Professional Documents

Culture Documents

PNB Sampatti Parameters Particulars Purpose

PNB Sampatti Parameters Particulars Purpose

Uploaded by

Rohit Jaroudiya0 ratings0% found this document useful (0 votes)

2K views4 pagesThis document outlines the parameters for PNB Sampatti, a loan scheme to provide working capital and term loans to businesses. Key eligibility includes individual/business proprietors engaged in trading, manufacturing or services. Loans can be used for working capital or fixed assets and are secured by mortgaging residential/commercial property. Loan amounts are assessed based on property value and financials. Interest rates are as per bank policy.

Original Description:

Original Title

PNB SAMPATTI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the parameters for PNB Sampatti, a loan scheme to provide working capital and term loans to businesses. Key eligibility includes individual/business proprietors engaged in trading, manufacturing or services. Loans can be used for working capital or fixed assets and are secured by mortgaging residential/commercial property. Loan amounts are assessed based on property value and financials. Interest rates are as per bank policy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2K views4 pagesPNB Sampatti Parameters Particulars Purpose

PNB Sampatti Parameters Particulars Purpose

Uploaded by

Rohit JaroudiyaThis document outlines the parameters for PNB Sampatti, a loan scheme to provide working capital and term loans to businesses. Key eligibility includes individual/business proprietors engaged in trading, manufacturing or services. Loans can be used for working capital or fixed assets and are secured by mortgaging residential/commercial property. Loan amounts are assessed based on property value and financials. Interest rates are as per bank policy.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

PNB SAMPATTI

PARAMETERS PARTICULARS

Purpose To provide hassle free credit to meet working capital

requirements / augment long-term margin / financing of fixed

assets related to business activity or for expansion of business.

The followings Business Entities are included under the scheme:

1. Trading 2. Manufacturing and Service Enterprises

(Both priority & Non priority).

Facility shall not be granted for:

Term loan/ OD to builders/developers against mortgage of

unsold flats or projects under construction.

Loans to Builders / Property dealers / Real estate agents/

Real estate/capital market/ investment in or for giving loans

to associate/group/sister concerns

Term loan/ OD backed by mortgage of land and building of

Educational Institution and/or mortgage of properties of

promoters for setting up of Educational Institution or for

infrastructural development of existing institution.

Term Loan/OD cannot be extended against property of

Nursing Homes/Hospitals, Orphanages, Old Age Homes or

any other Social Sector Infrastructure

Facility will not be considered for other than business activity.

Speculative & prohibited by Law purpose.

Third Party property shall not be eligible for loan under the

scheme (except family members or close relatives). Close

relative means: Spouse, Father, Mother, Son, Un married

daughter, Brother, Sister, Brother’s wife, Parents of spouse.

Eligibility 1. Individual, Proprietorship, Registered Partnership Firms,

Private /Public Ltd., Companies/ LLPs / Societies / Trusts,

engaged in business activity.

2. Business Unit should comply with applicable statutory

requirements such as GST Registration, License under Shops

& Commercial Establishment Act, Registration with Excise

Department, trade license etc.

3. The cash generation and repaying capacity of above said

business establishment shall be the primary criteria for

considering loan under the scheme.

4. The unit should have a Cash Profit in the normal course of

business in the immediate preceding year. However new

enterprises/Start Up Unit is also eligible to finance under the

Scheme.

5. The borrower shall not be in the defaulters list of the

Bank/caution list circulated by RBI/IBA/CIC/ECGC/ other

banks/FIs/Govt. of India from time to time.

6. Business entities dealing in gems & Jewellery/ Software/ IT

Enterprises can avail credit facility under the Scheme.

Eligible Properties The loan amount shall be covered by mortgage of

unencumbered residential house/ flat, non-agricultural

property or the commercial property.

In case of factory premises, only land and building are to be

considered (valuation towards plant and machinery are not

to be considered for the purpose of mortgage loan eligibility)

In case the property is leased out/ let out it should be backed

by lease/ rent agreement. The rent / lease amount shall be

assigned in favour of Bank and such proceeds shall be

credited to the A/c maintained with our Bank.

Stamped undertaking from the tenant(s) should be obtained

to the effect that he/she will vacate the property in the event

of Bank’s invoking SARFAESI action. In case of any change

in lease/ rental status of the property it should be intimated to

the Bank in time and aforesaid formalities are to be adhered.

Owner(s) of the property shall stand as a Guarantor.

The property which is well bounded/ properly demarcated

(having clear road access)/ enforceable / marketable can be

considered for the mortgage under this scheme.

Immovable property of the individuals having the age

exceeding 70 years will not be taken as security under the

scheme.

Area of operation All Branches are eligible

Type of Facilities Overdraft limit for working capital purpose.

