Professional Documents

Culture Documents

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Uploaded by

rishiCR78Copyright:

Available Formats

You might also like

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- E MythDocument1 pageE MythJoe Dager100% (2)

- Investment Journey and Key Learnings Kumar SaurabhDocument7 pagesInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNo ratings yet

- TMV Solved ProblemDocument27 pagesTMV Solved ProblemIdrisNo ratings yet

- L 3 Ss 12 Los 25Document12 pagesL 3 Ss 12 Los 25pier AcostaNo ratings yet

- Alpha or Assets? - Factor Alpha vs. Smart BetaDocument12 pagesAlpha or Assets? - Factor Alpha vs. Smart Betakishore13No ratings yet

- Excess Earnings Time To GoDocument5 pagesExcess Earnings Time To GoAyan NoorNo ratings yet

- Process Flow - Investment & Deposits: Start Accounting - Post TheDocument1 pageProcess Flow - Investment & Deposits: Start Accounting - Post TheFharook SyedNo ratings yet

- Comparable Company Transaction AnalysisDocument31 pagesComparable Company Transaction Analysismisha bansalNo ratings yet

- StepStone House ViewDocument29 pagesStepStone House ViewKunal KatariaNo ratings yet

- Reading Material-Relative ValuationDocument4 pagesReading Material-Relative ValuationDheia BinoyaNo ratings yet

- Alternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwiriDocument13 pagesAlternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwirijayRNo ratings yet

- Feasibility Study: Investment Take A DecisionDocument11 pagesFeasibility Study: Investment Take A Decisionمصعب سليمNo ratings yet

- PAINEL 1 - Transfer Pricing & IntangiblesDocument20 pagesPAINEL 1 - Transfer Pricing & Intangiblesedson souzaNo ratings yet

- Axis Business Cycle Fund NFO-LEAFLETDocument2 pagesAxis Business Cycle Fund NFO-LEAFLETamarnathb2001No ratings yet

- Presentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of FundDocument32 pagesPresentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of Fundlatest badlaNo ratings yet

- Wa0020.Document9 pagesWa0020.arya aryaNo ratings yet

- Is Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long VersionDocument12 pagesIs Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long Versionsakron100% (1)

- Financial Comparisons Handbook 1718237520Document13 pagesFinancial Comparisons Handbook 1718237520WILLNo ratings yet

- Axis Nifty 100 Index Fund - NFODocument12 pagesAxis Nifty 100 Index Fund - NFOhammarworldNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument15 pagesInvesting and Financing Decisions and The Balance SheetgeorgeredaNo ratings yet

- The Organization of The Firm Transaction Costs Variations On Asset SpecificityDocument11 pagesThe Organization of The Firm Transaction Costs Variations On Asset Specificitychizz popcornnNo ratings yet

- Strategic Planning 6aDocument1 pageStrategic Planning 6aBaher WilliamNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Section - 1 - AnalyzeDocument10 pagesSection - 1 - AnalyzemoorthyNo ratings yet

- Course OutlineDocument2 pagesCourse OutlineJawad BashirNo ratings yet

- Management ProjectDocument21 pagesManagement ProjectShivam KapoorNo ratings yet

- Dividend Decision Class NotesDocument18 pagesDividend Decision Class NotesSphamandla MakalimaNo ratings yet

- Investments For Accounting SummaryDocument2 pagesInvestments For Accounting SummarymyzevelNo ratings yet

- ResearchReport RecosDocument3 pagesResearchReport Recoskapil vaishnavNo ratings yet

- Chapter 3 Summary of Bussiness Valuation Approaches PDFDocument4 pagesChapter 3 Summary of Bussiness Valuation Approaches PDFAliux CuhzNo ratings yet

- User Guide I-Invest (Web Version)Document81 pagesUser Guide I-Invest (Web Version)Ronald LeeNo ratings yet

- Research MethodologyDocument3 pagesResearch Methodologyrobin boseNo ratings yet

