Professional Documents

Culture Documents

The Unofficial Cheat Sheet For The Ambiguous Subjects in Commercial Law

The Unofficial Cheat Sheet For The Ambiguous Subjects in Commercial Law

Uploaded by

colenearcainaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Unofficial Cheat Sheet For The Ambiguous Subjects in Commercial Law

The Unofficial Cheat Sheet For The Ambiguous Subjects in Commercial Law

Uploaded by

colenearcainaCopyright:

Available Formats

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

The Unofficial Cheat Sheet

for the Ambiguous Subjects in Commercial Law1

I. Letters of Credit

A. Definition and Nature of Letter of Credit

Written instrument whereby the writer requests or authorizes the addressee to pay money or

deliver goods to a third person and assumes responsibility for payment of debt therefor to the

addressee. (Transfield v. Luzon)

In commercial transactions: a letter of credit is a financial device developed by merchants as

a convenient and relatively safe mode of dealing with sales of goods to satisfy the seemingly

irreconcilable interests of a seller, who refuses to part with his goods before he is paid, and a

buyer, who wants to have control of the goods before paying.

o Its use serves to reduce risk of nonpayment of the purchase price under contract of

sale of goods. (Transfield)

B. Parties to a Letter of Credit

1. Rights and Obligations of Parties

C. Basic Principles of Letter of Credit

1. Doctrine of Independence

2. Fraud Exception Principle

3. Doctrine of Strict Compliance

1

Only the following subjects are included:

1. Letters of Credit

2. Trust Receipts

3. Negotiable Instruments

4. Banking

5. Securities Regulation

Based on 2018 Bar Syllabus for Commercial Law, 2018 Syllabus of Justice RPL Hernando for Commercial Law Review for the

relevant codal provisions, Sundiang & Aquino (2017), some points from 2016 Magis Summer Reviewer for Commercial Law

Love, Colene Arcaina.

The Unofficial Cheat Sheet | 1

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

II. Trust Receipts

A. Definition/Concept of a Trust Receipt Transaction

1. Loan/Security Feature

2. Ownership of the Goods, Documents, and Instruments under a Trust Receipt

B. Rights of the Entruster

1. Validity of the Security Interest as Against the Creditors of the Entrustee/Innocent

Purchasers for Value

C. Obligations and Liabilities of the Entrustee

1. Payment/Delivery of Proceeds of Sale/Disposition of Goods, Documents or Instruments

2. Return of Goods, Documents or Instruments in Case of Sale

3. Liability for Loss of Goods, Documents or Instruments

4. Penal Sanction if Offender is a Corporation

D. Remedies Available

E. Warehouseman’s Lien

The Unofficial Cheat Sheet | 2

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

III. Negotiable Instruments Law

A. Forms and Interpretation

1. Requisites of Negotiability

Sec. 1. Form of negotiable instruments. – An instrument to be negotiable must conform to the following

requirements:

a. It must be in writing and signed by the maker or drawer;

- Includes printed, and “writing” includes print. (Sec. 191)

- Signature may be in one’s handwriting, printed, engraved, lithographed, or

photographed, so long as they are adopted as the signature of the signer;

important: m/drwr used what he affixed as his own signature for authentication

(Sundiang & Aquino, 15)

b. Must contain an unconditional promise or order to pay a sum certain in money;

i. “Unconditional” though coupled with:

- An indication of a particular fund out of which reimbursement is to be made/a

particular account to be debited with the amount; or

- A statement of the transaction which gives rise to the instrument.

- NOTE: An order/promise to pay out of a particular fund is NOT unconditional. (Sec.

3, NIL)

ii. “Sum certain” although paid:

- With interest; or

- By stated installments; or

- By stated installments, with a provision that, upon default in payment of any

installment or of interest, the whole shall become due; (aka acceleration clauses) or

- With exchange, whether at a fixed rate or at the current rate; or

- With costs of collection or an attorney’s fee, in case payment shall not be made at

maturity (Sec. 2, NIL)

c. Must be payable on demand or at a fixed or determinable future time;

i. “Payable on demand”

- When so expressed to be payable on demand, or at sight, or on presentation; or

- In which no time for payment is expressed (Sec.7)

ii. “Determinable future time”

- At a fixed period after date or sight; or

- On or before a fixed or determinable future time specified therein; or

- On or at a fixed period after the occurrence of a specified event which is certain to

happen, though the time of happening be uncertain

- NOTE: An instrument payable upon a contingency is not negotiable, and the

happening of the event does not cure the defect. (Sec. 4)

d. Must be payable to order or to bearer; and

i. “Payable to order” – when drawn payable to the order of a specified person or to him or

his order. May be drawn payable to the order of:

- A payee who is not maker, drawer, or drawee; OOOOOR

- The drawer/maker; or

- The drawee; or

- Two or more payees jointly; or

- One or some of the several payees; or

- The holder of an office for the time being

ii. “Payable to bearer”

- When expressed to be so payable; or

- When it is payable to a person named therein; or

- When payable to the order of a fictitious or non-existing person, and such fact was

known to the person making it so payable; or

- When the name of the payee does not purport to be the name of any person; or

- When the only or last indorsement is an indorsement in blank

e. Where the instrument is addressed to a drawee, he must be named or otherwise

indicated therein with reasonable certainty

The Unofficial Cheat Sheet | 3

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

- NOTE: BoE may be addressed to more than one drawee jointly (but NOT in the

alternative or in SUCCESSION) (Sec. 128)

2. Kinds of Negotiable Instruments

Bill of Exchange (Sec. 126) Promissory Note (Sec. 184)

Unconditional order in writing Unconditional promise in writing

Addressed by one person to another Made by one person to another

Signed by the person giving it Signed by the maker

Requiring the person to whom it is Engaging to pay on demand, or at a fixed or

addressed to pay on demand or at a fixed or determinable future time

determinable future time A sum certain in money to order or to

A sum certain in money to order or to bearer bearer.

NOTE: Where note is drawn to maker’s own

order, it is not complete until indorsed by

him

3 parties 2 parties

Drawer – draws BoE and orders drawee to Maker – one who makes a PN and

pay a sum certain in money promises to pay the amount

Drawee – the person to whom the order to Payee

pay is addressed to

Payee – the person to receive payment

Drawer secondarily liable Maker primarily liable

Generally: two presentments: acceptance and for Only one presentment (for payment)

payment

NOTE:

Sec. 17 (e) Where the instrument is so ambiguous that there is doubt whether it is a bill or note,

the holder may treat it as either at his election;

Sec. 130. When bill may be treated as promissory note. – Where in a bill the drawer and drawee are

the same person, or where the drawee is a fictitious person, or a person not having capacity to

contract, the holder may treat the instrument, at his option, either as a bill of exchange or as a

promissory note.

B. Completion and Delivery

1. Insertion of Date

Sec. 13. When date may be inserted – Where an instrument expressed to be payable at a fixed period

after date is issued undated, or where the acceptance of an instrument payable at a fixed period after

sight is undated, any holder may insert therein the true date of issue or acceptance, and the

instrument shall be payable accordingly. The insertion of a wrong date does not avoid the

instrument in the hands of a subsequent holder in due course; but as to him, the date so inserted is to

be regarded as the true date.

