Professional Documents

Culture Documents

CIVABTech66829BrEstrAP - Valuation Numericals

CIVABTech66829BrEstrAP - Valuation Numericals

Uploaded by

AditiCopyright:

Available Formats

You might also like

- Principles of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesDocument673 pagesPrinciples of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesKarthik Ganesan86% (7)

- Statement 16jul2020Document6 pagesStatement 16jul2020K DNo ratings yet

- Mechanics of Structure: Diploma in Civil EngineeringDocument14 pagesMechanics of Structure: Diploma in Civil EngineeringBikee BikashNo ratings yet

- Virtual - Checkbook SimulationDocument34 pagesVirtual - Checkbook SimulationSteven HillNo ratings yet

- Estimation and Costing New by Made EasyDocument44 pagesEstimation and Costing New by Made EasyMutahhir Ahemad100% (2)

- CE 5016 de - of Hydraulic STRDocument52 pagesCE 5016 de - of Hydraulic STRTAMIL100% (3)

- Design and Drawing of RC Structures: Dr. G.S.SureshDocument47 pagesDesign and Drawing of RC Structures: Dr. G.S.SureshAniket WaghmareNo ratings yet

- Double Storeyed Building Estimation and Costing by 7th Sem Students of Assam Engineering CollegeDocument241 pagesDouble Storeyed Building Estimation and Costing by 7th Sem Students of Assam Engineering CollegeNafisa Nazneen Choudhury100% (6)

- Drainage DesignDocument17 pagesDrainage Designrameshbabu_1979No ratings yet

- Estimating 1 IgnouDocument248 pagesEstimating 1 IgnouVVRAO900% (1)

- Theory of Structures 1 - Lecture NotesDocument43 pagesTheory of Structures 1 - Lecture Notesgizmo kobeNo ratings yet

- Estimation - Costing (Valuation) - BTech Civil Engineering Notes - Ebook PDF DownloadDocument33 pagesEstimation - Costing (Valuation) - BTech Civil Engineering Notes - Ebook PDF DownloadSmitesh AhireNo ratings yet

- Module 2 PDFDocument32 pagesModule 2 PDFDhanendra TMGNo ratings yet

- Design of Residential BuildingDocument66 pagesDesign of Residential BuildingSTAR PRINTINGNo ratings yet

- Assignment 5 SolutionsDocument4 pagesAssignment 5 Solutionswafiullah sayedNo ratings yet

- Module 3 - QuantityDocument15 pagesModule 3 - QuantityKimberly Wealth Meonada MagnayeNo ratings yet

- Dog-Legged StaircaseDocument34 pagesDog-Legged StaircaseAbdul KareemNo ratings yet

- Quantity Surveying and EstimationDocument19 pagesQuantity Surveying and Estimationenoch_boatengNo ratings yet

- Civil Workshop Manual For Btech First YearDocument22 pagesCivil Workshop Manual For Btech First YearAkshath TiwariNo ratings yet

- Staad Questions PDFDocument8 pagesStaad Questions PDFannNo ratings yet

- Approximate Estimates MethodsDocument20 pagesApproximate Estimates Methodsऋषिकेश कोल्हे पाटिलNo ratings yet

- Manual For Civil EngineeringworksDocument182 pagesManual For Civil EngineeringworksJerry MorsNo ratings yet

- A Textbook of Estimating, Costing & Accounts (Civil) by R.C.Kohli - zBUKARfDocument2 pagesA Textbook of Estimating, Costing & Accounts (Civil) by R.C.Kohli - zBUKARfchiranjiv100% (3)

- BBS For Pier Cap & Pedestal P7Document1 pageBBS For Pier Cap & Pedestal P7SAYAN SARKARNo ratings yet

- Rate Analysis and Quantity EstimationDocument34 pagesRate Analysis and Quantity EstimationSandgrouse RajNo ratings yet

- Structural AnalysisDocument437 pagesStructural AnalysisTnp Pareewong Tee100% (1)

- Base Plate DesignDocument9 pagesBase Plate DesignprashantkothariNo ratings yet

- Basic Hydraulics Lecture Notes: Nigel WrightDocument25 pagesBasic Hydraulics Lecture Notes: Nigel Wrightguitarist Katuwal100% (1)

- Bisection MethodDocument9 pagesBisection MethodAnonymous 1VhXp1No ratings yet

- Fyp-Multi Storey Residential BuildingDocument131 pagesFyp-Multi Storey Residential BuildingsuryaNo ratings yet

