Professional Documents

Culture Documents

Result Update Bharti Airtel

Result Update Bharti Airtel

Uploaded by

Vrajesh ChitaliaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Result Update Bharti Airtel

Result Update Bharti Airtel

Uploaded by

Vrajesh ChitaliaCopyright:

Available Formats

Bharti Airtel (BHAAIR)

CMP: | 590 Target: | 700 (19%) Target Period: 12 months BUY

May 20, 2020

Another strong show led by India wireless!

Bharti Airtel’s Q4FY20 performance was strong on the operating front. Key Particulars

highlight was robust 12.5 million (mn) 4G subscribers net adds in the quarter Particulars Amount

coupled with tariff hike pass through that led to strong 14.3% QoQ growth

Result Update

Market Capitalisation (| Crore) 321,717

in ARPU at | 154. Consolidated revenue was at | 23722.7 crore, up 8.1% Total Debt (| Crore) 148,228

QoQ driven by 16% QoQ growth in Indian wireless revenues at | 12,953 Cash & Inv (| Crore) 29,061

crore while Africa revenues were up 3.5% QoQ at | 6488.8 crore. EV (| Crore) 440,884

Consolidated EBITDA margins were at 42.9% (up 70 bps QoQ). The margin 52 week H/L 603/ 322

expansion was led by Indian margin, up 150 bps QoQ at 42.7%, with Indian Equity capital 2,727.8

wireless margins at 39.2%, up 330 bps QoQ, largely a function of tariff hike. Face value 5.0

India wireless business – reflecting sustained strength

Key Highlights

Q4FY20 was the fifth consecutive quarter of India wireless revenues growth.

India’s wireless revenue came in at | 12953 crore (up 16% QoQ), with ARPU

Key highlight was robust 12.5 million

(mn) 4G subscribers net adds during

of | 154, up 14.3% QoQ. Superior pass through of tariff hike vis-à-vis peer

the quarter coupled with tariff hike pass

clearly reflects superior customer quality and revenue market share gain.

through leading to 14.3% QoQ growth

The company reported a net subscriber addition of 0.6 mn subscribers QoQ

in ARPU at | 154

and a strong 12.5 million (mn) 4G subscribers net adds during the quarter.

The company, notwithstanding the recent tariff hike, hopes for near term Maintain our BUY rating with revised

ARPU of | 200 and medium to long term ARPU of | 300, in order to make DCF based target price of | 700/share

decent RoCE. It indicated it would continue to drive ARPU growth ahead

ICICI Securities – Retail Equity Research

through natural upgrade to 4G and acceleration to post-paid (through Airtel

Thanks). We expect monthly ARPU to reach | 184 in FY22 vs. current levels Price Chart

of | 154 currently, as we do not bake in any step up tariff hike.

600 14000

AGR issue unresolved but company well-funded to tide over it 450 11200

We note that the Supreme Court has ordered that no exercise of self- 8400

300

assessment/reassessment is to be done and dues that were placed before 5600

the court have to be paid, including interest and penalty. The company has 150 2800

already paid | 17,749 crore and is awaiting a DoT plea of staggered payment

that will be heard at the next hearing (delayed owing to Covid-19). Most 0 0

Feb-18

May-20

May-17

Nov-18

importantly, while there is uncertainty on the AGR issue, fund raising has Aug-19

ensured it would be able to serve the same, even in full demand.

Valuation & Outlook Airtel(LHS) Nifty Index

Bharti Airtel continues to report a gain in revenue market share with stable

KPI across and also enjoys a comfortable leverage vis-à-vis peers. We note

that while the AGR issue is sub-judice, fund raising has ensured it would be

able to serve the same. With a resilient performance amid challenging times, Research Analyst

Airtel is one the better placed telecom players. We maintain our BUY rating

Bhupendra Tiwary, CFA

on the stock with a DCF based target price of | 700/share. The target price bhupendra.tiwary@icicisecurities.com

increase is expected to be largely led by superior medium term growth over

the next three to four years, driven by a favourable industry structure.

Key Financial Summary

(Year-end March) FY18 FY19 FY20E FY21E FY22E CAGR (FY19-22E)

Net Sales (| crore) 83,687.9 80,780.2 87,533.7 102,645.6 112,436.5 13.3

EBITDA (| crore) 30,065.0 25,629.5 36,485.6 47,058.5 53,859.9 21.5

Net Profit (| crore) 1,099.0 409.5 (32,188.6) 4,009.6 7,524.1 NA

EPS (|) 2.7 1.0 NA 7.3 13.8

P/E (x) 214.5 575.6 NA 80.2 42.8

Price / Book (x) 3.4 3.3 4.2 4.2 3.8

EV/EBITDA (x) 14.0 16.9 12.1 9.0 7.6

RoCE (%) 5.6 2.1 3.5 7.1 9.0

s

RoE (%) 2.7 (3.5) (4.7) 5.2 9.0

Source: Company, ICICI Direct Research

EMISPDF in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Exhibit 1: Variance Analysis

