Professional Documents

Culture Documents

India Macro Insight-Bop: in Brief

India Macro Insight-Bop: in Brief

Uploaded by

saty16Copyright:

Available Formats

You might also like

- Behringer EPR900 Powered Speaker Schematics PDFDocument14 pagesBehringer EPR900 Powered Speaker Schematics PDFAlvaro Canaviri Mamani100% (1)

- IO Model Vs Resource Based Model - Two Approaches To StrategyDocument14 pagesIO Model Vs Resource Based Model - Two Approaches To StrategyM ManjunathNo ratings yet

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasNo ratings yet

- Elevation Section: Full Top PlanDocument1 pageElevation Section: Full Top PlanROSE STONENo ratings yet

- Wu Ji-Horn in F 1Document1 pageWu Ji-Horn in F 1José Miguel S. JrNo ratings yet

- Sectional Plan, HFD, Ga Drawing - Bypass Line 5 - 4 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing - Bypass Line 5 - 4 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Sectional Plan, HFD, Ga Drawing of Bypass Line 2 - 2 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing of Bypass Line 2 - 2 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Denah Basement SKALA 1:200: R.STPDocument1 pageDenah Basement SKALA 1:200: R.STPnovita fi rizkiNo ratings yet

- SectionE 43Document1 pageSectionE 43NikNo ratings yet

- SECTION''A''-''A'' SECTION''B''-''B'': ''Spot Details'' Typical Reinforcement Stair DetailDocument1 pageSECTION''A''-''A'' SECTION''B''-''B'': ''Spot Details'' Typical Reinforcement Stair DetailAlyssa Juvelle Cusi AlfonsoNo ratings yet

- RSecTradEdge - Tech Mahindra and Cadila - 151116Document4 pagesRSecTradEdge - Tech Mahindra and Cadila - 151116kgarg06No ratings yet

- Sectional Plan, HFD, Ga Drawing of Bypass Line 1 - 1 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing of Bypass Line 1 - 1 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Alibaug Final DraftDocument1 pageAlibaug Final Draftshuchi masraniNo ratings yet

- Tchavolo Instrument EbDocument1 pageTchavolo Instrument Ebjhon giraldoNo ratings yet

- Lenoxx MC-245B PDFDocument5 pagesLenoxx MC-245B PDFEdnaelson SilvaNo ratings yet

- Sbwi Tma-Foz Arc 20220616Document1 pageSbwi Tma-Foz Arc 20220616CTA 2013No ratings yet

- Be - Computer Engineering - Semester 6 - 2023 - May - Artificial Intelligencerev 2019 C SchemeDocument3 pagesBe - Computer Engineering - Semester 6 - 2023 - May - Artificial Intelligencerev 2019 C Schemeakashsin583No ratings yet

- Characteristics Standard Pagina: 1/10 DataDocument14 pagesCharacteristics Standard Pagina: 1/10 Dataerik0007100% (1)

- Ruko Mingku MasukaDocument1 pageRuko Mingku MasukaHarry NovieNo ratings yet

- Denah BangunanDocument1 pageDenah BangunanHarry NovieNo ratings yet

- Type 1Document1 pageType 1Sabina CazacuNo ratings yet

- 415 ColoradoDocument53 pages415 Coloradodali yangNo ratings yet

- Land Scape 1Document1 pageLand Scape 1Ardit ValishtaNo ratings yet

- Z213x4xSch 1Document3 pagesZ213x4xSch 1Mehmet ÇetingürbüzNo ratings yet

- 1X-M6-AD-00003 1X-M6-AD-00003 1X-M6-AD-00003: New Assiut Combined Cycle Add-On Power PlantDocument1 page1X-M6-AD-00003 1X-M6-AD-00003 1X-M6-AD-00003: New Assiut Combined Cycle Add-On Power Plantwael zakariaNo ratings yet

- Inventio 15Document2 pagesInventio 15Deyan DenchevNo ratings yet

- JIB FMME Ae 04CL 307.000Document1 pageJIB FMME Ae 04CL 307.000MoustafaNo ratings yet

- B-5.011.646-0001 - 0001 - PTU LayoutDocument1 pageB-5.011.646-0001 - 0001 - PTU LayoutWison YangNo ratings yet

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahNo ratings yet

- Grommet 6.0mm IDDocument1 pageGrommet 6.0mm IDShrikant DeshmukhNo ratings yet

- Circuit Diagram 1175404Document3 pagesCircuit Diagram 1175404dtftfernandes9099No ratings yet

- Dwindling SuppliesDocument2 pagesDwindling SuppliesBenNo ratings yet

- X20030751002PROMINENCEPROPERTIESINC OrchardPlaceResidencesDocument1 pageX20030751002PROMINENCEPROPERTIESINC OrchardPlaceResidencesRhobbie NolloraNo ratings yet

- Be Electrical Engineering Semester 6 2023 May Signals and Systemsrev 2019 C SchemeDocument2 pagesBe Electrical Engineering Semester 6 2023 May Signals and Systemsrev 2019 C SchemePratik BhonkarNo ratings yet

