Professional Documents

Culture Documents

Teaching Schedule - Theory No. Topic Points To Be Covered

Teaching Schedule - Theory No. Topic Points To Be Covered

Uploaded by

डॉ. प्रशांत पवार0 ratings0% found this document useful (0 votes)

17 views2 pagesThis document outlines the teaching schedule and practical exercises for a course on agricultural finance and management. The teaching schedule covers topics like financial management, capital budgeting, sources of long-term finance, cost of capital, capital structure, leverage, working capital requirements, inventory management, receivables management, cash management, and dividend decisions. The practical exercises provide hands-on practice calculating metrics like net present worth, benefit-cost ratio, internal rate of return, profitability index, and payback period. Exercises also cover cash flow estimation, break-even analysis, sources of long-term finance, operating leverage, financial leverage, and working capital management.

Original Description:

Syllabus

Original Title

Chapter 6

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the teaching schedule and practical exercises for a course on agricultural finance and management. The teaching schedule covers topics like financial management, capital budgeting, sources of long-term finance, cost of capital, capital structure, leverage, working capital requirements, inventory management, receivables management, cash management, and dividend decisions. The practical exercises provide hands-on practice calculating metrics like net present worth, benefit-cost ratio, internal rate of return, profitability index, and payback period. Exercises also cover cash flow estimation, break-even analysis, sources of long-term finance, operating leverage, financial leverage, and working capital management.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesTeaching Schedule - Theory No. Topic Points To Be Covered

Teaching Schedule - Theory No. Topic Points To Be Covered

Uploaded by

डॉ. प्रशांत पवारThis document outlines the teaching schedule and practical exercises for a course on agricultural finance and management. The teaching schedule covers topics like financial management, capital budgeting, sources of long-term finance, cost of capital, capital structure, leverage, working capital requirements, inventory management, receivables management, cash management, and dividend decisions. The practical exercises provide hands-on practice calculating metrics like net present worth, benefit-cost ratio, internal rate of return, profitability index, and payback period. Exercises also cover cash flow estimation, break-even analysis, sources of long-term finance, operating leverage, financial leverage, and working capital management.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

6.

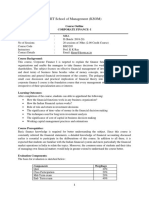

Agricultural Finance Proposals and Management

Teaching Schedule - Theory

Lecture Topic Points to be Covered

No.

1&2 Financial management. Meaning, nature, Importance, scope, and

objectives; Time value of money; Valuation of

long-term securities; Risk and return.

3 Capital Budgeting: Long term investment decisions.

4 Nature of investment decisions.

5 Forms of investment decisions.

6 -7 Estimation of project cash flows,

8 Evaluation of proposals.

9 Evaluation technique -Discounting and non-

discounting techniques

10 Risk analysis in capital budgeting.

11 Sources of Long Term finance. Sources of Long Term finance.

12 -13 Cost of Capital Cost of Capital

14- 15 Capital structure Capital structure: importance

Features of an optimal capital structure.

16 factors influencing capital structure

17- 18 Leverage Leverage: leverage in financial context

Measures of leverage.

19- 22 Estimation of Working Capital Estimation of Working Capital Requirements:

Requirements: Concept,

Factors affecting the working capital

requirement.

working capital requirement - operating cycle

approach

Criteria for evaluation of working capital

management

23 Inventory Management Inventory Management: nature and role

24-25 Inventory Management: purpose,

Inventory management : techniques.

26-27 Receivables Management Receivables Management: purpose

Cost of maintaining receivables.