Q4FY20 Q4FY20E Q4FY19 Q3FY20 YoY (%) QoQ (%) Comments

Revenue beat led by superior Indian wireless revenues

Revenue 23,722.7 22,716.9 20,602.2 21,947.1 15.1 8.1

driven by strong ARPU growth of ~14% QoQ

Employee Expenses 1,031.6 964.1 942.9 965.1 9.4 6.9

Marketing Expenses 2,477.3 2,218.4 2,901.6 2,324.2 -14.6 6.6

Access Charges 2,827.0 2,710.2 2,441.0 2,710.9 15.8 4.3

Network Operating 5,201.5 4,965.7 5,962.2 4,934.5 -12.8 5.4

License Fee 2,020.1 1,862.3 1,728.8 1,766.6 16.8 14.3

EBITDA 10,165.2 9,896.2 6,625.7 9,245.8 53.4 9.9

EBITDA Margin (%) 42.9 43.6 32.2 42.1 1069 bps 72 bps Margin expansion driven by Indian wireless business

Depreciation 7,055.0 7,054.8 5,493.4 6,940.8 28.4 1.6

Interest 3,307.6 3,137.2 2,532.3 2,984.6 30.6 10.8

Exceptional Items 7,004.0 0.0 -2,022.1 1,050.0 -446.4 567.0

Total Tax -2,033.5 -200.0 137.4 -1,037.9 -1,580.0 95.9

PAT -5,237.0 -425.7 107.2 -1,035.3 -4,985.3 405.8

Subscribers (Mn) 283.7 280.2 282.6 283.0 0.4 0.2

ARPU 154 148 123 135 25.2 14.3

Source: Company, ICICI Direct Research

Exhibit 2: Change in estimates

FY21E FY22E

(| Crore) Old New % Change Old New % Change Comments

Realign our estimates post FY20

Revenue 101,020 102,646 1.6 111282 112,437 1.0

numbers

EBITDA 46,831 47,058 0.5 53868 53,860 0.0

EBITDA Margin (%) 46.4 45.8 -55 bps 48.4 47.9 -50 bps

PAT 4,522 4,010 -11.3 8568 7,524 -12.2 Realign interest and depreciation costs

EPS (|) 8.3 7.3 -11.3 15.7 13.8 -12.2

Source: Company, ICICI Direct Research

Exhibit 3: Key Assumptions

Current Earlier

FY18 FY19E FY20 FY21E FY22E FY21E FY22E

India

Wireless Subs (Mn) 304.2 282.6 283.7 298.1 310.2 294.5 306.4

ARPU 132 113 135 171 184 172 188

Total Minutes (Bn) 1,946 2,811 3,035 3,329 3,482 3,104 3,247

MOU (mins) 561 798 893 954 954 900 901

Africa

Subscriber base 89.3 98.9 110.6 116.2 123.4 113.2 120.1

ARPU ($) 3.1 2.9 2.8 2.8 2.8 2.8 2.8

Total Minutes 162.0 207.3 250.1 302.8 360.9 281.7 308.3

MoU 159.5 183.7 199.0 222.5 251.0 212.6 220.3

Source: Company, ICICI Direct Research

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 2

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Business Highlights (India)

Overall revenues & EBITDA: India revenues were up 10.4% QoQ at

| 17438.3 crore. Overall Indian margin was up 150 bps QoQ at

42.7%. The company has guided that incremental EBITDA margins

would be 60-70%

Wireless revenues & EBITDA: Indian wireless revenues were up 16%

QoQ at | 12,953 crore, driven by strong ARPU growth of 14.3% at

| 154. The growth was largely a function of pass through of tariff

hike done in December, 2019 as well as strong addition of 4G data

customers that have higher ARPU. The company also indicated that

but for Covid impact in the last 10 days in Q4, revenues would have

been higher

Subscriber base and addition: Overall subscriber (sub) base saw net

addition of 0.6 mn QoQ at 283.7 mn. Churn rate was steady QoQ at

2.6%. Key positive highlight in the wireless business was healthy 4G

net adds of ~12.5 mn during the quarter, with 4G data sub base at

136.3 mn (overall data base of 148.6 mn). The company indicated

that 2G to 4G conversion will continue to drive sub addition traction

Minutes and data usage: Data usage/customer was up 7.5% QoQ to

14.6 GB. Minutes of usage (MOU) per subscriber was at 965 minutes,

up 7.5% QoQ. The total minutes on network was up 8.3% QoQ to

821.9 billion (bn) minutes

Non-wireless: On the India non-wireless front, home services

(broadband) revenues were up 3.2% QoQ at | 572.5 crore while

Airtel business (enterprise) revenues were up 1.8% QoQ at | 3376.2

crore. DTH reported revenues, however, witnessed a steep decline

of 23.8% QoQ at | 603.5 crore, largely due to revenue recognition

policy change with core revenue growth of 1.3% QoQ

Network capacity and capex: The company has maintained

continued access expansion in the form of sites additions (~4500

sites) and mobile broadband BTS additions (30000+ addition in Q4).

