Professional Documents

Culture Documents

Google PDF

Google PDF

Uploaded by

MrHohoho97Copyright:

Available Formats

You might also like

- SnowPro Core Exam PreparationDocument5 pagesSnowPro Core Exam PreparationkunalguptaindiaNo ratings yet

- Bayview Confidential Executive Summary - 2010 PDFs Bayview-Documentation Cut-And-paste Bayview-Marketing-BookDocument31 pagesBayview Confidential Executive Summary - 2010 PDFs Bayview-Documentation Cut-And-paste Bayview-Marketing-Booktraderash1020No ratings yet

- 2015 04 28 - Endurance International Group: A Web of DeceitDocument61 pages2015 04 28 - Endurance International Group: A Web of DeceitgothamcityresearchNo ratings yet

- Third Point Investor PresentationDocument29 pagesThird Point Investor PresentationValueWalkNo ratings yet

- Investor Presentation: July 2019Document35 pagesInvestor Presentation: July 2019Anjali ShahNo ratings yet

- Fundamental Analysis - Definition, Types, Benefits, and How To DoDocument5 pagesFundamental Analysis - Definition, Types, Benefits, and How To Dohavo lavoNo ratings yet

- What Is The Most Important Financial Information To Investors in Emerging Markets? and Why Is This Information Important?Document3 pagesWhat Is The Most Important Financial Information To Investors in Emerging Markets? and Why Is This Information Important?Jad RizkNo ratings yet

- APO Investor Presentation February 2014Document32 pagesAPO Investor Presentation February 2014Ram KumarNo ratings yet

- RGA Investment Advisors Envestnet Slides PDFDocument20 pagesRGA Investment Advisors Envestnet Slides PDFJason Gilbert100% (1)

- ULTI Aug 16 Short ReportDocument16 pagesULTI Aug 16 Short ReportAnonymous Ecd8rCNo ratings yet

- FVRR Company Presentation October 2020Document41 pagesFVRR Company Presentation October 2020tom thomasNo ratings yet

- Sub Section - III IPO GradingDocument4 pagesSub Section - III IPO GradingSachin SharmaNo ratings yet

- Moodys Disclosures On Credit Ratings of Fiji - 19 January 2012Document5 pagesMoodys Disclosures On Credit Ratings of Fiji - 19 January 2012Intelligentsiya HqNo ratings yet

- Bajaj Finance Limited: June 2011Document28 pagesBajaj Finance Limited: June 2011Harshil ShahNo ratings yet

- Corporate Rating Methodology (Agusto) 2Document7 pagesCorporate Rating Methodology (Agusto) 2Adedayo-ojo FiyinfoluwaNo ratings yet

- Individual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Document8 pagesIndividual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Tha RaniNo ratings yet

- Equity Research Group Project - TemplateDocument6 pagesEquity Research Group Project - TemplateGia Hân TrầnNo ratings yet

- SPACS and Their Growing RelevanceDocument8 pagesSPACS and Their Growing RelevancecoolNo ratings yet

- Basic Fundamental AnalysisDocument5 pagesBasic Fundamental AnalysisDeepal DhamejaNo ratings yet

- 2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIDocument8 pages2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIgothamcityresearchNo ratings yet

- Audit SM May 2024 CH11 Prospective Financial Information and OtherDocument38 pagesAudit SM May 2024 CH11 Prospective Financial Information and Othergolden.gyaanNo ratings yet

- Artikel Rating SukukDocument12 pagesArtikel Rating SukukDilaNo ratings yet

- Wepik Analyzing Wipro039s Financial Statements Unveiling The Financial Performance With Strategic Insights 20231104155642jmegDocument15 pagesWepik Analyzing Wipro039s Financial Statements Unveiling The Financial Performance With Strategic Insights 20231104155642jmegRUDRESHNo ratings yet

- Startegic Management AssignmnetDocument8 pagesStartegic Management Assignmnetharleen kaurNo ratings yet

- Financial AnalysisDocument18 pagesFinancial AnalysisNyssa AdiNo ratings yet

- 1.5 Investment Strategy DocumentDocument2 pages1.5 Investment Strategy Documenttasneem bilalNo ratings yet

