Professional Documents

Culture Documents

Risk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. Mahadik

Risk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. Mahadik

Uploaded by

Anusha AshokOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. Mahadik

Risk Management in Construction Industry: Mr. Satish K. Kamane, Mr. Sandip A. Mahadik

Uploaded by

Anusha AshokCopyright:

Available Formats

IOSR Journal of Mechanical and Civil Engineering (IOSR-JMCE)

ISSN: 2278-1684, PP: 59-65

www.iosrjournals.org

Risk Management in Construction Industry

Mr. Satish K. Kamane1, Mr. Sandip A. Mahadik2

1,2

(Asst. Prof Civil Engineering Dept. Ats Sbgi Miraj)

Abstract-Construction projects are characterized as very complex projects, where uncertainty comes from various

sources. Construction projects gather together hundreds of stakeholders, which makes it difficult to study a network

as a whole. But at the same time, these projects offer an ideal environment for network and risk management

research. Additionally, construction projects are frequently used in management research, and several different

tools and techniques have already been developed and especially for this type of project. However, there is a gap

between risk management techniques and their practical application by construction contractor. This paper deals

with the identification of risk by different methods, types of risks associated with construction project and different

risk mitigation techniques.

Key words- Risk, force majeure risk, delphi technique, risk mitigation, risk avoidance, risk retention

1. INTRODUCTION

In the construction industry, risk is often referred to as the presence of potential or actual threats or

opportunities that influence the objectives of a project during construction, commissioning, or at time of use. Risk is

also defined as the exposure to the chance of occurrences of events adversely or favorably affecting project

objectives as a consequence of uncertainty. There are two types of risk:

1) Pure risk in which there is the possibility of financial loss but no possibility of financial gain

2) Speculative risk that involves the possibility of both gains and losses.

It is necessary to identify all risks involved at all the stages of the project so as their assessment and analysis can

be done accordingly. There are various methods to identify risks, depending on type of project. Risk management

process in case of construction industry involves following stages :

1. Primary stage

- Risk Identification

2. Secondary stage

- Risk Assessment

- Risk Analysis

3. Tertiary stage

- Risk Mitigation

2.RISKS AT VARIOUS STAGES OF PROJECT

The following is a listing of many construction industry risks and exposures.

2.1. Financial risks

This risk is the totality of all risks that relate to financial developments external to the project that are not in the

control of the project developer. This results from consequences that may have adverse economic effects. Financial

risks fall into these categories: Exchange rate risk relates to the possibility that changes in foreign exchange rates

alter the exchange value of cash flows from the project. This risk may be considerable, since exchange rates are

particularly unstable in many developing countries or countries whose economies are in transition. In addition to

exchange rate fluctuations, the project company may face the risk that foreign exchange control or lowering reserves

of foreign exchange may limit the availability in the local market of foreign currency needed by the project company

to service its debt or repay the original investment. Interest rate risk forces the project to bear additional financing

costs. This risk may be significant in infrastructure projects given the usually large sums borrowed and the long

duration of projects, with some loans extending over a period of several years.

Second International Conference on Emerging Trends in engineering (SICETE) 59| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

2.2 Political risk

The project company and the lenders face the risk that the project execution may be negatively affected by acts

of the contracting authority (Government), another agency of the government or the host country’s legislature. Such

risks are often referred to as political risks. Political risk faced by firms can be defined as “the risk of a strategic,

financial, or personnel loss for a firm because of such nonmarket factors as macroeconomic and social policies.

Political risk includes risk such as change in law, payment failure by government, increase in taxes and change in

government.

2.3 Legal risks

It is the risk of non-compliance with legal or regulatory requirements. Much of the law is general and will apply

to all organizations e.g. employment law, health and safety, environmental legislation, etc. Others may be industry

specific e.g. covering specific transport services such as railways or airlines. Some of the legal risks that a

construction projects can face are related to lease of property, ownership of asset and breach of financial documents.

