Professional Documents

Culture Documents

Syngene International: Discovery Services Driving Growth Outlook Upbeat

Syngene International: Discovery Services Driving Growth Outlook Upbeat

Uploaded by

sanketsabale26Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syngene International: Discovery Services Driving Growth Outlook Upbeat

Syngene International: Discovery Services Driving Growth Outlook Upbeat

Uploaded by

sanketsabale26Copyright:

Available Formats

Syngene International ( SYNINT)

CMP: | 306 Target: | 360 (18%) Target Period: 12 months BUY

January 24, 2020

Discovery services driving growth; outlook upbeat

Revenues grew 11.1% YoY to | 519.1 crore on the back of strong growth in

discovery services business, combined with consistent performances in

Result Update

dedicated R&D centres and development services business. EBITDA

margins remained flat at ~30%. Higher employee cost was largely offset by

increase in gross margins and lower other expenditure. EBITDA grew 9.4% Particulars

YoY to | 153.5 crore. Net profit grew 5.9% YoY to | 91.8 crore. Amount

Particular

Market Capitalisation | 12238 crore

Integrated business model, customer stickiness to the fore | 813 crore

Debt (FY19)

Revenues grew at ~21% CAGR in FY15-19 to | 1826 crore due to new client Cash (FY19) | 437 crore

addition on a regular basis and scaled up revenues from existing clients led EV | 12614 crore

by integrated service offerings, high data integrity ethos and continuous 52 week H/L 369/276

endeavour to move up the value chain. Eight of the top 10 global pharma Equity capital | 400.0 crore

companies have been availing services for the last five years. It owns a pool Face value | 10

of 4060 scientists. As of FY19, the company had a client base of 331. Key Highlights

Global pharma landscape conducive to R&D outsourcing Revenues grew 11.1% YoY to | 519.1

crore on the back of strong growth in

Global pharma players are facing structural issues from the impending discovery services business,

patent cliff, a shrinking product pipeline, rising R&D costs and growing combined with consistent

competition. To maintain the structural balance and improve profitability, performances in dedicated R&D

they are inclined to outsource a substantial part of the R&D work. Similarly,

ICICI Securities – Retail Equity Research

centres and development services

the innovative/virtual companies that are extensively working on new business

products and which may not have the required capital/manpower also tend

to outsource a substantial part of their R&D. Strong client addition and expansion

of contracts by existing clients

Valuation & Outlook However, aggressive capex to

As per the management’s own assertion, revenue growth for 9MFY20 has support client addition is likely to

been behind the guidance curve as the order offtake is yet to gain the impact near term margins

expected momentum. That said, the management has guided for decent

Maintain BUY

traction for FY21 mainly due to continuous client additions, extension of

existing contracts besides increasing manufacturing and biological

contributions. The company remains aggressive on the capex front Research Analyst

(~US$425 million already spent + another US$ 125 million earmarked by Siddhant Khandekar

FY21), attributable to firm growth plans. The asset turnover from this mega siddhant.khandekar@icicisecurities.com

capex will be a significant determinant for future visibility. On the margins

Mitesh Shah, CFA

front, the company is witnessing some pressure due to compliance, safety mitesh.sha@icicisecurities.com

and quality related expenses besides employee addition, which, we believe,

are attributable to increasing scalability and which is likely to persist. The Sudarshan Agarwal

company has recently added some elite clients like Amgen, Zoetis, sudarshan.agarwal@icicisecurities.com

Herbalife, GSK and multiple year extension of BMS and Baxter contracts. In

a nutshell, the company remains well poised to capture opportunities in the

global CRO space on account of strategic outsourcing by global innovators.

We arrive at a target price of | 360 based on ~30x FY22 EPS of | 12.0.

