Professional Documents

Culture Documents

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Uploaded by

Rahul UberCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Issues in Contemporry ArtDocument45 pagesIssues in Contemporry ArtMycz Doña100% (1)

- The Baptist FaithDocument3 pagesThe Baptist FaithJeanelle Denosta100% (1)

- Ul 1004-2006Document76 pagesUl 1004-2006Alberto100% (1)

- Oilseeds and Veg Oils Report June 2009Document2 pagesOilseeds and Veg Oils Report June 2009Rahul UberNo ratings yet

- NEXTRA FAQs - 09062020Document53 pagesNEXTRA FAQs - 09062020Rahul UberNo ratings yet

- Symbol Expiry Date Commodity Ex-Basis Delivery Centre Price UnitDocument12 pagesSymbol Expiry Date Commodity Ex-Basis Delivery Centre Price UnitRahul UberNo ratings yet

- Complete Portfolios As On September 30 2010Document13 pagesComplete Portfolios As On September 30 2010Rahul UberNo ratings yet

- Arvind - Store Operation Protocol Training - LBD-EBD-HBD - A4Document12 pagesArvind - Store Operation Protocol Training - LBD-EBD-HBD - A4Rahul UberNo ratings yet

- ABC Back To Work Employee HandbookDocument11 pagesABC Back To Work Employee HandbookRahul UberNo ratings yet

- Complete Data For EmailersDocument304 pagesComplete Data For EmailersRahul UberNo ratings yet

- Political & Legal Enviroment Facing BusinessDocument15 pagesPolitical & Legal Enviroment Facing BusinessNaim H. FaisalNo ratings yet

- Weekly Internship Report For 4th WeekDocument5 pagesWeekly Internship Report For 4th WeekWarda Khawar100% (1)

- CCC419 Advance Notice AGM2009Document2 pagesCCC419 Advance Notice AGM2009gallerycourtNo ratings yet

- People's Trans East v. Doctors of New MillenniumDocument3 pagesPeople's Trans East v. Doctors of New MillenniumJayson RacalNo ratings yet

- Tax Audit Reference Manual - Tally TDL - College Management Software - Tally Implementation ServicesDocument48 pagesTax Audit Reference Manual - Tally TDL - College Management Software - Tally Implementation ServicesjohnabrahamstanNo ratings yet

- EDS Manufacturing v. HealthcheckDocument15 pagesEDS Manufacturing v. HealthcheckArnold BagalanteNo ratings yet

- Appointment Letter FormatDocument9 pagesAppointment Letter FormatNiraliNo ratings yet

- Omni Innovations LLC Et Al v. BMG Music Publishing NA Inc Et Al - Document No. 22Document2 pagesOmni Innovations LLC Et Al v. BMG Music Publishing NA Inc Et Al - Document No. 22Justia.comNo ratings yet

- Financial Managment Assessment 1A - Paciones ChemaDocument9 pagesFinancial Managment Assessment 1A - Paciones ChemaChema PacionesNo ratings yet

- New Jersey Superior Court Denies AppealDocument26 pagesNew Jersey Superior Court Denies AppealThe TrentonianNo ratings yet

- RR No. 11-2018 SummaryDocument6 pagesRR No. 11-2018 SummaryCaliNo ratings yet

- But The Fruit of The Spirit Is LoveDocument1 pageBut The Fruit of The Spirit Is LovextneNo ratings yet

- The Paradox of Being A Probationer Tales of Joy and SorrowDocument10 pagesThe Paradox of Being A Probationer Tales of Joy and SorrowInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 2 Labor Law Case Doctrines - Justice Marvic LeonenDocument21 pages2 Labor Law Case Doctrines - Justice Marvic Leonengreatchen m daldeNo ratings yet

- Mbof912d Assignment 1 PDFDocument8 pagesMbof912d Assignment 1 PDFArneet SarnaNo ratings yet

- FIN4110: Options and Futures: Zongbo Huang Cuhk (SZ)Document27 pagesFIN4110: Options and Futures: Zongbo Huang Cuhk (SZ)liuNo ratings yet