2.4 Environment risk

These are risks relating to occurrence of environmental incidents during the course of implementation of the

project. These risks are generally within the control of the construction and the operation and maintenance

consortium. This risk has increased due to the presence of strict legal liability in relation to such environmental

incidents, which can result not only in adverse affects on the financials of a project but may also cause a closure of

any work or operations of and in relation to the facility. The main environmental risks associated with hydro power

projects are

Loss of flora and fauna

Loss of fertile lands

Rehabilitation and resettlement problems

2.5 Force majeure risks

These risks are regarding the events that are outside the control of any party and cannot be reasonably prevented

by the concerned party. These risks generally arise due to causes extraneous to the project. The defining of force

majeure events, these include natural force majeure events, direct or indirect political force majeure events. Natural

force majeure events comprise of all events that can be attributed to natural conditions or acts of god such as

earthquakes, floods, cyclones and typhoons. These risks should be shared equally among the parties. Direct political

force majeure events are events attributable to political events that are specific to the project itself such as

exploration, nationalization. Indirect political force majeure events are events that have their origins in political

events but are not project specific such as war, riots etc.

2.6 Operating risks

Some of the risks that may face in a construction project apply during operations and maintenance (O&M) type

services. More specifically, operational risk can be defined as the risk of loss resulting from inadequate or failed

internal processes, people and systems, or from external events22. Some of the risks and actions available to the

concession company include:

1. Performance risk-The completed facility cannot be effectively operated or maintained to produce the expected

capacity, output or efficiency.

2. Operation cost overrun- The operating costs exceed the original estimates.

3. Operating contractor default- The concession company may terminate the operations and maintenance contract

and appoint a new O&M contractor.

4.Default- The default may be caused by the actions of a third party, in which case the concession company could

make claims of damages against that party.

Second International Conference on Emerging Trends in engineering (SICETE) 60| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

3. RISK IDENTIFICATION PROCESS:

Risks exist from the very outset of a project. Therefore we need to identify what they are, ascertain when they

might arise, what effect they may and what measures need to be taken to prevent their occurrence or mitigate their

potential impact. The identification of risks may be considered as the most important stage in Risk Management, if

only in terms of bringing considerable benefit to all parties in the greater understanding of the project, irrespective of

whether further action is taken or not. When identifying risks, it is important to appreciate not merely the risk itself

but the source, the event that may lead to the risk materializing and the effect of the risk if it does materialize. Table

shows the techniques, assessment and categorization of risk in risk identification process.

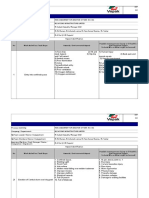

Table 1 Risk Identification

Techniques Assessment Categorization

Check list Potential Unacceptable

Interviews impact Critical

Expert system Significant

Questionnaire Probability Insignificant

The Delphi of Acceptable

technique occurrence

4. RISK IDENTIFICATION METHODS

4.1 Questionnaires or Checklists:-

Questionnaires are usually drawn up from a combination of previous experience and specific project criteria.

There are two forms of questionnaire, one is a very general form with non-specific prompts or questions and the

other can be detailed as is required by the particular project. Questionnaires also facilitate consistently presented

answers from different team members which allow less time consuming and more meaningful comparisons.

Therefore the risk manager can ascertain more readily any apparent consensus.

4.2 Interviews:-

This is technique that has been used historically by personnel departments and other consultants to extract

information. It has also been used by risk managers to identify possible risk in a development. The interviews may

take place on a one to one basis or on a many to one basis. The many to one basis should consist of projects

members from different disciplines so that the subjects raised can be viewed from different perspectives. The

problem with this method is that it is time consuming not only to carry out the interviewing but also record the risks

arrived at there from.

4.3 Expert system:-

A lot of research is being done on artificial intelligence and expert systems. Specifically, one of the most

sophisticated models that can be developed for risk management is by making use of knowledge-based systems or

human-computer cooperative systems. This system is designed to assist the project managers in achieving more

effective control over risks by providing them with appropriate knowledge, gathered from many project managers

and compiled into a knowledge-base. It is designed to warn project managers of risks that may follow etc. While

doing this, the logical thinking and the intuitive thinking of the managers is accounted for in the system

4. 4 The Delphe technique:-

The Delphe technique attempts to produce objective results from subjective discussions. It is a systematic,

interactive forecasting method which relies on a panel of independent experts. This method may be applicable to the

identification of risks but it is more suited to attaching likelihood of occurrence and potential impacts of previously

identified risk events. This method basically involves the following sequence of events:

1. A questionnaire is forwarded to all the appropriate members of the project team by the appointed risk

manager.

