Professional Documents

Culture Documents

Excise Return Cigarette Inventory Tax

Excise Return Cigarette Inventory Tax

Uploaded by

Bryan WilleyCopyright:

Available Formats

You might also like

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- Notice of Assessment 2023 04 11 12 04 11 210682Document6 pagesNotice of Assessment 2023 04 11 12 04 11 210682namenoname363No ratings yet

- B2B Products & Services StrategiesDocument37 pagesB2B Products & Services Strategiesnandini11100% (1)

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- Summary of Charges: My Bill Summary For October 2022Document3 pagesSummary of Charges: My Bill Summary For October 2022AmitNo ratings yet

- Invalidating Tax Assessment January 2024 2Document68 pagesInvalidating Tax Assessment January 2024 2arnulfojr hicoNo ratings yet

- Billing Statement: Address ToDocument3 pagesBilling Statement: Address ToP’wee SalamatNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- October 2020 Tax AlertDocument5 pagesOctober 2020 Tax AlertRheneir MoraNo ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- BIR Form 2307Document3 pagesBIR Form 2307Jocere LopezNo ratings yet

- Oct 2023Document3 pagesOct 2023poonamNo ratings yet

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address ToHihezzzNo ratings yet

- 2022 ItrDocument9 pages2022 Itrjoel.henderson3No ratings yet

- G.R. No. 178090 Panasonic Vs CIRDocument4 pagesG.R. No. 178090 Panasonic Vs CIRRene ValentosNo ratings yet

- Page 1 of 4 BIR RulingsDocument4 pagesPage 1 of 4 BIR RulingsleawisokaNo ratings yet

- Billing Statement: Address ToDocument5 pagesBilling Statement: Address ToP’wee SalamatNo ratings yet

- Billing Statement: Address ToDocument3 pagesBilling Statement: Address ToThess CabanaNo ratings yet

- IAS 30-09-2018 - Sara Burke PDFDocument2 pagesIAS 30-09-2018 - Sara Burke PDFAnonymous OZRWl5EDNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- 2023 Itr PravinvallikaduDocument18 pages2023 Itr PravinvallikadudennisNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument28 pagesValue-Added Tax Description: BIR Form 2550MDura LexNo ratings yet

- Summary of Charges: My Bill Summary For May 2023Document3 pagesSummary of Charges: My Bill Summary For May 2023AmitNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- 1702 RTsasaDocument4 pages1702 RTsasaEysOc11No ratings yet

- (J. Bersamin) : Code of Services Subject To VAT Is ExclusiveDocument7 pages(J. Bersamin) : Code of Services Subject To VAT Is ExclusiveED RCNo ratings yet

- US Internal Revenue Service: f8906 AccessibleDocument1 pageUS Internal Revenue Service: f8906 AccessibleIRSNo ratings yet

- L& C 1604E 2023 Form AmendedV3Document2 pagesL& C 1604E 2023 Form AmendedV3fitnessarmy2021No ratings yet

- 2200-S Jan 2018 Guide RevisedDocument2 pages2200-S Jan 2018 Guide RevisedJoseph DoctoNo ratings yet

- launchJasperReport 6Document1 pagelaunchJasperReport 6Husen WahidNo ratings yet

- Vat Guide Accounts PayableDocument24 pagesVat Guide Accounts Payablekrishnan_rajesh5740No ratings yet

- Cs Garment v. CirDocument19 pagesCs Garment v. CirIris MendiolaNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument15 pagesValue-Added Tax Description: BIR Form 2550MJAYAR MENDZNo ratings yet

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocument11 pages35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNo ratings yet

- Value - Added TaxDocument27 pagesValue - Added Tax723114bellaNo ratings yet

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNo ratings yet

- Value Added TaxDocument27 pagesValue Added TaxMark Joseph BajaNo ratings yet

- Accenture, Inc. vs. Commissioner of Internal RevenueDocument14 pagesAccenture, Inc. vs. Commissioner of Internal Revenuevince005No ratings yet