- DateDocument14 pagesDateerik0007No ratings yet

- Haier 21f9d-tDocument1 pageHaier 21f9d-tadithyanvsNo ratings yet

- SG-01 Circuito ControlDocument1 pageSG-01 Circuito ControlCRISTIANNo ratings yet

- Entrega AdecuacionesDocument8 pagesEntrega AdecuacionesDan GarzaNo ratings yet

- Topeak Comp 150Document2 pagesTopeak Comp 150Esteban LVNo ratings yet

- Birding-the-MAin Bay-Trail-2005Document2 pagesBirding-the-MAin Bay-Trail-2005GrahamBroNo ratings yet

- 200-300-500-700 Additional and Revised ISOsDocument19 pages200-300-500-700 Additional and Revised ISOsSantiago CruzNo ratings yet

- Mercury Medical Oxygen Sensors: Cross Reference Wall ChartDocument2 pagesMercury Medical Oxygen Sensors: Cross Reference Wall ChartpabloNo ratings yet

- Bicho Feo-FlautaDocument4 pagesBicho Feo-FlautaLuis Esteban Escobar CórdobaNo ratings yet

- Piano Sonata in B-Flat Major: (D. 960 From The Year 1828) Piece For PianoforteDocument16 pagesPiano Sonata in B-Flat Major: (D. 960 From The Year 1828) Piece For PianoforteAna Lucia Villela MorettoNo ratings yet

- Boot Mode Normal Mode: Ser Res 33R Ser Res 33RDocument3 pagesBoot Mode Normal Mode: Ser Res 33R Ser Res 33RKhamed TabetNo ratings yet

- TOIDEL 2020 02 12 Page 16 CroppedDocument1 pageTOIDEL 2020 02 12 Page 16 CroppedPradip RoyNo ratings yet

- A Music: Standard TuningDocument3 pagesA Music: Standard TuningxashayarNo ratings yet

- Marantz PMD 670 Service ManualDocument57 pagesMarantz PMD 670 Service Manualgarybirch5719No ratings yet

- Castrol Season SummaryDocument2 pagesCastrol Season SummaryDaniel BurtonNo ratings yet

- Be - Mechanical Engineering - Semester 6 - 2023 - May - Automation and Artificial Intelligencerev 2019 C SchemeDocument1 pageBe - Mechanical Engineering - Semester 6 - 2023 - May - Automation and Artificial Intelligencerev 2019 C SchemeJunaid KhanNo ratings yet

- 6 72431 Linked PDFDocument8 pages6 72431 Linked PDFАнатолій ГуменюкNo ratings yet

- Level (+10.68 M) Roof Beam-2 Beam186 Section 15x20: A-A B-B C-C D-DDocument2 pagesLevel (+10.68 M) Roof Beam-2 Beam186 Section 15x20: A-A B-B C-C D-DChia NgwahNo ratings yet

- Building 2 Extension For ApprovalDocument1 pageBuilding 2 Extension For Approvalchedita obiasNo ratings yet

- Ransformers Theme VoceDocument4 pagesRansformers Theme VoceGustava LafavaNo ratings yet

- 1TB02011 011C44 Amp FF R1 SDW Ar 10001Document1 page1TB02011 011C44 Amp FF R1 SDW Ar 10001Sher DilNo ratings yet

- Skipper - 1QFY18 Result Update - 060917Document5 pagesSkipper - 1QFY18 Result Update - 060917amankumar sahuNo ratings yet

- Hs-Se40-Intl Rev BDocument1 pageHs-Se40-Intl Rev BSaurabh GuptaNo ratings yet

- Behringer EPR900 Powered Speaker SchematicsDocument14 pagesBehringer EPR900 Powered Speaker SchematicsMichell Hernandez100% (2)

- Behringer EPR900 Powered Speaker SchematicsDocument14 pagesBehringer EPR900 Powered Speaker SchematicsJimNo ratings yet

- Kotak Mahindra Bank Limited Managements Discussion and Analysis FY18Document38 pagesKotak Mahindra Bank Limited Managements Discussion and Analysis FY18ss gNo ratings yet

- Fill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredFrom EverandFill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredNo ratings yet

- ExtendSim DatabaseDocument102 pagesExtendSim Databasesaty16No ratings yet

- Upgrading To ExtendSim 10Document15 pagesUpgrading To ExtendSim 10saty16No ratings yet

- License AgreementDocument4 pagesLicense Agreementsaty16No ratings yet

- QMBD - Module 2Document4 pagesQMBD - Module 2saty16No ratings yet

- Finance in RetailDocument14 pagesFinance in Retailsaty16No ratings yet

- Managing The Merchandise - Session RM6Document33 pagesManaging The Merchandise - Session RM6saty16No ratings yet

- Customer ServiceDocument40 pagesCustomer Servicesaty16No ratings yet

- India's Defence IndustryDocument3 pagesIndia's Defence Industrysaty16No ratings yet