Second International Conference on Emerging Trends in engineering (SICETE) 61| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

2. The members of project teams gives their objective views in response to the questionnaire and returns them

to the risk manager.

3. The risk manager then collects these results and redistributes them. Each project participant now receives a

different set of views and is requested to reconsider their original answers and resubmit them to the risk

manager.

4. These revised results are again collected by the risk manager and redistributed again in the same manner as

above.

5. This iterative process is continued until the risk manager is satisfied that a consensus o opinion has been

reached.

5 RISK ASSESMENT

Risk assessment is the process of estimating and communicating workplace safety risk, and deciding whether this

risk is acceptable. Conducting a risk assessment involves making a value judgement based on this information and

any available evidence within the workplace and industry. This may include numbers of current and past incidents,

severity of injuries from the identified hazard, lost work time from injuries and number of people involved in

incidents. Specific information such as environmental measurements of hazards, eg noise levels, dust levels, and

comparisons made between the workplace measurement and the legally required measurement can also assist in the

risk assessment process. Widely used method is risk matrix. The risk matrix records the level of risk which is

determined by the relationship between the likelihood of an incident occurring from the hazard, and the consequence

caused by the hazard. This is recorded as either a numerical or alphabetical code. The relationship between

likelihood and consequence determines how dangerous the hazard is.The level of risk or code that is determined is

referred to as a risk priority rating. This priority rating allows employers to prioritise the hazards identified to ensure

that the hazards with high potential of creating an incident are eliminated or controlled first. Controlling a hazard

may involve inspections, investigations and/or monitoring control activities with managers, supervisors and work

teams involved as appropriate depending on the circumstances.

Table 2 Risk Matrix

LIKEKYHOOD CONSEQUENCE

SEVER MAJOR MEDIUM MONOR NEGLIGIBLE

ALMOST

CERTAIN E H H M M

LIKELY

H H M M L

POSSIBLE

H M M L L

UNLIKELY

M M L L T

RARE

M L L T T

5. RISK MITIGATION

The uncertainty of a risk event as well as the probability of occurrence or potential impact should decrease by

selecting the appropriate risk mitigation strategy. Four mitigation strategy categories commonly used are:

5.1 Risk avoidance

Second International Conference on Emerging Trends in engineering (SICETE) 62| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

. Risk avoidance may include a review of the overall project objectives leading to a reappraisal of the project as

a whole. Risk avoidance is often perceived as the ultimate mitigation strategy in that it implies that the project may

be aborted. It means making a decision not to enter in to new way of working because of inherent risk this would

introduce. This method of mitigation involves the removal of the cause of the risk and therefore the risk itself.

Ideally any approach involving avoidance is best implemented by the consideration and adoption of an alternative

course of action. Other examples of risk avoidance include the use of exemption clauses in contracts, either to avoid

certain risks or to avoid certain consequences flowing from the risks. Risk avoidance is most likely to take place

where the level of risk is at a level where the project is potentially viable.

5.2 Risk reduction

This method adopts an approach whereby potential exposure to risks and their impact is alleviated. Often this is

achieved by the managing or designing out of potential risk. Methods of risks reduction may require some initial

investment that should then reduce the likelihood of the risk occurring. Risk reduction occurs where the level of risk

is unacceptable and alternative action is available. Typical action to reduce risk could be:

1. Detailed site investigation where adverse ground conditions are known to exist but the full extent is not

known; a detailed ground investigation will improve the information upon which the estimate has been

prepared.

2. Alternative procurement route- by utilizing an alternative contract strategy risks will be allocated between

project participants in a different way.

