Professional Documents

Culture Documents

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Uploaded by

Sze Sze LiCopyright:

Available Formats

You might also like

- Fin 550 Milestone 2Document6 pagesFin 550 Milestone 2writer topNo ratings yet

- RA PSPCL Question PaperDocument27 pagesRA PSPCL Question Paperankur sehgal100% (1)

- Dani Rodrik 2007Document25 pagesDani Rodrik 2007sawingbahar100% (1)

- Bridgewater Daily ObservationsDocument11 pagesBridgewater Daily ObservationsSoren K. GroupNo ratings yet

- Shares and DividendsDocument4 pagesShares and Dividendsricha_saini1953% (17)

- MetabicalDocument5 pagesMetabicalAsri Marwa UmniatiNo ratings yet

- Deutsche Bank - Maximum Containment, Social Distancing and The Economics of Stoppage 12 Unexpected Market and Economic Themes Defining 2020Document88 pagesDeutsche Bank - Maximum Containment, Social Distancing and The Economics of Stoppage 12 Unexpected Market and Economic Themes Defining 2020AryttNo ratings yet

- Better Markets - Cost of The CrisisDocument116 pagesBetter Markets - Cost of The Crisisrichardck61No ratings yet

- UBS Global Real Estate Bubble IndexDocument24 pagesUBS Global Real Estate Bubble IndexKiva DangNo ratings yet

- Global Economy Watch: Predictions For 2020: "Slowbalisation" Is The New GlobalisationDocument3 pagesGlobal Economy Watch: Predictions For 2020: "Slowbalisation" Is The New Globalisationullash prasadNo ratings yet

- Shemitah Collapse WebDocument27 pagesShemitah Collapse WebanisdangasNo ratings yet

- Third Wave of Glob.Document10 pagesThird Wave of Glob.františek lacinaNo ratings yet

- Dow Nasdaq S&P 500: Stocks/Gold ComparisonDocument5 pagesDow Nasdaq S&P 500: Stocks/Gold ComparisonAlbert L. PeiaNo ratings yet

- Preview Chartbook in Gold We Trust Report 2021Document88 pagesPreview Chartbook in Gold We Trust Report 2021TFMetalsNo ratings yet

- q4 Global Forecast ReportDocument8 pagesq4 Global Forecast ReportElysia M. AbainNo ratings yet

- Reflections: Every Economist's Career Ends in Failure - The Irony of Hyman MinskyDocument8 pagesReflections: Every Economist's Career Ends in Failure - The Irony of Hyman MinskyKKNo ratings yet

- Slides Chapter1 Global ImbalancesDocument52 pagesSlides Chapter1 Global ImbalancesLiu ChengNo ratings yet

- Economic Update and Challenges - EDHIE 2018 CBF BIDocument40 pagesEconomic Update and Challenges - EDHIE 2018 CBF BIAdityaBayuNo ratings yet

- Dow Nasdaq SP 500: Stocks/Gold ComparisonDocument5 pagesDow Nasdaq SP 500: Stocks/Gold ComparisonAlbert L. PeiaNo ratings yet

- Words From The Wise Jack Bogle On Building A Better Investment IndustryDocument32 pagesWords From The Wise Jack Bogle On Building A Better Investment IndustryRichard DennisNo ratings yet

- Crisi Finanziaria, Crisi Del Debito Sovrano e Guerra ValutariaDocument46 pagesCrisi Finanziaria, Crisi Del Debito Sovrano e Guerra Valutariamofir5306No ratings yet

- Globalization and Growth in Recent ResearchDocument12 pagesGlobalization and Growth in Recent Researchdoraemon4342rNo ratings yet

- Globalization Isn't Dead. But It's Changing. - WSJDocument10 pagesGlobalization Isn't Dead. But It's Changing. - WSJLung Ngok FUNGNo ratings yet

- g38n12d VariantPerceptionDocument2 pagesg38n12d VariantPerceptionVariant Perception ResearchNo ratings yet

- de Globalization Is A MythDocument6 pagesde Globalization Is A MythacayiplanNo ratings yet

- 022 Article A008 enDocument4 pages022 Article A008 enIbrahim AbidNo ratings yet

- WTO Success - No Trade Agreement But No Trade War - VOX, CEPR Policy Portal PDFDocument3 pagesWTO Success - No Trade Agreement But No Trade War - VOX, CEPR Policy Portal PDFTanatsiwa DambuzaNo ratings yet

- Trade DeficitDocument28 pagesTrade DeficitShaqena ZamriNo ratings yet

- February 102010 PostsDocument3 pagesFebruary 102010 PostsAlbert L. PeiaNo ratings yet

- WPS5316 (1) - Part-5Document6 pagesWPS5316 (1) - Part-5Enzo van der SluijsNo ratings yet

- Lajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverDocument5 pagesLajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverAlbert L. PeiaNo ratings yet

- February 162010 PostsDocument7 pagesFebruary 162010 PostsAlbert L. PeiaNo ratings yet

- The Next Decade - A Less Global GlobeDocument6 pagesThe Next Decade - A Less Global Globeramachandra rao sambangiNo ratings yet

- More Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Document5 pagesMore Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Albert L. PeiaNo ratings yet

- International Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesDocument74 pagesInternational Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesM Kaderi KibriaNo ratings yet

- Emerging Markets Economic Outlook Differentiation Across The RegionsDocument6 pagesEmerging Markets Economic Outlook Differentiation Across The RegionsFlametreeNo ratings yet

- Slides Chapter8 Capital MobilityDocument54 pagesSlides Chapter8 Capital MobilityLiu ChengNo ratings yet

- G20 Riot ReportDocument5 pagesG20 Riot ReportRaheela KhawajaNo ratings yet

- Market View and Outlook Post Unlock 1.0 - 020620Document4 pagesMarket View and Outlook Post Unlock 1.0 - 020620Ayush PandeyNo ratings yet

- The Weekly Bottom Line - Jan 16 2009Document9 pagesThe Weekly Bottom Line - Jan 16 2009International Business TimesNo ratings yet

- Willcocks 2021b Chapter 1 PDFDocument20 pagesWillcocks 2021b Chapter 1 PDFMarc SeignarbieuxNo ratings yet

- Weather and Economics: Why The Trends Favor Emerging MarketsDocument5 pagesWeather and Economics: Why The Trends Favor Emerging MarketsAlbert L. PeiaNo ratings yet

- WSJ Globalization Isnrt Dead. But Itrs Changing. - WSJDocument10 pagesWSJ Globalization Isnrt Dead. But Itrs Changing. - WSJTülay YildizNo ratings yet

- Household Debt-The Final Stage in An Artificially Extended Ponzi BubbleDocument15 pagesHousehold Debt-The Final Stage in An Artificially Extended Ponzi BubbleJohn GaudinoNo ratings yet

- Jaimini Bhagwati - Double Dip Recession 2010Document3 pagesJaimini Bhagwati - Double Dip Recession 20103bandhuNo ratings yet

- ECOS 3010 Assignment 1Document6 pagesECOS 3010 Assignment 1Shaggy Hobboo KatakataNo ratings yet

- Week 10 - The Consequences of The CrisisDocument4 pagesWeek 10 - The Consequences of The CrisisBibiane NjiakinNo ratings yet

- InglesDocument9 pagesInglesLuna DNo ratings yet

- Sell / Take Profits!: Double Dip in Action: - 2% U.S. GDP in Q3Document17 pagesSell / Take Profits!: Double Dip in Action: - 2% U.S. GDP in Q3Albert L. PeiaNo ratings yet

- What Forces Drive International Trade, Finance, and The External Deficit?Document16 pagesWhat Forces Drive International Trade, Finance, and The External Deficit?Stephen RoxasNo ratings yet

- Food Stamps Set Ever-Higher Record-32.8 Million People... 8.4 Million Jobs Lost in RecessionDocument9 pagesFood Stamps Set Ever-Higher Record-32.8 Million People... 8.4 Million Jobs Lost in RecessionAlbert L. PeiaNo ratings yet

- Euro Zone Debt Worries Sink Dow Below 10,000 (Reuters) : Sell / Take Profits While You Can Since Much, Much Worse To Come!Document13 pagesEuro Zone Debt Worries Sink Dow Below 10,000 (Reuters) : Sell / Take Profits While You Can Since Much, Much Worse To Come!Albert L. PeiaNo ratings yet

- Macro - Plateau, Break, Rebound, Then PurgatoryDocument13 pagesMacro - Plateau, Break, Rebound, Then PurgatoryResearchtimeNo ratings yet

- Liberty Newspost Sept-20-10Document88 pagesLiberty Newspost Sept-20-10anon_177682No ratings yet

- Eng MBFDocument33 pagesEng MBFgnimmadabo123No ratings yet

- Q2 Full Report 2020 PDFDocument24 pagesQ2 Full Report 2020 PDFhamefNo ratings yet

- Global-Economic-Prospects-June-2021-High Trade CostsDocument26 pagesGlobal-Economic-Prospects-June-2021-High Trade CostsRonanNo ratings yet

- 2023-10-03-What Happened To The Recession-EnDocument4 pages2023-10-03-What Happened To The Recession-EnstieberinspirujNo ratings yet

- 2020 Housing Market ForecastDocument109 pages2020 Housing Market ForecastC.A.R. Research & Economics100% (5)