- Updated Transfer of Property Act NotesDocument47 pagesUpdated Transfer of Property Act NotesscribdNo ratings yet

- Seguro Médico para EstudiantesDocument2 pagesSeguro Médico para EstudiantesLuis Domenech GarciaNo ratings yet

- Concept of LeadershipDocument9 pagesConcept of LeadershipVincent BernardoNo ratings yet

- (Cpar2016) AP-8007 (Audit of Receivables)Document4 pages(Cpar2016) AP-8007 (Audit of Receivables)Dawson Dela CruzNo ratings yet

- Bill TodayDocument3 pagesBill Todaymansoorsain42No ratings yet

- Sample MCQ Topics 1-5Document12 pagesSample MCQ Topics 1-5horace000715No ratings yet

- CA1 NewDocument39 pagesCA1 NewGarcia Rowell S.100% (1)

- Insurance Law in India Question and AnswerDocument15 pagesInsurance Law in India Question and AnswerMaitrayee NandyNo ratings yet

- Kci SL Inv 1471Document1 pageKci SL Inv 1471sNo ratings yet

- Aurora Land Vs NLRCDocument2 pagesAurora Land Vs NLRCNyx PerezNo ratings yet

- Lothar Schulz vs. Atty. Marcelo G. Flores A.C. No. 4219, December 8, 2003 FactsDocument7 pagesLothar Schulz vs. Atty. Marcelo G. Flores A.C. No. 4219, December 8, 2003 FactsHazel Martinii PanganibanNo ratings yet

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Uploaded by

Rahul UberOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Sbi Tax Advantage Fund-Series-I Portfolio (January-2018-104-1)

Uploaded by

Rahul UberCopyright:

Available Formats

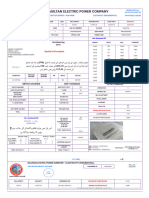

SBI MUTUAL FUND 159 Back to Index

NAME OF THE SCHEME : SBI TAX ADVANTAGE FUND-SERIES-I

PORTFOLIO STATEMENT AS ON : 1/31/2018

NAME OF THE INSTRUMENT ISIN QUANTITY MARKET VALUE RATING REMARKS INDUSTRY % TO NAV

(IN LAKHS)

Equity & Equity related

(a) Listed / Awaiting Listing on Stock Exchanges

Tata Steel Ltd. INE081A010R1 10,400 9.37 £ Ferrous Metals 0.02

Tata Steel Ltd. INE081A0101R 20,800 40.57 £ Ferrous Metals 0.09

Dixon Technologies (India) Ltd. INE935N01012 957 35.89 Consumer Durables 0.08

AU Small Finance Bank Ltd. INE949L01017 8,894 58.39 Banks 0.14

Ganesha Ecosphere Ltd. INE845D01014 288,144 1,155.46 Textiles - Synthetic 2.68

Procter & Gamble Hygiene and Health Care Ltd. INE179A01014 6,881 637.99 Consumer Non Durables 1.48

Gabriel India Ltd. INE524A01029 1,058,188 1,786.75 Auto Ancillaries 4.14

PI Industries Ltd. INE603J01030 276,770 2,465.61 Pesticides 5.72

Tata Steel Ltd. INE081A01012 130,000 916.57 Ferrous Metals 2.12

Hindalco Industries Ltd. INE038A01020 330,000 845.30 Non - Ferrous Metals 1.96

Hero MotoCorp Ltd. INE158A01026 23,000 849.03 Auto 1.97

Oracle Financial Services Software Ltd. INE881D01027 30,000 1,254.80 Software 2.91

Kotak Mahindra Bank Ltd. INE237A01028 130,000 1,441.64 Banks 3.34

Hindustan Unilever Ltd. INE030A01027 78,743 1,078.27 Consumer Non Durables 2.50

Bharti Airtel Ltd. INE397D01024 400,000 1,759.40 Telecom - Services 4.08

Bharti Infratel Ltd. INE121J01017 330,000 1,160.12 Telecom - Equipment & Accessories 2.69