- Retail Market Strategy - RMDocument55 pagesRetail Market Strategy - RMsaty16No ratings yet

- Paytm Payments BankDocument1 pagePaytm Payments Banksaty16No ratings yet

- Omni-Channel Retail StrategyDocument38 pagesOmni-Channel Retail Strategysaty16No ratings yet

- Markovid - FMCGDocument10 pagesMarkovid - FMCGsaty16No ratings yet

- Markovid - FMCG ReportDocument10 pagesMarkovid - FMCG Reportsaty16No ratings yet

- Markovid - FMCG IndustryDocument10 pagesMarkovid - FMCG Industrysaty16No ratings yet

- OTT Advertising: The Rise ofDocument11 pagesOTT Advertising: The Rise ofsaty16No ratings yet

- The Impact of COVID 19 On Employee EngagementDocument22 pagesThe Impact of COVID 19 On Employee Engagementsaty16No ratings yet

- Services August 2020Document31 pagesServices August 2020saty16No ratings yet

- Power August 2020Document36 pagesPower August 2020saty16No ratings yet

- Media and Entertainment September 2020Document40 pagesMedia and Entertainment September 2020saty16No ratings yet

- 08 SCI Chemistry Essay Final HadDocument3 pages08 SCI Chemistry Essay Final Had17SamanthaDNo ratings yet

- WFMV Bxwzgvjv-2006 (Lmov) : Ivó Gš¿YvjqDocument30 pagesWFMV Bxwzgvjv-2006 (Lmov) : Ivó Gš¿YvjqMd Abdul MominNo ratings yet

- Assignment 1Document9 pagesAssignment 1IshahNo ratings yet

- Martial LawDocument4 pagesMartial LawKim NaNo ratings yet

- Rural MarketingDocument49 pagesRural MarketingSnehashish ChowdharyNo ratings yet

- PIC Unlisted InvestmentsDocument6 pagesPIC Unlisted InvestmentsTiso Blackstar Group100% (1)

- Accounts Statement IiDocument51 pagesAccounts Statement Iiapi-19728905No ratings yet

- Aepep Accomplishment Report For Cy 2021 1St Quarter: GC and C, IncorporatedDocument4 pagesAepep Accomplishment Report For Cy 2021 1St Quarter: GC and C, Incorporatedjanel norbeNo ratings yet

- FTC v. Procter & Gamble Co., 386 U.S. 568 (1967)Document26 pagesFTC v. Procter & Gamble Co., 386 U.S. 568 (1967)Scribd Government DocsNo ratings yet

- Travel 109-118Document10 pagesTravel 109-118colorado2014No ratings yet

- On Ups LogisticsDocument14 pagesOn Ups LogisticsShivangi SharmaNo ratings yet

- HRM Research PaperDocument11 pagesHRM Research PaperAbd EssamiaNo ratings yet

- Final Kingfisher ProjectDocument46 pagesFinal Kingfisher ProjectKrishnasish NathNo ratings yet

- BMTC Final ProjectDocument117 pagesBMTC Final Projectseema100% (2)

- CHALLANDocument1 pageCHALLANalviroalphaNo ratings yet

- Food and Wine Tourism 1 IntroductionDocument3 pagesFood and Wine Tourism 1 IntroductionniluchiNo ratings yet

- ATRAM Investment Application FormDocument1 pageATRAM Investment Application FormValen ValibiaNo ratings yet

- Chapter 8 AnswersDocument4 pagesChapter 8 AnswersMarisa Vetter100% (1)

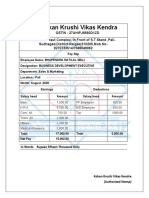

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- (9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthDocument28 pages(9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthEkoa Akono marie BéréniceNo ratings yet

- Free Market Ethics (Defense)Document4 pagesFree Market Ethics (Defense)Vicky ScraggNo ratings yet

- Action Plan TemplateDocument12 pagesAction Plan Templatepellazgus100% (2)

- Analysis of Tourism Industry With Special Reference To Travel PackagesDocument41 pagesAnalysis of Tourism Industry With Special Reference To Travel PackagesLakshit ChauhanNo ratings yet

- Companies That Benefited From TQMDocument4 pagesCompanies That Benefited From TQMdayday100% (1)

- The Dynamics of International Migration and Settlement in EuropeDocument318 pagesThe Dynamics of International Migration and Settlement in EuropeOsvaldino Monteiro100% (1)

- Local History in BindoyDocument3 pagesLocal History in BindoyMariegrace AmparadoNo ratings yet

- Energy SectorDocument76 pagesEnergy SectorthisissoirritatingNo ratings yet

- What Is Political InstitutionDocument3 pagesWhat Is Political InstitutionAllan Michelle BarreteNo ratings yet

- ShwenandawDocument4 pagesShwenandawmyochitmyanmarNo ratings yet

India Macro Insight-Bop: in Brief

India Macro Insight-Bop: in Brief

Uploaded by

saty16Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Macro Insight-Bop: in Brief

India Macro Insight-Bop: in Brief

Uploaded by

saty16Copyright:

Available Formats

1 Apr 2017

India Macro Insight-BoP Prof. Biswa Swarup Misra

BoP in Q3 of FY’17 underscores the need to strengthen forex reserves by taking chief.economist@bankofbaroda.com

advantage of dollar liquidity.

