pagesAFFIDAVITLudy Jane FelicianoNo ratings yet

- Note: Submit This Weekly Report Every Monday of The Following Week To The CEA SecretaryDocument1 pageNote: Submit This Weekly Report Every Monday of The Following Week To The CEA SecretaryLudy Jane FelicianoNo ratings yet

- Obillos v. Commissioner 139 SCRA 436 October 29, 1985Document1 pageObillos v. Commissioner 139 SCRA 436 October 29, 1985Ludy Jane FelicianoNo ratings yet

- RemainingtaxcaseskimakimDocument6 pagesRemainingtaxcaseskimakimLudy Jane FelicianoNo ratings yet

- HalamanDocument2 pagesHalamanLudy Jane FelicianoNo ratings yet

- Obillos v. Commissioner 139 SCRA 436 October 29, 1985Document1 pageObillos v. Commissioner 139 SCRA 436 October 29, 1985Ludy Jane FelicianoNo ratings yet

- Program FlowDocument1 pageProgram FlowLudy Jane FelicianoNo ratings yet

- Judicial Affidavit On Direct Examination: Roy MillerDocument5 pagesJudicial Affidavit On Direct Examination: Roy MillerLudy Jane FelicianoNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Tally NotesDocument44 pagesTally NotesJaydeep Paul100% (5)

- FIN 425 - Course Project 2 Stephenson Real Estate Capital RestructuringDocument2 pagesFIN 425 - Course Project 2 Stephenson Real Estate Capital RestructuringrajguptaNo ratings yet

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- TVM Practice Problems SolutionsDocument7 pagesTVM Practice Problems SolutionsAnne Bona100% (1)

- Lawyers Secret OathDocument24 pagesLawyers Secret OathSue Rhoades100% (4)

- Tata Capital Financial Services Limited ("TCFSL") NCDS: Frequently Asked QuestionsDocument4 pagesTata Capital Financial Services Limited ("TCFSL") NCDS: Frequently Asked Questions44abcNo ratings yet

- DPE GuidelinesDocument13 pagesDPE GuidelinesdskrishnaNo ratings yet

- International Money Market InstrumentsDocument18 pagesInternational Money Market InstrumentsThapar McaNo ratings yet

- CH 08Document19 pagesCH 08Ahmed Al EkamNo ratings yet

- Great Pacific LIfe Assurance Vs CA Oct 13, 1999Document2 pagesGreat Pacific LIfe Assurance Vs CA Oct 13, 1999Alvin-Evelyn GuloyNo ratings yet

- Invoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BDocument2 pagesInvoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BSvetlana Mitrovic100% (1)

- Chapter 9 PDFDocument24 pagesChapter 9 PDFJolina AynganNo ratings yet

- Accounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentDocument6 pagesAccounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentEmad WajehNo ratings yet

- Performance of Ocbc BankDocument13 pagesPerformance of Ocbc BankNguyễnThịHạnhLêNo ratings yet

- Advent Capital and Finance Corp. v. AlcantaraDocument5 pagesAdvent Capital and Finance Corp. v. AlcantaraMayumi RellitaNo ratings yet

- Chapter 3 Review QuizDocument1 pageChapter 3 Review QuizA. ZNo ratings yet

- Chapter 1: Introduction To Financial SystemDocument58 pagesChapter 1: Introduction To Financial Systemhizkel hermNo ratings yet

- Bailment and PledgeDocument7 pagesBailment and PledgeSHanimNo ratings yet

- 7case Digest Daguhoy Vs PonceDocument2 pages7case Digest Daguhoy Vs PonceJames ScoldNo ratings yet

- Option Pricing (FD)Document3 pagesOption Pricing (FD)Shrestha VarshneyNo ratings yet

- Profits and Gains of Business or ProfessionDocument14 pagesProfits and Gains of Business or Professionsadathnoori100% (1)

- Muñasque V Court of Appeals, G.R. No. L-39780, November 11, 1985Document2 pagesMuñasque V Court of Appeals, G.R. No. L-39780, November 11, 1985Lyle BucolNo ratings yet

- Continuous Compounding of InterestDocument10 pagesContinuous Compounding of InterestMichael Angelo Dela CruzNo ratings yet

- Assignment 1Document10 pagesAssignment 1Diana Lync SapurasNo ratings yet

- PD No. 957 Written ReportDocument3 pagesPD No. 957 Written ReportMarinel Abril50% (2)

- Life Insurance Corporation of IndiaDocument21 pagesLife Insurance Corporation of Indiaanon_508965751No ratings yet

Obillos Vs Cir

Obillos Vs Cir

Uploaded by

Ludy Jane FelicianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Obillos Vs Cir

Obillos Vs Cir

Uploaded by

Ludy Jane FelicianoCopyright:

Available Formats

OBILLOS v.

