Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

57 viewsProtecto Company Purchaesed 75 Percent of Strand

Protecto Company Purchaesed 75 Percent of Strand

Uploaded by

laale dijaanThe document summarizes the cash flow statement for Protecto Corporation for the year ended December 31, 20X3. It shows operating, investing and financing cash flows. The company had net cash provided by operating activities of $130,300. It used $79,600 in investing activities primarily to purchase land and equipment. Financing activities used $78,200 primarily to pay dividends to shareholders. Overall, this resulted in a $27,500 decrease in cash over the year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha83% (6)

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocument4 pagesFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNo ratings yet

- Church Company Completes These Transactions and Events During MarchDocument56 pagesChurch Company Completes These Transactions and Events During Marchlaale dijaanNo ratings yet

- Music Teachers, Inc., Is An Educational Association For Music Teachers That Has 20,000 MembersDocument7 pagesMusic Teachers, Inc., Is An Educational Association For Music Teachers That Has 20,000 Memberslaale dijaan100% (1)

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- VivaldiDocument3 pagesVivaldiAlia Azhara100% (1)

- Kubin Company's Relevant Range of ProductionDocument8 pagesKubin Company's Relevant Range of Productionlaale dijaanNo ratings yet

- Sample Final Exam With SolutionDocument17 pagesSample Final Exam With SolutionYevhenii VdovenkoNo ratings yet

- CFI Accounting Fundementals Jenga Inc SolutionDocument3 pagesCFI Accounting Fundementals Jenga Inc SolutionsovalaxNo ratings yet

- TESLA-financial Statement 2016-2020Document18 pagesTESLA-financial Statement 2016-2020XienaNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Sharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowDocument4 pagesSharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowKailash KumarNo ratings yet

- Practice CF Scooter KeyDocument4 pagesPractice CF Scooter KeyAllie LinNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Gina Purdiyanti - 20181211031 Asdos AKL2Document6 pagesGina Purdiyanti - 20181211031 Asdos AKL2gina amsyarNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Chap4 - Negative GWDocument3 pagesChap4 - Negative GWThanh PhuongNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- AsdasdsadwqrqewqerDocument4 pagesAsdasdsadwqrqewqerAdrian AranoNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- ACC CUỐI KÌDocument5 pagesACC CUỐI KÌNguyen Thi Thu Phuong (K16HL)No ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Alfiani - QUIZ 1 IASDocument23 pagesAlfiani - QUIZ 1 IASWilda Sania MtNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Practice 3 Balance SheetDocument4 pagesPractice 3 Balance SheetsherinaNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Cash FlowDocument1 pageCash FlowJannatul IsfaqNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- China Tea CompanyDocument4 pagesChina Tea CompanyLeika Gay Soriano OlarteNo ratings yet

- Net Cash Flow in Operating ActivitiesDocument1 pageNet Cash Flow in Operating ActivitiesMary Ann AmparoNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Assignment ChemalitDocument8 pagesAssignment ChemalitVinay JajuNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- James Corp. Applies Overhead On The Basis of Direct Labor HoursDocument9 pagesJames Corp. Applies Overhead On The Basis of Direct Labor Hourslaale dijaanNo ratings yet

- Jackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning BalancesDocument2 pagesJackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning Balanceslaale dijaanNo ratings yet

- He Gourmand Cooking School Runs Short Cooking Courses at Its Small Campus.Document6 pagesHe Gourmand Cooking School Runs Short Cooking Courses at Its Small Campus.laale dijaanNo ratings yet

- Haas Company Manufactures and Sells One ProductDocument2 pagesHaas Company Manufactures and Sells One Productlaale dijaanNo ratings yet

- Cooperative San Jose of Southern Sonora State in Mexico Makes A Unique SyrupDocument2 pagesCooperative San Jose of Southern Sonora State in Mexico Makes A Unique Syruplaale dijaanNo ratings yet

- Miller Toy Company Manufactures A Plastic Swimming PoolDocument10 pagesMiller Toy Company Manufactures A Plastic Swimming Poollaale dijaanNo ratings yet

