Professional Documents

Culture Documents

Theoretical Question 1 - Company Do Sea

Theoretical Question 1 - Company Do Sea

Uploaded by

RahulCopyright:

Available Formats

You might also like

- Lake Case StudyDocument3 pagesLake Case StudyVictor. HuamaniNo ratings yet

- Corporate Finance Workshop 4 DR Xiaohu Deng Due at 12:00pm (Noon) On Tuesday, 24 March 2020 Submission InstructionsDocument3 pagesCorporate Finance Workshop 4 DR Xiaohu Deng Due at 12:00pm (Noon) On Tuesday, 24 March 2020 Submission InstructionsAlia ShabbirNo ratings yet

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)From Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Rating: 4 out of 5 stars4/5 (3)

- BCG & Bain Case Interview Case InterviewsDocument69 pagesBCG & Bain Case Interview Case InterviewsTrung LêNo ratings yet

- Broker Business PlanDocument18 pagesBroker Business PlanJulie Flanagan100% (1)

- 2010 Recruitment Day One: Banking Track Case StudyDocument25 pages2010 Recruitment Day One: Banking Track Case StudySimar DhillonNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Exercises 2018Document21 pagesExercises 2018Max BeckerNo ratings yet

- Marriott Corporation (Project Chariot) : Case AnalysisDocument5 pagesMarriott Corporation (Project Chariot) : Case AnalysisChe hareNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Exam2014 London Version2Document3 pagesExam2014 London Version2Chris MiguelvivasNo ratings yet

- Marriott Corporation (Project Chariot) : Case AnalysisDocument5 pagesMarriott Corporation (Project Chariot) : Case AnalysisStefan RadisavljevicNo ratings yet

- Practice 4 - EngDocument3 pagesPractice 4 - Engiñigo molineroNo ratings yet

- Revised - Case Analysis 2nd SetDocument3 pagesRevised - Case Analysis 2nd SetJonalyn LodorNo ratings yet

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- FIN5342PS1Document3 pagesFIN5342PS1Samantha Hwey Min Ding100% (1)

- Iap Application Form Concept NoteDocument6 pagesIap Application Form Concept NoteOUSMAN SEIDNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Final CasesDocument22 pagesFinal CaseshadeerahmedNo ratings yet

- Corporate Finance ResitDocument3 pagesCorporate Finance ResitBERCELLESI ALBERTONo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- Exam Duration: Two Hours: Instructions For The ExamDocument5 pagesExam Duration: Two Hours: Instructions For The ExamSanJana NahataNo ratings yet

- Example Exam MoF Corporate Finance Instructor 12042016Document4 pagesExample Exam MoF Corporate Finance Instructor 12042016ciaoNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- Managing Financial ResourcesDocument16 pagesManaging Financial ResourcesNguyen Dac ThichNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 2024phamminhngoc2k4No ratings yet

- Smart Task-1 (VCE)Document3 pagesSmart Task-1 (VCE)Pampana Bala Sai Saroj RamNo ratings yet

- Hedge Fund Business PlanDocument22 pagesHedge Fund Business Planjdchandi123No ratings yet

- Consequences Player Material HY1Document3 pagesConsequences Player Material HY1janechntNo ratings yet

- UK High Tech Consulting Business PlanDocument38 pagesUK High Tech Consulting Business PlanmzafarshahidNo ratings yet

- Prabin GDocument7 pagesPrabin GPrabin ChaudharyNo ratings yet

- Case Study On Foreign Exchange (FX)Document2 pagesCase Study On Foreign Exchange (FX)HaannaaNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 202422070825No ratings yet

- VCE Summer Internship Program 2020: Sandeep Dwivedi SM02 Project FinanceDocument3 pagesVCE Summer Internship Program 2020: Sandeep Dwivedi SM02 Project Financesandeep dwivedi100% (1)

- IB ExamDocument3 pagesIB ExamAadit ParikhNo ratings yet

- Solutions To Assigned End of Chapter Questions: Massey University School of Economics & FinanceDocument54 pagesSolutions To Assigned End of Chapter Questions: Massey University School of Economics & FinanceMai Anh ThuNo ratings yet

- Plan Outline: Executive SummaryDocument22 pagesPlan Outline: Executive SummarySwapna GhiaNo ratings yet

