Professional Documents

Culture Documents

NAS 23 Borrowing Cost

NAS 23 Borrowing Cost

Uploaded by

Prashant TamangCopyright:

Available Formats

You might also like

- Chapter 1: Base Knowledge Worksheet: Name: - DateDocument370 pagesChapter 1: Base Knowledge Worksheet: Name: - DateMartim Coutinho100% (2)

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- G.R. No. L-35925. January 22, 1973 DigestDocument3 pagesG.R. No. L-35925. January 22, 1973 DigestMaritoni Roxas100% (1)

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- Ch2-2 IAS23 Borrowing CostsDocument16 pagesCh2-2 IAS23 Borrowing Costsxu lNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- Topic 4 - Borrowing Cost - MFRS 123Document21 pagesTopic 4 - Borrowing Cost - MFRS 1232023105069No ratings yet

- PCOA Module 6 - PAS 23 and 24Document8 pagesPCOA Module 6 - PAS 23 and 24Jan JanNo ratings yet

- PDF Presentasi SiklusproduksipadaptfapptxDocument27 pagesPDF Presentasi SiklusproduksipadaptfapptxJessica AlodiaNo ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- FInancial ReportingDocument2 pagesFInancial ReportingSuhag PatelNo ratings yet

- LESSON5Document5 pagesLESSON5Ira Charisse BurlaosNo ratings yet

- PF 1-4 2023 - RescheduledDocument240 pagesPF 1-4 2023 - RescheduledZJ XNo ratings yet

- Quiz 1 Far510 MFRS120 123 PDFDocument4 pagesQuiz 1 Far510 MFRS120 123 PDFiirene.ntshNo ratings yet

- UasDocument16 pagesUasAngela BrendaNo ratings yet

- IAS 23 Borrowing Cost F7Document10 pagesIAS 23 Borrowing Cost F7Maria100% (1)

- Financial Accounting 3B Assignment 2Document6 pagesFinancial Accounting 3B Assignment 2NangulaNo ratings yet

- BORROWING COSTS Supplementary Review MaterialDocument2 pagesBORROWING COSTS Supplementary Review MaterialCaseylyn RonquilloNo ratings yet

- LEC03E - BSA 2102 - 012021-Borrowing CostsDocument2 pagesLEC03E - BSA 2102 - 012021-Borrowing CostsKatarame LermanNo ratings yet

- Borrowing CostsDocument12 pagesBorrowing CostsTaimur ShahidNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostButt ArhamNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostArm ButtNo ratings yet

- As 16 PDFDocument2 pagesAs 16 PDFRamNo ratings yet

- Module 11 - Borrowing CostsDocument6 pagesModule 11 - Borrowing CostsJehPoyNo ratings yet

- IAS-23 (Borrowing Costs)Document5 pagesIAS-23 (Borrowing Costs)Nazmul HaqueNo ratings yet

- Ind As 23Document6 pagesInd As 23Savin AdhikaryNo ratings yet

- MFRS123Document23 pagesMFRS123Kelvin Leong100% (1)

- Module 3 - Borrowing CostsDocument3 pagesModule 3 - Borrowing CostsLui100% (1)

- Intacc 2Document22 pagesIntacc 2AngelKate MicabaniNo ratings yet

- CA Inter Accounts Suggested Ans Nov23 Castudynotes ComDocument31 pagesCA Inter Accounts Suggested Ans Nov23 Castudynotes ComShivaram ShivaramNo ratings yet

- Pas 23Document11 pagesPas 23Justine VeralloNo ratings yet

- Common Loan Appln Upto Rs 2 CroreDocument7 pagesCommon Loan Appln Upto Rs 2 CroreAashish DabhadeNo ratings yet

- Citn & Icag-11Document1 pageCitn & Icag-11AKINROYEJE TEMITOPENo ratings yet

- Annual Budget For The Operating Costs: Page 1 of 4Document4 pagesAnnual Budget For The Operating Costs: Page 1 of 4swarna dasNo ratings yet