Given the higher traction in data subs as well as data demand, the

company pulled forward some capex during the quarter. For Q3,

India mobile capex was at | 6969 crore (vs. | 2542 crore in Q3) with

overall India capex of | 9521 crore (vs. | 4082 crore in Q3). For FY20,

India mobile capex was at | 15145 crore (vs. | 20012 crore in FY19)

with overall India capex of | 20672 crore (vs. | 24187 crore in FY19)

Business highlights (Africa)

Africa revenues improved 2.9% QoQ to US$922 million (mn)

(constant currency driven by Nigeria, with EBITDA margins of 44.1%

(down 100 bps QoQ) largely owing to higher sales and marketing

expenses sequentially. In rupee terms, Africa revenues were up

3.5% QoQ at | 6488.8 crore

There was a one-time US$75 million forex loss on account of

devaluation on foreign exchange denominated liabilities as a result

of the devaluation of Nigerian naira, Kenyan and Ugandan shilling

and Zambian kwacha

Subscriber base was up 3.2% QoQ at 110.6 mn with ARPU at

US$2.8, down 0.8% QoQ. Data subs base was up 7.8% QoQ at 35

mn while data usage was up 15.4% QoQ at 219 bn MB. Data usage

per subscriber was at 2.1 GB per month, up 9.0% QoQ

In constant currency, Nigeria reported 7.3% QoQ growth to US$383

mn while EBITDA margins were up 80 bps QoQ at 55.5%

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 3

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

In constant currency, East Africa reported 0.6% QoQ growth to

US$279 mn while EBITDA margins were down 10 bps at 40.5%

In constant currency, Rest of Africa reported 0.9% QoQ revenue

decline at US$220 mn while EBITDA margins were at 32.6%

Airtel Money reported 2.4% QoQ revenue growth at US$86 mn

while EBITDA margins were at 47.2%

Africa net debt (including lease obligations) was at US$3.25 bn.

Capex was ~US$240 mn

Operating free cash flow for Q3FY20 was at US$125 million

Other Highlights

Covd-19 impact (so far): The company termed the Covid-19 as

mixed bag event with implications such as

o Significant surge in demand for home broadband

o Significant increase in B2B business

o Growth in new segments (through collaboration/video

conferencing)

o Resilient 4G customers base

o New device addition have been very low due to lockdown

o Significant pressure on low end subs

Digital: To scale up its digital platforms business, Airtel has been

betting on four pillars: data, distribution, payments and network. The

company has over 150 million monthly active users across its digital

assets viz Airtel Thanks, Wynk and X Stream. Furthermore, over 1.1

million retailers transact and make payments daily on its Mitra App.

Airtel has been partnering with several companies and is also doing

pilots for several services to develop new streams of revenues and

drive efficiencies. The company also alluded to strong partnerships

in the work from home area, cyber security services, in IoT and in

delivering cloud services through key global players such as Cisco,

Zoom, Symantec, Palo Alto Networks, Google, Microsoft, Amazon,

etc

Home broadband demand: The company added ~63k broadband

subs during the quarter. Airtel indicated that India is an underserved

market with home broadband demand being expedited during

lockdown. They have scope to expand beyond the top 10 cities and

are partnering with local cable operators. The home pass addition

has stepped up and cost per home pass has gone down significantly

Spectrum Holdings: While the company is comfortable with existing

spectrum footprints, they have refarmed 25 MHz of 3G spectrum for

4G. They also seek to fill the gap in the challengers markets of Kerala,

UP West, Haryana through sub-giga hertz spectrum

AGR case: Based on self-assessment, the company has made

payments aggregating | 12749 crore to DoT with an additional

| 5000 crore as a deposit (subject to subsequent refund/ adjustment)

to cover differences resulting from re-verification /reconciliation by

DoT. They also said that DoT had filed an application with respect to

giving reasonable time to the affected parties (a period of 20 years

with 8% interest). However, the Supreme Court ordered that no

exercise of self-assessment/reassessment is to be done. The dues

that were placed before the court have to be paid, including interest

and penalty. However, DoT’s plea of staggered payment will be

heard at the next hearing (delayed owing to Covid-19)

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 4

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Debt & capex: Net debt (excluding lease liability) was at ~| 88251

crore, with net debt to annualised reported EBITDA at 2.9x. Total

capex spend for the quarter was | 11,339 crore vs. | 5183 crore in

Q3 (FY20 capex at | 25359 crore vs. | 28743 crore in FY19). The

company indicated that while they would continue to invest in

networks, capex intensity will go down and FY21 capex will be lower

than FY20

Fund raise: During Q4, the company successfully raised | 21,502

crore of additional long term financing through a combination of

| 14400 crore in the form of QIP of equity shares (~32.36 crore

equity shares of face value | 5 each were issued and allotted at a

price of | 445 per equity share) and | 7102 crore in the form of 1.50%

FCCB offerings (issued at par and repayable in 2025 at 102.66% of

their outstanding principal amount)