3. Changes in design to accommodate the findings of the risk identification process.

5.3 Risk retention

Once all the avenues for response and mitigation have been explored a number of risks will remain. This does

not imply that these risks can be ignored; indeed it is these risks, which will in most instances, undergo detailed

quantitative analysis in order to assess and calculate theOverall contingency levels required. The aim of the previous

responses is to reduce project uncertainty and in doing so increase the base estimate to reflect the more certain

nature of the project. However, it does not imply that these retained risks can simply be ignored. Indeed, they should

be subject to effective monitoring, control and management to ensure that they are within the contingency

allowances set. It should be noted that this contingency should be made up of residual risks, which are assessed, to

be of a low likelihood and low potential impact. High probability and high impact risks should undergo further

rigorous examination so that that an alternative response can be found.

5.4 Risk transfer

Risk transfer is the technique that plays a far greater role in development projects and involves the complete or

partial transfer of risks among the various parties involved in the implementation of the project. Risk can be transfer

by two ways. First is through insurance and second is through contract.This is achieved through the web of

documents that is formulated during the course of implementation of projects. The documentation structure provides

for the flow of risk transfers that are negotiated and agreed to in the course of development of project.

Because all these risks can arise throughout the project life cycle, it is believed that effective risk management

should be an iterative process and not limited to a one-time analysis. Given the evolving nature of risk, the primary

value of the mitigation tool is highest during the program decision and pre-project planning phases and to be most

effective.

Though contracts are the mechanism to allocate liabilities and responsibilities of project participants in

construction, contract language alone is insufficient to specify and appoint all the risks, an ideal process would

address the individual needs of each organization and each project . The distribution of risk between the client and

contractor tends to overshadow effective management strategies and investigations show that contactors and owners

give minimal consideration to risks outside the realm of their own concerns.

Second International Conference on Emerging Trends in engineering (SICETE) 63| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

6.0 RISK MANAGEMENT EXAMPLE

A Company makes lysight girders for Asian market and is at present operating at near production capacity. The

sales and marketing director of company anticipated market for this product increase by 15% in next twelve months.

The board must decide how to react to this change in demand. There are three strategies that are being considered.

S1-Install new equipment to improve productivity with a new system of working.

S2-Institute overtime and weekend working.

S3-Continue to work at capacity and let rival or new firm satisfy the increase in demand.

First case will lead to profit of Rs.240000, second case would yield Rs 210000 and third case would yield Rs

170000. These values are based on assumption that market grows by 15%. There are two other outcomes are

possible.

Demand falls by 10% as result of new high Japanese technology Japanese entering in to European market.

Demand remain unchanged because lack of construction growth.

Decision matrix can be constructed as follows:

Strategy 15% Stable -10%

S1 240 130 0

S2 210 150 0

S3 170 150 0

Probabilities can be assigned to the various outcomes.

Market outcome Probability

15% rise 0.6

stable 0.3

10% fall 0.1

Expected values for particular strategy are obtained as follows

For Strategy 1

Outcome Pay off Probability EMV

15% rise 240000 0.6 144000

stable 130000 0.3 39000

10% fall 0 0.1 0

Total 183000

The same process can be repeated for S2 and S3

Strategy EMV

S1 183000

S2 171000

S3 147000

This leads to favors S1 because it has highest EMV.Other factors should be taken in to consideration in comparison

of these strategies. The variability of returns is important and can be used to give a further measure of degree of risk.

This can be found out by using standard deviation. It is calculated as follows.

Strategy 1

Outcome EMV Deviationn D2 Probabilityy Total

240 183 57 3249 0.6 1949

130 183 53 2809 0.3 842

0 183 -183 33489 0.1 3348.90

Second International Conference on Emerging Trends in engineering (SICETE) 64| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

Risk Management in Construction Industry

variance 6140.90

Std .deviation 78.36

The same process can be repeated for S2 and S3

Strategy Std Deviation

S1 78.36

S2 63.00

S3 49.80

Now we have EMV and std deviation. Since higher EMV tends to higher st deviation so we should calculate the

coefficient of variation.