Term Loan/ Demand Loan to acquire fixed assets for

general business purposes.

Non fund based limit

Non-fund based working capital facility can be extended only by

earmarking OD facility for fund based working capital

requirement. No standalone non-fund based facility will be

allowed.

Loan Limit For the property/ies located at Rural/Semi Urban areas:

Maximum Rs. 500.00 lakhs.

For the property/ies located at Urban/Metro areas:

Maximum Rs.1000.00 lakhs.

Margin 40% of the Realizable Value of the property

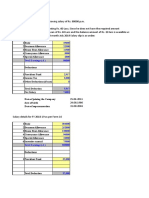

Assessment of A. Assessment of Working Capital Finance (Existing &

Loans newly established unit): [Where Financial Statements

(FS) are available]

60% of the realizable value of the property.

OR

25% of the estimated annual sales/gross income

Whichever is less

B. Assessment of Working Capital Finance: (Where financial

statements are not available): Restricted to Rs. 50 lakhs.

If the party is not maintaining proper financial statement,

such as professionals etc. then 4 times of annual income

(average of last two years).

OR

60% of the realizable value of the property

Whichever is less.

Income of co-borrowers shall be considered in

determining the loan amount in case the loan is taken

jointly.

C. Assessment of Term loan:

60% of the realizable value of the property

OR

75% of the assets to be created out of term loan

Whichever is less

It is clarified here that if the Term Loan is considered for

augmenting long-term margin in the business, quantum of loan

will be maximum upto 60% of realizable value of the property.

Note:

Working capital finance and term loan together should not

exceed 60% of the realizable value of the property taken as

collateral security.

Tenure of Loan Overdraft: For 12 Months subject to annual renewal/ review

Term Loan: Upto 180 months including moratorium period of

maximum upto 6 months

Primary Security Mortgage (Registered or Equitable) of immovable

property(s)/ Factory Land & Building and / or any other

property (Land & Building).

Visit shall be conducted at the time of renewal of Account to

ensure that the existing mortgaged property is in good

condition. However, in case apparent deterioration is

observed in the property fresh valuation shall be undertaken

for reassessment of the existing facility. In case of need,

efforts are to be made to replace the security/ taking exit from

the exposure.

In case of term loan, it shall be ensured that the residual life

of the mortgaged property is well within the repayment period

of the loan.

Guarantee / Other In case of Proprietorship/ Partnership Firm/ Company/ Trust/

Security Society, personal guarantee of proprietor/ individual major

partners/ promoter directors/ Trustees/office bearers or

authorized signatory/ies shall be taken as per Bank’s Policy

guidelines in addition to Equitable Mortgage.

Rate of Interest As per Bank’s Policy guidelines

You might also like

- Nike Shoegate IncidentDocument11 pagesNike Shoegate IncidentAvas Adhikary100% (1)

- Vijayakumar Project ReportDocument6 pagesVijayakumar Project ReportkaranNo ratings yet

- Distribution Agreement - Lending Services Andromeda.1Document4 pagesDistribution Agreement - Lending Services Andromeda.1Santosh DasNo ratings yet

- Living and Nonliving Things PDFDocument2 pagesLiving and Nonliving Things PDFRelingado GraceNo ratings yet

- Sbi Stock Statement Format in ExcelDocument33 pagesSbi Stock Statement Format in ExcelShadab Malik67% (3)

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3ANo ratings yet

- Project Report For DairyDocument20 pagesProject Report For DairyKaushik KansaraNo ratings yet

- Dena Retail BankingDocument16 pagesDena Retail BankingSunil Kumar ChauhanNo ratings yet

- LC Assessment: Vikas Anand Y. G. GurnaniDocument17 pagesLC Assessment: Vikas Anand Y. G. GurnaniVikas A.No ratings yet

- House of Candy PresentationDocument42 pagesHouse of Candy PresentationRohit JaroudiyaNo ratings yet

- Finacle 10 Menu OptionsDocument96 pagesFinacle 10 Menu OptionsSatyajeet Chowdhury100% (5)

- Domain 1 Teacher Self-ReflectionDocument3 pagesDomain 1 Teacher Self-ReflectionleezenarosaNo ratings yet

- PNB Process NoteDocument36 pagesPNB Process NotePawan BagrechaNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- Hand Book On Retail Loan Products PDFDocument78 pagesHand Book On Retail Loan Products PDFparadise_27No ratings yet

- Gold Loan LatestDocument42 pagesGold Loan LatestNirmal RajNo ratings yet

- Pmfme Loan PolicyDocument7 pagesPmfme Loan PolicyHarika VenuNo ratings yet

- Loan CalculatorDocument15 pagesLoan CalculatorMahrukh ZubairNo ratings yet

- MSME Application Up To Rs.2.00 CRDocument9 pagesMSME Application Up To Rs.2.00 CRsayanNo ratings yet