Dividends: The board has recommend a dividend of | 2 per share

for FY20, largely a pass through of dividends received from Infratel

Exceptional items: Overall exceptional charge of | 7004 crore, was

mainly on account of one time spectrum charge related matter of

| 5642 crore and interest on the provision of license fee and

spectrum usage charges of | 871 crore, among others

Exhibit 4: Segmental revenues

| crore FY18 FY19 FY20 FY21E FY22E

India 70, 898 67, 256 71, 111 85, 216 94, 623

Mobility 46,264 41,554 45,966 58,940 66,654

Broadband 2,526 2,239 2,245 2,593 2,903

Enterprise 11,322 12,454 13,233 14,124 15,168

Passive Infrastructure 6,628 6,819 6,742 7,033 7,206

Digital +Others 4,158 4,190 2,924 2,526 2,692

Africa 20, 156 22, 346 24, 217 27, 366 28, 898

South Asia 405 444 455 460 460

Total Gross Revenue 91, 459 90, 046 95, 783 113, 042 123, 980

Intersegmental Elimination -7,572 -7,978 -7,789 -10,396 -11,544

Net Revenue 83, 688 81, 624 87, 539 102, 646 112, 437

Source: Company, ICICI Direct Research

Exhibit 5: Segmental EBITDA

| crore FY18 FY19 FY20 FY21E FY22E

India & South Asia 23, 798 17, 936 26, 376 35, 154 41, 202

Africa 6, 653 8, 363 10, 726 12, 128 12, 774

Gross EBITDA 30, 451 26, 300 37, 102 47, 282 53, 976

Intersegmental Elimination 386 670 617 223 116

Reported EBITDA 30065 25630 36486 47058 53860

Source: Company, ICICI Direct Research

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 5

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Exhibit 6: India subscriber details

360 2,811 3,482 4,000

3,035 3,329

310 1,946 3,500

260 3,000

2,500

(in Billion)

In Million

210

310 2,000

160 304 298

283 284 1,500

110 1,000

60 500

10 0

FY18 FY19 FY20 FY21E FY22E

Mobile Subscribers Total Minutes (Billion)

Source: Company, ICICI Direct Research

Exhibit 7: Data volume and data subs trend

210 36,942 40,000

190 35,000

30,352

170

21,020 30,000

150

(in Billion)

130 11,733 25,000

In Million

190

110 3,902 20,000

90 171 15,000

149

70

115 10,000

50 86

30 5,000

10 0

FY18 FY19 FY20 FY21E FY22E

Data Subscribers (RHS) Data Volume

Source: Company, ICICI Direct Research

Exhibit 8: India mobile ARPU trend

200

184.4

180 170.7

160

|

132.4 135.5

140

120 113.0

100

FY18 FY19 FY20 FY21E FY22E

ARPU

Source: Company, ICICI Direct Research

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 6

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Financial summary

Exhibit 9: Profit and loss statement | crore Exhibit 10: Cash flow statement

es

| crore

(Year-end March) FY19 FY20 FY21E FY22E (Year-end March) FY19 FY20 FY21E FY22E

Total operating Income 80, 780. 2 87, 533. 7 102, 645. 6 112, 436. 5 Profit after Tax 409.5 -32,188.6 4,009.6 7,524.1

Growth (%) -3.5 8.4 17.3 9.5 Add: Depreciation 21,347.5 27,689.6 29,869.9 33,168.8

Employee Expenses 3,797.5 3,807.2 4,172.6 4,451.9 Add: Interest Paid 9,589.4 12,382.0 12,679.0 11,536.0

Marketing Expenses 12,668.5 9,544.7 10,222.6 11,044.2 (Inc)/dec in Current Assets 1,635.6 (26,805.6) (8,111.1) (5,255.1)

Access Charges 9,352.1 10,739.5 11,052.0 11,445.5 Inc/(dec) in CL and Prov 3,025.6 43,834.5 17,232.0 11,056.8

Network Operating 22,390.0 19,700.6 21,368.0 22,017.9 Others 0.0 0.0 0.0 0.0

License Fee 6,942.6 7,256.1 8,772.0 9,617.1 CF from op activities 36, 007. 6 24, 911. 9 55, 679. 3 58, 030. 6

Other Costs 0.0 0.0 0.0 0.0 (Inc)/dec in Investments 2,271.4 -9,833.6 0.0 0.0

Total Operating Expenditure 55,150.7 51,048.1 55,587.2 58,576.6 (Inc)/dec in Fixed Assets -34,863.6 -50,761.7 -22,000.0 -22,000.0

EBITDA 25, 629. 5 36, 485. 6 47, 058. 5 53, 859. 9 Others -6,082.2 -4,858.4 336.1 -7,915.5

Growth (%) -14.8 42.4 29.0 14.5 CF from invactivities -38, 674. 4 -65, 453. 7 -21, 663. 9 -29, 915. 5

Depreciation 21,347.5 27,689.6 29,869.9 33,168.8 Issue/(Buy back) of Equity 0.0 729.1 0.0 0.0

Interest 9,589.4 12,382.0 12,679.0 11,536.0 Inc/(dec) in loan funds 14,094.8 22,799.8 -14,700.0 -10,700.0

Other Income 291.2 316.2 400.0 500.0 Dividend paid & dividend tax 0.0 -1,276.6 0.0 0.0

Exceptional Items (2,928.8) 40,234.4 - - Interest Paid 9,589.4 12,382.0 12,679.0 11,536.0

PBT -2,087.4 -43,504.2 4,909.6 9,655.1 Others -17,700.6 13,694.7 -30,100.7 -23,072.1

MI / Profit from associates 922.4 866.7 200.0 200.0 CF from fin activities 5, 983. 6 48, 329. 0 -32, 121. 7 -22, 236. 0

Total Tax -3,419.3 -12,182.3 700.0 1,931.0 Net Cash flow 3,316.8 7,787.2 1,893.8 5,879.1

PAT 409. 5 -32, 188. 6 4, 009. 6 7, 524. 1 Opening Cash 4,788.6 8,105.5 15,892.7 17,786.5