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- TQ VatDocument6 pagesTQ VatJaneNo ratings yet

- Lupoaeveronica 2022 1BDocument18 pagesLupoaeveronica 2022 1BBianca DuracNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- Commissioner of Internal Revenue vs. Liquigaz Philippines CorporationDocument17 pagesCommissioner of Internal Revenue vs. Liquigaz Philippines CorporationKing KingNo ratings yet

- 2019 Tax Year Assessment Ivolpe PDFDocument5 pages2019 Tax Year Assessment Ivolpe PDFLISA VOLPENo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDocument14 pagesb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNo ratings yet

- Bir Forms CompilationDocument40 pagesBir Forms Compilationpascual.angeline20No ratings yet

- Notice of Assessment 2021 03 11 12 47 30 085217Document4 pagesNotice of Assessment 2021 03 11 12 47 30 085217gilli billiNo ratings yet

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- Abk Ltd. - Korean Etax Invoices 2 PDFDocument6 pagesAbk Ltd. - Korean Etax Invoices 2 PDFэкспресс сервисNo ratings yet

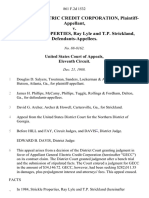

- General Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Document8 pagesGeneral Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- IND - IRS 1095A Tax Form-6900930177-21-Jan-2023Document6 pagesIND - IRS 1095A Tax Form-6900930177-21-Jan-2023Roberto E. Rodriguez0% (1)

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address Tomqhy9b622hNo ratings yet

- AAT ITAX LRP Assessment FA2015 - Questions 2015-16Document8 pagesAAT ITAX LRP Assessment FA2015 - Questions 2015-16LindaBakóNo ratings yet

- Problem Set 7. Contingencies and Other LiabilitiesDocument3 pagesProblem Set 7. Contingencies and Other LiabilitiesAngeline Gonzales PaneloNo ratings yet

- Blank Tax OrganizerDocument14 pagesBlank Tax Organizerapi-344263788No ratings yet

- Summary of Charges: My Bill Summary For March 2024Document2 pagesSummary of Charges: My Bill Summary For March 2024excellencepubgmNo ratings yet

- 2023 Omnibus Notes - Part 2 - Taxation Law LawDocument18 pages2023 Omnibus Notes - Part 2 - Taxation Law LawAPRIL BETONIONo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Beer Revenue Worksheet: Section A - Brewer InformationDocument2 pagesBeer Revenue Worksheet: Section A - Brewer InformationBryan WilleyNo ratings yet

- Registration Form: Dedicated Telephone ServiceDocument2 pagesRegistration Form: Dedicated Telephone ServiceBryan WilleyNo ratings yet

- Beer Credit Claim Worksheet: Section A - Brewer InformationDocument2 pagesBeer Credit Claim Worksheet: Section A - Brewer InformationBryan WilleyNo ratings yet

- Return For Self-Assessment of The First Nations Goods and Services Tax (FNGST)Document2 pagesReturn For Self-Assessment of The First Nations Goods and Services Tax (FNGST)Bryan WilleyNo ratings yet

- Summary of Dispositions of Capital Property (2011 and Later Tax Years)Document4 pagesSummary of Dispositions of Capital Property (2011 and Later Tax Years)Bryan WilleyNo ratings yet

- Sworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioDocument1 pageSworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioBryan WilleyNo ratings yet

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyNo ratings yet

- Charitable Donations and Gifts (2019 and Later Tax Years) : Schedule 2Document4 pagesCharitable Donations and Gifts (2019 and Later Tax Years) : Schedule 2Bryan WilleyNo ratings yet

- Ontario Tax Credit For Manufacturing and Processing (2019 and Later Tax Years)Document3 pagesOntario Tax Credit For Manufacturing and Processing (2019 and Later Tax Years)Bryan WilleyNo ratings yet