- Financial Management C.I.A.-1.2 Topic: Construction of Capital Structure For A Business IdeaDocument9 pagesFinancial Management C.I.A.-1.2 Topic: Construction of Capital Structure For A Business Ideaabhishek anandNo ratings yet

- Midterm Review Term 3 2011 - 2012Document4 pagesMidterm Review Term 3 2011 - 2012Milles ManginsayNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- The Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeDocument7 pagesThe Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeOzioma IhekwoabaNo ratings yet

- Microeconomics Canadian 15th Edition Ragan Test Bank instant download all chapterDocument79 pagesMicroeconomics Canadian 15th Edition Ragan Test Bank instant download all chapterndokatucan100% (6)

- I and F CT 2201209 Exam FinalDocument7 pagesI and F CT 2201209 Exam FinalAkshay GoyalNo ratings yet

- Presentation 1Document8 pagesPresentation 1Eiad JouhaNo ratings yet

- Full download Microeconomics Canadian 15th Edition Ragan Test Bank all chapter 2024 pdfDocument44 pagesFull download Microeconomics Canadian 15th Edition Ragan Test Bank all chapter 2024 pdfmendvichy100% (11)

- Instant Download PDF Microeconomics Canadian 15th Edition Ragan Test Bank Full ChapterDocument79 pagesInstant Download PDF Microeconomics Canadian 15th Edition Ragan Test Bank Full Chapterdugliohaleen100% (8)

- Valuation of A Tech Start'up in PractiseDocument15 pagesValuation of A Tech Start'up in PractiseTarek MghNo ratings yet

- Corporate Finance MasterDocument3 pagesCorporate Finance MasterHenkNo ratings yet

- HSBC BankDocument18 pagesHSBC BankJessia Margaret GomesNo ratings yet

- Resit MIB - 010 Assessment Deadline 7 AugustDocument6 pagesResit MIB - 010 Assessment Deadline 7 AugustHasan MahmoodNo ratings yet

- Problem Set 3Document8 pagesProblem Set 3Patt PanayongNo ratings yet

- IMCI Project Financing Teaser 01.11.2022 - Light VersionDocument6 pagesIMCI Project Financing Teaser 01.11.2022 - Light VersionthtukenanNo ratings yet

- Assignment 1Document3 pagesAssignment 1Ivan BaranovNo ratings yet

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimNo ratings yet

- Final Memo For New Product Proposal Kiya Law OffDocument5 pagesFinal Memo For New Product Proposal Kiya Law OffHabtu AsratNo ratings yet

- CT2 PXS 07Document72 pagesCT2 PXS 07AmitNo ratings yet

- Chapters 9 and 10 EditedDocument18 pagesChapters 9 and 10 Editedomar_geryesNo ratings yet

- Advanced Auditing and Assurance - Revision KitDocument244 pagesAdvanced Auditing and Assurance - Revision Kitmulika99No ratings yet

- Theoretical Question 2 - Nana PDFDocument1 pageTheoretical Question 2 - Nana PDFRahulNo ratings yet

- One Line Rent Roll (April 17, 2020)Document24 pagesOne Line Rent Roll (April 17, 2020)RahulNo ratings yet

- Model Number of Fans Number of Cooling Coils Manufacturing Time (Hours)Document5 pagesModel Number of Fans Number of Cooling Coils Manufacturing Time (Hours)RahulNo ratings yet

- Purchasing Power Parity (PPP)Document3 pagesPurchasing Power Parity (PPP)RahulNo ratings yet

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulNo ratings yet

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulNo ratings yet

Theoretical Question 1 - Company Do Sea

Theoretical Question 1 - Company Do Sea

Uploaded by

RahulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Theoretical Question 1 - Company Do Sea

Theoretical Question 1 - Company Do Sea

Uploaded by

RahulCopyright:

Available Formats

Please submit your answer with less than 500 words as a .

pdf file

[500 words maximum, equivalent to 1 word page: You are now playing the game of answer effectiveness.

Incomplete answers will obviously not receive full points. Excessively long and redundant answers may

earn you negative points. Write carefully and logically and do not surpass 500 words.]