Growth (%) -62.7 NA NA NA Closing Cash 8, 105. 5 15, 892. 7 17, 786. 5 23, 665. 5

EPS (|) 1. 0 -59. 0 7. 3 13. 8 Source: Company, ICICI Direct Research

Source: Company, ICICI Direct Research

Exhibit 11: Balance sheet

es

| crore Exhibit 12: Key ratios | crore

(Year-end March) FY19 FY20 FY21E FY22E (Year-end March) FY19 FY20 FY21E FY22E

Liabilities Per share data (|)

Equity Capital 1,998.7 2,727.8 2,727.8 2,727.8 EPS 1.0 -59.0 7.3 13.8

Reserve and Surplus 69,423.5 74,417.0 73,683.9 81,208.0 Cash EPS 54.4 -8.2 62.1 74.6

Total Shareholders funds 71,422.2 77,144.8 76,411.7 83,935.8 BV 178.7 141.4 140.1 153.9

Total Debt 125,428.3 148,228.1 133,528.1 122,828.1 DPS 0.0 2.3 0.0 0.0

Deferred Tax Liability 1,129.7 1,687.7 1,687.7 1,687.7 Cash Per Share 20.3 29.1 32.6 43.4

Others 22,345.3 35,011.9 35,348.0 27,432.5 Operating Ratios

Total Liabilities 220, 325. 5 262, 072. 5 246, 975. 5 235, 884. 1 EBITDA Margin (%) 31.7 41.7 45.8 47.9

EBIT Margin (%) 5.3 10.0 16.7 18.4

Assets PAT Margin (%) -3.1 -4.1 3.9 6.7

Gross Block 379,841.0 430,602.7 452,604.7 474,604.7 Inventory days 0.4 0.0 0.0 0.0

Less: Acc Depreciation 169,375.3 197,064.9 226,934.8 260,103.6 Debtor days 19.4 19.2 19.2 19.2

Net Block 210,465.7 233,537.8 225,669.9 214,501.1 Creditor days 126.5 104.3 105.0 105.0

Investments 17,989.4 27,823.0 27,823.0 27,823.0 Return Ratios (%)

Inventory 88.4 0.0 0.0 0.0 RoE -3.5 -4.7 5.2 9.0

Debtors 4,300.6 4,605.8 5,401.0 5,916.1 RoCE 2.1 3.5 7.1 9.0

Loans and Advances 13,711.1 21,045.3 24,678.6 27,032.6 RoIC 2.3 4.5 9.6 12.8

Other Current Assets 2,076.9 21,331.5 25,014.2 27,400.2 Valuation Ratios (x)

Cash 8,105.5 15,892.7 17,786.5 23,665.5 P/E 575.6 NA 80.2 42.8

Total Current Assets 28,282.5 62,875.3 72,880.2 84,014.4 EV / EBITDA 16.9 12.1 9.0 7.6

Creditors 28,003.1 25,019.9 29,528.2 32,344.8 EV / Net Sales 5.4 5.0 4.1 3.6

Provisions 219.7 0.0 0.0 0.0 Market Cap / Sales 4.0 3.7 3.1 2.9

Other Current Liabilities 26,651.2 73,688.6 86,412.3 94,652.6 Price to Book Value 3.3 4.2 4.2 3.8

Total Current Liabilities 54,874.0 98,708.5 115,940.5 126,997.3 Solvency Ratios

Net Current Assets -26,591.5 -35,833.2 -43,060.3 -42,982.9 Debt/EBITDA 4.9 4.1 2.8 2.3

Others Assets 18,459.9 36,542.9 36,542.9 36,542.9 Debt / Equity 1.8 1.9 1.7 1.5

Application of Funds 220, 323. 5 262, 072. 5 246, 975. 5 235, 884. 1 Current Ratio 0.4 0.5 0.5 0.5

Source: Company, ICICI Direct Research es

Quick Ratio 0.4 0.5 0.5 0.5

Source: Company, ICICI Direct Research

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 7

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

Exhibit 13: ICICI Direct Coverage Universe (Telecom)

Sector / CMP M Cap EPS (|) P/E (x) EV/EBITDA (x) RoCE (%) RoE (%)

TP (|) Rating

Company (|) (| Cr) FY19 FY20E FY21E FY19 FY20E FY21E FY19 FY20E FY21E FY19 FY20E FY21E FY19 FY20E FY21E

Bharti Airtel 590 700 Buy 321,880 1.0 -59.0 7.3 575.9 NM 80.3 17.0 12.1 9.0 2.1 3.5 7.1 -3.5 -4.7 5.2

Bharti Infratel 198 175 Hold 28,114 13.5 17.8 16.3 14.7 11.1 12.2 4.6 4.7 4.5 21.2 18.1 19.4 17.2 24.4 23.3

Vodafone Idea 6 UR UR 11,465 -5.1 -23.7 -5.4 NM NM NM 31.7 8.4 6.3 -5.0 -5.1 -3.3 -25.9 -120.8 -108.6

Sterlite Tech 99 95 Hold 3,975 14.0 10.8 8.5 7.1 9.2 11.6 5.1 5.6 6.0 29.7 27.8 20.9 28.7 33.0 25.1