- Fuel Charge Return For Fuel Held in A Listed Province On Adjustment DayDocument4 pagesFuel Charge Return For Fuel Held in A Listed Province On Adjustment DayBryan WilleyNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- Nunavut Credits: Adjusted Net IncomeDocument2 pagesNunavut Credits: Adjusted Net IncomeBryan WilleyNo ratings yet

- Fuel Charge Return Schedule For Fuel Held in A Listed Province On Adjustment DayDocument2 pagesFuel Charge Return Schedule For Fuel Held in A Listed Province On Adjustment DayBryan WilleyNo ratings yet

- Worksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedDocument1 pageWorksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedBryan WilleyNo ratings yet

- RFQ For Early Train Operator ADDENDUM3Document88 pagesRFQ For Early Train Operator ADDENDUM3jackson michaelNo ratings yet

- ICM (Communication Work)Document6 pagesICM (Communication Work)Rifki Warri ZainNo ratings yet

- Unit II Company Audit and VouchingDocument36 pagesUnit II Company Audit and VouchingMuskan TyagiNo ratings yet

- Ayu Nurfitriadi-4111711020Document1,375 pagesAyu Nurfitriadi-4111711020Ayu NurfitriadiNo ratings yet

- Tigist Girma Thesis Final Final PDFDocument85 pagesTigist Girma Thesis Final Final PDFsultannesru2030No ratings yet

- Proxy Form / Borang ProksiDocument36 pagesProxy Form / Borang ProksiJonathan OngNo ratings yet

- New Fashion Collection: Mintmadefashi ONDocument25 pagesNew Fashion Collection: Mintmadefashi ONDhruv TayalNo ratings yet

- How To Draft Publicity Guidelines For Product and Corporate Ads During An IPODocument14 pagesHow To Draft Publicity Guidelines For Product and Corporate Ads During An IPODinesh GadkariNo ratings yet

- Zara Business Canvas ModelDocument3 pagesZara Business Canvas Modelkoko.keeganNo ratings yet

- Project: Integration ManagementDocument71 pagesProject: Integration ManagementMustefa MohammedNo ratings yet

- Entrep 1Document5 pagesEntrep 1Eddie PagalanNo ratings yet

- Phosphate/Oil Corrosion Protective Coatings For FastenersDocument2 pagesPhosphate/Oil Corrosion Protective Coatings For FastenersDarwin DarmawanNo ratings yet

- GURPS Traveller - Far TraderDocument146 pagesGURPS Traveller - Far TraderMarcos Inki100% (2)

- Img 20150623 0002Document1 pageImg 20150623 0002Hein MaungNo ratings yet

- Brand RevitalizationDocument16 pagesBrand RevitalizationAmar PatroNo ratings yet

- Strategic Audit and Strategy Evaluation & ControlDocument47 pagesStrategic Audit and Strategy Evaluation & Controlshweta_4666493% (14)

- Exam 2 Q&ADocument7 pagesExam 2 Q&AJennifer WillardNo ratings yet

- A Study On "Port Industry" - An Empirical ResearchDocument55 pagesA Study On "Port Industry" - An Empirical ResearchDimpu Sarath KumarNo ratings yet

- Case Analysis On Atlas Copco Company HRMDocument9 pagesCase Analysis On Atlas Copco Company HRMNam LêNo ratings yet

- Product Management - Case Study Progress ReviewDocument7 pagesProduct Management - Case Study Progress Reviewm sriNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Alireza RabieiDocument1 pageAlireza Rabieidayan malekNo ratings yet

- Consumer Psychology UGB310Document13 pagesConsumer Psychology UGB310dobriyoka Dobriy100% (1)

- NIKE CASE - Alice Roullet de La BouillerieDocument9 pagesNIKE CASE - Alice Roullet de La BouillerieAlice dlbNo ratings yet

- GROUP 3 FINAL - WORKING PAPER - v3Document85 pagesGROUP 3 FINAL - WORKING PAPER - v3cunbg vubNo ratings yet

