Professional Documents

Culture Documents

JackieLunaSamplePolicy PDF

JackieLunaSamplePolicy PDF

Uploaded by

Dom De Ocampo DaigoCopyright:

Available Formats

You might also like

- Cases and Materials On Contracts 6th WaddamsDocument909 pagesCases and Materials On Contracts 6th WaddamsheynickletsgoNo ratings yet

- Health Prime: Plan DetailsDocument12 pagesHealth Prime: Plan DetailsAntoniette Samantha NacionNo ratings yet

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDocument5 pagesC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNo ratings yet

- MCQ Ic 83Document83 pagesMCQ Ic 83Pratik ChahwalaNo ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Payer - Provider AgreementDocument36 pagesPayer - Provider AgreementTorrie FieldsNo ratings yet

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- Three Payment Plan (3PP) Plus: IllustrationDocument2 pagesThree Payment Plan (3PP) Plus: IllustrationShohel MiahNo ratings yet

- Endowment Plus: Wealth CreationDocument4 pagesEndowment Plus: Wealth CreationMd. Rahad HossainNo ratings yet

- Pruposal - Mrms. ReyesDocument1 pagePruposal - Mrms. ReyesKriza Matro-FloresNo ratings yet

- One Page Summary of The Proposal 2Document3 pagesOne Page Summary of The Proposal 2Grace Yambao InmenzoNo ratings yet

- CeylincoQuoteDocument3 pagesCeylincoQuotejulani pabasariNo ratings yet

- Koti Suraksha - PA - One Pager - 5L-5CR NewPlanDocument3 pagesKoti Suraksha - PA - One Pager - 5L-5CR NewPlanManish SinhaNo ratings yet

- Aviva Life Insurance Company India LimitedDocument3 pagesAviva Life Insurance Company India Limitedvarun_chd86No ratings yet

- SBI Life - Poorna Suraksha - Product GuideDocument2 pagesSBI Life - Poorna Suraksha - Product GuideVenkateswarlu BusamNo ratings yet

- Mr. Rajesh K: - Age:46 YearsDocument6 pagesMr. Rajesh K: - Age:46 YearsRajesh KNo ratings yet

- IFLGuaranteed Pension PlanDocument3 pagesIFLGuaranteed Pension PlanAshutosh JaiswalNo ratings yet

- Jawaban LatihanDocument13 pagesJawaban Latihanpurna.irawanNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- HLV CalculationDocument5 pagesHLV CalculationPhuntru PhiNo ratings yet

- Divi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)Document3 pagesDivi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)cjagath725No ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- ASSIGNMENT Taxable IncomeDocument4 pagesASSIGNMENT Taxable Incomes.adhishriNo ratings yet

- LIC S Jeevan Rekha 512N211V01Document4 pagesLIC S Jeevan Rekha 512N211V01Ramu448No ratings yet

- LIC New Bhima KiranDocument3 pagesLIC New Bhima Kiranvirgoshee12No ratings yet

- Prudential PruPersonal AccidentDocument13 pagesPrudential PruPersonal AccidentpriscillasooNo ratings yet

- Summary One PagerDocument113 pagesSummary One PagerAnthony MateoNo ratings yet

- Defined Benefit Pension Reporting - Chapter 19 - Assignment SetDocument3 pagesDefined Benefit Pension Reporting - Chapter 19 - Assignment SetNicoleNo ratings yet

- Koti Suraksha One Pager - HealthDocument2 pagesKoti Suraksha One Pager - HealthShobhit MathurNo ratings yet

- Columbres J Mlprime 24052021030741Document16 pagesColumbres J Mlprime 24052021030741Sibin PiptiNo ratings yet

- AIAVoluntaryHealthInsurancePrivilegeScheme enDocument24 pagesAIAVoluntaryHealthInsurancePrivilegeScheme ensean8782No ratings yet

- VIVENCIA PRIME All RidersDocument12 pagesVIVENCIA PRIME All RidersRalph RUzzelNo ratings yet

- Correction IRA No. 3 (G)Document1 pageCorrection IRA No. 3 (G)Prolen AcantoNo ratings yet

- Nuñez R Mlprime 02102021182517Document16 pagesNuñez R Mlprime 02102021182517Rommel Capinpin NunezNo ratings yet

