Professional Documents

Culture Documents

Amount in Rupees Crore, Rate in Per Cent

Amount in Rupees Crore, Rate in Per Cent

Uploaded by

TrollTrends inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amount in Rupees Crore, Rate in Per Cent

Amount in Rupees Crore, Rate in Per Cent

Uploaded by

TrollTrends inc.Copyright:

Available Formats

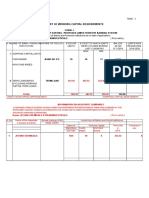

�ेस �काशनी PRESS RELEASE

भारतीय �रज़व� ब� क

RESERVE BANK OF INDIA

संचार िवभाग, क� �ीय कायार्लय, एस.बी.एस.मागर्, मुंबई-400001 0वेबसाइट : www.rbi.org.in/hindi

_____________________________________________________________________________________________________________________

Department of Communication, Central Office, S.B.S.Marg, Mumbai-400001 Website : www.rbi.org.in

फोन/Phone: 022- 22660502 ई-मेल/email: helpdoc@rbi.org.in

May 28, 2020

Money Market Operations as on May 27, 2020

(Amount in Rupees Crore, Rate in Per cent)

MONEY MARKETS @ Volume Weighted Range

(One Leg) Average Rate

A. Overnight Segment (I+II+III+IV) 3,08,011.58 2.96 0.25-4.50

I. Call Money 11,951.98 3.61 1.80-4.15

II. Triparty Repo 2,10,814.70 2.95 2.80-3.05

III. Market Repo 83,889.90 2.85 0.25-3.10

IV. Repo in Corporate Bond 1,355.00 4.43 3.60-4.50

B. Term Segment

I. Notice Money** 114.44 3.16 2.20-4.35

II. Term Money@@ 761.10 - 3.50-4.35

III. Triparty Repo 40.00 2.50 2.50-2.50

IV. Market Repo 0.00 - -

V. Repo in Corporate Bond 0.00 - -

RBI OPERATIONS@ Auction Date Tenor Maturity Amount Current

(Days) Date Rate/Cut

off Rate

C. Liquidity Adjustment Facility (LAF) & Marginal Standing Facility (MSF)

I Today's Operations

1. Fixed Rate

(i) Reverse Repo Wed, 27/05/2020 1 Thu, 28/05/2020 7,35,369.00 3.35

2. Variable Rate&

(I) Main Operation

(a) Reverse Repo

(II) Fine Tuning Operations

(a) Repo

(b) Reverse Repo - - - - -

3. MSF Wed, 27/05/2020 1 Thu, 28/05/2020 0.00 4.25

4. Long-Term Repo Operations - - -

5. Targeted Long Term Repo

- - - - -

Operations

6. Targeted Long Term Repo

- - - - -

Operations 2.0

7. Net liquidity injected from today's operations

-7,35,369.00

[injection (+)/absorption (-)]*

II Outstanding Operations

1. Fixed Rate

(i) Reverse Repo

2. Variable Rate&

(I) Main Operation

2

(a) Reverse Repo

(II) Fine Tuning Operations

(a) Repo

(b) Reverse Repo

3. MSF

4. Long-Term Repo Operations Mon, 24/02/2020 365 Tue, 23/02/2021 25,021.00 5.15

Mon, 17/02/2020 1095 Thu, 16/02/2023 25,035.00 5.15

Mon, 02/03/2020 1094 Wed, 01/03/2023 25,028.00 5.15

Mon, 09/03/2020 1093 Tue, 07/03/2023 25,021.00 5.15

Wed, 18/03/2020 1094 Fri, 17/03/2023 25,012.00 5.15

5. Targeted Long Term Repo Fri, 27/03/2020 1092 Fri, 24/03/2023 25,009.00 4.40

Operations Fri, 03/04/2020 1095 Mon, 03/04/2023 25,016.00 4.40

Thu, 09/04/2020 1093 Fri, 07/04/2023 25,016.00 4.40

Fri, 17/04/2020 1091 Thu, 13/04/2023 25,009.00 4.40

6. Targeted Long Term Repo

Thu, 23/04/2020 1093 Fri, 21/04/2023 12,850.00 4.40

Operations 2.0

D. Standing Liquidity Facility (SLF)

22,741.16

Availed from RBI$

E. Special Liquidity Facility for Mutual Funds (SLF-MF)$$ 2430.00#

F. Net liquidity injected from outstanding operations

2,63,188.16

[injection (+)/absorption (-)]*

G. Net liquidity injected (outstanding including today's

-4,72,180.84

operations) [injection (+)/absorption (-)]*

RESERVE POSITION@

H. Cash Reserves Position of Scheduled Commercial Banks

(i) Cash balances with RBI as on May 27, 2020 4,12,639.84

(ii) Average daily cash reserve requirement for the fortnight ending June 05, 2020 4,21,922.00