COMMISSIONER OF INTERNAL REVENUE and COURT OF TAX APPEALS

139 SCRA 436

October 29, 1985

By: Tristan Jan P. Bagat

PONENTE: AQUINO, J.

FACTS:

Jose Obillos Sr. bought two lots at Greenhills, San Juan, Rizal from Ortigas & Co., Ltd.

He transferred his rights to his four children for them to build their residences. The titles

issued showed the siblings as co-owners of the lots.

After more than a year, the children sold the lots to Walled City Securities

Corporation and Olga Cruz Canda. They earned a profit of P134,341.88 total, or P33,584 for

each of them. Treating the profit as a capital gain, they paid income tax on P16,792 each.

The Commissioner of Internal Revenue assessed the siblings for corporate income

tax on the total profit of P134,341.88, in addition to the individual income tax on their

shares. He assessed them corporate income tax of P37,018, P18,509 as surcharge, and

P15,547.56 as interest for a total of P71,074.56. He also held each of them liable for income

tax in the full amount of P33,584, not capital gain on the ½. The Commissioner claimed that

the siblings had formed an unregistered partnership or joint venture within the meaning of

the tax code.

ISSUE: Whether the siblings are liable for corporate income tax as an unregistered

partnership

RULING:

We hold that it is error to consider the petitioners as having formed a partnership

under article 1767 of the Civil Code simply because they allegedly contributed P178,708.12

to buy the two lots, resold the same and divided the profit among themselves.

To regard the petitioners as having formed a taxable unregistered partnership would

result in oppressive taxation and confirm the dictum that the power to tax involves the

power to destroy. That eventuality should be obviated.

As testified by Jose Obillos, Jr., they had no such intention. They were co-owners

pure and simple. To consider them as partners would obliterate the distinction between a

co-ownership and a partnership. The petitioners were not engaged in any joint venture by

reason of that isolated transaction.

Their original purpose was to divide the lots for residential purposes. If later on

they found it not feasible to build their residences on the lots because of the high cost of

construction, then they had no choice but to resell the same to dissolve the co-ownership.

The division of the profit was merely incidental to the dissolution of the co-ownership

which was in the nature of things a temporary state. It had to be terminated sooner or later

You might also like

- Contract To SellDocument3 pagesContract To SellChamp041850% (2)

- Course Overview: Venture Capital-FIN 9895Document9 pagesCourse Overview: Venture Capital-FIN 9895Maheen MahmoodNo ratings yet

- Case 2: Vs - Sandiganbayan (Fourth Division), Jose LDocument3 pagesCase 2: Vs - Sandiganbayan (Fourth Division), Jose Lidmu bcpo100% (1)

- Berkshire Hathaway Dividend Policy ParadigmDocument12 pagesBerkshire Hathaway Dividend Policy ParadigmsdNo ratings yet

- Ic 26 Practice Test 1 PDFDocument33 pagesIc 26 Practice Test 1 PDFLaxminarayana Madavi0% (1)

- Leviste vs. CADocument16 pagesLeviste vs. CAnathNo ratings yet

- Cir vs. Marubeni Corp., 372 Scra 577 - VelosoDocument1 pageCir vs. Marubeni Corp., 372 Scra 577 - VelosoAlan GultiaNo ratings yet

- Obillos vs. CIRDocument1 pageObillos vs. CIRElleNo ratings yet

- 2019 - Sample Articles of Incorporation Natural PersonDocument3 pages2019 - Sample Articles of Incorporation Natural PersonRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Heirs of Lorilla Vs CA c.8Document3 pagesHeirs of Lorilla Vs CA c.8sitty hannan mangotaraNo ratings yet

- Lagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFDocument22 pagesLagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFhenzencameroNo ratings yet

- Batch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Document55 pagesBatch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Jc RobredilloNo ratings yet

- Copiaco v. Luzon Brokerage - DigestDocument2 pagesCopiaco v. Luzon Brokerage - DigestMel Kenneth MabuteNo ratings yet

- Philippine Revised Penal Code Book 2 Midterm ReviewerDocument20 pagesPhilippine Revised Penal Code Book 2 Midterm ReviewerArnold ArizaNo ratings yet