- 10 Depreciation and Income TaxDocument53 pages10 Depreciation and Income TaxDyahKuntiSuryaNo ratings yet

- Annual State of The Residential Mortgage Market in CanadaDocument43 pagesAnnual State of The Residential Mortgage Market in Canadaderailedcapitalism.comNo ratings yet

- Corporate ValuationDocument42 pagesCorporate ValuationPrasannakumar SNo ratings yet

- Model Lucrare de Licenta Universitatea Transilvania Din BrașovDocument41 pagesModel Lucrare de Licenta Universitatea Transilvania Din BrașovElena MădălinaNo ratings yet

Excise Return Cigarette Inventory Tax

Excise Return Cigarette Inventory Tax

Uploaded by

Bryan WilleyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excise Return Cigarette Inventory Tax

Excise Return Cigarette Inventory Tax

Uploaded by

Bryan WilleyCopyright:

Available Formats

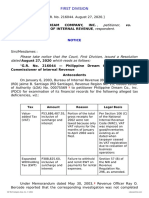

Protected B when completed

Excise return

Cigarette inventory tax

Business name

Send this completed return to:

Canada Revenue Agency

Mailing Address

Prince Edward Island Tax Centre

275 Pope Road

City Summerside PE C1N 6E7

Province Postal code

Under the Excise Act, 2001, the rates of excise duty on tobacco products will be adjusted annually every April 1 based on changes to the

Consumer Price Index. In addition, a cigarette inventory tax will be imposed on inventories of duty paid and special duty paid cigarettes held

in inventory at 12:01 am on April 1, 2020.

Please read the instructions on page 2 before completing this return.

1 Account number 2 Reporting period (YYYYMMDD) 3 Due date (YYYYMMDD)

RD 2020-04-01 2020-05-31

4. Inventory calculation

Product description Number of containers Units per container Number of cigarettes

Cartons of 200 cigarettes 200

Packages of 20 cigarettes 20

Packages of 25 cigarettes 25

Total: Enter the total number of cigarettes in the shaded box. 5

Transfer this amount to the "Quantity" field in the Tax Calculation table below.

6. Tax calculation

Product description Code Quantity Tax rate Tax payable

(Cigarettes) (Per cigarette)

Cigarettes 49521 $0.00232

Total due 7

Payment 8

Contact name Telephone number Ext

Certification

As an authorized person, I certify that the information given on this return is correct and complete. It is a serious offence to make a false statement. Incomplete or

incorrect information may delay the processing of your return.

Print name Title

Telephone number Ext Signature Date (YYYYMMDD)

Form prescribed by the Minister of National Revenue

Personal information is collected for purposes of the administration or enforcement of the Excise Tax Act, 2001 and related programs and activities such as administering

tax, rebates, elections, audit, compliance, and collection. Personal information may be shared for the purposes of other federal Acts that provide for the imposition and

collection of a tax or duty. Personal information may also be shared with other federal, provincial, territorial or foreign government institutions to the extent authorized by

law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right to access their personal

information, request correction, or file a complaint to the Privacy Commissioner of Canada regarding the handling of the individual’s personal information. Refer to

Personal Information Bank CRA PPU 224 at canada.ca/cra-info-source.

B273 E (20) (Ce formulaire est disponible en français.) Page 1 of 2

Instructions for completing page 1

Identification Enter the business name and mailing address of the business. For sole proprietorship enter the first and last name of the

individual. For corporations and partnerships, enter the legal name.

1. Account number Enter the RD account number that was assigned to you. If you don’t have an RD account number, then provide the first 9 digits of

your Business Number.

2. Reporting period April 1, 2020

3. Due date Form B273, Excise Return – Cigarette Inventory Tax, and payment are both due on May 31, 2020. Interest will apply after that

date on late or deficient payments. When a due date falls on a Saturday, a Sunday, or a public holiday, we consider your return

and payment to be sent on time if we receive them on the next business day.