- 11.++monetary Political+Union+v2Document21 pages11.++monetary Political+Union+v2Mira LandesmanNo ratings yet

- 16.8% Annual?: Stocks Rally Riiiiight!Document5 pages16.8% Annual?: Stocks Rally Riiiiight!Albert L. PeiaNo ratings yet

- If The Chinese Bubble Bursts : Who Globally Would Be Most Affected?Document17 pagesIf The Chinese Bubble Bursts : Who Globally Would Be Most Affected?Otavio FakhouryNo ratings yet

- PGIM Reuters A New Era Deglobalization To Regionalization 032023Document25 pagesPGIM Reuters A New Era Deglobalization To Regionalization 032023qixin chenNo ratings yet

- Bubbles, Booms, and Busts: The Rise and Fall of Financial AssetsFrom EverandBubbles, Booms, and Busts: The Rise and Fall of Financial AssetsNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Body and HealthDocument2 pagesBody and HealthSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Reading Chinese ScriptDocument1 pageReading Chinese ScriptSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Musical Phrase BoundariesDocument9 pagesMusical Phrase BoundariesSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Dyslexia HeterogeneityDocument17 pagesDyslexia HeterogeneitySze Sze LiNo ratings yet

- New Paradigms of The 2020S: Exhibit 1: Bofaml Transforming World: 2010S vs. 2020SDocument1 pageNew Paradigms of The 2020S: Exhibit 1: Bofaml Transforming World: 2010S vs. 2020SSze Sze LiNo ratings yet

- Smartkarma Special Report Editors PicksDocument234 pagesSmartkarma Special Report Editors PicksSze Sze LiNo ratings yet

- U.S. Views of China Increasingly Negative Amid Coronavirus OutbreakDocument25 pagesU.S. Views of China Increasingly Negative Amid Coronavirus OutbreakSze Sze LiNo ratings yet

- Importance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNDocument8 pagesImportance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNmehedeeNo ratings yet

- Accounting For Intangible AssetsDocument47 pagesAccounting For Intangible AssetsMarriel Fate CullanoNo ratings yet

- Quick Notes PEZADocument8 pagesQuick Notes PEZAVic FabeNo ratings yet

- Fintech in IndiaDocument39 pagesFintech in IndiaKunwarbir Singh lohat100% (2)

- Handbook - Handbook of Industrial Organization VOL IIDocument605 pagesHandbook - Handbook of Industrial Organization VOL IIraimissonejescNo ratings yet

- Commercial Bank Management PDFDocument42 pagesCommercial Bank Management PDFaparajita promaNo ratings yet

- Incentive QualificationDocument4 pagesIncentive QualificationMani Kumar SarvepalliNo ratings yet

- Session 4 (Global Marketing)Document30 pagesSession 4 (Global Marketing)Hassan ShafiqNo ratings yet

- Research Proposal For Tyre Retreading Industry PDFDocument13 pagesResearch Proposal For Tyre Retreading Industry PDFBharat ChatrathNo ratings yet

- iGE AIESEC in - Job DescriptionsDocument26 pagesiGE AIESEC in - Job DescriptionsMargarita JiménezNo ratings yet

- Basic Accounting TutorialsDocument1 pageBasic Accounting TutorialsJasper Andrew AdjaraniNo ratings yet

- Network Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososDocument36 pagesNetwork Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososEduardo MoreiraNo ratings yet

- Auditing Theory Activity 2Document7 pagesAuditing Theory Activity 2Christian Arnel Jumpay LopezNo ratings yet

- ET Phones Home - Fundoo ProfessorDocument1 pageET Phones Home - Fundoo ProfessorSubham JainNo ratings yet

- SHRM Action PlanDocument3 pagesSHRM Action PlanAvery Jan Magabanua SilosNo ratings yet

- WHO STOLE THE AMERICAN DREAM? (Random House, 2012) Academic FlyerDocument2 pagesWHO STOLE THE AMERICAN DREAM? (Random House, 2012) Academic FlyerRandomHouseAcademicNo ratings yet

- Introduction of FinanceDocument2 pagesIntroduction of FinanceWilsonNo ratings yet

- Financing Decision: Compiled By: RabachDocument14 pagesFinancing Decision: Compiled By: RabachRafael M. BachanichaNo ratings yet

- CIPFA Diploma in Contract Management 11 2019Document5 pagesCIPFA Diploma in Contract Management 11 2019kaafiNo ratings yet

- ECE8803 Syllabus Sp2015Document2 pagesECE8803 Syllabus Sp2015Saad MuftahNo ratings yet

- Cffinals PDFDocument82 pagesCffinals PDFsultaniiuNo ratings yet

- 2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleDocument2 pages2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleUdita KaushikNo ratings yet

- 2014 - Pharmaceuticals and Healthcare Q214 Round Up (BMI)Document33 pages2014 - Pharmaceuticals and Healthcare Q214 Round Up (BMI)SamNo ratings yet

- Chapter 9Document12 pagesChapter 9fatoumatta jaitehNo ratings yet

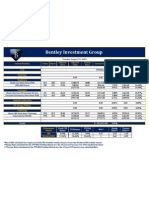

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperShehroze Ali JanNo ratings yet

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Uploaded by

Sze Sze LiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Theme 2020 - 1. Peak Globalization - The World Is Not Flat

Uploaded by

Sze Sze LiCopyright:

Available Formats

1.