- 05 Handout 1Document18 pages05 Handout 1Jay PinedaNo ratings yet

- Ias 23Document18 pagesIas 23Shah KamalNo ratings yet

- Material of As 16Document21 pagesMaterial of As 16emmanuel JohnyNo ratings yet

- As 16Document10 pagesAs 16RAJASHEKARNo ratings yet

- Borrowing Costs IAS 23Document10 pagesBorrowing Costs IAS 23Tinashe ZhouNo ratings yet

- Ind As 23 - SolutionsDocument10 pagesInd As 23 - Solutionssoumya saswatNo ratings yet

- CM All AS SummaryDocument64 pagesCM All AS SummaryP KarthikeyanNo ratings yet

- 5.IAS 23 .Borrowing Cost Q&ADocument12 pages5.IAS 23 .Borrowing Cost Q&AAbdulkarim Hamisi KufakunogaNo ratings yet

- FR Session 2 - 8th July 2023Document40 pagesFR Session 2 - 8th July 2023irmaya.safitraNo ratings yet

- Ias: 23 Barrowing Cost: What Are Qualifying Assets?Document4 pagesIas: 23 Barrowing Cost: What Are Qualifying Assets?nishanthanNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- Chapter13 HKAS23Document9 pagesChapter13 HKAS23Kelviw02 WuuoqwoNo ratings yet

- Accounting Standard (AS) - 16 Borrowing Costs: Vinod JainDocument29 pagesAccounting Standard (AS) - 16 Borrowing Costs: Vinod Jainpriyajas303No ratings yet

- Borrowing CostsDocument4 pagesBorrowing CostsNoella Marie BaronNo ratings yet

- IC 1928-2020union MudraDocument11 pagesIC 1928-2020union Mudraamit_200619No ratings yet

- Model DPR For End Borrower DIDF Scheme 05 Jan2018Document52 pagesModel DPR For End Borrower DIDF Scheme 05 Jan2018muthukrishnanNo ratings yet

- To Complete This Workbook, Answer The Questions On Each WorksheetDocument12 pagesTo Complete This Workbook, Answer The Questions On Each WorksheetRizza L. MacarandanNo ratings yet

- CA-365 190117-AsDocument5 pagesCA-365 190117-AsGmt HspNo ratings yet

- International Accounting Standard 23Document4 pagesInternational Accounting Standard 23sami ullahNo ratings yet

- IPSAS 25 Borrowing CostsDocument24 pagesIPSAS 25 Borrowing CostsKibromWeldegiyorgisNo ratings yet

- Indv FINNANCEDocument7 pagesIndv FINNANCEMuhammad Aiezaqul Haikal bin ZainuriNo ratings yet

- AS 16 Borrowing CostsDocument16 pagesAS 16 Borrowing CostsRENU PALINo ratings yet

- EdgeReport UTKARSHBNK IPONotes 11 07 2023 599Document21 pagesEdgeReport UTKARSHBNK IPONotes 11 07 2023 599prashant_natureNo ratings yet

- 6 - As-16 Borrowing CostsDocument15 pages6 - As-16 Borrowing CostsKrishna JhaNo ratings yet

- Case 7.3 and 8Document24 pagesCase 7.3 and 8Bertha Muhammad SyahNo ratings yet

- Exrcises and Topics For Discussions DB 2024Document6 pagesExrcises and Topics For Discussions DB 2024Nguyễn Hồng HạnhNo ratings yet

- Investment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsFrom EverandInvestment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsNo ratings yet

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDocument5 pagesNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNo ratings yet

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDocument5 pagesNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNo ratings yet

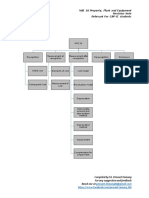

- Advanced Financial Reporting Marks WeightageDocument3 pagesAdvanced Financial Reporting Marks WeightagePrashant TamangNo ratings yet

- Unit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsDocument11 pagesUnit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsPrashant TamangNo ratings yet

- NAS 16-Property, Plant and EquipmentDocument10 pagesNAS 16-Property, Plant and EquipmentPrashant TamangNo ratings yet

- Unit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsDocument13 pagesUnit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsPrashant TamangNo ratings yet