- 2017 06 06 - Aac Report II Preview - Is This A Smoking Gun?Document15 pages2017 06 06 - Aac Report II Preview - Is This A Smoking Gun?gothamcityresearch67% (3)

- Internal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Document3 pagesInternal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Nishant BhartiNo ratings yet

- Investing in An IPO: Investor BulletinDocument8 pagesInvesting in An IPO: Investor BulletinAlexis RoyerNo ratings yet

- 4th Edition Summary Valuation Measuring and Managing The ValueDocument17 pages4th Edition Summary Valuation Measuring and Managing The Valuekrb2709No ratings yet

- Ipo X-RayDocument3 pagesIpo X-Rayrahul kumarNo ratings yet

- Return On EquityDocument7 pagesReturn On EquityTumwine Kahweza ProsperNo ratings yet

- ACCT 504 MART Perfect EducationDocument58 pagesACCT 504 MART Perfect EducationdavidwarnNo ratings yet

- Investment Case For Fiat Chrysler AutomotiveDocument17 pagesInvestment Case For Fiat Chrysler AutomotiveCanadianValue100% (1)

- The 2011 HEC-DowJones PE Performance Ranking ReportDocument6 pagesThe 2011 HEC-DowJones PE Performance Ranking ReportDan PrimackNo ratings yet

- Revised Current Ratio & Data SourceDocument5 pagesRevised Current Ratio & Data SourceportfolioxNo ratings yet

- FVRR Company Presentation August 2022 (Confidential)Document45 pagesFVRR Company Presentation August 2022 (Confidential)Veronica Alvarez PerezNo ratings yet

- Discounted Cash Flow Analysis: by Ben McclureDocument17 pagesDiscounted Cash Flow Analysis: by Ben McclureresearchanalystbankingNo ratings yet

- Financial Ratio AnalysisDocument8 pagesFinancial Ratio AnalysisVarun SharmaNo ratings yet

- Sample Valuation ReportDocument17 pagesSample Valuation ReportabhidadNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosFahad Ahmed NooraniNo ratings yet

- Running Head: Impact of Trade Credit On The Profitability of Firms 1Document10 pagesRunning Head: Impact of Trade Credit On The Profitability of Firms 1Click HereNo ratings yet

- 1ratio Analysis of Automobile Sector For InvestmentDocument29 pages1ratio Analysis of Automobile Sector For Investmentpranab_nandaNo ratings yet

- FVRR Company Presentation Feb 2024Document49 pagesFVRR Company Presentation Feb 2024steven.tranNo ratings yet

- Sub Section - Iii IPO Grading: WWW - Sebi.gov - inDocument4 pagesSub Section - Iii IPO Grading: WWW - Sebi.gov - inArwa KapasiNo ratings yet

- Corporate Governance and Value Creation - Private Equity StyleDocument9 pagesCorporate Governance and Value Creation - Private Equity StylemokitiNo ratings yet

- Damodaran's Target SelectionDocument3 pagesDamodaran's Target SelectionVineet MishraNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (21)

- Corporate Stock Evaluation: Category 1: The BasicsDocument3 pagesCorporate Stock Evaluation: Category 1: The BasicsaliNo ratings yet

- Steps To A Basic Company Financial AnalysisDocument21 pagesSteps To A Basic Company Financial AnalysisIvana PopovicNo ratings yet

- Independence of Mind ExampleDocument11 pagesIndependence of Mind ExampleThao BuiNo ratings yet

- Auto Sector: Industry Sales Up 6.5%yoy in 6mfy14Document2 pagesAuto Sector: Industry Sales Up 6.5%yoy in 6mfy14jibranqqNo ratings yet

- Oneliners P3Document4 pagesOneliners P3Nirvana BoyNo ratings yet

- Aksujomas 03 01 05Document20 pagesAksujomas 03 01 05Rasaq MojeedNo ratings yet

- SECURITY ANALYSIS TERM PAPER FinalDocument19 pagesSECURITY ANALYSIS TERM PAPER FinalRavi ThapaNo ratings yet

- Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceDocument86 pagesRatio Analysis at Il&Fs Invest Smart Mba Project FinanceBabasab Patil (Karrisatte)No ratings yet

- Sarbanes Oxley ActDocument7 pagesSarbanes Oxley ActSara RivasNo ratings yet

- Persistent Company UpdateDocument4 pagesPersistent Company UpdateAngel BrokingNo ratings yet

- An Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsFrom EverandAn Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Malaysia'S Media Landscape: Then. Now. Next.: Nielsen Media Syndicated ReportDocument1 pageMalaysia'S Media Landscape: Then. Now. Next.: Nielsen Media Syndicated ReportMrHohoho97No ratings yet

- HH PDFDocument12 pagesHH PDFMrHohoho97No ratings yet

- Credit Evaluation Perspective of Dual-Banking and Full-Fledge of Islamic Banking Approach in Malaysia: Current Practices and IssuesDocument17 pagesCredit Evaluation Perspective of Dual-Banking and Full-Fledge of Islamic Banking Approach in Malaysia: Current Practices and IssuesMrHohoho97No ratings yet

- Compliance Report Based On: AAOIFI Shariah Guidelines: Apple Inc. (AAPL US)Document4 pagesCompliance Report Based On: AAOIFI Shariah Guidelines: Apple Inc. (AAPL US)MrHohoho97No ratings yet

- 07 Affin - Home - Invest I - ENG - v4 7 (1) (090819) Amended PDFDocument8 pages07 Affin - Home - Invest I - ENG - v4 7 (1) (090819) Amended PDFMrHohoho97No ratings yet

- Topic 3.1 Data Transmission and Networking MediaDocument47 pagesTopic 3.1 Data Transmission and Networking MediaمحمدجوزيايNo ratings yet

- LMS6048 LowresDocument4 pagesLMS6048 LowrestamanogNo ratings yet

- MMC Pigtail OS2-PIG XX y OS2 ED.1.0 (GB)Document2 pagesMMC Pigtail OS2-PIG XX y OS2 ED.1.0 (GB)Indra HayadiNo ratings yet

- 3fak 1998Document47 pages3fak 1998motorciNo ratings yet

- Lec 7 - Intro To CryptographyDocument38 pagesLec 7 - Intro To CryptographygNo ratings yet

- DSNHP09375890000100835Document1 pageDSNHP09375890000100835Janeshwar ChauhanNo ratings yet

- Barnagay Inventory Form 1Document2 pagesBarnagay Inventory Form 1Barangay San Jose Csfp100% (2)

- B&Plus Proximity Sensor - 001.BES07e - Usm8-1Document1 pageB&Plus Proximity Sensor - 001.BES07e - Usm8-1Hussein RamzaNo ratings yet

- Design of Hologram App Using Real Time 3-D Live Video StreamingDocument5 pagesDesign of Hologram App Using Real Time 3-D Live Video StreamingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Department of Computer Science and EngineeringDocument25 pagesDepartment of Computer Science and EngineeringjesudosssNo ratings yet

- oSIST prEN 12680 2 2024Document11 pagesoSIST prEN 12680 2 2024IgorNo ratings yet

- Ai-102 8Document26 pagesAi-102 8solutions4worksNo ratings yet

- Techtest L I M I T e D Maintenance Manual Crash Position Indicator SystemDocument20 pagesTechtest L I M I T e D Maintenance Manual Crash Position Indicator SystemaburizqiNo ratings yet

- Exercises With Finite State Machines: CS 64: Computer Organization and Design Logic Lecture #17 Winter 2019Document17 pagesExercises With Finite State Machines: CS 64: Computer Organization and Design Logic Lecture #17 Winter 2019Gabriel CañadasNo ratings yet

- Syllabus The Contemporary WorldDocument8 pagesSyllabus The Contemporary WorldLenicho MarquezNo ratings yet

- SCM Lecture 3Document2 pagesSCM Lecture 3rishabh choudhryNo ratings yet

- Chapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisDocument9 pagesChapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisRel XandrrNo ratings yet