2. Completion of Blanks (Incomplete but Delivered [ID])

Sec. 14. Blanks; when may be filled. – Where the instrument is wanting in any material particular,

The Unofficial Cheat Sheet | 4

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

the person in possession thereof has a prima facie authority to complete it by filling up the

blanks therein. And a signature on a blank paper delivered by the person making the signature in

order that the paper may be converted into a negotiable instrument operates as a prima facie authority

to fill it up as such for any amount. In order, however, that any such instrument when completed may

be enforced against any person who became a party thereto prior to its completion, it must be filled

up strictly in accordance with the authority given and within a reasonable time. But if any such

instrument, after completion, is negotiated to a holder in due course, it is valid and effectual for all

purposes in his hands, and he may enforce it as if it had been filled up strictly in accordance with the

authority given and within a reasonable time.

3. Incomplete and Undelivered Instruments (IU)

Sec. 15. Incomplete instrument not delivered. – Where an incomplete instrument has not been

delivered, it will not, if completed and negotiated without authority, be a valid contract in the hands of

any holder, as against any person whose signature was placed thereon before delivery.

4. Complete but Undelivered Instruments (CU)

Sec. 16. Delivery; when effectual; when presumed. – Every contract on a negotiable instrument is

incomplete and revocable until delivery of the instrument for the purpose of giving effect thereto. As

between immediate parties, and as regards a remote party other than a holder in due course, the

delivery, in order to be effectual, must be made either by or under the authority of the party making,

drawing, accepting, or indorsing, as the case may be; and, in such case, the delivery may be shown to

have been conditional, or for a special purpose only, and not for the purpose of transferring the

property in the instrument. But where the instrument is in the hands of a holder in due course, a valid

delivery thereof by all parties prior to him so as to make them liable to him is conclusively presumed.

And where the instrument is no longer in the possession of a party whose signature appears thereon, a

valid and intentional delivery by him is presumed until the contrary is proved.

C. Signature

1. Signing in Trade Name

Sec. 18. …One who signs in a trade/assumed name will be liable to the same extent as if he had

signed in his own name.

2. Signature of Agent

Sec. 19. The signature of any party may be made by a duly authorized agent. No particular form of

appointment is necessary for this purpose; and the authority of the agent may be established as in

other cases of agency.

Sec. 20. …not liable on the instrument if he was duly authorized; but the mere addition of words

describing him as an agent, or as filling a representative character, without disclosing his principal,

does not exempt him from personal liability.

3. Indorsement by Minor or Corporation

Sec. 22. Indorsement/assignment by a corp/infant passes the property therein, notwithstanding that

from want of capacity, the corporation/infant may incur no liability thereon.

4. Forgery

The Unofficial Cheat Sheet | 5

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

Sec. 23. Forged signature; effect of. – When a signature is forged or made without the authority of the

person whose signature it purports to be, it is wholly inoperative, and no right to retain the

instrument, or to give a discharge therefor, or to enforce payment thereof against any party

thereto, can be acquired through or under such signature,

Unless the party against whom it is sought to enforce such right is precluded from setting up the

forgery or want of authority.

NOTES (Sundiang, 38-39)

Only forged signature is wholly inoperative; not instrument itself nor genuine signatures

In case of forgery of an indorsement of an instrument payable to order, who are NOT liable?

o One whose signature was forged AND

o Also the parties prior to such person

Who are precluded from setting up forgery?

o Those who warrants like the acceptors, indorsers;

o Those who ratified the forgery express or implied;

o Those who were negligent

GR: in case of forgery of the indorsement of the payee of the check, drawee bank cannot debit the

drawer’s account and that loss shall be borne by the drawee bank. Depositary/collecting bank is

liable to drawee in case of forged indorsement because it guarantees all prior indorsement.

o Subject to Q that the drawee himself was not negligent or guilty of such conduct as would estop

him from asserting the forged character of indorsement as against drawer.

D. Consideration

Sec. 24. Presumption of Consideration. – Every negotiable instrument is deemed prima facie to

have issued for a valuable consideration; and every person whose signature appears thereon to

have become a party thereto for value.

Sec. 25. Value, what constitutes. – Value is any consideration sufficient to support a simple contract.

An antecedent or pre-existing debt constitutes value; and is deemed such whether the instrument is

payable on demand or at a future time.

Sec. 28. Effect of want of consideration. – Absence or failure of consideration is a matter of defense

as against any person not a holder in due course; and partial failure of consideration is a

defense pro tanto, whether the failure is an ascertained and liquidated amount or otherwise.

E. Accommodation Party

Sec. 29. Liability of accommodation party. – An accommodation party is one who has signed the

instrument as maker, drawer, acceptor, or indorser, without receiving value therefor, and for the

purpose of lending his name to some other person. Such a person is liable on the instrument to a

holder for value, notwithstanding such holder, at the time of taking the instrument, knew him to be only

an accommodation party.

NOTE:

A corporation cannot act as an accommodation party. ULTRA VIRES! (Crisologo v. CA)

F. Negotiation

1. Distinguished from Assignment

The Unofficial Cheat Sheet | 6

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

Assignment Negotiation

Pertains to contracts in general Pertains to negotiable instruments

One who takes instrument by assignment takes A person, who takes the instrument by

the instrument subject to the defenses obtaining negotiation, takes it free from personal defenses

among the original parties available among the parties

2. Modes of Negotiation

Sec. 30. What constitutes negotiation. – An instrument is negotiated when it is transferred from one

person to another in such manner as to constitute the transferee the holder thereof.

If payable to bearer, it is negotiated by delivery;

if payable to order, it is negotiated by the indorsement of the holder completed by delivery.

3. Kinds of Indorsements

SPECIAL BLANK RESTRICTIVE QUALIFIED CONDITIONAL

Specifies the Specifies NO Either: Constitutes the Where an

person to whom, indorsee, and an Prohibits indorser a mere indorsement is

or to whose order, instrument so further assignor of the conditional, the

the instrument is indorsed is negotiation of title to the party required to

to be payable, and payable to bearer, the instrument. It may pay the instrument

the indorsement and may be instrument; or be made by may disregard the

of such indorsee negotiated by Constitutes adding to the condition and

is necessary to delivery (Sec. 34) the indorsee indorser’s make payment to

the further the agent of signature the the indorsee or his

negotiation of the Sec. 35. Blank the indorser; words “without transferee

instrument indorsement; how or recourse” or any whether the

(Sec. 34) changed to Vests the title words of similar condition has

special in the import. Such an been fulfilled or

indorsement. – indorsee in indorsement does not. But any

The holder may trust for or to not impair the person to whom

convert a blank the use of negotiable an instrument so

indorsement into a some other character of the indorsed is

special persons instrument. (Sec. negotiated will

indorsement by 38) hold the same, or

writing over the But the mere the proceeds

signature of the absence of words thereof, subject to

indorser in blank implying power to the rights of the

any contract negotiate does not person indorsing

consistent with the make an conditionally.

character of the indorsement (Sec. 39)

indorsement. restrictive. (Sec.

36)

Sec. 37. Effect of

restrictive

indorsement;

rights of indorsee.

– A restrictive

indorsement

confers upon the

indorsee the right

–

(a) To receive

payment on

The Unofficial Cheat Sheet | 7

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

the instrument;

(b) To bring any

action thereon

that the

indorser could

bring;

(c) To transfer his

rights as such

indorsee,

where the form

of the

indorsement

authorizes him

to do so.

But all subsequent

indorsees acquire

only the title of the

first indorsee

under the

restrictive

indorsement.