Tata Comm 459 345 Buy 13,089 -2.9 8.1 12.2 NM 56.6 37.7 8.0 7.0 6.6 5.9 5.4 7.4 9.4 127.7 -118.8

Source: Company, ICICI Direct Research

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 8

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 9

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

Result Update | Bharti Airtel ICICI Direct Research

ANALYST CERTIFICATION

I/We, Bhupendra Tiwary, MBA, CFA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s)

or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report

have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities Limited is a SEBI registered

Research Analyst with SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank

and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on

www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the

securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this

report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | RetailEMISPDF

Research

in-spjainmr from 61.8.139.218 on 2020-06-05 04:13:21 BST. DownloadPDF. 10

Downloaded by in-spjainmr from 61.8.139.218 at 2020-06-05 04:13:21 BST. EMIS. Unauthorized Distribution Prohibited.

You might also like

- Foreign Exchange Operations of Commercial Banks in BangladeshDocument11 pagesForeign Exchange Operations of Commercial Banks in BangladeshSharifMahmud0% (1)

- Merger and Acquisition. CIA 1.2docxDocument13 pagesMerger and Acquisition. CIA 1.2docxSaloni Jain 1820343No ratings yet

- TP Catalyst DocumentManagerDocument8 pagesTP Catalyst DocumentManagergunawanNo ratings yet

- Pentagrowth Ideas For Change V4 - InGLESDocument36 pagesPentagrowth Ideas For Change V4 - InGLESJOCSCRIBDNo ratings yet

- ILEC Unit 2Document14 pagesILEC Unit 2pacificcoasthighway1No ratings yet

- Bharti - Airtel Q1 Result UpdateDocument10 pagesBharti - Airtel Q1 Result UpdateRatan PalankiNo ratings yet

- Bharti - Airtel SharekhanDocument10 pagesBharti - Airtel SharekhandarshanmaldeNo ratings yet

- 1 Bharti Airtel 06feb24 Kotak InstDocument23 pages1 Bharti Airtel 06feb24 Kotak InstDinaNo ratings yet

- Bharati Airtel 2018Document11 pagesBharati Airtel 2018Swathi BollineniNo ratings yet

- AIRTEL - Analysis Subsector Thesis by JainDocument3 pagesAIRTEL - Analysis Subsector Thesis by JainShorya JainNo ratings yet

- Vodafone IdeaDocument12 pagesVodafone IdeaUtkarsh YdvNo ratings yet

- IDEA 03082022181130 SEIntimationResultsQ1FY23Document17 pagesIDEA 03082022181130 SEIntimationResultsQ1FY23vijaya babuNo ratings yet

- Bharati Airtel 2018Document15 pagesBharati Airtel 2018Swathi BollineniNo ratings yet

- Airtel ReportDocument14 pagesAirtel Reportayushabhishek64No ratings yet

- Sterlite Technologies (STETEC) : Export Demand Drives GrowthDocument10 pagesSterlite Technologies (STETEC) : Export Demand Drives Growthsaran21No ratings yet

- 5673211172023921bharti Airtel Limited - 20231107Document4 pages5673211172023921bharti Airtel Limited - 20231107Sanjeedeep Mishra , 315No ratings yet

- Stock Update: Bharti AirtelDocument3 pagesStock Update: Bharti Airtelsaran21No ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Strong Revenue Growth of 6.0% Supported by Prepaid Tariff Hike Integration Near Completion and Merger Synergies Fully DeliveredDocument5 pagesStrong Revenue Growth of 6.0% Supported by Prepaid Tariff Hike Integration Near Completion and Merger Synergies Fully DeliveredDhanush Kumar RamanNo ratings yet

- HFCL - Initiating Coverage - KSL 210521Document14 pagesHFCL - Initiating Coverage - KSL 210521Dhiren DesaiNo ratings yet

- NewYearPicks 2022Document15 pagesNewYearPicks 2022Raghuram BathulaNo ratings yet

- Idea Vodafone QuitDocument12 pagesIdea Vodafone Quitvarunjain0392No ratings yet

- Robi-Airtel Merger Analysis by RobiDocument13 pagesRobi-Airtel Merger Analysis by RobiTarek MahmudNo ratings yet

- Dish+TV Initiation Centrum 04042011Document16 pagesDish+TV Initiation Centrum 04042011Raghu BharatNo ratings yet

- Credit Research Report: Team 545Document22 pagesCredit Research Report: Team 545D Ban ChoNo ratings yet

- Bharti Airtel: Company FocusDocument5 pagesBharti Airtel: Company FocusthomsoncltNo ratings yet

- Bharti Airtel: Q4 FY 2022 ResultsDocument7 pagesBharti Airtel: Q4 FY 2022 ResultsdarshanmaldeNo ratings yet

- Rating Rationale CRISILDocument10 pagesRating Rationale CRISILjagadeeshNo ratings yet

- GTPL Hathway LTD.: A) About The CompanyDocument10 pagesGTPL Hathway LTD.: A) About The CompanyPayal SinghNo ratings yet

- Robi Axiata Limited: Q1 2021 ResultsDocument22 pagesRobi Axiata Limited: Q1 2021 ResultsNiamul HasanNo ratings yet