- Pat Miranda, The New Controller of Vault Hard DrivesDocument11 pagesPat Miranda, The New Controller of Vault Hard Driveslaale dijaanNo ratings yet

- Waddell Company Had The Following BalancesDocument6 pagesWaddell Company Had The Following Balanceslaale dijaanNo ratings yet

- Tami Tyler Opened Tami's Creations, IncDocument11 pagesTami Tyler Opened Tami's Creations, Inclaale dijaanNo ratings yet

- Information For Hobson Corp. For The Current Year ($ in Millions)Document2 pagesInformation For Hobson Corp. For The Current Year ($ in Millions)laale dijaanNo ratings yet

- Currently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.Document1 pageCurrently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.laale dijaanNo ratings yet

- The Following Information Was Available As of The Close of Business June 1, 2004, On Government of Canada BondsDocument2 pagesThe Following Information Was Available As of The Close of Business June 1, 2004, On Government of Canada Bondslaale dijaanNo ratings yet

- 16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit IDocument29 pages16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit Ilaale dijaanNo ratings yet

- 1, Nitish Corp.'s Board of Directors Moved TheDocument3 pages1, Nitish Corp.'s Board of Directors Moved Thelaale dijaanNo ratings yet

- Paper - 8: Cost Accounting Bit QuestionsDocument56 pagesPaper - 8: Cost Accounting Bit Questionslaale dijaanNo ratings yet

- Glacier Products Inc. Is A Wholesaler of Rock Climbing Gear.Document6 pagesGlacier Products Inc. Is A Wholesaler of Rock Climbing Gear.laale dijaanNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS)Document27 pagesQuestion Bank - Multiple Choice Questions (MCQS)laale dijaanNo ratings yet

- Referencer For Quick Revision: Final Course Paper-5: Strategic Cost Management and Performance EvaluationDocument45 pagesReferencer For Quick Revision: Final Course Paper-5: Strategic Cost Management and Performance Evaluationlaale dijaanNo ratings yet

- Water Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, TheDocument3 pagesWater Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, Thelaale dijaanNo ratings yet

- MCQ 4 Macro Economics 1 CorrectedDocument16 pagesMCQ 4 Macro Economics 1 Correctedlaale dijaanNo ratings yet

- MCQ On Communication - Extensive 12 Years Solved NET ExamDocument33 pagesMCQ On Communication - Extensive 12 Years Solved NET Examlaale dijaanNo ratings yet

- Wells Technical InstituteDocument24 pagesWells Technical Institutelaale dijaanNo ratings yet

- Martinez Company's Relevant Range of Production IsDocument3 pagesMartinez Company's Relevant Range of Production Islaale dijaan0% (1)

- Sunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000Document9 pagesSunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000laale dijaanNo ratings yet

- NewTune Company Exchanges Shares of Its Common Stock For All of The Outstanding Shares of On-the-GoDocument6 pagesNewTune Company Exchanges Shares of Its Common Stock For All of The Outstanding Shares of On-the-Golaale dijaanNo ratings yet

- Ledger TalemboDocument2 pagesLedger TalemboAmalia Areola BuenoNo ratings yet

- AR DJP 2012-Eng (Lowres)Document225 pagesAR DJP 2012-Eng (Lowres)HenryNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25No ratings yet

- WCM Complete NumericalDocument5 pagesWCM Complete Numericalabubakar naeemNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- Partnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerDocument9 pagesPartnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerKarl Wilson Gonzales100% (1)

- Financial Statement Version-TPCODLDocument87 pagesFinancial Statement Version-TPCODLBiswajit GhoshNo ratings yet

- TSPC Q2 2021 FSDocument81 pagesTSPC Q2 2021 FSPanama TreasureNo ratings yet

- PFRS SummaryDocument20 pagesPFRS Summaryrena chavezNo ratings yet

- Introduction To Tax Accounting: This Chapter Is Based On Information Available Up To 1 August 2014Document10 pagesIntroduction To Tax Accounting: This Chapter Is Based On Information Available Up To 1 August 2014Rediet UtteNo ratings yet