In Brief Major Components of BoP

BoP in Q3 of FY’17 reflected widening of CAD, net FII outflow and drop in net FDI and (US$Bn)

depletion of forex on a sequential basis. Components

Dec-

15

Mar-

16

Jun-

16

Sep-

16

Dec-

16

The combined effect of sluggish FDI and outflow of FII led to the depreciation of the Current account

Deficit (CAD)

-7.1 -0.3 -0.3 -3.4 -7.9

rupee vis a vis the dollar in the Dec 2016 quarter. The rupee dollar exchange rate which Trade Balance -16.0 -8.7 -8.1 -9.4 -15.6

(Goods and

was 66.85 in October depreciated to 67.95 in December 2016. Services)

The recent strengthening of rupee is guided by expectations of FIIs on the ability of the Exports

Imports

102.8

118.8

105.2

113.9

106.0

114.1

108.3

117.7

110.9

126.5

government to pursue reform oriented policies, post the election outcomes in some of Primary income -6.4 -6.6 -6.2 -7.9 -6.2

Secondary 15.3 15.0 14.0 13.9 13.9

the bigger states in March 2017 and the positive developments with regard to GST roll income

out. Invisibles 26.9 24.4 23.6 22.2 25.4

Capital Account 0.0 0.0 0.2 -0.0 -0.0

However, RBI should guard itself from a possible depreciation of rupee from an expected Financial Account

FDI

6.8

10.7

0.1

8.8

-0.0

3.8

4.3

16.9

7.4

9.8

slump in Q4 GDP growth on account of lagged impact of demonetisation and uncertainties FPI 0.6 -1.5 2.1 6.1 -11.3

associated with the implementation of GST which can make FIIs wary about Indian Accretion(-)/ -4.1 -3.3 -6.9 -8.5 1.2

Depletion (+) of

markets. Forex

BoP numbers for Q3 underscores the need for mopping dollars by RBI to build the forex Note-All figures are on a net basis

reserves so as to avoid exchange rate volaitility in the event of FII disinterest in the Indian

economy.

CAD AS PERCENT OF GDP

-0.1

-0.1

-0.1

-0.2

-0.6

-0.9

-1.2

-1.2

-1.4

-1.4

-1.5

-1.5

-1.7

-2.2

-3.6

-4.8

D E C - 1 2 -6.8

DEC-13

DEC-14

DEC-15

DEC-16

MAR-13

MAR-14

MAR-15

MAR-16

JUN-13

SEP-13

JUN-14

SEP-14

JUN-15

SEP-15

JUN-16

SEP-16

GOLD IMPORT(US$BN)

17.8

Note: All figures are on a a net basis

16.5

15.8

Only components with major share in overall BoP have been included.

Drivers of BoP in Q3 of 2016-17

11.1

10.0

The December quarter involved a number of significant developments both on the global

9.8

9.0

8.5

7.7

7.5

7.1

and domestic front which shaped India’s BoP.

5.3

5.3

At the domestic front, the historic step of demonetisation created some amount of

4.0

3.9

3.9

3.1

uncertainty with regard to its impact on growth.

The protectionist flavored announcements with a commitment for massive

DEC-12

MAR-13

DEC-13

MAR-14

DEC-14

MAR-15

DEC-15

MAR-16

DEC-16

JUN-13

JUN-14

JUN-15

JUN-16

SEP-13

SEP-14

SEP-15

SEP-16

infrastructure spending by the new US presidential elections kept markets at the edge.

Improving labour market conditions prompted the US Fed to increase policy rate in

December 2016 after a gap of one year.

@ 2017 Bank of Baroda. All rights reserved

Please refer page No. 3 for disclaimer.

2

Key Takeaway

Export and Import Growth

21.8

Current Account

17.5

10.7

9.4

CAD in Q3 of FY’17 deteriorated (in absolute terms as well as a percentage of

9.0

8.3

GDP) on both sequential and annual basis. Inspite of improved trade balance in

5.5

4.6

Q3 of FY’17; CAD widened due to lower invisible receipts. Net invisibles declined

4.3 0.1

2.4

1.4

by 5.5% in Q3 of FY’17 primarily due to lower earnings from software, financial

services and charges for intellectual property rights.

-0.1

-0.1

-0.7

CAD increased to $7.9 billion in Q3 of FY’17 compared to $3.4 billion in Q2 of

-5.6

-6.8

-7.4

FY’17 and $7.1 billion in Q3 of FY’16. CAD as a percentage of GDP increased to

1.4% in Q3, FY 2016-17 compared to 0.6% in Q2, FY 2016-17.