Key Financial Summary

(Year End March) FY19 FY20E FY21E FY22E CAGR (FY19-22E) %

Revenues (| crore) 1825.6 2015.8 2373.2 2743.9 14.5

EBITDA (| crore) 535.8 603.7 740.1 872.3 17.6

EBITDA margins (%) 29.3 29.9 31.2 31.8

Net Profit (| crore) 330.8 418.9 385.9 478.9 13.1

EPS (|) 8.3 8.7 9.6 12.0

P/E (x) 37.0 29.2 31.7 25.6

RoCE (%) 16.8 14.7 14.1 14.9

RoE (x) 14.8 13.7 13.1 15.1

Result Update | Syngene International ICICI Direct Research

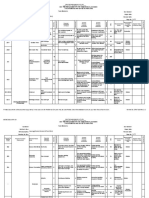

Exhibit 1: Variance Analysis

Q3FY20 Q3FY20E Q3FY19 Q2FY20 YoY (%) QoQ (%) Comments

YoY growth driven by strong growth in discovery services and

Revenue 519.1 537.2 467.1 464.5 11.1 11.8 supported by steady performance in development services and

dedicated R&D centres

A 267 bps YoY improvement in gross margins, mainly due to a change

Raw Material Expenses 144.6 164.0 142.6 125.1 1.4 15.6

in product mix

Increased due to 1) 10-12% of salary hike, 2) 3% of impact due to

Employee Expenses 152.3 134.1 116.6 131.8 30.6 15.6 recruitment in new Hyderabad plant and 3) hiring at senior level

management

Other Expenditure 68.7 77.7 67.6 68.5 1.6 0.3

EBITDA 153.5 161.3 140.3 139.1 9.4 10.4

Increase in employee cost largely offset by improvement in gross

EBITDA (%) 29.6 30.0 30.0 29.9 -47 bps -38 bps

margins and lower other expenditure

Interest 9.8 8.4 8.2 8.4 19.5 16.7

YoY increase mainly due to additional depreciation reported due to

Depreciation 57.0 52.6 42.9 52.6 32.9 8.4

commissioning of Hyderabad plant and expansion of Bangalore

Other Income 20.0 23.8 17.3 20.6 15.6 -2.9

PBT 106.7 124.2 106.5 170.0 0.2 -37.2

Tax 14.9 21.5 19.8 42.0 -24.7 -64.5

PAT before MI 91.8 102.6 86.7 128.0 5.9 -28.3

Delta vis-à-vis EBITDA mainly due to higher depreciation, which was

partially offset by lower tax rate. Miss vis-à-vis I-direct estimates

Adj. Net Profit 91.8 102.6 86.7 82.0 5.9 12.0

mainly due to lower-than-expected operational performance and higher

interest cost

Source: ICICI Direct Research

Exhibit 2: Change in Estimates

FY20E FY21E

(| Crore) Old New % Change Old New % Change

Revenue 2,081.0 2,015.8 -3.1 2,451.1 2,373.2 -3.2 Changed mainly due to lower-than-expected revenues in 9MFY20

EBITDA 623.2 603.7 -3.1 750.2 740.1 -1.3

EBITDA Margin (%) 29.9 29.9 5 bps 30.6 31.2 59 bps

PAT 429.1 418.9 -2.4 399.6 385.9 -3.4 Changed mainly in sync with operational performance