Repco Home Finance Ltd. INE612J01015 100 0.62 Finance -

Bajaj Auto Ltd. INE917I01010 27,000 901.03 Auto 2.09

HCL Technologies Ltd. INE860A01027 90,000 887.90 Software 2.06

Mahindra & Mahindra Financial Services Ltd. INE774D01024 500,000 2,317.50 Finance 5.37

Tata Consultancy Services Ltd. INE467B01029 50,000 1,556.18 Software 3.61

ITC Ltd. INE154A01025 470,000 1,275.58 Consumer Non Durables 2.96

ICICI Bank Ltd. INE090A01021 700,000 2,470.65 Banks 5.73

State Bank of India INE062A01020 700,000 2,192.75 Banks 5.08

HDFC Bank Ltd. INE040A01026 210,000 4,211.97 Banks 9.76

Larsen & Toubro Ltd. INE018A01030 105,000 1,487.33 Construction Project 3.45

Infosys Ltd. INE009A01021 156,478 1,799.89 Software 4.17

Reliance Industries Ltd. INE002A01018 260,000 2,499.38 Petroleum Products 5.79

Housing Development Finance Corporation Ltd. INE001A01036 130,000 2,543.19 Finance 5.90

Total 39,639.13 91.89

(b) Unlisted NIL

(c ) Preference Shares/ Warrants/ IDRs NIL

Mutual Fund Units

(a) Listed / Awaiting Listing on Stock Exchanges NIL

(b) Unlisted NIL

Debt Instruments

(a) Listed / Awaiting listing on Stock Exchanges NIL

(b) Privately Placed / Unlisted NIL

(c) Securitized Debt Instruments NIL

Central Government Securities NIL

State Government Securities NIL

Inflation Indexed Bonds NIL

Money Market Instruments

CBLO 139.19 0.32

Commercial Paper NIL

Certificate of Deposits NIL

Treasury Bill NIL

Bills Re- Discounting NIL

Reverse repo NIL

Repo in Corporate Debt NIL

Money Market Instruments Total 139.19 0.32

Fixed & Term Deposits NIL

Fixed & Term Deposits Placed as Margins NIL

Cash and Bank Balances

Margin amount for Derivative positions NIL

Others - Cash and Bank Balances 59.36 0.14

- Net current assets 3,297.62 7.65

Total 3,356.98 7.79

Grand Total 43,135.30 100.00

NOTES :-

T** -> Thinly Traded Securities

N** -> Non Traded Securities

# -> Less Than 0.005%

£ -> Rights Issue

A** -> Awaiting Listing on Stock Exchanges

I** -> Illiquid Shares

Î -> Indian Depository Receipts

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Issues in Contemporry ArtDocument45 pagesIssues in Contemporry ArtMycz Doña100% (1)

- The Baptist FaithDocument3 pagesThe Baptist FaithJeanelle Denosta100% (1)

- Ul 1004-2006Document76 pagesUl 1004-2006Alberto100% (1)

- Oilseeds and Veg Oils Report June 2009Document2 pagesOilseeds and Veg Oils Report June 2009Rahul UberNo ratings yet

- NEXTRA FAQs - 09062020Document53 pagesNEXTRA FAQs - 09062020Rahul UberNo ratings yet

- Symbol Expiry Date Commodity Ex-Basis Delivery Centre Price UnitDocument12 pagesSymbol Expiry Date Commodity Ex-Basis Delivery Centre Price UnitRahul UberNo ratings yet

- Complete Portfolios As On September 30 2010Document13 pagesComplete Portfolios As On September 30 2010Rahul UberNo ratings yet

- Arvind - Store Operation Protocol Training - LBD-EBD-HBD - A4Document12 pagesArvind - Store Operation Protocol Training - LBD-EBD-HBD - A4Rahul UberNo ratings yet

- ABC Back To Work Employee HandbookDocument11 pagesABC Back To Work Employee HandbookRahul UberNo ratings yet

- Complete Data For EmailersDocument304 pagesComplete Data For EmailersRahul UberNo ratings yet