- E2d5b985fe2f809a1645591333765 1645591531613 1645591533097Document2 pagesE2d5b985fe2f809a1645591333765 1645591531613 1645591533097klassociates.vatNo ratings yet

- Validity of 3dDocument4 pagesValidity of 3dVijayNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- Wilma Dapog Flexilink 1mDocument10 pagesWilma Dapog Flexilink 1mTweetie Borja DapogNo ratings yet

- Exide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanDocument5 pagesExide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanEticala RohithNo ratings yet

- Job OfferDocument2 pagesJob OfferJam AzenithNo ratings yet

- Mapacpac J Mlprime 14112021160254Document19 pagesMapacpac J Mlprime 14112021160254Jonas MapacpacNo ratings yet

- Ramios N Mlprime 04112021083721Document18 pagesRamios N Mlprime 04112021083721Elaina DuarteNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- Sunlife Proposal Bianca OseraDocument2 pagesSunlife Proposal Bianca OseraBianca Joy OseraNo ratings yet

- Screenshot 2024-04-23 at 12.17.40 PMDocument44 pagesScreenshot 2024-04-23 at 12.17.40 PMspencer sparrowNo ratings yet

- Funding ProjectionDocument4 pagesFunding ProjectionBiki BhaiNo ratings yet

- GoSecure BroDocument2 pagesGoSecure BrogreatdsaNo ratings yet

- e9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Document2 pagese9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Fawzar SabirNo ratings yet

- Sun MaxiLink PrimeDocument8 pagesSun MaxiLink PrimeEric CorbezaNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- Exide Life Guaranteed Income Insurance Plan1633941626957Document2 pagesExide Life Guaranteed Income Insurance Plan1633941626957Prashant PrinceNo ratings yet

- Salary StackDocument3 pagesSalary StackAbdul Khadar Jilani ShaikNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Celebrating 60 Years of Excellence, Sri Lanka Insurance PresentsDocument2 pagesCelebrating 60 Years of Excellence, Sri Lanka Insurance PresentsSivaneswaran ChandrasekaranNo ratings yet

- De Minimis Benefits (PINGAD)Document4 pagesDe Minimis Benefits (PINGAD)Vee YaNo ratings yet

- Sales IllustrationDocument36 pagesSales IllustrationHaricharaanNo ratings yet

- BDC-PNL Wilmar Ref PLTG 2018Document18 pagesBDC-PNL Wilmar Ref PLTG 2018Biyan FarabiNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- 05 - Main Report HIB FinalDocument39 pages05 - Main Report HIB FinalShurendra GhimireNo ratings yet

- Chap5 Nature and Structure of InsDocument25 pagesChap5 Nature and Structure of InsNurul SyazwaniNo ratings yet

- NEC3 Engineering and Construction ContractDocument45 pagesNEC3 Engineering and Construction ContractpatrickNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- No Fault Liability PDFDocument10 pagesNo Fault Liability PDFfaizan waniNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 5 5 4 4Document6 pages(A) Policy Schedule (Policy Certificate) : Policyall 5 5 4 4Om Prakash SinghNo ratings yet

- What Are The Most Important Changes in Incoterms 2020Document5 pagesWhat Are The Most Important Changes in Incoterms 2020frNo ratings yet

- Mortgage Acquisition AgreementDocument46 pagesMortgage Acquisition AgreementRohit WankhedeNo ratings yet

- Secure Documents Download Fileloan Id 0000305572&object Id 42773697Document1 pageSecure Documents Download Fileloan Id 0000305572&object Id 42773697lorrieNo ratings yet

- Car Insurance. Surf The Net For A Better DealDocument2 pagesCar Insurance. Surf The Net For A Better DealABINo ratings yet

- Subcontractor Agreement (Draft Bilingual)Document44 pagesSubcontractor Agreement (Draft Bilingual)Jimmy Agung SilitongaNo ratings yet

- IP Q4 FY19 Final - InternationalDocument58 pagesIP Q4 FY19 Final - InternationalVinit SatishNo ratings yet

- PAM Contract 2006 (Without Quantity)Document38 pagesPAM Contract 2006 (Without Quantity)Jonathan ChongNo ratings yet