Coefficient of variation= Standard Deviation/ Expected Value

Strategy EMV Std Deviation Coeff. Of variance

S1 183 78.36 0.42

S2 178 63.00 0.36

S3 154 49.80 0.33

Select the option S3 as it having lower value of std. deviation and coeff. Of variation

7. CONCLUSION

It may be stated that risk Management is the core of project management. The success of every project

depends on how efficiently and effectively the. Risk avoidance may include a review of the overall project

objectives leading to a reappraisal of the project as a whole. depends on how efficiently and effectively the

uncertainties are handled. Every project is unlike the earlier one, the problems are distinctive and their solutions

are also different. Risk management will not remove all risks from the projects. Its main objective is to ensure that

risks are managed most effectively. The formal risk analysis and management techniques are rarely used by

construction industry due to lack of knowledge and expertise. The industry is also unknown about the suitability of

these techniques to construction industry. The control and risk transfer is most useful method in construction

industry. Joint venture widely used as a tool for risk transfer

REFERENCES

[1] Anna Klemetti” Risk management in construction project network” Laboratory of industrial management report 2006/2.

[2] Bayu Aditya , Bambang” Risk analysis in feasibility study of building construction project” The Tenth East Asia-Pacific Conference on

Structural Engineering and Constructio August 3-5, 2006, Bangkok, Thailand

[3] Building future planning “Risk assessment planning”2000

[4] Debasis sarkar,Gautam data” A framework of project risk management for the underground corridor construction of metro rail” W.P. No.

2011-02-05.

[5] Kajsa Simu”Risk management in small construction project” Licentiate thesis ISSN:1402-1757,2006:57

[6] ”Risk management standard”Arimic,alarm,irm 2002.

Second International Conference on Emerging Trends in engineering (SICETE) 65| Page

Dr. J.J. Magdum College of Engineering, Jaysingpur

You might also like

- JSA For Fabrication WorkDocument11 pagesJSA For Fabrication WorkRanjan KumarNo ratings yet

- Jump Form RAMSDocument35 pagesJump Form RAMSyusufuNo ratings yet

- Jsa For Complete Erection of Tank-001Document52 pagesJsa For Complete Erection of Tank-001Ashutosh80% (10)

- Risk Assessment TemplateDocument3 pagesRisk Assessment TemplateGus VanGeijtenbeekNo ratings yet

- Risk Assessment in Construction ProjectsDocument5 pagesRisk Assessment in Construction ProjectsIJRASETPublicationsNo ratings yet

- Risk Management PlanDocument5 pagesRisk Management PlanMary Angel HerdezNo ratings yet

- AnakaputhurDocument3 pagesAnakaputhurAnusha AshokNo ratings yet

- Offshore Installation Scope of WorkDocument37 pagesOffshore Installation Scope of Worktoyuedoxx100% (7)

- NYDFS Assessment ToolkitDocument236 pagesNYDFS Assessment ToolkitApoorva Badola33% (3)

- Risk ManagementDocument18 pagesRisk ManagementAnusha KishoreNo ratings yet

- Day 4 - Operations - Risk ManagementDocument37 pagesDay 4 - Operations - Risk ManagementPhilip CabuhatNo ratings yet

- Risk AssignmentDocument53 pagesRisk AssignmentNafiz ImtiazNo ratings yet

- 153 155ncice 078Document4 pages153 155ncice 078Dewa Gede Soja PrabawaNo ratings yet

- Qualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraDocument9 pagesQualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraInternational Jpurnal Of Technical Research And ApplicationsNo ratings yet

- Risks in Project and Risk Mitigation Measures - An OverviewDocument42 pagesRisks in Project and Risk Mitigation Measures - An OverviewashishNo ratings yet

- A Review of Risk Management Techniques For Construction ProjectsDocument6 pagesA Review of Risk Management Techniques For Construction ProjectsIJRASETPublicationsNo ratings yet

- Group 1 RMFD SynopsisDocument7 pagesGroup 1 RMFD SynopsisguptadivyeNo ratings yet

- PGP IDM-31 - Project Risk Mgmt.Document33 pagesPGP IDM-31 - Project Risk Mgmt.suhas vermaNo ratings yet

- Junal 1 Tugas 5Document6 pagesJunal 1 Tugas 5Hery AgustianNo ratings yet

- PRM Chapter 1Document9 pagesPRM Chapter 1Kan Fock-KuiNo ratings yet

- Tema17ICARiesgos enProyectosdeIngenieriaDocument7 pagesTema17ICARiesgos enProyectosdeIngenieriaTpomaNo ratings yet

