Professional Documents

Culture Documents

1207BZP031

1207BZP031

Uploaded by

MDirk41Copyright:

Available Formats

You might also like

- 1Q 941Document3 pages1Q 941justin_hahn_6No ratings yet

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocument3 pagesNRB Commercial Bank Limited Principal Branch Statement of Accountsamdadul hoqueNo ratings yet

- NCB LC FormDocument2 pagesNCB LC FormMohsin KhanNo ratings yet

- Thesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostDocument1 pageThesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostImpulsive collectorNo ratings yet

- The Wall Streetjournal 20 June 2023Document36 pagesThe Wall Streetjournal 20 June 2023Sanjeedeep Mishra , 315No ratings yet

- TheSun 2009-06-29 Page14 World Financial System Not Out of Woods YetDocument1 pageTheSun 2009-06-29 Page14 World Financial System Not Out of Woods YetImpulsive collectorNo ratings yet

- International Financing Review Asia April 11 2020 PDFDocument44 pagesInternational Financing Review Asia April 11 2020 PDFLêTrọngQuangNo ratings yet

- Yes Bank CrisisDocument6 pagesYes Bank CrisisKrishnaNo ratings yet

- UBS IBD Asia Pacific ViewDocument16 pagesUBS IBD Asia Pacific Viewvishwasmaheshwari10No ratings yet

- BOB - Bank of Baroda Plans To Step Up Corporate LoansDocument5 pagesBOB - Bank of Baroda Plans To Step Up Corporate LoansStarNo ratings yet

- TheSun 2008-11-18 Page14 Japan in Recession IMF Needs More MoneyDocument1 pageTheSun 2008-11-18 Page14 Japan in Recession IMF Needs More MoneyImpulsive collectorNo ratings yet

- Poster Template SeptemberDocument1 pagePoster Template SeptemberAhmed usamaNo ratings yet

- SNL0MA0050719Document1 pageSNL0MA0050719June C StraightNo ratings yet

- How Asia Buys and Pays 2023Document25 pagesHow Asia Buys and Pays 2023K58 Nguyễn Minh KhuêNo ratings yet

- Thesun 2008-12-15 Page20 N. Asian Leaders Team Up To Fight CrisisDocument1 pageThesun 2008-12-15 Page20 N. Asian Leaders Team Up To Fight CrisisImpulsive collectorNo ratings yet

- Ujjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Document10 pagesUjjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Sanjeedeep Mishra , 315No ratings yet

- 华尔街日报 2023 3 21Document28 pages华尔街日报 2023 3 21shichao.yuanNo ratings yet

- Morning: Credit Suisse Ignites Global Market Rout As Banking Fears ReturnDocument24 pagesMorning: Credit Suisse Ignites Global Market Rout As Banking Fears ReturnkrisindiemusicNo ratings yet

- TheSun 2008-11-03 Page21: Hedge Funds Take A Beating - Brown Urges Gulf States To Give Funds To IMFDocument1 pageTheSun 2008-11-03 Page21: Hedge Funds Take A Beating - Brown Urges Gulf States To Give Funds To IMFImpulsive collectorNo ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- TheSun 2009-05-04 Page13 Adb Asia Must Retool To Boost Domestic DemandDocument1 pageTheSun 2009-05-04 Page13 Adb Asia Must Retool To Boost Domestic DemandImpulsive collectorNo ratings yet

- SPC AsiaDocument5 pagesSPC AsiaChetan PujaraNo ratings yet

- J.P. Morgan Private Bank Outlook 2021Document79 pagesJ.P. Morgan Private Bank Outlook 2021FredNo ratings yet

- Yes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesDocument2 pagesYes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesTushar SharmaNo ratings yet

- Morning: BriefDocument27 pagesMorning: BriefQuint WongNo ratings yet

- Characteristics of Nigerian Deposit Money Banks and Their Financial OutcomeDocument8 pagesCharacteristics of Nigerian Deposit Money Banks and Their Financial OutcomeEditor IJTSRDNo ratings yet

- Wallstreetjournaleurope 20160921 The Wall Street Journal EuropeDocument24 pagesWallstreetjournaleurope 20160921 The Wall Street Journal EuropestefanoNo ratings yet

- ABA Lending AnalysisDocument4 pagesABA Lending AnalysisFOXBusiness.comNo ratings yet

- Business Weekly 15032024Document16 pagesBusiness Weekly 15032024EffortNo ratings yet