- NAS 2 InventoriesDocument12 pagesNAS 2 InventoriesPrashant TamangNo ratings yet

- Importance of The Marketing Environment Analysis IDocument9 pagesImportance of The Marketing Environment Analysis IkatieNo ratings yet

- Ivylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0Document4 pagesIvylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0ivy loraine enriquezNo ratings yet

- Brief History Jeep. 22Document2 pagesBrief History Jeep. 22Crystal Jane Tic-ing100% (1)

- Banking SWOT Analysis v2Document29 pagesBanking SWOT Analysis v2Chiraroj AngsumaleeNo ratings yet

- N-23-05 Republic V EquitableDocument1 pageN-23-05 Republic V EquitableAndrew GallardoNo ratings yet

- Appearance and Non-Appearance of The PartyDocument16 pagesAppearance and Non-Appearance of The PartySlim ShadyNo ratings yet

- 1 - Prosodic Features of Speech-COMPLETEDocument39 pages1 - Prosodic Features of Speech-COMPLETEMendoza EmmaNo ratings yet

- Jerome Littles NewspaperDocument14 pagesJerome Littles NewspaperJerome LittlesNo ratings yet

- Pag Ibig FundDocument5 pagesPag Ibig FundeyNo ratings yet

- MUH 2512 Exam 2 Study GuideDocument14 pagesMUH 2512 Exam 2 Study GuideAlan DeVall100% (1)

- ISFIF Programme Schedule - 08 12 2017Document31 pagesISFIF Programme Schedule - 08 12 2017Saurav DashNo ratings yet

- Assemblage Art Shadow Box Eller's ArtistsDocument1 pageAssemblage Art Shadow Box Eller's ArtistsRadu CiurariuNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- FFG Star Wars RPG EquipmentDocument44 pagesFFG Star Wars RPG EquipmentguiloNo ratings yet

- YCMOU Study Center Submission Slip: Application No: Distance EducationDocument4 pagesYCMOU Study Center Submission Slip: Application No: Distance Educationvaibhavpardeshi55No ratings yet

- Inglés Ix: Dra. Mercy Noelia Páliza ChampiDocument30 pagesInglés Ix: Dra. Mercy Noelia Páliza ChampiEdwin Christian Laurente HuertasNo ratings yet

- Cadenas Drives USA PDFDocument238 pagesCadenas Drives USA PDFCamilo Araya ArayaNo ratings yet

- Company Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesDocument3 pagesCompany Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesTequila Mhae LopezNo ratings yet

- PF Enomination Job AidDocument9 pagesPF Enomination Job Aidashritha prakashNo ratings yet

- Https Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTDocument2 pagesHttps Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTBill Singh100% (1)

- Rowan AtkinsonDocument5 pagesRowan AtkinsonDelia AndreeaNo ratings yet

- Daniel Burnham in The PhilippinesDocument6 pagesDaniel Burnham in The PhilippinesJanelleNo ratings yet

- SpaceHulk Death AngelDocument5 pagesSpaceHulk Death Angelfuffa02No ratings yet

- Possessive Adjectives: Interchange 1Document4 pagesPossessive Adjectives: Interchange 1Islam MohammadNo ratings yet

- Current Affairs of February 2024Document36 pagesCurrent Affairs of February 2024imrankhan872019No ratings yet

- BH Eu 05 SensepostDocument37 pagesBH Eu 05 SensepostblwztrainingNo ratings yet

- Tese - Cristiana AlmeidaDocument257 pagesTese - Cristiana AlmeidaDeia AlmeidaNo ratings yet

NAS 23 Borrowing Cost

NAS 23 Borrowing Cost

Uploaded by

Prashant TamangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NAS 23 Borrowing Cost

NAS 23 Borrowing Cost

Uploaded by

Prashant TamangCopyright:

Available Formats

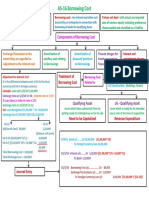

NAS 23 Borrowing cost

Revision Note

Reference for CAP-II Students

1. Key Terms Used

Borrowing cost Interest and other costs that an entity incurs in connection

with borrowing of Fund.