- Azerbaijan State University of EconomicsDocument15 pagesAzerbaijan State University of EconomicsAnar hummatovNo ratings yet

- Case Study Risk Management: Highland TowerDocument5 pagesCase Study Risk Management: Highland ToweristtNo ratings yet

- Module 3Document5 pagesModule 3anshikasinha9812No ratings yet

- Methodological Tools For Project Risk ManagementDocument6 pagesMethodological Tools For Project Risk ManagementDEJENEESUBALEWNo ratings yet

- Lecture On Risk ManagementDocument21 pagesLecture On Risk ManagementEnusah AbdulaiNo ratings yet

- 41 - KTS-CM-13Document8 pages41 - KTS-CM-13IrenataNo ratings yet

- Risk Assessment and Allocation For Highway Construction ManagementDocument2 pagesRisk Assessment and Allocation For Highway Construction ManagementHari PrasadNo ratings yet

- An Assessment of Risk Identification in Large Construction ProjectsDocument13 pagesAn Assessment of Risk Identification in Large Construction ProjectsadaneNo ratings yet

- Risk Management in Construction Projects in Iraq: Contractors PerspectiveDocument16 pagesRisk Management in Construction Projects in Iraq: Contractors PerspectiveHaithamAlaubaidy100% (1)

- Risk ManagementDocument22 pagesRisk Managementاحمد مفرجNo ratings yet

- Risk Analysis & Assessment in Nigerian Banks IIDocument16 pagesRisk Analysis & Assessment in Nigerian Banks IIShowman4100% (1)

- Infra PranjalDocument5 pagesInfra PranjalpranjalNo ratings yet

- Unit-11 - Project Risk Management-2Document17 pagesUnit-11 - Project Risk Management-2linpawsachariNo ratings yet

- Group 8 Risk ManagementDocument22 pagesGroup 8 Risk ManagementStephen OlufekoNo ratings yet

- Risk Analysis and Management inDocument16 pagesRisk Analysis and Management inwahyuNo ratings yet

- Risk Analysis Techniques in Construction Engineering ProjectsDocument9 pagesRisk Analysis Techniques in Construction Engineering ProjectsOm PrakashNo ratings yet

- Research Proposal For Risk Management: HIRE Verified WriterDocument8 pagesResearch Proposal For Risk Management: HIRE Verified WriteraiahikehNo ratings yet

- International Journal of Engineering and Science Invention (IJESI)Document4 pagesInternational Journal of Engineering and Science Invention (IJESI)inventionjournalsNo ratings yet

- Implementation-of-Risk-Management-In-the-Construction-Industry-in-Developing-CountriesDocument22 pagesImplementation-of-Risk-Management-In-the-Construction-Industry-in-Developing-CountriesIsmail A IsmailNo ratings yet

- Risk Management and Information Technology Projects PDFDocument9 pagesRisk Management and Information Technology Projects PDFArup DasNo ratings yet

- Giao Trinh RiskDocument3 pagesGiao Trinh RiskNguyễn Ngọc QuỳnhNo ratings yet

- BSCE4-E Manibog Mart-Lliam Activity 5 Research-ManuscriptDocument20 pagesBSCE4-E Manibog Mart-Lliam Activity 5 Research-ManuscriptMiNT MatiasNo ratings yet

- Risk Assesment N Allocation in UAE Construction IndustryDocument8 pagesRisk Assesment N Allocation in UAE Construction IndustrysimaksinanNo ratings yet

- Risk Management in Construction ProjectsDocument7 pagesRisk Management in Construction ProjectsAntonyNo ratings yet

- PRM Chapter 3Document20 pagesPRM Chapter 3Kan Fock-KuiNo ratings yet

- Managing Risk in Infrastructure Projects Ijariie2757Document7 pagesManaging Risk in Infrastructure Projects Ijariie2757Ahmed IdreesNo ratings yet

- Lecture 2 - Risk ManagementDocument41 pagesLecture 2 - Risk ManagementchristopherNo ratings yet