28 Credit policy. Credit policy.

29-30 Cash management: Cash management: liquidity– profitability trade

off,

Need and objectives,

31 Cash budget. Cash budget.

32 Dividend Dividend decisions of a firm.

Practical

Exercise Title of Exercise

1. Practical exercise on calculation of Net Present Worth (NPW)

2. Calculation of Benefit Cost Ratio (BCR)

3. To study of Internal Rate of Return (IRR)

4. Calculation of Profitability Index (PI)

5. Calculation of Pay Back Period (PBP)

6. Exercise on principles of cash flow estimation.

7. Practical exercise on Financial Break Even Analysis.

8. Study of different sources of long term finance.

9. Practical on Calculation / illustrations on Operating Leverage

10. Practical on Calculation / illustrations on Financial Leverage

11. Practical on Calculation / illustrations on Combined Leverage.

12. Practical on Valuation of stocks.

13. Practical on Valuation of debentures.

14. Exercise on estimation of operating cycle / Inventory Turnover

15. Computation of costs of borrowed capital and preferred stock.

16. Computation of costs of equity capital and retained earnings

You might also like

- Mba III Advanced Financial Management NotesDocument49 pagesMba III Advanced Financial Management NotesThahir Shah100% (2)

- IMC, The Next Generation: Five Steps for Delivering Value and Measuring Returns Using Marketing CommunicationFrom EverandIMC, The Next Generation: Five Steps for Delivering Value and Measuring Returns Using Marketing CommunicationRating: 4.5 out of 5 stars4.5/5 (4)

- Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementFrom EverandAnalyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementRating: 5 out of 5 stars5/5 (5)

- BusFin QuestionsDocument6 pagesBusFin QuestionsMaedelle Anne TiradoNo ratings yet

- Uniform COMMERCIAL CODE (Illinois)Document361 pagesUniform COMMERCIAL CODE (Illinois)Edward WinfreyS100% (1)

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- Advanced Financial Management: Corporate Finance Ross Westerfield Jaffe-TMHDocument3 pagesAdvanced Financial Management: Corporate Finance Ross Westerfield Jaffe-TMHSushobhan DasNo ratings yet

- CF - CO Section - BDocument31 pagesCF - CO Section - BAditya SinghNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- L III: Evel 2019-2020Document2 pagesL III: Evel 2019-2020jitenNo ratings yet

- Into Duct Ion To FMDocument24 pagesInto Duct Ion To FMSunil PillaiNo ratings yet

- Financial Management IIDocument3 pagesFinancial Management IIjakartiNo ratings yet

- CF - Co - MaDocument32 pagesCF - Co - MaANKIT GUPTANo ratings yet

- FM Spring 2023Document7 pagesFM Spring 2023laibashahzad726No ratings yet

- Mba II Financial Management (14mba22) NotesDocument53 pagesMba II Financial Management (14mba22) NotesPriya PriyaNo ratings yet

- Financial - Management SentDocument58 pagesFinancial - Management SentOishik Rahman SiddiqiNo ratings yet

- FM Course Outline & Materials-Thappar UnivDocument74 pagesFM Course Outline & Materials-Thappar Univharsimranjitsidhu661No ratings yet

- MSC510 Corporate FinanceDocument1 pageMSC510 Corporate FinanceRahul PandeyNo ratings yet

- Course Outline - Fin 223Document3 pagesCourse Outline - Fin 223DenisNo ratings yet

- 0.1 Course Outline SYBcom CF II 2022Document5 pages0.1 Course Outline SYBcom CF II 2022Harshit ChauhanNo ratings yet

- Corporate Finance NotesDocument99 pagesCorporate Finance NotesmwendaflaviushilelmutembeiNo ratings yet

- Working CapitalDocument62 pagesWorking CapitalHrithika AroraNo ratings yet

- TheoryDocument2 pagesTheoryAbhijit RoyNo ratings yet

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNo ratings yet

- Unit 1Document37 pagesUnit 1anmolpahawabsrNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- S5 SFMDocument3 pagesS5 SFMWaqas AnjumNo ratings yet

- Module Handbook - Financial Management - 2022 - 21.1 BatchDocument8 pagesModule Handbook - Financial Management - 2022 - 21.1 BatchThanushi FernandoNo ratings yet

- Module-1 - BAV For Students ReferenceDocument54 pagesModule-1 - BAV For Students ReferenceYash LataNo ratings yet

- MBS 2nd Sem SyllabusDocument11 pagesMBS 2nd Sem SyllabusABishnu BagaleNo ratings yet