- Intangible AssetsDocument6 pagesIntangible AssetsChris tine Mae MendozaNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- PitchBook Fundraising Guide For StartupsDocument13 pagesPitchBook Fundraising Guide For StartupsBobby QuintosNo ratings yet

- 01 Investment ManagementDocument19 pages01 Investment ManagementSachin SinghNo ratings yet

- Slides For Chapters 8 and 9Document28 pagesSlides For Chapters 8 and 9Amit kumarNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- Accounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDocument2 pagesAccounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDING ZHONG JUNNo ratings yet

- Deloitte - Capex - Allocation-ManagementDocument17 pagesDeloitte - Capex - Allocation-ManagementRohitNo ratings yet

- Strategic Risk Management: Mapping The Commanding Heights and HazardsDocument19 pagesStrategic Risk Management: Mapping The Commanding Heights and HazardsHaVinhDuyNo ratings yet

- Igloa - Costs SpeasioDocument1 pageIgloa - Costs SpeasioSteve MedhurstNo ratings yet

- PM OverviewDocument15 pagesPM OverviewRajeev TripathiNo ratings yet

- IDXTalent Professional RecruitmentDocument12 pagesIDXTalent Professional RecruitmentmmiftachurrohmaNo ratings yet

- Corporate Risk ManagementDocument8 pagesCorporate Risk ManagementMontserrat DelgadoNo ratings yet

- Quant Tax PlanDocument2 pagesQuant Tax PlanGori BehenNo ratings yet

- Lecture 3.3 - SlidesDocument21 pagesLecture 3.3 - Slidessfalcao91No ratings yet

- Course OutlineDocument1 pageCourse OutlineNaumaanNo ratings yet

- Module - 1 NewDocument69 pagesModule - 1 NewSunitha JenaNo ratings yet

- Technical AnalysisDocument2 pagesTechnical AnalysistrishaNo ratings yet

- MLF BF 2021 - 2 Lecture 6 Initial Public Offerings (Lecture Version)Document39 pagesMLF BF 2021 - 2 Lecture 6 Initial Public Offerings (Lecture Version)Eusebio Olindo Lopez SamudioNo ratings yet

- Corporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDocument26 pagesCorporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDayana MasturaNo ratings yet

- Report WritingDocument17 pagesReport Writingkhanjawadkhan11225No ratings yet

- Invest India BrochureDocument16 pagesInvest India BrochurebakulhariaNo ratings yet

- Intangible AssetsDocument1 pageIntangible Assetsarmor.coverNo ratings yet

- RESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofDocument5 pagesRESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofsumonNo ratings yet

- Brochure - Investment Strategies Online - 08-07-2022 - V22Document14 pagesBrochure - Investment Strategies Online - 08-07-2022 - V22Κομμουνιστικο ΣχέδιοNo ratings yet

- Methods of Valuing IPDocument2 pagesMethods of Valuing IPjaysonNo ratings yet

- Guide To Core InvestingDocument16 pagesGuide To Core InvestingKevin BenderskyNo ratings yet

- A simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeFrom EverandA simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Poultry Meat Supply Chains in CameroonDocument17 pagesPoultry Meat Supply Chains in CameroonAyoniseh CarolNo ratings yet

- ICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleDocument22 pagesICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleNash A. Dugasan100% (3)

- 67 5 3 AccountancyDocument27 pages67 5 3 AccountancyDhanshitha RaviNo ratings yet

- Forensic+ MLDocument4 pagesForensic+ MLAlamin Rahman JuwelNo ratings yet

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyNo ratings yet

- Germany BranchDocument2 pagesGermany BranchparuNo ratings yet

- 5 jfc-11-2019-0147Document14 pages5 jfc-11-2019-0147Thiwanka GunasekaraNo ratings yet

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Document36 pagesTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNo ratings yet

- Industrial Policies and Incentives in NigeriaDocument11 pagesIndustrial Policies and Incentives in NigeriaAlima TazabekovaNo ratings yet

- Inventory SheetDocument1 pageInventory SheetSarah GoebelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)R SubbiahNo ratings yet

- Riph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Document2 pagesRiph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Eau Claire DomingoNo ratings yet