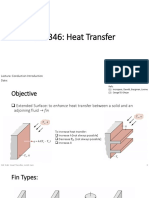

- ME 346: Heat Transfer: Instructor: Ankit JainDocument23 pagesME 346: Heat Transfer: Instructor: Ankit JainDeepankar Sakya KusumaNo ratings yet

- Small Leak Leads To Catastrophic Failure: Did You Know?Document1 pageSmall Leak Leads To Catastrophic Failure: Did You Know?mkkamarajNo ratings yet

- Design & Analysis of Steering System For Solar VehicleDocument4 pagesDesign & Analysis of Steering System For Solar VehicleYesh100% (1)

- Infinix Zero 2023Document2 pagesInfinix Zero 2023LEVIATHANDAVIDNo ratings yet

- ICT Careers and Job TypesDocument4 pagesICT Careers and Job Typesshdfan aseel95100% (1)

- NMRVDocument114 pagesNMRVNur SugiartoNo ratings yet

- May 2021 Examination Diet School of Mathematics & Statistics MT4614Document6 pagesMay 2021 Examination Diet School of Mathematics & Statistics MT4614Tev WallaceNo ratings yet

- Qualys Virtual Scanner Appliance User GuideDocument19 pagesQualys Virtual Scanner Appliance User GuideTama OlanNo ratings yet

- Ethical Use of Artificial Intelligence ADocument6 pagesEthical Use of Artificial Intelligence AGreg ChatsiosNo ratings yet

- Brentwood Cooling Tower Products - Rev2Document12 pagesBrentwood Cooling Tower Products - Rev2Kaushal100% (1)

- Image Encryption Using Elliptic Curve Cryptography: SciencedirectDocument10 pagesImage Encryption Using Elliptic Curve Cryptography: SciencedirectNguyễn Quang HuyNo ratings yet

Google PDF

Google PDF

Uploaded by

MrHohoho97Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Google PDF

Google PDF

Uploaded by

MrHohoho97Copyright:

Available Formats

IDEALRATINGS RESEARCH REPORT – PIR143-2011 AUGUST 08, 2011

, 2011

Quarterly Compliance Report based on

AAOIFI Shariah Mandate (Q2-2011)

Google Inc. (GOOG US)

Description

Google Inc. (Google) is focused on improving the ways people connect with information. The Company

generates revenue primarily by delivering online advertising. The Company focuses on areas, such as search,

advertising, operating systems and platforms, and enterprise. The Company maintains an index of Websites and

other online content, and make it available through its search engine to anyone with an Internet connection.

Company Status

IdealRatings analysts have issued a new report regarding the company:

Name: Google Inc.

Ticker: GOOG US

Country: United States

Core Business Activity: IT Services / Consulting

Exchange: NASDAQ

Compliance Status: Shariah-compliant

IdealRatings reviewed the most recent financial statements (Q2-2011) for Google Inc. The report has

been prepared to determine the Shariah-compliance status of the company based on the AAOIFI Shariah

mandate.

Business Screening

Based on the business of the company the core business is on-line information service provider / search

engine.

The revenue segmentation is as follows:

IDEALRATINGS RESEARCH PAGE 1 OF 4

WWW.IDEALRATINGS.COM/RESEARCH

(Source: Google Inc. 10-Q Statement Q2-2011)

Other revenue includes revenue from media planning as well as direct-to-consumer web store distributing the

Nexus One mobile phone.

Google Inc. has defined a set of restrictions for categories not to be advertised and thus no revenue is

generated from these categories such as:

- Gambling

- Adult or non-family safe content such as

o Alcohol

o Sex / Porn

Thus the income from the core business is compliant. Non-permissible income mainly comes from non-

operating income sources such as interest income and is minor compared to the total income of the company

and thus does not exceed the 5% threshold as defined by AAOIFI.