4. Inventory An inventory of duty paid and special duty paid cigarettes owned by a person at the beginning (12:01 a.m.) of April 1, 2020, must be

determined in a fair and reasonable manner and be supported by appropriate books and records. This information should be kept for

audit purposes.

All duty paid and special duty paid cigarettes owned by the person must be counted and shall include products:

(a) stored in any place, such as in the person's warehouse, store rooms, cash-and-carry outlets, retail outlets, display areas or

delivery trucks; and

(b) purchased by the person before April 1, 2020, but received after the inventory count.

For duty paid and special duty paid cigarettes that you own in your inventory, enter the number of containers in the "Number of

containers" column.

Multiply this number by the units assigned in the "Units per container" column. Enter the result in the "Number of cigarettes" column.

Transfer the total of that column to the "Quantity" column in the "Tax calculation" section.

6. Tax calculation Multiply the total “Quantity (Cigarettes)” by the “Tax rate (per cigarette)” and enter the results in “Tax Payable” box.

If a person has a separate retail establishment with an inventory of more than 30,000 duty paid and special duty paid cigarettes,

the tax is payable on the inventory held at that location.

8. Payment Enter the amount being paid with this return.

Certification An authorized person must sign this section certifying that the information provided on the return is correct and complete.

General

• "Person" means an individual, a partnership, a corporation, a trust, the estate of a deceased individual, a government or a body that is a society, a

union, a club, an association, a commission, or another organization of any kind.

• "duty paid and special duty paid cigarette" refers to

– duty-paid and special duty-paid cigarettes, that is cigarettes on which excise duty has been paid as indicated by "Duty Paid Canada Droit Acquitté"

on the affixed tobacco stamp and

– imported unstamped cigarettes on which special duty was paid by a duty-free shop.

• "Unit" means one cigarette

• It does not include duty-paid cigarettes in vending machines.

Who has to file a return and pay cigarette inventory tax:

At the beginning of April 1,2020, all persons who own an inventory of duty paid and special duty paid cigarettes must complete and file a form B273

Excise Return – Cigarette Inventory Tax except those persons who do not hold more than 30,000 duty paid and special duty paid cigarettes. Note that

30,000 cigarettes equates to 150 cartons of 200 cigarettes per carton.

Supporting documentation

Keep a duplicate copy of completed Form B273, Excise Return – Cigarette Inventory Tax, together with supporting documentation, for verification by the

Canada Revenue Agency.

Several locations

GST/HST registrants who have elected to file GST/HST returns as separate branches or divisions may also file separate cigarette inventory tax returns

for each branch or division.

More information

If you need more information, consult Excise Duty Notice EDN64, Cigarette Inventory Tax on April 1, 2020, or call a regional excise office. For a list of

these offices, go to Contact Information – Excise Duties, Excise Taxes, Fuel Charge and Air Travellers Security Charge.

Where to send the return and make the payment

Send your copy of the signed Form B273, Excise Return – Cigarette Inventory Tax and payment to:

Canada Revenue Agency

Prince Edward Island Tax Centre

275 Pope Road

Summerside PE C1N 6E7

Page 2 of 2

You might also like

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- Notice of Assessment 2023 04 11 12 04 11 210682Document6 pagesNotice of Assessment 2023 04 11 12 04 11 210682namenoname363No ratings yet

- B2B Products & Services StrategiesDocument37 pagesB2B Products & Services Strategiesnandini11100% (1)

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- Summary of Charges: My Bill Summary For October 2022Document3 pagesSummary of Charges: My Bill Summary For October 2022AmitNo ratings yet

- Invalidating Tax Assessment January 2024 2Document68 pagesInvalidating Tax Assessment January 2024 2arnulfojr hicoNo ratings yet

- Billing Statement: Address ToDocument3 pagesBilling Statement: Address ToP’wee SalamatNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- October 2020 Tax AlertDocument5 pagesOctober 2020 Tax AlertRheneir MoraNo ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- BIR Form 2307Document3 pagesBIR Form 2307Jocere LopezNo ratings yet