Peak Globalization: the world is not flat

8

Summary: Unrestricted global flows of people, goods, and capital are no longer guaranteed, creating opportunities for smaller firms, local markets, and unloved real

Thematic Investing | 11 November 2019

assets.

Exhibit 7: Real assets at all-time lows vs. financial assets Exhibit 8: World Trade Uncertainty

Real Assets vs. Financial Assets (relative price)

1.00

War on

0.90 Inflation

GATT/ Bretton

0.80 Woods

0.70 Fall of Berlin

New Deal Wall

0.60

0.50

GFC

War on NAFTA China

0.40 Poverty WTO

Great

Depression 9/11

0.30

Peak

WWII Globalization

0.20 End of Bretton

Woods

0.10

'25 '30 '35 '40 '45 '50 '55 '60 '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 '15 '20

Source: BofA Merrill Lynch Global Investment Strategy, Global Financial Data, Bloomberg, USDA, Savills, Shiller, ONS, Spaenjers,

Source: International Monetary Fund, Knoema. *Higher index score denotes higher trade uncertainty based on country reports

Historic Auto Group. Note: Real Assets (Commodities, Real Estate, Collectibles), vs. Financials Assets (Large cap stocks, long-

term Govt bonds).

Exhibit 9: Themes, Trends and Strategy for Peak Globalization

Source: BofAML Global Research

Michael Hartnett Jared Woodard

BofAS BofAS

michael.hartnett@bofa.com jared.woodard@bofa.com

Tommy Ricketts

BofAS

tommy.ricketts@bofa.com

The following three sections are contributed by the BofAML Global Investment Strategy

Team.

The world is not flat

Proponents of globalization argue that high inflation in the 1970s was corrected by

removing barriers to capital (deregulation, open capital accounts, fall of the Berlin

Wall…). Those same changes are now under threat as societies grapple with inequality

and the heavy burden of social security, pensions and disinflation. The moment of “peak

globalization” is likely behind us. The 1981-2016 era of unchecked flow of goods, people

and capital is coming to an end, catalyzed by the widespread recognition that while

globalization has meant lower consumer prices, it has also meant slower growth,

precarious employment and social disruption. Signs the transition is already underway:

x People: after the fall of the Berlin Wall in 1989, there were 15 physical barriers

delineating international borders…now there are 77. Today the US is the only large

economy to grant unconditional birth right citizenship; other developed countries

have skilled or points-based immigration systems.

x Goods: the US/China trade war is only the first among many signs that the global

flow of goods is being renegotiated. Global trade growth in 2019 (+2.5%) is falling

below global GDP growth (2.7%) for the second time since the financial crisis, a rare

event outside of a recession (Exhibit 10). Bilateral trade battles (US/China,

Japan/Korea, US/UK) are replacing multilateral frameworks (NAFTA, TPP), and some

corporates are planning relocations of supply chains to regional allies. These

tectonic shifts will likely lead to greater macroeconomic volatility.

x Capital: from 1960-80 the US averaged a small trade surplus (0.3% GDP), since

then the average current account deficit has fallen to -2.5% of GDP. The obverse of

any trade deficit is a capital account surplus, which means countries running large

trade & budget surpluses (e.g. China, Germany, South Korea) continue to export

deflation to the US and other deficit economies. These persistent imbalances

generate stronger political will to weaken the US dollar and limit capital inflows, in

our view.

The transition to stronger local and regional economic ties is likely to accelerate as

recent elections (Trump, Brexit, Bolsonaro, Salvini, Orban) proved it is possible to

succeed politically while rejecting one or more aspects of globalization.