Therefore the status of the company from a business activity is as follows:

Threshold Company Compliance

Non‐permissible Income 5% Less than 5% PASS

IDEALRATINGS RESEARCH PAGE 2 OF 4

WWW.IDEALRATINGS.COM/RESEARCH

Financial Screening

According to the most recent available financial statement with adequate information (2011-Q2) the

financial ratios with respect to the AAOIFI Shariah mandate for the company are as follows:

Threshold Company Compliance

Interest‐bearing Investments 30% Less PASS

Interest‐bearing Debts 30% Less PASS

Liquidity 67% Less PASS

Share Type (Preference or Common) Common Common PASS

Compliance Status

Based on the available information and the above figures according to the AAOIFI Shariah mandate for

Majesco Entertainment Co. is to be considered Shariah-compliant.

IDEALRATINGS RESEARCH PAGE 3 OF 4

WWW.IDEALRATINGS.COM/RESEARCH

Disclosures

This research is for our clients only. This research is based on current public information that we consider reliable, but we do not represent it is

accurate or complete, and it should not be relied on as such. The research reports are published at irregular intervals based on clients’ request or

as appropriate in our analysts’ judgment.

This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction especially where such an offer or

solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives,

financial situations, or needs of individual clients. Clients should consider whether any advice or recommendation in this research is suitable for

their particular circumstances and, if appropriate, seek professional advice, including tax advice. The price and value of investments referred to

in this research and the income from them may fluctuate. Past performance is not a guide to future performance, future returns are not

guaranteed, and a loss of original capital may occur. Fluctuations in exchange rates could have adverse effects on the value or price of, or

income derived from, certain investments.

Copyright 2011 IdealRatings, Inc. No part of this material may be (i) copied, photocopied or duplicated in any form by any means

or (ii) redistributed without the prior written consent of IdealRatings, Inc.

IDEALRATINGS RESEARCH PAGE 4 OF 4

WWW.IDEALRATINGS.COM/RESEARCH

You might also like

- SnowPro Core Exam PreparationDocument5 pagesSnowPro Core Exam PreparationkunalguptaindiaNo ratings yet

- Bayview Confidential Executive Summary - 2010 PDFs Bayview-Documentation Cut-And-paste Bayview-Marketing-BookDocument31 pagesBayview Confidential Executive Summary - 2010 PDFs Bayview-Documentation Cut-And-paste Bayview-Marketing-Booktraderash1020No ratings yet

- 2015 04 28 - Endurance International Group: A Web of DeceitDocument61 pages2015 04 28 - Endurance International Group: A Web of DeceitgothamcityresearchNo ratings yet

- Third Point Investor PresentationDocument29 pagesThird Point Investor PresentationValueWalkNo ratings yet

- Investor Presentation: July 2019Document35 pagesInvestor Presentation: July 2019Anjali ShahNo ratings yet

- Fundamental Analysis - Definition, Types, Benefits, and How To DoDocument5 pagesFundamental Analysis - Definition, Types, Benefits, and How To Dohavo lavoNo ratings yet

- What Is The Most Important Financial Information To Investors in Emerging Markets? and Why Is This Information Important?Document3 pagesWhat Is The Most Important Financial Information To Investors in Emerging Markets? and Why Is This Information Important?Jad RizkNo ratings yet

- APO Investor Presentation February 2014Document32 pagesAPO Investor Presentation February 2014Ram KumarNo ratings yet

- RGA Investment Advisors Envestnet Slides PDFDocument20 pagesRGA Investment Advisors Envestnet Slides PDFJason Gilbert100% (1)

- ULTI Aug 16 Short ReportDocument16 pagesULTI Aug 16 Short ReportAnonymous Ecd8rCNo ratings yet

- FVRR Company Presentation October 2020Document41 pagesFVRR Company Presentation October 2020tom thomasNo ratings yet

- Sub Section - III IPO GradingDocument4 pagesSub Section - III IPO GradingSachin SharmaNo ratings yet

- Moodys Disclosures On Credit Ratings of Fiji - 19 January 2012Document5 pagesMoodys Disclosures On Credit Ratings of Fiji - 19 January 2012Intelligentsiya HqNo ratings yet