- Oct 2023Document3 pagesOct 2023poonamNo ratings yet

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address ToHihezzzNo ratings yet

- 2022 ItrDocument9 pages2022 Itrjoel.henderson3No ratings yet

- G.R. No. 178090 Panasonic Vs CIRDocument4 pagesG.R. No. 178090 Panasonic Vs CIRRene ValentosNo ratings yet

- Page 1 of 4 BIR RulingsDocument4 pagesPage 1 of 4 BIR RulingsleawisokaNo ratings yet

- Billing Statement: Address ToDocument5 pagesBilling Statement: Address ToP’wee SalamatNo ratings yet

- Billing Statement: Address ToDocument3 pagesBilling Statement: Address ToThess CabanaNo ratings yet

- IAS 30-09-2018 - Sara Burke PDFDocument2 pagesIAS 30-09-2018 - Sara Burke PDFAnonymous OZRWl5EDNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- BoothPeterDarren 2022 1Document14 pagesBoothPeterDarren 2022 1Αριστείδης ΜέγαςNo ratings yet

- 2023 Itr PravinvallikaduDocument18 pages2023 Itr PravinvallikadudennisNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument28 pagesValue-Added Tax Description: BIR Form 2550MDura LexNo ratings yet

- Summary of Charges: My Bill Summary For May 2023Document3 pagesSummary of Charges: My Bill Summary For May 2023AmitNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- 1702 RTsasaDocument4 pages1702 RTsasaEysOc11No ratings yet

- (J. Bersamin) : Code of Services Subject To VAT Is ExclusiveDocument7 pages(J. Bersamin) : Code of Services Subject To VAT Is ExclusiveED RCNo ratings yet

- US Internal Revenue Service: f8906 AccessibleDocument1 pageUS Internal Revenue Service: f8906 AccessibleIRSNo ratings yet

- L& C 1604E 2023 Form AmendedV3Document2 pagesL& C 1604E 2023 Form AmendedV3fitnessarmy2021No ratings yet

- 2200-S Jan 2018 Guide RevisedDocument2 pages2200-S Jan 2018 Guide RevisedJoseph DoctoNo ratings yet

- launchJasperReport 6Document1 pagelaunchJasperReport 6Husen WahidNo ratings yet

- Vat Guide Accounts PayableDocument24 pagesVat Guide Accounts Payablekrishnan_rajesh5740No ratings yet

- Cs Garment v. CirDocument19 pagesCs Garment v. CirIris MendiolaNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument15 pagesValue-Added Tax Description: BIR Form 2550MJAYAR MENDZNo ratings yet

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocument11 pages35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNo ratings yet

- Value - Added TaxDocument27 pagesValue - Added Tax723114bellaNo ratings yet

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNo ratings yet

- Value Added TaxDocument27 pagesValue Added TaxMark Joseph BajaNo ratings yet

- Accenture, Inc. vs. Commissioner of Internal RevenueDocument14 pagesAccenture, Inc. vs. Commissioner of Internal Revenuevince005No ratings yet

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- TQ VatDocument6 pagesTQ VatJaneNo ratings yet

- Lupoaeveronica 2022 1BDocument18 pagesLupoaeveronica 2022 1BBianca DuracNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- Commissioner of Internal Revenue vs. Liquigaz Philippines CorporationDocument17 pagesCommissioner of Internal Revenue vs. Liquigaz Philippines CorporationKing KingNo ratings yet

- 2019 Tax Year Assessment Ivolpe PDFDocument5 pages2019 Tax Year Assessment Ivolpe PDFLISA VOLPENo ratings yet

- Tax ReturnDocument26 pagesTax ReturnjoshuaharaldNo ratings yet

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDocument14 pagesb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNo ratings yet

- Bir Forms CompilationDocument40 pagesBir Forms Compilationpascual.angeline20No ratings yet