Qualifying asset An asset that takes substantial period of time to get ready

for its intended use or sale.

Example:

i. Inventories

ii. Manufacturing Plant

iii. Power Generation facilities

iv. Intangible asset

2. What is the core principle of this standard?

Borrowing costs that are directly attributable to the acquisition, construction or

production of a qualifying asset are included in the cost of that asset.

Other borrowing costs are recognised as an expense in Statement of profit or loss.

3. Types of Borrowing:

a. Specific Borrowing:

Where a loan is taken out specifically to finance the construction of an asset,

the amount to be capitalised (I.e. included in cost of the respective asset) :

= Interest payable on that loan - any investment income on the temporary

investment of the borrowings.

b. General Borrowing:

If construction of a qualifying asset is financed from an entity's general borrowings,

the borrowing costs eligible to be capitalised are determined by applying a

capitalisation rate to the expenditure incurred on the asset.

What is capitalisation rate?

Capitalisation rate= Total general borrowing cost for the period (excluding

specific borrowings) / weighted average total general

borrowings (excluding specific borrowings)

Now this capitalisation rate is applied to the average carrying amount of the

asset during the period.

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 23 Borrowing cost

Revision Note

Reference for CAP-II Students

Example 1:

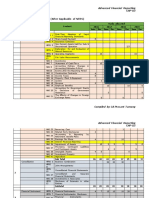

Beta Ltd had the following loans in place at the end of 31st March, 20X2: (In thousand)

Loan 1st April, 20X1 31st March,

20X2

18% Bank Loan 1,000 1,000

16% Term loan 3,000 3,000

14% Debentures 2000

14% debenture was issued to fund the construction of Office building on 1st July, 20X1

but the development activities has yet to be started.

On 1st April, 20X1, Beta ltd began the construction of a Plant being qualifying asset

using the existing borrowings. Expenditure drawn down f or the construction was: Rs

500(000 )on 1st April, 20X1 and Rs 2,500 (000) on 1st January, 20X2.

Required

Calculate the borrowing cost that can be capitalised for the plant.

Answer:

Calculation of Borrowing cost to be capitalised

Condition:

Borrowing costs that are directly attributable to the acquisition, construction or

production of a qualifying asset are included in the cost of that asset.

Type of loan 31s t March, 20X2 Remarks

18% Bank Loan

1000 General borrowing for

qualifying asset

(Construction of plant)

16% Term loan

3000 General Borrowing for

qualifying asset

(construction of plant)

14% Debentures

2000 Specific Borrowing for

qualifying asset

(construction of building)

Now, Capitalisation Rate for General borrowing:

Type of loan Loan Amount as Interest cost (In

on 31s t March, thousand)

20X2

18% Bank Loan =1000*12/12 =1000*18%*12/12

(Used for whole =180

year)

16% Term Loan =3000*12/12 =3000*16%*12/12

(Used for whole =480

year)

Total 4000 660

Capitalisation =660/4000

Rate

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 23 Borrowing cost

Revision Note

Reference for CAP-II Students

=16.5% per

annum

Borrowing cost to be capitalized for Plant = 500*16.5%+ 2500*16.5%*3/12=

185.625 (in thousand).

Note: 14% debenture is specific borrowings (hence ignore in capitalization of

general borrowing)

Exam Question

M/s Biotic Company Limited obtained a loan for Rs. 14 crores on Shrawan 15, 2069

from Nepal Bank Limited, to be utilized as under:

Construction of Factory building Rs. 2.5 crores

Purchase of Plant and Equipment Rs. 2.0 crores

Working Capital Rs'. 1.5 crores

Advance for purchase of trucks Rs. 1.0 crore

In Ashadh 2070, construction of the factory building was completed and Plant and

Equipments, which was ready for its intended use, was installed. Delivery of trucks was

received in the next FY. Total interest of Rs. 9,100,000 was charged by the bank for the

financial year ending 31.3.2070.