- Future of Islamic BankingDocument12 pagesFuture of Islamic BankingHammad AhmedNo ratings yet

- 2022 05 28 Ifr AsiaDocument46 pages2022 05 28 Ifr AsiajanuszNo ratings yet

- TheSun 2008-11-26 Page16 Asia Shares Rally On Citi Rescue But Risks RemainDocument1 pageTheSun 2008-11-26 Page16 Asia Shares Rally On Citi Rescue But Risks RemainImpulsive collectorNo ratings yet

- MARCH 2017: A Shankar IAS Academy InitiativeDocument30 pagesMARCH 2017: A Shankar IAS Academy InitiativeLaxmi Prasad IndiaNo ratings yet

- The Future of ASEAN:: Viet Nam PerspectiveDocument42 pagesThe Future of ASEAN:: Viet Nam PerspectiveMai LeNo ratings yet

- Asia Free TradeDocument1 pageAsia Free TradeYashwardhanPratapSinghNo ratings yet

- Usiness: Zim Gets US$300m For Covid-19 RecoveryDocument9 pagesUsiness: Zim Gets US$300m For Covid-19 RecoveryraphaelmashapaNo ratings yet

- Winning Strategies For Emerging Markets in AsiaDocument5 pagesWinning Strategies For Emerging Markets in AsiaGanesh KothandapaniNo ratings yet

- Tie-Up of 5 Asian Nations Can Help Avert Water Crises GloballyDocument1 pageTie-Up of 5 Asian Nations Can Help Avert Water Crises GloballyMelissaNo ratings yet

- Sawp 043Document30 pagesSawp 043123cyuanNo ratings yet

- Capitalising On Market UncertaintiesDocument6 pagesCapitalising On Market UncertaintiesAdilQureshiNo ratings yet

- Forbes July21Document93 pagesForbes July21Agnish GhatakNo ratings yet

- Thesun 2009-01-19 Page17 Taiwan Hands Out Vouchers To Lift Faltering EconomyDocument1 pageThesun 2009-01-19 Page17 Taiwan Hands Out Vouchers To Lift Faltering EconomyImpulsive collectorNo ratings yet

- Sign of Stress in The Asia Financial SystemDocument9 pagesSign of Stress in The Asia Financial SystemMeygantara Faozal HNo ratings yet

- Funds of The MonthDocument9 pagesFunds of The MonthsomebodymisterNo ratings yet

- Blowing Bubbles: Money's Too Loose in AsiaDocument20 pagesBlowing Bubbles: Money's Too Loose in Asiamauliksanghavi100% (3)

- Banking Sector - Consolidation ProgressDocument7 pagesBanking Sector - Consolidation ProgresshartaNo ratings yet

- Final Presentation 30.8.2019 FM's ConferenceDocument33 pagesFinal Presentation 30.8.2019 FM's Conferencepranathi.862539No ratings yet

- ASEAN The Resilience of BanksDocument4 pagesASEAN The Resilience of BanksmichelleNo ratings yet

- KPMG Uae Banking Perspectives 2022Document37 pagesKPMG Uae Banking Perspectives 2022RayrayNo ratings yet

- 2013-06-08, MSME Status, UN, E - ESCWA - EDGD - 2013 - WP1 - E PDFDocument16 pages2013-06-08, MSME Status, UN, E - ESCWA - EDGD - 2013 - WP1 - E PDFMohamed Ali AtigNo ratings yet

- 2013, e - Escwa - Edgd - 2013 - WP1 - E-1 PDFDocument16 pages2013, e - Escwa - Edgd - 2013 - WP1 - E-1 PDFMohamed Ali AtigNo ratings yet

- 2013, e - Escwa - Edgd - 2013 - WP1 - E-1Document16 pages2013, e - Escwa - Edgd - 2013 - WP1 - E-1Mohamed Ali AtigNo ratings yet

- Citibank Case PDFDocument6 pagesCitibank Case PDFAnshul YadavNo ratings yet

- Managing The Great Transaction Banking Sea Change: Research ReportDocument4 pagesManaging The Great Transaction Banking Sea Change: Research Reportkoundinya99No ratings yet

- Yes Bank (YES IN) : RBI Places Bank Under Moratorium. Now What?Document5 pagesYes Bank (YES IN) : RBI Places Bank Under Moratorium. Now What?Siddharth PrabhuNo ratings yet

- Economy Grows Robust 8.4% in Q2: Public Shareholders To Take Big Hit Anil Ambani Barely HurtDocument12 pagesEconomy Grows Robust 8.4% in Q2: Public Shareholders To Take Big Hit Anil Ambani Barely HurtrosanaNo ratings yet