- Deloitte Au Risk Unlocking Sustainable Development Goals 250716Document4 pagesDeloitte Au Risk Unlocking Sustainable Development Goals 250716alberto dhammavirya100% (1)

- Lecture Notes - Capital Budgeting TechniquesDocument27 pagesLecture Notes - Capital Budgeting TechniquesHimanshu DuttaNo ratings yet

- Louis Vouitton in Japan, Ivey Case: January 2012Document9 pagesLouis Vouitton in Japan, Ivey Case: January 2012Asaf RajputNo ratings yet

- Corporate Law May 2019Document2 pagesCorporate Law May 2019sreehari dineshNo ratings yet

- Dip IFR 2020 June QuestionDocument11 pagesDip IFR 2020 June Questionluckyjulie567100% (2)

- Module 5 BankingDocument42 pagesModule 5 Bankingg.prasanna saiNo ratings yet

- Marketing Department of Parle: BiscuitsDocument5 pagesMarketing Department of Parle: BiscuitsradhikaNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- List of Index Funds in India 2024 Download ExcelDocument8 pagesList of Index Funds in India 2024 Download ExcelMana PlanetNo ratings yet

- A Survey On Islamic Economics and Finance Literatures Indexed by Scopus Q1 Via Thematic Analysis ApproachDocument16 pagesA Survey On Islamic Economics and Finance Literatures Indexed by Scopus Q1 Via Thematic Analysis ApproachsalmanNo ratings yet

- MM Is A Wholly-Owned Subsidiary of Injap Investments Inc., Which Also Owns 35% of Doubledragon Properties CorpDocument4 pagesMM Is A Wholly-Owned Subsidiary of Injap Investments Inc., Which Also Owns 35% of Doubledragon Properties CorpTrisha Mae Mendoza MacalinoNo ratings yet

- WK 4 SA Financial Market Shareholder AnalysisDocument7 pagesWK 4 SA Financial Market Shareholder AnalysisShirley HaynesNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- IFA s1 QDocument8 pagesIFA s1 QКсения НиколоваNo ratings yet

- Bombay Stock ExchangeDocument18 pagesBombay Stock Exchangethe crashNo ratings yet

- Consumer PPT ActivityDocument7 pagesConsumer PPT ActivityNachtKunokanjiruNo ratings yet

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Uploaded by

rishiCR78Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Investor - Job Map: Stages in Getting The Job Done Define Identify Entry Order Modify Exit Micro Jobs

Uploaded by

rishiCR78Copyright:

Available Formats

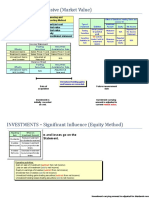

Investor - Job Map

Stages in getting the job done

Define Identify Entry Order Modify Exit

Micro Jobs Identify expected returns Find instruments that match Track the instruments for the Calculate position size Track investment Exit Position

investment hypothesis entry point for exit point

Form an investment hypthesis Eg. Analyse fundamentals of the Track market sentiment Determine price ( market/ Modify investment Calculate P/L

Choosing to invest in FMCG stocks instrument Eg. P/E ratios limit ) based on market

based on a new government law. behaviour

Gather instruments to track in a Track news about the instrument Determine stoploss Track news about Calculate Taxes

single place the investment.

Group instruments based on Determine order type Calculate

common attributes Brokerage

Check available funds

Painpoints Too much irrelevant information Search experience is very Watchlists are poorly organised. The order screen is too Categorization of P/L statement is

making it hard to choose. complicated complicated positions and confusing.

investments in

portfolio is

confusing.

Research reports have too much

extraneous information.

Needs Minimize the effort spent in finding Maximise the effectiveness of the Minimize the likelihood of missing Increase the confidence in Increase/Decrease Increase the insight

instruments to invest in. time spent in research out a good entry point. providing the right order the likelihood of gained regarding

details. benefitting/affected profits and charges

from favourable/

unfavourable

market movement

post investment.

Minimize the effort in staying

updated with market sentiment.