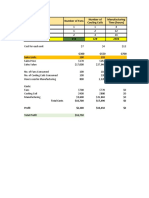

Theoretical Question 1 – Company Do Sea:

Company Do Sea currently has a market value of equity of 40 million euros, with 10 million shares

outstanding, and a D/E ratio of 0.6. The company announces that it intends to raise additional debt by

asking for a 20 million € bank loan to finance future projects.

Describe the market value balance sheet before and after the loan has been provided (i.e. provide the

market value of assets, debt and equity at period 0 - before the announcement; and at period 1 - after the

credit has been made available to the company). What are the benefits of this move to shareholders

(quantify)? Why might this transaction be harmful to shareholders? What reasons could have led the bank

to disapprove conceding this credit?

You might also like

- Lake Case StudyDocument3 pagesLake Case StudyVictor. HuamaniNo ratings yet

- Corporate Finance Workshop 4 DR Xiaohu Deng Due at 12:00pm (Noon) On Tuesday, 24 March 2020 Submission InstructionsDocument3 pagesCorporate Finance Workshop 4 DR Xiaohu Deng Due at 12:00pm (Noon) On Tuesday, 24 March 2020 Submission InstructionsAlia ShabbirNo ratings yet

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)From Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Rating: 4 out of 5 stars4/5 (3)

- BCG & Bain Case Interview Case InterviewsDocument69 pagesBCG & Bain Case Interview Case InterviewsTrung LêNo ratings yet

- Broker Business PlanDocument18 pagesBroker Business PlanJulie Flanagan100% (1)

- 2010 Recruitment Day One: Banking Track Case StudyDocument25 pages2010 Recruitment Day One: Banking Track Case StudySimar DhillonNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Exercises 2018Document21 pagesExercises 2018Max BeckerNo ratings yet

- Marriott Corporation (Project Chariot) : Case AnalysisDocument5 pagesMarriott Corporation (Project Chariot) : Case AnalysisChe hareNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- Exam2014 London Version2Document3 pagesExam2014 London Version2Chris MiguelvivasNo ratings yet

- Marriott Corporation (Project Chariot) : Case AnalysisDocument5 pagesMarriott Corporation (Project Chariot) : Case AnalysisStefan RadisavljevicNo ratings yet

- Practice 4 - EngDocument3 pagesPractice 4 - Engiñigo molineroNo ratings yet

- Revised - Case Analysis 2nd SetDocument3 pagesRevised - Case Analysis 2nd SetJonalyn LodorNo ratings yet

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- FIN5342PS1Document3 pagesFIN5342PS1Samantha Hwey Min Ding100% (1)

- Iap Application Form Concept NoteDocument6 pagesIap Application Form Concept NoteOUSMAN SEIDNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Final CasesDocument22 pagesFinal CaseshadeerahmedNo ratings yet

- Corporate Finance ResitDocument3 pagesCorporate Finance ResitBERCELLESI ALBERTONo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- Exam Duration: Two Hours: Instructions For The ExamDocument5 pagesExam Duration: Two Hours: Instructions For The ExamSanJana NahataNo ratings yet

- Example Exam MoF Corporate Finance Instructor 12042016Document4 pagesExample Exam MoF Corporate Finance Instructor 12042016ciaoNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- Managing Financial ResourcesDocument16 pagesManaging Financial ResourcesNguyen Dac ThichNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 2024phamminhngoc2k4No ratings yet

- Smart Task-1 (VCE)Document3 pagesSmart Task-1 (VCE)Pampana Bala Sai Saroj RamNo ratings yet

- Hedge Fund Business PlanDocument22 pagesHedge Fund Business Planjdchandi123No ratings yet

- Consequences Player Material HY1Document3 pagesConsequences Player Material HY1janechntNo ratings yet

- UK High Tech Consulting Business PlanDocument38 pagesUK High Tech Consulting Business PlanmzafarshahidNo ratings yet

- Prabin GDocument7 pagesPrabin GPrabin ChaudharyNo ratings yet

- Case Study On Foreign Exchange (FX)Document2 pagesCase Study On Foreign Exchange (FX)HaannaaNo ratings yet

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 202422070825No ratings yet

- VCE Summer Internship Program 2020: Sandeep Dwivedi SM02 Project FinanceDocument3 pagesVCE Summer Internship Program 2020: Sandeep Dwivedi SM02 Project Financesandeep dwivedi100% (1)