- Notice of Assessment 2021 03 11 12 47 30 085217Document4 pagesNotice of Assessment 2021 03 11 12 47 30 085217gilli billiNo ratings yet

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- Abk Ltd. - Korean Etax Invoices 2 PDFDocument6 pagesAbk Ltd. - Korean Etax Invoices 2 PDFэкспресс сервисNo ratings yet

- General Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Document8 pagesGeneral Electric Credit Corporation v. Strickle Properties, Ray Lyle and T.P. Strickland, 861 F.2d 1532, 11th Cir. (1988)Scribd Government DocsNo ratings yet

- IND - IRS 1095A Tax Form-6900930177-21-Jan-2023Document6 pagesIND - IRS 1095A Tax Form-6900930177-21-Jan-2023Roberto E. Rodriguez0% (1)

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address Tomqhy9b622hNo ratings yet

- AAT ITAX LRP Assessment FA2015 - Questions 2015-16Document8 pagesAAT ITAX LRP Assessment FA2015 - Questions 2015-16LindaBakóNo ratings yet

- Problem Set 7. Contingencies and Other LiabilitiesDocument3 pagesProblem Set 7. Contingencies and Other LiabilitiesAngeline Gonzales PaneloNo ratings yet

- Blank Tax OrganizerDocument14 pagesBlank Tax Organizerapi-344263788No ratings yet

- Summary of Charges: My Bill Summary For March 2024Document2 pagesSummary of Charges: My Bill Summary For March 2024excellencepubgmNo ratings yet

- 2023 Omnibus Notes - Part 2 - Taxation Law LawDocument18 pages2023 Omnibus Notes - Part 2 - Taxation Law LawAPRIL BETONIONo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Beer Revenue Worksheet: Section A - Brewer InformationDocument2 pagesBeer Revenue Worksheet: Section A - Brewer InformationBryan WilleyNo ratings yet

- Registration Form: Dedicated Telephone ServiceDocument2 pagesRegistration Form: Dedicated Telephone ServiceBryan WilleyNo ratings yet

- Beer Credit Claim Worksheet: Section A - Brewer InformationDocument2 pagesBeer Credit Claim Worksheet: Section A - Brewer InformationBryan WilleyNo ratings yet

- Return For Self-Assessment of The First Nations Goods and Services Tax (FNGST)Document2 pagesReturn For Self-Assessment of The First Nations Goods and Services Tax (FNGST)Bryan WilleyNo ratings yet

- Summary of Dispositions of Capital Property (2011 and Later Tax Years)Document4 pagesSummary of Dispositions of Capital Property (2011 and Later Tax Years)Bryan WilleyNo ratings yet

- Sworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioDocument1 pageSworn Statement For A Family Gift of A Used Vehicle in The Province of OntarioBryan WilleyNo ratings yet

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyNo ratings yet

- Charitable Donations and Gifts (2019 and Later Tax Years) : Schedule 2Document4 pagesCharitable Donations and Gifts (2019 and Later Tax Years) : Schedule 2Bryan WilleyNo ratings yet

- Ontario Tax Credit For Manufacturing and Processing (2019 and Later Tax Years)Document3 pagesOntario Tax Credit For Manufacturing and Processing (2019 and Later Tax Years)Bryan WilleyNo ratings yet

- Fuel Charge Return For Fuel Held in A Listed Province On Adjustment DayDocument4 pagesFuel Charge Return For Fuel Held in A Listed Province On Adjustment DayBryan WilleyNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- Nunavut Credits: Adjusted Net IncomeDocument2 pagesNunavut Credits: Adjusted Net IncomeBryan WilleyNo ratings yet

- Fuel Charge Return Schedule For Fuel Held in A Listed Province On Adjustment DayDocument2 pagesFuel Charge Return Schedule For Fuel Held in A Listed Province On Adjustment DayBryan WilleyNo ratings yet

- Worksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedDocument1 pageWorksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedBryan WilleyNo ratings yet