- KENNEDY's THEORY Limitations & AssumptionsDocument8 pagesKENNEDY's THEORY Limitations & AssumptionsGaurav BalodiyaNo ratings yet

- Spillway NotesDocument15 pagesSpillway Notesvinod choudhariNo ratings yet

- Tee Beam ProbDocument14 pagesTee Beam ProbSai GowthamNo ratings yet

- Moment Distribution MethodDocument62 pagesMoment Distribution Methoddixn__100% (2)

- Eccentric ConnectionsDocument10 pagesEccentric ConnectionsJin ShahNo ratings yet

- NumericalDocument24 pagesNumericalDIMariaAUnitedNo ratings yet

- Excavation ToolsDocument41 pagesExcavation ToolsTejas Eknath PawarNo ratings yet

- Vertical AlignmentDocument14 pagesVertical AlignmentHanamant HunashikattiNo ratings yet

- Estimation ESTIMATE OF Single RoomDocument31 pagesEstimation ESTIMATE OF Single RoomDeepak Sah100% (1)

- Wind Load Calculation For Pitched RoofDocument2 pagesWind Load Calculation For Pitched RoofNAYAN RANPURANo ratings yet

- Numericals On RCC DESIGNDocument10 pagesNumericals On RCC DESIGNsirfmein50% (2)

- Design ProjectDocument43 pagesDesign ProjectJayani Tharika100% (1)

- Stress Caused by External LoadsDocument97 pagesStress Caused by External Loadsazhar100% (1)

- Chapter 3 Earth Dam 2020Document61 pagesChapter 3 Earth Dam 2020Ali ahmed100% (1)

- Prestressed Concrete: BY:-Dr. Mohd Ashraf Iqbal Associate Professor Department of Civil Engineering, IIT, RoorkeeDocument153 pagesPrestressed Concrete: BY:-Dr. Mohd Ashraf Iqbal Associate Professor Department of Civil Engineering, IIT, RoorkeeAllyson DulfoNo ratings yet

- Theory of StructuresDocument67 pagesTheory of Structuresjoyce_mabitasan67% (3)

- Reinforced Concrete Design-Krishnaraju PDFDocument318 pagesReinforced Concrete Design-Krishnaraju PDFJustin100% (4)

- PierDocument4 pagesPierAtulkumar ManchalwarNo ratings yet

- Memo STRUCTURAL ANALYSIS II - SAN2601 Assignments 2020Document28 pagesMemo STRUCTURAL ANALYSIS II - SAN2601 Assignments 2020Rachel Du PreezNo ratings yet

- Doubly Reinforced BeamDocument9 pagesDoubly Reinforced BeamBaharulHussainNo ratings yet

- Design of Reinforced Concrete Structures by Krishna RajuDocument318 pagesDesign of Reinforced Concrete Structures by Krishna RajuMaazHussain88% (42)

- CE2404 Pre Stressed Concrete StructuresDocument149 pagesCE2404 Pre Stressed Concrete StructuresPrantik Adhar Samanta100% (1)

- Secondary Consolidation Settlement Part 2 - AGUILOR (PPT Used)Document16 pagesSecondary Consolidation Settlement Part 2 - AGUILOR (PPT Used)Kyohai RinggoNo ratings yet

- Design of Tension MembersDocument10 pagesDesign of Tension MembersSandgrouse RajNo ratings yet

- Unit 2 Tacheometric Surveying: StructureDocument14 pagesUnit 2 Tacheometric Surveying: Structuresharonlly toumasNo ratings yet

- Bar Bending ScheduleDocument5 pagesBar Bending ScheduleAnton_Young_1962100% (2)

- Major Components of FlyoverDocument3 pagesMajor Components of FlyoverSaran KumarNo ratings yet

- Example 1.: (B) The Annual Percent Return On The Total Initial Investment AfterDocument3 pagesExample 1.: (B) The Annual Percent Return On The Total Initial Investment AfterBansi TumbadiaNo ratings yet

- L 2 TIMEV1 - Class NotesDocument12 pagesL 2 TIMEV1 - Class NotesSEKEETHA DE NOBREGANo ratings yet

- UntitledDocument7 pagesUntitledlulu luvelyNo ratings yet

- Exercises (Time Value Money) 2022Document2 pagesExercises (Time Value Money) 2022wstNo ratings yet

- Case Study (Latest)Document16 pagesCase Study (Latest)MAHEN DRANNo ratings yet

- Summative Test Perpetuity and CapitalizationDocument6 pagesSummative Test Perpetuity and CapitalizationAmethyst ChiongNo ratings yet