Thematic Investing | 11 November 2019 9

Exhibit 10: World Trade vs GDP growth Exhibit 11: US duties collected as a % of total imports

30

US duties collected, % of

total imports

25

Smoot-Hawley 1930

20

15

GATT

1947 Trump*

10 2018

WTO

1995

5

0

1891190019091918192719361945195419631972198119901999200820172026

Source: BofAML Global Research Investment Strategy

Source: BofA Merrill Lynch Global Investment Strategy, U.S. International Trade Commission

The start of history

The disruption of the flow of goods, people and capital will have profound implications for

global supply chains, labor markets, interest rates, and corporate earnings over the next

decade. Initially, it will mean rising costs of business as big regional powers attempt to

dominate local geography and natural resources, and exercise tighter controls over currency

and financial markets. Subsequently, we expect this rebalancing will raise productivity and

set the global economy on a path to higher, sustainable growth. In the deflationary 2010s

average global GDP growth fell from 3.9% to 3.6%, CPI in advanced economies dropped

from 4.4% to 3.4%, and ex-US equities the best-performing assets globally were JGBs and

European corporate and government bonds. The 2020s will likely mean higher growth, higher

inflation, higher interest rates, and outperformance by global equities and commodities vs

bonds. Key catalysts for this shift:

Geopolitical infrastructure spending will accelerate as countries expand their

influence. Trade wars in the early 2020s may quickly give way to competitive

investment cycles. The US/China conflict over trade and security will continue, whatever

the outcome of any short-term negotiations: military spending is forecast to rise

substantially in the coming decades to US$4.2tn in China and US$2.9tn in the US. By

2027 China’s US$1.3tn One Belt, One Road initiative will span 65 countries, accounting

for almost one-third of global GDP and two-thirds of the world population. Russia is

spending a tenth of its investment budget on the Arctic “Polar Silk Road”, and the on-

going 5G rollout will accelerate (US$77bn revenue opportunity).

Countries will develop explicit national industrial policies and boost spending on

R&D to foster local innovation, protect nascent industries, and shield national

champions from hostile foreign takeovers, e.g. the 2019 German proposals to increase

its European manufacturing share by 1.8%, and the Japanese plan to limit foreign

ownership in security-sensitive companies from 10% to just 1%.

Ageing demographics will force states either to pursue aggressive pro-nationalist

policies or to compete for highly trained labor in the context of tight immigration policy,

e.g. bipartisan US support now for family leave policies, Japan now offering visas to

attract 250k foreign workers.

Open capital accounts will likely be the last domino to fall. Every trade deficit has

an equal and offsetting capital surplus and we expect developed countries will learn

that: (1) “capital controls are good and easy to use” (easier than tariffs, anyway); and (2)

blocking the inflow of risk-averse savings is necessary for economic sustainability and

trade stability. The financial “opening-up” of China and other EMs may prove too late as

the risks from “hot money” flows prove greater than the benefits of access to foreign

capital, while awareness rises in developed countries of problems caused by the global

10 Thematic Investing | 11 November 2019

savings glut; e.g. US Senate bills to tax capital inflows and to prohibit public pensions

from buying Chinese equities, Canadian plan to tax foreign housing speculation.

Exhibit 12: US vs China trade balance and Treasury Holdings

Source: BofAML Global Research Investment Strategy

Investment: think locally, act globally

Globalization has rewarded financial assets at the expense of real assets, and has

pushed companies toward domestic services vs exported goods and profit maximization

vs economic productivity. Our top investment ideas focus on the reversal of these

trends:

Long real assets vs financial assets: own assets that benefit from higher growth and

inflation, e.g. commodities, farmland, real estate, collectibles, and precious metals.

Long infrastructure and defense: as national security and economic sovereignty

dominate policy, own aerospace and defense, energy and water, plus infrastructure.

Long small cap vs large, value vs growth: asset-light growth stocks will likely

underperform as national industrial policies and import substitution incentivize higher

operating leverage, investment in fixed assets, and higher returns to labor…all features

of small-cap and cyclical value sectors e.g. industrials, resources and financials rather

than tech and healthcare.

Long FX and rates volatility: bond volatility has already started to rise (MOVE jumped

from 40 to 90 in 2019) and is expected to increase to 150 in coming years with a rising

risk of competitive FX devaluations, aggressive fiscal expansion, and more restrictions

to capital flows.

Thematic Investing | 11 November 2019 11

You might also like

- Fin 550 Milestone 2Document6 pagesFin 550 Milestone 2writer topNo ratings yet

- RA PSPCL Question PaperDocument27 pagesRA PSPCL Question Paperankur sehgal100% (1)

- Dani Rodrik 2007Document25 pagesDani Rodrik 2007sawingbahar100% (1)

- Bridgewater Daily ObservationsDocument11 pagesBridgewater Daily ObservationsSoren K. GroupNo ratings yet

- Shares and DividendsDocument4 pagesShares and Dividendsricha_saini1953% (17)