- IB ExamDocument3 pagesIB ExamAadit ParikhNo ratings yet

- Solutions To Assigned End of Chapter Questions: Massey University School of Economics & FinanceDocument54 pagesSolutions To Assigned End of Chapter Questions: Massey University School of Economics & FinanceMai Anh ThuNo ratings yet

- Plan Outline: Executive SummaryDocument22 pagesPlan Outline: Executive SummarySwapna GhiaNo ratings yet

- Financial Management C.I.A.-1.2 Topic: Construction of Capital Structure For A Business IdeaDocument9 pagesFinancial Management C.I.A.-1.2 Topic: Construction of Capital Structure For A Business Ideaabhishek anandNo ratings yet

- Midterm Review Term 3 2011 - 2012Document4 pagesMidterm Review Term 3 2011 - 2012Milles ManginsayNo ratings yet

- VCE Summer Internship Program 2020: Ruchit GuptaDocument5 pagesVCE Summer Internship Program 2020: Ruchit Guptaruchit guptaNo ratings yet

- The Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeDocument7 pagesThe Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeOzioma IhekwoabaNo ratings yet

- Microeconomics Canadian 15th Edition Ragan Test Bank instant download all chapterDocument79 pagesMicroeconomics Canadian 15th Edition Ragan Test Bank instant download all chapterndokatucan100% (6)

- I and F CT 2201209 Exam FinalDocument7 pagesI and F CT 2201209 Exam FinalAkshay GoyalNo ratings yet

- Presentation 1Document8 pagesPresentation 1Eiad JouhaNo ratings yet

- Full download Microeconomics Canadian 15th Edition Ragan Test Bank all chapter 2024 pdfDocument44 pagesFull download Microeconomics Canadian 15th Edition Ragan Test Bank all chapter 2024 pdfmendvichy100% (11)

- Instant Download PDF Microeconomics Canadian 15th Edition Ragan Test Bank Full ChapterDocument79 pagesInstant Download PDF Microeconomics Canadian 15th Edition Ragan Test Bank Full Chapterdugliohaleen100% (8)

- Valuation of A Tech Start'up in PractiseDocument15 pagesValuation of A Tech Start'up in PractiseTarek MghNo ratings yet

- Corporate Finance MasterDocument3 pagesCorporate Finance MasterHenkNo ratings yet

- HSBC BankDocument18 pagesHSBC BankJessia Margaret GomesNo ratings yet

- Resit MIB - 010 Assessment Deadline 7 AugustDocument6 pagesResit MIB - 010 Assessment Deadline 7 AugustHasan MahmoodNo ratings yet

- Problem Set 3Document8 pagesProblem Set 3Patt PanayongNo ratings yet

- IMCI Project Financing Teaser 01.11.2022 - Light VersionDocument6 pagesIMCI Project Financing Teaser 01.11.2022 - Light VersionthtukenanNo ratings yet

- Assignment 1Document3 pagesAssignment 1Ivan BaranovNo ratings yet

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimNo ratings yet

- Final Memo For New Product Proposal Kiya Law OffDocument5 pagesFinal Memo For New Product Proposal Kiya Law OffHabtu AsratNo ratings yet

- CT2 PXS 07Document72 pagesCT2 PXS 07AmitNo ratings yet

- Chapters 9 and 10 EditedDocument18 pagesChapters 9 and 10 Editedomar_geryesNo ratings yet

- Advanced Auditing and Assurance - Revision KitDocument244 pagesAdvanced Auditing and Assurance - Revision Kitmulika99No ratings yet

- Theoretical Question 2 - Nana PDFDocument1 pageTheoretical Question 2 - Nana PDFRahulNo ratings yet

- One Line Rent Roll (April 17, 2020)Document24 pagesOne Line Rent Roll (April 17, 2020)RahulNo ratings yet

- Model Number of Fans Number of Cooling Coils Manufacturing Time (Hours)Document5 pagesModel Number of Fans Number of Cooling Coils Manufacturing Time (Hours)RahulNo ratings yet

- Purchasing Power Parity (PPP)Document3 pagesPurchasing Power Parity (PPP)RahulNo ratings yet

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulNo ratings yet

- Write A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksDocument4 pagesWrite A Note For The Audit File That Evaluated The Company's Business Risks and The Related Inherent RisksRahulNo ratings yet