Professional Documents

Culture Documents

Practice Question 2

Practice Question 2

Uploaded by

Prerna AroraCopyright:

Available Formats

You might also like

- DocxDocument5 pagesDocxSylvia Al-a'maNo ratings yet

- Case Study:: SNC Lavalin Group IncDocument7 pagesCase Study:: SNC Lavalin Group IncPrerna AroraNo ratings yet

- Practice Sheet 2Document4 pagesPractice Sheet 2Prerna AroraNo ratings yet

- Consignment Agreement Template 02Document3 pagesConsignment Agreement Template 02Elle VergaraNo ratings yet

- Chapter 18Document10 pagesChapter 18Ali Abu Al Saud100% (2)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- Audit of Inventories and Cost of Goods SDocument16 pagesAudit of Inventories and Cost of Goods SAira Nhaira MecateNo ratings yet

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocument1 pageAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNo ratings yet

- Accounting For Merchandize OperationDocument7 pagesAccounting For Merchandize OperationMUHAMMAD ARIF BASHIRNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- Chapter 18Document21 pagesChapter 18Sunny SunnyNo ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Test # 3 Review Material - BACC 152 16th EditionDocument17 pagesTest # 3 Review Material - BACC 152 16th EditionskswNo ratings yet

- Ch10 ExercisesDocument15 pagesCh10 Exercisesjamiahamdard001No ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- CH 10 PA 2Document2 pagesCH 10 PA 2lisahuang2032No ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- Solutions - CH 5Document4 pagesSolutions - CH 5Khánh AnNo ratings yet

- Exercise 13.22Document3 pagesExercise 13.22MynameNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Practice MCQs - ClassDocument3 pagesPractice MCQs - Classemannajmi786No ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Solutions To Exercises - Chap 3Document27 pagesSolutions To Exercises - Chap 3InciaNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- ch05 ExercisesDocument13 pagesch05 ExercisesTowkirNo ratings yet

- Government FundDocument23 pagesGovernment Fund20211211017 SKOLASTIKA ANABELNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- CH5 Accounting QuizDocument7 pagesCH5 Accounting QuizTarun ImandiNo ratings yet

- Weygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesDocument2 pagesWeygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesHương ThưNo ratings yet

- Prepare in Good Form The 20X9 GAAP Based Statement of RevenuesDocument1 pagePrepare in Good Form The 20X9 GAAP Based Statement of Revenuestrilocksp SinghNo ratings yet

- Practice Exercise - Pas 7Document4 pagesPractice Exercise - Pas 7Martha Nicole MaristelaNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- DocDocument19 pagesDocCj BarrettoNo ratings yet

- Solutiondone 2-207Document1 pageSolutiondone 2-207trilocksp SinghNo ratings yet

- Total: Balance Sheet Total-' 82,120. The Following EntryDocument2 pagesTotal: Balance Sheet Total-' 82,120. The Following EntryTanishq BindalNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Fa AssignmentDocument6 pagesFa AssignmentemnagrichiNo ratings yet

- MK 2102-BAE2020 - Accounting For Merchandising ReDocument3 pagesMK 2102-BAE2020 - Accounting For Merchandising ReAngela Thrisananda0% (1)

- Longer-Run Decisions: Capital Budgeting: Changes From Eleventh EditionDocument19 pagesLonger-Run Decisions: Capital Budgeting: Changes From Eleventh EditionAlka NarayanNo ratings yet

- ClassworkDocument2 pagesClassworkFolakemi OgunyemiNo ratings yet

- CHAPTER 17 INVESTMENTS ExercisesDocument14 pagesCHAPTER 17 INVESTMENTS ExercisesAila Marie MovillaNo ratings yet

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- Exercise 18Document9 pagesExercise 18raihan aqilNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- Accounting For NPOs (Answers)Document6 pagesAccounting For NPOs (Answers)Anna FaqingerNo ratings yet

- Problem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundDocument17 pagesProblem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundNCTNo ratings yet

- CHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Document6 pagesCHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Maurice AgbayaniNo ratings yet

- Reporting and Evaluation: Changes From The Eleventh EditionDocument13 pagesReporting and Evaluation: Changes From The Eleventh EditionAlka NarayanNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- Urban China: Toward Efficient, Inclusive, and Sustainable UrbanizationFrom EverandUrban China: Toward Efficient, Inclusive, and Sustainable UrbanizationNo ratings yet