- CC Loan ProjectDocument11 pagesCC Loan ProjectAjay ThakurNo ratings yet

- India Home Loans LTD Credit Policy of India Home Loans LTDDocument9 pagesIndia Home Loans LTD Credit Policy of India Home Loans LTDvinayak_cNo ratings yet

- CS - EXE - Income Tax - Notes - Combined PDFDocument437 pagesCS - EXE - Income Tax - Notes - Combined PDFRam Iyer100% (1)

- Quick Documentation GuideDocument43 pagesQuick Documentation GuideHimanshu MishraNo ratings yet

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- Facility & Scheme Wise Loan DocumentsDocument109 pagesFacility & Scheme Wise Loan DocumentsSheenam Bansal100% (2)

- PNB Retail Lending SchemesDocument6 pagesPNB Retail Lending Schemesanon_617153150No ratings yet

- KCC Application FormatDocument14 pagesKCC Application Formatsonigaurav22No ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Loan Against PropertyDocument5 pagesLoan Against Propertysandeep11661No ratings yet

- Prom 158Document158 pagesProm 158Bibin PHNo ratings yet

- Project Report: Name and Address:-Of The ApplicantDocument10 pagesProject Report: Name and Address:-Of The Applicantakki_6551No ratings yet

- KVIC PMEGP ManualDocument13 pagesKVIC PMEGP ManualD SRI KRISHNANo ratings yet

- IDBI Bank Home LoanDocument11 pagesIDBI Bank Home Loansahil7827No ratings yet

- SBI Business LoanDocument12 pagesSBI Business LoanAjit SamalNo ratings yet

- Form No 3CDDocument8 pagesForm No 3CDSURANA1973No ratings yet

- Project ReportDocument15 pagesProject ReportMichael AdonikarNo ratings yet

- Canara Bank Book Debt Statement Format PDFDocument77 pagesCanara Bank Book Debt Statement Format PDFMohamed YousufNo ratings yet

- XX Credit Appraisal Project FinalDocument40 pagesXX Credit Appraisal Project FinalDhaval ShahNo ratings yet

- FranchiseDocument5 pagesFranchiseNilesh JadhavNo ratings yet

- Retail Loan in BankingDocument27 pagesRetail Loan in Banking...ADITYA… JAINNo ratings yet

- PMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमDocument31 pagesPMEGP Scheme प्रधानमंत्री रोजगार सृजन कार्यक्रमAbinash MandilwarNo ratings yet

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- SIDBI Loan ApplicationDocument12 pagesSIDBI Loan ApplicationakshayaNo ratings yet

- MSME SchemesDocument53 pagesMSME SchemesKalyani BorkarNo ratings yet

- Mcqs Based On Bank'S Circulars During July, 2021Document8 pagesMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaNo ratings yet

- NABARD Bankable Scheme PomegranateDocument8 pagesNABARD Bankable Scheme PomegranateAlok TiwariNo ratings yet

- Kosamattam Finance Limited Prospectus AprilDocument287 pagesKosamattam Finance Limited Prospectus Aprilmehtarahul999No ratings yet

- Name: Arpita SengarDocument69 pagesName: Arpita Sengartripti48No ratings yet

- Loan TypesDocument7 pagesLoan TypesRkenterpriseNo ratings yet

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Document4 pagesMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNo ratings yet

- Project 2Document66 pagesProject 2Richa MittalNo ratings yet

- Tent House UnitDocument18 pagesTent House UnitSrinivasa NNo ratings yet

- Iba Cir FormatDocument1 pageIba Cir FormatUCO BANKNo ratings yet

- By Akshay Tyagi: NBFC PlaybookDocument13 pagesBy Akshay Tyagi: NBFC PlaybookAkshay TyagiNo ratings yet

- Project Report On General StoreDocument10 pagesProject Report On General StoreApplication's ManagerNo ratings yet

- Principles and Practices of Banking - JAIIB: Timing: 3 HoursDocument20 pagesPrinciples and Practices of Banking - JAIIB: Timing: 3 HoursMallikarjuna RaoNo ratings yet

- Project Report: Manufacturing of Masala PowderDocument10 pagesProject Report: Manufacturing of Masala PowderSuraj Singh RajvanshiNo ratings yet

- Sanction Letter HDFC LTDDocument9 pagesSanction Letter HDFC LTDShan PrajapatiNo ratings yet

- Vidya Deepam Circ Gist Mar20 - Mar21Document105 pagesVidya Deepam Circ Gist Mar20 - Mar21pradeep kumar0% (1)

- Canara Start Up061023Document2 pagesCanara Start Up061023Mahim DangiNo ratings yet