- Indian Banks Building Resilient LeadershipDocument88 pagesIndian Banks Building Resilient Leadershiparul.btugNo ratings yet

- Newsletter November 082010Document1 pageNewsletter November 082010bcbcfaNo ratings yet

- Beltone UAE Banking Sector Review For BEDocument75 pagesBeltone UAE Banking Sector Review For BEMunia R. BadhonNo ratings yet

- MoneyWeek 16 02 2024Document40 pagesMoneyWeek 16 02 2024Eddy ChanNo ratings yet

- Signs of Stress: Is Asia Heading Toward A Debt Crisis?: Global Banking PracticeDocument9 pagesSigns of Stress: Is Asia Heading Toward A Debt Crisis?: Global Banking PracticeFadhila PriyankaNo ratings yet

- World Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthFrom EverandWorld Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Statement Sep 23 XXXXXXXX0143Document2 pagesStatement Sep 23 XXXXXXXX0143mohdasimraza84No ratings yet

- INTRODUCTIONDocument51 pagesINTRODUCTIONHarichandran KarthikeyanNo ratings yet

- Form 2 PDFDocument22 pagesForm 2 PDFAnonymous h0XgkOUNo ratings yet

- Varonis and PCI DSSDocument4 pagesVaronis and PCI DSSnchavezgNo ratings yet

- Unit 5. Audit PlanningDocument7 pagesUnit 5. Audit Planningzelalem kebedeNo ratings yet

- Indemnity Agreement: ASIA UNITED BANK ("Indemnitee/s") and Their/its Successors and Assigns, From Any Claim, ActionDocument1 pageIndemnity Agreement: ASIA UNITED BANK ("Indemnitee/s") and Their/its Successors and Assigns, From Any Claim, ActionJP PalamNo ratings yet

- Interest Rates: Type Interest Rate Savings AccountDocument16 pagesInterest Rates: Type Interest Rate Savings Accountrohanfyaz00No ratings yet

- Assignment-Banking Sector PDFDocument12 pagesAssignment-Banking Sector PDFএম.এস. ইকার সাকিবNo ratings yet

- Dissertation Report ON: A Study of Investment Avenues AT Karvy Stock Broking LimitedDocument90 pagesDissertation Report ON: A Study of Investment Avenues AT Karvy Stock Broking Limitedamruth_shubhNo ratings yet

- Import-Export Procedures at CFSDocument19 pagesImport-Export Procedures at CFSShubham GhandadeNo ratings yet

- Reforms in Banking SectorDocument18 pagesReforms in Banking SectorPrabhjotkaur650% (2)

- Chamar Vankar PatrakDocument24 pagesChamar Vankar PatrakNarayan NathNo ratings yet

- Industry Profile: Banking Sector in IndiaDocument15 pagesIndustry Profile: Banking Sector in Indiasri1031No ratings yet

- American Depositary System and Global Depositary SystemDocument13 pagesAmerican Depositary System and Global Depositary SystemDr. Shiraj SherasiaNo ratings yet

- Wise Tender 310510Document335 pagesWise Tender 310510Moorthy SylvesterNo ratings yet

- Audit of Hospital - Mcom Part II ProjectDocument28 pagesAudit of Hospital - Mcom Part II ProjectKunal KapoorNo ratings yet

- Economics - 3 - RBIDocument14 pagesEconomics - 3 - RBIArisha AzharNo ratings yet

- Dubai Islamic Bank Pakistan Internship ReportdocxDocument19 pagesDubai Islamic Bank Pakistan Internship ReportdocxAzhar HassanNo ratings yet

- SuperCard SOCDocument1 pageSuperCard SOCManish BhagatNo ratings yet

- 07 June 2021 Unopposed Motion Roll For Judge Keightly JDocument5 pages07 June 2021 Unopposed Motion Roll For Judge Keightly Jinstallment paymentNo ratings yet

- 1305 Disposal of Impaired InventoryDocument2 pages1305 Disposal of Impaired InventoryAlejandroNo ratings yet

- CT 3911Document1 pageCT 3911Kizito MarowaNo ratings yet

- Applying The KANO Model For Developing An Objective Based Performance Measurement and Incentive PlanDocument24 pagesApplying The KANO Model For Developing An Objective Based Performance Measurement and Incentive PlanbustinNo ratings yet