G. Rights of the Holder

1. Holder in Due Course

A holder in due course is a holder who has taken the instrument under the following conditions: (COFI)

(a) That it is complete and regular upon its face;

(b) That he became the holder of it before it was overdue, and without notice that it has been

previously dishonored, if such was the fact;

(c) That he took it in good faith and for value;

(d) That at the time it was negotiated to him, he had no notice of any infirmity in the instrument

or defect in the title of the person negotiating it. (Sec. 52)

Every holder is deemed prima facie to be a holder in due course; but when it is shown that the title of

any person who has negotiated the instrument was defective, the burden is on the holder to prove that

he or some person under whom he claims acquired the title as holder in due course. But the last-

mentioned rule does not apply in favor of a party who became bound on the instrument prior to the

acquisition of such defective title. (Sec. 59)

2. Defenses Against the Holder

Sec. 57. Rights of holder in due course. – A holder in due course holds the instrument free from any

defect of title of prior parties, and free from defenses available to prior parties among themselves, and

may enforce payment of the instrument for the full amount thereof against all parties liable thereon.

Free from PERSONAL, but NOT REAL defenses.

Sec. 58. When subject to original defenses. – In the hands of any holder other than a holder in due

course, a negotiable instrument is subject to the same defenses as if it were non-negotiable. But a

holder who derives his title through a holder in due course, and who is not himself a party to any fraud

The Unofficial Cheat Sheet | 8

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

or illegality affecting the instrument, has all the rights of such former holder in respect of all parties prior

to the latter.

REAL DEFENSES PERSONAL DEFENSES

1. Minority (available only to the minor) 1. Failure or absence of consideration

2. Forgery 2. Illegal consideration

3. Non-delivery of Incomplete instrument 3. Non-delivery of complete instrument

4. Material alteration 4. Conditional delivery of complete

5. Ultra vires acts of a corporation instrument

6. Fraud in factum or in esse contractus 5. Fraud in inducement

- Present when a person is induced to - The person who signs the instrument

sign an instrument not knowing its intends to sign the name as a

character as a note or a bill. negotiable instrument, but was

7. Illegality – if declared void for any purpose induced to do so only through fraud

8. Vicious force or violence 6. Filling up blank not within authority

9. Want of authority 7. Duress or intimidation

10. Prescription (10 years) 8. Filling up blank beyond reasonable time

11. Discharge of insolvency 9. Transfer in break of faith

10. Mistake

11. Insertion of wrong date

12. Ante-dating/post-dating for illegal or

fraudulent purpose

(Sundiang & Aquino, 36)

H. Liabilities of Parties

MAKER DRAWER ACCEPTOR

(primary liability) (secondary liability) (and drawee who pays without

accepting the instrument

primary liability;)

Sec. 60. Liability of maker. – Sec. 61. Liability of drawer. – Sec. 62. Liability of acceptor. –

The maker of a negotiable The drawer by drawing the The acceptor, by accepting the

instrument, by making it, instrument admits the existence instrument, engages that he will

engages that he will pay it of the payee and his then pay it according to the tenor of

according to its tenor, and capacity to indorse; and his acceptance; and admits:

admits the existence of the engages that, on due (a) The existence of the drawer,

payee and his then capacity to presentment, the instrument will the genuineness of his

indorse. be accepted or paid, or both, signature, and his capacity and

according to its tenor, and that if authority to draw the instrument;

it be dishonored and the and

necessary proceedings on (b) The existence of the payee

dishonor be duly taken, he will and his then capacity to indorse.

pay the amount thereof to the

holder or to any subsequent

indorser who may be compelled

to pay it. But the drawer may

insert in the instrument an

express stipulation negativing or

limiting his own liability to the

The Unofficial Cheat Sheet | 9

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

holder.

INDORSER

Sec. 63. When a person deemed indorser. – A person placing his signature upon an instrument

otherwise than as maker or acceptor, is deemed to be an indorser, unless he clearly indicates by

appropriate words his intention to be bound in some other capacity.

Sec. 68. Order in which indorsers are liable. – As respects one another, indorsers are liable prima facie

in the order in which they indorse; but evidence is admissible to show that, as between or among

themselves, they have agreed otherwise. Joint payees or joint indorsees who indorse are deemed to

indorse jointly and severally.

Sec. 64. Liability of irregular indorser. – Where a Sec. 67. Liability of indorser where paper

person, not otherwise a party to an instrument, negotiable by delivery. – Where a person places

places thereon his signature in blank before his indorsement on an instrument negotiable by

delivery, he is liable as indorser, in accordance delivery, he incurs all the liability of an indorser.

with the following rules:

(a) If the instrument is payable to the order of a

third person, he is liable to the payee and to all

subsequent parties.

(b) If the instrument is payable to the order of the

maker or drawer, or is payable to bearer, he is

liable to all parties subsequent to the maker or

drawer.

(c) If he signs for the accommodation of the

payee, he is liable to all parties subsequent to the

payee.

WARRANTIES

Sec. 65. Warranty; where negotiation by delivery Sec. 66. Liability of general indorser. – Every

and so forth. – Every person negotiating an indorser who indorses without qualification,

instrument by delivery or by a qualified warrants, to all subsequent holders in due course:

indorsement, warrants:

(a) That the instrument is genuine and in all (a) The matters and things mentioned in

respects what it purports to be; subdivisions (a), (b), and (c) of the next preceding

(b) That he has a good title to it; section; and

(c) That all prior parties had capacity to contract; (b) That the instrument is, at the time of his

(d) That he has no knowledge of any fact which indorsement, valid and subsisting;

would impair the validity of the instrument or And, in addition, he engages that, on due

render it valueless. presentment, it shall be accepted or paid, or both,

But when the negotiation is by delivery only, the as the case may be, according to its tenor, and

warranty extends in favor of no holder other than that if it be dishonored and the necessary

the immediate transferee. proceedings on dishonor be duly taken, he will

pay the amount thereof to the holder, or to any

The provisions of subdivision (c) of this section do subsequent indorser who may be compelled to

not apply to persons negotiating public or pay it.

corporation securities, other than bills and notes.

I. Presentment for Payment

1. Necessity of Presentment for Payment

The Unofficial Cheat Sheet | 10

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

Sec. 70. Effect of want of demand on principal debtor. – Presentment for payment is not necessary in

order to charge the person primarily liable on the instrument; but if the instrument is, by its terms,

payable at a special place, and he is able and willing to pay it there at maturity, such ability and

willingness are equivalent to a tender of payment upon his part. But, except as herein otherwise

provided, presentment for payment is necessary in order to charge the drawer and indorsers.

Sec. 79. When presentment not required to charge the drawer. – Presentment for payment is not

required in order to charge the drawer where he has no right to expect or require that the drawee

or acceptor will pay the instrument.

Sec. 80. When presentment not required to charge the indorser. – Presentment is not required in

order to charge an indorser where the instrument was made or accepted for his accommodation

and he has no reason to expect that the instrument will be paid if presented.

2. Parties to whom Presentment for Payment should be made

Sec. 76. Presentment where principal debtor is dead. – Where the person primarily liable on the

instrument is dead and no place of payment is specified, presentment for payment must be made to his

personal representative, if such there be, and if, with the exercise of reasonable diligence, he can be

found.

Sec. 77. Presentment to persons liable as partners. – Where the persons primarily liable on the

instrument are liable as partners, and no place of payment is specified, presentment for payment may

be made to any of them, even though there has been a dissolution of the firm.

Sec. 78. Presentment to joint debtors. – Where there are several persons not partners, primarily liable

on the instrument, and no place of payment is specified, presentment must be made to them all.

3. Dispensation with Presentment for Payment

Sec. 82. When presentment for payment is excused. – Presentment for payment is excused:

(a) Where after the exercise of reasonable diligence, presentment as required by this Act, cannot be

made;

(b) Where the drawee is a fictitious person;

(c) By waiver of presentment, expressed or implied.