- Chapter 1 - Concept Questions and Exercises StudentDocument19 pagesChapter 1 - Concept Questions and Exercises StudentHương NguyễnNo ratings yet

- Chap 4Document15 pagesChap 4Tran Pham Quoc ThuyNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- 1103-001 Piutang Usaha IDR Account Receivable IDRDocument6 pages1103-001 Piutang Usaha IDR Account Receivable IDRirma febianNo ratings yet

- Assessment 1 ACCT600Document10 pagesAssessment 1 ACCT600Ankit ParmarNo ratings yet

- Ceres Gardening Company SubmissionDocument7 pagesCeres Gardening Company SubmissionpranamyaNo ratings yet

- FA#7Document10 pagesFA#7Gvm Joy MagalingNo ratings yet

- RFJPIA 01 Quiz Bee - P1 and TOA (Easy)Document1 pageRFJPIA 01 Quiz Bee - P1 and TOA (Easy)Dawn Rei DangkiwNo ratings yet

- James and Family IncDocument11 pagesJames and Family IncThia FelizNo ratings yet

- Fire Nymph Products LTD V The Heating CentreDocument8 pagesFire Nymph Products LTD V The Heating CentrenorshafinahabdhalimNo ratings yet

- Internal ReconstructionDocument5 pagesInternal ReconstructionJoshua StarkNo ratings yet

- Senior Financial AnalystDocument8 pagesSenior Financial AnalystMark GalloNo ratings yet

- Quiz On Partnerhsip Formation - Final Term PeriodDocument3 pagesQuiz On Partnerhsip Formation - Final Term PeriodCeejay Mancilla100% (2)

- Pantaloons Ratio AnalysisDocument15 pagesPantaloons Ratio Analysisdhwani3192No ratings yet

- HintDocument6 pagesHintAppleNo ratings yet

- Form C Corporate Income Tax Return Taxpayer GuideDocument31 pagesForm C Corporate Income Tax Return Taxpayer GuideDanielNo ratings yet

- 13 05 CHDocument8 pages13 05 CHCirilo Gazzingan IIINo ratings yet

Protecto Company Purchaesed 75 Percent of Strand

Protecto Company Purchaesed 75 Percent of Strand

Uploaded by

laale dijaan0 ratings0% found this document useful (0 votes)

57 views4 pagesThe document summarizes the cash flow statement for Protecto Corporation for the year ended December 31, 20X3. It shows operating, investing and financing cash flows. The company had net cash provided by operating activities of $130,300. It used $79,600 in investing activities primarily to purchase land and equipment. Financing activities used $78,200 primarily to pay dividends to shareholders. Overall, this resulted in a $27,500 decrease in cash over the year.

Original Description:

qq

Original Title

protecto company purchaesed 75 percent of strand

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the cash flow statement for Protecto Corporation for the year ended December 31, 20X3. It shows operating, investing and financing cash flows. The company had net cash provided by operating activities of $130,300. It used $79,600 in investing activities primarily to purchase land and equipment. Financing activities used $78,200 primarily to pay dividends to shareholders. Overall, this resulted in a $27,500 decrease in cash over the year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

57 views4 pagesProtecto Company Purchaesed 75 Percent of Strand

Protecto Company Purchaesed 75 Percent of Strand

Uploaded by

laale dijaanThe document summarizes the cash flow statement for Protecto Corporation for the year ended December 31, 20X3. It shows operating, investing and financing cash flows. The company had net cash provided by operating activities of $130,300. It used $79,600 in investing activities primarily to purchase land and equipment. Financing activities used $78,200 primarily to pay dividends to shareholders. Overall, this resulted in a $27,500 decrease in cash over the year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