Trader - Job Map

Stages in getting the job done

Define Identify Entry Order Modify Exit

Micro Jobs Identify expected returns Find instruments that match Track the instruments for the Calculate position size Track investment Exit Position

investment hypothesis entry point for exit point

Identify the event/rationale to trade Analyse technicals of the Track market sentiment Determine price ( market/ Modify investment Calculate P/L

around instrument. limit ) based on market

behaviour

Gather instruments to track in a Track news about the instrument Determine stoploss Track news about Calculate Taxes

single place the investment.

Group instruments based on Check OI Determine order type Calculate

common attributes Brokerage

Compare different strike prices for Check available funds

options

Identify leverage offered Define time restriction

Painpoints Too much irrelevant information Search experience is very Watchlists are poorly organised. The order screen is too Categorization of P/L statement is

making it hard to choose. complicated complicated positions and confusing.

investments in

portfolio is

confusing.

Research reports have too much How much leverage is

extraneous information. being offered is not

communicated

Comparing OI of different strike

prices is difficult

Charts do not provide the right

kind of information.

Needs Increase the likelihood of identifying Maximise the effectiveness of the Minimize the likelihood of missing Increase the confidence in Increase/Decrease Increase the insight

instruments with higher leverage time spent in research out a good entry point. providing the right order the likelihood of gained regarding

details. benefitting/affected profits and charges

from favourable/

unfavourable

market movement

post investment.

Reduce the effort involved in Minimize the effort in staying

comparing different strike prices updated with market sentiment.

for the same underlying.

You might also like

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- E MythDocument1 pageE MythJoe Dager100% (2)

- Investment Journey and Key Learnings Kumar SaurabhDocument7 pagesInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNo ratings yet

- TMV Solved ProblemDocument27 pagesTMV Solved ProblemIdrisNo ratings yet

- L 3 Ss 12 Los 25Document12 pagesL 3 Ss 12 Los 25pier AcostaNo ratings yet

- Alpha or Assets? - Factor Alpha vs. Smart BetaDocument12 pagesAlpha or Assets? - Factor Alpha vs. Smart Betakishore13No ratings yet

- Excess Earnings Time To GoDocument5 pagesExcess Earnings Time To GoAyan NoorNo ratings yet

- Process Flow - Investment & Deposits: Start Accounting - Post TheDocument1 pageProcess Flow - Investment & Deposits: Start Accounting - Post TheFharook SyedNo ratings yet

- Comparable Company Transaction AnalysisDocument31 pagesComparable Company Transaction Analysismisha bansalNo ratings yet

- StepStone House ViewDocument29 pagesStepStone House ViewKunal KatariaNo ratings yet

- Reading Material-Relative ValuationDocument4 pagesReading Material-Relative ValuationDheia BinoyaNo ratings yet

- Alternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwiriDocument13 pagesAlternative Investments - Structures and Outlook 2021: By: F.A. Emlyn NgwirijayRNo ratings yet

- Feasibility Study: Investment Take A DecisionDocument11 pagesFeasibility Study: Investment Take A Decisionمصعب سليمNo ratings yet

- PAINEL 1 - Transfer Pricing & IntangiblesDocument20 pagesPAINEL 1 - Transfer Pricing & Intangiblesedson souzaNo ratings yet

- Axis Business Cycle Fund NFO-LEAFLETDocument2 pagesAxis Business Cycle Fund NFO-LEAFLETamarnathb2001No ratings yet

- Presentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of FundDocument32 pagesPresentation Mirae Asset Nifty Smallcap 250 Momentum Quality 100 Etf Fund of Fundlatest badlaNo ratings yet

- Wa0020.Document9 pagesWa0020.arya aryaNo ratings yet

- Is Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long VersionDocument12 pagesIs Your Private Company Return On Investment Adequate-How To Correctly Measure Adn Significantly Improve ROI - Long Versionsakron100% (1)

- Financial Comparisons Handbook 1718237520Document13 pagesFinancial Comparisons Handbook 1718237520WILLNo ratings yet