- Qualified Written RequestDocument9 pagesQualified Written Requestteachezi100% (3)

- General Safety Notes For Products From The MFX - 4 Range: LiabilityDocument5 pagesGeneral Safety Notes For Products From The MFX - 4 Range: LiabilityKao Thanh MaiNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Yu Pang v. CA 105 Phil 930 (1959) (Casabuena)Document2 pagesYu Pang v. CA 105 Phil 930 (1959) (Casabuena)Nelly Louie CasabuenaNo ratings yet

- Grts Inc. v. Philippine Charter Insurance Corp.Document3 pagesGrts Inc. v. Philippine Charter Insurance Corp.Mary Rose Aguinaldo HipolitoNo ratings yet

- Deck OfficerDocument39 pagesDeck OfficerYudistira Aurum StoreNo ratings yet

- Professional Indemnity - 20LKB0001189-00Document14 pagesProfessional Indemnity - 20LKB0001189-00ZamzuriNo ratings yet

- Occupational GuidelinesDocument3 pagesOccupational GuidelinesJovelyn ArgeteNo ratings yet

- Estate Tax 3Document50 pagesEstate Tax 3Lea JoaquinNo ratings yet

- Top Indian Bureaucracy News Whispers in The CorridorsDocument1 pageTop Indian Bureaucracy News Whispers in The CorridorsCBS CHANDIGARHNo ratings yet

- Safety RST!: Family Accident Care Insurance PolicyDocument5 pagesSafety RST!: Family Accident Care Insurance PolicyHarikrishnan DNo ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument3 pagesAllianz General Insurance Company (Malaysia) Berhadmysara othmanNo ratings yet

JackieLunaSamplePolicy PDF

JackieLunaSamplePolicy PDF

Uploaded by

Dom De Ocampo DaigoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JackieLunaSamplePolicy PDF

JackieLunaSamplePolicy PDF

Uploaded by

Dom De Ocampo DaigoCopyright:

Available Formats

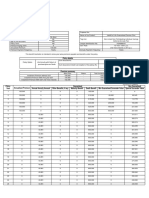

FOR THE FINANCIAL PLANNING OF JACKIE LUNA

Policy Owner: Jackie Luna

Priority: Savings; Investment and Protection

Needs: Critical illness insurance benefit: ideally Php 2-4M

Monthly allowance:

Target retirement age: 60 years old

Average life expectancy: 100 years old

Average annual inflation rate: 3%

Age: 26

OVERVIEW

OPTION 1 OPTION 2 OPTION 2 OPTION 2 OPTION 2

Policy Name PAA + PAA + PAA + PAA + PAA +

Annual Savings 72,000 48,000 30,000 24,000 18,000

Monthly Savings 6,000 4,000 2,500 2,000 1,500

Savings Term in Years 30 (Flexible) 30 (Flexible) 30 (Flexible) 30 (Flexible) 30 (Flexible)

PROTECTION COMPONENT *

Death Benefit (sum assured indicated; on top of the investment component) 2,000,000 2,000,000 2,000,000 1,500,000 1,000,000

Future Safe Rider 1,000,000 1,000,000 1,000,000 - -

Accelerated Total and Permanent Disability (TPD) 1,000,000 1,000,000 _ 500,000 500,000

Accidental Death and Disablement 60,000 60,000 60,000 60,000 60,000

Personal Accident - Accidental Death and Disablement 1,000,000 1,000,000 1,000,000 800,000 500,000

Personal Accident -Accidental Total and Permanet Disability 1,000,000 1,000,000 1,000,000 800,000 500,000

Personal Accident - Murder and Assault 500,000 500,000 500,000 400,000 250,000

Personal Accident - Double Indemnity Benefit 1,000,000 1,000,000 _ _ _

Personal Accident - Accidental Medical Reimbursement 100,000 100,000 _ _ _

Accelerated Life Care Benefit (effective in 90 days) _ _ _ _ _

Multiple Life Care Plus 1,000,000 _ _ _ _

Life Care Plus _ _ _ _ _

Waiver of Premium on TPD 60,000 36,000 _ _ _

Life Care Waiver 60,000 36,000 30,000 24,000 _

Hospital Income Rider Benefit (effective in 30 days) 36,000 27,000 3,000 3,000 1,000