Show the treatment of interest under NAS 23 “Borrowing Cost” and also explain the

nature of assets. (June 2014- 5marks)

Answer:

Condition: (As per NAS 23)

Borrowing costs that are directly attributable to the acquisition, construction or

production of a qualifying asset are included in the cost of that asset.

Other borrowing cost charged as expenses.

Here,

Effective interest rate= Interest cost/ Fund borrowed*100%

=0.91/14*100

= 6.5%

Treatment of Borrowing cost under NAS 23 Borrowing cost:

Particulars Nature Interest to Interest to Total

be be charge as

capitalised expenses

Construction of Qualifying =2.5 *6.5%

Factory asset =0.1625

Building

Purchase of =2*6.5%

plant and Non- =0.13

equipment Qualifying

Working asset =1.5*6.5%

capital =0.0975

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 23 Borrowing cost

Revision Note

Reference for CAP-II Students

Advance for =1*6.5%

purchase of =0.065

trucks

Remaining 0.455

Total 0.1625 0.7475 0.91

Notes:

Assumed that construction of a factory building was completed on 31st Ashadh,

2070.

Assumed that the Plant and Equipment was ready for its intended use at the time

of its acquisition.

Exam Question:

A company obtained term loan during the year ended 31st March, 2012 to an extent of

Rs. 650 lakhs for modernization and development of its factory. Building worth Rs. 120

lakhs were completed and plant and machinery worth Rs. 350 lakhs were installed by 31st

March, 2012. A sum of Rs. 70 lakhs has been advanced for assets the installation of which

is expected in the following year. Rs. 110 lakhs has been utilized for working capital

requirements. Interest paid on the loan of Rs. 650 lakhs during the fiscal year 2011-012

amounted to Rs. 58.50 lakhs. How should the interest amount be treated in the account

of the company? Give your comments for the financial year ending on 31-03-2012 in the

context of relevant NAS.

Answer:

As per NAS 23:

Borrowing costs that are directly attributable to the acquisition, construction

or production of a qualifying asset are included in the cost of that asset.

Other borrowing costs are recognised as an expense in Statement of profit or

loss.

Interest rate= Interest expenses/Loan borrowed= 58.5/650 = 9%

Nature Fund used (in Interest cost To be Interest cost to

lakh) capitalised be charged as

expenses

Building Qualifying 120 =9%*120 -

asset =10.8

(This cost added to

Building)

Plant and Qualifying 350 =9%* 350

Machinery asset =31.5 (This cost

added to Plant and

Machinery)

Advance Non 70 =9%*70

for assets Qualifying =6.3

Working Non 110 =110*9%

Capital Qualifying =9.9

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

NAS 23 Borrowing cost

Revision Note

Reference for CAP-II Students

Total 650

(equivalent to

Borrowed

loan)

4. Period of Capitalisation: (Important for Theory Question)

a. Commencement of Capitalisation (When borrowing cost is Capitalised?)

The COMMENCEMENT date for capitalisation is the date when the entity first meets

ALL of the following conditions cumulatively on a particular date:

i. It incurs expenditures for the asset.

ii. It incurs borrowing cost.

iii. It undertakes activities that are necessary to prepare the asset for its intended use

or sale.

b. Suspension of capitalisation:

Capitalisation of borrowing costs should be SUSPENDED during extended periods in

which active development is interrupted. Such costs are costs of holding partially

completed assets and do not qualify for capitalisation.

c. Cessation of capitalisation:

An entity should CEASE capitalising borrowing costs when substantially all the

activities necessary to prepare the qualifying asset for its intended use or sale are

complete.

When construction of a qualifying asset is completed in parts and each part is capable

of being used while construction continues on other parts, capitalisation of

borrowing costs relating to a part should cease when substantially all the

activities that are necessary to get that part ready for use are completed.

Discuss the treatment of capitalization of borrowing cost as per NAS 23.