I. Government of India Surplus Cash Balance Reckoned for Auction as on ¥ May 27, 2020 0.00

J. Net durable liquidity [surplus (+)/deficit (-)] as on May 08, 2020 4,14,907.00

@ Based on Reserve Bank of India (RBI) / Clearing Corporation of India Limited (CCIL).

- Not Applicable / No Transaction

** Relates to uncollateralized transactions of 2 to 14 days tenor.

@@ Relates to uncollateralized transactions of 15 days to one year tenor

$ Includes refinance facilities extended by RBI

& As per the Press Release No. 2019-2020/1900 dated February 06, 2020

¥ As per the Press Release No. 2014-2015/1971 dated March 19, 2015

* Net liquidity is calculated as Repo+MSF+SLF+SLFMF-Reverse Repo

$$ As per the Press Release No. 2019-2020/2276 dated April 27, 2020

# The amount outstanding under SLF-MF includes an amount of ₹2,000 crore allotted on April 27, 2020 and an amount of ₹430 crore

allotted on April 30, 2020.

Ajit Prasad

Press Release : 2019-2020/2410 Director

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- DBM Form 706Document4 pagesDBM Form 706Joyce Ann Caigas - BarcelonNo ratings yet

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentA-Series OfficialNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentVasu Ram JayanthNo ratings yet

- Money Market Operations As On July 16, 2021Document2 pagesMoney Market Operations As On July 16, 2021Vasu Ram JayanthNo ratings yet

- (Amount in Rupees Crore, Rate in Per cent) : �ेस �काशनी PRESS RELEASEDocument2 pages(Amount in Rupees Crore, Rate in Per cent) : �ेस �काशनी PRESS RELEASEVasu Ram JayanthNo ratings yet

- Money Market Operations As On January 15, 2022: Press ReleaseDocument2 pagesMoney Market Operations As On January 15, 2022: Press ReleaseAayush GuptaNo ratings yet

- Money Market Operations As On May 29, 2023: Press ReleaseDocument2 pagesMoney Market Operations As On May 29, 2023: Press ReleaseVasu Ram JayanthNo ratings yet

- Well Documented Document On RbiDocument2 pagesWell Documented Document On RbiSurendra Singh ChandravatNo ratings yet

- India DailyDocument22 pagesIndia Dailyaram seNo ratings yet

- Market Update 5th March 2018Document1 pageMarket Update 5th March 2018Anonymous iFZbkNwNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- Daily Market Update 18.01Document1 pageDaily Market Update 18.01Inde Pendent LkNo ratings yet

- 14march 2019 - India - Daily PDFDocument59 pages14march 2019 - India - Daily PDFsameer deshmukhNo ratings yet

- Market Update 23rd March 2018Document1 pageMarket Update 23rd March 2018Anonymous iFZbkNwNo ratings yet

- First Resources Limited Berhad: Exponential Earnings Growth at Inexpensive - 3/6/2010Document8 pagesFirst Resources Limited Berhad: Exponential Earnings Growth at Inexpensive - 3/6/2010Rhb InvestNo ratings yet

- Market Update 29th March 2018Document1 pageMarket Update 29th March 2018Anonymous iFZbkNwNo ratings yet

- Faber Group Berhad: Award of Contract by Abu Dhabi Health Services - 6/7/2010Document3 pagesFaber Group Berhad: Award of Contract by Abu Dhabi Health Services - 6/7/2010Rhb InvestNo ratings yet

- Market Update 28th February 2018Document1 pageMarket Update 28th February 2018Anonymous iFZbkNwNo ratings yet

- Market Update 24th April 2018Document1 pageMarket Update 24th April 2018Anonymous iFZbkNwNo ratings yet

- Market Update 26th February 2018Document1 pageMarket Update 26th February 2018Anonymous iFZbkNwNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital RequirementsAkash RanabhatNo ratings yet

- Market Update 22nd May 2018Document1 pageMarket Update 22nd May 2018Anonymous iFZbkNwNo ratings yet