EPS (|) 10.7 10.5 -2.1 10.0 9.6 -3.5

Source: ICICI Direct Research

ICICI Securities | Retail Research 2

Result Update | Syngene International ICICI Direct Research

Conference Call Highlights

The company has extended its biologics discovery and preclinical

research capabilities in CAR-T therapy, an innovative cell-based

approach to treat cancer

The company has received cGMP approval from Russian Ministry of

Health. Also, Syngene’s viral testing facility has received good

laboratory practice (GLP) certification in India

Capex for 9MFY20 is at US$81 million with API accounting for US$34

million, Discovery services – US$23 million and dedicated centres &

development services – US$24 million

Cumulative capex as of 9MFY20- US$425 million. The company is

on track to take total asset base to US$550 million by end the of FY21

Construction of the Mangalore facility is complete and is expected

to be operational by the end of FY20

The company will file the final/fourth instalment claim for the fire

incidence at the S2 building in Q4FY20 with the claim being likely

fulfilled in FY21. Till date, the company has received | 177 crore

against total loss of | 106 crore

Breakup of revenue mix – Discovery services – 30%; Development

services – 30%; Dedicated R&D – 30% and manufacturing – 10%

Cost from the Mangalore facility is likely to hit the P&L from Q1FY21

onwards

The official launch of Hyderabad facility is slated for February, 2020

As per the management, Q4FY20 growth is expected to be in low to

mid-teens but better than current quarter. Growth in FY21 is

expected to be propelled by increased demand of discovery and

development services

Phase 1 capex for the biologics plant has already been completed.

The ramp-up of the biologics segments is a key monitorable for the

next 12 months

Exhibit 3: Trends in quarterly performance

(| Crore) Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20 YoY (%) QoQ(%)

Total Operating Income332.1 291.0 291.1 335.2 387.7 409.1 406.0 418.6 467.1 533.9 420.9 464.5 519.1 11.1 11.8

Raw Material Expenses91.1 88.0 69.3 80.0 106.8 125.6 128.8 110.3 142.6 149.6 105.5 125.1 144.6 1.4 15.6

% to revenues 27.4 30.2 23.8 23.9 27.5 30.7 31.7 26.3 30.5 28.0 25.1 26.9 27.9

Gross Profit 241.0 203.0 221.8 255.2 280.9 283.5 277.2 308.3 324.5 384.3 315.4 339.4 374.5 15.4 10.3

Gross Profit Margin (%)72.6 69.8 76.2 76.1 72.5 69.3 68.3 73.7 69.5 72.0 74.9 73.1 72.1 267 bps -92 bps

Employee Expenses 80.1 78.0 86.0 93.7 95.8 104.1 105.6 114.9 116.6 130.2 132.2 131.8 152.3 30.6 15.6

% to revenues 24.1 26.8 29.5 28.0 24.7 25.4 26.0 27.4 25.0 24.4 31.4 28.4 29.3 438 bps 96 bps

Other Manufacturing Expenses

48.1 25.0 39.8 48.0 58.9 50.3 62.4 66.7 67.6 94.5 62.1 68.5 68.7 1.6 0.3

% to revenues 14.5 8.6 13.7 14.3 15.2 12.3 15.4 15.9 14.5 17.7 14.8 14.7 13.2 -124 bps -151 bps

Total Expenditure 219.3 191.0 195.1 221.7 261.5 280.0 296.8 291.9 326.8 374.3 299.8 325.4 365.6 11.9 12.4

% to revenues 66.0 65.6 67.0 66.1 67.4 68.4 73.1 69.7 70.0 70.1 71.2 70.1 70.4

EBIDTA 112.8 100.0 96.0 113.5 126.2 129.1 109.2 126.7 140.3 159.6 121.1 139.1 153.5 9.4 10.4

EBITDA Margin (%) 34.0 34.4 33.0 33.9 32.6 31.6 26.9 30.3 30.0 29.9 28.8 29.9 29.6 -47 bps -38 bps

Depreciation 28.8 31.0 31.9 30.3 35.0 34.2 37.3 39.9 42.9 44.1 47.4 52.6 57.0 32.9 8.4

Interest 6.8 3.0 5.3 5.2 5.1 7.1 7.9 8.2 8.2 8.0 7.1 8.4 9.8 19.5 16.7

Other Income 14.6 24.0 17.2 16.4 11.6 16.6 18.8 18.2 17.3 20.8 20.5 20.6 20.0 15.6 -2.9

PBT 91.8 90.0 76.0 94.4 97.7 104.4 82.8 96.8 106.5 128.3 87.1 98.7 106.7 0.2 8.1

Total Tax 17.4 12.0 14.0 17.5 15.7 19.9 16.8 18.5 19.8 28.5 15.1 42.0 14.9 -24.7 -64.5

