Professional Documents

Culture Documents

W-2 Form George PDF

W-2 Form George PDF

Uploaded by

George LucasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W-2 Form George PDF

W-2 Form George PDF

Uploaded by

George LucasCopyright:

Available Formats

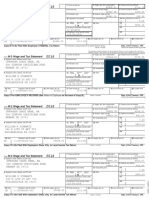

2019 W-2 and EARNINGS SUMMARY

Employee Reference Copy This blue section is your Earnings Summary which provides more detailed

W-2 Wage and Tax

Statement

Copy C for employee’srecords.

OMB No.

2019 1545-0008

information on the generation of your W-2 statement and W-4 profile. The

reverse side includes instructions and other general information.

d Control number Dept. Corp. Employer use only

290288 CHIC/5EZ 201050 T 203

c Employer’s name, address, and ZIP code

GREAT LAKES SERVICES 1

LLC

1255 FOURIER DRIVE # 201

MADISON WI 53717

1. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch #03110

Wages, Tips, other Social Security Medicare OH. State Wages,

e/f Employee’s name, address, and ZIP code Compensation Wages Wages Tips, Etc.

Box 1 of W-2 Box 3 of W-2 Box 5 of W-2 Box 16 of W-2

LUCAS L GEORGE RAUL

4600 MILAN ROAD Gross Pay 4,778.55 4,778.55 4,778.55 4,778.55

SANDUKSY OH 44870 Less Exempt Wages N/A 4,778.55 4,778.55 N/A

Reported W-2 Wages 4,778.55 0.00 0.00 4,778.55

b Employer’s FED ID number a Employee’s SSA number

27-1371313 APPLIED FOR

1 Wages, tips, other comp. 2 Federal income tax withheld

4778.55 360.35

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 2. Employee Current W-4 Profile. To make changes, file a new W-4 with your payroll department.

11 Nonqualified plans 12a See instructionsfor box 12

12b

LUCAS L GEORGE RAUL Social Security Number: APPLIED FOR

14 Other

12c 4600 MILAN ROAD Taxable Marital Status: SINGLE

12d SANDUKSY OH 44870 Exemptions/Allowances:

____________________

13 Stat emp. Ret. plan 3rd party sick pay FEDERAL: 1

STATE: 1

15 State Employer’s state ID no. 16 State wages, tips, etc.

OH 52-7599690 4778.55

17 State income tax 18 Local wages, tips, etc.

93.28

19 Local income tax 20 Locality name 2019 ADP, LLC

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

4778.55 360.35 4778.55 360.35 4778.55 360.35

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

290288 CHIC/5EZ 201050 T 203 290288 CHIC/5EZ 201050 T 203 290288 CHIC/5EZ 201050 T 203

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

GREAT LAKES SERVICES GREAT LAKES SERVICES GREAT LAKES SERVICES

LLC LLC LLC

1255 FOURIER DRIVE # 201 1255 FOURIER DRIVE # 201 1255 FOURIER DRIVE # 201

MADISON WI 53717 MADISON WI 53717 MADISON WI 53717

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

27-1371313 APPLIED FOR 27-1371313 APPLIED FOR 27-1371313 APPLIED FOR

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 9 10 Dependent care benefits 9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

14 Other 12b 14 Other 12b 14 Other 12b

12c 12c 12c

12d 12d 12d

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

LUCAS L GEORGE RAUL LUCAS L GEORGE RAUL LUCAS L GEORGE RAUL

4600 MILAN ROAD 4600 MILAN ROAD 4600 MILAN ROAD

SANDUKSY OH 44870 SANDUKSY OH 44870 SANDUKSY OH 44870

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

OH 52-7599690 4778.55 OH 52-7599690 4778.55 OH 52-7599690 4778.55

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

93.28 93.28 93.28

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Federal Filing Copy OH.State Reference Copy OH.State Filing Copy

W-2 Wage and Tax

Statement

Copy B to be filed with employee’s

OMB

2019 W-2

No. 1545-0008

Federal IncomeTax Return.

Wage and Tax

Statement

Copy 2 to be filed with employee’sState IncomeTax Return.

2019 W-2

OMB No. 1545-0008

Wage and Tax

Statement OMB

2019

Copy 2 to be filed with employee’sState IncomeTax Return.

No. 1545-0008

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Adp w2 2019 TemplateDocument1 pageAdp w2 2019 Templatetokahontas85No ratings yet

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- File by Mail Instructions For Your 2019 Federal Tax ReturnDocument10 pagesFile by Mail Instructions For Your 2019 Federal Tax ReturnAquanis El-Bey50% (2)

- Barry Bozeman-Public Values and Public Interest - Counterbalancing Economic Individualism (Public Management and Change) - Georgetown University Press (2007) PDFDocument223 pagesBarry Bozeman-Public Values and Public Interest - Counterbalancing Economic Individualism (Public Management and Change) - Georgetown University Press (2007) PDFliman2100% (2)

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (2)

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- W 2Document3 pagesW 2lysprr33% (3)

- Profit Or: Loss From BusinessDocument2 pagesProfit Or: Loss From BusinessBryan Pasqueci100% (2)

- Adopt A School MOA TemplateDocument5 pagesAdopt A School MOA TemplateLakanPH96% (26)

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Solving 9-11 The Deception That Changed The World (Christopher Bollyn)Document265 pagesSolving 9-11 The Deception That Changed The World (Christopher Bollyn)Rocket RepublicNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- Marie Aladin 2019 Tax PDFDocument60 pagesMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument11 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnCoughman Matt67% (3)

- Objectives of Foreign Policy of PakistanDocument4 pagesObjectives of Foreign Policy of Pakistanasis93% (15)