-13.0

-13.5

-17.9

Trade Balance strengthened owing to improved exports. Exports of goods and

-22.9

services increased by 7.8% in Q3 of FY’17 compared to a decline of 13.3% in Q3

of FY’16. Imports on the other hand, increased by 6.5% in Q3 of FY’16 compared

16-Apr

16-May

16-Jun

16-Jul

16-Aug

16-Sep

16-Oct

16-Nov

16-Dec

17-Jan

19-Feb

to a decline of 13.7% in Q3 of FY’16.

Gold Imports (Nonmonetary gold) increased by 8.7% in Q3 of FY’17 compared to

Exports Imports

a decline of 19.0% in Q3 of FY’16. Trade Deficit as a percentage of GDP stood at

2.8 % in Q3 of FY’17 compared to 3.1% in Q3 of FY’16.

TREND IN FDI AND FPI INFLOWS

Inspite of an improved trade balance, the increase in current account deficit is ($US BILLION)

attributable to:

16.9

Decline in Net Primary Income by 3.6% in Q3 of FY’17 compared to an

12.5

10.7

10.0

increase of 10% in Q3 of FY’16.

9.8

9.3

8.8

Within Primary Income, investment income registered a sharp decline of

6.5

6.1

3.8

2.4% in Q3 of FY’17. The major slump was attributable to the sharp fall in

2.1

0.6

Portfolio Investment especially investment income on equity and

investment fund shares.

0.0

-1.5

Secondary Income was impacted due to decline in Private transfer receipts,

-3.5

mainly representing remittances by Indians employed overseas.

D E C - 1 6 -11.3

Capital Account Balance

MAR-15

SEP-15

MAR-16

SEP-16

DEC-15

JUN-15

JUN-16

Capital account registered net outflow of US$0.02 billion in Q3 of FY’17 as against

net inflow of US$0.02 billion in Q3 of FY’16.

Capital Transfers credited to BoP account declined primarily due to decline in Net FDI Net FPI

private capital transfers.

Financial Account

The second rate hike by Fed after a gap of one year coupled with uncertainties

associated with the possible adverse impact of demonetisation on growth led to FIIs Major Components of BoP- As Percent of

GDP

pulling out funds from the Indian market.

2015-16 2016-17

Portfolio Investment recorded an outflow both in equity and debt segments. FPI Component Q1 Q2 Q1 Q2 Q3

outflow was US$11.3 billion in Q3 of FY’17 as against an inflow of US$ 0.6 billion in

Q3 of FY’16 and US$6.1 billion in Q2 of FY’17. Current -1.4 -0.1 -0.1 -0.6 -1.4

Account

FDI was also quite sluggish in the December quarter and dropped to US$9.8 billion Deficit

Trade -3.0 -1.6 -1.5 -1.7 -2.8

in quarter ended Dec-2016 from US$16.9 billion in the September quarter. Deficit

Reflecting the redemption of FCNR (B) deposits, non-resident Indian (NRI)

Capital

Account

0 0 0 0 0

deposits declined by US$ 18.5 billion in Q3 of FY’17 as against an inflow of US$ 1.6 Financial 1.3 0.03 -0.01 0.7 1.3

Account

billion a year ago.

FDI 2.0 1.6 0.7 3.0 1.7

Net Loan receipts through external assistance, ECBs and Banking Capital stood at FII 0.1 -0.3 0.4 1.1 -2

$20.4 billion in Q3 of FY’17 compared to net repayments of US$0.8 billion in Q3 of

FY’16. Errors and 0.1 0 0 -0.2 0.1

Omission

Borrowings through the External Commercial Borrowings (ECB) route indicated a

rise in repayment of about US$ 1.4 billion in Q3 of FY’17.

Foreign exchange reserves in Q3 of FY’17 depleted by US$ 1.2 billion as against an

increase of US$ 4.1 billion in Q3 of FY’16 and US$8.5 bn in Q2 of FY’17.

@ 2017 Bank of Baroda. All rights reserved

Please refer page No. 3 for disclaimer. India Macro Insight-BoP for Q3 of 2016-17

3

Disclaimer:

The views expressed in this Note are personal views of the author(s) and do not necessarily reflect the views of

Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/

purchase or as an invitation or solicitation to do so for any securities of any entity. Bank of Baroda and/ or its

Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any

information contained herein or otherwise provided and hereby disclaim any liability with regard to the same.

Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or

personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/

or companies or issues or matters as contained in this publication and such commercial capacity or interest

whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group

liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors

shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or

access of any information that may be displayed in this publication from time to time.