- Labor Law Arbitration 2016Document168 pagesLabor Law Arbitration 2016Ck Bongalos AdolfoNo ratings yet

- Logical Reasoning 2Document2 pagesLogical Reasoning 2luigimanzanaresNo ratings yet

- Manungas vs. Loreto. G.R No. 193161. 22 August 2011Document6 pagesManungas vs. Loreto. G.R No. 193161. 22 August 2011Jay CruzNo ratings yet

- Dennis Subscribed To 10,000 Shares of XYZ Corporation With A Par Value ofDocument1 pageDennis Subscribed To 10,000 Shares of XYZ Corporation With A Par Value ofSara LeeNo ratings yet

- Fortich V CADocument2 pagesFortich V CABananaNo ratings yet

- Ledesma v. Enriquez (1949)Document5 pagesLedesma v. Enriquez (1949)Reinerr NuestroNo ratings yet

- AGENCY Obligations of The AgentDocument11 pagesAGENCY Obligations of The AgentALEXANDRIA RABANESNo ratings yet

- French Oil Machinery Company Vs CADocument1 pageFrench Oil Machinery Company Vs CAMoon BeamsNo ratings yet

- Tuazon Labor RevDocument78 pagesTuazon Labor RevianlaynoNo ratings yet

- 04 - Bartolome v. IACDocument1 page04 - Bartolome v. IACElise Rozel DimaunahanNo ratings yet

- Republic vs. Rayos Del SolDocument4 pagesRepublic vs. Rayos Del SolAnjNo ratings yet

- 3 Case Digest - People v. SamontañezDocument2 pages3 Case Digest - People v. SamontañezJoyce AllenNo ratings yet

- CHua-Burce Vs CADocument1 pageCHua-Burce Vs CAAJMordenoNo ratings yet

- Fernando v. CA 208 Scra 714Document10 pagesFernando v. CA 208 Scra 714Deb BieNo ratings yet

- SILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUEDocument4 pagesSILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUETrishaNo ratings yet

- Case Digest - Transpo - 2 PDFDocument11 pagesCase Digest - Transpo - 2 PDFAngemeir Chloe FranciscoNo ratings yet

- Grace PoeDocument7 pagesGrace PoeDanny CastilloNo ratings yet

- Zuelling Freight and Cargo Systems vs. National Labor Relations CommissionDocument6 pagesZuelling Freight and Cargo Systems vs. National Labor Relations CommissionRam Migue SaintNo ratings yet

- Given To Messrs. Kuenzle and Streiff."Document2 pagesGiven To Messrs. Kuenzle and Streiff."Mickey RodentNo ratings yet

- Labor Law Review Assignment CBA 2017Document2 pagesLabor Law Review Assignment CBA 2017KM MacNo ratings yet

- Gordoland Devt. Corp. Vs RepublicDocument2 pagesGordoland Devt. Corp. Vs RepublicBarrrMaidenNo ratings yet

- Agbayani v. Lupa Realty Holding CorporationDocument13 pagesAgbayani v. Lupa Realty Holding CorporationAnonymousNo ratings yet

- Salvador Escano v. Rafael OrtigasDocument9 pagesSalvador Escano v. Rafael OrtigasHv EstokNo ratings yet

- LCD Digest For Rem 1 Session 4 (Super Fortified) PDFDocument25 pagesLCD Digest For Rem 1 Session 4 (Super Fortified) PDFLance Cedric Egay DadorNo ratings yet

- 1 Digest Harden V Benguet Conso MiningDocument2 pages1 Digest Harden V Benguet Conso MiningSharon G. BalingitNo ratings yet

- 8 Gilda C. Lim vs. Patricia Lim-YuDocument2 pages8 Gilda C. Lim vs. Patricia Lim-YuIraNo ratings yet

- Nera Vs Rimando: G.R. L-5971 February 27, 1911 Ponente: Carson, J.Document4 pagesNera Vs Rimando: G.R. L-5971 February 27, 1911 Ponente: Carson, J.Lyndon OliverosNo ratings yet

- Digest 2Document27 pagesDigest 2Vianice BaroroNo ratings yet

- Taxation Law 1 CasesDocument4 pagesTaxation Law 1 CasesAna RobinNo ratings yet

- Spouses Tirso Vintola and Loreta Dy Vs Insular Bank of Asia AndamericaDocument3 pagesSpouses Tirso Vintola and Loreta Dy Vs Insular Bank of Asia Andamericaangelsu04No ratings yet