- Bajaj Finance Limited: June 2011Document28 pagesBajaj Finance Limited: June 2011Harshil ShahNo ratings yet

- Corporate Rating Methodology (Agusto) 2Document7 pagesCorporate Rating Methodology (Agusto) 2Adedayo-ojo FiyinfoluwaNo ratings yet

- Individual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Document8 pagesIndividual Assignment: Name Id Number K.K.Kavitharane A/P Kuppusamy 1207201012Tha RaniNo ratings yet

- Equity Research Group Project - TemplateDocument6 pagesEquity Research Group Project - TemplateGia Hân TrầnNo ratings yet

- SPACS and Their Growing RelevanceDocument8 pagesSPACS and Their Growing RelevancecoolNo ratings yet

- Basic Fundamental AnalysisDocument5 pagesBasic Fundamental AnalysisDeepal DhamejaNo ratings yet

- 2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIDocument8 pages2015 05 05 - Eigi - Adjusted EBITDA Is A Meaningless Metric, As It Does Not Correlate With Free Cash Flow - 4 Questions All Analyst Should Ask EIGIgothamcityresearchNo ratings yet

- Audit SM May 2024 CH11 Prospective Financial Information and OtherDocument38 pagesAudit SM May 2024 CH11 Prospective Financial Information and Othergolden.gyaanNo ratings yet

- Artikel Rating SukukDocument12 pagesArtikel Rating SukukDilaNo ratings yet

- Wepik Analyzing Wipro039s Financial Statements Unveiling The Financial Performance With Strategic Insights 20231104155642jmegDocument15 pagesWepik Analyzing Wipro039s Financial Statements Unveiling The Financial Performance With Strategic Insights 20231104155642jmegRUDRESHNo ratings yet

- Startegic Management AssignmnetDocument8 pagesStartegic Management Assignmnetharleen kaurNo ratings yet

- Financial AnalysisDocument18 pagesFinancial AnalysisNyssa AdiNo ratings yet

- 1.5 Investment Strategy DocumentDocument2 pages1.5 Investment Strategy Documenttasneem bilalNo ratings yet

- 2017 06 06 - Aac Report II Preview - Is This A Smoking Gun?Document15 pages2017 06 06 - Aac Report II Preview - Is This A Smoking Gun?gothamcityresearch67% (3)

- Internal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Document3 pagesInternal Assessment Based On Summer Internship Company (Praedico Global Research Private Limited)Nishant BhartiNo ratings yet

- Investing in An IPO: Investor BulletinDocument8 pagesInvesting in An IPO: Investor BulletinAlexis RoyerNo ratings yet

- 4th Edition Summary Valuation Measuring and Managing The ValueDocument17 pages4th Edition Summary Valuation Measuring and Managing The Valuekrb2709No ratings yet

- Ipo X-RayDocument3 pagesIpo X-Rayrahul kumarNo ratings yet

- Return On EquityDocument7 pagesReturn On EquityTumwine Kahweza ProsperNo ratings yet

- ACCT 504 MART Perfect EducationDocument58 pagesACCT 504 MART Perfect EducationdavidwarnNo ratings yet

- Investment Case For Fiat Chrysler AutomotiveDocument17 pagesInvestment Case For Fiat Chrysler AutomotiveCanadianValue100% (1)

- The 2011 HEC-DowJones PE Performance Ranking ReportDocument6 pagesThe 2011 HEC-DowJones PE Performance Ranking ReportDan PrimackNo ratings yet

- Revised Current Ratio & Data SourceDocument5 pagesRevised Current Ratio & Data SourceportfolioxNo ratings yet

- FVRR Company Presentation August 2022 (Confidential)Document45 pagesFVRR Company Presentation August 2022 (Confidential)Veronica Alvarez PerezNo ratings yet

- Discounted Cash Flow Analysis: by Ben McclureDocument17 pagesDiscounted Cash Flow Analysis: by Ben McclureresearchanalystbankingNo ratings yet

- Financial Ratio AnalysisDocument8 pagesFinancial Ratio AnalysisVarun SharmaNo ratings yet