- Paparan Faktor Yang Mempengaruhi Investasi-15.06.2021-Part 1Document25 pagesPaparan Faktor Yang Mempengaruhi Investasi-15.06.2021-Part 1Subkhan NgalimunNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Market Update 25th October 2017Document1 pageMarket Update 25th October 2017Anonymous iFZbkNwNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementssantosh kumarNo ratings yet

- Financial Model SampleDocument8 pagesFinancial Model SamplekaajitkumarNo ratings yet

- Bifurcation of New Garah More Sub Division RevisedDocument9 pagesBifurcation of New Garah More Sub Division Revisedadmin xenNo ratings yet

- Aqu Vol23 IssueIVDocument2 pagesAqu Vol23 IssueIVvisheshNo ratings yet

- Genting Singapore PLC: The Competition Starts Now... - 27/04/2010Document9 pagesGenting Singapore PLC: The Competition Starts Now... - 27/04/2010Rhb InvestNo ratings yet

- Bval 01.25Document1 pageBval 01.25Althea Johnna Alvar AldojesaNo ratings yet

- FM 75 Imp Que May 2024Document149 pagesFM 75 Imp Que May 2024ಶ್ರೀ ಮಾರಮ್ಮ ದೇವಿ ಬೆಳಗುಂಬNo ratings yet

- UnionBankofthePhilippinesPSEUBP PublicCompanyDocument1 pageUnionBankofthePhilippinesPSEUBP PublicCompanyLester FarewellNo ratings yet

- Faber Group Berhad: Still A Good Buy-01/04/2010Document3 pagesFaber Group Berhad: Still A Good Buy-01/04/2010Rhb InvestNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- 21 03 2024 Dse Daily HighlightDocument3 pages21 03 2024 Dse Daily HighlightHabakuki HussenNo ratings yet

- COSCO - PH Cosco Capital Inc. Financial Statements - WSJDocument1 pageCOSCO - PH Cosco Capital Inc. Financial Statements - WSJjannahaaliyahdNo ratings yet

- Plantation:Closer To B5 Biodiesel Mandate Implementation - 25/03/2010Document3 pagesPlantation:Closer To B5 Biodiesel Mandate Implementation - 25/03/2010Rhb InvestNo ratings yet

- Market Update 15th March 2018Document1 pageMarket Update 15th March 2018Anonymous iFZbkNwNo ratings yet

- Market Update 8th November 2017Document1 pageMarket Update 8th November 2017Anonymous iFZbkNwNo ratings yet

- Bdip 2020-2025Document18 pagesBdip 2020-2025Evelyn Agustin Blones67% (3)

- SFM MTP 1 Nov 18 ADocument12 pagesSFM MTP 1 Nov 18 ASampath KumarNo ratings yet

- VAM World Growth B Fund Fact Sheet - April 2020Document3 pagesVAM World Growth B Fund Fact Sheet - April 2020Ian ThaiNo ratings yet

- Financial Reporting StandardDocument9 pagesFinancial Reporting StandardZakiah ZainuddinNo ratings yet

- Market Update 24th November 2017Document1 pageMarket Update 24th November 2017Anonymous iFZbkNwNo ratings yet

- IJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Document3 pagesIJM Corporation Berhad: Raising Stakes in Two Indian Units - 06/10/2010Rhb InvestNo ratings yet

- Market Update 6th March 2018Document1 pageMarket Update 6th March 2018Anonymous iFZbkNwNo ratings yet

- Competitive Analysis Template 26Document14 pagesCompetitive Analysis Template 26bakhoiruddinNo ratings yet

- Lis Elem Dept. Revised AppppmpDocument7 pagesLis Elem Dept. Revised AppppmpAdolf OdaniNo ratings yet

- Canara Rob Emerging Equitties FundDocument1 pageCanara Rob Emerging Equitties Fundjaspreet AnandNo ratings yet

- Market Update 21st May 2018Document1 pageMarket Update 21st May 2018Anonymous iFZbkNwNo ratings yet

- 2024-07-15-PH-DDocument5 pages2024-07-15-PH-Dphilnabank1217No ratings yet

- Question Bank Memo 2022 Second SemesterDocument59 pagesQuestion Bank Memo 2022 Second SemesterWorship NtshuxekaniNo ratings yet

- Ar 15Document324 pagesAr 15ed bookerNo ratings yet

- Cma Ravi Sharma 23-24Document12 pagesCma Ravi Sharma 23-24logicsin85No ratings yet