- Legal Developments 2015Document13 pagesLegal Developments 2015hasnansuaimiNo ratings yet

- Sa20190515 PDFDocument4 pagesSa20190515 PDFMitess Boñon BrusolaNo ratings yet

- Company Profile Ocean VoiceDocument13 pagesCompany Profile Ocean VoicemareebNo ratings yet

- Software Requirement Specification For Bank Management SystemDocument10 pagesSoftware Requirement Specification For Bank Management Systemnnjdxnxj40% (5)

1207BZP031

1207BZP031

Uploaded by

MDirk41Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1207BZP031

1207BZP031

Uploaded by

MDirk41Copyright:

Available Formats

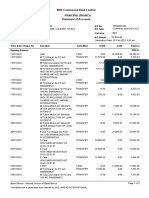

today Monday July 12, 2010 B4

Business

A ‘vote of confidence’ Dubai World arm sells M’sia stake

for Asian growth

‘You

DUBAI — A property arm of struggling state US$23.8 million ($32.8 million) in the deal,

forced me

conglomerate Dubai World is backing out according to a regulatory filing on Malay-

out, Rafa’

SINGAPORE — Recent moves terest rate increases “are of a plan to build luxury homes in Malaysia sia’s stock exchange.

by Asian central banks to a loud vote of confidence as it looks to shore up its finances. Limitless said in a statement yes- Benayoun says

ex-boss Benitez

ra i s e i n te re st ra te s a re from Asia’s central banks The cash-strapped company’s Limitless terday that it continues “to review our

made life

a st ro n g vote o f c o n f i - that (Asia’s) growth will con- division is selling off its stake in a partner- business activity to reflect market condi- miserable for

dence that the region will tinue despite weakness” in ship with Malaysia’s Bandar Raya Develop- tions”. him at Liverpool.

weather risks stemming from Europe, the US and Japan, ments to develop waterfront land in the The company’s parent, Dubai World,

¢ Page 28

the European debt crisis, ana- the region’s top trading part- southern city of Nusajaya. needs cash as it works to pay back

lysts say. ners. Limitless will generate about US$23.5 billion in debt. AP

Since June 24, the cen- By increasing interest

tral banks of Taiwan, India, rates, Asian central banks

EYE ONTHE MARKET

Malaysia and South Korea are signalling that while

have lifted interest rates these three markets mat-

by between 12.5 and 25 ter, “Asia matters more”, DBS

basis points, citing the need added.

to tame inflation as their econ- Mr David Cohen, a Singa-

Asian markets still attractive to investors

omies rebound from the global pore-based regional econo-

downturn. mist with Action Economics,

While Asia is not totally said the spate of interest

immune to the effects of a rate hikes reflected grow- As the World Cup season draws to a Visit www.siasresearch.com

slowdown in Europe and ing Asian confidence as the close, investors are starting to take for daily market calls and invest-

the United States, the re- region leads global growth. an interest in the equity markets ment strategies reports.

gion's dependence on them “As far as the economic again.

has been reduced as Asian outlook is concerned, glo- Last week the MSCI World Equity Contributed by Edmund Seow

consumers now play a big- b a l m a rkets a re c l e a rly Index rose 4.6 per cent at the end of from SIAS Research

ger role in supporting do- nervous about potential Thursday, week on week, to end at

mestic economies, analysts faltering in the global re- 1,084 points. Asia-Pacific markets,

said. covery but so far the data too, saw a recovery late in the week. Upcoming Events

“Concerns over Eu- out of Asia has been encourag- The MSCI Asia-Pacific ex Japan

rope’s debt crisis continue ing,” he told AFP. Index closed on Thursday at 389 Structured Warrants —

to smoulder but that hasn’t Mr Cohen added that points, up 3.2 per cent from the week covery is on the way. The Hang Seng Going Beyond the Basics

stopped Asia's central banks second quarter gross domes- before. World commodity prices rose tested its resistance level at about by SGX Academy

Date: July 17

from pushing ahead with tic product (GDP) figures, overall, and the Dow Jones UBS index 19,790 points last week and has since Time: 9.00am to 1.15pm

monetar y tightening” in expected to come out this closed on Thursday at 126 points, a 1.9 recovered above the psychological- Venue: SGX Auditorium

Registration: Call 6327 5438 or visit

the wake of rapid and sustained month, are likely to show per cent rise week-on-week. ly-significant 20,000 point mark. The www.sgxacademy.com

GDP growth, said DBS Bank. a continuation of Asia’s In June, there were some con- South Korean MSCI Korea recovered

