Professional Documents

Culture Documents

Checklist For Fintree

Checklist For Fintree

Uploaded by

shrijit “shri” tembheharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Checklist For Fintree

Checklist For Fintree

Uploaded by

shrijit “shri” tembheharCopyright:

Available Formats

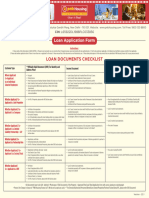

LOGIN CHECKLIST

Document List/Details Document Submitted

Application Form -Completely filled, details exactly as per KYC documents

-Signed by Individual Applicant/Promoters with rubber stamp (Director/partner) for non-

Individual

-Stamp of DSA

KYC Docs (Attested) Borrower/Promoters/UBO/Guarantors/Sister Concern

ID Proof - Borrower & Co-borrower Individual - PAN

Non-Individual - PAN + GST Registration

Constitutional & related Documents

(For Non Individual) - Borrower/ UBO/

Guarantor/Sister concern Company - MOA, AOA, COI, Latest LOD & LOS

Unregistered Partnership Firm - Latest notarized Partnership Deed, Latest LOP on letter

head

Registered Firm - Form A & C, Latest notarized Partnership Deed, latest LOP on letter

head

LLP - COI, LLP Agreement, latest LODP

Trust/Society-Reg. certificate/Trust Deed Agreement/ Bye Laws

a. Company - 25%

UBO Compliance b. Partnership firm/others - 15%

ID Proof- Shareholder/Director/UBO

/Guarantor / Sister concern PAN

VAT, CST, ST, GST Certificate/ Shop and Establishment Certificate/ Udyog Aadhar/ Any

Vintage Proof other specific certificate related to any Specific Industry

Sale Deed/ Latest commercial Tax Receipt/ Bank Statement/ Latest Utility Bill (not older

Office Address Documents than 60 days)/ Rent Agreement + Landlord utility bill (not older than 60 days)

ADHAAR CARD/ PASSPORT/ VOTER ID/ DL/ Bank Statement/ Sale Deed/ Latest House

Tax Receipt/Rent Agreement/ Latest Utility Bill (not older than 60 days)/Rent

Residence Address Documents Agreement + Landlord utility bill (not older than 60 days)

Ownership Proof for Unsecured Loans/ Equipment Loans

Income Docs

For Unsecured BL:

1. Provisional Balance Sheet & P&L (Post Q1 of next year, prior to that key figures viz

sales, capital, profit, debtors, creditors)

2. Latest 3 years Financials -

Self Employed/ Business - Borrower a. Balance Sheet & P&L

(Attestation on first & last page of each b. Complete schedules and annexures & Notes to A/c's

set) c. Auditor stamp and signatures

For Unsecured BL upto INR 20 lakhs, audited financials for latest 2 years are required

Income Tax record for 3 Years -

a. ITR's with Computation

b. Audit Report

For Company's - 3 years Auditor's & Director's Report

Income tax record of Promoters

(attested) Latest 2 ITR's with Computation

GST Returns (OSV and Attestation not

mandatory) GST Returns-3B for the unaudited period

You might also like

- Prince2 Foundation Training Manual Frank PDFDocument20 pagesPrince2 Foundation Training Manual Frank PDFshahaab7860% (4)

- DocxDocument119 pagesDocxRene Lopez100% (1)

- Acctg122 - Chapter 1Document25 pagesAcctg122 - Chapter 1Ice James Pachano0% (1)

- Non Individual - KYC Application FormDocument4 pagesNon Individual - KYC Application Formlaxmans20No ratings yet

- Undertaking in Lieu of Self Attestation of Partnership FirmDocument1 pageUndertaking in Lieu of Self Attestation of Partnership FirmRanbir Bahadur SinghNo ratings yet

- A Report On Corporate Governance Issue of Dutch Bangla Bank LimitedDocument12 pagesA Report On Corporate Governance Issue of Dutch Bangla Bank LimitedVictor DasNo ratings yet

- Tutorial 2Document2 pagesTutorial 2sanjeet kumarNo ratings yet

- Home Loan Lap Login ChecklistDocument1 pageHome Loan Lap Login ChecklistAditya KhareNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- List of Documents - Existing CompanyDocument1 pageList of Documents - Existing CompanyJugal GorNo ratings yet

- Loan Application Form: Salaried - Self-Employed - BusinessDocument7 pagesLoan Application Form: Salaried - Self-Employed - Businesskarthi vjNo ratings yet