- Market Update 14th November 2017Document1 pageMarket Update 14th November 2017Anonymous iFZbkNwNo ratings yet

- WCT Berhad: No Further Provision For Bakun-25/05/2010Document4 pagesWCT Berhad: No Further Provision For Bakun-25/05/2010Rhb InvestNo ratings yet

- Cma Shree Tirupati Trading CompanyDocument12 pagesCma Shree Tirupati Trading Companylogicsin85No ratings yet

- Interim Order in The Matter of Kamalakshi Finance Corp. Ltd.Document37 pagesInterim Order in The Matter of Kamalakshi Finance Corp. Ltd.Shyam SunderNo ratings yet

- Finance MarketDocument29 pagesFinance MarketAjay MsdNo ratings yet

- Impact of Foreign Direct Investment in Life Insurance IndustryDocument22 pagesImpact of Foreign Direct Investment in Life Insurance Industryvajaajay100% (1)

- PKP 5 - Cash Flow Statement-Indirect MethodDocument5 pagesPKP 5 - Cash Flow Statement-Indirect MethodIR WanNo ratings yet

- Financial Performance Analysis Mba ProjectDocument55 pagesFinancial Performance Analysis Mba ProjectAnonymous ej7PpdNo ratings yet

- (France Digitale) Bootstraping Vs Fundraising PDFDocument64 pages(France Digitale) Bootstraping Vs Fundraising PDFJu WeissNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideKiran KrishnaNo ratings yet

- Stock Market Mafia and NSE Scandal - The Sunday Guardian Live PDFDocument8 pagesStock Market Mafia and NSE Scandal - The Sunday Guardian Live PDFDheeraj RajNo ratings yet

- PMS Kaleed E UrduDocument325 pagesPMS Kaleed E Urdusamra khanNo ratings yet

- SM Chapter 4Document31 pagesSM Chapter 4bekali811No ratings yet

- Market View - HSBC MF - May '23Document27 pagesMarket View - HSBC MF - May '23Akshay ChaudhryNo ratings yet

- PRTC FAR-1stPB 5.22Document9 pagesPRTC FAR-1stPB 5.22Ciatto SpotifyNo ratings yet

- Thayer VinFast, Electric Vehicles and U.S.-Vietnam RelationsDocument3 pagesThayer VinFast, Electric Vehicles and U.S.-Vietnam RelationsCarlyle Alan ThayerNo ratings yet

- Taju Assignment 2 (IFM - PDPU)Document15 pagesTaju Assignment 2 (IFM - PDPU)TajuzarNo ratings yet

- CashDocument16 pagesCashJemson YandugNo ratings yet

- Scripts For YouTube Videos About FinanceDocument2 pagesScripts For YouTube Videos About FinanceCyerill GoNo ratings yet

- 11 - NikeDocument41 pages11 - NikePranali SanasNo ratings yet

- Understanding The Gold Silver RatioDocument7 pagesUnderstanding The Gold Silver RatioVIKAS ARORANo ratings yet

- CHAPTER 6 Caselette - Audit of InvestDocument34 pagesCHAPTER 6 Caselette - Audit of InvestMr.AccntngNo ratings yet

- NSDLDocument7 pagesNSDLNimesh_No ratings yet

- Advanced Financial Management: Course ObjectivesDocument2 pagesAdvanced Financial Management: Course ObjectivesGrand OverallNo ratings yet

- Unit 2 - Legal - Forms - of - BusinessDocument14 pagesUnit 2 - Legal - Forms - of - BusinessKouame AdjepoleNo ratings yet

- Business Plan: Sections To Be CoveredDocument50 pagesBusiness Plan: Sections To Be CoveredDavid Caen MwangosiNo ratings yet

- 1.4 Investment in Government SecuritiesDocument17 pages1.4 Investment in Government SecuritiesMd. Ruhol AminNo ratings yet

- MPRA Paper 60110Document14 pagesMPRA Paper 60110Imam AwaluddinNo ratings yet

- CFA® Prep Course: BrochureDocument6 pagesCFA® Prep Course: BrochureSunil PatilNo ratings yet

- The Fama-French Five-StageDocument2 pagesThe Fama-French Five-StageAhmed El KhateebNo ratings yet

- Curriculum Vate MelbinDocument3 pagesCurriculum Vate MelbinMelbinNo ratings yet

- Invb 6572Document24 pagesInvb 6572Temp RoryNo ratings yet