- RFQ For Early Train Operator ADDENDUM3Document88 pagesRFQ For Early Train Operator ADDENDUM3jackson michaelNo ratings yet

- ICM (Communication Work)Document6 pagesICM (Communication Work)Rifki Warri ZainNo ratings yet

- Unit II Company Audit and VouchingDocument36 pagesUnit II Company Audit and VouchingMuskan TyagiNo ratings yet

- Ayu Nurfitriadi-4111711020Document1,375 pagesAyu Nurfitriadi-4111711020Ayu NurfitriadiNo ratings yet

- Tigist Girma Thesis Final Final PDFDocument85 pagesTigist Girma Thesis Final Final PDFsultannesru2030No ratings yet

- Proxy Form / Borang ProksiDocument36 pagesProxy Form / Borang ProksiJonathan OngNo ratings yet

- New Fashion Collection: Mintmadefashi ONDocument25 pagesNew Fashion Collection: Mintmadefashi ONDhruv TayalNo ratings yet

- How To Draft Publicity Guidelines For Product and Corporate Ads During An IPODocument14 pagesHow To Draft Publicity Guidelines For Product and Corporate Ads During An IPODinesh GadkariNo ratings yet

- Zara Business Canvas ModelDocument3 pagesZara Business Canvas Modelkoko.keeganNo ratings yet

- Project: Integration ManagementDocument71 pagesProject: Integration ManagementMustefa MohammedNo ratings yet

- Entrep 1Document5 pagesEntrep 1Eddie PagalanNo ratings yet

- Phosphate/Oil Corrosion Protective Coatings For FastenersDocument2 pagesPhosphate/Oil Corrosion Protective Coatings For FastenersDarwin DarmawanNo ratings yet

- GURPS Traveller - Far TraderDocument146 pagesGURPS Traveller - Far TraderMarcos Inki100% (2)

- Img 20150623 0002Document1 pageImg 20150623 0002Hein MaungNo ratings yet

- Brand RevitalizationDocument16 pagesBrand RevitalizationAmar PatroNo ratings yet

- Strategic Audit and Strategy Evaluation & ControlDocument47 pagesStrategic Audit and Strategy Evaluation & Controlshweta_4666493% (14)

- Exam 2 Q&ADocument7 pagesExam 2 Q&AJennifer WillardNo ratings yet

- A Study On "Port Industry" - An Empirical ResearchDocument55 pagesA Study On "Port Industry" - An Empirical ResearchDimpu Sarath KumarNo ratings yet

- Case Analysis On Atlas Copco Company HRMDocument9 pagesCase Analysis On Atlas Copco Company HRMNam LêNo ratings yet

- Product Management - Case Study Progress ReviewDocument7 pagesProduct Management - Case Study Progress Reviewm sriNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Alireza RabieiDocument1 pageAlireza Rabieidayan malekNo ratings yet

- Consumer Psychology UGB310Document13 pagesConsumer Psychology UGB310dobriyoka Dobriy100% (1)

- NIKE CASE - Alice Roullet de La BouillerieDocument9 pagesNIKE CASE - Alice Roullet de La BouillerieAlice dlbNo ratings yet

- GROUP 3 FINAL - WORKING PAPER - v3Document85 pagesGROUP 3 FINAL - WORKING PAPER - v3cunbg vubNo ratings yet

- 10 Depreciation and Income TaxDocument53 pages10 Depreciation and Income TaxDyahKuntiSuryaNo ratings yet

- Annual State of The Residential Mortgage Market in CanadaDocument43 pagesAnnual State of The Residential Mortgage Market in Canadaderailedcapitalism.comNo ratings yet

- Corporate ValuationDocument42 pagesCorporate ValuationPrasannakumar SNo ratings yet

- Model Lucrare de Licenta Universitatea Transilvania Din BrașovDocument41 pagesModel Lucrare de Licenta Universitatea Transilvania Din BrașovElena MădălinaNo ratings yet