- MetabicalDocument5 pagesMetabicalAsri Marwa UmniatiNo ratings yet

- Deutsche Bank - Maximum Containment, Social Distancing and The Economics of Stoppage 12 Unexpected Market and Economic Themes Defining 2020Document88 pagesDeutsche Bank - Maximum Containment, Social Distancing and The Economics of Stoppage 12 Unexpected Market and Economic Themes Defining 2020AryttNo ratings yet

- Better Markets - Cost of The CrisisDocument116 pagesBetter Markets - Cost of The Crisisrichardck61No ratings yet

- UBS Global Real Estate Bubble IndexDocument24 pagesUBS Global Real Estate Bubble IndexKiva DangNo ratings yet

- Global Economy Watch: Predictions For 2020: "Slowbalisation" Is The New GlobalisationDocument3 pagesGlobal Economy Watch: Predictions For 2020: "Slowbalisation" Is The New Globalisationullash prasadNo ratings yet

- Shemitah Collapse WebDocument27 pagesShemitah Collapse WebanisdangasNo ratings yet

- Third Wave of Glob.Document10 pagesThird Wave of Glob.františek lacinaNo ratings yet

- Dow Nasdaq S&P 500: Stocks/Gold ComparisonDocument5 pagesDow Nasdaq S&P 500: Stocks/Gold ComparisonAlbert L. PeiaNo ratings yet

- Preview Chartbook in Gold We Trust Report 2021Document88 pagesPreview Chartbook in Gold We Trust Report 2021TFMetalsNo ratings yet

- q4 Global Forecast ReportDocument8 pagesq4 Global Forecast ReportElysia M. AbainNo ratings yet

- Reflections: Every Economist's Career Ends in Failure - The Irony of Hyman MinskyDocument8 pagesReflections: Every Economist's Career Ends in Failure - The Irony of Hyman MinskyKKNo ratings yet

- Slides Chapter1 Global ImbalancesDocument52 pagesSlides Chapter1 Global ImbalancesLiu ChengNo ratings yet

- Economic Update and Challenges - EDHIE 2018 CBF BIDocument40 pagesEconomic Update and Challenges - EDHIE 2018 CBF BIAdityaBayuNo ratings yet

- Dow Nasdaq SP 500: Stocks/Gold ComparisonDocument5 pagesDow Nasdaq SP 500: Stocks/Gold ComparisonAlbert L. PeiaNo ratings yet

- Words From The Wise Jack Bogle On Building A Better Investment IndustryDocument32 pagesWords From The Wise Jack Bogle On Building A Better Investment IndustryRichard DennisNo ratings yet

- Crisi Finanziaria, Crisi Del Debito Sovrano e Guerra ValutariaDocument46 pagesCrisi Finanziaria, Crisi Del Debito Sovrano e Guerra Valutariamofir5306No ratings yet

- Globalization and Growth in Recent ResearchDocument12 pagesGlobalization and Growth in Recent Researchdoraemon4342rNo ratings yet

- Globalization Isn't Dead. But It's Changing. - WSJDocument10 pagesGlobalization Isn't Dead. But It's Changing. - WSJLung Ngok FUNGNo ratings yet

- g38n12d VariantPerceptionDocument2 pagesg38n12d VariantPerceptionVariant Perception ResearchNo ratings yet

- de Globalization Is A MythDocument6 pagesde Globalization Is A MythacayiplanNo ratings yet

- 022 Article A008 enDocument4 pages022 Article A008 enIbrahim AbidNo ratings yet

- WTO Success - No Trade Agreement But No Trade War - VOX, CEPR Policy Portal PDFDocument3 pagesWTO Success - No Trade Agreement But No Trade War - VOX, CEPR Policy Portal PDFTanatsiwa DambuzaNo ratings yet

- Trade DeficitDocument28 pagesTrade DeficitShaqena ZamriNo ratings yet

- February 102010 PostsDocument3 pagesFebruary 102010 PostsAlbert L. PeiaNo ratings yet

- WPS5316 (1) - Part-5Document6 pagesWPS5316 (1) - Part-5Enzo van der SluijsNo ratings yet

- Lajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverDocument5 pagesLajolla Bank Among 4 Closures: True Unemployment Figure Reveals Recession Far From OverAlbert L. PeiaNo ratings yet

- February 162010 PostsDocument7 pagesFebruary 162010 PostsAlbert L. PeiaNo ratings yet

- The Next Decade - A Less Global GlobeDocument6 pagesThe Next Decade - A Less Global Globeramachandra rao sambangiNo ratings yet

- More Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Document5 pagesMore Spin, Merger Bubble Activity Helps Lift Stocks For 3rd Day (AP)Albert L. PeiaNo ratings yet

- International Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesDocument74 pagesInternational Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesM Kaderi KibriaNo ratings yet

- Emerging Markets Economic Outlook Differentiation Across The RegionsDocument6 pagesEmerging Markets Economic Outlook Differentiation Across The RegionsFlametreeNo ratings yet