- 4th TH TH PDFDocument1 page4th TH TH PDFAditiNo ratings yet

- Sheet Title: Kitchen Markup Plan: Working DrawingDocument1 pageSheet Title: Kitchen Markup Plan: Working DrawingAditiNo ratings yet

- Room Legend: A.H.U 5 Toilet F 6 Fire Stair 4Document1 pageRoom Legend: A.H.U 5 Toilet F 6 Fire Stair 4AditiNo ratings yet

- Room Legend: UP A.H.U 5 Toilet F 6 Fire Stair 4Document1 pageRoom Legend: UP A.H.U 5 Toilet F 6 Fire Stair 4AditiNo ratings yet

- Site Analysis .... ConceptDocument14 pagesSite Analysis .... ConceptAditiNo ratings yet

- ARCHABArch78389rElerAP - Lifestyle and Climate Responsiveness of Traditional Houses of KeralaDocument6 pagesARCHABArch78389rElerAP - Lifestyle and Climate Responsiveness of Traditional Houses of KeralaAditiNo ratings yet

- Presentation 11Document23 pagesPresentation 11AditiNo ratings yet

- Room Legend: A.H.U 5 Fire Stair 4Document1 pageRoom Legend: A.H.U 5 Fire Stair 4AditiNo ratings yet

- Functional Diagram: Office BlockDocument6 pagesFunctional Diagram: Office BlockAditiNo ratings yet

- CIVABTech66829BrEstrAP - Estimation and CostingDocument73 pagesCIVABTech66829BrEstrAP - Estimation and CostingAditiNo ratings yet

- Ankit Thakur Assistant Professor Civil EngineeringDocument53 pagesAnkit Thakur Assistant Professor Civil EngineeringAditiNo ratings yet

- APK-Contemporary ArchitectureDocument26 pagesAPK-Contemporary ArchitectureAditiNo ratings yet

- Sheet Title: Part Plan of Toilet: Working DrawingDocument1 pageSheet Title: Part Plan of Toilet: Working DrawingAditiNo ratings yet

- "My Buildings Are Declarations of Love For Their Sites ": Born - 1943 Basel, SwitzerlandDocument32 pages"My Buildings Are Declarations of Love For Their Sites ": Born - 1943 Basel, SwitzerlandAditiNo ratings yet

- Denial Libeskind: Submitted By: Aditi Chandel 18001256Document29 pagesDenial Libeskind: Submitted By: Aditi Chandel 18001256AditiNo ratings yet

- Contemp Orary: Submitted By-Mrinali Tirkey ENROLLNO - 17001091Document40 pagesContemp Orary: Submitted By-Mrinali Tirkey ENROLLNO - 17001091AditiNo ratings yet

- Louis Kahn: "Architecture Is The Reaching Out The Truth."Document21 pagesLouis Kahn: "Architecture Is The Reaching Out The Truth."AditiNo ratings yet

- Laurie Baker: (The Gandhi of Architecture - Who Built Sustainable Buildings)Document38 pagesLaurie Baker: (The Gandhi of Architecture - Who Built Sustainable Buildings)AditiNo ratings yet

- Joseph Allen Stein !!: Submitted by - Anmol Singh Submitted To - Ar. MugdhaDocument32 pagesJoseph Allen Stein !!: Submitted by - Anmol Singh Submitted To - Ar. MugdhaAditiNo ratings yet

- Ar. Balkrisna Vithaldas Doshi: Submitted To: Ar. Mugdha Sharma Submitted By: Aditi ChandelDocument44 pagesAr. Balkrisna Vithaldas Doshi: Submitted To: Ar. Mugdha Sharma Submitted By: Aditi ChandelAditiNo ratings yet

- Charles Correa: Presented By: Rilarympei MarbaniangDocument38 pagesCharles Correa: Presented By: Rilarympei MarbaniangAditiNo ratings yet

- Ar. Moshe Safdie: Submitted byDocument8 pagesAr. Moshe Safdie: Submitted byAditiNo ratings yet

- What Is Sound ??Document30 pagesWhat Is Sound ??AditiNo ratings yet

- Alvar Aaltos: Submitted To:-Ar Mugdha Submitted By: - SachinDocument36 pagesAlvar Aaltos: Submitted To:-Ar Mugdha Submitted By: - SachinAditiNo ratings yet

- Glass: A Building MaterialDocument31 pagesGlass: A Building MaterialAditiNo ratings yet

- Arata Isozaki: TrainingDocument2 pagesArata Isozaki: TrainingAditiNo ratings yet

- Site AnalysisDocument1 pageSite AnalysisAditiNo ratings yet

- Assignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerDocument2 pagesAssignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerKate HerederoNo ratings yet