(Dec 2014, June 2015)

Compiled by CA. Prasant Tamang

For any suggestion and feedback

Reach me at prasant.tamang02@gmail.com

https://www.facebook.com/prasant.tamang.144

You might also like

- Chapter 1: Base Knowledge Worksheet: Name: - DateDocument370 pagesChapter 1: Base Knowledge Worksheet: Name: - DateMartim Coutinho100% (2)

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- G.R. No. L-35925. January 22, 1973 DigestDocument3 pagesG.R. No. L-35925. January 22, 1973 DigestMaritoni Roxas100% (1)

- 13.8 AS 16 Borrowing CostsDocument8 pages13.8 AS 16 Borrowing CostsAakshi SharmaNo ratings yet

- Ch2-2 IAS23 Borrowing CostsDocument16 pagesCh2-2 IAS23 Borrowing Costsxu lNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- Topic 4 - Borrowing Cost - MFRS 123Document21 pagesTopic 4 - Borrowing Cost - MFRS 1232023105069No ratings yet

- PCOA Module 6 - PAS 23 and 24Document8 pagesPCOA Module 6 - PAS 23 and 24Jan JanNo ratings yet

- PDF Presentasi SiklusproduksipadaptfapptxDocument27 pagesPDF Presentasi SiklusproduksipadaptfapptxJessica AlodiaNo ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Module 6 CFAS PAS 23 - BORROWING COSTDocument6 pagesModule 6 CFAS PAS 23 - BORROWING COSTJan JanNo ratings yet

- FInancial ReportingDocument2 pagesFInancial ReportingSuhag PatelNo ratings yet

- LESSON5Document5 pagesLESSON5Ira Charisse BurlaosNo ratings yet

- PF 1-4 2023 - RescheduledDocument240 pagesPF 1-4 2023 - RescheduledZJ XNo ratings yet

- Quiz 1 Far510 MFRS120 123 PDFDocument4 pagesQuiz 1 Far510 MFRS120 123 PDFiirene.ntshNo ratings yet

- UasDocument16 pagesUasAngela BrendaNo ratings yet

- IAS 23 Borrowing Cost F7Document10 pagesIAS 23 Borrowing Cost F7Maria100% (1)

- Financial Accounting 3B Assignment 2Document6 pagesFinancial Accounting 3B Assignment 2NangulaNo ratings yet

- BORROWING COSTS Supplementary Review MaterialDocument2 pagesBORROWING COSTS Supplementary Review MaterialCaseylyn RonquilloNo ratings yet

- LEC03E - BSA 2102 - 012021-Borrowing CostsDocument2 pagesLEC03E - BSA 2102 - 012021-Borrowing CostsKatarame LermanNo ratings yet

- Borrowing CostsDocument12 pagesBorrowing CostsTaimur ShahidNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostButt ArhamNo ratings yet

- IAS 23 Borrowing CostDocument6 pagesIAS 23 Borrowing CostArm ButtNo ratings yet

- As 16 PDFDocument2 pagesAs 16 PDFRamNo ratings yet

- Module 11 - Borrowing CostsDocument6 pagesModule 11 - Borrowing CostsJehPoyNo ratings yet

- IAS-23 (Borrowing Costs)Document5 pagesIAS-23 (Borrowing Costs)Nazmul HaqueNo ratings yet

- Ind As 23Document6 pagesInd As 23Savin AdhikaryNo ratings yet

- MFRS123Document23 pagesMFRS123Kelvin Leong100% (1)

- Module 3 - Borrowing CostsDocument3 pagesModule 3 - Borrowing CostsLui100% (1)

- Intacc 2Document22 pagesIntacc 2AngelKate MicabaniNo ratings yet

- CA Inter Accounts Suggested Ans Nov23 Castudynotes ComDocument31 pagesCA Inter Accounts Suggested Ans Nov23 Castudynotes ComShivaram ShivaramNo ratings yet

- Pas 23Document11 pagesPas 23Justine VeralloNo ratings yet

- Common Loan Appln Upto Rs 2 CroreDocument7 pagesCommon Loan Appln Upto Rs 2 CroreAashish DabhadeNo ratings yet

- Citn & Icag-11Document1 pageCitn & Icag-11AKINROYEJE TEMITOPENo ratings yet

- Annual Budget For The Operating Costs: Page 1 of 4Document4 pagesAnnual Budget For The Operating Costs: Page 1 of 4swarna dasNo ratings yet

