Professional Documents

Culture Documents

Homework 8

Homework 8

Uploaded by

Victor CabrejosCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ITEC 136 Homework 3 NameDocument2 pagesITEC 136 Homework 3 NameVictor CabrejosNo ratings yet

- csc241 Assignment 4Document4 pagescsc241 Assignment 4Victor CabrejosNo ratings yet

- # Tommy Trojan # ITP 449 Fall 2021 # Final Project # Q1Document6 pages# Tommy Trojan # ITP 449 Fall 2021 # Final Project # Q1Victor CabrejosNo ratings yet

- Homework 4Document1 pageHomework 4Victor CabrejosNo ratings yet

- Final Project Option #1 - Restaurant Simulation: GoalsDocument11 pagesFinal Project Option #1 - Restaurant Simulation: GoalsVictor CabrejosNo ratings yet

- HW Week 4) Insights From Web ScrapingDocument2 pagesHW Week 4) Insights From Web ScrapingVictor CabrejosNo ratings yet

- Reading Stock Data (Quotes and Trades)Document17 pagesReading Stock Data (Quotes and Trades)Victor CabrejosNo ratings yet

- Homework 6Document1 pageHomework 6Victor CabrejosNo ratings yet

- Portfolio Selection: Optimizing An Error: Assignment #1 (Based On Case From Textbook)Document10 pagesPortfolio Selection: Optimizing An Error: Assignment #1 (Based On Case From Textbook)Victor CabrejosNo ratings yet

- Homework 5Document1 pageHomework 5Victor CabrejosNo ratings yet

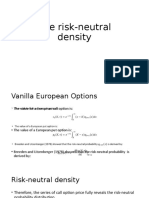

- Risk Neutral Density LectureDocument6 pagesRisk Neutral Density LectureVictor CabrejosNo ratings yet

- Tree Models LectureDocument8 pagesTree Models LectureVictor CabrejosNo ratings yet

- Quantitative Methods With Python Exam 3Document1 pageQuantitative Methods With Python Exam 3Victor CabrejosNo ratings yet

Homework 8

Homework 8

Uploaded by

Victor CabrejosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework 8

Homework 8

Uploaded by

Victor CabrejosCopyright:

Available Formats

Homework 8

Due November 3rd by 11:59 PM

Submit assignments as last_first_hw8.py

Homework Instructions:

The data for this assignment will be obtained from WRDS using the classroom login

Download daily stock data for NFLX from July 1st, 2016, to December 31st 2017.

Download option data from Option Metrics over the time period June 1st, 2017 to December

31st 2017 for a put and call for NFLX with a strike price of $150.00 and an expiration date of

the third Friday of December.

Download daily 1-year treasury bill rates from treasury.gov

1. Throughout the 6-month period of the option, calculate the Black-Scholes put and call

option prices (Using the standard formula) with the following inputs:

A.The rolling 6-month standard deviation as a measure of volatility,

B.The daily 1-year treasury bill as the risk-free rate

C.The daily price of NFLX as the spot price.

D.The time until expiration is the current date being estimated minus the

expiration date of the option.

2. Calculate the average price discrepancy for both the put and call options.

3. Plot the actual put price and the BS put price on a single graph, with time on the x-

axis and prices on the y-axis.

4. Plot the actual call price and the BS call price on a single graph.

5. Plot the call discrepancy, put discrepancy, and volatility measure on a single graph.

Grading Process

I will award points according the rubric in the syllabus. To determine whether the script

is correct and efficient, the program will be run on a separate stock-day file. The script, if

done correctly, will report accurate results for a random stock day file.

If you are unable to complete all the tasks above, at a minimum make sure your script can

run and produce some output. A script that doesn’t run receives the least amount of points.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ITEC 136 Homework 3 NameDocument2 pagesITEC 136 Homework 3 NameVictor CabrejosNo ratings yet

- csc241 Assignment 4Document4 pagescsc241 Assignment 4Victor CabrejosNo ratings yet

- # Tommy Trojan # ITP 449 Fall 2021 # Final Project # Q1Document6 pages# Tommy Trojan # ITP 449 Fall 2021 # Final Project # Q1Victor CabrejosNo ratings yet

- Homework 4Document1 pageHomework 4Victor CabrejosNo ratings yet

- Final Project Option #1 - Restaurant Simulation: GoalsDocument11 pagesFinal Project Option #1 - Restaurant Simulation: GoalsVictor CabrejosNo ratings yet

- HW Week 4) Insights From Web ScrapingDocument2 pagesHW Week 4) Insights From Web ScrapingVictor CabrejosNo ratings yet

- Reading Stock Data (Quotes and Trades)Document17 pagesReading Stock Data (Quotes and Trades)Victor CabrejosNo ratings yet

- Homework 6Document1 pageHomework 6Victor CabrejosNo ratings yet

- Portfolio Selection: Optimizing An Error: Assignment #1 (Based On Case From Textbook)Document10 pagesPortfolio Selection: Optimizing An Error: Assignment #1 (Based On Case From Textbook)Victor CabrejosNo ratings yet

- Homework 5Document1 pageHomework 5Victor CabrejosNo ratings yet

- Risk Neutral Density LectureDocument6 pagesRisk Neutral Density LectureVictor CabrejosNo ratings yet

- Tree Models LectureDocument8 pagesTree Models LectureVictor CabrejosNo ratings yet

- Quantitative Methods With Python Exam 3Document1 pageQuantitative Methods With Python Exam 3Victor CabrejosNo ratings yet