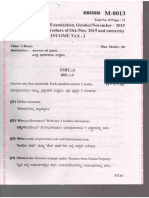

- 3sem B.com 8013 Oct - Nov 2019 Income Tax - IDocument12 pages3sem B.com 8013 Oct - Nov 2019 Income Tax - IPramathesh M SNo ratings yet

- Larsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Document4 pagesLarsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Kannan GnanaprakasamNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Invoice 50698496Document1 pageInvoice 50698496monicahmuthee22No ratings yet

- Game of Bitcoins Mega Airdrop SheetDocument9 pagesGame of Bitcoins Mega Airdrop SheetDeeKoo Co.No ratings yet

- G.R. No. 210836Document4 pagesG.R. No. 210836GH IAYAMAENo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Acc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Document1 pageAcc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Agung MaharNo ratings yet

- GST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Document19 pagesGST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Balkrushna ShingareNo ratings yet

- 11 Procedure Text 2Document10 pages11 Procedure Text 2sebastian wibowoNo ratings yet

- Comparative Incentives - BOI PEZADocument3 pagesComparative Incentives - BOI PEZAayen_buenafeNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- 06 Quiz 1Document1 page06 Quiz 1Angelo MorenoNo ratings yet

- Noon Doc 80038888 PDFDocument1 pageNoon Doc 80038888 PDFjohn faredNo ratings yet

- Assignment Part 2 Checked and AdjustedDocument3 pagesAssignment Part 2 Checked and AdjustedDarwin Dionisio ClementeNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Bank Statement 0501 To 05312023Document6 pagesBank Statement 0501 To 05312023Jc RNo ratings yet

- CIR vs. Mitsubishi MetalDocument3 pagesCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Emirates Fare ConditionsDocument13 pagesEmirates Fare ConditionsozelNo ratings yet

- Statement of Axis Account No:917010078961373 For The Period (From: 16-01-2023 To: 15-02-2023)Document2 pagesStatement of Axis Account No:917010078961373 For The Period (From: 16-01-2023 To: 15-02-2023)philipsjjNo ratings yet

- Devendra ResumeDocument2 pagesDevendra ResumeSomnath KhandagaleNo ratings yet

- BAM 208 - SAS - Day 4 - OUTDocument7 pagesBAM 208 - SAS - Day 4 - OUTAriane Grace Hiteroza MargajayNo ratings yet

- CRF - For All Customers PDFDocument3 pagesCRF - For All Customers PDFVipan KumarNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

CIVABTech66829BrEstrAP - Valuation Numericals

CIVABTech66829BrEstrAP - Valuation Numericals

Uploaded by

AditiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIVABTech66829BrEstrAP - Valuation Numericals

CIVABTech66829BrEstrAP - Valuation Numericals

Uploaded by

AditiCopyright:

Available Formats

Numerical Problems on sinking Funds

By

Ankit Thakur

Assistant Professor

(Civil Engineering)

Example 1. A building in an A class city is let out @ Rs. 5000 PM .( per

month) The total outgoings of the property is estimated to be 15% of the

gross income, calculate the capitalized value of the property if the present

rate interest is 6% and life of the property is 50 Years.

Solution: Gross rent = 5000*12 = Rs 60000 P.A (per year)

Outgoings = 15% of gross rent

=60000*15/100 = Rs 9000 P.A Net Rent

= 60000-9000 = Rs 51000

Since the life expectancy is quite lengthy therefore, the income is considered to

be perpetual (identifying long time) hence

Y.P = 1/R = 16.67

Capitalized value = 51000*1/0.06

= Rs 850000

In case sinking fund allowance is also to be accounted for

Sc = (R/[(1 + R)n – 1]

= 0.06/[(1+0.06)50-1]

= 0.0034 Y.P = 1/ (R + Sc)

= 1/ (0.06+0.0034) = 15.77

Capitalized value = 51000*15.77

= Rs 804270.

Example: 2 a) The Present estimate of a building is Rs 200000. it is 20 yrs

old and maintained in a good condition. The life of the structure is assumed

to be 80 yrs. Work out the present value of the building for acquisition. b)

With the present value of the building calculate the standard rent, the rate

of interest may be assumed 6%.

Solution: a) The depreciated value of the building is:

D= P*((100- rd)/100)n

Where, D= Depreciate value P = Rs 200000 (i.e Cost of a present Market Rate)

rd= 1 (assumed) – fixed percentage of depreciation

Where r stands for rate and d for depreciation

n=20 Therefore, D=163581.0

b) Annual rent @ 6% = 163581*6/100

= 9815.0

Rent per Month or Standard Rent = 9815/12 = Rs 818.