4. Dishonor by Non-Payment

Sec. 83. When instrument dishonored by non-payment. – The instrument is dishonored by non-

payment when:

(a) It is duly presented for payment and payment is refused or cannot be obtained; or

(b) Presentment is excused and the instrument is overdue and unpaid.

Sec. 84. Liability of person secondarily liable, when instrument dishonored. – Subject to the provisions

of this Act, when the instrument is dishonored by non-payment, an immediate right of recourse to all

parties secondarily liable thereon accrues to the holder.

The Unofficial Cheat Sheet | 11

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

J. Notice of Dishonor

1. Parties to be notified

Sec. 89. To whom notice of dishonor must be given. – Except as herein otherwise provided, when a

negotiable instrument has been dishonored by non-acceptance or non-payment, notice of dishonor

must be given to the drawer and to each indorser, and any drawer or indorser to whom such notice is

not given is discharged.

2. Parties who may give notice and dishonor

Sec. 90. By whom given. – The notice may be given by or on behalf of the holder, or by or on behalf of

any party to the instrument who might be compelled to pay it to the holder, and who, upon taking it up,

would have a right to reimbursement from the party to whom the notice is given.

NOTE: So (1) holder; (2) agent or rep of holder; (3) any party who may be compelled to pay like

indorsers; and (4) agent of any party who may be compelled

Sec. 91. Notice given by agent. – Notice of dishonor may be given by an agent either in his own name

or in the name of any party entitled to give notice, whether that party be his principal or not.

3. Effect of Notice

Sec. 92. Effect of notice given on behalf of holder. – Where notice is given by or on behalf of the

holder, it inures to the benefit of all subsequent holders and all prior parties who have a right of

recourse against the party to whom it is given.

Sec. 93. Effect where notice is given by party entitled thereto. – Where notice is given by or on behalf

of a party entitled to give notice, it inures to the benefit of the holder and all parties subsequent to the

party to whom notice is given.

4. Form of Notice

Sec. 96. Form of notice. – The notice may be in writing or merely oral, and may be given in any terms

which sufficiently identify the instrument, and indicate that it has been dishonored by non-acceptance

or non-payment. It may in all cases be given by delivering it personally or through the mails.

5. Waiver

Sec. 109. Waiver of notice. – Notice of dishonor may be waived either before the time of giving notice

has arrived or after the omission to give due notice, and the waiver may be expressed or implied.

6. Dispensation with Notice

Sec. 112. When notice is dispensed with. – Notice of dishonor is dispensed with when, after the

exercise of reasonable diligence, it cannot be given to or does not reach the parties to be charged.

Sec. 113. Delay in giving notice; how excused. – Delay in giving notice of dishonor is excused when

the delay is caused by circumstances beyond the control of the holder and not imputable to his default,

misconduct, or negligence. When the cause of delay ceases to operate, notice must be given with

reasonable diligence.

Sec. 114. When notice need not be given to drawer. – Notice of dishonor is not required to be given to

The Unofficial Cheat Sheet | 12

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

the drawer in either of the following cases:

(a) Where the drawer and drawee are the same person;

(b) When the drawee is fictitious person or a person not having capacity to contract;

(c) When the drawer is the person to whom the instrument is presented for payment;

(d) Where the drawer has no right to expect or require that the drawee or acceptor will honor the

instrument;

(e) Where the drawer has countermanded payment.

Sec. 115. When notice need not be given to indorser. – Notice of dishonor is not required to be given to

an indorser in either of the following cases:

(a) When the drawee is a fictitious person or a person not having capacity to contract, and the indorser

was aware of that fact at the time he indorsed the instrument;

(b) Where the indorser is the person to whom the instrument is presented for payment;

(c) Where the instrument was made or accepted for his accommodation.

7. Effect of Failure to Give Notice

Sec. 117. Effect of omission to give notice of non-acceptance. – An omission to give notice of dishonor

by non-acceptance does not prejudice the rights of a holder in due course subsequent to the omission.

K. Discharge of Negotiable Instrument

1. Discharge of Negotiable Instrument

Sec. 119. Instrument; how discharged. – A negotiable instrument is discharged:

(a) By payment in due course by or on behalf of the principal debtor;

(b) By payment in due course by the party accommodated, where the instrument is made or accepted

for his accommodation;

(c) By the intentional cancellation thereof by the holder;

(d) By any other act which will discharge a simple contract for the payment of money;

(e) When the principal debtor becomes the holder of the instrument at or after maturity in his own right.

2. Discharge of Parties Secondarily Liable

Sec. 120. When persons secondarily liable on the instrument are discharged. – A person secondarily

liable on the instrument is discharged:

(a) By any act which discharges the instrument;

(b) By the intentional cancellation of his signature by the holder;

(c) By the discharge of a prior party;

(d) By a valid tender or payment made by a prior party;

(e) By a release of the principal debtor, unless the holder’s right of recourse against the party

secondarily liable is expressly reserved;

(f) By any agreement binding upon the holder to extend the time of payment, or to postpone the

holder’s right to enforce the instrument, unless made with the assent of the party secondarily liable, or

unless the right of recourse against such party is expressly reserved.

3. Right of Party who Discharged Instrument

Sec. 121. Right of party who discharges instrument. – Where the instrument is paid by a party

secondarily liable thereon, it is not discharged; but the party so paying it is remitted to his former rights

as regard all prior parties, and he may strike out his own and all subsequent indorsements and against

The Unofficial Cheat Sheet | 13

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

negotiate the instrument, except:

(a) Where it is payable to the order of a third person and has been paid by the drawer; and

(b) Where it was made or accepted for accommodation and has been paid by the party

accommodated.

4. Renunciation by Holder

Sec. 122. Renunciation by holder. – The holder may expressly renounce his rights against any party to

the instrument before, at, or after its maturity. An absolute and unconditional renunciation of his rights

against the principal debtor made at or after the maturity of the instrument discharges the instrument.

But a renunciation does not affect the rights of a holder in due course without notice. A renunciation

must be in writing, unless the instrument is delivered up to the person primarily liable thereon.

L. Material Alteration

1. Concept

Sec. 125. What constitutes a material alteration. – Any alteration which changes:

(a) The date;

(b) The sum payable, either for principal or interest;

(c) The time or place of payment:

(d) The number or the relations of the parties;

(e) The medium or currency in which payment is to be made;

Or which adds a place of payment where no place of payment is specified, or any other change or

addition which alters the effect of the instrument in any respect is a material alteration.

Q: Is alteration of the serial number of a check a material alteration?

A: No. It does not change any of the items required to be stated under Section 1, NIL (PNB v. CA)

2. Effect of Material Alteration

Sec. 124. Alteration of instrument; effect of . – Where a negotiable instrument is materially altered

without the assent of all parties liable thereon, it is avoided, except as against a party who has himself

made, authorized, or assented to the alteration and subsequent indorsers.

But when an instrument has been materially altered and is in the hands of a holder in due course not a

party to the alteration, he may enforce payment thereof according to its original tenor

M. Acceptance

1. Definition

2. Manner

Sec. 132. Acceptance; how made and so forth. – The acceptance of a bill is the signification by the

drawee of his assent to the order of the drawee. The acceptance must be in writing and signed by the

drawee. It must not express that the drawee will perform his promise by any other means than the

payment of money.