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortFrom EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Prerna Arora BUS 261 Assignment 4Document8 pagesPrerna Arora BUS 261 Assignment 4Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 3Document7 pagesPrerna Arora BUS 261 Assignment 3Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 5Document7 pagesPrerna Arora BUS 261 Assignment 5Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 6Document8 pagesPrerna Arora BUS 261 Assignment 6Prerna AroraNo ratings yet

- CMNS 235 FVI Public Speaking Course Outline - FinalDocument11 pagesCMNS 235 FVI Public Speaking Course Outline - FinalPrerna AroraNo ratings yet

- Case StudyDocument15 pagesCase StudyPrerna AroraNo ratings yet

- Citation GeneratorDocument2 pagesCitation GeneratorPrerna AroraNo ratings yet

- BUS 261 Assignment 2Document1 pageBUS 261 Assignment 2Prerna AroraNo ratings yet

- Body Mass IndexDocument3 pagesBody Mass IndexPrerna AroraNo ratings yet

- Bus 261Document3 pagesBus 261Prerna AroraNo ratings yet

- Practice Sheet For ClassDocument4 pagesPractice Sheet For ClassPrerna AroraNo ratings yet

- Canadian Entrepreneurship & Small Business Management: Balderson and MombourquetteDocument23 pagesCanadian Entrepreneurship & Small Business Management: Balderson and MombourquettePrerna AroraNo ratings yet

- Test Bank - Chapter 9 Profit PlanningDocument34 pagesTest Bank - Chapter 9 Profit PlanningAiko E. Lara67% (3)

- Practice Sheet STD CostingDocument3 pagesPractice Sheet STD CostingPrerna AroraNo ratings yet

- Integrated Holidays HW ClassIIIDocument1 pageIntegrated Holidays HW ClassIIIPrerna AroraNo ratings yet

- We Are A Democratic CountryDocument2 pagesWe Are A Democratic CountryPrerna AroraNo ratings yet

- Class-IV Assignment L-1 Food Our Basic NeedDocument3 pagesClass-IV Assignment L-1 Food Our Basic NeedPrerna AroraNo ratings yet

- In SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredDocument7 pagesIn SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredPrerna AroraNo ratings yet

- 1902 Presidency College, MadrasDocument5 pages1902 Presidency College, MadrasPrerna AroraNo ratings yet

- Objection HandlingDocument4 pagesObjection HandlingPrerna AroraNo ratings yet

- Chapter 1 - Overview of OBDocument31 pagesChapter 1 - Overview of OBPrerna AroraNo ratings yet

- Print External Shipping LabelDocument1 pagePrint External Shipping Labeliamperfectionist17No ratings yet

- Ewm OutboundDocument28 pagesEwm OutboundDipak BanerjeeNo ratings yet

- Returns Inwards and Returns Outwards JournalDocument15 pagesReturns Inwards and Returns Outwards Journaldrishti.singh0609No ratings yet

- What Customs Manual Says About Disposal of Unclaimed and Uncleared CargoDocument3 pagesWhat Customs Manual Says About Disposal of Unclaimed and Uncleared CargoCM AngNo ratings yet

- Vendor ConsignmentDocument26 pagesVendor ConsignmentraghuNo ratings yet

- Merchandising Consignment and Concession 19.0 White PaperDocument24 pagesMerchandising Consignment and Concession 19.0 White Paperpraveendxb.baskarNo ratings yet

- SAP SD Questions and AnswersDocument22 pagesSAP SD Questions and AnswersJinu MathewNo ratings yet

- Consignment Sales: Name: Date: Professor: Section: Score: QuizDocument3 pagesConsignment Sales: Name: Date: Professor: Section: Score: QuizAndrea Florence Guy VidalNo ratings yet

- Consigned NotesDocument7 pagesConsigned NotesNaveen SNNo ratings yet

- Ho4 Inventories PDFDocument13 pagesHo4 Inventories PDFYamyam ZehcnasNo ratings yet

- Accounting For Special Transactions and Cost Accounting and ControlDocument12 pagesAccounting For Special Transactions and Cost Accounting and ControlRNo ratings yet

- Intacc Reviewer - Module 3Document20 pagesIntacc Reviewer - Module 3Lizette Janiya SumantingNo ratings yet