- Home, Mortgage, LAP, Reverse Mortgage - Loan ApplicationDocument10 pagesHome, Mortgage, LAP, Reverse Mortgage - Loan ApplicationReshma JoseNo ratings yet

- Home Loan Application IDBIDocument10 pagesHome Loan Application IDBIMuthuKumaran NadarNo ratings yet

- Home - Loan - Application - Form 1Document8 pagesHome - Loan - Application - Form 1Salman KhanNo ratings yet

- Document For Car CVDocument1 pageDocument For Car CVkrishna varmaNo ratings yet

- Money Tree International Finance Corp. Checklist of Standard Loan RequirementsDocument2 pagesMoney Tree International Finance Corp. Checklist of Standard Loan RequirementsAgape LabuntogNo ratings yet

- Login Checklist - Personal Loan and Easy Draft V6Document1 pageLogin Checklist - Personal Loan and Easy Draft V6orient finservNo ratings yet

- Home Loan Application Form EnglishDocument8 pagesHome Loan Application Form EnglishAFFII MARKETINGNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- Financial Accounting Assignment 1Document4 pagesFinancial Accounting Assignment 1Julle Lester PamaNo ratings yet

- Document Checklist (Non Income Documents)Document2 pagesDocument Checklist (Non Income Documents)Hussain bashaNo ratings yet

- NEW ACCOUNT - OPENING - FORM - IndiaDocument2 pagesNEW ACCOUNT - OPENING - FORM - IndiaDeepak PanghalNo ratings yet

- Goodyear Vendor Creation Form Apac2Document4 pagesGoodyear Vendor Creation Form Apac2reihan narendraNo ratings yet

- Indicative Check List of Documents Required For The Credit ProposalDocument2 pagesIndicative Check List of Documents Required For The Credit ProposalPrakashNo ratings yet

- BL ChecklistDocument7 pagesBL ChecklistshaikhNo ratings yet

- Check List of Documents For Home LoanDocument3 pagesCheck List of Documents For Home LoanRavi AgarwalNo ratings yet

- Zerodha CDocument13 pagesZerodha CGopagani DharshanNo ratings yet

- Checklist For Partnership ConcernDocument9 pagesChecklist For Partnership Concernm3788999No ratings yet

- 2307 Creditable Tax Withheld at SourceDocument6 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- WA NILS Document Checklist v2Document1 pageWA NILS Document Checklist v2Adam Di GiuseppeNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- To Be Submitted Along With Documents As Per The Check ListDocument4 pagesTo Be Submitted Along With Documents As Per The Check ListArun VijilanNo ratings yet

- LLP Form No. 8: Statement of Account & SolvencyDocument5 pagesLLP Form No. 8: Statement of Account & SolvencyPadmini VasanthNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument15 pagesInstructions / Checklist For Filling KYC FormAdarsh SinghNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument35 pagesInstructions / Checklist For Filling KYC FormAjay Kumar MattupalliNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument27 pagesInstructions / Checklist For Filling KYC FormMayank KumarNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument13 pagesInstructions / Checklist For Filling KYC Formsuraj rautNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument21 pagesInstructions / Checklist For Filling KYC FormdhritimohanNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument28 pagesInstructions / Checklist For Filling KYC Formvishnu ksNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument15 pagesInstructions / Checklist For Filling KYC FormMohmmad ShahnawazNo ratings yet

- Legal and Compliance KYB PresentationDocument13 pagesLegal and Compliance KYB PresentationfalconkudakwasheNo ratings yet

- Documents To Be SubmittedDocument1 pageDocuments To Be Submittedtarun solankiNo ratings yet

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsNo ratings yet

- Form - Ii BDocument1 pageForm - Ii BBidhannagar Circle, PW Dte., Govt. of WB PWDNo ratings yet

- Credit Note and Debit Note Under GST - Masters IndiaDocument5 pagesCredit Note and Debit Note Under GST - Masters Indiaarun alwaysNo ratings yet

- Login/ Sanction Checklist-Self Employed: (1. Applicant, 2,3,4 Co-Applicants)Document2 pagesLogin/ Sanction Checklist-Self Employed: (1. Applicant, 2,3,4 Co-Applicants)Prem KumarNo ratings yet

- LAP Sales Officer Check ListDocument2 pagesLAP Sales Officer Check Listkirubaharan2022No ratings yet