- Sample Valuation ReportDocument17 pagesSample Valuation ReportabhidadNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosFahad Ahmed NooraniNo ratings yet

- Running Head: Impact of Trade Credit On The Profitability of Firms 1Document10 pagesRunning Head: Impact of Trade Credit On The Profitability of Firms 1Click HereNo ratings yet

- 1ratio Analysis of Automobile Sector For InvestmentDocument29 pages1ratio Analysis of Automobile Sector For Investmentpranab_nandaNo ratings yet

- FVRR Company Presentation Feb 2024Document49 pagesFVRR Company Presentation Feb 2024steven.tranNo ratings yet

- Sub Section - Iii IPO Grading: WWW - Sebi.gov - inDocument4 pagesSub Section - Iii IPO Grading: WWW - Sebi.gov - inArwa KapasiNo ratings yet

- Corporate Governance and Value Creation - Private Equity StyleDocument9 pagesCorporate Governance and Value Creation - Private Equity StylemokitiNo ratings yet

- Damodaran's Target SelectionDocument3 pagesDamodaran's Target SelectionVineet MishraNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (21)

- Corporate Stock Evaluation: Category 1: The BasicsDocument3 pagesCorporate Stock Evaluation: Category 1: The BasicsaliNo ratings yet

- Steps To A Basic Company Financial AnalysisDocument21 pagesSteps To A Basic Company Financial AnalysisIvana PopovicNo ratings yet

- Independence of Mind ExampleDocument11 pagesIndependence of Mind ExampleThao BuiNo ratings yet

- Auto Sector: Industry Sales Up 6.5%yoy in 6mfy14Document2 pagesAuto Sector: Industry Sales Up 6.5%yoy in 6mfy14jibranqqNo ratings yet

- Oneliners P3Document4 pagesOneliners P3Nirvana BoyNo ratings yet

- Aksujomas 03 01 05Document20 pagesAksujomas 03 01 05Rasaq MojeedNo ratings yet

- SECURITY ANALYSIS TERM PAPER FinalDocument19 pagesSECURITY ANALYSIS TERM PAPER FinalRavi ThapaNo ratings yet

- Ratio Analysis at Il&Fs Invest Smart Mba Project FinanceDocument86 pagesRatio Analysis at Il&Fs Invest Smart Mba Project FinanceBabasab Patil (Karrisatte)No ratings yet

- Sarbanes Oxley ActDocument7 pagesSarbanes Oxley ActSara RivasNo ratings yet

- Persistent Company UpdateDocument4 pagesPersistent Company UpdateAngel BrokingNo ratings yet

- An Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsFrom EverandAn Investment Journey II The Essential Tool Kit: Building A Successful Portfolio With Stock FundamentalsNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Malaysia'S Media Landscape: Then. Now. Next.: Nielsen Media Syndicated ReportDocument1 pageMalaysia'S Media Landscape: Then. Now. Next.: Nielsen Media Syndicated ReportMrHohoho97No ratings yet

- HH PDFDocument12 pagesHH PDFMrHohoho97No ratings yet

- Credit Evaluation Perspective of Dual-Banking and Full-Fledge of Islamic Banking Approach in Malaysia: Current Practices and IssuesDocument17 pagesCredit Evaluation Perspective of Dual-Banking and Full-Fledge of Islamic Banking Approach in Malaysia: Current Practices and IssuesMrHohoho97No ratings yet

- Compliance Report Based On: AAOIFI Shariah Guidelines: Apple Inc. (AAPL US)Document4 pagesCompliance Report Based On: AAOIFI Shariah Guidelines: Apple Inc. (AAPL US)MrHohoho97No ratings yet

- 07 Affin - Home - Invest I - ENG - v4 7 (1) (090819) Amended PDFDocument8 pages07 Affin - Home - Invest I - ENG - v4 7 (1) (090819) Amended PDFMrHohoho97No ratings yet

- Topic 3.1 Data Transmission and Networking MediaDocument47 pagesTopic 3.1 Data Transmission and Networking MediaمحمدجوزيايNo ratings yet