- Lec # 09 Construction ManagementDocument17 pagesLec # 09 Construction ManagementNoor Uddin ZangiNo ratings yet

- 10aug201701083623 Rupalee Dharmapal Sukhadeve 86-88 PDFDocument3 pages10aug201701083623 Rupalee Dharmapal Sukhadeve 86-88 PDFPrantikNo ratings yet

- Project Risks and BarriersDocument7 pagesProject Risks and Barrierssamu hayesNo ratings yet

- Mb0049 Unit 07-SlmDocument25 pagesMb0049 Unit 07-Slmpmg3067No ratings yet

- Contract DocumentDocument78 pagesContract DocumentEngineeri TadiyosNo ratings yet

- Risk Management in Construction Projects As Per Indian ScenarioDocument10 pagesRisk Management in Construction Projects As Per Indian ScenarioIAEME PublicationNo ratings yet

- Risk Factors in Construction ProjectsDocument3 pagesRisk Factors in Construction ProjectsRay Ronald AgaciaNo ratings yet

- Research PaperDocument12 pagesResearch PaperAbhishek GuptaNo ratings yet

- Risk Assessment and Risk MappingDocument7 pagesRisk Assessment and Risk MappingAJER JOURNALNo ratings yet

- Risk Management ReportDocument15 pagesRisk Management ReportMaverick CardsNo ratings yet

- Ehab Risk Management QUIZ - 3Document6 pagesEhab Risk Management QUIZ - 3offical padovaNo ratings yet

- Adjusted Risk Management Assignment GRP 2Document24 pagesAdjusted Risk Management Assignment GRP 2john wambuaNo ratings yet

- Ijtra1505236 PDFDocument9 pagesIjtra1505236 PDFRushi NaikNo ratings yet

- Risk ManagementDocument17 pagesRisk ManagementRawaz KanabieNo ratings yet

- Risk Management in Construction Project ManagementDocument8 pagesRisk Management in Construction Project ManagementShakil AhmedNo ratings yet

- Construction InsuranceDocument27 pagesConstruction InsuranceCUTto1122No ratings yet

- PPLE - Assignment 2Document6 pagesPPLE - Assignment 2Sumit DasNo ratings yet

- Aviation Manager’s Toolkit: How to Develop Php/Mysql-Based Interactive Communication Platform: A Computational Approach to Aviation MaintenanceFrom EverandAviation Manager’s Toolkit: How to Develop Php/Mysql-Based Interactive Communication Platform: A Computational Approach to Aviation MaintenanceNo ratings yet

- Books To Refer TitleDocument1 pageBooks To Refer TitleAnusha AshokNo ratings yet

- Outline Designers Risk AssessmentDocument2 pagesOutline Designers Risk AssessmentAnusha AshokNo ratings yet

- TD Sip172384 Tender Notice Master Plan DPR RFPDocument1 pageTD Sip172384 Tender Notice Master Plan DPR RFPAnusha AshokNo ratings yet

- Locdrawings PDFDocument76 pagesLocdrawings PDFAnusha AshokNo ratings yet

- SFT 100 Product FeaturesDocument1 pageSFT 100 Product FeaturesAnusha AshokNo ratings yet

- UNIT 2 HSPDocument46 pagesUNIT 2 HSPAnusha AshokNo ratings yet

- Application Form / Document: India Tourism Development Corporation Limited (Engineering Division)Document22 pagesApplication Form / Document: India Tourism Development Corporation Limited (Engineering Division)Anusha AshokNo ratings yet

- Local Governance: Human Settlement and PlanningDocument11 pagesLocal Governance: Human Settlement and PlanningAnusha AshokNo ratings yet

- Returning To Workspace Post COVID: How To Handle Existing Facility? What Can Be Done?Document7 pagesReturning To Workspace Post COVID: How To Handle Existing Facility? What Can Be Done?Anusha AshokNo ratings yet

- Water Front Development: Assignment 2 - URBAN DESIGNDocument21 pagesWater Front Development: Assignment 2 - URBAN DESIGNAnusha Ashok100% (1)