Note: The value of rd may be taken as 1 for building having life 80 yrs.

Example 3. An RCC framed structure building having estimated future life

80 yrs, fetches a gross annual rent of Rs 2220 per month. Work out its

capitalized value on the basis of 6% net yield. The rate of compound

interest for sinking fund may be taken 4%. The land Plot of above building

measures 1400 sqm and cost of land may be taken to be Rs. 120 per sqm.

The other Outgoing are:

i) Repair and maintenance 1/12th of the gross income.

ii) Municipal taxes and Property tax – 25% of gross income.

iii) Management and Miscellaneous charges – 7% of gross income

iv) The Plinth area of the building is 800 sqm and plinth area rate of

the above type of building may be taken

Solution:

Gross income per year = 2220*12 =Rs 26640.

Outgoing Per Annum:

i) Repair and Maintenance 1/12 of Gross income = 26640/12

= Rs 2220

ii) Municipal taxes and property tax @ 25% = 26640*25/100

=Rs 6660

iii) Management and Miscellaneous charges @ 7%

= 26640*7/100

= Rs 1864

Sinking fund Coeff. (Sc)=R/((1+R)n-1)

= 0.04/((1+0.04)80-1)

= 0.0018

iv) Sinking Fund Req to accumulate the cost of the building (which is at

the rate of Rs 150 / sqm of plinth area

= 800*150=Rs 120000 in 80 years @ 4% interest

= 120000*0.0018= Rs 216.0

Total Out going per annum = Rs 10960.8

Net annual Return = 26640-10960.8

= Rs 15679.20

Capitalised value of the Building = Net income * YP

= 15679.20*100/6

= 261320 Cost of land @ Rs 120 per Sqm (1400*120)

= Rs 168000.0 Total = Rs 429320.0

Total value of whole property = Rs 429320

You might also like

- Principles of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesDocument673 pagesPrinciples of Taxation For Business and Investment Planning 2018 Edition 21st Edition - Sally JonesKarthik Ganesan86% (7)

- Statement 16jul2020Document6 pagesStatement 16jul2020K DNo ratings yet

- Mechanics of Structure: Diploma in Civil EngineeringDocument14 pagesMechanics of Structure: Diploma in Civil EngineeringBikee BikashNo ratings yet

- Virtual - Checkbook SimulationDocument34 pagesVirtual - Checkbook SimulationSteven HillNo ratings yet

- Estimation and Costing New by Made EasyDocument44 pagesEstimation and Costing New by Made EasyMutahhir Ahemad100% (2)

- CE 5016 de - of Hydraulic STRDocument52 pagesCE 5016 de - of Hydraulic STRTAMIL100% (3)

- Design and Drawing of RC Structures: Dr. G.S.SureshDocument47 pagesDesign and Drawing of RC Structures: Dr. G.S.SureshAniket WaghmareNo ratings yet

- Double Storeyed Building Estimation and Costing by 7th Sem Students of Assam Engineering CollegeDocument241 pagesDouble Storeyed Building Estimation and Costing by 7th Sem Students of Assam Engineering CollegeNafisa Nazneen Choudhury100% (6)

- Drainage DesignDocument17 pagesDrainage Designrameshbabu_1979No ratings yet

- Estimating 1 IgnouDocument248 pagesEstimating 1 IgnouVVRAO900% (1)

- Theory of Structures 1 - Lecture NotesDocument43 pagesTheory of Structures 1 - Lecture Notesgizmo kobeNo ratings yet

- Estimation - Costing (Valuation) - BTech Civil Engineering Notes - Ebook PDF DownloadDocument33 pagesEstimation - Costing (Valuation) - BTech Civil Engineering Notes - Ebook PDF DownloadSmitesh AhireNo ratings yet

- Module 2 PDFDocument32 pagesModule 2 PDFDhanendra TMGNo ratings yet

- Design of Residential BuildingDocument66 pagesDesign of Residential BuildingSTAR PRINTINGNo ratings yet

- Assignment 5 SolutionsDocument4 pagesAssignment 5 Solutionswafiullah sayedNo ratings yet

- Module 3 - QuantityDocument15 pagesModule 3 - QuantityKimberly Wealth Meonada MagnayeNo ratings yet

- Dog-Legged StaircaseDocument34 pagesDog-Legged StaircaseAbdul KareemNo ratings yet

- Quantity Surveying and EstimationDocument19 pagesQuantity Surveying and Estimationenoch_boatengNo ratings yet