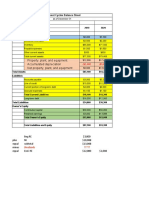

PROTECTO CORPORATION AND SUBSIDIARY

Consolidated Cash Flow Worksheet

Year Ended December 31, 20X3

Consolidation Entries

Item Balance 1/1/X3 Debit Credit Balance 12/31/X3

Assets

Cash $ 103,000 $ 27,500 $ 75,500

Accounts receivable $ 205,000 $ 66,200 $ 138,800

Inventory $ 152,000 $ 59,600 $ 211,600

Land $ 84,000 $ 3,600 $ 87,600

Buildings and equipment $ 540,000 $ 271,000 $ 811,000

Less: Accumulated depreciation $ (201,000) $ 76,000 $ (277,000)

Patents $ 33,300 $ 5,550 $ 27,750

Total Assets $ 916,300 $ 1,075,250

Liabilities & Equity

Accounts payable $ 165,540 $ 44,300 $ 121,240

Bonds payable $ 86,000 $ 195,000 $ 281,000

Common stock $ 260,000 $ 260,000

Retained earnings $ 286,000 $ 63,000 $ 76,110 $ 299,110

Noncontrolling interest $ 118,760 $ 15,200 $ 10,340 $ 113,900

Total Liabilities & Equity $ 916,300 $ 456,700 $ 456,700 $ 1,075,250

Cash Flows from Operating Activities:

Consolidated net income $ 86,450

Amortization expense $ 5,550

Depreciation expense $ 76,000

Decrease in accounts receivable $ 66,200

Increase in inventory $ 59,600

Decrease in accounts payable $ 44,300

Cash Flows from Investing Activities:

Purchase of land $ 3,600

Acquisition of buildings and equipment from bond issue $ 195,000

Purchase of buildings and equipment $ 76,000

Cash Flows from Financing Activities:

Dividends Paid:

To Protecto Corp. shareholders $ 63,000

To noncontrolling shareholders $ 15,200

Issuance of bonds for buildings and equipment $ 195,000

Decrease in cash $ 27,500

$ 456,700 $ 456,700

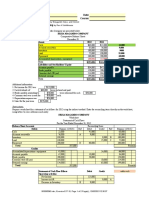

PROTECTO CORPORATION AND SUBSIDIARY

Consolidated Statement of Cash Flows

Year Ended December 31, 20X3

Cash Flows from Operating Activities:

Consolidated net income $ 86,450

Adjustments for noncash items:

Amortization expense $ 5,550

Depreciation expense $ 76,000

Changes in operating assets and liabilities:

Decrease in accounts receivable $ 66,200

Increase in inventory $ (59,600)

Decrease in accounts payable $ (44,300)

Net cash provided by operating activities $ 130,300

Cash Flows from Investing Activities:

Purchase of land $ (3,600)

Purchase of buildings and equipment $ (76,000)

Net cash used in investing activities $ (79,600)

Cash Flows from Financing Activities:

Dividends Paid:

To Parent Company shareholders $ (63,000)

To noncontrolling shareholders $ (15,200)

Net cash used in financing activities $ (78,200)

Net decrease in cash $ (27,500)

Cash balance at beginning of year $ 103,000

Cash balance at end of year $ 75,500

PROTECTO CORPORATION AND SUBSIDIARY

Consolidated Cash Flow Worksheet

Year Ended December 31, 20X3

Consolidation Entries

Item Balance 1/1/X3 Debit Credit Balance 12/31/X3

Assets

Cash $ 95,000 $ 31,800 $ 63,200

Accounts receivable $ 145,000 $ 24,200 $ 120,800

Inventory $ 135,000 $ 63,500 $ 198,500

Land $ 72,000 $ 6,400 $ 78,400

Buildings and equipment $ 440,000 $ 154,000 $ 594,000

Less: Accumulated depreciation $ (211,000) $ 44,000 $ (255,000)