- AP 500Q Pages 1 19 Quizzer Audit of Current AssetsDocument19 pagesAP 500Q Pages 1 19 Quizzer Audit of Current AssetsJessa Crystal QuinagonNo ratings yet

- IntroductionDocument4 pagesIntroductionBrian Reyes GangcaNo ratings yet

- 6481 FinalExamDocument48 pages6481 FinalExamJuan Dela cruzNo ratings yet

- Solutions To Text Book Exercises: Consignment AccountsDocument23 pagesSolutions To Text Book Exercises: Consignment AccountsM JEEVARATHNAM NAIDUNo ratings yet

- Ch18 - 2 - Accounting For Revenue Recognition IssuesDocument45 pagesCh18 - 2 - Accounting For Revenue Recognition Issuesselvy anaNo ratings yet

- RMC No 57 - Annexes A CDocument5 pagesRMC No 57 - Annexes A CVicky Tamo-oNo ratings yet

- Unit 9 - Consignment SalesDocument2 pagesUnit 9 - Consignment SalesKen-Ei BautistaNo ratings yet

- Safal Foods 3000592393Document1 pageSafal Foods 3000592393rajiv ranjanNo ratings yet

- Negros Occidental Consignment SystemDocument42 pagesNegros Occidental Consignment SystemThrees See100% (3)

- Advance Chapter 3Document12 pagesAdvance Chapter 3abel habtamuNo ratings yet

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburNo ratings yet

- Ecnote X40784457Document1 pageEcnote X40784457custom shopNo ratings yet

- How To Start A Printing BusinessDocument17 pagesHow To Start A Printing Businessfejiro91No ratings yet

- Consignment Accounting Journal EntriesDocument2 pagesConsignment Accounting Journal EntriesVenn Bacus RabadonNo ratings yet

- Revenue Recognition: FranchiseDocument4 pagesRevenue Recognition: FranchiseJoeNo ratings yet

- APC 316 Accounting For Special Transactions OkayDocument14 pagesAPC 316 Accounting For Special Transactions Okaynot funny didn't laughNo ratings yet

Practice Question 2

Practice Question 2

Uploaded by

Prerna AroraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Question 2

Practice Question 2

Uploaded by

Prerna AroraCopyright:

Available Formats

Ex.

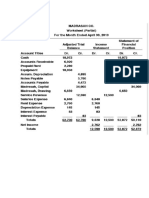

6-107Percentage-of-completion method

Oilers Construction was awarded a contract to construct an interchange at the junction of two major

freeways in a Canadian city at a total contract price of $ 10,000,000. The estimated total costs to complete

the project were $ 8,000,000, and it is expected to take two years.

Instructions

Using the percentage-of-completion method and the cost-to-cost basis,

a) Prepare the journal entry to record construction costs of $ 4,400,000 for the first year.

b) Prepare the journal entry to record progress billings of $ 5,000,000 for the first year.

c) Prepare the journal entry to recognize the revenue and gross profit for the first year.

Solution 6-107

% complete = 4,400,000 ÷ 8,000,000 = 55%

a) Construction in Process............................................................................ 4,400,000

Materials, Cash, A/P, etc................................................................... 4,400,000

b) Accounts Receivable................................................................................ 5,000,000

Billings on Construction in Process.................................................. 5,000,000

c) Construction Expenses............................................................................. 4,400,000

Construction in Process (gross profit)...................................................... 1,100,000

Revenue from Long-term Contract (55% x $ 10,000,000)................ 5,500,000

Ex6-109Kimbo Corporation sold 500 widgets during 2020 at a total price of $ 1.4 million, with a

warranty guarantee that the widgets were free from any defects. The cost of widgets sold is $ 600,000.

The term of the assurance warranty is one year, with an estimated cost of $ 10,000.

Instructions

What are the journal entries that Kimbo Company should make in 2020 related to the sale and the related

warranties?

Solution 6-109

To record the revenue and liabilities related to the warranties:

Cash..................................................................................... 1,400,000

Warranty Liability........................................................ 10,000

Warranty expenses would be recorded as incurred and the liability reduced accordingly

To reduce inventory and recognize cost of goods sold:

Cost of goods sold................................................................ 600,000

Inventory...................................................................... 600,000

Ex. 6-111Consignment sale

In 2020, the following transaction occurred between Senators Wholesale Corp. (consignor) and

Canadiens Stores (consignee):

On March 2, 2020 Senators shipped merchandise costing $ 52,000 to Canadiens. Senators paid $ 4,000

for freight and Canadiens paid $ 3,000 for advertising (to be reimbursed by Senators). By the end of the

third quarter of 2020 (September 30, 2020), Canadiens advised Senators that all the merchandise has been

sold for $ 70,000, and forwarded the proceeds (net of a 15% commission and the outlay for advertising)

to Senators.

Instructions

a) Prepare all entries for Canadiens to account for this transaction.

b) Prepare all entries for Senators to account for this transaction.

Solution 6-111

a) Canadiens

Receivable from Consignor.............................................................................. 3,000

Cash.......................................................................................................... 3,000

To set up receivable for advertising

Cash................................................................................................................. 70,000

Payable to Consignor................................................................................ 70,000

To record sale

Payable to Consignor....................................................................................... 70,000

Receivable from Consignor...................................................................... 3,000

Commission Revenue*............................................................................. 10,500

*$ 70,000 x 15% = $ 10,500

Cash.......................................................................................................... 56,500

To record Remittance to consignor

b) Senators

Inventory on Consignment............................................................................... 52,000

Merchandise Inventory............................................................................. 52,000

To record Shipment of consigned merchandise

Inventory on Consignment............................................................................... 4,000

Cash.......................................................................................................... 4,000

To record Payment of freight costs

Cash................................................................................................................. 56,500

Advertising Expense........................................................................................ 3,000

Commission Expense....................................................................................... 10,500

Revenue from Consignment Sales............................................................ 70,000

To record Remittance from consignee

Cost of Goods Sold (52,000 + 4,000)............................................................... 56,000

Inventory on Consignment....................................................................... 56,000

To record Cost of sales for consignment sales

You might also like

- DocxDocument5 pagesDocxSylvia Al-a'maNo ratings yet

- Case Study:: SNC Lavalin Group IncDocument7 pagesCase Study:: SNC Lavalin Group IncPrerna AroraNo ratings yet

- Practice Sheet 2Document4 pagesPractice Sheet 2Prerna AroraNo ratings yet

- Consignment Agreement Template 02Document3 pagesConsignment Agreement Template 02Elle VergaraNo ratings yet

- Chapter 18Document10 pagesChapter 18Ali Abu Al Saud100% (2)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- Audit of Inventories and Cost of Goods SDocument16 pagesAudit of Inventories and Cost of Goods SAira Nhaira MecateNo ratings yet

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocument1 pageAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNo ratings yet

- Accounting For Merchandize OperationDocument7 pagesAccounting For Merchandize OperationMUHAMMAD ARIF BASHIRNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- Chapter 18Document21 pagesChapter 18Sunny SunnyNo ratings yet

- Cash FlowsDocument6 pagesCash FlowsZaheer AhmadNo ratings yet

- Test # 3 Review Material - BACC 152 16th EditionDocument17 pagesTest # 3 Review Material - BACC 152 16th EditionskswNo ratings yet

- Ch10 ExercisesDocument15 pagesCh10 Exercisesjamiahamdard001No ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- CH 10 PA 2Document2 pagesCH 10 PA 2lisahuang2032No ratings yet

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Document4 pagesBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- Solutions - CH 5Document4 pagesSolutions - CH 5Khánh AnNo ratings yet

- Exercise 13.22Document3 pagesExercise 13.22MynameNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Practice MCQs - ClassDocument3 pagesPractice MCQs - Classemannajmi786No ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Solutions To Exercises - Chap 3Document27 pagesSolutions To Exercises - Chap 3InciaNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- ch05 ExercisesDocument13 pagesch05 ExercisesTowkirNo ratings yet

- Government FundDocument23 pagesGovernment Fund20211211017 SKOLASTIKA ANABELNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- CH5 Accounting QuizDocument7 pagesCH5 Accounting QuizTarun ImandiNo ratings yet

- Weygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesDocument2 pagesWeygandt Accounting Principles, 12e Chapter Five Solutions To Challenge ExercisesHương ThưNo ratings yet

- Prepare in Good Form The 20X9 GAAP Based Statement of RevenuesDocument1 pagePrepare in Good Form The 20X9 GAAP Based Statement of Revenuestrilocksp SinghNo ratings yet

- Practice Exercise - Pas 7Document4 pagesPractice Exercise - Pas 7Martha Nicole MaristelaNo ratings yet

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- DocDocument19 pagesDocCj BarrettoNo ratings yet

- Solutiondone 2-207Document1 pageSolutiondone 2-207trilocksp SinghNo ratings yet

- Total: Balance Sheet Total-' 82,120. The Following EntryDocument2 pagesTotal: Balance Sheet Total-' 82,120. The Following EntryTanishq BindalNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Fa AssignmentDocument6 pagesFa AssignmentemnagrichiNo ratings yet

- MK 2102-BAE2020 - Accounting For Merchandising ReDocument3 pagesMK 2102-BAE2020 - Accounting For Merchandising ReAngela Thrisananda0% (1)

- Longer-Run Decisions: Capital Budgeting: Changes From Eleventh EditionDocument19 pagesLonger-Run Decisions: Capital Budgeting: Changes From Eleventh EditionAlka NarayanNo ratings yet

- ClassworkDocument2 pagesClassworkFolakemi OgunyemiNo ratings yet

- CHAPTER 17 INVESTMENTS ExercisesDocument14 pagesCHAPTER 17 INVESTMENTS ExercisesAila Marie MovillaNo ratings yet

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- Exercise 18Document9 pagesExercise 18raihan aqilNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- Accounting For NPOs (Answers)Document6 pagesAccounting For NPOs (Answers)Anna FaqingerNo ratings yet

- Problem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundDocument17 pagesProblem I: Note To Instructor: The Following Entry Would Be Made in The Endowment FundNCTNo ratings yet

- CHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Document6 pagesCHAPTER 11 - Franchise Accounting Solutions To Problems Problem 11 - 1Maurice AgbayaniNo ratings yet

- Reporting and Evaluation: Changes From The Eleventh EditionDocument13 pagesReporting and Evaluation: Changes From The Eleventh EditionAlka NarayanNo ratings yet

- Some Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandFrom EverandSome Small Countries Do It Better: Rapid Growth and Its Causes in Singapore, Finland, and IrelandNo ratings yet

- Urban China: Toward Efficient, Inclusive, and Sustainable UrbanizationFrom EverandUrban China: Toward Efficient, Inclusive, and Sustainable UrbanizationNo ratings yet

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortFrom EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Prerna Arora BUS 261 Assignment 4Document8 pagesPrerna Arora BUS 261 Assignment 4Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 3Document7 pagesPrerna Arora BUS 261 Assignment 3Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 5Document7 pagesPrerna Arora BUS 261 Assignment 5Prerna AroraNo ratings yet

- Prerna Arora BUS 261 Assignment 6Document8 pagesPrerna Arora BUS 261 Assignment 6Prerna AroraNo ratings yet

- CMNS 235 FVI Public Speaking Course Outline - FinalDocument11 pagesCMNS 235 FVI Public Speaking Course Outline - FinalPrerna AroraNo ratings yet

- Case StudyDocument15 pagesCase StudyPrerna AroraNo ratings yet

- Citation GeneratorDocument2 pagesCitation GeneratorPrerna AroraNo ratings yet

- BUS 261 Assignment 2Document1 pageBUS 261 Assignment 2Prerna AroraNo ratings yet

- Body Mass IndexDocument3 pagesBody Mass IndexPrerna AroraNo ratings yet

- Bus 261Document3 pagesBus 261Prerna AroraNo ratings yet

- Practice Sheet For ClassDocument4 pagesPractice Sheet For ClassPrerna AroraNo ratings yet

- Canadian Entrepreneurship & Small Business Management: Balderson and MombourquetteDocument23 pagesCanadian Entrepreneurship & Small Business Management: Balderson and MombourquettePrerna AroraNo ratings yet

- Test Bank - Chapter 9 Profit PlanningDocument34 pagesTest Bank - Chapter 9 Profit PlanningAiko E. Lara67% (3)

- Practice Sheet STD CostingDocument3 pagesPractice Sheet STD CostingPrerna AroraNo ratings yet

- Integrated Holidays HW ClassIIIDocument1 pageIntegrated Holidays HW ClassIIIPrerna AroraNo ratings yet

- We Are A Democratic CountryDocument2 pagesWe Are A Democratic CountryPrerna AroraNo ratings yet

- Class-IV Assignment L-1 Food Our Basic NeedDocument3 pagesClass-IV Assignment L-1 Food Our Basic NeedPrerna AroraNo ratings yet

- In SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredDocument7 pagesIn SBI, Education Loan Is Granted To Indian Nationals For Pursuing Higher Education in India or Abroad Where Admission Has Been SecuredPrerna AroraNo ratings yet

- 1902 Presidency College, MadrasDocument5 pages1902 Presidency College, MadrasPrerna AroraNo ratings yet

- Objection HandlingDocument4 pagesObjection HandlingPrerna AroraNo ratings yet

- Chapter 1 - Overview of OBDocument31 pagesChapter 1 - Overview of OBPrerna AroraNo ratings yet

- Print External Shipping LabelDocument1 pagePrint External Shipping Labeliamperfectionist17No ratings yet

- Ewm OutboundDocument28 pagesEwm OutboundDipak BanerjeeNo ratings yet

- Returns Inwards and Returns Outwards JournalDocument15 pagesReturns Inwards and Returns Outwards Journaldrishti.singh0609No ratings yet

- What Customs Manual Says About Disposal of Unclaimed and Uncleared CargoDocument3 pagesWhat Customs Manual Says About Disposal of Unclaimed and Uncleared CargoCM AngNo ratings yet

- Vendor ConsignmentDocument26 pagesVendor ConsignmentraghuNo ratings yet

- Merchandising Consignment and Concession 19.0 White PaperDocument24 pagesMerchandising Consignment and Concession 19.0 White Paperpraveendxb.baskarNo ratings yet

- SAP SD Questions and AnswersDocument22 pagesSAP SD Questions and AnswersJinu MathewNo ratings yet

- Consignment Sales: Name: Date: Professor: Section: Score: QuizDocument3 pagesConsignment Sales: Name: Date: Professor: Section: Score: QuizAndrea Florence Guy VidalNo ratings yet

- Consigned NotesDocument7 pagesConsigned NotesNaveen SNNo ratings yet

- Ho4 Inventories PDFDocument13 pagesHo4 Inventories PDFYamyam ZehcnasNo ratings yet

- Accounting For Special Transactions and Cost Accounting and ControlDocument12 pagesAccounting For Special Transactions and Cost Accounting and ControlRNo ratings yet

- Intacc Reviewer - Module 3Document20 pagesIntacc Reviewer - Module 3Lizette Janiya SumantingNo ratings yet

- AP 500Q Pages 1 19 Quizzer Audit of Current AssetsDocument19 pagesAP 500Q Pages 1 19 Quizzer Audit of Current AssetsJessa Crystal QuinagonNo ratings yet

- IntroductionDocument4 pagesIntroductionBrian Reyes GangcaNo ratings yet

- 6481 FinalExamDocument48 pages6481 FinalExamJuan Dela cruzNo ratings yet

- Solutions To Text Book Exercises: Consignment AccountsDocument23 pagesSolutions To Text Book Exercises: Consignment AccountsM JEEVARATHNAM NAIDUNo ratings yet

- Ch18 - 2 - Accounting For Revenue Recognition IssuesDocument45 pagesCh18 - 2 - Accounting For Revenue Recognition Issuesselvy anaNo ratings yet

- RMC No 57 - Annexes A CDocument5 pagesRMC No 57 - Annexes A CVicky Tamo-oNo ratings yet

- Unit 9 - Consignment SalesDocument2 pagesUnit 9 - Consignment SalesKen-Ei BautistaNo ratings yet

- Safal Foods 3000592393Document1 pageSafal Foods 3000592393rajiv ranjanNo ratings yet

- Negros Occidental Consignment SystemDocument42 pagesNegros Occidental Consignment SystemThrees See100% (3)

- Advance Chapter 3Document12 pagesAdvance Chapter 3abel habtamuNo ratings yet

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburNo ratings yet

- Ecnote X40784457Document1 pageEcnote X40784457custom shopNo ratings yet

- How To Start A Printing BusinessDocument17 pagesHow To Start A Printing Businessfejiro91No ratings yet

- Consignment Accounting Journal EntriesDocument2 pagesConsignment Accounting Journal EntriesVenn Bacus RabadonNo ratings yet

- Revenue Recognition: FranchiseDocument4 pagesRevenue Recognition: FranchiseJoeNo ratings yet

- APC 316 Accounting For Special Transactions OkayDocument14 pagesAPC 316 Accounting For Special Transactions Okaynot funny didn't laughNo ratings yet