- Civil Workshop Manual For Btech First YearDocument22 pagesCivil Workshop Manual For Btech First YearAkshath TiwariNo ratings yet

- Staad Questions PDFDocument8 pagesStaad Questions PDFannNo ratings yet

- Approximate Estimates MethodsDocument20 pagesApproximate Estimates Methodsऋषिकेश कोल्हे पाटिलNo ratings yet

- Manual For Civil EngineeringworksDocument182 pagesManual For Civil EngineeringworksJerry MorsNo ratings yet

- A Textbook of Estimating, Costing & Accounts (Civil) by R.C.Kohli - zBUKARfDocument2 pagesA Textbook of Estimating, Costing & Accounts (Civil) by R.C.Kohli - zBUKARfchiranjiv100% (3)

- BBS For Pier Cap & Pedestal P7Document1 pageBBS For Pier Cap & Pedestal P7SAYAN SARKARNo ratings yet

- Rate Analysis and Quantity EstimationDocument34 pagesRate Analysis and Quantity EstimationSandgrouse RajNo ratings yet

- Structural AnalysisDocument437 pagesStructural AnalysisTnp Pareewong Tee100% (1)

- Base Plate DesignDocument9 pagesBase Plate DesignprashantkothariNo ratings yet

- Basic Hydraulics Lecture Notes: Nigel WrightDocument25 pagesBasic Hydraulics Lecture Notes: Nigel Wrightguitarist Katuwal100% (1)

- Bisection MethodDocument9 pagesBisection MethodAnonymous 1VhXp1No ratings yet

- Fyp-Multi Storey Residential BuildingDocument131 pagesFyp-Multi Storey Residential BuildingsuryaNo ratings yet

- KENNEDY's THEORY Limitations & AssumptionsDocument8 pagesKENNEDY's THEORY Limitations & AssumptionsGaurav BalodiyaNo ratings yet

- Spillway NotesDocument15 pagesSpillway Notesvinod choudhariNo ratings yet

- Tee Beam ProbDocument14 pagesTee Beam ProbSai GowthamNo ratings yet

- Moment Distribution MethodDocument62 pagesMoment Distribution Methoddixn__100% (2)

- Eccentric ConnectionsDocument10 pagesEccentric ConnectionsJin ShahNo ratings yet

- NumericalDocument24 pagesNumericalDIMariaAUnitedNo ratings yet

- Excavation ToolsDocument41 pagesExcavation ToolsTejas Eknath PawarNo ratings yet

- Vertical AlignmentDocument14 pagesVertical AlignmentHanamant HunashikattiNo ratings yet

- Estimation ESTIMATE OF Single RoomDocument31 pagesEstimation ESTIMATE OF Single RoomDeepak Sah100% (1)

- Wind Load Calculation For Pitched RoofDocument2 pagesWind Load Calculation For Pitched RoofNAYAN RANPURANo ratings yet

- Numericals On RCC DESIGNDocument10 pagesNumericals On RCC DESIGNsirfmein50% (2)

- Design ProjectDocument43 pagesDesign ProjectJayani Tharika100% (1)

- Stress Caused by External LoadsDocument97 pagesStress Caused by External Loadsazhar100% (1)

- Chapter 3 Earth Dam 2020Document61 pagesChapter 3 Earth Dam 2020Ali ahmed100% (1)

- Prestressed Concrete: BY:-Dr. Mohd Ashraf Iqbal Associate Professor Department of Civil Engineering, IIT, RoorkeeDocument153 pagesPrestressed Concrete: BY:-Dr. Mohd Ashraf Iqbal Associate Professor Department of Civil Engineering, IIT, RoorkeeAllyson DulfoNo ratings yet

- Theory of StructuresDocument67 pagesTheory of Structuresjoyce_mabitasan67% (3)

- Reinforced Concrete Design-Krishnaraju PDFDocument318 pagesReinforced Concrete Design-Krishnaraju PDFJustin100% (4)

- PierDocument4 pagesPierAtulkumar ManchalwarNo ratings yet

- Memo STRUCTURAL ANALYSIS II - SAN2601 Assignments 2020Document28 pagesMemo STRUCTURAL ANALYSIS II - SAN2601 Assignments 2020Rachel Du PreezNo ratings yet

- Doubly Reinforced BeamDocument9 pagesDoubly Reinforced BeamBaharulHussainNo ratings yet

- Design of Reinforced Concrete Structures by Krishna RajuDocument318 pagesDesign of Reinforced Concrete Structures by Krishna RajuMaazHussain88% (42)

