Professional Documents

Culture Documents

Global Economic Outlook: Crisis Update May 2020: Coronavirus Shock Broadens

Global Economic Outlook: Crisis Update May 2020: Coronavirus Shock Broadens

Uploaded by

Manas TiwariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Economic Outlook: Crisis Update May 2020: Coronavirus Shock Broadens

Global Economic Outlook: Crisis Update May 2020: Coronavirus Shock Broadens

Uploaded by

Manas TiwariCopyright:

Available Formats

Global Economic Outlook:

Crisis Update May 2020

Coronavirus Shock Broadens

Highlights

• Fitch lowers world GDP forecast for 2020 to

-4.6% from -3.9%

• Eurozone and UK economies now expected

to shrink by around 8% in 2020

• Large cut to emerging markets excluding

China GDP, as health crisis has escalated

• Brazil, Russia, India GDP now expected to fall

by between 5% and 6% in 2020

• US, China and Japan forecasts unchanged

from late-April GEO

• Economic activity near to bottoming out as

lockdowns start to ease

• Recovery hindered by labour market rupture,

ongoing social distancing

• Return to pre-virus GDP to take more than two

years in US and Europe, despite huge stimulus

www.fitchratings.com | 26 May 2020

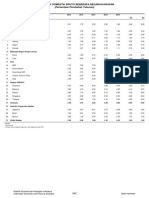

Global Forecast Summary

Annual Average

(%) 2014-2018 2018 2019 2020F 2021F

GDP Growth

US 2.5 2.9 2.3 -5.6 4.0

Eurozone 2.0 1.9 1.2 -8.2 4.4

China 7.0 6.7 6.1 0.7 7.9

Japan 0.9 0.3 0.7 -5.0 3.2

UK 2.0 1.3 1.4 -7.8 4.5

Developed a 2.0 2.1 1.7 -6.4 4.1

Emerging b 4.8 5.2 4.4 -1.7 6.6

World c

3.0 3.2 2.7 -4.6 5.1

Inflation (end of period)

US 1.5 1.9 2.3 0.5 0.9

Eurozone 0.8 1.5 1.3 -0.4 0.8

China 1.8 1.9 4.5 2.0 1.6

Japan 1.0 0.3 0.8 -0.2 0.3

UK 1.5 2.1 1.3 0.4 1.0

Interest Rates (end of period)

US 0.83 2.50 1.75 0.25 0.25

Eurozone 0.04 0.00 0.00 0.00 0.00

China d

3.49 3.30 3.25 2.55 2.55

Japan -0.02 -0.10 -0.10 -0.10 -0.10

UK 0.46 0.75 0.75 0.10 0.10

US 10-Year Yield 2.32 2.68 1.92 0.90 1.20

Exchange Rates and Oil

Oil (USD/barrel) 64.7 71.5 64.1 35.0 45.0

USDJPY (end-period) 111.7 110.8 109.1 107.0 107.0

USDEUR (end-period) 0.86 0.87 0.89 0.92 0.92

GBPUSD (end-period) 1.43 1.27 1.31 1.20 1.20

USDCNY (end-period) 6.48 6.85 6.99 7.10 7.20

a

US, Japan, France, Germany, Italy, Spain, UK, Canada, Australia and Switzerland

b

Brazil, Russia, India, China, South Africa, Korea, Mexico, Indonesia, Poland and Turkey

c

‘Fitch 20’ countries weighted by nominal GDP in US dollars at market exchange rates (three-year average)

d

One-year Medium-Term Lending Facility

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 3

Further Forecast Cuts, but Close to Trough The eurozone experienced a particularly large decline in GDP in

1Q20 at -3.8% (compared with an estimate of -3.5% in the previous

The economic fallout from the coronavirus crisis continues to GEO) owing to the earlier imposition of lockdowns in Italy, France

broaden and deepen but Fitch Ratings’ forecasts are starting to show and Spain. France suffered a fall of nearly 6%, consistent with a daily

some signs of stabilisation. Activity levels should start to rise in the loss in activity of more than 30% relative to pre-virus norms. France,

months ahead, provided that a sharp resurgence in virus cases is Italy and Spain have had some of the most restrictive lockdown

avoided as lockdowns are relaxed. However, it will take a long time to policies globally according to the University of Oxford’s Lockdown

return to normality: we are unlikely to reach pre-virus levels of GDP Stringency Index, and this is borne out in daily mobility data from

before mid-2022 in the US and significantly later in Europe. Google that show a sharper fall in visits to retail and recreation

We have further lowered our global GDP forecast for 2020 to venues than in the US. With the daily activity loss through lockdown

-4.6% from -3.9% in our late-April Global Economic Outlook in these three European countries looking larger than assumed, we

(GEO) update. This reflects further cuts of more than 1pp to our now anticipate a near 9% decline in GDP in 2Q20 in the eurozone.

eurozone and UK forecasts to around -8% and, most significantly, UK GDP fell by 2% in 1Q20 (compared with 2.3% in the prior GEO),

a 2.6pp cut to our forecast for emerging markets (EM) excluding but the monthly breakdown showed a 5.8% decline in March despite

China. The latter reflects the growing health crises in Brazil, only seven out of 22 working days spent in full lockdown. This points

Russia and India. However, our 2020 forecasts for the US, China, to activity declining by around a fifth for each day in lockdown. With

Japan, Korea, Australia and South Africa are unchanged since the lockdown being eased only very gradually in the presence of

late-April, in contrast to repeated forecast downgrades in recent a still-high daily number of new virus cases, we now expect a 13%

GEO updates. decline in (non-annualised) 2Q20 GDP.

We have revised up our global growth forecast for 2021, but by only US GDP did not fall as much as we expected in 1Q20 (-1% compared

0.1pp to 5.1%. This is despite the increased scope for a technical with -2% in the previous GEO) but April data for industrial production

rebound from a deeper 2020 trough and the announcement of and retail sales and the Purchasing Managers’ Indices (PMI) surveys

more policy easing since the previous GEO. The severity of the all confirmed a severe collapse in activity after state lockdowns were

labour market shock in the US and elsewhere and ongoing social put in place. Most strikingly, unemployment surged to almost 15%,

distancing will weigh heavily on the post-crisis recovery. up from just 3.5% in February. Our high-frequency activity trackers

point to a 10% yoy decline in GDP in 2Q20. This would be nearly

Lockdown Impact Revealed three times the yoy pace of decline in the previous worse quarter

The enormous magnitude of the lockdown-related shock to global since the World War II but is in line with our previous forecast.

activity has now started to reveal itself in hard macroeconomic The biggest contribution to the downward revision in global GDP

data. No less than 17 of the Fitch 20 countries have reported - or for 2020 comes from EM excluding China, where we now see GDP

are expected to report – economic contractions in 1Q20 and all but falling by 5% in India and Russia and by 6%-7% in Brazil and Mexico.