Daily Hospital Income 2,000 1,500 1,000 1,000 1,000

Surgical Expense Reimbursement Benefit 30,000 22,500 _ _ _

Long Term Hospitalization Benefit _ _ _ _ _

Intensive Care Unit Benefit 4,000 3,000 2,000 2,000 _

INVESTMENT COMPONENT **

Your Age

Projected Fund Value at Year 5 31 129,780 53,753 51,707 44,045 41,384

Total Savings Invested 360,000 144,000 90,000 72,000 54,000

Projected Fund Value at Year 10 36 527,902 239,925 217,817 185,699 162,043

Total Savings Invested 720,000 480,000 300,000 240,000 180,000

Projected Fund Value at Year 15 41 1,161,802 559,586 501,458 428,044 367,507

Total Savings Invested 1,080,000 720,000 450,000 360,000 270,000

Projected Fund Value at Year 20 46 2,104,469 1,057,618 945,007 809,782 695,224

Total Savings Invested 1,440,000 960,000 600,000 480,000 360,000

Projected Fund Value at Year 34 60 7,853,143 8,177,961 7,333,764 6,545,157 5,856,214

Total Savings Invested 2,448,000 1,632,000 1,020,000 816,000 612,000

Projected Fund Value at Year 39 65 12,055,431 12,819,816 11,483,814 10,385,747 9,393,002

Total Savings Invested - 2,808,000 1,872,000 1,170,000 936,000 702,000

Notes:

* Effective upon approval unless otherwise stated.

** Chosen fund is Equity Fund, projected at 10% per annum for the purpose of illustration. Annual historical compounded rate is 14.54% since inception.

** Investment returns used are net of final tax, annual management charge and other investment expenses.

** Loyalty bonus of 10% will be added to the fund value on the 11th - 20th year if premiums are paid on or before the due date.

** Fund allocation is at 0%, 50% and 50% on Year 1, 2 and 3 respectively. Premiums will be 100% allocated to the fund’s investments on Year

4 onwards.

Prepared by:

ANNA KATRINA R. SARMIENTO

Assistant Unit Manager

You might also like

- Cases and Materials On Contracts 6th WaddamsDocument909 pagesCases and Materials On Contracts 6th WaddamsheynickletsgoNo ratings yet

- Health Prime: Plan DetailsDocument12 pagesHealth Prime: Plan DetailsAntoniette Samantha NacionNo ratings yet

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDocument5 pagesC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNo ratings yet

- MCQ Ic 83Document83 pagesMCQ Ic 83Pratik ChahwalaNo ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Payer - Provider AgreementDocument36 pagesPayer - Provider AgreementTorrie FieldsNo ratings yet

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- Three Payment Plan (3PP) Plus: IllustrationDocument2 pagesThree Payment Plan (3PP) Plus: IllustrationShohel MiahNo ratings yet

- Endowment Plus: Wealth CreationDocument4 pagesEndowment Plus: Wealth CreationMd. Rahad HossainNo ratings yet

- Pruposal - Mrms. ReyesDocument1 pagePruposal - Mrms. ReyesKriza Matro-FloresNo ratings yet

- One Page Summary of The Proposal 2Document3 pagesOne Page Summary of The Proposal 2Grace Yambao InmenzoNo ratings yet

- CeylincoQuoteDocument3 pagesCeylincoQuotejulani pabasariNo ratings yet

- Koti Suraksha - PA - One Pager - 5L-5CR NewPlanDocument3 pagesKoti Suraksha - PA - One Pager - 5L-5CR NewPlanManish SinhaNo ratings yet

- Aviva Life Insurance Company India LimitedDocument3 pagesAviva Life Insurance Company India Limitedvarun_chd86No ratings yet

- SBI Life - Poorna Suraksha - Product GuideDocument2 pagesSBI Life - Poorna Suraksha - Product GuideVenkateswarlu BusamNo ratings yet

- Mr. Rajesh K: - Age:46 YearsDocument6 pagesMr. Rajesh K: - Age:46 YearsRajesh KNo ratings yet

- IFLGuaranteed Pension PlanDocument3 pagesIFLGuaranteed Pension PlanAshutosh JaiswalNo ratings yet