- CE2404 Pre Stressed Concrete StructuresDocument149 pagesCE2404 Pre Stressed Concrete StructuresPrantik Adhar Samanta100% (1)

- Secondary Consolidation Settlement Part 2 - AGUILOR (PPT Used)Document16 pagesSecondary Consolidation Settlement Part 2 - AGUILOR (PPT Used)Kyohai RinggoNo ratings yet

- Design of Tension MembersDocument10 pagesDesign of Tension MembersSandgrouse RajNo ratings yet

- Unit 2 Tacheometric Surveying: StructureDocument14 pagesUnit 2 Tacheometric Surveying: Structuresharonlly toumasNo ratings yet

- Bar Bending ScheduleDocument5 pagesBar Bending ScheduleAnton_Young_1962100% (2)

- Major Components of FlyoverDocument3 pagesMajor Components of FlyoverSaran KumarNo ratings yet

- Example 1.: (B) The Annual Percent Return On The Total Initial Investment AfterDocument3 pagesExample 1.: (B) The Annual Percent Return On The Total Initial Investment AfterBansi TumbadiaNo ratings yet

- L 2 TIMEV1 - Class NotesDocument12 pagesL 2 TIMEV1 - Class NotesSEKEETHA DE NOBREGANo ratings yet

- UntitledDocument7 pagesUntitledlulu luvelyNo ratings yet

- Exercises (Time Value Money) 2022Document2 pagesExercises (Time Value Money) 2022wstNo ratings yet

- Case Study (Latest)Document16 pagesCase Study (Latest)MAHEN DRANNo ratings yet

- Summative Test Perpetuity and CapitalizationDocument6 pagesSummative Test Perpetuity and CapitalizationAmethyst ChiongNo ratings yet

- 4th TH TH PDFDocument1 page4th TH TH PDFAditiNo ratings yet

- Sheet Title: Kitchen Markup Plan: Working DrawingDocument1 pageSheet Title: Kitchen Markup Plan: Working DrawingAditiNo ratings yet

- Room Legend: A.H.U 5 Toilet F 6 Fire Stair 4Document1 pageRoom Legend: A.H.U 5 Toilet F 6 Fire Stair 4AditiNo ratings yet

- Room Legend: UP A.H.U 5 Toilet F 6 Fire Stair 4Document1 pageRoom Legend: UP A.H.U 5 Toilet F 6 Fire Stair 4AditiNo ratings yet

- Site Analysis .... ConceptDocument14 pagesSite Analysis .... ConceptAditiNo ratings yet

- ARCHABArch78389rElerAP - Lifestyle and Climate Responsiveness of Traditional Houses of KeralaDocument6 pagesARCHABArch78389rElerAP - Lifestyle and Climate Responsiveness of Traditional Houses of KeralaAditiNo ratings yet

- Presentation 11Document23 pagesPresentation 11AditiNo ratings yet

- Room Legend: A.H.U 5 Fire Stair 4Document1 pageRoom Legend: A.H.U 5 Fire Stair 4AditiNo ratings yet

- Functional Diagram: Office BlockDocument6 pagesFunctional Diagram: Office BlockAditiNo ratings yet

- CIVABTech66829BrEstrAP - Estimation and CostingDocument73 pagesCIVABTech66829BrEstrAP - Estimation and CostingAditiNo ratings yet

- Ankit Thakur Assistant Professor Civil EngineeringDocument53 pagesAnkit Thakur Assistant Professor Civil EngineeringAditiNo ratings yet

- APK-Contemporary ArchitectureDocument26 pagesAPK-Contemporary ArchitectureAditiNo ratings yet

- Sheet Title: Part Plan of Toilet: Working DrawingDocument1 pageSheet Title: Part Plan of Toilet: Working DrawingAditiNo ratings yet

- "My Buildings Are Declarations of Love For Their Sites ": Born - 1943 Basel, SwitzerlandDocument32 pages"My Buildings Are Declarations of Love For Their Sites ": Born - 1943 Basel, SwitzerlandAditiNo ratings yet

- Denial Libeskind: Submitted By: Aditi Chandel 18001256Document29 pagesDenial Libeskind: Submitted By: Aditi Chandel 18001256AditiNo ratings yet

- Contemp Orary: Submitted By-Mrinali Tirkey ENROLLNO - 17001091Document40 pagesContemp Orary: Submitted By-Mrinali Tirkey ENROLLNO - 17001091AditiNo ratings yet

- Louis Kahn: "Architecture Is The Reaching Out The Truth."Document21 pagesLouis Kahn: "Architecture Is The Reaching Out The Truth."AditiNo ratings yet