PAT 74.4 78.0 62.0 76.9 82.0 84.5 66.0 78.3 86.7 99.8 72.0 56.7 91.8 5.9 61.9

PAT Margin (%) 22.4 26.8 21.3 22.9 21.2 20.7 16.3 18.7 18.6 18.7 17.1 12.2 17.7 -88 bps 548 bps

Source: ICICI Direct Research

ICICI Securities | Retail Research 3

Result Update | Syngene International ICICI Direct Research

Company Background

Incorporated in 1993 as a subsidiary of Biocon, Syngene International (SIL) Revenue Bifurcation

is a leading contract research organisation (CRO), which supports R&D

programmes of global innovative companies. SIL offers outsourced services

to support discovery and development for organisations across industrial

Develop Dedicat

sectors like pharmaceuticals, biopharmaceuticals, neutraceuticals, animal ed

ment &

health, agro-chemicals, etc. It currently caters to 293 global players including Manufa Centers

Bristol-Myers Squibb (BMS), Abbott, Baxter and Amgen, among others. cturing 33%

38%

SIL derives ~95% of its revenues from exports. In terms of classification on

a contractual basis, it derives ~30% of revenues from long term dedicated Discove

ry

contracts with a contractual commitment of five years and more. In this case, Service

the company offers a dedicated, customised and ring-fenced infrastructure s

in line with client’s requirements. These dedicated centres are generally 29%

multi-disciplinary, full time engagements, which support the R&D

requirements of clients. Source: ICICI Direct Research; Company

The remaining comes from 1) discovery services (29% of revenues; full time

equipment (FTE)) and 2) development & manufacturing services [38% of

revenues; fee for service (FFS)].

The discovery services vertical consists of multiple client engagements

across discovery chemistry and discovery biology based service offerings.

It entails an in-depth understanding of discovery chemistry and discovery

biology pertaining to small and large molecules.

The development and manufacturing segment encompasses the services,

which support a molecule once it moves beyond in-vivo testing to preclinical

studies and clinical development. It also includes manufacturing of

molecules for clinical supplies and commercialisation.

In FTE contracts, the company does billing based on the number of scientists

deployed. In this case, there is an agreement with clients for minimum

utilisation of a specific number of scientists dedicated to their work. The

scope of services and deliverables under FTE contracts generally evolves

over time. FTE contracts are generally renewable annually. FFS contracts are

mostly short-term in nature. In FFS contracts, the agreement is for fixed price

for agreed services within a defined scope.

The company has developed long-term relationships with many clients,

including four long-duration multi-disciplinary partnerships, each with a

dedicated research centre, with four of the world’s leading global healthcare

organisations Bristol-Myers Squibb Company (BMS), Abbott Laboratories

(Singapore) Pte Ltd (Abbott), Baxter International Inc. (Baxter) and Amgen.

BMS – The first dedicated centre was set up for BMS in 2009 and engages

over 400 of scientists. Under the new agreement in Q3FY18, Syngene will

set up an additional new facility. It will put up a dedicated team of Syngene

scientists within that and support the future R&D requirements of BMS. The

duration of the collaboration has been extended to 2026.

Baxter – Dedicated centre developed in 2013. The Baxter Global Research

Centre has a multidisciplinary team of about 150 of scientists who work on

product and analytical development, preclinical evaluation in parenteral

nutrition and renal therapy. The company has recently expanded its contract

with Baxter till 2024. Under the new extension of contract, Syngene will set

up additional infrastructure as well as increase the size of its scientific team.

Amgen– In Q2FY17, the company announced the establishment of a

dedicated centre for Amgen, Inc. in Bengaluru. This centre, named Syngene

Amgen Research and Development Centre (SARC), will be Syngene’s fourth

such exclusive R&D centre and first for a biologics company. SARC will be

staffed by a team of more than 100 Syngene scientists, working with Amgen

researchers around the world on the discovery and development of

innovative medicines. In Q1FY18, the company expanded its SARC

collaboration to 50000 square feet floor space and ~185 Syngene scientists

ICICI Securities | Retail Research 4

Result Update | Syngene International ICICI Direct Research

Herbalife - In Q3FY17, Herbalife announced the opening of its first R&D

centre in India in Partnership with Syngene. The 3000 sq ft facility will be

located inside the Syngene Bengaluru campus.