- PPDocument2 pagesPPSNG RYKNo ratings yet

- Oscar Velazquez Ortega 2021 - TaxReturnDocument12 pagesOscar Velazquez Ortega 2021 - TaxReturnoscar velasquezNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- 2018 Turbo Tax ReturnDocument5 pages2018 Turbo Tax ReturnAnfacNo ratings yet

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsRebecca AtesNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocument2 pagesU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- Code of Ethics - Habib Bank Limited - PakistanDocument15 pagesCode of Ethics - Habib Bank Limited - PakistanPinkAlert100% (4)

- Reading Plus Languages Unit 1: Cambridge English Empower B1+Document2 pagesReading Plus Languages Unit 1: Cambridge English Empower B1+Alcatras BreakNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Document2 pagesWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- U.S. Individual Income Tax Return: Popescu 879-47-5788 MariusDocument8 pagesU.S. Individual Income Tax Return: Popescu 879-47-5788 MariusMarius Popescu0% (1)

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- File by Mail Instructions For Your 2019 Federal Tax ReturnDocument7 pagesFile by Mail Instructions For Your 2019 Federal Tax ReturnKevin Osorio100% (2)

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument6 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnSindy Cruz100% (1)

- 2022 Calderon C Form 1040 Individual Tax Return - RecordsDocument46 pages2022 Calderon C Form 1040 Individual Tax Return - RecordsSali CaliNo ratings yet

- 2020 Tax Return Documents (DERICK BROOKS A)Document2 pages2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- 2021 Tax Return: Prepared ByDocument12 pages2021 Tax Return: Prepared ByRobert James100% (1)

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument15 pagesU.S. Individual Income Tax Return: Standard Deductionchantel100% (2)

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument3 pagesWage and Tax Statement: Copy C-For Employee'S RecordsyoNo ratings yet

- E Name w2 2021 WithInstructionsDocument3 pagesE Name w2 2021 WithInstructionsKandice ChandlerNo ratings yet

- WCEihh 05607 H 434910223005072219102Document2 pagesWCEihh 05607 H 434910223005072219102whitneydemetria007No ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Georgia WVS 2008 1Document66 pagesGeorgia WVS 2008 1David SichinavaNo ratings yet

- Hard Core Power, Pleasure, and The Frenzy of The VisibleDocument340 pagesHard Core Power, Pleasure, and The Frenzy of The VisibleRyan Gliever100% (5)

- (FILING) Comments of Adam Thierer - Mercatus Center - FTC COPPA 2011 AmmendmentsDocument12 pages(FILING) Comments of Adam Thierer - Mercatus Center - FTC COPPA 2011 AmmendmentsAdam ThiererNo ratings yet

- BANAJIDocument1 pageBANAJISayati DasNo ratings yet

- Indian National ArmyDocument2 pagesIndian National ArmybhagyalakshmipranjanNo ratings yet

- Module 10 To 12 Distribution of CasesDocument2 pagesModule 10 To 12 Distribution of CasesFritzie G. PuctiyaoNo ratings yet

- Pengaruh Kepemimpinan Etis Dan Budaya or Fd775c0eDocument8 pagesPengaruh Kepemimpinan Etis Dan Budaya or Fd775c0eMalinda AmeliaNo ratings yet

- Tolerance Vs Violence - EssayDocument2 pagesTolerance Vs Violence - Essaymata69.96.69No ratings yet

- The Hasty Generalization FallacyDocument11 pagesThe Hasty Generalization Fallacyapi-305353294No ratings yet

- Roman Senate: HistoryDocument9 pagesRoman Senate: HistorylimentuNo ratings yet

- Legal Aspects of LeasingDocument1 pageLegal Aspects of LeasingredsaluteNo ratings yet

- The Significance of Improving Intercultural Communicative Competence in Educational ProcessDocument3 pagesThe Significance of Improving Intercultural Communicative Competence in Educational ProcessEditor IJTSRDNo ratings yet

- Consti Case Analysis PDFDocument8 pagesConsti Case Analysis PDFManish KumarNo ratings yet

- Colombia: Sustaining Reforms Over TimeDocument6 pagesColombia: Sustaining Reforms Over TimeHerly TorresNo ratings yet

- Animal RightsDocument4 pagesAnimal RightsWan NajmieNo ratings yet

- Abu-Lughod - Se As Mulheres Muçulmanas Precisam Ser SalvasDocument8 pagesAbu-Lughod - Se As Mulheres Muçulmanas Precisam Ser SalvasAntoinette MadureiraNo ratings yet

- Criminal Complaint: United States v. Jack Eugene Carpenter IIIDocument7 pagesCriminal Complaint: United States v. Jack Eugene Carpenter IIIBen OrnerNo ratings yet

- SummaryDocument2 pagesSummarySayantan MondalNo ratings yet

- Plaintiffs Witness and Ex HibiDocument5 pagesPlaintiffs Witness and Ex Hibipaul weichNo ratings yet

- Charles Hale El Indio PermitidoDocument19 pagesCharles Hale El Indio Permitidoemanoel.barrosNo ratings yet

- Lisbon Treaty Allows For Death Penalty Across E.U.Document1 pageLisbon Treaty Allows For Death Penalty Across E.U.GodIsTruthNo ratings yet

- BU IHRM Mod 1 - 3 T&D Performance, ExpatriatesDocument25 pagesBU IHRM Mod 1 - 3 T&D Performance, ExpatriatesVishnu NairNo ratings yet

- Reaction Paper On PRRD Fifth Sona - Misterio, JohnDocument1 pageReaction Paper On PRRD Fifth Sona - Misterio, JohnJani MisterioNo ratings yet

- Email To Court Cover Sheet With PetitionDocument6 pagesEmail To Court Cover Sheet With PetitionQuaesha ScottNo ratings yet