- Wipro LTD (WIPRO) : Growth and Margin Visibility Improving..Document13 pagesWipro LTD (WIPRO) : Growth and Margin Visibility Improving..ashok yadavNo ratings yet

- 1Q23 Oppday Presentation FinalDocument13 pages1Q23 Oppday Presentation FinalOaker WinkoNo ratings yet

- Q3 - FY24 - Press - Release AirtelDocument3 pagesQ3 - FY24 - Press - Release Airtelbravemonk2792No ratings yet

- Ki Isat 20240213Document8 pagesKi Isat 20240213muh.asad.amNo ratings yet

- Press Release 271020Document4 pagesPress Release 271020asadasiudNo ratings yet

- PLDT Inc.: Raising The Bar - Upgrade To BuyDocument10 pagesPLDT Inc.: Raising The Bar - Upgrade To BuyP RosenbergNo ratings yet

- 4116226162022832wipro Limited - 20220613 SignedDocument5 pages4116226162022832wipro Limited - 20220613 SignedbradburywillsNo ratings yet

- Vedanta Credit ReportDocument23 pagesVedanta Credit ReportvishnuNo ratings yet

- Binging Big On BTG : BUY Key Take AwayDocument17 pagesBinging Big On BTG : BUY Key Take AwaymittleNo ratings yet

- T-Mobile US Q4 and Full Year 2013Document18 pagesT-Mobile US Q4 and Full Year 2013Spit FireNo ratings yet

- Reliance Communication Ltd.Document2 pagesReliance Communication Ltd.ratika_bvpNo ratings yet

- Excellent Numbers From AirtelDocument5 pagesExcellent Numbers From AirtelAnurag Alla100% (1)

- Sonata Software (SONSOF) : Healthy PerformanceDocument5 pagesSonata Software (SONSOF) : Healthy PerformanceADNo ratings yet

- Tata Elxsi Limited: Result UpdateDocument6 pagesTata Elxsi Limited: Result UpdateinvestfortestNo ratings yet

- Bharti Airtel, 4th February, 2013Document14 pagesBharti Airtel, 4th February, 2013Angel BrokingNo ratings yet

- FY20 Investor Presentation: Future Supply Chain Solutions LimitedDocument17 pagesFY20 Investor Presentation: Future Supply Chain Solutions LimitedDhruvin SutariyaNo ratings yet

- Bharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDocument14 pagesBharti Airtel: CMP: INR349 TP: INR420 (+20%) Stability EmergingDivyansh SinghNo ratings yet

- Media Release - RJIL - 4Q FY18-19 - 18042019 PDFDocument9 pagesMedia Release - RJIL - 4Q FY18-19 - 18042019 PDFFlameOfTruthNo ratings yet

- MTN Uganda Limited FY2023 Earnings ReleaseDocument14 pagesMTN Uganda Limited FY2023 Earnings Releaseowereonyango19No ratings yet

- Reliance by Motilal OswalDocument34 pagesReliance by Motilal OswalQUALITY12No ratings yet

- Wipro Q4FY09 Result UpdateDocument4 pagesWipro Q4FY09 Result UpdateHardikNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- Bharti Airtel Limited: Key HighlightsDocument7 pagesBharti Airtel Limited: Key HighlightsMonika GuptaNo ratings yet

- Atul Auto 1QFY20 Result Update - 190813 - Antique ResearchDocument4 pagesAtul Auto 1QFY20 Result Update - 190813 - Antique ResearchdarshanmadeNo ratings yet

- Corporate Briefing Notes - PTCDocument4 pagesCorporate Briefing Notes - PTCAbdullah CheemaNo ratings yet

- V-Guard Industries: Operationally Strong QuarterDocument5 pagesV-Guard Industries: Operationally Strong QuarterUmesh ThawareNo ratings yet

- Wipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Document15 pagesWipro - Initiating Coverage - 08122020 - 08-12-2020 - 08Devaansh RakhechaNo ratings yet

- Jio Media Release Q3 FY1718Document7 pagesJio Media Release Q3 FY1718FlameOfTruthNo ratings yet

- Wabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!Document5 pagesWabco India (WABIND) : Higher Content Per Vehicle To Fuel Growth!darshanmadeNo ratings yet

- Bharti Airtel (BHATE) : Case For A Strong BuyDocument9 pagesBharti Airtel (BHATE) : Case For A Strong BuyRicha GargNo ratings yet

- GMR Infra: Robust Traffic GrowthDocument4 pagesGMR Infra: Robust Traffic GrowthRaunak MukherjeeNo ratings yet

- Britannia Industries Limited: Healthy Growth With Strong Rural PerformanceDocument5 pagesBritannia Industries Limited: Healthy Growth With Strong Rural Performanceraspberryskittles2605No ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Pharmacy Retail Market in India 2019 Update PDFDocument20 pagesPharmacy Retail Market in India 2019 Update PDFVrajesh ChitaliaNo ratings yet

- Analysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityDocument5 pagesAnalysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityVrajesh ChitaliaNo ratings yet

- Technological Innovations in Microfinance Institutions in The Three Northern Regions of GhanaDocument18 pagesTechnological Innovations in Microfinance Institutions in The Three Northern Regions of GhanaVrajesh ChitaliaNo ratings yet