The company owns the largest CRO facility in India, spread over 1,300,000

sq ft, in Bengaluru. The facility has been accredited with major regulatory

compliance. It operates laboratory and manufacturing facilities to standards

that are consistent with the requirements of its large global clients. In the

last three years, the USFDA has cleared five audits without 483 observations.

Apart from this, it is in the process of establishing a new commercial-scale

facility in Mangaluru (SEZ) to manufacture novel small molecules for

innovator companies as it plans to foray into commercial manufacturing for

customers.

The company has signed commercial contracts for late stage products with

existing clients. Of this, two molecules have already been commercialised

and the company has started supply of intermediaries for these products.

The company’s existing facility at Bengaluru would initially support SIL’s

CMO business. This novel CMO business would extend the company’s

services to existing customers. The CMO business is expected to start

meaningful contribution from FY18E. In addition, the company is in the

process of setting up a new unit for biologic manufacturing in Bengaluru.

We believe the CMO business would be an add-on driver for the company

over medium to long term.

The company intends to evolve from a CRO into a contract research and

manufacturing services (CRAMS) organisation with commercial-scale

manufacturing capabilities. This is in keeping with SIL’s plan to leverage its

existing relationships with clients and provide forward integration on the

discovery and development continuum.

ICICI Securities | Retail Research 5

Result Update | Syngene International ICICI Direct Research

Key Metrics

Exhibit 4: Revenues to grow at CAGR of 14% over FY19-22E Exhibit 5: EBITDA and EBITDA margins trend

1000 872.3 35

3000 CAGR 14.5% 2743.9 900 34.4

33.9

800 740.1 33

2373.2 32.7 32.6

2500 700 603.7

CAGR 20.7% 2015.8 31.8

1825.6 600 535.8 31.2 31

2000 464.4

500 380.4 407.6

(| crore)

(| crore)

29.9

1423.1 29.3

(%)

1500 400 29

1107.0 1200.9 300

281.1

859.9

1000 200 27

100

500

0 25

0 FY15 FY16 FY17 FY18 FY19 FY20E FY21E FY22E

FY15 FY16 FY17 FY18 FY19 FY20E FY21E FY22E

Revenues EBITDA EBITDA Margins (%)

Source: ICICI Direct Research, Company Source: ICICI Direct Research, Company

Exhibit 6: Net profit & profit margins trend Exhibit 7: Return ratios trend

600 30.0 26

478.9 23.5

500 25.0 24 20.7

23.9

21.8 21.4 385.9 22 20.3

400 20.4 347.6

330.818.1 20.0

287.3 305.1 17.2 17.5 20

16.3 19.5

300 15.0

(| crore)

240.8 18 17.716.8

175.0

(%)

200 10.0 16 16.0 14.7 15.1

15.1 14.8 14.1

14 14.6 14.9

100 5.0 13.7 13.1

12

0 0.0

10

FY15 FY16 FY17 FY18 FY19 FY20E FY21E FY22E

FY15 FY16 FY17 FY18 FY19 FY20E FY21E FY22E

Net Profit NPM (%) RoCE (%) RoNW (%)

Source: ICICI Direct Research, Company Source: ICICI Direct Research, Company

Exhibit 8: Valuation

Revenues Growth Adj. EPS Growth P/E EV/EBITDA RoE RoCE

(| crore) (%) (|) (%) (x) (X) (%) (%)

FY19 1826 28.3 8.3 8.4 37.0 22.2 16.8 14.8

FY20E 2016 10.4 8.7 26.6 29.2 20.4 14.7 13.7

FY21E 2373 17.7 9.6 -7.9 31.7 16.7 14.1 13.1

FY22E 2744 15.6 12.0 24.1 25.6 13.7 14.9 15.1

Source: ICICI Direct Research

ICICI Securities | Retail Research 6

Result Update | Syngene International ICICI Direct Research

Exhibit 9: Recommendation history vs Consensus

450 90.0

400 80.0

350 70.0

300 60.0

250 50.0

(|)