Inflation rates are healthy economic expansion. cerns over the possibility of a glo- to close at 479 points on Thursday Understanding Extended

Settlement Contracts in

“nearly back to average The International Mon- bal economic slowdown after debt evening after testing a low of 464 Volatile Markets by

in all Asian countries and etary Fund on July 8 upgrad- issues in the European Union (EU) points last Monday. In Singapore, the Phillip Securities

Date: July 19

surely headed higher in months ed its GDP growth forecast came to light. Last week, however, Straits Times Index (STI) has been Time: 6.30pm to 7.30pm

to come”, it noted in a market for Asia this year to 7.5 per cent we saw some of those fears put to trading upwards steadily and closed Venue: Raffles City Tower, Level 7

analysis. from 7 per cent, moderating to rest for the time being and the Asia- above 2,900 points on Friday evening. Registration: Call 6336 4564 or

email esc@phillip.com.sg

DBS said the latest in- 6.8 per cent next year. AFP Pacific region remains at the fore- There might be significant vola-

front of economic recovery. tility in individual equity markets as Approaching Commodities

Globally, the International Mon- they recover in the coming weeks. and Money Markets via

Exchange Traded Funds by

¢ Fraud-hit Satyam eyes World Cup rehabilitation etary Fund raised its global growth As such we recommend investors Phillip Securities

Nearly 18 months ago, India’s ensuring the logistics were in forecast for 2010 to 4.6 per cent. In diversify their portfolios using Ex- Date: July 31

Time: 9.00am to 1.00pm

Satyam was rocked by a false- place for the mega-event to Asia Pacific, China allowed its cur- change Traded Funds such as the Venue: SGX Auditorium

accounting scandal that threat- pass off without a hitch. rency to appreciate for the first time DBXT MSAsExJp 10US$, Lyxor Asia Registration: Visit www.phillipetf.com

ened its very existence. But The firm’s logo has been on in over two years; and South Korea, 10US$, and the Lyxor APEX50 10US$

Market Outlook for Second

bosses believe the firm’s image pitch-side advertising hoardings Malaysia, Taiwan and India allowed to minimise risk while remaining in- Half of 2010 / Portfolio

has been restored — thanks to at every match, while around their central banks to raise interest vested in the region. While there is no Allocation using Exchange

the World Cup. 150 staff have been working rates over the last two weeks — sig- way to directly hedge open positions Traded Funds and Warrants by

OCBC Securities

The software outsourc- behind the scenes to ensure nalling that debt issues in the EU did in Asia-Pacific, buying structured Date: July 31

ing giant, rebranded as fans, organisers, volun- not have a detrimental effect on the put warrants on key market indices Time: 2.00pm to 5.00pm

Venue: OCBC Bank Centre Auditorium,

Mahindra Satyam, has been the teers and the media are in region’s economic recovery. such as the Hang Seng, the Nikkei 225 Level 50

main IT services provider for the right place at the right Technical analysis showed that and the STI could provide protection Registration: Call 1800 338 8688 or

the tournament in South Africa, time. AFP many markets in Asia Pacific bot- against any unforeseen downsides email seminar@ocbcsec.com

tomed out over the last week and re- in the markets.

¢ ECB launches offensive on euro zone fears

The European Central Bank deadline passed smoothly and Disclaimer: Readers should seek independent financial advice before making any investment decision. Today and all presenting parties cannot be held liable for any consequence arising from the use of this information.

insists the euro zone will not German data showed industri-

fall back into recession, say- al production in Europe’s top

Brought to you by

ing the worst of the debt crisis economy had soared in May.

is past and other economies ECB president Jean-

should now be fixing their public Claude Trichet cautioned

finances. that “it is still too early to

ECB chief economist declare the crisis over”, but

Juergen Stark told reporters last added: “The latest signs that we

week: “It seems that the worst are receiving from the economy

is over” after a key ECB loan are encouraging.” AFP

You might also like

- 1Q 941Document3 pages1Q 941justin_hahn_6No ratings yet

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocument3 pagesNRB Commercial Bank Limited Principal Branch Statement of Accountsamdadul hoqueNo ratings yet

- NCB LC FormDocument2 pagesNCB LC FormMohsin KhanNo ratings yet

- Thesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostDocument1 pageThesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostImpulsive collectorNo ratings yet

- The Wall Streetjournal 20 June 2023Document36 pagesThe Wall Streetjournal 20 June 2023Sanjeedeep Mishra , 315No ratings yet