Patents $ 39,000 $ 6,500 $ 32,500

Total Assets $ 715,000 $ 832,400

Liabilities & Equity

Accounts payable $ 164,100 $ 37,400 $ 126,700

Bonds payable $ 94,000 $ 110,000 $ 204,000

Common stock $ 120,000 $ 120,000

Retained earnings $ 278,000 $ 54,000 $ 93,850 $ 317,850

Noncontrolling interest $ 58,900 $ 5,400 $ 10,350 $ 63,850

Total Liabilities & Equity $ 715,000 $ 320,700 $ 320,700 $ 832,400

Cash Flows from Operating Activities:

Consolidated net income $ 104,200

Amortization expense $ 6,500

Depreciation expense $ 44,000

Decrease in accounts receivable $ 24,200

Increase in inventory $ 63,500

Decrease in accounts payable $ 37,400

Cash Flows from Investing Activities:

Purchase of land $ 6,400

Acquisition of buildings and equipment from bond issue $ 110,000

Purchase of buildings and equipment $ 44,000

Cash Flows from Financing Activities:

Dividends Paid:

To Protecto Corp. shareholders $ 54,000

To noncontrolling shareholders $ 5,400

Issuance of bonds for buildings and equipment $ 110,000

Decrease in cash $ 31,800

$ 320,700 $ 320,700

PROTECTO CORPORATION AND SUBSIDIARY

Consolidated Statement of Cash Flows

Year Ended December 31, 20X3

Cash Flows from Operating Activities:

Consolidated net income $ 104,200

Adjustments for noncash items:

Amortization expense $ 6,500

Depreciation expense $ 44,000

Changes in operating assets and liabilities:

Decrease in accounts receivable $ 24,200

Increase in inventory $ (63,500)

Decrease in accounts payable $ (37,400)

Net cash provided by operating activities $ 78,000

Cash Flows from Investing Activities:

Purchase of land $ (6,400)

Purchase of buildings and equipment $ (44,000)

Net cash used in investing activities $ (50,400)

Cash Flows from Financing Activities:

Dividends Paid:

To Parent Company shareholders $ (54,000)

To noncontrolling shareholders $ (5,400)

Net cash used in financing activities $ (59,400)

Net decrease in cash $ (31,800)

Cash balance at beginning of year $ 95,000

Cash balance at end of year $ 63,200

You might also like

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha83% (6)

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocument4 pagesFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNo ratings yet

- Church Company Completes These Transactions and Events During MarchDocument56 pagesChurch Company Completes These Transactions and Events During Marchlaale dijaanNo ratings yet

- Music Teachers, Inc., Is An Educational Association For Music Teachers That Has 20,000 MembersDocument7 pagesMusic Teachers, Inc., Is An Educational Association For Music Teachers That Has 20,000 Memberslaale dijaan100% (1)

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- VivaldiDocument3 pagesVivaldiAlia Azhara100% (1)

- Kubin Company's Relevant Range of ProductionDocument8 pagesKubin Company's Relevant Range of Productionlaale dijaanNo ratings yet

- Sample Final Exam With SolutionDocument17 pagesSample Final Exam With SolutionYevhenii VdovenkoNo ratings yet

- CFI Accounting Fundementals Jenga Inc SolutionDocument3 pagesCFI Accounting Fundementals Jenga Inc SolutionsovalaxNo ratings yet

- TESLA-financial Statement 2016-2020Document18 pagesTESLA-financial Statement 2016-2020XienaNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Sharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowDocument4 pagesSharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowKailash KumarNo ratings yet

- Practice CF Scooter KeyDocument4 pagesPractice CF Scooter KeyAllie LinNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Gina Purdiyanti - 20181211031 Asdos AKL2Document6 pagesGina Purdiyanti - 20181211031 Asdos AKL2gina amsyarNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Chap4 - Negative GWDocument3 pagesChap4 - Negative GWThanh PhuongNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- AsdasdsadwqrqewqerDocument4 pagesAsdasdsadwqrqewqerAdrian AranoNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- ACC CUỐI KÌDocument5 pagesACC CUỐI KÌNguyen Thi Thu Phuong (K16HL)No ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Alfiani - QUIZ 1 IASDocument23 pagesAlfiani - QUIZ 1 IASWilda Sania MtNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Practice 3 Balance SheetDocument4 pagesPractice 3 Balance SheetsherinaNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Cash FlowDocument1 pageCash FlowJannatul IsfaqNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- China Tea CompanyDocument4 pagesChina Tea CompanyLeika Gay Soriano OlarteNo ratings yet