The Unofficial Cheat Sheet | 14

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

3. Time for Acceptance

Sec. 136. Time allowed drawee to accept. – The drawee is allowed twenty-four hours after

presentment in which to decide whether or not he will accept the bill; the acceptance, if given, dates as

of the day of presentation.

4. Rules Governing Acceptance

Sec. 138. Acceptance of incomplete bill. – A bill may be accepted before it has been signed by the

drawer, or while otherwise incomplete, or when it is overdue, or after it has been dishonored by a

previous refusal to accept, or by non-payment. But when a bill payable after sight is dishonored by non-

acceptance and the drawee subsequently accepts it, the holder, in the absence of any different

agreement, is entitled to have the bill accepted as of the date of the first presentment.

Sec. 139. Kinds of acceptance. – An acceptance is either general or qualified. A general acceptance

assents without qualification to the order of the drawer. A qualified acceptance in express terms varies

the effect of the bill as drawn.

Sec. 140. What constitutes a general acceptance. – An acceptance to pay at a particular place is a

general acceptance unless it expressly states that the bill is to be paid there only and not elsewhere.

Sec. 141. Qualified acceptance. – An acceptance is qualified which is:

(a) Conditional; that is to say, which makes payment by the acceptor dependent on the fulfillment of a

condition therein stated;

(b) Partial; that is to say, an acceptance to pay part only of the amount for which the bill is drawn;

(c) Local; that is to say, an acceptance to pay only at a particular place;

(d) Qualified as to time;

(e) The acceptance of some, one or more of the drawees but not of all.

Sec. 142. Rights of parties as to qualified acceptance. – The holder may refuse to take a qualified

acceptance and if he does not obtain an unqualified acceptance, he may treat the bill as dishonored by

non-acceptance. Where a qualified acceptance is taken, the drawer and indorsers are discharged from

liability on the bill, unless they have expressly or impliedly authorized the holder to take a qualified

acceptance, or subsequently assent thereto. When the drawer or an indorser receives notice of a

qualified acceptance, he must, within a reasonable time, express his dissent to the holder or he will be

deemed to have assented thereto.

N. Presentment for Acceptance

1. Time/Place/Manner of Presentment

Sec. 143. When presentment for acceptance must be made. – Presentment for acceptance must be

made:

(a) Where the bill is payable after sight, or in any other case, where presentment for acceptance is

necessary in order to fix the maturity of the instrument; or

(b) Where the bill expressly stipulates that it shall be presented for acceptance; or

(c) Where the bill is drawn payable elsewhere than at the residence or place of business of the drawee.

In no other case is presentment for acceptance necessary in order to render any party to the bill liable.

NOTE (Sundiang & Aquino): Not necessary to present a check for acceptance because it is not one of

those required to be presented for acceptance under Section 143.

Sec. 145. Presentment; how made. – Presentment for acceptance must be made by or on behalf of the

holder at a reasonable hour, on a business day and before the bill is overdue, to the drawee or some

person authorized to accept or refuse acceptance on his behalf; and

(a) Where a bill is addressed to two or more drawees who are not partners, presentment must be made

The Unofficial Cheat Sheet | 15

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

to them all, unless one has authority to accept or refuse acceptance for all, in which case presentment

may be made to him only;

(b) Where the drawee is dead, presentment may be made to his personal representative;

(c) Where the drawee has been adjudged a bankrupt or an insolvent, or has made an assignment for

the benefit of creditors, presentment may be made to him or to his trustee or assignee.

Sec. 146. On what days presentment may be made. – A bill may be presented for acceptance on any

day on which negotiable instruments may be presented for payment under the provisions of Sections

72 and 85 of this Act. When Saturday is not otherwise a holiday, presentment for acceptance may be

made before twelve o’clock, noon, on that day.

2. Effect of Failure to Make Presentment

Sec. 144. When failure to present releases drawer and indorser. – Except as herein otherwise

provided, the holder of a bill which is required by the next preceding section to be presented for

acceptance must either present it for acceptance or negotiate it within a reasonable time. If he fails to

do so, the drawer and all indorsers are discharged.

3. Dishonor by Non-Acceptance

Sec. 149. When dishonored by non-acceptance. – A bill is dishonored by non-acceptance:

(a) When it is duly presented for acceptance and such an acceptance as is prescribed by this Act is

refused or can not be obtained;

(b) When presentment for acceptance is excused, and the bill is not accepted.

O. Promissory Notes (see above, Sec. 184)

P. Checks

1. Definition

Sec. 185. Check, defined. – A check is a bill of exchange drawn on a bank payable on demand. Except

as herein otherwise provided, the provisions of this Act applicable to a bill of exchange payable on

demand apply to a check.

2. Kinds (Sundiang & Aquino, 66-69)

Cashier’s Certified Crossed Memorandum Traveler’s

A BoE drawn by a One drawn by a Done by writing Check on which Instruments

bank upon itself, depositor upon two (2) parallel the word purchased from

and is accepted funds to his credit lines diagonally on “memorandum” is banks, express

by its issuance. in a bank which a the left top portion written, signifying companies, or the

proper officer of of the checks. The that the drawer like, in various

Manager’s check the bank certifies crossing is special engages to pay denominations,

is of the same will be paid when where the name the bona fide which can be

nature, although duty of a bank or a holder absolutely used like cash

instead of being business and not upon a upon second

signed by the (From Magis 2016 institution is condition to signature by the

cashier, it is Summer written between pay upon purchaser.

signed by the Reviewer) two (2) parallel presentment or

manager who lines, which non-payment. Has the

signs the same for A check on which means that the characteristics of

The Unofficial Cheat Sheet | 16

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

the bank the drawee bank drawee should Such a check is a cashier’s check

has written an pay only with the evidence of debt of the issuer.

agreement intervention of that against the

whereby it company. The drawer, and Requires the

undertakes to pay crossing is although it may signature of the

the check at any general where the not be intended to purchaser at the

future time when words written be presented, has time he buys it

presented for between two (2) the same effect as and also at the

payment, such parallel lines are an ordinary check, time he uses it –

as by stamping on “and Co.” or “for and if passed to a when he obtains

the check the payee’s account third person, will the check from the

word “certified” only” (Associated be valid in his bank and when he

and underneath it Bank v. CA) hands like any delivers the same

is written the other check. to the

signature of the (From Magis 2016 (People v. establishment that

cashier. Summer Nitafan) will be paid

Reviewer) thereby.

EFFECTS OF

CERTIFICATION: EFFECTS:

a. Equivalent to

acceptance and is • The check may

the operative act not be encashed

that makes the but

drawee bank only deposited in

liable the bank

b. It operates as • The check may

an assignment of be negotiated only

the funds of once

the drawer in the – to one who has

hands of the an account with a

drawee bank bank

c. If obtained by • The act of

the holder, it crossing the

discharges the check serves as

persons warning to the

secondarily liable holder that the

check has

been issued for a

definite purpose

so that he must

inquire if he has

received the

check pursuant to

that purpose,

otherwise, he is

not a holder in

due course

OTHER NOTES:

• A holder of

crossed-checks is

obliged to

The Unofficial Cheat Sheet | 17

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

inquire as to the

purpose for which

the checks were

issued. (Bataan

Cigar v. CA,

G.R. No. 93048,

March 3, 1994)

• The law does not

require the payee

to be interested in

the obligation in

consideration

for which the

check was issued.

The cause

or reason of

issuance is

inconsequential

(in connection

with BP 22) in

determining

criminal liability.

(Ngo v. People,

G.R. No.

155815, July 14,

2004)

• When a payee of

a crossed check

issued with the

notation ”for

payee’s account

only” the proceeds

of the said check

belong only

to the payee.