(%)

200 40.0

150 30.0

100 20.0

50 10.0

0 0.0

Mar-17

Oct-17

Oct-18

Oct-19

May-17

Nov-17

Mar-18

May-18

Nov-18

Aug-18

Mar-19

May-19

Nov-19

Jun-17

Jun-18

Jun-19

Jan-17

Feb-17

Aug-17

Sep-17

Aug-18

Dec-19

Jul-17

Dec-17

Jan-18

Feb-18

Jul-18

Dec-18

Jan-19

Jan-19

Feb-19

Aug-19

Sep-19

Jul-19

Jan-20

Apr-17

Apr-18

Apr-19

Price Idirect target Consensus Target Mean % Consensus with BUY

Source: ICICI Direct Research; Bloomberg

Exhibit 10: Top 10 Shareholders

Rank Investor Name Filing Date % O/S Position (m) Change

1 Biocon Ltd 30-Jun-19 70.2 280.97m 0.0m

2 Camas Investments 30-Jun-19 2.4 9.57m 0.0m

3 Standard Life Aberdeen Plc 31-Dec-19 2.1 8.57m 0.2m

4 Mirae Asset Global Investments Co 31-Dec-19 2.0 7.93m 1.4m

5 UTI Asset Management Co Ltd 30-Nov-19 1.6 6.46m 0.2m

6 Matthews International Capital Man 30-Sep-19 1.5 5.92m 0.2m

7 Reliance Capital Trustee Co Ltd 30-Nov-19 1.4 5.52m (0.2)m

8 Aberdeen Asset Manageme 30-Jun-19 1.1 4.56m 4.6m

9 Hillhouse Capital Advisors Ltd 30-Jun-19 1.0 4.04m (0.3)m

10 Biocon Employee Welfare Trust 30-Jun-19 0.8 3.10m 3.1m

Source: ICICI Direct Research, Bloomberg

Exhibit 11: Shareholding Pattern

(in %) Dec-18 Mar-19 Jun-19 Sep-19 Dec-19

Promoter 71.1 71.1 71.0 70.8 70.7

Public 27.9 27.9 27.9 28.3 28.4

Others 1.1 1.1 1.1 0.9 0.9

Source: ICICI Direct Research, Company

ICICI Securities | Retail Research 7

Result Update | Syngene International ICICI Direct Research

Financial Summary

Exhibit 12: Profit and loss statement | crore Exhibit 13: Cash Flow Statement | crore

(Year-end March) FY19 FY20E FY21E FY22E (Year-end March) FY19 FY20E FY21E FY22E

Total Operating Income 1,825.6 2,015.8 2,373.2 2,743.9 Profit/(Loss) after taxation 235.5 418.9 385.9 478.9

Growth (%) 28.3 10.4 17.7 15.6 Add: Depreciation & Amortization 164.2 214.0 294.5 334.4

Raw Material Expenses 531.3 585.7 688.3 794.4 Other operating activities 18.7 0.0 0.0 0.0

Gross Profit 1,294.3 1,430.2 1,684.9 1,949.5 Net Increase in Current Assets -40.4 -79.5 -106.3 -93.4

Gross Profit Margins (%) 70.9 70.9 71.0 71.0 Net Increase in Current Liabilities 222.5 84.5 100.8 72.7

Employee Expenses 467.3 504.0 565.0 638.1 CF from operating activities 630.4 666.3 703.4 810.6

Other Expenditure 535.8 603.7 740.1 872.3 (Inc)/dec in Fixed Assets -583.3 -1,029.5 -674.5 -355.0

Total Operating Expenditure 1,534.4 1,693.3 1,993.4 2,304.9 (Inc)/dec in Investments 98.5 300.0 0.0 -100.0