China will see GDP fall in 2Q20. Fitch estimates that world GDP fell by This reflects the surge in coronavirus infections from mid-April and

3.4% q/q in 1Q20 and forecasts that it will decline by 5.8% in 2Q20, measures taken to contain the outbreak. The biggest revision by far

numbers simply unimaginable prior to the pandemic. The global has been for India, where the virus outbreak has prompted a very

recession this year will be more than twice as severe as in 2009. severe lockdown that has lasted much longer than expected.

Fitch Ratings 2020 GDP Growth Forecasts

(%) Latest GEO Previous GEO (22 April 2020)

2

1

0

-1

-2

-3

-4

-5

-6

-7

-8

-9

-10

Switzerland

Japan

EM ex China

Poland

Russia

India (FY)

Italy

Korea

Germany

Brazil

World

UK

Mexico

US

South Africa

Indonesia

China

Australia

Spain

France

Eurozone

Turkey

Canada

Source: Fitch Ratings' estimates

www.fitchratings.com | 26 May 2020 4

Recovery Signs Emerging

Some signs that the slump in activity in April is bottoming out

are starting to emerge. France and Italy recently began to ease

lockdowns and this has coincided with a pick-up in daily retail

visits. Flash PMI readings increased in May in Europe and the

US (although they remained below 50); the ZEW, Philadelphia

Fed and Empire State industrial confidence measures improved

slightly and the University of Michigan consumer confidence

index rose.

These are all highly tentative signs but China’s experience points

to the likelihood of activity increasing after lockdowns are

eased. Industrial production levels have now recovered back to

December 2019 values with fixed-asset investment rising again

yoy and credit growth is rising. Our monthly China GDP tracker

– which captured the 1Q20 collapse –points to positive yoy GDP

growth in 2Q20.

Since our previous GEO there has also been further significant

policy easing. The US passed the 2.4%-of-GDP Payroll Protection

Programme (and more fiscal easing is being discussed); Italy

announced a second round of stimulus; the UK has extended its

job subsidy scheme to October and China has ramped up fiscal

support. We expect global quantitative-easing asset purchases

to hit USD6 trillion in 2020, an explosion in central bank liquidity

that has paved the way for a recent pick-up in credit growth to

the a recent pick-up in credit to the real economy - specifically to

firms - in stark contrast, a stark contrast to 2009.

A Long Road Back

The path back to pre-crisis levels of activity will be prolonged,

however, with job losses and bankruptcies in the lockdown

contributing to lasting damage both to demand and supply. Latest

weekly claims data point to US unemployment rising further to

20% in May, while the UK claimant count unemployment measure

surged to nearly 6% in April from 3.5% in March despite massive

take-up of the government’s furlough scheme. This alone will

make people cautious, but there will be further challenges to

consumer spending from voluntary social distancing behaviour

and remaining restrictions on travel, retail and recreational activity.

With firms also remaining extremely cautious about capex, the

post-crisis recovery is unlikely to be rapid enough to return

GDP in developed economies to pre-virus levels by end-2021.

We forecast that US GDP in 4Q21 will remain 0.8% below 4Q19;

2.7% below in the UK; and 3.3% below in the eurozone. And this

is despite massive fiscal and monetary stimulus. A resurgence

of the virus that necessitated greatly extended or renewed

lockdowns later in the year would lead to an even worse outcome.

Our downside scenario sees GDP falling by around 12% in 2020 in

the US and Europe, with global GDP shrinking by 9%.

www.fitchratings.com | 26 May 2020 5

United States - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.5 2.9 2.3 -5.6 4.0

Consumer Spending 3.0 3.0 2.6 -6.8 2.5

Fixed Investment 4.1 4.6 1.3 -10.6 0.3

Net Trade (contribution pp) -0.4 -0.4 -0.2 0.4 0.0

CPI Inflation (end-year) 1.5 1.9 2.3 0.5 0.9

Unemployment Rate 4.9 3.9 3.7 10.3 7.8

Policy Interest Rate (end-year) 0.83 2.50 1.75 0.25 0.25

Exchange Rate, USDEUR (end-year) 0.86 0.87 0.89 0.92 0.92

Source: Fitch Ratings

Eurozone - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.0 1.9 1.2 -8.2 4.4

Consumer Spending 1.6 1.4 1.3 -8.2 5.0

Fixed Investment 3.2 2.3 5.7 -5.7 3.6

Net Trade (contribution pp) 0.1 0.4 -0.5 -2.8 -0.2

CPI Inflation (end-year) 0.8 1.5 1.3 -0.4 0.8

Unemployment Rate 10.0 8.2 7.6 10.7 10.5

Policy Interest Rate (end-year) 0.04 0.00 0.00 0.00 0.00

Exchange Rate, EURUSD (end-year) 1.17 1.15 1.12 1.09 1.09

Source: Fitch Ratings

China - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 7.0 6.7 6.1 0.7 7.9

Consumer Spending 8.8 8.1 6.9 0.6 7.1

Fixed Investment 7.3 6.6 4.4 -0.4 9.4

Net Trade (contribution pp) -0.3 -0.5 0.7 -1.4 -0.5

CPI Inflation (end-year) 1.8 1.9 4.5 2.0 1.6

Policy Interest Rate (end-year) 3.49 3.30 3.25 2.55 2.55

Exchange Rate, USDCNY (end-year) 6.48 6.85 6.99 7.10 7.20

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 6

Japan - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 0.9 0.3 0.7 -5.0 3.2

Consumer Spending 0.0 0.0 0.2 -5.1 4.0

Fixed Investment 1.6 0.6 1.3 -6.7 4.7

Net Trade (contribution pp) 0.3 0.0 -0.2 -0.8 -0.5

CPI Inflation (end-year) 1.0 0.3 0.8 -0.2 0.3

Unemployment Rate 3.1 2.4 2.4 4.0 3.4

Policy Interest Rate (end-year) -0.02 -0.10 -0.10 -0.10 -0.10

Exchange Rate, USDJPY (end-year) 111.7 110.8 109.1 107.0 107.0

Source: Fitch Ratings

United Kingdom - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.0 1.3 1.4 -7.8 4.5

Consumer Spending 2.5 1.6 1.1 -8.0 1.3

Fixed Investment 3.1 -0.2 0.6 -13.5 -1.8

Net Trade (contribution pp) -0.3 -0.2 0.0 -0.5 0.2

CPI Inflation (end-year) 1.5 2.1 1.3 0.4 1.0

Unemployment Rate 5.0 4.1 3.8 6.3 6.3

Policy Interest Rate (end-year) 0.46 0.75 0.75 0.10 0.10

Exchange Rate, GBPUSD (end-year) 1.43 1.27 1.31 1.20 1.20

Source: Fitch Ratings

Germany - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.0 1.5 0.6 -6.7 4.8

Consumer Spending 1.6 1.3 1.6 -6.1 7.4

Fixed Investment 2.9 3.5 2.5 -6.2 1.4

Net Trade (contribution pp) 0.0 -0.5 -0.6 -2.7 -0.2

CPI Inflation (end-year) 1.1 1.7 1.5 0.3 1.3

Unemployment Rate 4.2 3.4 3.2 5.0 5.0

Policy Interest Rate (end-year) 0.04 0.00 0.00 0.00 0.00

Exchange Rate, EURUSD (end-year) 1.17 1.15 1.12 1.09 1.09

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 7

France - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 1.4 1.7 1.3 -9.0 4.3

Consumer Spending 1.3 0.9 1.3 -9.4 4.0

Fixed Investment 2.2 2.8 3.6 -12.9 6.0

Net Trade (contribution pp) -0.1 0.7 -0.1 -1.7 -0.5

CPI Inflation (end-year) 0.7 1.6 1.5 -0.5 1.5

Unemployment Rate 9.8 9.0 8.5 11.2 11.1

Policy Interest Rate (end-year) 0.04 0.00 0.00 0.00 0.00

Exchange Rate, EURUSD (end-year) 1.17 1.15 1.12 1.09 1.09

Source: Fitch Ratings

Italy - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 0.9 0.8 0.3 -9.5 4.2

Consumer Spending 1.1 0.9 0.4 -10.0 4.0

Fixed Investment 2.0 3.1 1.4 -10.3 3.2

Net Trade (contribution pp) -0.3 -0.3 0.5 -1.2 0.2

CPI Inflation (end-year) 0.6 1.2 0.5 -0.5 0.8

Unemployment Rate 11.6 10.6 10.0 12.4 12.1

Policy Interest Rate (end-year) 0.04 0.00 0.00 0.00 0.00

Exchange Rate, EURUSD (end-year) 1.17 1.15 1.12 1.09 1.09

Source: Fitch Ratings

Spain - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.7 2.4 2.0 -9.6 4.4

Consumer Spending 2.4 1.9 1.1 -12.0 4.0

Fixed Investment 4.5 5.3 1.8 -11.6 3.0

Net Trade (contribution pp) 0.0 -0.3 0.5 -1.3 0.6

CPI Inflation (end-year) 0.5 1.2 0.8 -0.9 1.2

Unemployment Rate 19.7 15.3 14.1 21.5 21.8

Policy Interest Rate (end-year) 0.04 0.00 0.00 0.00 0.00

Exchange Rate, EURUSD (end-year) 1.17 1.15 1.12 1.09 1.09

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 8

Switzerland - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.0 2.7 0.9 -7.0 3.3

Consumer Spending 1.3 1.0 1.1 -5.4 5.7

Fixed Investment 2.5 1.1 0.7 -4.6 2.4

Net Trade (contribution pp) 1.1 2.1 1.2 -2.1 -0.9

CPI Inflation (end-year) 0.0 0.8 -0.1 -0.6 0.5

Unemployment Rate 3.0 2.5 2.3 4.1 4.0

Policy Interest Rate (end-year) -0.60 -0.75 -0.75 -0.75 -0.75

Exchange Rate, USDCHF (end-year) 0.97 0.98 0.97 1.05 1.05

Source: Fitch Ratings

Australia - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.6 2.7 1.8 -5.0 4.8

Consumer Spending 2.5 2.7 1.4 -6.3 4.6

Fixed Investment -0.5 2.5 -2.3 -10.9 4.5

Net Trade (contribution pp) 0.7 0.2 1.0 -0.8 0.2

CPI Inflation (end-year) 1.8 1.8 1.8 1.2 1.6

Unemployment Rate 5.7 5.3 5.2 7.5 6.9

Policy Interest Rate (end-year) 1.87 1.50 0.75 0.25 0.25

Exchange Rate, USDAUD (end-year) 1.33 1.42 1.43 1.57 1.48

Source: Fitch Ratings

Canada - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 1.9 2.0 1.6 -7.1 3.9

Consumer Spending 2.5 2.1 1.6 -6.2 4.3

Fixed Investment -0.6 1.2 -0.7 -10.4 1.7

Net Trade (contribution pp) 0.3 0.1 0.3 -1.6 -0.1

CPI Inflation (end-year) 1.7 2.0 2.2 0.6 0.9

Unemployment Rate 6.6 5.8 5.7 10.3 8.2

Policy Interest Rate (end-year) 0.85 1.75 1.75 0.25 0.25

Exchange Rate, USDCAD (end-year) 1.26 1.36 1.31 1.45 1.42

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 9

Brazil - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP -0.7 1.3 1.1 -6.0 3.2

Consumer Spending -0.2 2.1 1.8 -7.3 3.5

Fixed Investment -5.8 3.9 2.3 -9.4 1.6

Net Trade (contribution pp) 0.8 -0.5 -0.5 0.0 0.0

CPI Inflation (end-year) 6.2 3.7 4.3 2.0 3.3

Policy Interest Rate (end-year) 10.51 6.50 4.50 2.25 3.50

Exchange Rate, USDBRL (end-year) 3.20 3.87 4.03 5.30 4.90

Source: Fitch Ratings

Russia - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 0.7 2.5 1.3 -5.0 3.0

Consumer Spending -0.6 3.3 2.5 -5.6 4.5

Fixed Investment -1.3 0.2 1.5 -14.8 4.2

Net Trade (contribution pp) 2.1 0.9 -1.4 0.4 -0.6

CPI Inflation (end-year) 7.4 4.3 3.0 3.9 4.0

Policy Interest Rate (end-year) 9.56 7.75 6.25 4.75 5.50

Exchange Rate, USDRUB (end-year) 57.48 69.47 61.91 72.00 70.00

Source: Fitch Ratings

India - Forecast Summary

(%) FY starting April Ann. Av.2014-18 FY18-19 FY19-20F FY20-21F FY21-22F

GDP 7.4 6.2 3.9 -5.0 9.5

Consumer Spending 7.4 7.4 3.6 -8.3 10.9

Fixed Investment 6.8 9.7 -1.5 -9.7 10.4

Net Trade (contribution pp) -0.5 -0.4 1.5 1.3 -0.5

CPI Inflation (end-cal. year) 4.7 2.1 7.4 3.3 4.0

Policy Interest Rate (end-cal. year) 6.83 6.50 5.15 3.75 4.00

Exchange Rate, USDINR (end-cal. year) 65.18 69.79 71.27 76.00 74.00

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 10

Korea - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 3.0 2.7 2.0 -1.2 4.0

Consumer Spending 2.5 2.8 1.9 -4.3 4.9

Fixed Investment 4.5 -2.4 -3.5 0.5 3.1

Net Trade (contribution pp) -0.4 1.2 0.9 -0.5 0.2

CPI Inflation (end-year) 1.3 1.5 0.4 0.2 0.7

Policy Interest Rate (end-year) 1.63 1.75 1.25 0.75 1.00

Exchange Rate, USDKRW (end-year) 1115 1118 1158 1180 1110

Source: Fitch Ratings

Indonesia - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 5.0 5.2 5.0 -1.8 6.8

Consumer Spending 5.1 5.1 5.2 -2.2 7.1

Fixed Investment 5.3 6.7 4.5 -4.2 5.6

Net Trade (contribution pp) 0.0 -1.0 1.4 0.2 0.6

CPI Inflation (end-year) 4.7 3.2 2.6 2.4 2.8

Policy Interest Rate (end-year) 6.06 6.00 5.00 4.00 4.50

Exchange Rate, USDIDR (end-year) 13236 14481 13901 15000 14700

Source: Fitch Ratings

Mexico - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 2.7 2.1 -0.1 -7.4 3.2

Consumer Spending 2.8 2.3 0.6 -7.7 3.8

Fixed Investment 1.7 0.9 -4.9 -15.3 3.9

Net Trade (contribution pp) 0.1 0.0 0.8 0.2 -0.5

CPI Inflation (end-year) 4.1 4.9 3.6 3.0 3.0

Policy Interest Rate (end-year) 4.99 8.25 7.25 4.70 5.00

Exchange Rate, USDMXN (end-year) 17.20 19.68 18.85 22.00 21.50

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 11

Poland - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 4.1 5.3 4.1 -3.2 4.5

Consumer Spending 3.6 4.3 3.9 -5.0 5.1

Fixed Investment 4.3 9.3 7.2 0.1 4.6

Net Trade (contribution pp) 0.0 -0.1 1.1 -0.2 -0.7

CPI Inflation (end-year) 0.5 1.2 3.2 2.6 2.8

Policy Interest Rate (end-year) 1.69 1.50 1.50 0.50 1.00

Exchange Rate, USDPLN (end-year) 3.65 3.76 3.80 4.00 4.00

Source: Fitch Ratings

Turkey - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 4.9 2.8 0.9 -3.0 5.0

Consumer Spending 3.7 0.0 0.7 -2.9 6.2

Fixed Investment 4.9 -0.6 -12.4 -8.1 5.5

Net Trade (contribution pp) 1.0 3.6 2.3 -1.6 -0.5

CPI Inflation (end-year) 10.3 20.3 11.8 9.0 10.0

Policy Interest Rate (end-year) 9.57 24.00 12.00 8.00 8.00

Exchange Rate, USDTRY (end-year) 3.28 5.27 5.95 6.95 7.20

Source: Fitch Ratings

South Africa - Forecast Summary

(%) Ann. Av.2014-18 2018 2019 2020F 2021F

GDP 1.1 0.8 0.2 -5.5 3.7

Consumer Spending 1.4 1.8 1.0 -6.2 4.5

Fixed Investment -0.1 -1.4 -0.9 -9.5 4.3

Net Trade (contribution pp) 0.2 -0.2 -0.6 1.1 -0.2

CPI Inflation (end-year) 5.4 4.5 4.0 4.3 4.6

Policy Interest Rate (end-year) 6.39 6.75 6.50 3.50 4.00

Exchange Rate, USDZAR (end-year) 12.98 14.38 14.03 16.80 16.30

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 12

Lockdown Stringency and Retail Visits Oxford University Lockdown Stringency Index

(Lockdown stringency index, 100=maximum) France Italy

40 50 60 70 80 90 100 (Index)

Spain United Kingdom

0

100

-10 South Korea

(Visits, % of pre-virus baseline)

Sweden 90

-20 80

United

-30 Japan States 70

Australia Indonesia

-40 60

Poland

-50 Canada Germany 50

Brazil Mexico 40

-60 Turkey

Switzerland South Africa 30

-70

United Italy 20

-80 France

Kingdom 10

-90 Spain India 0

05 Feb

12 Feb

19 Feb

26 Feb

22 Jan

29 Jan

04 Mar

11 Mar

18 Mar

25 Mar

01 Apr

08 Apr

15 Apr

22 Apr

29 Apr

06 May

13 May

20 May

-100

Note: Google Mobility Report (Retail and Recreation venues) daily average for 15-

30 April as % daily average 3 Jan-6 Feb 2020;

Oxford University Stringency Index average for 15-30 April 2020

Source: Fitch Ratings, Oxford University, Google, Haver Analytics Source: Fitch Ratings, University of Oxford, Haver Analytics

China - Industrial Production US Weekly Economic Activity Tracker (AT)

Level (LHS) YoY

110 10 Real GDP Growth Weekly AT

(%, yoy)

6

(Index, Dec 2019 = 100)

100 5

4

90 0 2

(%, yoy)

0

80 -5 -2

-4

70 -10 -6

-8

60 -15 -10

1Q18 3Q18 1Q19 3Q19 1Q20

Feb 19

Feb 20

May 19

Jul 19

Jan 19

Jun 19

Jan 20

Aug 19

Sep 19

Nov 19

Dec 19

Oct 19

Apr 19

Apr 20

Mar 19

Mar 20

Note: Based on a principal components analysis of weekly indicators

including energy and steel production, retail sales and jobless claims

Source: Fitch Ratings, National Bureau of Statistics, Haver Analytics

Source: Fitch Ratings' estimates

Visits to Retail and Recreation Venues India - Economic Activity Data

Passenger car registrations (LHS) Services PMI

France Germany Italy UK US

(%, yoy) (Index)

20

60 100.0

(Visits as % pre-virus baseline)

0 45 87.5

30 75.0

-20

15 62.5

-40 0 50.0

-60 -15 37.5

-30 25.0

-80

-45 12.5

-100 -60 0.0

Feb 20 Mar 20 Mar 20 Apr 20 Apr 20 May 20 2008 2010 2012 2014 2016 2018 2020

Source: Fitch Ratings, Google COVID-19 Mobility Report, Haver Analytics Source: Fitch Ratings, OECD, IHSM Markit, Haver Analytics

www.fitchratings.com | 26 May 2020 13

Appendix 1: Quarterly GDP QOQ

(%) Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21

US 0.5 0.5 -1.2 -10.4 4.8 1.9 1.2 1.2 1.2 1.2

Euro area 0.3 0.1 -3.8 -8.7 2.4 2.5 2.2 1.3 0.6 0.6

China 1.4 1.4 -9.8 8.0 4.4 3.3 0.6 0.3 0.5 0.5

Japan 0.0 -1.9 -0.9 -7.4 4.8 1.3 0.8 0.7 0.6 0.6

UK 0.5 0.0 -2.0 -12.8 6.0 3.5 1.0 1.1 1.1 0.6

Germany 0.3 -0.1 -2.2 -8.1 1.9 2.3 2.2 2.1 0.6 0.6

France 0.3 -0.1 -5.8 -8.0 3.8 2.9 1.1 0.9 0.7 0.7

Italy 0.1 -0.3 -4.7 -8.8 2.3 2.9 2.2 0.7 0.7 0.5

Spain 0.4 0.4 -5.2 -8.4 1.5 2.1 2.5 1.4 1.0 0.8

Switzerland 0.4 0.3 -3.0 -8.4 2.5 2.3 1.5 0.8 0.6 0.6

Australia 0.6 0.5 -0.5 -8.8 1.8 2.2 2.1 1.8 1.4 1.5

Canada 0.3 0.1 -2.6 -8.9 1.6 3.9 1.4 0.8 0.8 0.7

Brazil 0.6 0.5 -1.9 -9.3 2.9 2.9 0.8 0.9 0.8 0.8

Russia 0.5 0.6 0.1 -8.1 -0.2 1.7 2.1 1.6 0.9 0.6

India 1.1 1.2 -2.7 -12.4 8.8 4.6 2.5 1.2 1.2 1.2

Korea 0.4 1.3 -1.4 -3.9 2.7 1.7 1.3 1.0 0.6 0.1

Mexico -0.1 -0.1 -1.6 -9.6 2.4 1.7 1.5 1.3 1.2 1.2

Indonesia 1.2 1.2 -0.8 -7.1 4.0 2.8 2.0 1.4 1.9 1.9

Turkey 0.8 1.9 1.2 -9.2 0.7 1.9 2.6 2.0 1.9 1.9

Poland 1.2 0.2 -0.5 -6.9 2.3 2.1 1.6 1.4 1.2 1.2

South Africa -0.2 -0.4 0.1 -8.4 1.2 1.4 1.9 1.6 1.6 1.2

Developed a 0.4 0.0 -2.0 -9.5 4.0 2.2 1.4 1.2 1.0 0.9

Emerging b

1.0 1.1 -5.8 0.2 4.0 3.0 1.2 0.8 0.8 0.7

World c 0.6 0.4 -3.4 -5.9 4.0 2.5 1.3 1.0 0.9 0.9

a

US, Japan, France, Germany, Italy, Spain, UK, Canada, Australia and Switzerland

b

Brazil, Russia, India, China, South Africa, Korea, Mexico, Indonesia, Poland and Turkey

c

‘Fitch 20’ countries weighted by nominal GDP in US dollars at market exchange rates (three-year average)

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 14

Appendix 2: Quarterly GDP YOY

(%) Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21

US 2.1 2.3 0.3 -10.6 -6.8 -5.5 -3.1 9.4 5.7 4.9

Euro area 1.3 1.0 -3.2 -11.8 -9.9 -7.8 -2.1 8.6 6.7 4.8

China 6.0 6.0 -6.8 0.2 3.2 5.1 17.3 8.9 4.8 2.0

Japan 1.8 -0.7 -2.2 -9.9 -5.5 -2.5 -0.9 7.8 3.5 2.8

UK 1.3 1.1 -1.6 -14.1 -9.4 -6.3 -3.4 12.0 6.8 3.8

Germany 0.7 0.4 -2.3 -10.0 -8.5 -6.2 -2.1 8.8 7.3 5.5

France 1.5 0.9 -5.4 -13.2 -10.1 -7.4 -0.5 9.1 5.7 3.4

Italy 0.5 0.1 -4.8 -13.3 -11.4 -8.6 -1.9 8.3 6.6 4.2

Spain 1.9 1.8 -4.1 -12.5 -11.5 -10.0 -2.7 7.8 7.2 5.8

Switzerland 1.1 1.5 -2.0 -10.6 -8.7 -6.9 -2.5 7.3 5.3 3.6

Australia 1.8 2.2 1.1 -8.3 -7.2 -5.6 -3.1 8.1 7.7 6.9

Canada 1.6 1.5 -1.4 -10.9 -9.7 -6.3 -2.5 7.8 7.0 3.7

Brazil 1.2 1.7 -0.3 -10.0 -7.9 -5.8 -3.1 7.7 5.4 3.3

Russia 1.5 2.1 1.6 -7.0 -7.6 -6.6 -4.6 5.3 6.5 5.3

India 5.1 4.7 0.6 -12.8 -6.2 -3.0 2.2 18.1 9.9 6.3

Korea 2.0 2.3 1.3 -3.7 -1.5 -1.0 1.7 6.8 4.7 3.0

Mexico -0.3 -0.5 -1.6 -11.2 -9.0 -7.3 -4.4 7.1 5.8 5.2

Indonesia 5.0 5.0 3.0 -5.6 -3.0 -1.4 1.3 10.5 8.4 7.4

Turkey 1.0 6.0 5.2 -5.6 -5.6 -5.6 -4.3 7.5 8.8 8.7

Poland 4.0 3.2 1.6 -6.1 -5.0 -3.3 -1.3 7.5 6.4 5.5

South Africa 0.1 -0.5 0.4 -8.8 -7.5 -5.9 -4.2 6.3 6.8 6.6

Developed a 1.7 1.4 -1.2 -11.0 -7.7 -5.7 -2.5 9.1 5.8 4.5

Emerging b

4.3 4.5 -2.6 -3.9 -1.1 0.7 8.9 9.3 5.9 3.5

World c 2.7 2.6 -1.7 -8.3 -5.2 -3.3 1.9 9.2 5.9 4.1

a

US, Japan, France, Germany, Italy, Spain, UK, Canada, Australia and Switzerland

b

Brazil, Russia, India, China, South Africa, Korea, Mexico, Indonesia, Poland and Turkey

c

‘Fitch 20’ countries weighted by nominal GDP in US dollars at market exchange rates (three-year average)

Source: Fitch Ratings

www.fitchratings.com | 26 May 2020 15

Contacts

Economics

Brian Coulton

Chief Economist Robert Ojeda-Sierra

Tel: +44 20 3530 1140 Tel: +44 20 3530 6094

brian.coulton@fitchratings.com robert.ojeda-sierra@fitchratings.com

Maxime Darmet-Cucchiarini Pawel Borowski

Tel: +44 20 3530 1624 Tel: +44 20 3530 1861

maxime.darmet@fitchratings.com pawel.borowski@fitchratings.com

Marina Stefani

Tel: +44203 530 1809

marina.stefani@fitchratings.com

Sovereign Ratings

Charles Seville Shelly Shetty

Americas Americas

Tel: + 1 212 908 0277 Tel: +1 212 908 0324

charles.seville@fitchratings.com shelly.shetty@fitchratings.com

Stephen Schwartz Paul Gamble

Asia Emerging Europe

Tel: +852 2263 9938 Tel: +44 20 3530 1623

stephen.schwartz@fitchratings.com paul.gamble@fitchratings.com

Michele Napolitano Jan Friederich

Western Europe Middle East and Africa

Tel: +44 20 3530 1882 Tel: + 852 2263 9910

michele.napolitano@fitchratings.com jan.friederich@fitchratings.com

www.fitchratings.com | 26 May 2020 16

Disclaimer

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTPS://WWW.

FITCHRATINGS.COM/SITE/DEFINITIONS?RD_FILE=INTRO. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY’S PUBLIC WEB

SITE AT WWW.FITCHRATINGS.COM. PUBLISHED RATINGS, CRITERIA, AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH’S CODE OF CONDUCT, CONFIDENTIALITY,

CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE, AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE CODE OF CONDUCT SECTION OF THIS SITE.

FITCH MAY HAVE PROVIDED ANOTHER PERMISSIBLE SERVICE TO THE RATED ENTITY OR ITS RELATED THIRD PARTIES. DETAILS OF THIS SERVICE FOR RATINGS FOR WHICH THE LEAD ANALYST

IS BASED IN AN EU-REGISTERED ENTITY CAN BE FOUND ON THE ENTITY SUMMARY PAGE FOR THIS ISSUER ON THE FITCH WEBSITE. Copyright © 2020 by Fitch Ratings, Inc., Fitch Ratings Ltd.

and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited

except by permission. All rights reserved. In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch relies on factual information it receives from

issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings

methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The

manner of Fitch’s factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices

in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer

and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions

and other reports provided by third parties, the availability of independent and competent third-party verification sources with respect to the particular security or in the particular jurisdiction of

the issuer, and a variety of other factors. Users of Fitch’s ratings and reports should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all

of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information

they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with

respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are inherently forward-looking and embody

assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings and forecasts can be affected by

future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed. The information in this report is provided “as is” without any representation or

warranty of any kind, and Fitch does not represent or warrant that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is an opinion as

to the creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore,

ratings and reports are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due

to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in

a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a

prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed

or withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security.

Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any

security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable

currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single

annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall

not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets

Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available

to electronic subscribers up to three days earlier than to print subscribers.For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services

license (AFS license no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not intended to be used by persons who

are retail clients within the meaning of the Corporations Act 2001. DC-3641

www.fitchratings.com | 26 May 2020 17

You might also like

- General Information Sheet (Gis) : Stock Corporation General InstructionsDocument19 pagesGeneral Information Sheet (Gis) : Stock Corporation General InstructionsMichelle GonzalesNo ratings yet

- FitchRatings - Global Economic Outlook - Crisis Update 2 April 2020 Coronavirus Crisis Sparks Deep Global RecessionDocument17 pagesFitchRatings - Global Economic Outlook - Crisis Update 2 April 2020 Coronavirus Crisis Sparks Deep Global RecessionAryttNo ratings yet

- Informe Bianual de l'OCDE 2019-2020Document16 pagesInforme Bianual de l'OCDE 2019-2020naciodigitalNo ratings yet

- IEO106 Handout FinalDocument16 pagesIEO106 Handout FinalValter SilveiraNo ratings yet

- Global Growth Weakening As Some Risks Materialise OECD Interim Economic Outlook Handout March 2019Document13 pagesGlobal Growth Weakening As Some Risks Materialise OECD Interim Economic Outlook Handout March 2019Valter SilveiraNo ratings yet

- Ae8c39ec enDocument22 pagesAe8c39ec enStathis MetsovitisNo ratings yet

- 2024global Economic Report by World BankDocument50 pages2024global Economic Report by World Bankkellymeinhold327No ratings yet

- GDP Growth Q4 2023Document3 pagesGDP Growth Q4 2023Popa ManuelNo ratings yet

- Unprecedented Fall in OECD GDP by 9.8% in Q2 2020Document2 pagesUnprecedented Fall in OECD GDP by 9.8% in Q2 2020Βασίλης ΒήτταςNo ratings yet

- Global Economic Forecast Q1 2020 AnalysisDocument57 pagesGlobal Economic Forecast Q1 2020 AnalysisCoulibaly SékouNo ratings yet

- EO PresentationDocument23 pagesEO PresentationjrmiztliNo ratings yet

- DR Nariman Behravesh WorldFlash0222Document3 pagesDR Nariman Behravesh WorldFlash0222Swapnil PatilNo ratings yet

- OECD Interim Economic Outlook September 2019Document19 pagesOECD Interim Economic Outlook September 2019Valter SilveiraNo ratings yet

- April 2020Document9 pagesApril 2020Ren SuzakuNo ratings yet

- 2021 06 22 Merelli Macro ScenarioDocument66 pages2021 06 22 Merelli Macro ScenarioVito GiacovelliNo ratings yet

- Global Economy and China Economy in Jan2021Document22 pagesGlobal Economy and China Economy in Jan2021CIPS CorporacionNo ratings yet

- Global Prospects and PoliciesDocument64 pagesGlobal Prospects and PoliciesZerohedge100% (2)

- M&A Conference - Global Markets and MacroeconomicsDocument20 pagesM&A Conference - Global Markets and Macroeconomicsjm petit100% (1)

- BIMBSec Corp Day - 2022 Economic OutlookDocument17 pagesBIMBSec Corp Day - 2022 Economic Outlookmuhammad ihsanNo ratings yet

- World Advanced Economies: (Percent Change From Previous Year)Document32 pagesWorld Advanced Economies: (Percent Change From Previous Year)Edwin SoetirtoNo ratings yet

- Real GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Document19 pagesReal GDP: World 3.0 2.3 - 4.3 4.0 3.8 0.9 - 0.2 Advanced Economies 2.2 1.6 - 5.4 3.3 3.5 1.6 - 0.6Suhe EndraNo ratings yet

- Global Economic Forecasts - Euromonitor InternationalDocument30 pagesGlobal Economic Forecasts - Euromonitor InternationalDavid CézarNo ratings yet

- Economic Out Look 190603Document14 pagesEconomic Out Look 190603sirdquantsNo ratings yet

- Eco Growth Selected EcoDocument2 pagesEco Growth Selected EcoAldoNo ratings yet

- Berenberg Global ForecastsDocument15 pagesBerenberg Global ForecastsbobmezzNo ratings yet

- GDP ProjectDocument2 pagesGDP Projectnghiah5No ratings yet

- World Economy OutlookDocument24 pagesWorld Economy OutlookFaiz BurhaniNo ratings yet

- (Percent Change, Unless Otherwise Noted) : Table 1.1. Overview of The World Economic Outlook ProjectionsDocument3 pages(Percent Change, Unless Otherwise Noted) : Table 1.1. Overview of The World Economic Outlook ProjectionsSathish KumarNo ratings yet

- The Economist Intelligence Unit PDFDocument40 pagesThe Economist Intelligence Unit PDFhahulaniNo ratings yet

- WEO - April 2020 - Executive SummaryDocument4 pagesWEO - April 2020 - Executive SummaryMuthu nayagamNo ratings yet

- SM Basic Econometrics Gujarati Porter 5th EditionDocument10 pagesSM Basic Econometrics Gujarati Porter 5th EditionMuhammad Mohab83% (6)

- Prices and Inflation: Successful Tight-Rope WalkingDocument28 pagesPrices and Inflation: Successful Tight-Rope WalkingÂshùtôsh KúmårNo ratings yet

- Table 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)Document2 pagesTable 1.1. Overview of The World Economic Outlook Projections (Percent Change, Unless Noted Otherwise)sy yusufNo ratings yet

- Contractionary Forces Receding But Weak Recovery Ahead: Figure 1. Global GDP GrowthDocument8 pagesContractionary Forces Receding But Weak Recovery Ahead: Figure 1. Global GDP Growthpeter_martin9335No ratings yet

- Choose Your Poison: Growth or Inflation: December 2021Document60 pagesChoose Your Poison: Growth or Inflation: December 2021EricNo ratings yet

- Colombia: The End of Magical Realism?: Munir JalilDocument98 pagesColombia: The End of Magical Realism?: Munir Jalilcesar sarmientoNo ratings yet

- Global Industry Forecast - Consumer Goods Q1 2020 PDFDocument32 pagesGlobal Industry Forecast - Consumer Goods Q1 2020 PDFaashmeen25No ratings yet

- Weekly Market Update June 2 2023Document11 pagesWeekly Market Update June 2 2023dwikazanzaNo ratings yet

- Short Range Outlook October 202020 TableDocument1 pageShort Range Outlook October 202020 TableArie HendriyanaNo ratings yet

- Insentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19Document24 pagesInsentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19kacaribuantonNo ratings yet

- Macroeconomic Performance and Prospects: Global Economic OutlookDocument10 pagesMacroeconomic Performance and Prospects: Global Economic OutlookZahangir AlamNo ratings yet

- Chap 58Document1 pageChap 58Tarit MondalNo ratings yet

- OECD's Interim AssessmentDocument23 pagesOECD's Interim AssessmentTheGlobeandMailNo ratings yet

- Solution Manual For Basic Econometrics Gujarati Porter 5th EditionDocument24 pagesSolution Manual For Basic Econometrics Gujarati Porter 5th EditionWilliamHammondcgaz100% (41)

- 2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFODocument55 pages2015 Annual Results: Umut Zenar, CEO and Dr. Carsten Sauerland, CFOFrédéric GuillemetNo ratings yet

- Barkleys Bank Interest RateDocument2 pagesBarkleys Bank Interest Ratemarina321No ratings yet

- Lobal Usiness CenarioDocument38 pagesLobal Usiness CenariozunaaliNo ratings yet

- Stronger Growth But Risks Loom Large, OECD Economic Outlook May 2018Document27 pagesStronger Growth But Risks Loom Large, OECD Economic Outlook May 2018The BubbleNo ratings yet

- Economic Outlook 2H22Document30 pagesEconomic Outlook 2H22AriefNoviantoWongsoharjoNo ratings yet

- Mid-Year Economic Update: 2010: The United States and CaliforniaDocument29 pagesMid-Year Economic Update: 2010: The United States and CaliforniajddishotskyNo ratings yet

- Euromonitor Forecasts GEF2019-Q3Document33 pagesEuromonitor Forecasts GEF2019-Q3asolteiroNo ratings yet

- Growth and InflationDocument5 pagesGrowth and InflationmanowarNo ratings yet

- Mahamoud IslamDocument21 pagesMahamoud Islamvkumar66No ratings yet

- GDP Growth Q420Document2 pagesGDP Growth Q420Nina KondićNo ratings yet

- Ashmore Weekly Commentary 27 Jan 2023Document3 pagesAshmore Weekly Commentary 27 Jan 2023Jordanata TjiptarahardjaNo ratings yet

- Prices and InflationDocument28 pagesPrices and InflationÂshùtôsh KúmårNo ratings yet

- Global Market Review Outlook-May 2023Document3 pagesGlobal Market Review Outlook-May 2023YasahNo ratings yet

- Globaliza:on, Technological Progress and The Demand For LaborDocument12 pagesGlobaliza:on, Technological Progress and The Demand For LaborAshepNo ratings yet

- Population GrowthDocument34 pagesPopulation GrowthErik RodriguezNo ratings yet

- Profile of the International Pump Industry: Market Prospects to 2010From EverandProfile of the International Pump Industry: Market Prospects to 2010Rating: 1 out of 5 stars1/5 (1)

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Efficient Market Hypothesis Tests and Technical Analysis FOR Avenue Supermarts (DMART)Document36 pagesEfficient Market Hypothesis Tests and Technical Analysis FOR Avenue Supermarts (DMART)Manas TiwariNo ratings yet

- Product ManagementDocument15 pagesProduct ManagementManas TiwariNo ratings yet

- A Case Study Supply Chain Model of FlipkartDocument14 pagesA Case Study Supply Chain Model of FlipkartManas TiwariNo ratings yet

- Welding, Bonding, and The Design of Permanent JointsDocument66 pagesWelding, Bonding, and The Design of Permanent JointsManas Tiwari100% (2)

- 22 - GAIL - GLENMARK - Final ReportDocument85 pages22 - GAIL - GLENMARK - Final ReportManas TiwariNo ratings yet

- Machine Design and Drawing: (ME / MF F241)Document36 pagesMachine Design and Drawing: (ME / MF F241)Manas TiwariNo ratings yet

- Demand and Its Determinants Lecture 6Document31 pagesDemand and Its Determinants Lecture 6vineet_vishnoi02No ratings yet

- Know The Pulse Masterclass 4 PatternsDocument2 pagesKnow The Pulse Masterclass 4 Patternsstoinis harshitNo ratings yet

- Contract of Work in The Construction and Painting of Table For E-ClassroomDocument1 pageContract of Work in The Construction and Painting of Table For E-ClassroomAileen Rizaldo MejiaNo ratings yet

- Secrets About Personal Finance Software UncoveredDocument2 pagesSecrets About Personal Finance Software Uncoveredpullrelish7No ratings yet

- 2019 Supreme Court Cases Involving The COMMISSION On AUDITDocument376 pages2019 Supreme Court Cases Involving The COMMISSION On AUDITLiane V.No ratings yet

- Women in AgricultureDocument3 pagesWomen in AgricultureRajul C DasNo ratings yet

- Annual Report: GSP Finance Company (Bangladesh) LimitedDocument101 pagesAnnual Report: GSP Finance Company (Bangladesh) LimitedSakib AhmedNo ratings yet

- Syed Fahad Faiyaz HassanDocument5 pagesSyed Fahad Faiyaz HassanSyed Fahad HasanNo ratings yet

- CG Assignment 2022Document16 pagesCG Assignment 2022Messi The 10No ratings yet

- PIRELLI 2012 Sustainability ReportDocument174 pagesPIRELLI 2012 Sustainability ReportCSRMedia NetworkNo ratings yet

- CHAPTER II Review of Related LiteratureDocument8 pagesCHAPTER II Review of Related LiteratureRonald AbletesNo ratings yet

- IllustrationDocument3 pagesIllustrationVamsi Krishna BNo ratings yet

- MccainDocument5 pagesMccainknnaikNo ratings yet

- Go Negosyo ActDocument26 pagesGo Negosyo ActEngiemar Barbasa TupasNo ratings yet

- ASAL Business CB Chapter 31 AnswersDocument12 pagesASAL Business CB Chapter 31 Answers-shinagami-No ratings yet

- Child Labor Condition of Nila Market, Bashundhara, Dhaka, BangladeshDocument21 pagesChild Labor Condition of Nila Market, Bashundhara, Dhaka, BangladeshSadia HossainNo ratings yet

- Promotion, Transfer & SeparationDocument14 pagesPromotion, Transfer & Separationsakshi royNo ratings yet

- Pension Portion: Hints For Calculation of Pension "1 Step"Document55 pagesPension Portion: Hints For Calculation of Pension "1 Step"Willeuge100% (1)

- Amazon Case StudyDocument3 pagesAmazon Case StudyMalik UsamaNo ratings yet

- General Principles of Corp. Law.Document5 pagesGeneral Principles of Corp. Law.DebarchitaMahapatraNo ratings yet

- Purchasing Power ParityDocument5 pagesPurchasing Power ParityRahul Kumar AwadeNo ratings yet

- Promissory Note1Document1 pagePromissory Note1Ayumi Xuie MontefalcoNo ratings yet

- Chapter 7 - Notes - Part 1Document10 pagesChapter 7 - Notes - Part 1XienaNo ratings yet

- Standard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Document2 pagesStandard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Icel LacanilaoNo ratings yet

- Safesmart White PaperDocument7 pagesSafesmart White PaperDon KenixNo ratings yet

- Analysis On How Dell Technologies Manage Their CompanyDocument15 pagesAnalysis On How Dell Technologies Manage Their CompanyRitika MehtaNo ratings yet

- EMS Grade 88 Paper 2 Nov QP Final-1 (Original)Document6 pagesEMS Grade 88 Paper 2 Nov QP Final-1 (Original)umarmall628No ratings yet

- ITU-EU Project PNG PresentationDocument6 pagesITU-EU Project PNG PresentationLj TodockinNo ratings yet

- Scanner - CA Inter Incorporation of Company and Matters Incidental TheretoDocument35 pagesScanner - CA Inter Incorporation of Company and Matters Incidental TheretoNikhil NagendraNo ratings yet