- Slides Chapter8 Capital MobilityDocument54 pagesSlides Chapter8 Capital MobilityLiu ChengNo ratings yet

- G20 Riot ReportDocument5 pagesG20 Riot ReportRaheela KhawajaNo ratings yet

- Market View and Outlook Post Unlock 1.0 - 020620Document4 pagesMarket View and Outlook Post Unlock 1.0 - 020620Ayush PandeyNo ratings yet

- The Weekly Bottom Line - Jan 16 2009Document9 pagesThe Weekly Bottom Line - Jan 16 2009International Business TimesNo ratings yet

- Willcocks 2021b Chapter 1 PDFDocument20 pagesWillcocks 2021b Chapter 1 PDFMarc SeignarbieuxNo ratings yet

- Weather and Economics: Why The Trends Favor Emerging MarketsDocument5 pagesWeather and Economics: Why The Trends Favor Emerging MarketsAlbert L. PeiaNo ratings yet

- WSJ Globalization Isnrt Dead. But Itrs Changing. - WSJDocument10 pagesWSJ Globalization Isnrt Dead. But Itrs Changing. - WSJTülay YildizNo ratings yet

- Household Debt-The Final Stage in An Artificially Extended Ponzi BubbleDocument15 pagesHousehold Debt-The Final Stage in An Artificially Extended Ponzi BubbleJohn GaudinoNo ratings yet

- Jaimini Bhagwati - Double Dip Recession 2010Document3 pagesJaimini Bhagwati - Double Dip Recession 20103bandhuNo ratings yet

- ECOS 3010 Assignment 1Document6 pagesECOS 3010 Assignment 1Shaggy Hobboo KatakataNo ratings yet

- Week 10 - The Consequences of The CrisisDocument4 pagesWeek 10 - The Consequences of The CrisisBibiane NjiakinNo ratings yet

- InglesDocument9 pagesInglesLuna DNo ratings yet

- Sell / Take Profits!: Double Dip in Action: - 2% U.S. GDP in Q3Document17 pagesSell / Take Profits!: Double Dip in Action: - 2% U.S. GDP in Q3Albert L. PeiaNo ratings yet

- What Forces Drive International Trade, Finance, and The External Deficit?Document16 pagesWhat Forces Drive International Trade, Finance, and The External Deficit?Stephen RoxasNo ratings yet

- Food Stamps Set Ever-Higher Record-32.8 Million People... 8.4 Million Jobs Lost in RecessionDocument9 pagesFood Stamps Set Ever-Higher Record-32.8 Million People... 8.4 Million Jobs Lost in RecessionAlbert L. PeiaNo ratings yet

- Euro Zone Debt Worries Sink Dow Below 10,000 (Reuters) : Sell / Take Profits While You Can Since Much, Much Worse To Come!Document13 pagesEuro Zone Debt Worries Sink Dow Below 10,000 (Reuters) : Sell / Take Profits While You Can Since Much, Much Worse To Come!Albert L. PeiaNo ratings yet

- Macro - Plateau, Break, Rebound, Then PurgatoryDocument13 pagesMacro - Plateau, Break, Rebound, Then PurgatoryResearchtimeNo ratings yet

- Liberty Newspost Sept-20-10Document88 pagesLiberty Newspost Sept-20-10anon_177682No ratings yet

- Eng MBFDocument33 pagesEng MBFgnimmadabo123No ratings yet

- Q2 Full Report 2020 PDFDocument24 pagesQ2 Full Report 2020 PDFhamefNo ratings yet

- Global-Economic-Prospects-June-2021-High Trade CostsDocument26 pagesGlobal-Economic-Prospects-June-2021-High Trade CostsRonanNo ratings yet

- 2023-10-03-What Happened To The Recession-EnDocument4 pages2023-10-03-What Happened To The Recession-EnstieberinspirujNo ratings yet

- 2020 Housing Market ForecastDocument109 pages2020 Housing Market ForecastC.A.R. Research & Economics100% (5)

- 11.++monetary Political+Union+v2Document21 pages11.++monetary Political+Union+v2Mira LandesmanNo ratings yet

- 16.8% Annual?: Stocks Rally Riiiiight!Document5 pages16.8% Annual?: Stocks Rally Riiiiight!Albert L. PeiaNo ratings yet

- If The Chinese Bubble Bursts : Who Globally Would Be Most Affected?Document17 pagesIf The Chinese Bubble Bursts : Who Globally Would Be Most Affected?Otavio FakhouryNo ratings yet

- PGIM Reuters A New Era Deglobalization To Regionalization 032023Document25 pagesPGIM Reuters A New Era Deglobalization To Regionalization 032023qixin chenNo ratings yet