Visit us at www.bankofbaroda.com

Twitter: @bankofbaroda

Facebook: https://www.facebook.com/officialbankofbarodapage/

You Tube: https:/bitly.bobYT

For further details about this publication, please contact

Prof. Biswa Swarup Misra

Chief Economist

Bank of Baroda

Phone:+9122 66985713

E-Mail: chief.economist@bankofbaorda.com

bs.misra@bankofbaroda.com

India Macro Insight-BoP for Q3 of 2016-17

You might also like

- Behringer EPR900 Powered Speaker Schematics PDFDocument14 pagesBehringer EPR900 Powered Speaker Schematics PDFAlvaro Canaviri Mamani100% (1)

- IO Model Vs Resource Based Model - Two Approaches To StrategyDocument14 pagesIO Model Vs Resource Based Model - Two Approaches To StrategyM ManjunathNo ratings yet

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasNo ratings yet

- Elevation Section: Full Top PlanDocument1 pageElevation Section: Full Top PlanROSE STONENo ratings yet

- Wu Ji-Horn in F 1Document1 pageWu Ji-Horn in F 1José Miguel S. JrNo ratings yet

- Sectional Plan, HFD, Ga Drawing - Bypass Line 5 - 4 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing - Bypass Line 5 - 4 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Sectional Plan, HFD, Ga Drawing of Bypass Line 2 - 2 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing of Bypass Line 2 - 2 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Denah Basement SKALA 1:200: R.STPDocument1 pageDenah Basement SKALA 1:200: R.STPnovita fi rizkiNo ratings yet

- SectionE 43Document1 pageSectionE 43NikNo ratings yet

- SECTION''A''-''A'' SECTION''B''-''B'': ''Spot Details'' Typical Reinforcement Stair DetailDocument1 pageSECTION''A''-''A'' SECTION''B''-''B'': ''Spot Details'' Typical Reinforcement Stair DetailAlyssa Juvelle Cusi AlfonsoNo ratings yet

- RSecTradEdge - Tech Mahindra and Cadila - 151116Document4 pagesRSecTradEdge - Tech Mahindra and Cadila - 151116kgarg06No ratings yet

- Sectional Plan, HFD, Ga Drawing of Bypass Line 1 - 1 of 5 - 11.10.2022Document1 pageSectional Plan, HFD, Ga Drawing of Bypass Line 1 - 1 of 5 - 11.10.2022Anirban MukherjeeNo ratings yet

- Alibaug Final DraftDocument1 pageAlibaug Final Draftshuchi masraniNo ratings yet

- Tchavolo Instrument EbDocument1 pageTchavolo Instrument Ebjhon giraldoNo ratings yet

- Lenoxx MC-245B PDFDocument5 pagesLenoxx MC-245B PDFEdnaelson SilvaNo ratings yet

- Sbwi Tma-Foz Arc 20220616Document1 pageSbwi Tma-Foz Arc 20220616CTA 2013No ratings yet

- Be - Computer Engineering - Semester 6 - 2023 - May - Artificial Intelligencerev 2019 C SchemeDocument3 pagesBe - Computer Engineering - Semester 6 - 2023 - May - Artificial Intelligencerev 2019 C Schemeakashsin583No ratings yet

- Characteristics Standard Pagina: 1/10 DataDocument14 pagesCharacteristics Standard Pagina: 1/10 Dataerik0007100% (1)

- Ruko Mingku MasukaDocument1 pageRuko Mingku MasukaHarry NovieNo ratings yet

- Denah BangunanDocument1 pageDenah BangunanHarry NovieNo ratings yet

- Type 1Document1 pageType 1Sabina CazacuNo ratings yet

- 415 ColoradoDocument53 pages415 Coloradodali yangNo ratings yet

- Land Scape 1Document1 pageLand Scape 1Ardit ValishtaNo ratings yet

- Z213x4xSch 1Document3 pagesZ213x4xSch 1Mehmet ÇetingürbüzNo ratings yet

- 1X-M6-AD-00003 1X-M6-AD-00003 1X-M6-AD-00003: New Assiut Combined Cycle Add-On Power PlantDocument1 page1X-M6-AD-00003 1X-M6-AD-00003 1X-M6-AD-00003: New Assiut Combined Cycle Add-On Power Plantwael zakariaNo ratings yet

- Inventio 15Document2 pagesInventio 15Deyan DenchevNo ratings yet

- JIB FMME Ae 04CL 307.000Document1 pageJIB FMME Ae 04CL 307.000MoustafaNo ratings yet

- B-5.011.646-0001 - 0001 - PTU LayoutDocument1 pageB-5.011.646-0001 - 0001 - PTU LayoutWison YangNo ratings yet

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahNo ratings yet

- Grommet 6.0mm IDDocument1 pageGrommet 6.0mm IDShrikant DeshmukhNo ratings yet

- Circuit Diagram 1175404Document3 pagesCircuit Diagram 1175404dtftfernandes9099No ratings yet

- Dwindling SuppliesDocument2 pagesDwindling SuppliesBenNo ratings yet

- X20030751002PROMINENCEPROPERTIESINC OrchardPlaceResidencesDocument1 pageX20030751002PROMINENCEPROPERTIESINC OrchardPlaceResidencesRhobbie NolloraNo ratings yet