- Jawaban LatihanDocument13 pagesJawaban Latihanpurna.irawanNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- HLV CalculationDocument5 pagesHLV CalculationPhuntru PhiNo ratings yet

- Divi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)Document3 pagesDivi Thilina: (This Illustration Is Based On The Actual Bonus Declared For Current Year)cjagath725No ratings yet

- IllustrationDocument2 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- ASSIGNMENT Taxable IncomeDocument4 pagesASSIGNMENT Taxable Incomes.adhishriNo ratings yet

- LIC S Jeevan Rekha 512N211V01Document4 pagesLIC S Jeevan Rekha 512N211V01Ramu448No ratings yet

- LIC New Bhima KiranDocument3 pagesLIC New Bhima Kiranvirgoshee12No ratings yet

- Prudential PruPersonal AccidentDocument13 pagesPrudential PruPersonal AccidentpriscillasooNo ratings yet

- Summary One PagerDocument113 pagesSummary One PagerAnthony MateoNo ratings yet

- Defined Benefit Pension Reporting - Chapter 19 - Assignment SetDocument3 pagesDefined Benefit Pension Reporting - Chapter 19 - Assignment SetNicoleNo ratings yet

- Koti Suraksha One Pager - HealthDocument2 pagesKoti Suraksha One Pager - HealthShobhit MathurNo ratings yet

- Columbres J Mlprime 24052021030741Document16 pagesColumbres J Mlprime 24052021030741Sibin PiptiNo ratings yet

- AIAVoluntaryHealthInsurancePrivilegeScheme enDocument24 pagesAIAVoluntaryHealthInsurancePrivilegeScheme ensean8782No ratings yet

- VIVENCIA PRIME All RidersDocument12 pagesVIVENCIA PRIME All RidersRalph RUzzelNo ratings yet

- Correction IRA No. 3 (G)Document1 pageCorrection IRA No. 3 (G)Prolen AcantoNo ratings yet

- Nuñez R Mlprime 02102021182517Document16 pagesNuñez R Mlprime 02102021182517Rommel Capinpin NunezNo ratings yet

- E2d5b985fe2f809a1645591333765 1645591531613 1645591533097Document2 pagesE2d5b985fe2f809a1645591333765 1645591531613 1645591533097klassociates.vatNo ratings yet

- Validity of 3dDocument4 pagesValidity of 3dVijayNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- Wilma Dapog Flexilink 1mDocument10 pagesWilma Dapog Flexilink 1mTweetie Borja DapogNo ratings yet

- Exide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanDocument5 pagesExide Life Smart Term Plus - Benefit Illustration A Non-Linked, Non-Participating Individual Life Insurance Savings PlanEticala RohithNo ratings yet

- Job OfferDocument2 pagesJob OfferJam AzenithNo ratings yet

- Mapacpac J Mlprime 14112021160254Document19 pagesMapacpac J Mlprime 14112021160254Jonas MapacpacNo ratings yet

- Ramios N Mlprime 04112021083721Document18 pagesRamios N Mlprime 04112021083721Elaina DuarteNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- Sunlife Proposal Bianca OseraDocument2 pagesSunlife Proposal Bianca OseraBianca Joy OseraNo ratings yet

- Screenshot 2024-04-23 at 12.17.40 PMDocument44 pagesScreenshot 2024-04-23 at 12.17.40 PMspencer sparrowNo ratings yet

- Funding ProjectionDocument4 pagesFunding ProjectionBiki BhaiNo ratings yet

- GoSecure BroDocument2 pagesGoSecure BrogreatdsaNo ratings yet

- e9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Document2 pagese9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Fawzar SabirNo ratings yet

- Sun MaxiLink PrimeDocument8 pagesSun MaxiLink PrimeEric CorbezaNo ratings yet

- Employee Benefits 2 Employee Benefits 2Document4 pagesEmployee Benefits 2 Employee Benefits 2XNo ratings yet

- Exide Life Guaranteed Income Insurance Plan1633941626957Document2 pagesExide Life Guaranteed Income Insurance Plan1633941626957Prashant PrinceNo ratings yet