- TheSun 2009-06-29 Page14 World Financial System Not Out of Woods YetDocument1 pageTheSun 2009-06-29 Page14 World Financial System Not Out of Woods YetImpulsive collectorNo ratings yet

- International Financing Review Asia April 11 2020 PDFDocument44 pagesInternational Financing Review Asia April 11 2020 PDFLêTrọngQuangNo ratings yet

- Yes Bank CrisisDocument6 pagesYes Bank CrisisKrishnaNo ratings yet

- UBS IBD Asia Pacific ViewDocument16 pagesUBS IBD Asia Pacific Viewvishwasmaheshwari10No ratings yet

- BOB - Bank of Baroda Plans To Step Up Corporate LoansDocument5 pagesBOB - Bank of Baroda Plans To Step Up Corporate LoansStarNo ratings yet

- TheSun 2008-11-18 Page14 Japan in Recession IMF Needs More MoneyDocument1 pageTheSun 2008-11-18 Page14 Japan in Recession IMF Needs More MoneyImpulsive collectorNo ratings yet

- Poster Template SeptemberDocument1 pagePoster Template SeptemberAhmed usamaNo ratings yet

- SNL0MA0050719Document1 pageSNL0MA0050719June C StraightNo ratings yet

- How Asia Buys and Pays 2023Document25 pagesHow Asia Buys and Pays 2023K58 Nguyễn Minh KhuêNo ratings yet

- Thesun 2008-12-15 Page20 N. Asian Leaders Team Up To Fight CrisisDocument1 pageThesun 2008-12-15 Page20 N. Asian Leaders Team Up To Fight CrisisImpulsive collectorNo ratings yet

- Ujjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Document10 pagesUjjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Sanjeedeep Mishra , 315No ratings yet

- 华尔街日报 2023 3 21Document28 pages华尔街日报 2023 3 21shichao.yuanNo ratings yet

- Morning: Credit Suisse Ignites Global Market Rout As Banking Fears ReturnDocument24 pagesMorning: Credit Suisse Ignites Global Market Rout As Banking Fears ReturnkrisindiemusicNo ratings yet

- TheSun 2008-11-03 Page21: Hedge Funds Take A Beating - Brown Urges Gulf States To Give Funds To IMFDocument1 pageTheSun 2008-11-03 Page21: Hedge Funds Take A Beating - Brown Urges Gulf States To Give Funds To IMFImpulsive collectorNo ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- TheSun 2009-05-04 Page13 Adb Asia Must Retool To Boost Domestic DemandDocument1 pageTheSun 2009-05-04 Page13 Adb Asia Must Retool To Boost Domestic DemandImpulsive collectorNo ratings yet

- SPC AsiaDocument5 pagesSPC AsiaChetan PujaraNo ratings yet

- J.P. Morgan Private Bank Outlook 2021Document79 pagesJ.P. Morgan Private Bank Outlook 2021FredNo ratings yet

- Yes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesDocument2 pagesYes Bank Failure Exposes India To Wider Credit Risk - Nomura - The Economic TimesTushar SharmaNo ratings yet

- Morning: BriefDocument27 pagesMorning: BriefQuint WongNo ratings yet

- Characteristics of Nigerian Deposit Money Banks and Their Financial OutcomeDocument8 pagesCharacteristics of Nigerian Deposit Money Banks and Their Financial OutcomeEditor IJTSRDNo ratings yet

- Wallstreetjournaleurope 20160921 The Wall Street Journal EuropeDocument24 pagesWallstreetjournaleurope 20160921 The Wall Street Journal EuropestefanoNo ratings yet

- ABA Lending AnalysisDocument4 pagesABA Lending AnalysisFOXBusiness.comNo ratings yet

- Business Weekly 15032024Document16 pagesBusiness Weekly 15032024EffortNo ratings yet

- Future of Islamic BankingDocument12 pagesFuture of Islamic BankingHammad AhmedNo ratings yet

- 2022 05 28 Ifr AsiaDocument46 pages2022 05 28 Ifr AsiajanuszNo ratings yet

- TheSun 2008-11-26 Page16 Asia Shares Rally On Citi Rescue But Risks RemainDocument1 pageTheSun 2008-11-26 Page16 Asia Shares Rally On Citi Rescue But Risks RemainImpulsive collectorNo ratings yet

- MARCH 2017: A Shankar IAS Academy InitiativeDocument30 pagesMARCH 2017: A Shankar IAS Academy InitiativeLaxmi Prasad IndiaNo ratings yet