- Bubbles, Booms, and Busts: The Rise and Fall of Financial AssetsFrom EverandBubbles, Booms, and Busts: The Rise and Fall of Financial AssetsNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Body and HealthDocument2 pagesBody and HealthSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Reading Chinese ScriptDocument1 pageReading Chinese ScriptSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Musical Phrase BoundariesDocument9 pagesMusical Phrase BoundariesSze Sze LiNo ratings yet

- Technology Predictions For 2025Document1 pageTechnology Predictions For 2025Sze Sze LiNo ratings yet

- Dyslexia HeterogeneityDocument17 pagesDyslexia HeterogeneitySze Sze LiNo ratings yet

- New Paradigms of The 2020S: Exhibit 1: Bofaml Transforming World: 2010S vs. 2020SDocument1 pageNew Paradigms of The 2020S: Exhibit 1: Bofaml Transforming World: 2010S vs. 2020SSze Sze LiNo ratings yet

- Smartkarma Special Report Editors PicksDocument234 pagesSmartkarma Special Report Editors PicksSze Sze LiNo ratings yet

- U.S. Views of China Increasingly Negative Amid Coronavirus OutbreakDocument25 pagesU.S. Views of China Increasingly Negative Amid Coronavirus OutbreakSze Sze LiNo ratings yet

- Importance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNDocument8 pagesImportance of Strategic Management in Business: Yakup DURMAZ and Zeynep Derya DÜŞÜNmehedeeNo ratings yet

- Accounting For Intangible AssetsDocument47 pagesAccounting For Intangible AssetsMarriel Fate CullanoNo ratings yet

- Quick Notes PEZADocument8 pagesQuick Notes PEZAVic FabeNo ratings yet

- Fintech in IndiaDocument39 pagesFintech in IndiaKunwarbir Singh lohat100% (2)

- Handbook - Handbook of Industrial Organization VOL IIDocument605 pagesHandbook - Handbook of Industrial Organization VOL IIraimissonejescNo ratings yet

- Commercial Bank Management PDFDocument42 pagesCommercial Bank Management PDFaparajita promaNo ratings yet

- Incentive QualificationDocument4 pagesIncentive QualificationMani Kumar SarvepalliNo ratings yet

- Session 4 (Global Marketing)Document30 pagesSession 4 (Global Marketing)Hassan ShafiqNo ratings yet

- Research Proposal For Tyre Retreading Industry PDFDocument13 pagesResearch Proposal For Tyre Retreading Industry PDFBharat ChatrathNo ratings yet

- iGE AIESEC in - Job DescriptionsDocument26 pagesiGE AIESEC in - Job DescriptionsMargarita JiménezNo ratings yet

- Basic Accounting TutorialsDocument1 pageBasic Accounting TutorialsJasper Andrew AdjaraniNo ratings yet

- Network Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososDocument36 pagesNetwork Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososEduardo MoreiraNo ratings yet

- Auditing Theory Activity 2Document7 pagesAuditing Theory Activity 2Christian Arnel Jumpay LopezNo ratings yet

- ET Phones Home - Fundoo ProfessorDocument1 pageET Phones Home - Fundoo ProfessorSubham JainNo ratings yet

- SHRM Action PlanDocument3 pagesSHRM Action PlanAvery Jan Magabanua SilosNo ratings yet

- WHO STOLE THE AMERICAN DREAM? (Random House, 2012) Academic FlyerDocument2 pagesWHO STOLE THE AMERICAN DREAM? (Random House, 2012) Academic FlyerRandomHouseAcademicNo ratings yet

- Introduction of FinanceDocument2 pagesIntroduction of FinanceWilsonNo ratings yet

- Financing Decision: Compiled By: RabachDocument14 pagesFinancing Decision: Compiled By: RabachRafael M. BachanichaNo ratings yet

- CIPFA Diploma in Contract Management 11 2019Document5 pagesCIPFA Diploma in Contract Management 11 2019kaafiNo ratings yet

- ECE8803 Syllabus Sp2015Document2 pagesECE8803 Syllabus Sp2015Saad MuftahNo ratings yet

- Cffinals PDFDocument82 pagesCffinals PDFsultaniiuNo ratings yet

- 2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleDocument2 pages2) Financial Problems: 2.1) Lack of Shareholder Approval For SaleUdita KaushikNo ratings yet

- 2014 - Pharmaceuticals and Healthcare Q214 Round Up (BMI)Document33 pages2014 - Pharmaceuticals and Healthcare Q214 Round Up (BMI)SamNo ratings yet

- Chapter 9Document12 pagesChapter 9fatoumatta jaitehNo ratings yet

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperShehroze Ali JanNo ratings yet