- Hotel Minimum ReqDocument28 pagesHotel Minimum ReqAnusha AshokNo ratings yet

- Case Study - Five Star Hotel, London For WebDocument2 pagesCase Study - Five Star Hotel, London For WebAnusha AshokNo ratings yet

- Landscape - Case StudyDocument15 pagesLandscape - Case StudyAnusha Ashok0% (1)

- Jason Shahrey: Career ObjectiveDocument4 pagesJason Shahrey: Career Objectiveruhul01No ratings yet

- Risk Assessment Worksheet BlankDocument5 pagesRisk Assessment Worksheet BlankisolongNo ratings yet

- Taylor County Iowa Hazard Mitigation Plan 2022 Public Review DraftDocument307 pagesTaylor County Iowa Hazard Mitigation Plan 2022 Public Review DraftTaylor CountyNo ratings yet

- PRM Chapter 1Document9 pagesPRM Chapter 1Kan Fock-KuiNo ratings yet

- Risk Assesment For Shifting of MEP Services and Re-Installations 26-03-2022Document5 pagesRisk Assesment For Shifting of MEP Services and Re-Installations 26-03-2022Zameer Basha Navzath AliNo ratings yet

- Applying Health-Based Risk Assessments To Worker and Product Safety For Potent Pharmaceuticals in Contract Manufacturing OperationsDocument5 pagesApplying Health-Based Risk Assessments To Worker and Product Safety For Potent Pharmaceuticals in Contract Manufacturing OperationsJoe Luis Villa MedinaNo ratings yet

- ACCTG 136 Module 2 Audit PlanningDocument21 pagesACCTG 136 Module 2 Audit PlanningKaren PortiaNo ratings yet

- Risk Assessment (House)Document2 pagesRisk Assessment (House)Oliver HorsfieldNo ratings yet

- PDODocument24 pagesPDOmuna al harthyNo ratings yet

- Dealing With White Collar CrimeDocument70 pagesDealing With White Collar CrimeAndrew FordredNo ratings yet

- Fire SafetyDocument19 pagesFire SafetyZulvita AmandaNo ratings yet

- Sample Army Risk Assessment FormDocument3 pagesSample Army Risk Assessment FormToufeeq AbrarNo ratings yet

- Health, Safety & Environmental Plan: Communication LinkDocument50 pagesHealth, Safety & Environmental Plan: Communication Linkmadhurajsh100% (1)

- Method Statement External Application of Corrosion InhibitorDocument4 pagesMethod Statement External Application of Corrosion InhibitorKannan MurugesanNo ratings yet

- Risks and Liabilities of Computer-Based SystemsDocument28 pagesRisks and Liabilities of Computer-Based SystemsMarlene MahidlayonNo ratings yet

- Audit Quality: A Literature Overview and Research Synthesis: IOSR Journal of Business and Management February 2020Document12 pagesAudit Quality: A Literature Overview and Research Synthesis: IOSR Journal of Business and Management February 2020siti rizki ayuniahNo ratings yet

- Blasting and Painting ProcedureDocument27 pagesBlasting and Painting ProcedurePerlie BellomosNo ratings yet

- MBA641 T2 2020 Assessment 03 v1 Strategic Project Management PDFDocument5 pagesMBA641 T2 2020 Assessment 03 v1 Strategic Project Management PDFFarwa KhalidNo ratings yet

- 20.JSA - Hendra Manual Pouring CongcreteDocument3 pages20.JSA - Hendra Manual Pouring CongcreteMuhamad Rizki AzisNo ratings yet

- A Bring Your Own Device Risk Assessment ModelDocument20 pagesA Bring Your Own Device Risk Assessment ModelAI Coordinator - CSC JournalsNo ratings yet

- ISO 27001 RessaDocument10 pagesISO 27001 RessaressaNo ratings yet

- Standard Field HSE PlanDocument89 pagesStandard Field HSE PlanMalik Nasar Ali100% (1)

- Risk Management Exam OutlineDocument28 pagesRisk Management Exam OutlineTran Van HienNo ratings yet

- Fire Risk AssessmentDocument39 pagesFire Risk AssessmentMutu PalembangNo ratings yet