- The Future of ASEAN:: Viet Nam PerspectiveDocument42 pagesThe Future of ASEAN:: Viet Nam PerspectiveMai LeNo ratings yet

- Asia Free TradeDocument1 pageAsia Free TradeYashwardhanPratapSinghNo ratings yet

- Usiness: Zim Gets US$300m For Covid-19 RecoveryDocument9 pagesUsiness: Zim Gets US$300m For Covid-19 RecoveryraphaelmashapaNo ratings yet

- Winning Strategies For Emerging Markets in AsiaDocument5 pagesWinning Strategies For Emerging Markets in AsiaGanesh KothandapaniNo ratings yet

- Tie-Up of 5 Asian Nations Can Help Avert Water Crises GloballyDocument1 pageTie-Up of 5 Asian Nations Can Help Avert Water Crises GloballyMelissaNo ratings yet

- Sawp 043Document30 pagesSawp 043123cyuanNo ratings yet

- Capitalising On Market UncertaintiesDocument6 pagesCapitalising On Market UncertaintiesAdilQureshiNo ratings yet

- Forbes July21Document93 pagesForbes July21Agnish GhatakNo ratings yet

- Thesun 2009-01-19 Page17 Taiwan Hands Out Vouchers To Lift Faltering EconomyDocument1 pageThesun 2009-01-19 Page17 Taiwan Hands Out Vouchers To Lift Faltering EconomyImpulsive collectorNo ratings yet

- Sign of Stress in The Asia Financial SystemDocument9 pagesSign of Stress in The Asia Financial SystemMeygantara Faozal HNo ratings yet

- Funds of The MonthDocument9 pagesFunds of The MonthsomebodymisterNo ratings yet

- Blowing Bubbles: Money's Too Loose in AsiaDocument20 pagesBlowing Bubbles: Money's Too Loose in Asiamauliksanghavi100% (3)

- Banking Sector - Consolidation ProgressDocument7 pagesBanking Sector - Consolidation ProgresshartaNo ratings yet

- Final Presentation 30.8.2019 FM's ConferenceDocument33 pagesFinal Presentation 30.8.2019 FM's Conferencepranathi.862539No ratings yet

- ASEAN The Resilience of BanksDocument4 pagesASEAN The Resilience of BanksmichelleNo ratings yet

- KPMG Uae Banking Perspectives 2022Document37 pagesKPMG Uae Banking Perspectives 2022RayrayNo ratings yet

- 2013-06-08, MSME Status, UN, E - ESCWA - EDGD - 2013 - WP1 - E PDFDocument16 pages2013-06-08, MSME Status, UN, E - ESCWA - EDGD - 2013 - WP1 - E PDFMohamed Ali AtigNo ratings yet

- 2013, e - Escwa - Edgd - 2013 - WP1 - E-1 PDFDocument16 pages2013, e - Escwa - Edgd - 2013 - WP1 - E-1 PDFMohamed Ali AtigNo ratings yet

- 2013, e - Escwa - Edgd - 2013 - WP1 - E-1Document16 pages2013, e - Escwa - Edgd - 2013 - WP1 - E-1Mohamed Ali AtigNo ratings yet

- Citibank Case PDFDocument6 pagesCitibank Case PDFAnshul YadavNo ratings yet

- Managing The Great Transaction Banking Sea Change: Research ReportDocument4 pagesManaging The Great Transaction Banking Sea Change: Research Reportkoundinya99No ratings yet

- Yes Bank (YES IN) : RBI Places Bank Under Moratorium. Now What?Document5 pagesYes Bank (YES IN) : RBI Places Bank Under Moratorium. Now What?Siddharth PrabhuNo ratings yet

- Economy Grows Robust 8.4% in Q2: Public Shareholders To Take Big Hit Anil Ambani Barely HurtDocument12 pagesEconomy Grows Robust 8.4% in Q2: Public Shareholders To Take Big Hit Anil Ambani Barely HurtrosanaNo ratings yet

- Indian Banks Building Resilient LeadershipDocument88 pagesIndian Banks Building Resilient Leadershiparul.btugNo ratings yet

- Newsletter November 082010Document1 pageNewsletter November 082010bcbcfaNo ratings yet

- Beltone UAE Banking Sector Review For BEDocument75 pagesBeltone UAE Banking Sector Review For BEMunia R. BadhonNo ratings yet