- Business Loan Application PacketDocument9 pagesBusiness Loan Application PacketSupreet Kaur100% (1)

- Document Check List For Project LoanDocument2 pagesDocument Check List For Project LoanVishy BhatiaNo ratings yet

- GST MasterDocument22 pagesGST MasterShubham DhimaanNo ratings yet

- REVOS Channel Partner Application FormDocument15 pagesREVOS Channel Partner Application FormharshitNo ratings yet

- Customer Updation Form For Re Kyc - Non-IndividualsDocument2 pagesCustomer Updation Form For Re Kyc - Non-Individualsprabs20069178100% (1)

- Zerodha CDocument18 pagesZerodha CJaved HakimNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMAHALAKSHMI NAGESH BUDDHANo ratings yet

- 2023 KYBP Profile and Services (Latest Promo)Document14 pages2023 KYBP Profile and Services (Latest Promo)Kenny Diego ChenNo ratings yet

- Home ChecklistDocument3 pagesHome ChecklisthomeloansNo ratings yet

- Templete For AllDocument18 pagesTemplete For AllCommerce Adda ConsultancyNo ratings yet

- Maha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreDocument2 pagesMaha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreRohith RaoNo ratings yet

- ChecklistDocument4 pagesChecklistPiyush KumarNo ratings yet

- Key Doc ContDocument5 pagesKey Doc ContBeauTech Engg. & Construction Pvt. Ltd.No ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Tableau Internal For M1 Batch: AnswersDocument1 pageTableau Internal For M1 Batch: Answersshrijit “shri” tembheharNo ratings yet

- M1 - PGDM 182011840Document1 pageM1 - PGDM 182011840shrijit “shri” tembheharNo ratings yet

- Supply ChainDocument26 pagesSupply Chainshrijit “shri” tembheharNo ratings yet

- SPSS FinalDocument8 pagesSPSS Finalshrijit “shri” tembheharNo ratings yet

- STRDocument33 pagesSTRshrijit “shri” tembheharNo ratings yet

- M1-PGDM182010085 Marketing Analytics Internals - 3Document1 pageM1-PGDM182010085 Marketing Analytics Internals - 3shrijit “shri” tembheharNo ratings yet

- Tableau Internal For M1 Batch: Name - Divya Chaubey PGDM182010190Document1 pageTableau Internal For M1 Batch: Name - Divya Chaubey PGDM182010190shrijit “shri” tembheharNo ratings yet

- Uber Drive Practice DP PDFDocument10 pagesUber Drive Practice DP PDFshrijit “shri” tembheharNo ratings yet

- M1 Anand Krishna 2087Document1 pageM1 Anand Krishna 2087shrijit “shri” tembheharNo ratings yet

- LinksDocument1 pageLinksshrijit “shri” tembheharNo ratings yet

- GEP EV - Charger Report - Shrijit - 12 - Aug - 22Document20 pagesGEP EV - Charger Report - Shrijit - 12 - Aug - 22shrijit “shri” tembheharNo ratings yet

- Sadaf Tahir ATS Proof Resume Template 1651915589Document1 pageSadaf Tahir ATS Proof Resume Template 1651915589shrijit “shri” tembheharNo ratings yet

- Integrated Program in Business Analytics 1 1Document19 pagesIntegrated Program in Business Analytics 1 1shrijit “shri” tembheharNo ratings yet

- For Franchise Owners V2 0Document17 pagesFor Franchise Owners V2 0shrijit “shri” tembheharNo ratings yet

- SM1001809 Reference Material - Vocabulary Word List - BeginnerDocument53 pagesSM1001809 Reference Material - Vocabulary Word List - Beginnershrijit “shri” tembheharNo ratings yet

- Life Cycle of A Let's MD CustomerDocument8 pagesLife Cycle of A Let's MD Customershrijit “shri” tembheharNo ratings yet

- Fintree Process With SMCDocument11 pagesFintree Process With SMCshrijit “shri” tembheharNo ratings yet

- Fintree 10X Workbench V02 FinalDocument6 pagesFintree 10X Workbench V02 Finalshrijit “shri” tembheharNo ratings yet

- Indian Companies Hiring During Covid-19 PDFDocument116 pagesIndian Companies Hiring During Covid-19 PDFshrijit “shri” tembheharNo ratings yet

- Updated CV (1) NewDocument2 pagesUpdated CV (1) Newshrijit “shri” tembheharNo ratings yet