- Net Cash Flow in Operating ActivitiesDocument1 pageNet Cash Flow in Operating ActivitiesMary Ann AmparoNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Assignment ChemalitDocument8 pagesAssignment ChemalitVinay JajuNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- James Corp. Applies Overhead On The Basis of Direct Labor HoursDocument9 pagesJames Corp. Applies Overhead On The Basis of Direct Labor Hourslaale dijaanNo ratings yet

- Jackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning BalancesDocument2 pagesJackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning Balanceslaale dijaanNo ratings yet

- He Gourmand Cooking School Runs Short Cooking Courses at Its Small Campus.Document6 pagesHe Gourmand Cooking School Runs Short Cooking Courses at Its Small Campus.laale dijaanNo ratings yet

- Haas Company Manufactures and Sells One ProductDocument2 pagesHaas Company Manufactures and Sells One Productlaale dijaanNo ratings yet

- Cooperative San Jose of Southern Sonora State in Mexico Makes A Unique SyrupDocument2 pagesCooperative San Jose of Southern Sonora State in Mexico Makes A Unique Syruplaale dijaanNo ratings yet

- Miller Toy Company Manufactures A Plastic Swimming PoolDocument10 pagesMiller Toy Company Manufactures A Plastic Swimming Poollaale dijaanNo ratings yet

- Pat Miranda, The New Controller of Vault Hard DrivesDocument11 pagesPat Miranda, The New Controller of Vault Hard Driveslaale dijaanNo ratings yet

- Waddell Company Had The Following BalancesDocument6 pagesWaddell Company Had The Following Balanceslaale dijaanNo ratings yet

- Tami Tyler Opened Tami's Creations, IncDocument11 pagesTami Tyler Opened Tami's Creations, Inclaale dijaanNo ratings yet

- Information For Hobson Corp. For The Current Year ($ in Millions)Document2 pagesInformation For Hobson Corp. For The Current Year ($ in Millions)laale dijaanNo ratings yet

- Currently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.Document1 pageCurrently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.laale dijaanNo ratings yet

- The Following Information Was Available As of The Close of Business June 1, 2004, On Government of Canada BondsDocument2 pagesThe Following Information Was Available As of The Close of Business June 1, 2004, On Government of Canada Bondslaale dijaanNo ratings yet

- 16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit IDocument29 pages16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit Ilaale dijaanNo ratings yet

- 1, Nitish Corp.'s Board of Directors Moved TheDocument3 pages1, Nitish Corp.'s Board of Directors Moved Thelaale dijaanNo ratings yet

- Paper - 8: Cost Accounting Bit QuestionsDocument56 pagesPaper - 8: Cost Accounting Bit Questionslaale dijaanNo ratings yet

- Glacier Products Inc. Is A Wholesaler of Rock Climbing Gear.Document6 pagesGlacier Products Inc. Is A Wholesaler of Rock Climbing Gear.laale dijaanNo ratings yet

- Question Bank - Multiple Choice Questions (MCQS)Document27 pagesQuestion Bank - Multiple Choice Questions (MCQS)laale dijaanNo ratings yet

- Referencer For Quick Revision: Final Course Paper-5: Strategic Cost Management and Performance EvaluationDocument45 pagesReferencer For Quick Revision: Final Course Paper-5: Strategic Cost Management and Performance Evaluationlaale dijaanNo ratings yet

- Water Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, TheDocument3 pagesWater Wonders, Inc., Ocean Adventures Makers of Custom-Made Jet Skis, Thelaale dijaanNo ratings yet

- MCQ 4 Macro Economics 1 CorrectedDocument16 pagesMCQ 4 Macro Economics 1 Correctedlaale dijaanNo ratings yet