- AFM Study TextDocument224 pagesAFM Study TextleandrealouisNo ratings yet

- Syllabus Semester 4Document13 pagesSyllabus Semester 4Vidhi GabaNo ratings yet

- NotesDocument146 pagesNoteshudaNo ratings yet

- Class XII Commerce TERM - 1 Syllabus-4Document15 pagesClass XII Commerce TERM - 1 Syllabus-4Ashren rijeren TiggaNo ratings yet

- Mba-III-Advanced Financial Management m1Document6 pagesMba-III-Advanced Financial Management m1KedarNo ratings yet

- Dcom505 Working Capital Management PDFDocument242 pagesDcom505 Working Capital Management PDFRaj KumarNo ratings yet

- Finance - SEED Preparatory MaterialDocument103 pagesFinance - SEED Preparatory MaterialChirag MittalNo ratings yet

- Financial Management March2024Document84 pagesFinancial Management March2024Hazlina HusseinNo ratings yet

- Course Outline Financial Management NTUDocument6 pagesCourse Outline Financial Management NTUHassaanNo ratings yet

- Course Outline-CF-I PDFDocument3 pagesCourse Outline-CF-I PDFAkankshya PanigrahiNo ratings yet

- Business Finance Reviewer Chapters 3 7 PDFDocument4 pagesBusiness Finance Reviewer Chapters 3 7 PDFKevin T. OnaroNo ratings yet

- Mba-IV-project, Appraisal, Planning & Control (12mbafm425) - NotesDocument77 pagesMba-IV-project, Appraisal, Planning & Control (12mbafm425) - Notesghostriderr29No ratings yet

- Il - 401 - Finance Management PDFDocument2 pagesIl - 401 - Finance Management PDFKairavi BhattNo ratings yet

- 1 - T2036-Financial ManagementDocument2 pages1 - T2036-Financial ManagementBhawna YadavNo ratings yet

- Schedule - PMDocument3 pagesSchedule - PMVishnuvardhan YarramreddyNo ratings yet

- Financial ManagementDocument107 pagesFinancial ManagementFarshan SulaimanNo ratings yet

- Asset Management PDFDocument47 pagesAsset Management PDFloli2323No ratings yet

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate FinancevivekNo ratings yet

- Asset and Liability Management in BanksDocument73 pagesAsset and Liability Management in Bankslaser544100% (2)

- Financial Accounting For The Lending BankerDocument3 pagesFinancial Accounting For The Lending BankerRobert NzulwaNo ratings yet

- Finanical ManagementDocument589 pagesFinanical Managementsnarramneni81% (21)

- Mas Study Plan: May 2019 Exam RecapDocument5 pagesMas Study Plan: May 2019 Exam RecapoxennnnNo ratings yet

- S3 - SESI 3 - Okt 2022Document14 pagesS3 - SESI 3 - Okt 2022RuddyNo ratings yet

- Bba 4 Semester BBA417C3 Financial Management COURSE OBJECTIVE: To Acquaint Students With The Techniques of Financial Management and TheirDocument2 pagesBba 4 Semester BBA417C3 Financial Management COURSE OBJECTIVE: To Acquaint Students With The Techniques of Financial Management and TheirNoOneNo ratings yet

- The Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesFrom EverandThe Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesNo ratings yet

- Recent Trends in Valuation: From Strategy to ValueFrom EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerNo ratings yet

- Financial Management: Partner in Driving Performance and ValueFrom EverandFinancial Management: Partner in Driving Performance and ValueNo ratings yet

- Lesson No. Name of Topic ContentDocument3 pagesLesson No. Name of Topic Contentडॉ. प्रशांत पवारNo ratings yet

- Teaching Schedule-Theory No. Topic SubtopicDocument3 pagesTeaching Schedule-Theory No. Topic Subtopicडॉ. प्रशांत पवारNo ratings yet

- Teaching Schedule-Theory Lectures No Topics SubtopicDocument2 pagesTeaching Schedule-Theory Lectures No Topics Subtopicडॉ. प्रशांत पवारNo ratings yet

- Teaching Schedule Sno Main Topic Sub Topics Agricultural Marketing-Agricultural Input MarketingDocument2 pagesTeaching Schedule Sno Main Topic Sub Topics Agricultural Marketing-Agricultural Input Marketingडॉ. प्रशांत पवारNo ratings yet