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Marketing Analytics Experiments CalculationsDocument7 pagesMarketing Analytics Experiments Calculationsshrijit “shri” tembheharNo ratings yet

- Order Item DetailsDocument6 pagesOrder Item Detailsshrijit “shri” tembheharNo ratings yet

- Building Brand Architature Report On Apple and Samsung: Imagination Liberty Regained Innovation PassionDocument6 pagesBuilding Brand Architature Report On Apple and Samsung: Imagination Liberty Regained Innovation Passionshrijit “shri” tembheharNo ratings yet

- Building Brand Architature Report On Apple and Samsung: Imagination Liberty Regained Innovation PassionDocument6 pagesBuilding Brand Architature Report On Apple and Samsung: Imagination Liberty Regained Innovation Passionshrijit “shri” tembheharNo ratings yet

- Partner Address City PIN Contact PersonDocument22 pagesPartner Address City PIN Contact Personamitdesai92100% (1)

- Hybrid Work Arrangements - V1Document3 pagesHybrid Work Arrangements - V1Teuku Muhammad RizkyNo ratings yet

- 121 Bip ReportsDocument617 pages121 Bip ReportsMuhammad NadeemNo ratings yet

- Blank Vendor Profile Form - NewDocument6 pagesBlank Vendor Profile Form - Newthanhphong3005No ratings yet

- The Interrelationship Between Culture, Capital Structure, and Performance: Evidence From European RetailersDocument7 pagesThe Interrelationship Between Culture, Capital Structure, and Performance: Evidence From European RetailersNgọc Minh PhúNo ratings yet

- Reverse LogisticsDocument37 pagesReverse Logisticsblogdogunleashed100% (7)

- MCQ SDLCDocument7 pagesMCQ SDLCShipra Sharma100% (1)

- Entrep12 q1 m5 7p S of Marketing and BrandingDocument36 pagesEntrep12 q1 m5 7p S of Marketing and BrandingChristian Carlo SasumanNo ratings yet

- Sandeep Koyya - TC PagpDocument1 pageSandeep Koyya - TC PagpSandeep KoyyaNo ratings yet

- Mukund Herbals - Class 35Document2 pagesMukund Herbals - Class 35yedhulaprakash4927No ratings yet

- SP-New Venture Creation 2 32 v2Document5 pagesSP-New Venture Creation 2 32 v2Michael NcubeNo ratings yet

- Resource Generated CommitteeDocument12 pagesResource Generated Committeerhea marieNo ratings yet

- Terms and Conditions of The Vertiv Partner ProgramDocument4 pagesTerms and Conditions of The Vertiv Partner Programacarlessi1No ratings yet

- Supply of C C Block For Jambuva Division Office: Page NoDocument3 pagesSupply of C C Block For Jambuva Division Office: Page NoABCDNo ratings yet

- Icam Exam Answer SheetDocument12 pagesIcam Exam Answer SheetAlfred MwayutaNo ratings yet

- IFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsDocument18 pagesIFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsBruce ChengNo ratings yet

- Benihana of Tokyo: Aamir AnsariDocument15 pagesBenihana of Tokyo: Aamir AnsariAlain SayeghNo ratings yet

- Company Profile - Media Agency - Company ProfileDocument17 pagesCompany Profile - Media Agency - Company ProfileKhabib ROXNo ratings yet

- CPVNDocument8 pagesCPVNiC60No ratings yet

- Cours 1 - Defining MarketingDocument39 pagesCours 1 - Defining MarketingKévin PereiraNo ratings yet

- General Principles of Income Taxation - KKDocument11 pagesGeneral Principles of Income Taxation - KKKenncyNo ratings yet

- Corporation Law Case DigestsDocument24 pagesCorporation Law Case DigestsMaryluz CabalongaNo ratings yet

- Country Oak 140cm Fixed 6 Seater Dining TableDocument1 pageCountry Oak 140cm Fixed 6 Seater Dining Tablemimixtra612No ratings yet

- Impact On Post Purchase Advertising On Consumer BehaviourDocument2 pagesImpact On Post Purchase Advertising On Consumer BehaviourNayan BhalotiaNo ratings yet

- Topic 2 - Ias 16Document46 pagesTopic 2 - Ias 16jpatrickNo ratings yet

- April 2023 FS CANTEEN REportDocument5 pagesApril 2023 FS CANTEEN REportYyahm YserolfNo ratings yet