- Axis Nifty 100 Index Fund - NFODocument12 pagesAxis Nifty 100 Index Fund - NFOhammarworldNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument15 pagesInvesting and Financing Decisions and The Balance SheetgeorgeredaNo ratings yet

- The Organization of The Firm Transaction Costs Variations On Asset SpecificityDocument11 pagesThe Organization of The Firm Transaction Costs Variations On Asset Specificitychizz popcornnNo ratings yet

- Strategic Planning 6aDocument1 pageStrategic Planning 6aBaher WilliamNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Section - 1 - AnalyzeDocument10 pagesSection - 1 - AnalyzemoorthyNo ratings yet

- Course OutlineDocument2 pagesCourse OutlineJawad BashirNo ratings yet

- Management ProjectDocument21 pagesManagement ProjectShivam KapoorNo ratings yet

- Dividend Decision Class NotesDocument18 pagesDividend Decision Class NotesSphamandla MakalimaNo ratings yet

- Investments For Accounting SummaryDocument2 pagesInvestments For Accounting SummarymyzevelNo ratings yet

- ResearchReport RecosDocument3 pagesResearchReport Recoskapil vaishnavNo ratings yet

- Chapter 3 Summary of Bussiness Valuation Approaches PDFDocument4 pagesChapter 3 Summary of Bussiness Valuation Approaches PDFAliux CuhzNo ratings yet

- User Guide I-Invest (Web Version)Document81 pagesUser Guide I-Invest (Web Version)Ronald LeeNo ratings yet

- Research MethodologyDocument3 pagesResearch Methodologyrobin boseNo ratings yet

- Intangible AssetsDocument6 pagesIntangible AssetsChris tine Mae MendozaNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- PitchBook Fundraising Guide For StartupsDocument13 pagesPitchBook Fundraising Guide For StartupsBobby QuintosNo ratings yet

- 01 Investment ManagementDocument19 pages01 Investment ManagementSachin SinghNo ratings yet

- Slides For Chapters 8 and 9Document28 pagesSlides For Chapters 8 and 9Amit kumarNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- Accounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDocument2 pagesAccounting Environment Class Activity ACT3100 SEM I 2021-22 (1) SumbittedDING ZHONG JUNNo ratings yet

- Deloitte - Capex - Allocation-ManagementDocument17 pagesDeloitte - Capex - Allocation-ManagementRohitNo ratings yet

- Strategic Risk Management: Mapping The Commanding Heights and HazardsDocument19 pagesStrategic Risk Management: Mapping The Commanding Heights and HazardsHaVinhDuyNo ratings yet

- Igloa - Costs SpeasioDocument1 pageIgloa - Costs SpeasioSteve MedhurstNo ratings yet

- PM OverviewDocument15 pagesPM OverviewRajeev TripathiNo ratings yet

- IDXTalent Professional RecruitmentDocument12 pagesIDXTalent Professional RecruitmentmmiftachurrohmaNo ratings yet

- Corporate Risk ManagementDocument8 pagesCorporate Risk ManagementMontserrat DelgadoNo ratings yet

- Quant Tax PlanDocument2 pagesQuant Tax PlanGori BehenNo ratings yet

- Lecture 3.3 - SlidesDocument21 pagesLecture 3.3 - Slidessfalcao91No ratings yet

- Course OutlineDocument1 pageCourse OutlineNaumaanNo ratings yet

- Module - 1 NewDocument69 pagesModule - 1 NewSunitha JenaNo ratings yet

- Technical AnalysisDocument2 pagesTechnical AnalysistrishaNo ratings yet

- MLF BF 2021 - 2 Lecture 6 Initial Public Offerings (Lecture Version)Document39 pagesMLF BF 2021 - 2 Lecture 6 Initial Public Offerings (Lecture Version)Eusebio Olindo Lopez SamudioNo ratings yet

- Corporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDocument26 pagesCorporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDayana MasturaNo ratings yet

- Report WritingDocument17 pagesReport Writingkhanjawadkhan11225No ratings yet

- Invest India BrochureDocument16 pagesInvest India BrochurebakulhariaNo ratings yet