- ULP (Word)Document2 pagesULP (Word)RithikaNo ratings yet

- SIDBI CSAS-Scheme DetailsDocument4 pagesSIDBI CSAS-Scheme DetailsPRIYAM VAGHASIYANo ratings yet

- 6 File General Term Loan Scheme Oct 2017 2Document1 page6 File General Term Loan Scheme Oct 2017 2Ashwet GaonkarNo ratings yet

- Asset Finance CompanyDocument3 pagesAsset Finance Companychetanjayant1No ratings yet

- Business Loan: Normal Current AccountDocument16 pagesBusiness Loan: Normal Current AccountUthaiah CmNo ratings yet

- Kathi Nation Brochure 2020 Take AwayDocument30 pagesKathi Nation Brochure 2020 Take AwayRohit JaroudiyaNo ratings yet

- We Support CAA - Vinod Kumar SarvodyaDocument12 pagesWe Support CAA - Vinod Kumar SarvodyaRohit JaroudiyaNo ratings yet

- Chapter I Proposal Title First Aid Education in ChildrenDocument2 pagesChapter I Proposal Title First Aid Education in ChildrenidaNo ratings yet

- Masters ThesisDocument61 pagesMasters ThesissampathdtNo ratings yet

- Yoga InvocationsDocument4 pagesYoga InvocationsJon DoughNo ratings yet

- Dutch Reformed ChurchDocument4 pagesDutch Reformed ChurchSebastiaan BrinkNo ratings yet

- Modern Art TimelineDocument21 pagesModern Art TimelineTot ChingNo ratings yet

- HW 5Document15 pagesHW 5ottoporNo ratings yet

- No Strings AttachedDocument7 pagesNo Strings AttachedTrallo Fewdays ChibweNo ratings yet

- Proof by Induction - FactorialsDocument1 pageProof by Induction - FactorialsejlflopNo ratings yet

- Synfocity 632 PDFDocument2 pagesSynfocity 632 PDFMizoram Presbyterian Church SynodNo ratings yet

- Q2 - Lesson 1 - Worksheet 3 - Card CatalogDocument3 pagesQ2 - Lesson 1 - Worksheet 3 - Card CatalogTine DayotNo ratings yet

- The Perfect Server - Debian 8 Jessie (Apache2, BIND, Dovecot, IsPConfig 3)Document23 pagesThe Perfect Server - Debian 8 Jessie (Apache2, BIND, Dovecot, IsPConfig 3)Charly DecanoNo ratings yet

- Written Statement SwapnilDocument5 pagesWritten Statement SwapnilMayank KumarNo ratings yet

- Kiecolt-Glaser - PNI 2002Document11 pagesKiecolt-Glaser - PNI 2002LaviniaNo ratings yet

- Crime: Functionalist, Strain, SubculturalDocument8 pagesCrime: Functionalist, Strain, SubculturalCharlotte BrennanNo ratings yet

- Final ImmersionDocument14 pagesFinal ImmersionKzyrelle Aeyni Aparri PalañaNo ratings yet

- Pastel Doodle Emotional Management in Childhood PresentationDocument12 pagesPastel Doodle Emotional Management in Childhood Presentationrozel.lopezNo ratings yet

- Details of Module and Its Structure: Ms. Kulwant KaurDocument14 pagesDetails of Module and Its Structure: Ms. Kulwant KaurAnkur TiwariNo ratings yet

- Sample Size CalculationDocument2 pagesSample Size CalculationAljon AgustinNo ratings yet

- Customs of The TagalogsDocument14 pagesCustoms of The TagalogsACIO, STEPHANY G.No ratings yet

- Standard Styles in Related Literature, References, or CitationsDocument2 pagesStandard Styles in Related Literature, References, or CitationsGuinevere B.No ratings yet

- RFP Rejection LetterDocument3 pagesRFP Rejection LetterSerge Olivier Atchu YudomNo ratings yet

- LPAC and ARD CommitteeDocument3 pagesLPAC and ARD CommitteenewgenoogenNo ratings yet

- ADL Project TemplateDocument6 pagesADL Project TemplateOm JiNo ratings yet

- Ram Rattan V State of UPDocument8 pagesRam Rattan V State of UPNiveditha Ramakrishnan ThantlaNo ratings yet

- UNIT 1 Eng FORM 5Document4 pagesUNIT 1 Eng FORM 5leonal neevedthanNo ratings yet

- 8 Ways To Defeat Persistent Unwanted ThoughtsDocument2 pages8 Ways To Defeat Persistent Unwanted ThoughtsE-consulting NigeriaNo ratings yet

- Muslim Army of Jesus & Mahdi & Their 7 SignsDocument13 pagesMuslim Army of Jesus & Mahdi & Their 7 SignsAbdulaziz Khattak Abu FatimaNo ratings yet