Failure of the

collecting bank

to follow said

notation will make

it liable in case it

allows it to be

withdrawn by an

unauthorized

individual.

(Associated Bank

v. CA, G.R. No.

89802, May 7,

1992)

3. Presentment for Payment

i. Time

The Unofficial Cheat Sheet | 18

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

Sec. 186. Within what time a check must be presented. – A check must be presented for payment

within a reasonable time after its issue or the drawer will be discharged from liability thereon to the

extent of the loss caused by the delay.

ii. Effect of Delay

The Unofficial Cheat Sheet | 19

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

VIII. Banking Laws

A. The New Central Bank Act ( R.A. No. 7653)

1. State Policies

- Sec. 1, New Central Bank Act (NCBA)

Section 1. Declaration of Policy. - The State shall maintain a central monetary authority that shall

function and operate as an independent and accountable body corporate in the discharge of its

mandated responsibilities concerning money, banking and credit. In line with this policy, and

considering its unique functions and responsibilities, the central monetary authority established under

this Act, while being a government-owned corporation, shall enjoy fiscal and administrative autonomy.

2. Responsibility and Primary Objective

- Sec. 3, NCBA

Section 3. Responsibility and Primary Objective. - The Bangko Sentral shall provide policy

directions in the areas of money, banking, and credit. It shall have supervision over the operations of

banks and exercise such regulatory powers as provided in this Act and other pertinent laws over the

operations of finance companies and non-bank financial institutions performing quasi-banking

functions, hereafter referred to as quasi-banks, and institutions performing similar functions.

The primary objective of the Bangko Sentral is to maintain price stability conducive to a

balanced and sustainable growth of the economy. It shall also promote and maintain monetary stability

and the convertibility of the peso.

- Functions as Banker and Financial Advisor of the Government – Secs.

110-115, Sec. 123, NCBA

Section 110. Designation of Bangko Sentral as Banker of the Government. - The Bangko Sentral

shall act as a banker of the Government, its political subdivisions and instrumentalities.

Section 111. Representation with the International Monetary Fund. - The Bangko Sentral shall

represent the Government in all dealings, negotiations and transactions with the International Monetary

Fund and shall carry such accounts as may result from Philippine membership in, or operations with,

said Fund.

Section 112. Representation with Other Financial Institutions. - The Bangko Sentral may be

authorized by the Government to represent it in dealings, negotiations or transactions with the

International Bank for Reconstruction and Development and with other foreign or international financial

institutions or agencies. The President may, however, designate any of his other financial advisors to

jointly represent the Government in such dealings, negotiations or transactions.

Section 113. Official Deposits. - The Bangko Sentral shall be the official depository of the

Government, its political subdivisions and instrumentalities as well as of government-owned or

controlled corporations and, as a general policy, their cash balances should be deposited with the

Bangko Sentral, with only minimum working balances to be held by government-owned banks and

such other banks incorporated in the Philippines as the Monetary Board may designate, subject to

such rules and regulations as the Board may prescribe: Provided, That such banks may hold deposits

of the political subdivisions and instrumentalities of the Government beyond their minimum working

The Unofficial Cheat Sheet | 20

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

balances whenever such subdivisions or instrumentalities have outstanding loans with said banks.

The Bangko Sentral may pay interest on deposits of the Government or of its political

subdivisions and instrumentalities, as well as on deposits of banks with the Bangko Sentral.

Section 114. Fiscal Operations. - The Bangko Sentral shall open a general cash account for

the Treasurer of the Philippines, in which the liquid funds of the Government shall be deposited.

Transfers of funds from this account to other accounts shall be made only upon order of the

Treasurer of the Philippines.

Section 115. Other Banks as Agents of the Bangko Sentral. - In the performance of its

functions as fiscal agent, the Bangko Sentral may engage the services of other government-owned and

controlled banks and of other domestic banks for operations in localities at home or abroad in which

the Bangko Sentral does not have offices or agencies adequately equipped to perform said operations:

Provided, however, That for fiscal operations in foreign countries, the Bangko Sentral may engage the

services of foreign banking and financial institutions.

Section 123. Financial Advice on Official Credit Operations. - Before undertaking any credit

operation abroad, the Government, through the Secretary of Finance, shall request the opinion, in

writing, of the Monetary Board on the monetary implications of the contemplated action. Such opinions

must similarly be requested by all political subdivisions and instrumentalities of the Government before

any credit operation abroad is undertaken by them.

The opinion of the Monetary Board shall be based on the gold and foreign exchange resources

and obligations of the nation and on the effects of the proposed operation on the balance of payments

and on monetary aggregates.

Whenever the Government, or any of its political subdivisions or instrumentalities, contemplates

borrowing within the Philippines, the prior opinion of the Monetary Board shall likewise be requested in

order that the Board may render an opinion on the probable effects of the proposed operation on

monetary aggregates, the price level, and the balance of payments.

- No Injunction Rule on Supervisory Powers of BSP – Sec 25, NCBA

Section 25. Supervision and Examination. - The Bangko Sentral shall have supervision over, and

conduct periodic or special examinations of, banking institutions and quasi-banks, including their

subsidiaries and affiliates engaged in allied activities.

For purposes of this section, a subsidiary means a corporation more than fifty percent (50%) of

the voting stock of which is owned by a bank or quasi-bank and an affiliate means a corporation the

voting stock of which, to the extent of fifty percent (50%) or less, is owned by a bank or quasi-bank or

which is related or linked to such institution or intermediary through common stockholders or such

other factors as may be determined by the Monetary Board.

The department heads and the examiners of the supervising and/or examining departments are

hereby authorized to administer oaths to any director, officer, or employee of any institution under their

respective supervision or subject to their examination and to compel the presentation of all books,

documents, papers or records necessary in their judgment to ascertain the facts relative to the true

condition of any institution as well as the books and records of persons and entities relative to or in

connection with the operations, activities or transactions of the institution under examination, subject to

the provision of existing laws protecting or safeguarding the secrecy or confidentiality of bank deposits

as well as investments of private persons, natural or juridical, in debt instruments issued by the

Government.

The Unofficial Cheat Sheet | 21

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

No restraining order or injunction shall be issued by the court enjoining the Bangko Sentral from

examining any institution subject to supervision or examination by the Bangko Sentral, unless there is

convincing proof that the action of the Bangko Sentral is plainly arbitrary and made in bad faith and the

petitioner or plaintiff files with the clerk or judge of the court in which the action is pending a bond

executed in favor of the Bangko Sentral, in an amount to be fixed by the court. The provisions of Rule

58 of the New Rules of Court insofar as they are applicable and not inconsistent with the provisions of

this section shall govern the issuance and dissolution of the restraining order or injunction

contemplated in this section.

3. Monetary Board - Powers and Functions

- Secs. 6-16, NCBA

Section 6. Composition of the Monetary Board. - The powers and functions of the Bangko Sentral

shall be exercised by the Bangko Sentral Monetary Board, hereafter referred to as the Monetary Board,

composed of seven (7) members appointed by the President of the Philippines for a term of six (6)

years.