- Ambit Insights: DailyDocument23 pagesAmbit Insights: DailyVrajesh ChitaliaNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Chinese Economy - Macroeconomic Analysis For Tesla's Investment DecisionDocument6 pagesChinese Economy - Macroeconomic Analysis For Tesla's Investment DecisionVrajesh ChitaliaNo ratings yet

- Chapter - 2.2 Compound InterestDocument18 pagesChapter - 2.2 Compound InterestsaudzulfiquarNo ratings yet

- ZambiaDocument2 pagesZambiaKelz YouknowmynameNo ratings yet

- Corporate Finance 1st Edition Booth Test BankDocument31 pagesCorporate Finance 1st Edition Booth Test Banka430138385No ratings yet

- HDFCDocument43 pagesHDFCKripa DuttaNo ratings yet

- Textbook Ebook Wiley Practitioners Guide To Gaas 2023 Covering All Sass Ssaes Ssarss and Interpretations Wiley Regulatory Reporting 2Nd Edition Joanne M Flood All Chapter PDFDocument43 pagesTextbook Ebook Wiley Practitioners Guide To Gaas 2023 Covering All Sass Ssaes Ssarss and Interpretations Wiley Regulatory Reporting 2Nd Edition Joanne M Flood All Chapter PDFmichael.schweinsberg369100% (7)

- GST-Test Paper FormatDocument2 pagesGST-Test Paper FormatManisha ChaturvediNo ratings yet

- Berhampur University: Application For Admission Into M.A/M.Sc. in Mathematics Academic Session 2019-20Document2 pagesBerhampur University: Application For Admission Into M.A/M.Sc. in Mathematics Academic Session 2019-20Subham PriyadarshiNo ratings yet

- Financial Market 2021Document24 pagesFinancial Market 2021Sophia RazaliNo ratings yet

- Simple Compound Interest Study MaterialDocument6 pagesSimple Compound Interest Study MaterialSurender100% (1)

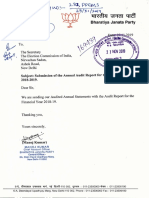

- The Secretary The Election Commission of India, Nirvachan Sadan Ashokroad, New DelhiDocument15 pagesThe Secretary The Election Commission of India, Nirvachan Sadan Ashokroad, New DelhiAkshat GoyalNo ratings yet

- Asia Property Buyer's Guide: 2019 EditionDocument24 pagesAsia Property Buyer's Guide: 2019 EditionAndrew Richard ThompsonNo ratings yet

- Risk and Return For PrintDocument30 pagesRisk and Return For PrintTahir DestaNo ratings yet

- Fundamental Analysis of INFOSYSDocument25 pagesFundamental Analysis of INFOSYSsohelrangrej21No ratings yet

- CORPORATE REPORTING - MFRS137 - Provisions, Contingent Liabilities and Contingent Assets - Dayana MasturaDocument12 pagesCORPORATE REPORTING - MFRS137 - Provisions, Contingent Liabilities and Contingent Assets - Dayana MasturaDayana MasturaNo ratings yet

- Fee Structure 2024 25Document3 pagesFee Structure 2024 25Hunter JattNo ratings yet

- Final Examination Principles of Finance (DPF 24153)Document9 pagesFinal Examination Principles of Finance (DPF 24153)USHA PERUMALNo ratings yet

- 3 - BAF - Direct Tax IDocument3 pages3 - BAF - Direct Tax Isid pjNo ratings yet

- 27 3 2014 - MWDDocument26 pages27 3 2014 - MWDTheMyawadyDailyNo ratings yet

- The IMF Cannot Solve Argentina's Dysfunction - The EconomistDocument5 pagesThe IMF Cannot Solve Argentina's Dysfunction - The Economist100453432No ratings yet

- Dividend Discount Models: Relative Valuation - IIDocument92 pagesDividend Discount Models: Relative Valuation - IIbhaskkarNo ratings yet

- Cornerstones of Cost Management, 3E: Product and Service Costing: Job-Order SystemDocument46 pagesCornerstones of Cost Management, 3E: Product and Service Costing: Job-Order SystemEhtesham HaqueNo ratings yet

- BOT PR Tagihan MyRepublic Dewata-April 24-6-PR-SAS-IV-2024Document4 pagesBOT PR Tagihan MyRepublic Dewata-April 24-6-PR-SAS-IV-2024ANGGINo ratings yet

- Mrs. DEEPA SANJAY Deepa - Pen@yahoo - Co.in Mobile # - 07875436967 O BJECTIVEDocument4 pagesMrs. DEEPA SANJAY Deepa - Pen@yahoo - Co.in Mobile # - 07875436967 O BJECTIVEdeepa_penNo ratings yet

- Ila IBAN Letter BH60 ABCO 5461 2669 1010 01Document1 pageIla IBAN Letter BH60 ABCO 5461 2669 1010 01masud alamNo ratings yet

- DAY - NRLM (DAY - National Rural Livelihoods Mission) 'राष्ट्रीय ग्रामीण आजीविका मिशन'Document12 pagesDAY - NRLM (DAY - National Rural Livelihoods Mission) 'राष्ट्रीय ग्रामीण आजीविका मिशन'Abinash MandilwarNo ratings yet

- Revenue Per EmployeeDocument5 pagesRevenue Per EmployeeAmit SharmaNo ratings yet