- Be Electrical Engineering Semester 6 2023 May Signals and Systemsrev 2019 C SchemeDocument2 pagesBe Electrical Engineering Semester 6 2023 May Signals and Systemsrev 2019 C SchemePratik BhonkarNo ratings yet

- DateDocument14 pagesDateerik0007No ratings yet

- Haier 21f9d-tDocument1 pageHaier 21f9d-tadithyanvsNo ratings yet

- SG-01 Circuito ControlDocument1 pageSG-01 Circuito ControlCRISTIANNo ratings yet

- Entrega AdecuacionesDocument8 pagesEntrega AdecuacionesDan GarzaNo ratings yet

- Topeak Comp 150Document2 pagesTopeak Comp 150Esteban LVNo ratings yet

- Birding-the-MAin Bay-Trail-2005Document2 pagesBirding-the-MAin Bay-Trail-2005GrahamBroNo ratings yet

- 200-300-500-700 Additional and Revised ISOsDocument19 pages200-300-500-700 Additional and Revised ISOsSantiago CruzNo ratings yet

- Mercury Medical Oxygen Sensors: Cross Reference Wall ChartDocument2 pagesMercury Medical Oxygen Sensors: Cross Reference Wall ChartpabloNo ratings yet

- Bicho Feo-FlautaDocument4 pagesBicho Feo-FlautaLuis Esteban Escobar CórdobaNo ratings yet

- Piano Sonata in B-Flat Major: (D. 960 From The Year 1828) Piece For PianoforteDocument16 pagesPiano Sonata in B-Flat Major: (D. 960 From The Year 1828) Piece For PianoforteAna Lucia Villela MorettoNo ratings yet

- Boot Mode Normal Mode: Ser Res 33R Ser Res 33RDocument3 pagesBoot Mode Normal Mode: Ser Res 33R Ser Res 33RKhamed TabetNo ratings yet

- TOIDEL 2020 02 12 Page 16 CroppedDocument1 pageTOIDEL 2020 02 12 Page 16 CroppedPradip RoyNo ratings yet

- A Music: Standard TuningDocument3 pagesA Music: Standard TuningxashayarNo ratings yet

- Marantz PMD 670 Service ManualDocument57 pagesMarantz PMD 670 Service Manualgarybirch5719No ratings yet

- Castrol Season SummaryDocument2 pagesCastrol Season SummaryDaniel BurtonNo ratings yet

- Be - Mechanical Engineering - Semester 6 - 2023 - May - Automation and Artificial Intelligencerev 2019 C SchemeDocument1 pageBe - Mechanical Engineering - Semester 6 - 2023 - May - Automation and Artificial Intelligencerev 2019 C SchemeJunaid KhanNo ratings yet

- 6 72431 Linked PDFDocument8 pages6 72431 Linked PDFАнатолій ГуменюкNo ratings yet

- Level (+10.68 M) Roof Beam-2 Beam186 Section 15x20: A-A B-B C-C D-DDocument2 pagesLevel (+10.68 M) Roof Beam-2 Beam186 Section 15x20: A-A B-B C-C D-DChia NgwahNo ratings yet

- Building 2 Extension For ApprovalDocument1 pageBuilding 2 Extension For Approvalchedita obiasNo ratings yet

- Ransformers Theme VoceDocument4 pagesRansformers Theme VoceGustava LafavaNo ratings yet

- 1TB02011 011C44 Amp FF R1 SDW Ar 10001Document1 page1TB02011 011C44 Amp FF R1 SDW Ar 10001Sher DilNo ratings yet

- Skipper - 1QFY18 Result Update - 060917Document5 pagesSkipper - 1QFY18 Result Update - 060917amankumar sahuNo ratings yet

- Hs-Se40-Intl Rev BDocument1 pageHs-Se40-Intl Rev BSaurabh GuptaNo ratings yet

- Behringer EPR900 Powered Speaker SchematicsDocument14 pagesBehringer EPR900 Powered Speaker SchematicsMichell Hernandez100% (2)

- Behringer EPR900 Powered Speaker SchematicsDocument14 pagesBehringer EPR900 Powered Speaker SchematicsJimNo ratings yet

- Kotak Mahindra Bank Limited Managements Discussion and Analysis FY18Document38 pagesKotak Mahindra Bank Limited Managements Discussion and Analysis FY18ss gNo ratings yet

- Fill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredFrom EverandFill Your Glass With Gold-When It's Half-Full or Even Completely ShatteredNo ratings yet

- ExtendSim DatabaseDocument102 pagesExtendSim Databasesaty16No ratings yet

- Upgrading To ExtendSim 10Document15 pagesUpgrading To ExtendSim 10saty16No ratings yet

- License AgreementDocument4 pagesLicense Agreementsaty16No ratings yet

- QMBD - Module 2Document4 pagesQMBD - Module 2saty16No ratings yet

- Finance in RetailDocument14 pagesFinance in Retailsaty16No ratings yet

- Managing The Merchandise - Session RM6Document33 pagesManaging The Merchandise - Session RM6saty16No ratings yet