- 05 Handout 1Document18 pages05 Handout 1Jay PinedaNo ratings yet

- Ias 23Document18 pagesIas 23Shah KamalNo ratings yet

- Material of As 16Document21 pagesMaterial of As 16emmanuel JohnyNo ratings yet

- As 16Document10 pagesAs 16RAJASHEKARNo ratings yet

- Borrowing Costs IAS 23Document10 pagesBorrowing Costs IAS 23Tinashe ZhouNo ratings yet

- Ind As 23 - SolutionsDocument10 pagesInd As 23 - Solutionssoumya saswatNo ratings yet

- CM All AS SummaryDocument64 pagesCM All AS SummaryP KarthikeyanNo ratings yet

- 5.IAS 23 .Borrowing Cost Q&ADocument12 pages5.IAS 23 .Borrowing Cost Q&AAbdulkarim Hamisi KufakunogaNo ratings yet

- FR Session 2 - 8th July 2023Document40 pagesFR Session 2 - 8th July 2023irmaya.safitraNo ratings yet

- Ias: 23 Barrowing Cost: What Are Qualifying Assets?Document4 pagesIas: 23 Barrowing Cost: What Are Qualifying Assets?nishanthanNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- Chapter13 HKAS23Document9 pagesChapter13 HKAS23Kelviw02 WuuoqwoNo ratings yet

- Accounting Standard (AS) - 16 Borrowing Costs: Vinod JainDocument29 pagesAccounting Standard (AS) - 16 Borrowing Costs: Vinod Jainpriyajas303No ratings yet

- Borrowing CostsDocument4 pagesBorrowing CostsNoella Marie BaronNo ratings yet

- IC 1928-2020union MudraDocument11 pagesIC 1928-2020union Mudraamit_200619No ratings yet

- Model DPR For End Borrower DIDF Scheme 05 Jan2018Document52 pagesModel DPR For End Borrower DIDF Scheme 05 Jan2018muthukrishnanNo ratings yet

- To Complete This Workbook, Answer The Questions On Each WorksheetDocument12 pagesTo Complete This Workbook, Answer The Questions On Each WorksheetRizza L. MacarandanNo ratings yet

- CA-365 190117-AsDocument5 pagesCA-365 190117-AsGmt HspNo ratings yet

- International Accounting Standard 23Document4 pagesInternational Accounting Standard 23sami ullahNo ratings yet

- IPSAS 25 Borrowing CostsDocument24 pagesIPSAS 25 Borrowing CostsKibromWeldegiyorgisNo ratings yet

- Indv FINNANCEDocument7 pagesIndv FINNANCEMuhammad Aiezaqul Haikal bin ZainuriNo ratings yet

- AS 16 Borrowing CostsDocument16 pagesAS 16 Borrowing CostsRENU PALINo ratings yet

- EdgeReport UTKARSHBNK IPONotes 11 07 2023 599Document21 pagesEdgeReport UTKARSHBNK IPONotes 11 07 2023 599prashant_natureNo ratings yet

- 6 - As-16 Borrowing CostsDocument15 pages6 - As-16 Borrowing CostsKrishna JhaNo ratings yet

- Case 7.3 and 8Document24 pagesCase 7.3 and 8Bertha Muhammad SyahNo ratings yet

- Exrcises and Topics For Discussions DB 2024Document6 pagesExrcises and Topics For Discussions DB 2024Nguyễn Hồng HạnhNo ratings yet

- Investment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsFrom EverandInvestment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsNo ratings yet

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDocument5 pagesNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNo ratings yet

- NAS 37 Provision, Contingent Asset and Contingent LiabilitiesDocument5 pagesNAS 37 Provision, Contingent Asset and Contingent LiabilitiesPrashant TamangNo ratings yet

- Advanced Financial Reporting Marks WeightageDocument3 pagesAdvanced Financial Reporting Marks WeightagePrashant TamangNo ratings yet

- Unit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsDocument11 pagesUnit Overview:: NAS 17 Lease Revision Note Relevant For CAP-II StudentsPrashant TamangNo ratings yet