- MCQ On Communication - Extensive 12 Years Solved NET ExamDocument33 pagesMCQ On Communication - Extensive 12 Years Solved NET Examlaale dijaanNo ratings yet

- Wells Technical InstituteDocument24 pagesWells Technical Institutelaale dijaanNo ratings yet

- Martinez Company's Relevant Range of Production IsDocument3 pagesMartinez Company's Relevant Range of Production Islaale dijaan0% (1)

- Sunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000Document9 pagesSunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000laale dijaanNo ratings yet

- NewTune Company Exchanges Shares of Its Common Stock For All of The Outstanding Shares of On-the-GoDocument6 pagesNewTune Company Exchanges Shares of Its Common Stock For All of The Outstanding Shares of On-the-Golaale dijaanNo ratings yet

- Ledger TalemboDocument2 pagesLedger TalemboAmalia Areola BuenoNo ratings yet

- AR DJP 2012-Eng (Lowres)Document225 pagesAR DJP 2012-Eng (Lowres)HenryNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25No ratings yet

- WCM Complete NumericalDocument5 pagesWCM Complete Numericalabubakar naeemNo ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- Partnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerDocument9 pagesPartnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerKarl Wilson Gonzales100% (1)

- Financial Statement Version-TPCODLDocument87 pagesFinancial Statement Version-TPCODLBiswajit GhoshNo ratings yet

- TSPC Q2 2021 FSDocument81 pagesTSPC Q2 2021 FSPanama TreasureNo ratings yet

- PFRS SummaryDocument20 pagesPFRS Summaryrena chavezNo ratings yet

- Introduction To Tax Accounting: This Chapter Is Based On Information Available Up To 1 August 2014Document10 pagesIntroduction To Tax Accounting: This Chapter Is Based On Information Available Up To 1 August 2014Rediet UtteNo ratings yet

- Chapter 1 - Concept Questions and Exercises StudentDocument19 pagesChapter 1 - Concept Questions and Exercises StudentHương NguyễnNo ratings yet

- Chap 4Document15 pagesChap 4Tran Pham Quoc ThuyNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- 1103-001 Piutang Usaha IDR Account Receivable IDRDocument6 pages1103-001 Piutang Usaha IDR Account Receivable IDRirma febianNo ratings yet

- Assessment 1 ACCT600Document10 pagesAssessment 1 ACCT600Ankit ParmarNo ratings yet

- Ceres Gardening Company SubmissionDocument7 pagesCeres Gardening Company SubmissionpranamyaNo ratings yet

- FA#7Document10 pagesFA#7Gvm Joy MagalingNo ratings yet

- RFJPIA 01 Quiz Bee - P1 and TOA (Easy)Document1 pageRFJPIA 01 Quiz Bee - P1 and TOA (Easy)Dawn Rei DangkiwNo ratings yet

- James and Family IncDocument11 pagesJames and Family IncThia FelizNo ratings yet

- Fire Nymph Products LTD V The Heating CentreDocument8 pagesFire Nymph Products LTD V The Heating CentrenorshafinahabdhalimNo ratings yet

- Internal ReconstructionDocument5 pagesInternal ReconstructionJoshua StarkNo ratings yet

- Senior Financial AnalystDocument8 pagesSenior Financial AnalystMark GalloNo ratings yet

- Quiz On Partnerhsip Formation - Final Term PeriodDocument3 pagesQuiz On Partnerhsip Formation - Final Term PeriodCeejay Mancilla100% (2)

- Pantaloons Ratio AnalysisDocument15 pagesPantaloons Ratio Analysisdhwani3192No ratings yet

- HintDocument6 pagesHintAppleNo ratings yet

- Form C Corporate Income Tax Return Taxpayer GuideDocument31 pagesForm C Corporate Income Tax Return Taxpayer GuideDanielNo ratings yet

- 13 05 CHDocument8 pages13 05 CHCirilo Gazzingan IIINo ratings yet