- 107 108 112 Fisher V TrinidadDocument4 pages107 108 112 Fisher V TrinidadBeata CarolinoNo ratings yet

- Agency 1 Rallos vs. Felix Go ChanDocument19 pagesAgency 1 Rallos vs. Felix Go ChanAnonymous fnlSh4KHIgNo ratings yet

- Meralco V CtaDocument40 pagesMeralco V Ctajb13_ruiz4200No ratings yet

- Challenges of Intercountry AdoptionDocument16 pagesChallenges of Intercountry Adoptionlex librisNo ratings yet

- 07 CIR Vs Algue INCDocument3 pages07 CIR Vs Algue INCjamNo ratings yet

- Eurotech Vs Erwin Cuizon and Edwin Cuizon FactsDocument1 pageEurotech Vs Erwin Cuizon and Edwin Cuizon Factsroland deschainNo ratings yet

- Corpo Full CasesDocument105 pagesCorpo Full CasesGGT InteriorsNo ratings yet

- Incitti v. FerranteDocument1 pageIncitti v. FerranteJullianne Micaell CarlayNo ratings yet

- Baluyut v. PanoDocument1 pageBaluyut v. PanoCarlo MarcaidaNo ratings yet

- Agustin vs. InocencioDocument2 pagesAgustin vs. InocencioJose IbarraNo ratings yet

- 32aznar V Garcia DigestDocument1 page32aznar V Garcia DigestXing Keet LuNo ratings yet

- Philex Mining Vs CIRDocument6 pagesPhilex Mining Vs CIRArjay PuyotNo ratings yet

- Modesto Leoveras vs. Casimero ValdezDocument4 pagesModesto Leoveras vs. Casimero ValdezMitchi BarrancoNo ratings yet

- 216428-2018-Andrino v. Top Services Inc.20210424-12-GzqkjnDocument2 pages216428-2018-Andrino v. Top Services Inc.20210424-12-GzqkjnGina RothNo ratings yet

- DBP Vs CapulongDocument2 pagesDBP Vs CapulongRepolyo Ket CabbageNo ratings yet

- 03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990Document4 pages03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990kram.erri2012No ratings yet

- Obillos, Jr. vs. CIRDocument5 pagesObillos, Jr. vs. CIRAaron CariñoNo ratings yet

- Jose P. Obillos, JR., Et - Al vs. CIRDocument1 pageJose P. Obillos, JR., Et - Al vs. CIRVel JuneNo ratings yet

- Obillos v. Cir, 139 Scra 436Document1 pageObillos v. Cir, 139 Scra 436Juby D. CucalNo ratings yet

- Christie S. Dela Cruz 639289455929 Loboc Lapuz La Paz, Iloilo City, Iloilo City, Iloilo, Vi Sayas Iloilo City Iloilo Visayas 5000Document2 pagesChristie S. Dela Cruz 639289455929 Loboc Lapuz La Paz, Iloilo City, Iloilo City, Iloilo, Vi Sayas Iloilo City Iloilo Visayas 5000Ludy Jane FelicianoNo ratings yet

- 012521Document35 pages012521Ludy Jane FelicianoNo ratings yet

- Mark Harold Petrache 639637389003 #163 Cocohills Banlat Road Tandang Sora Quezo N City, Quezon City, Metro Manila, Metro Manila Quezon City Metro Manila Metro Manila 1116Document13 pagesMark Harold Petrache 639637389003 #163 Cocohills Banlat Road Tandang Sora Quezo N City, Quezon City, Metro Manila, Metro Manila Quezon City Metro Manila Metro Manila 1116Ludy Jane FelicianoNo ratings yet

- 011821Document41 pages011821Ludy Jane FelicianoNo ratings yet

- CERTIFICATIONDocument1 pageCERTIFICATIONLudy Jane FelicianoNo ratings yet

- CERTIFICATIONDocument1 pageCERTIFICATIONLudy Jane FelicianoNo ratings yet

- Collector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonDocument2 pagesCollector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonLudy Jane FelicianoNo ratings yet

- Office of The City Prosecutor PM Real Estate Corp. As Represented by Philip MendozaDocument3 pagesOffice of The City Prosecutor PM Real Estate Corp. As Represented by Philip MendozaLudy Jane FelicianoNo ratings yet

- Mu BuildDocument1 pageMu BuildLudy Jane FelicianoNo ratings yet

- AFFIDAVITDocument3 pagesAFFIDAVITLudy Jane FelicianoNo ratings yet

- Note: Submit This Weekly Report Every Monday of The Following Week To The CEA SecretaryDocument1 pageNote: Submit This Weekly Report Every Monday of The Following Week To The CEA SecretaryLudy Jane FelicianoNo ratings yet