The seven (7) members are:

(a) the Governor of the Bangko Sentral, who shall be the Chairman of the Monetary Board. The

Governor of the Bangko Sentral shall be head of a department and his appointment shall be subject to

confirmation by the Commission on Appointments. Whenever the Governor is unable to attend a

meeting of the Board, he shall designate a Deputy Governor to act as his alternate: Provided, That in

such event, the Monetary Board shall designate one of its members as acting Chairman;

(b) a member of the Cabinet to be designated by the President of the Philippines. Whenever the

designated Cabinet Member is unable to attend a meeting of the Board, he shall designate an

Undersecretary in his Department to attend as his alternate; and

(c) five (5) members who shall come from the private sector, all of whom shall serve full-time:

Provided, however, That of the members first appointed under the provisions of this subsection, three

(3) shall have a term of six (6) years, and the other two (2), three (3) years.

No member of the Monetary Board may be reappointed more than once.

Section 7. Vacancies. - Any vacancy in the Monetary Board created by the death, resignation,

or removal of any member shall be filled by the appointment of a new member to complete the

unexpired period of the term of the member concerned.

Section 8. Qualifications. - The members of the Monetary Board must be natural-born citizens

of the Philippines, at least thirty-five (35) years of age, with the exception of the Governor who should

at least be forty (40) years of age, of good moral character, of unquestionable integrity, of known

probity and patriotism, and with recognized competence in social and economic disciplines.

Section 9. Disqualifications. - In addition to the disqualifications imposed by Republic Act No.

6713, a member of the Monetary Board is disqualified from being a director, officer, employee,

consultant, lawyer, agent or stockholder of any bank, quasi-bank or any other institution which is

subject to supervision or examination by the Bangko Sentral, in which case such member shall resign

from, and divest himself of any and all interests in such institution before assumption of office as

member of the Monetary Board.

The members of the Monetary Board coming from the private sector shall not hold any other

public office or public employment during their tenure.

The Unofficial Cheat Sheet | 22

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

No person shall be a member of the Monetary Board if he has been connected directly with any

multilateral banking or financial institution or has a substantial interest in any private bank in the

Philippines, within one (1) year prior to his appointment; likewise, no member of the Monetary Board

shall be employed in any such institution within two (2) years after the expiration of his term except

when he serves as an official representative of the Philippine Government to such institution.

Section 10. Removal. - The President may remove any member of the Monetary Board for any

of the following reasons:

(a) If the member is subsequently disqualified under the provisions of Section 8 of this Act; or

(b) If he is physically or mentally incapacitated that he cannot properly discharge his duties and

responsibilities and such incapacity has lasted for more than six (6) months; or

(c) If the member is guilty of acts or operations which are of fraudulent or illegal character or which

are manifestly opposed to the aims and interests of the Bangko Sentral; or

(d) If the member no longer possesses the qualifications specified in Section 8 of this Act.

Section 11. Meetings. - The Monetary Board shall meet at least once a week. The Board may

be called to a meeting by the Governor of the Bangko Sentral or by two (2) other members of the

Board.

The presence of four (4) members shall constitute a quorum: Provided, That in all cases the

Governor or his duly designated alternate shall be among the four (4).

Unless otherwise provided in this Act, all decisions of the Monetary Board shall require the

concurrence of at least four (4) members.

The Bangko Sentral shall maintain and preserve a complete record of the proceedings and

deliberations of the Monetary Board, including the tapes and transcripts of the stenographic notes,

either in their original form or in microfilm.

Section 12. Attendance of the Deputy Governors. - The Deputy Governors may attend the

meetings of the Monetary Board with the right to be heard.

Section 13. Salary. - The salary of the Governor and the members of the Monetary Board from

the private sector shall be fixed by the President of the Philippines at a sum commensurate to the

importance and responsibility attached to the position.

Section 14. Withdrawal of Persons Having a Personal Interest. - In addition to the

requirements of Republic Act No. 6713, any member of the Monetary Board with personal or pecuniary

interest in any matter in the agenda of the Monetary Board shall disclose his interest to the Board and

shall retire from the meeting when the matter is taken up. The decision taken on the matter shall be

made public. The minutes shall reflect the disclosure made and the retirement of the member

concerned from the meeting.

Section 15. Exercise of Authority. - In the exercise of its authority, the Monetary Board shall:

(a) issue rules and regulations it considers necessary for the effective discharge of the

responsibilities and exercise of the powers vested upon the Monetary Board and the Bangko Sentral.

The rules and regulations issued shall be reported to the President and the Congress within fifteen (15)

days from the date of their issuance;

(b) direct the management, operations, and administration of the Bangko Sentral, reorganize its

The Unofficial Cheat Sheet | 23

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

personnel, and issue such rules and regulations as it may deem necessary or convenient for this

purpose. The legal units of the Bangko Sentral shall be under the exclusive supervision and control of

the Monetary Board;

(c) establish a human resource management system which shall govern the selection, hiring,

appointment, transfer, promotion, or dismissal of all personnel. Such system shall aim to establish

professionalism and excellence at all levels of the Bangko Sentral in accordance with sound principles

of management.

A compensation structure, based on job evaluation studies and wage surveys and subject to the

Board's approval, shall be instituted as an integral component of the Bangko Sentral's human resource

development program: Provided, That the Monetary Board shall make its own system conform as

closely as possible with the principles provided for under Republic Act No. 6758: Provided, however,

That compensation and wage structure of employees whose positions fall under salary grade 19 and

below shall be in accordance with the rates prescribed under Republic Act No. 6758.

On the recommendation of the Governor, appoint, fix the remunerations and other emoluments,

and remove personnel of the Bangko Sentral, subject to pertinent civil service laws: Provided, That the

Monetary Board shall have exclusive and final authority to promote, transfer, assign, or reassign

personnel of the Bangko Sentral and these personnel actions are deemed made in the interest of the

service and not disciplinary: Provided, further, That the Monetary Board may delegate such authority to

the Governor under such guidelines as it may determine.

(d) adopt an annual budget for and authorize such expenditures by the Bangko Sentral as are in

the interest of the effective administration and operations of the Bangko Sentral in accordance with

applicable laws and regulations; and

(e) indemnify its members and other officials of the Bangko Sentral, including personnel of the

departments performing supervision and examination functions against all costs and expenses

reasonably incurred by such persons in connection with any civil or criminal action, suit or proceedings

to which he may be, or is, made a party by reason of the performance of his functions or duties, unless

he is finally adjudged in such action or proceeding to be liable for negligence or misconduct.

In the event of a settlement or compromise, indemnification shall be provided only in connection

with such matters covered by the settlement as to which the Bangko Sentral is advised by external

counsel that the person to be indemnified did not commit any negligence or misconduct.

The costs and expenses incurred in defending the aforementioned action, suit or proceeding

may be paid by the Bangko Sentral in advance of the final disposition of such action, suit or proceeding

upon receipt of an undertaking by or on behalf of the member, officer, or employee to repay the amount

advanced should it ultimately be determined by the Monetary Board that he is not entitled to be

indemnified as provided in this subsection.

Section 16. Responsibility. - Members of the Monetary Board, officials, examiners, and

employees of the Bangko Sentral who willfully violate this Act or who are guilty of negligence, abuses

or acts of malfeasance or misfeasance or fail to exercise extraordinary diligence in the performance of

his duties shall be held liable for any loss or injury suffered by the Bangko Sentral or other banking

institutions as a result of such violation, negligence, abuse, malfeasance, misfeasance or failure to

exercise extraordinary diligence.

Similar responsibility shall apply to members, officers, and employees of the Bangko Sentral

for: (1) the disclosure of any information of a confidential nature, or any information on the discussions

or resolutions of the Monetary Board, or about the confidential operations of the Bangko Sentral,

unless the disclosure is in connection with the performance of official functions with the Bangko

Sentral, or is with prior authorization of the Monetary Board or the Governor; or (2) the use of such

The Unofficial Cheat Sheet | 24

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

information for personal gain or to the detriment of the Government, the Bangko Sentral or third parties:

Provided, however, That any data or information required to be submitted to the President and/or the

Congress, or to be published under the provisions of this Act shall not be considered confidential.