- Political & Legal Enviroment Facing BusinessDocument15 pagesPolitical & Legal Enviroment Facing BusinessNaim H. FaisalNo ratings yet

- Weekly Internship Report For 4th WeekDocument5 pagesWeekly Internship Report For 4th WeekWarda Khawar100% (1)

- CCC419 Advance Notice AGM2009Document2 pagesCCC419 Advance Notice AGM2009gallerycourtNo ratings yet

- People's Trans East v. Doctors of New MillenniumDocument3 pagesPeople's Trans East v. Doctors of New MillenniumJayson RacalNo ratings yet

- Tax Audit Reference Manual - Tally TDL - College Management Software - Tally Implementation ServicesDocument48 pagesTax Audit Reference Manual - Tally TDL - College Management Software - Tally Implementation ServicesjohnabrahamstanNo ratings yet

- EDS Manufacturing v. HealthcheckDocument15 pagesEDS Manufacturing v. HealthcheckArnold BagalanteNo ratings yet

- Appointment Letter FormatDocument9 pagesAppointment Letter FormatNiraliNo ratings yet

- Omni Innovations LLC Et Al v. BMG Music Publishing NA Inc Et Al - Document No. 22Document2 pagesOmni Innovations LLC Et Al v. BMG Music Publishing NA Inc Et Al - Document No. 22Justia.comNo ratings yet

- Financial Managment Assessment 1A - Paciones ChemaDocument9 pagesFinancial Managment Assessment 1A - Paciones ChemaChema PacionesNo ratings yet

- New Jersey Superior Court Denies AppealDocument26 pagesNew Jersey Superior Court Denies AppealThe TrentonianNo ratings yet

- RR No. 11-2018 SummaryDocument6 pagesRR No. 11-2018 SummaryCaliNo ratings yet

- But The Fruit of The Spirit Is LoveDocument1 pageBut The Fruit of The Spirit Is LovextneNo ratings yet

- The Paradox of Being A Probationer Tales of Joy and SorrowDocument10 pagesThe Paradox of Being A Probationer Tales of Joy and SorrowInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 2 Labor Law Case Doctrines - Justice Marvic LeonenDocument21 pages2 Labor Law Case Doctrines - Justice Marvic Leonengreatchen m daldeNo ratings yet

- Mbof912d Assignment 1 PDFDocument8 pagesMbof912d Assignment 1 PDFArneet SarnaNo ratings yet

- FIN4110: Options and Futures: Zongbo Huang Cuhk (SZ)Document27 pagesFIN4110: Options and Futures: Zongbo Huang Cuhk (SZ)liuNo ratings yet

- Updated Transfer of Property Act NotesDocument47 pagesUpdated Transfer of Property Act NotesscribdNo ratings yet

- Seguro Médico para EstudiantesDocument2 pagesSeguro Médico para EstudiantesLuis Domenech GarciaNo ratings yet

- Concept of LeadershipDocument9 pagesConcept of LeadershipVincent BernardoNo ratings yet

- (Cpar2016) AP-8007 (Audit of Receivables)Document4 pages(Cpar2016) AP-8007 (Audit of Receivables)Dawson Dela CruzNo ratings yet

- Bill TodayDocument3 pagesBill Todaymansoorsain42No ratings yet

- Sample MCQ Topics 1-5Document12 pagesSample MCQ Topics 1-5horace000715No ratings yet

- CA1 NewDocument39 pagesCA1 NewGarcia Rowell S.100% (1)

- Insurance Law in India Question and AnswerDocument15 pagesInsurance Law in India Question and AnswerMaitrayee NandyNo ratings yet

- Kci SL Inv 1471Document1 pageKci SL Inv 1471sNo ratings yet

- Aurora Land Vs NLRCDocument2 pagesAurora Land Vs NLRCNyx PerezNo ratings yet

- Lothar Schulz vs. Atty. Marcelo G. Flores A.C. No. 4219, December 8, 2003 FactsDocument7 pagesLothar Schulz vs. Atty. Marcelo G. Flores A.C. No. 4219, December 8, 2003 FactsHazel Martinii PanganibanNo ratings yet