- LMS6048 LowresDocument4 pagesLMS6048 LowrestamanogNo ratings yet

- MMC Pigtail OS2-PIG XX y OS2 ED.1.0 (GB)Document2 pagesMMC Pigtail OS2-PIG XX y OS2 ED.1.0 (GB)Indra HayadiNo ratings yet

- 3fak 1998Document47 pages3fak 1998motorciNo ratings yet

- Lec 7 - Intro To CryptographyDocument38 pagesLec 7 - Intro To CryptographygNo ratings yet

- DSNHP09375890000100835Document1 pageDSNHP09375890000100835Janeshwar ChauhanNo ratings yet

- Barnagay Inventory Form 1Document2 pagesBarnagay Inventory Form 1Barangay San Jose Csfp100% (2)

- B&Plus Proximity Sensor - 001.BES07e - Usm8-1Document1 pageB&Plus Proximity Sensor - 001.BES07e - Usm8-1Hussein RamzaNo ratings yet

- Design of Hologram App Using Real Time 3-D Live Video StreamingDocument5 pagesDesign of Hologram App Using Real Time 3-D Live Video StreamingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Department of Computer Science and EngineeringDocument25 pagesDepartment of Computer Science and EngineeringjesudosssNo ratings yet

- oSIST prEN 12680 2 2024Document11 pagesoSIST prEN 12680 2 2024IgorNo ratings yet

- Ai-102 8Document26 pagesAi-102 8solutions4worksNo ratings yet

- Techtest L I M I T e D Maintenance Manual Crash Position Indicator SystemDocument20 pagesTechtest L I M I T e D Maintenance Manual Crash Position Indicator SystemaburizqiNo ratings yet

- Exercises With Finite State Machines: CS 64: Computer Organization and Design Logic Lecture #17 Winter 2019Document17 pagesExercises With Finite State Machines: CS 64: Computer Organization and Design Logic Lecture #17 Winter 2019Gabriel CañadasNo ratings yet

- Syllabus The Contemporary WorldDocument8 pagesSyllabus The Contemporary WorldLenicho MarquezNo ratings yet

- SCM Lecture 3Document2 pagesSCM Lecture 3rishabh choudhryNo ratings yet

- Chapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisDocument9 pagesChapter 3 - Linear Programming: Computer Solution and Sensitivity AnalysisRel XandrrNo ratings yet

- ME 346: Heat Transfer: Instructor: Ankit JainDocument23 pagesME 346: Heat Transfer: Instructor: Ankit JainDeepankar Sakya KusumaNo ratings yet

- Small Leak Leads To Catastrophic Failure: Did You Know?Document1 pageSmall Leak Leads To Catastrophic Failure: Did You Know?mkkamarajNo ratings yet

- Design & Analysis of Steering System For Solar VehicleDocument4 pagesDesign & Analysis of Steering System For Solar VehicleYesh100% (1)

- Infinix Zero 2023Document2 pagesInfinix Zero 2023LEVIATHANDAVIDNo ratings yet

- ICT Careers and Job TypesDocument4 pagesICT Careers and Job Typesshdfan aseel95100% (1)

- NMRVDocument114 pagesNMRVNur SugiartoNo ratings yet

- May 2021 Examination Diet School of Mathematics & Statistics MT4614Document6 pagesMay 2021 Examination Diet School of Mathematics & Statistics MT4614Tev WallaceNo ratings yet

- Qualys Virtual Scanner Appliance User GuideDocument19 pagesQualys Virtual Scanner Appliance User GuideTama OlanNo ratings yet

- Ethical Use of Artificial Intelligence ADocument6 pagesEthical Use of Artificial Intelligence AGreg ChatsiosNo ratings yet

- Brentwood Cooling Tower Products - Rev2Document12 pagesBrentwood Cooling Tower Products - Rev2Kaushal100% (1)

- Image Encryption Using Elliptic Curve Cryptography: SciencedirectDocument10 pagesImage Encryption Using Elliptic Curve Cryptography: SciencedirectNguyễn Quang HuyNo ratings yet