- Customer ServiceDocument40 pagesCustomer Servicesaty16No ratings yet

- India's Defence IndustryDocument3 pagesIndia's Defence Industrysaty16No ratings yet

- Retail Market Strategy - RMDocument55 pagesRetail Market Strategy - RMsaty16No ratings yet

- Paytm Payments BankDocument1 pagePaytm Payments Banksaty16No ratings yet

- Omni-Channel Retail StrategyDocument38 pagesOmni-Channel Retail Strategysaty16No ratings yet

- Markovid - FMCGDocument10 pagesMarkovid - FMCGsaty16No ratings yet

- Markovid - FMCG ReportDocument10 pagesMarkovid - FMCG Reportsaty16No ratings yet

- Markovid - FMCG IndustryDocument10 pagesMarkovid - FMCG Industrysaty16No ratings yet

- OTT Advertising: The Rise ofDocument11 pagesOTT Advertising: The Rise ofsaty16No ratings yet

- The Impact of COVID 19 On Employee EngagementDocument22 pagesThe Impact of COVID 19 On Employee Engagementsaty16No ratings yet

- Services August 2020Document31 pagesServices August 2020saty16No ratings yet

- Power August 2020Document36 pagesPower August 2020saty16No ratings yet

- Media and Entertainment September 2020Document40 pagesMedia and Entertainment September 2020saty16No ratings yet

- 08 SCI Chemistry Essay Final HadDocument3 pages08 SCI Chemistry Essay Final Had17SamanthaDNo ratings yet

- WFMV Bxwzgvjv-2006 (Lmov) : Ivó Gš¿YvjqDocument30 pagesWFMV Bxwzgvjv-2006 (Lmov) : Ivó Gš¿YvjqMd Abdul MominNo ratings yet

- Assignment 1Document9 pagesAssignment 1IshahNo ratings yet

- Martial LawDocument4 pagesMartial LawKim NaNo ratings yet

- Rural MarketingDocument49 pagesRural MarketingSnehashish ChowdharyNo ratings yet

- PIC Unlisted InvestmentsDocument6 pagesPIC Unlisted InvestmentsTiso Blackstar Group100% (1)

- Accounts Statement IiDocument51 pagesAccounts Statement Iiapi-19728905No ratings yet

- Aepep Accomplishment Report For Cy 2021 1St Quarter: GC and C, IncorporatedDocument4 pagesAepep Accomplishment Report For Cy 2021 1St Quarter: GC and C, Incorporatedjanel norbeNo ratings yet

- FTC v. Procter & Gamble Co., 386 U.S. 568 (1967)Document26 pagesFTC v. Procter & Gamble Co., 386 U.S. 568 (1967)Scribd Government DocsNo ratings yet

- Travel 109-118Document10 pagesTravel 109-118colorado2014No ratings yet

- On Ups LogisticsDocument14 pagesOn Ups LogisticsShivangi SharmaNo ratings yet

- HRM Research PaperDocument11 pagesHRM Research PaperAbd EssamiaNo ratings yet

- Final Kingfisher ProjectDocument46 pagesFinal Kingfisher ProjectKrishnasish NathNo ratings yet

- BMTC Final ProjectDocument117 pagesBMTC Final Projectseema100% (2)

- CHALLANDocument1 pageCHALLANalviroalphaNo ratings yet

- Food and Wine Tourism 1 IntroductionDocument3 pagesFood and Wine Tourism 1 IntroductionniluchiNo ratings yet

- ATRAM Investment Application FormDocument1 pageATRAM Investment Application FormValen ValibiaNo ratings yet

- Chapter 8 AnswersDocument4 pagesChapter 8 AnswersMarisa Vetter100% (1)

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- (9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthDocument28 pages(9781785360503 - Handbook of Finance and Development) Financial Development and Innovation-Led GrowthEkoa Akono marie BéréniceNo ratings yet

- Free Market Ethics (Defense)Document4 pagesFree Market Ethics (Defense)Vicky ScraggNo ratings yet

- Action Plan TemplateDocument12 pagesAction Plan Templatepellazgus100% (2)

- Analysis of Tourism Industry With Special Reference To Travel PackagesDocument41 pagesAnalysis of Tourism Industry With Special Reference To Travel PackagesLakshit ChauhanNo ratings yet

- Companies That Benefited From TQMDocument4 pagesCompanies That Benefited From TQMdayday100% (1)

- The Dynamics of International Migration and Settlement in EuropeDocument318 pagesThe Dynamics of International Migration and Settlement in EuropeOsvaldino Monteiro100% (1)

- Local History in BindoyDocument3 pagesLocal History in BindoyMariegrace AmparadoNo ratings yet

- Energy SectorDocument76 pagesEnergy SectorthisissoirritatingNo ratings yet

- What Is Political InstitutionDocument3 pagesWhat Is Political InstitutionAllan Michelle BarreteNo ratings yet

- ShwenandawDocument4 pagesShwenandawmyochitmyanmarNo ratings yet