- Obillos v. Commissioner 139 SCRA 436 October 29, 1985Document1 pageObillos v. Commissioner 139 SCRA 436 October 29, 1985Ludy Jane FelicianoNo ratings yet

- RemainingtaxcaseskimakimDocument6 pagesRemainingtaxcaseskimakimLudy Jane FelicianoNo ratings yet

- HalamanDocument2 pagesHalamanLudy Jane FelicianoNo ratings yet

- Obillos v. Commissioner 139 SCRA 436 October 29, 1985Document1 pageObillos v. Commissioner 139 SCRA 436 October 29, 1985Ludy Jane FelicianoNo ratings yet

- Program FlowDocument1 pageProgram FlowLudy Jane FelicianoNo ratings yet

- Judicial Affidavit On Direct Examination: Roy MillerDocument5 pagesJudicial Affidavit On Direct Examination: Roy MillerLudy Jane FelicianoNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Tally NotesDocument44 pagesTally NotesJaydeep Paul100% (5)

- FIN 425 - Course Project 2 Stephenson Real Estate Capital RestructuringDocument2 pagesFIN 425 - Course Project 2 Stephenson Real Estate Capital RestructuringrajguptaNo ratings yet

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- TVM Practice Problems SolutionsDocument7 pagesTVM Practice Problems SolutionsAnne Bona100% (1)

- Lawyers Secret OathDocument24 pagesLawyers Secret OathSue Rhoades100% (4)

- Tata Capital Financial Services Limited ("TCFSL") NCDS: Frequently Asked QuestionsDocument4 pagesTata Capital Financial Services Limited ("TCFSL") NCDS: Frequently Asked Questions44abcNo ratings yet

- DPE GuidelinesDocument13 pagesDPE GuidelinesdskrishnaNo ratings yet

- International Money Market InstrumentsDocument18 pagesInternational Money Market InstrumentsThapar McaNo ratings yet

- CH 08Document19 pagesCH 08Ahmed Al EkamNo ratings yet

- Great Pacific LIfe Assurance Vs CA Oct 13, 1999Document2 pagesGreat Pacific LIfe Assurance Vs CA Oct 13, 1999Alvin-Evelyn GuloyNo ratings yet

- Invoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BDocument2 pagesInvoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BSvetlana Mitrovic100% (1)

- Chapter 9 PDFDocument24 pagesChapter 9 PDFJolina AynganNo ratings yet

- Accounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentDocument6 pagesAccounting For Service Businesses: The Islamic University, Gaza Faculty of Commerce Accounting DepartmentEmad WajehNo ratings yet

- Performance of Ocbc BankDocument13 pagesPerformance of Ocbc BankNguyễnThịHạnhLêNo ratings yet

- Advent Capital and Finance Corp. v. AlcantaraDocument5 pagesAdvent Capital and Finance Corp. v. AlcantaraMayumi RellitaNo ratings yet

- Chapter 3 Review QuizDocument1 pageChapter 3 Review QuizA. ZNo ratings yet

- Chapter 1: Introduction To Financial SystemDocument58 pagesChapter 1: Introduction To Financial Systemhizkel hermNo ratings yet

- Bailment and PledgeDocument7 pagesBailment and PledgeSHanimNo ratings yet

- 7case Digest Daguhoy Vs PonceDocument2 pages7case Digest Daguhoy Vs PonceJames ScoldNo ratings yet

- Option Pricing (FD)Document3 pagesOption Pricing (FD)Shrestha VarshneyNo ratings yet

- Profits and Gains of Business or ProfessionDocument14 pagesProfits and Gains of Business or Professionsadathnoori100% (1)

- Muñasque V Court of Appeals, G.R. No. L-39780, November 11, 1985Document2 pagesMuñasque V Court of Appeals, G.R. No. L-39780, November 11, 1985Lyle BucolNo ratings yet

- Continuous Compounding of InterestDocument10 pagesContinuous Compounding of InterestMichael Angelo Dela CruzNo ratings yet

- Assignment 1Document10 pagesAssignment 1Diana Lync SapurasNo ratings yet

- PD No. 957 Written ReportDocument3 pagesPD No. 957 Written ReportMarinel Abril50% (2)

- Life Insurance Corporation of IndiaDocument21 pagesLife Insurance Corporation of Indiaanon_508965751No ratings yet