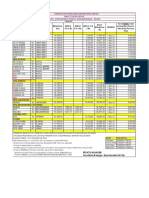

4. How BSP Handles Banks in Distress

o Note: Dean Hofi says read the following provisions from new PDIC Charter (RA 10846):

Sections 8-16), coupled with Section 29 of the NCBA.

o Note: “Resolution” is a new thing under the PDIC Charter where PDIC is going to try to

sell the bank (Sec 11, PDIC Charter)

o Note: under PDIC Charter, if you’re put under Receivership: CLOSED ka na (Sec 12),

NO MORE REHABILITATION, unlike Sec 30 of the NCBA. See also: Sec 13.

o For summarized version of everything: SEE Dean Hofi’s flowchart for Banks in

Distress below.

Context: your first step: look at “Corrective Measures (MB).” GR: Things start

there; XPN: you voluntarily go straight to LIQUIDATION. Liquidation is your

WORST CASE SCENARIO.

4.1. No Injunction Rule on Conservatorship, Receivership

and Liquidation - Sec. 30, NCBA

Conservatorship – remedy of the BSP when you don’t have the “ready money”

The Unofficial Cheat Sheet | 25

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

Section 30. Proceedings in Receivership and Liquidation. - Whenever, upon report of the head of

the supervising or examining department, the Monetary Board finds that a bank or quasi-bank:

(a) is unable to pay its liabilities as they become due in the ordinary course of business: Provided,

That this shall not include inability to pay caused by extraordinary demands induced by financial panic

in the banking community;

(b) has insufficient realizable assets, as determined by the Bangko Sentral, to meet its liabilities; or

(c) cannot continue in business without involving probable losses to its depositors or creditors; or

(d) has willfully violated a cease and desist order under Section 37 that has become final, involving

acts or transactions which amount to fraud or a dissipation of the assets of the institution; in which

cases, the Monetary Board may summarily and without need for prior hearing forbid the institution from

doing business in the Philippines and designate the Philippine Deposit Insurance Corporation as

receiver of the banking institution.

For a quasi-bank, any person of recognized competence in banking or finance may be

designed as receiver.

The receiver shall immediately gather and take charge of all the assets and liabilities of the

institution, administer the same for the benefit of its creditors, and exercise the general powers of a

receiver under the Revised Rules of Court but shall not, with the exception of administrative

expenditures, pay or commit any act that will involve the transfer or disposition of any asset of the

institution: Provided, That the receiver may deposit or place the funds of the institution in non-

speculative investments. The receiver shall determine as soon as possible, but not later than ninety

(90) days from take over, whether the institution may be rehabilitated or otherwise placed in such a

condition so that it may be permitted to resume business with safety to its depositors and creditors and

the general public: Provided, That any determination for the resumption of business of the institution

shall be subject to prior approval of the Monetary Board.

If the receiver determines that the institution cannot be rehabilitated or permitted to resume

business in accordance with the next preceding paragraph, the Monetary Board shall notify in writing

the board of directors of its findings and direct the receiver to proceed with the liquidation of the

institution. The receiver shall:

(1) file ex parte with the proper regional trial court, and without requirement of prior notice or any

other action, a petition for assistance in the liquidation of the institution pursuant to a liquidation plan

adopted by the Philippine Deposit Insurance Corporation for general application to all closed banks. In

case of quasi-banks, the liquidation plan shall be adopted by the Monetary Board. Upon acquiring

jurisdiction, the court shall, upon motion by the receiver after due notice, adjudicate disputed claims

against the institution, assist the enforcement of individual liabilities of the stockholders, directors and

officers, and decide on other issues as may be material to implement the liquidation plan adopted. The

receiver shall pay the cost of the proceedings from the assets of the institution.

(2) convert the assets of the institutions to money, dispose of the same to creditors and other

parties, for the purpose of paying the debts of such institution in accordance with the rules on

concurrence and preference of credit under the Civil Code of the Philippines and he may, in the name

of the institution, and with the assistance of counsel as he may retain, institute such actions as may be

necessary to collect and recover accounts and assets of, or defend any action against, the institution.

The assets of an institution under receivership or liquidation shall be deemed in custodia legis in the

hands of the receiver and shall, from the moment the institution was placed under such receivership or

liquidation, be exempt from any order of garnishment, levy, attachment, or execution.

The actions of the Monetary Board taken under this section or under Section 29 of this Act shall

The Unofficial Cheat Sheet | 26

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)

be final and executory, and may not be restrained or set aside by the court except on petition for

certiorari on the ground that the action taken was in excess of jurisdiction or with such grave abuse of

discretion as to amount to lack or excess of jurisdiction. The petition for certiorari may only be filed by

the stockholders of record representing the majority of the capital stock within ten (10) days from

receipt by the board of directors of the institution of the order directing receivership, liquidation or

conservatorship.

The designation of a conservator under Section 29 of this Act or the appointment of a receiver

under this section shall be vested exclusively with the Monetary Board. Furthermore, the designation of

a conservator is not a precondition to the designation of a receiver.

a. Conservatorship

- Sec. 29, NCBA

Section 29. Appointment of Conservator. - Whenever, on the basis of a report submitted by the

appropriate supervising or examining department, the Monetary Board finds that a bank or a quasi-

bank is in a state of continuing inability or unwillingness to maintain a condition of liquidity deemed

adequate to protect the interest of depositors and creditors, the Monetary Board may appoint a

conservator with such powers as the Monetary Board shall deem necessary to take charge of the

assets, liabilities, and the management thereof, reorganize the management, collect all monies and

debts due said institution, and exercise all powers necessary to restore its viability. The conservator

shall report and be responsible to the Monetary Board and shall have the power to overrule or revoke

the actions of the previous management and board of directors of the bank or quasi-bank.

The conservator should be competent and knowledgeable in bank operations and

management. The conservatorship shall not exceed one (1) year.

The conservator shall receive remuneration to be fixed by the Monetary Board in an amount not

to exceed two-thirds (2/3) of the salary of the president of the institution in one (1) year, payable in

twelve (12) equal monthly payments: Provided, That, if at any time within one-year period, the

conservatorship is terminated on the ground that the institution can operate on its own, the conservator

shall receive the balance of the remuneration which he would have received up to the end of the year;

but if the conservatorship is terminated on other grounds, the conservator shall not be entitled to such

remaining balance. The Monetary Board may appoint a conservator connected with the Bangko

Sentral, in which case he shall not be entitled to receive any remuneration or emolument from the

Bangko Sentral during the conservatorship. The expenses attendant to the conservatorship shall be

borne by the bank or quasi-bank concerned.

The Monetary Board shall terminate the conservatorship when it is satisfied that the institution

can continue to operate on its own and the conservatorship is no longer necessary. The

conservatorship shall likewise be terminated should the Monetary Board, on the basis of the report of

the conservator or of its own findings, determine that the continuance in business of the institution

would involve probable loss to its depositors or creditors, in which case the provisions of Section 30

shall apply.

b. Closure

- “Close Now-Hear Later” Scheme – Vivas v. Monetary Board of

BSP and PDIC, GR No. 191424, Aug. 7, 2013

c. Receivership

The Unofficial Cheat Sheet | 27

COMMERCIAL LAW

(Letters of Credit, Trust Receipts,

Nego, Banking, SecReg)