- MoneyWeek 16 02 2024Document40 pagesMoneyWeek 16 02 2024Eddy ChanNo ratings yet

- Signs of Stress: Is Asia Heading Toward A Debt Crisis?: Global Banking PracticeDocument9 pagesSigns of Stress: Is Asia Heading Toward A Debt Crisis?: Global Banking PracticeFadhila PriyankaNo ratings yet

- World Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthFrom EverandWorld Bank East Asia and Pacific Economic Update, October 2013: Rebuilding Policy Buffers, Reinvigorating GrowthNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Statement Sep 23 XXXXXXXX0143Document2 pagesStatement Sep 23 XXXXXXXX0143mohdasimraza84No ratings yet

- INTRODUCTIONDocument51 pagesINTRODUCTIONHarichandran KarthikeyanNo ratings yet

- Form 2 PDFDocument22 pagesForm 2 PDFAnonymous h0XgkOUNo ratings yet

- Varonis and PCI DSSDocument4 pagesVaronis and PCI DSSnchavezgNo ratings yet

- Unit 5. Audit PlanningDocument7 pagesUnit 5. Audit Planningzelalem kebedeNo ratings yet

- Indemnity Agreement: ASIA UNITED BANK ("Indemnitee/s") and Their/its Successors and Assigns, From Any Claim, ActionDocument1 pageIndemnity Agreement: ASIA UNITED BANK ("Indemnitee/s") and Their/its Successors and Assigns, From Any Claim, ActionJP PalamNo ratings yet

- Interest Rates: Type Interest Rate Savings AccountDocument16 pagesInterest Rates: Type Interest Rate Savings Accountrohanfyaz00No ratings yet

- Assignment-Banking Sector PDFDocument12 pagesAssignment-Banking Sector PDFএম.এস. ইকার সাকিবNo ratings yet

- Dissertation Report ON: A Study of Investment Avenues AT Karvy Stock Broking LimitedDocument90 pagesDissertation Report ON: A Study of Investment Avenues AT Karvy Stock Broking Limitedamruth_shubhNo ratings yet

- Import-Export Procedures at CFSDocument19 pagesImport-Export Procedures at CFSShubham GhandadeNo ratings yet

- Reforms in Banking SectorDocument18 pagesReforms in Banking SectorPrabhjotkaur650% (2)

- Chamar Vankar PatrakDocument24 pagesChamar Vankar PatrakNarayan NathNo ratings yet

- Industry Profile: Banking Sector in IndiaDocument15 pagesIndustry Profile: Banking Sector in Indiasri1031No ratings yet

- American Depositary System and Global Depositary SystemDocument13 pagesAmerican Depositary System and Global Depositary SystemDr. Shiraj SherasiaNo ratings yet

- Wise Tender 310510Document335 pagesWise Tender 310510Moorthy SylvesterNo ratings yet

- Audit of Hospital - Mcom Part II ProjectDocument28 pagesAudit of Hospital - Mcom Part II ProjectKunal KapoorNo ratings yet

- Economics - 3 - RBIDocument14 pagesEconomics - 3 - RBIArisha AzharNo ratings yet

- Dubai Islamic Bank Pakistan Internship ReportdocxDocument19 pagesDubai Islamic Bank Pakistan Internship ReportdocxAzhar HassanNo ratings yet

- SuperCard SOCDocument1 pageSuperCard SOCManish BhagatNo ratings yet

- 07 June 2021 Unopposed Motion Roll For Judge Keightly JDocument5 pages07 June 2021 Unopposed Motion Roll For Judge Keightly Jinstallment paymentNo ratings yet

- 1305 Disposal of Impaired InventoryDocument2 pages1305 Disposal of Impaired InventoryAlejandroNo ratings yet

- CT 3911Document1 pageCT 3911Kizito MarowaNo ratings yet

- Applying The KANO Model For Developing An Objective Based Performance Measurement and Incentive PlanDocument24 pagesApplying The KANO Model For Developing An Objective Based Performance Measurement and Incentive PlanbustinNo ratings yet

- Legal Developments 2015Document13 pagesLegal Developments 2015hasnansuaimiNo ratings yet

- Sa20190515 PDFDocument4 pagesSa20190515 PDFMitess Boñon BrusolaNo ratings yet

- Company Profile Ocean VoiceDocument13 pagesCompany Profile Ocean VoicemareebNo ratings yet

- Software Requirement Specification For Bank Management SystemDocument10 pagesSoftware Requirement Specification For Bank Management Systemnnjdxnxj40% (5)