- Laurie Baker: (The Gandhi of Architecture - Who Built Sustainable Buildings)Document38 pagesLaurie Baker: (The Gandhi of Architecture - Who Built Sustainable Buildings)AditiNo ratings yet

- Joseph Allen Stein !!: Submitted by - Anmol Singh Submitted To - Ar. MugdhaDocument32 pagesJoseph Allen Stein !!: Submitted by - Anmol Singh Submitted To - Ar. MugdhaAditiNo ratings yet

- Ar. Balkrisna Vithaldas Doshi: Submitted To: Ar. Mugdha Sharma Submitted By: Aditi ChandelDocument44 pagesAr. Balkrisna Vithaldas Doshi: Submitted To: Ar. Mugdha Sharma Submitted By: Aditi ChandelAditiNo ratings yet

- Charles Correa: Presented By: Rilarympei MarbaniangDocument38 pagesCharles Correa: Presented By: Rilarympei MarbaniangAditiNo ratings yet

- Ar. Moshe Safdie: Submitted byDocument8 pagesAr. Moshe Safdie: Submitted byAditiNo ratings yet

- What Is Sound ??Document30 pagesWhat Is Sound ??AditiNo ratings yet

- Alvar Aaltos: Submitted To:-Ar Mugdha Submitted By: - SachinDocument36 pagesAlvar Aaltos: Submitted To:-Ar Mugdha Submitted By: - SachinAditiNo ratings yet

- Glass: A Building MaterialDocument31 pagesGlass: A Building MaterialAditiNo ratings yet

- Arata Isozaki: TrainingDocument2 pagesArata Isozaki: TrainingAditiNo ratings yet

- Site AnalysisDocument1 pageSite AnalysisAditiNo ratings yet

- Assignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerDocument2 pagesAssignment 2.1 Taxable Income and Income Tax Payable of Individual TaxpayerKate HerederoNo ratings yet

- 3sem B.com 8013 Oct - Nov 2019 Income Tax - IDocument12 pages3sem B.com 8013 Oct - Nov 2019 Income Tax - IPramathesh M SNo ratings yet

- Larsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Document4 pagesLarsen & Toubro Limited, Construction.: WOM Bill Annexure - E8419FBL6000100 DT:21 May 2016Kannan GnanaprakasamNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Invoice 50698496Document1 pageInvoice 50698496monicahmuthee22No ratings yet

- Game of Bitcoins Mega Airdrop SheetDocument9 pagesGame of Bitcoins Mega Airdrop SheetDeeKoo Co.No ratings yet

- G.R. No. 210836Document4 pagesG.R. No. 210836GH IAYAMAENo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Acc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Document1 pageAcc Statement 1120566636663 2023-10-01 2023-10-31 20231215111413Agung MaharNo ratings yet

- GST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Document19 pagesGST (Goods & Service Tax: Submitted by Nikita Sawant 44 Aditya Kadam 22Balkrushna ShingareNo ratings yet

- 11 Procedure Text 2Document10 pages11 Procedure Text 2sebastian wibowoNo ratings yet

- Comparative Incentives - BOI PEZADocument3 pagesComparative Incentives - BOI PEZAayen_buenafeNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- 06 Quiz 1Document1 page06 Quiz 1Angelo MorenoNo ratings yet

- Noon Doc 80038888 PDFDocument1 pageNoon Doc 80038888 PDFjohn faredNo ratings yet

- Assignment Part 2 Checked and AdjustedDocument3 pagesAssignment Part 2 Checked and AdjustedDarwin Dionisio ClementeNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Bank Statement 0501 To 05312023Document6 pagesBank Statement 0501 To 05312023Jc RNo ratings yet

- CIR vs. Mitsubishi MetalDocument3 pagesCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Emirates Fare ConditionsDocument13 pagesEmirates Fare ConditionsozelNo ratings yet

- Statement of Axis Account No:917010078961373 For The Period (From: 16-01-2023 To: 15-02-2023)Document2 pagesStatement of Axis Account No:917010078961373 For The Period (From: 16-01-2023 To: 15-02-2023)philipsjjNo ratings yet

- Devendra ResumeDocument2 pagesDevendra ResumeSomnath KhandagaleNo ratings yet

- BAM 208 - SAS - Day 4 - OUTDocument7 pagesBAM 208 - SAS - Day 4 - OUTAriane Grace Hiteroza MargajayNo ratings yet

- CRF - For All Customers PDFDocument3 pagesCRF - For All Customers PDFVipan KumarNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet