Professional Documents

Culture Documents

BFIN400 GA One V3

BFIN400 GA One V3

Uploaded by

Mohammad Al Akoum0 ratings0% found this document useful (0 votes)

42 views2 pagesThe document provides the balance sheet and income statement data for Pal Pot Inc. for the years ended December 31, 2016 and December 31, 2017. It then lists 3 problems: [1] Enter the statement data into an Excel file with two sheets named "Balance Sheet" and "Income Statement". [2] Prepare common size statements for 2016 and 2017. [3] Prepare a cash flow statement for 2017. The problems are assigned weights of 20%, 40%, and 40% respectively.

Original Description:

Original Title

BFIN400 GA One V3 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the balance sheet and income statement data for Pal Pot Inc. for the years ended December 31, 2016 and December 31, 2017. It then lists 3 problems: [1] Enter the statement data into an Excel file with two sheets named "Balance Sheet" and "Income Statement". [2] Prepare common size statements for 2016 and 2017. [3] Prepare a cash flow statement for 2017. The problems are assigned weights of 20%, 40%, and 40% respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

42 views2 pagesBFIN400 GA One V3

BFIN400 GA One V3

Uploaded by

Mohammad Al AkoumThe document provides the balance sheet and income statement data for Pal Pot Inc. for the years ended December 31, 2016 and December 31, 2017. It then lists 3 problems: [1] Enter the statement data into an Excel file with two sheets named "Balance Sheet" and "Income Statement". [2] Prepare common size statements for 2016 and 2017. [3] Prepare a cash flow statement for 2017. The problems are assigned weights of 20%, 40%, and 40% respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

BFIN400 – Financial Modeling Graded Assignment One Spring 2020

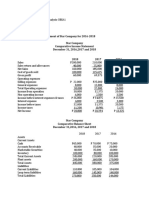

Pal Pot Inc. reported the data presented below:

Pal Pot Inc. Pal Pot Inc.

Balance Sheet Balance Sheet

For the Year Ended Dec. 31,2016 and

2017 For the Year Ended December 31, 2017

12/31/1 12/31/17 12/31/16 12/31/17

6

Cash 15,000 65,000 Sales 102,000 120,000

A/R 37,000 33,000 Cost of goods sold 34,000 40,000

Inventory 25,000 43,000 Gross Profit 68,000 80,000

Prepaid Expenses 3,000 6,000 Salaries & other 31,45

operating expenses 0 37,000

Total Cur. Assets 80,000 147,000 Bad debt expense 3,400 4,000

PPE 215,000 240,000 Dep. & Amort. 9,350 11,000

Accum. Dep. 80,000 91,000 EBIT 23,800 28,000

Net PPE 135,000 149,000 Interest expense 2,250 3,000

Total Assets 215,000 296,000 EBT 21,550 25,000

Taxes exp. (42%) 9,051 10,500

Accounts Payable 23,000 31,000 Net income 12,499 14,500

Salaries Payable 2,000 9,000

Interest payable 3,500 15,000

TCL 28,500 55,000

Long term liabilities 25,000 15,000

Common stock 100,000 150,000

Retained Earnings 61,500 76,000

TL&E 215,000 296,000

# of shares 10,000 15,000

outstanding

Problem One: (20%)

Enter the above statements into an excel file on two separate sheets using formulas and name

them “Balance Sheet” and “Income Statement”.

Problem Two: (40%)

Use the given income statements and balance sheets from Problem One to prepare common size

statements on new sheets (Income statement and Balance sheet) for years 2016 and 2017.

Problem Three: (40%)

Use the given income statements and balance sheets from Problem One to prepare cash flow

statement for 2017 on a new sheet and name it “statement of Cash flow”.

You might also like

- Car Detailing Business Plan ExampleDocument35 pagesCar Detailing Business Plan ExampleYcn YousefiNo ratings yet

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- 3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant ExampleDocument6 pages3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant Examplemohd_shaarNo ratings yet

- R e V I e W Q U e S T I o N S A N D P R o B L e M SDocument21 pagesR e V I e W Q U e S T I o N S A N D P R o B L e M SMonina CahiligNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- Engaging Activity 1 Financial AnalysisDocument3 pagesEngaging Activity 1 Financial AnalysisCatherineNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Assignment Financial Ratio Fin420Document8 pagesAssignment Financial Ratio Fin420FATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- Apple Inc Com in Dollar US in ThousandsDocument6 pagesApple Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Financial StatementDocument4 pagesFinancial StatementLizlee LaluanNo ratings yet

- Part III Ratio AnalysisDocument7 pagesPart III Ratio AnalysisamahaktNo ratings yet

- VCMMMM Final RequirementDocument8 pagesVCMMMM Final RequirementMaxine Lois PagaraganNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Analysis of Financial StatementsDocument11 pagesAnalysis of Financial StatementsBri CorpuzNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- Cash Flow Assignment-TusharDocument8 pagesCash Flow Assignment-TusharAssignments ExpressNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- Tutorial Meeting 6Document5 pagesTutorial Meeting 6Ve DekNo ratings yet

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Financial Management #3Document4 pagesFinancial Management #3Roel AsduloNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Answer Key For Module 4 To 10 1Document8 pagesAnswer Key For Module 4 To 10 1mae annNo ratings yet

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- Initial File For 3 StatementDocument9 pagesInitial File For 3 StatementanmolpahawabsrNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Financial Information Used in Ratios CompletedDocument1 pageFinancial Information Used in Ratios Completeddario.ramirezNo ratings yet

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet

- Finman P1 Compilation PDFDocument33 pagesFinman P1 Compilation PDFJev CastroverdeNo ratings yet

- Practice Questions For Final W Brick FinancialsDocument7 pagesPractice Questions For Final W Brick FinancialsJoana SilvaNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Business Plan: Product DescriptionDocument7 pagesBusiness Plan: Product DescriptionNikhil BirajNo ratings yet

- DocxDocument11 pagesDocxMikey MadRatNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Financial Statement Analysis - Illustrative Problem - FOR STUDENTSDocument6 pagesFinancial Statement Analysis - Illustrative Problem - FOR STUDENTShobi stanNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- Accountancy Auditing 2018Document7 pagesAccountancy Auditing 2018Abdul basitNo ratings yet

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- Technopreneurship PPT Presentation Group 1Document57 pagesTechnopreneurship PPT Presentation Group 1Mia ElizabethNo ratings yet

- Example CH 2Document1 pageExample CH 2HananNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document16 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- Complex GroupDocument5 pagesComplex Grouptαtmαn dє grєαtNo ratings yet

- BFIN400 Quiz One V3Document1 pageBFIN400 Quiz One V3Mohammad Al AkoumNo ratings yet

- Case Study: Slow Response Times, Shortage in Supplies, Etc) Is The Supply Chain ManagementDocument1 pageCase Study: Slow Response Times, Shortage in Supplies, Etc) Is The Supply Chain ManagementMohammad Al AkoumNo ratings yet

- Chapter 3Document8 pagesChapter 3Mohammad Al AkoumNo ratings yet

- Solution of Excercises of Chapters OneDocument2 pagesSolution of Excercises of Chapters OneMohammad Al AkoumNo ratings yet

- Exerciese of Chapter ThreeDocument6 pagesExerciese of Chapter ThreeMohammad Al AkoumNo ratings yet

- Exerciese of Chapter Three (Solution)Document15 pagesExerciese of Chapter Three (Solution)Mohammad Al AkoumNo ratings yet

- Excercises of Chapter Two-SolutionDocument7 pagesExcercises of Chapter Two-SolutionMohammad Al AkoumNo ratings yet

- Questions of Chapter Two: Question OneDocument3 pagesQuestions of Chapter Two: Question OneMohammad Al AkoumNo ratings yet

- Excercises of Chapters OneDocument2 pagesExcercises of Chapters OneMohammad Al AkoumNo ratings yet

- Solution of Excercises of Chapters OneDocument2 pagesSolution of Excercises of Chapters OneMohammad Al AkoumNo ratings yet

- Nature of Accounting Mind MapDocument12 pagesNature of Accounting Mind MapJared 03No ratings yet

- Inventory Management A&BDocument17 pagesInventory Management A&BAb PiousNo ratings yet

- BAC 112 Final Departmental Exam (Answer Key) RevisedDocument12 pagesBAC 112 Final Departmental Exam (Answer Key) Revisedjanus lopezNo ratings yet

- CLASS NOTES Topic 8 Conceptual Framework of AccountingDocument11 pagesCLASS NOTES Topic 8 Conceptual Framework of AccountingKiasha WarnerNo ratings yet

- Chapter 13 Managerial AccountingDocument168 pagesChapter 13 Managerial AccountingChandler Schleifs100% (4)

- Advance Chapter 6Document18 pagesAdvance Chapter 6abel habtamuNo ratings yet

- Annual Report 2020 PT Federal International Finance CompressedDocument465 pagesAnnual Report 2020 PT Federal International Finance CompressedFikri RamadhaniNo ratings yet

- The Budgeting of Account ReceivableDocument7 pagesThe Budgeting of Account ReceivableAnanda RiskiNo ratings yet

- Capital BudgetingDocument4 pagesCapital Budgetingsheraaa100% (1)

- WINDOW DRESSING SDocument2 pagesWINDOW DRESSING SShubhalaxmiNo ratings yet

- Chapter 36 Financial InstrumentsDocument5 pagesChapter 36 Financial InstrumentsEllen MaskariñoNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- BAFB3013 Financial ManagementDocument9 pagesBAFB3013 Financial ManagementSarah ShiphrahNo ratings yet

- Airbus Equity ResearchDocument9 pagesAirbus Equity ResearchArnaud SeiteNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- CVP Analysis: PG D M2 0 21-23 RelevantreadingsDocument21 pagesCVP Analysis: PG D M2 0 21-23 RelevantreadingsAthi SivaNo ratings yet

- Chapter 16Document47 pagesChapter 16Irin HaNo ratings yet

- Final Accounts - 2 Solved ProblemsDocument6 pagesFinal Accounts - 2 Solved ProblemsrijaNo ratings yet

- Chapter 9 The Accounting For BarangaysDocument26 pagesChapter 9 The Accounting For BarangaysAimerose ObedencioNo ratings yet

- Balance SheetDocument3 pagesBalance SheetDina JurķeNo ratings yet

- Investment Office ANRS: Project Profile On The Establishment of Bicycle Assembling PlantDocument27 pagesInvestment Office ANRS: Project Profile On The Establishment of Bicycle Assembling Plantbig john100% (1)

- A. All of The AboveDocument11 pagesA. All of The AbovetikaNo ratings yet

- Costing By-Product and Joint ProductsDocument34 pagesCosting By-Product and Joint ProductsArika KameliaNo ratings yet

- PDF PDFDocument29 pagesPDF PDFJenifer KlintonNo ratings yet

- Illustration of Accounting CycleDocument15 pagesIllustration of Accounting Cycleአረጋዊ ሐይለማርያምNo ratings yet

- ch4 PDFDocument43 pagesch4 PDFAliaa HosamNo ratings yet