- Intangible AssetsDocument1 pageIntangible Assetsarmor.coverNo ratings yet

- RESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofDocument5 pagesRESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofsumonNo ratings yet

- Brochure - Investment Strategies Online - 08-07-2022 - V22Document14 pagesBrochure - Investment Strategies Online - 08-07-2022 - V22Κομμουνιστικο ΣχέδιοNo ratings yet

- Methods of Valuing IPDocument2 pagesMethods of Valuing IPjaysonNo ratings yet

- Guide To Core InvestingDocument16 pagesGuide To Core InvestingKevin BenderskyNo ratings yet

- A simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeFrom EverandA simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Poultry Meat Supply Chains in CameroonDocument17 pagesPoultry Meat Supply Chains in CameroonAyoniseh CarolNo ratings yet

- ICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleDocument22 pagesICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleNash A. Dugasan100% (3)

- 67 5 3 AccountancyDocument27 pages67 5 3 AccountancyDhanshitha RaviNo ratings yet

- Forensic+ MLDocument4 pagesForensic+ MLAlamin Rahman JuwelNo ratings yet

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyNo ratings yet

- Germany BranchDocument2 pagesGermany BranchparuNo ratings yet

- 5 jfc-11-2019-0147Document14 pages5 jfc-11-2019-0147Thiwanka GunasekaraNo ratings yet

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Document36 pagesTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNo ratings yet

- Industrial Policies and Incentives in NigeriaDocument11 pagesIndustrial Policies and Incentives in NigeriaAlima TazabekovaNo ratings yet

- Inventory SheetDocument1 pageInventory SheetSarah GoebelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)R SubbiahNo ratings yet

- Riph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Document2 pagesRiph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Eau Claire DomingoNo ratings yet

- Deloitte Au Risk Unlocking Sustainable Development Goals 250716Document4 pagesDeloitte Au Risk Unlocking Sustainable Development Goals 250716alberto dhammavirya100% (1)

- Lecture Notes - Capital Budgeting TechniquesDocument27 pagesLecture Notes - Capital Budgeting TechniquesHimanshu DuttaNo ratings yet

- Louis Vouitton in Japan, Ivey Case: January 2012Document9 pagesLouis Vouitton in Japan, Ivey Case: January 2012Asaf RajputNo ratings yet

- Corporate Law May 2019Document2 pagesCorporate Law May 2019sreehari dineshNo ratings yet

- Dip IFR 2020 June QuestionDocument11 pagesDip IFR 2020 June Questionluckyjulie567100% (2)

- Module 5 BankingDocument42 pagesModule 5 Bankingg.prasanna saiNo ratings yet

- Marketing Department of Parle: BiscuitsDocument5 pagesMarketing Department of Parle: BiscuitsradhikaNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- List of Index Funds in India 2024 Download ExcelDocument8 pagesList of Index Funds in India 2024 Download ExcelMana PlanetNo ratings yet

- A Survey On Islamic Economics and Finance Literatures Indexed by Scopus Q1 Via Thematic Analysis ApproachDocument16 pagesA Survey On Islamic Economics and Finance Literatures Indexed by Scopus Q1 Via Thematic Analysis ApproachsalmanNo ratings yet

- MM Is A Wholly-Owned Subsidiary of Injap Investments Inc., Which Also Owns 35% of Doubledragon Properties CorpDocument4 pagesMM Is A Wholly-Owned Subsidiary of Injap Investments Inc., Which Also Owns 35% of Doubledragon Properties CorpTrisha Mae Mendoza MacalinoNo ratings yet

- WK 4 SA Financial Market Shareholder AnalysisDocument7 pagesWK 4 SA Financial Market Shareholder AnalysisShirley HaynesNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- IFA s1 QDocument8 pagesIFA s1 QКсения НиколоваNo ratings yet

- Bombay Stock ExchangeDocument18 pagesBombay Stock Exchangethe crashNo ratings yet

- Consumer PPT ActivityDocument7 pagesConsumer PPT ActivityNachtKunokanjiruNo ratings yet