- Salary StackDocument3 pagesSalary StackAbdul Khadar Jilani ShaikNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Celebrating 60 Years of Excellence, Sri Lanka Insurance PresentsDocument2 pagesCelebrating 60 Years of Excellence, Sri Lanka Insurance PresentsSivaneswaran ChandrasekaranNo ratings yet

- De Minimis Benefits (PINGAD)Document4 pagesDe Minimis Benefits (PINGAD)Vee YaNo ratings yet

- Sales IllustrationDocument36 pagesSales IllustrationHaricharaanNo ratings yet

- BDC-PNL Wilmar Ref PLTG 2018Document18 pagesBDC-PNL Wilmar Ref PLTG 2018Biyan FarabiNo ratings yet

- StewpeedDocument10 pagesStewpeedau4seventeenNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- 05 - Main Report HIB FinalDocument39 pages05 - Main Report HIB FinalShurendra GhimireNo ratings yet

- Chap5 Nature and Structure of InsDocument25 pagesChap5 Nature and Structure of InsNurul SyazwaniNo ratings yet

- NEC3 Engineering and Construction ContractDocument45 pagesNEC3 Engineering and Construction ContractpatrickNo ratings yet

- FRI AssignmentDocument18 pagesFRI AssignmentHaider SaleemNo ratings yet

- No Fault Liability PDFDocument10 pagesNo Fault Liability PDFfaizan waniNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 5 5 4 4Document6 pages(A) Policy Schedule (Policy Certificate) : Policyall 5 5 4 4Om Prakash SinghNo ratings yet

- What Are The Most Important Changes in Incoterms 2020Document5 pagesWhat Are The Most Important Changes in Incoterms 2020frNo ratings yet

- Mortgage Acquisition AgreementDocument46 pagesMortgage Acquisition AgreementRohit WankhedeNo ratings yet

- Secure Documents Download Fileloan Id 0000305572&object Id 42773697Document1 pageSecure Documents Download Fileloan Id 0000305572&object Id 42773697lorrieNo ratings yet

- Car Insurance. Surf The Net For A Better DealDocument2 pagesCar Insurance. Surf The Net For A Better DealABINo ratings yet

- Subcontractor Agreement (Draft Bilingual)Document44 pagesSubcontractor Agreement (Draft Bilingual)Jimmy Agung SilitongaNo ratings yet

- IP Q4 FY19 Final - InternationalDocument58 pagesIP Q4 FY19 Final - InternationalVinit SatishNo ratings yet

- PAM Contract 2006 (Without Quantity)Document38 pagesPAM Contract 2006 (Without Quantity)Jonathan ChongNo ratings yet

- Qualified Written RequestDocument9 pagesQualified Written Requestteachezi100% (3)

- General Safety Notes For Products From The MFX - 4 Range: LiabilityDocument5 pagesGeneral Safety Notes For Products From The MFX - 4 Range: LiabilityKao Thanh MaiNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Yu Pang v. CA 105 Phil 930 (1959) (Casabuena)Document2 pagesYu Pang v. CA 105 Phil 930 (1959) (Casabuena)Nelly Louie CasabuenaNo ratings yet

- Grts Inc. v. Philippine Charter Insurance Corp.Document3 pagesGrts Inc. v. Philippine Charter Insurance Corp.Mary Rose Aguinaldo HipolitoNo ratings yet

- Deck OfficerDocument39 pagesDeck OfficerYudistira Aurum StoreNo ratings yet

- Professional Indemnity - 20LKB0001189-00Document14 pagesProfessional Indemnity - 20LKB0001189-00ZamzuriNo ratings yet

- Occupational GuidelinesDocument3 pagesOccupational GuidelinesJovelyn ArgeteNo ratings yet

- Estate Tax 3Document50 pagesEstate Tax 3Lea JoaquinNo ratings yet

- Top Indian Bureaucracy News Whispers in The CorridorsDocument1 pageTop Indian Bureaucracy News Whispers in The CorridorsCBS CHANDIGARHNo ratings yet

- Safety RST!: Family Accident Care Insurance PolicyDocument5 pagesSafety RST!: Family Accident Care Insurance PolicyHarikrishnan DNo ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument3 pagesAllianz General Insurance Company (Malaysia) Berhadmysara othmanNo ratings yet