- CETDocument25 pagesCETडॉ. प्रशांत पवारNo ratings yet

- J D Jadhav 2018 RanchiDocument3 pagesJ D Jadhav 2018 Ranchiडॉ. प्रशांत पवारNo ratings yet

- TORTS DamagesDocument84 pagesTORTS Damagesjamaica_maglinteNo ratings yet

- Gaston Browne - Booklet On de RiskingDocument24 pagesGaston Browne - Booklet On de RiskingJ'Moul A. FrancisNo ratings yet

- NWPCap PrivateDebt Q2-2023Document2 pagesNWPCap PrivateDebt Q2-2023zackzyp98No ratings yet

- A Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Document28 pagesA Survey Report On Consumer Buying Behaviour: Submitted To, MR - Bhavik Shah (Vnsgu)Dipak BagsariyaNo ratings yet

- The Treasurer of Murray Golf Club Has Prepared The FollowingDocument1 pageThe Treasurer of Murray Golf Club Has Prepared The FollowingBube KachevskaNo ratings yet

- 22 ORACLE 11i & R12 AP - Volume 22Document248 pages22 ORACLE 11i & R12 AP - Volume 22Train TNo ratings yet

- What Is Average Salary in EUDocument4 pagesWhat Is Average Salary in EUMy Visa Online Immigration InvestNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)nhat duy leNo ratings yet

- Ucc Mock Board Exam 2021 Taxation 70Document15 pagesUcc Mock Board Exam 2021 Taxation 70Veronika BlairNo ratings yet

- Fabm 121.week 6-10 ModuleDocument22 pagesFabm 121.week 6-10 Modulekhaizer matias100% (1)

- CUTE Tutorial - Sample QuestionsDocument72 pagesCUTE Tutorial - Sample QuestionsRamakrishnan Ramachandran100% (1)

- Saving and Deposit Analysis of Rastriya Banijya Bank Limited 1 PDFDocument36 pagesSaving and Deposit Analysis of Rastriya Banijya Bank Limited 1 PDFSaipal Education Help Desk100% (1)

- PPL Brokers Setup and Usage: March 2020Document23 pagesPPL Brokers Setup and Usage: March 2020saxobobNo ratings yet

- Should Darden Invest With UVUMCO Case StudyDocument2 pagesShould Darden Invest With UVUMCO Case StudysufyanNo ratings yet

- Accenture Global Boom in Fintech InvestmentDocument16 pagesAccenture Global Boom in Fintech InvestmentRachid IdbouzghibaNo ratings yet

- Cost II Assignment IIDocument2 pagesCost II Assignment IIAmanuel GenetNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- Call Money MarketDocument21 pagesCall Money Marketjames40440No ratings yet

- FM - Module 4.BSMA 2-1.Maglipon-Kristian Denise-UDocument4 pagesFM - Module 4.BSMA 2-1.Maglipon-Kristian Denise-UKate ManalansanNo ratings yet

- Theory and Practice of Insurance: January 1998Document9 pagesTheory and Practice of Insurance: January 1998VISWA A RNo ratings yet

- Alteration of Share CapitalDocument20 pagesAlteration of Share Capitalmohitag72100% (2)

- WSO Resume 66Document1 pageWSO Resume 66John MathiasNo ratings yet

- Week 2 Lecture Notes (1 Slide)Document71 pagesWeek 2 Lecture Notes (1 Slide)Sarthak GargNo ratings yet

- Habibmetro BankDocument18 pagesHabibmetro Bankfoqia nishatNo ratings yet

- Finman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalDocument15 pagesFinman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalHoney MuliNo ratings yet

- Games of Chance Law PDFDocument38 pagesGames of Chance Law PDFAna B. AdamsNo ratings yet

- CAP 2 Audit Summer Paper 2013 - FINALDocument9 pagesCAP 2 Audit Summer Paper 2013 - FINALXiaojie LiuNo ratings yet

- Prescient Messages About Indian Companies Circulate in WhatsApp Groups - The Economic TimesDocument4 pagesPrescient Messages About Indian Companies Circulate in WhatsApp Groups - The Economic TimesAnupNo ratings yet