- NAS 16-Property, Plant and EquipmentDocument10 pagesNAS 16-Property, Plant and EquipmentPrashant TamangNo ratings yet

- Unit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsDocument13 pagesUnit Overview:: NAS 2 Inventories Revision Note Relevant For CAP-II StudentsPrashant TamangNo ratings yet

- NAS 2 InventoriesDocument12 pagesNAS 2 InventoriesPrashant TamangNo ratings yet

- Importance of The Marketing Environment Analysis IDocument9 pagesImportance of The Marketing Environment Analysis IkatieNo ratings yet

- Ivylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0Document4 pagesIvylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0ivy loraine enriquezNo ratings yet

- Brief History Jeep. 22Document2 pagesBrief History Jeep. 22Crystal Jane Tic-ing100% (1)

- Banking SWOT Analysis v2Document29 pagesBanking SWOT Analysis v2Chiraroj AngsumaleeNo ratings yet

- N-23-05 Republic V EquitableDocument1 pageN-23-05 Republic V EquitableAndrew GallardoNo ratings yet

- Appearance and Non-Appearance of The PartyDocument16 pagesAppearance and Non-Appearance of The PartySlim ShadyNo ratings yet

- 1 - Prosodic Features of Speech-COMPLETEDocument39 pages1 - Prosodic Features of Speech-COMPLETEMendoza EmmaNo ratings yet

- Jerome Littles NewspaperDocument14 pagesJerome Littles NewspaperJerome LittlesNo ratings yet

- Pag Ibig FundDocument5 pagesPag Ibig FundeyNo ratings yet

- MUH 2512 Exam 2 Study GuideDocument14 pagesMUH 2512 Exam 2 Study GuideAlan DeVall100% (1)

- ISFIF Programme Schedule - 08 12 2017Document31 pagesISFIF Programme Schedule - 08 12 2017Saurav DashNo ratings yet

- Assemblage Art Shadow Box Eller's ArtistsDocument1 pageAssemblage Art Shadow Box Eller's ArtistsRadu CiurariuNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- FFG Star Wars RPG EquipmentDocument44 pagesFFG Star Wars RPG EquipmentguiloNo ratings yet

- YCMOU Study Center Submission Slip: Application No: Distance EducationDocument4 pagesYCMOU Study Center Submission Slip: Application No: Distance Educationvaibhavpardeshi55No ratings yet

- Inglés Ix: Dra. Mercy Noelia Páliza ChampiDocument30 pagesInglés Ix: Dra. Mercy Noelia Páliza ChampiEdwin Christian Laurente HuertasNo ratings yet

- Cadenas Drives USA PDFDocument238 pagesCadenas Drives USA PDFCamilo Araya ArayaNo ratings yet

- Company Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesDocument3 pagesCompany Information: 32nd Street Corner 7th Avenue, Bonifacio Global City @globemybusiness Taguig, PhilippinesTequila Mhae LopezNo ratings yet

- PF Enomination Job AidDocument9 pagesPF Enomination Job Aidashritha prakashNo ratings yet

- Https Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTDocument2 pagesHttps Ecf - Njb.uscourts - Gov Cgi-Bin DKTRPTBill Singh100% (1)

- Rowan AtkinsonDocument5 pagesRowan AtkinsonDelia AndreeaNo ratings yet

- Daniel Burnham in The PhilippinesDocument6 pagesDaniel Burnham in The PhilippinesJanelleNo ratings yet

- SpaceHulk Death AngelDocument5 pagesSpaceHulk Death Angelfuffa02No ratings yet

- Possessive Adjectives: Interchange 1Document4 pagesPossessive Adjectives: Interchange 1Islam MohammadNo ratings yet

- Current Affairs of February 2024Document36 pagesCurrent Affairs of February 2024imrankhan872019No ratings yet

- BH Eu 05 SensepostDocument37 pagesBH Eu 05 SensepostblwztrainingNo ratings yet

- Tese - Cristiana AlmeidaDocument257 pagesTese - Cristiana AlmeidaDeia AlmeidaNo ratings yet