Operating Profit (EBITDA) 535.8 603.7 740.1 872.3 Other Investing Activities -479.0 -12.6 -9.2 6.1

Growth (%) 15.4 12.7 22.6 17.9 CF from investing activities -963.8 -742.1 -683.7 -448.9

Interest 32.3 28.5 28.5 18.0 Inc / (Dec) in Equity Capital 1.9 0.0 0.0 0.0

Depreciation 164.2 214.0 294.5 334.4 Inc / (Dec) in Loan funds -20.3 0.0 0.0 -300.0

Other Income 75.1 84.7 59.3 71.3 Dividend & Dividend Tax -24.1 -15.0 -13.8 -17.1

PBT after Exceptional Items 414.4 517.2 476.5 591.3 Others -29.9 -28.5 -28.5 -18.0

Total Tax 83.6 98.3 90.5 112.3 CF from financing activities -72.4 -43.5 -42.3 -335.1

PAT before MI 330.8 418.9 385.9 478.9 Net Cash flow -405.8 -119.2 -22.5 26.6

Minority Interest 0.0 0.0 0.0 0.0 Opening Cash 842.7 436.9 317.7 295.1

PAT 330.8 418.9 385.9 478.9 Closing Cash 436.9 317.7 295.1 321.7

Growth (%) 8.4 26.6 -7.9 24.1 Free Cash Flow 47.1 -363.2 28.9 455.6

EPS (Adjusted) 8.3 8.7 9.6 12.0 Source: ICICI Direct Research

Source: ICICI Direct Research

Exhibit 14: Balance Sheet | crore Exhibit 15: Ratio Analysis | crore

(Year-end March) FY19 FY20E FY21E FY22E (Year-end March) FY19 FY20E FY21E FY22E

Equity Capital 200.0 200.0 200.0 200.0 Per share data (|)

Reserve and Surplus 1,768.4 2,172.3 2,544.4 3,006.2 EPS 8.3 8.7 9.6 12.0

Total Shareholders funds 1,968.4 2,372.3 2,744.4 3,206.2 BV 49.2 59.3 68.6 80.2

Total Debt 813.3 813.3 813.3 513.3 DPS 0.3 0.4 0.3 0.4

Long Term Provisions 37.4 41.1 45.3 49.8 Cash Per Share 10.9 7.9 7.4 8.0

Other Non Current Liabilities 207.4 228.1 251.0 276.0 Operating Ratios (%)

Source of Funds 3,026.5 3,454.9 3,853.9 4,045.4 Gross Profit Margins 70.9 70.9 71.0 71.0

Gross Block 2,121.2 2,618.2 3,825.2 4,180.2 EBITDA margins 29.3 29.9 31.2 31.8

Accumulated Depreciation 784.4 998.4 1,292.9 1,627.4 Net Profit margins 18.1 17.2 16.3 17.5

Net Block 1,336.8 1,619.8 2,532.3 2,552.8 Inventory days 8.7 10.0 10.0 10.0

Capital WIP 273.7 806.2 273.7 273.7 Debtor days 67.7 67.7 67.7 67.7

Fixed Assets 1,610.5 2,426.0 2,806.0 2,826.5 Creditor days 44.7 44.7 44.7 44.7

Investments 756.0 456.0 456.0 556.0 EBITDA Conversion Rate 117.7 110.4 95.0 92.9

Other Non current asets 197.4 225.3 251.4 263.9 Return Ratios (%)

Inventory 43.4 55.2 65.0 75.2 RoE 16.8 14.7 14.1 14.9

Debtors 338.7 374.0 440.3 509.1 RoCE 14.8 13.7 13.1 15.1

Loans and Advances 0.0 0.0 0.0 0.0 RoIC 28.3 24.5 17.8 21.1

Other Current Assets 229.1 261.5 291.7 306.2 Valuation Ratios (x)

Cash 436.9 317.7 295.1 321.7 P/E 37.0 29.2 31.7 25.6

Total Current Assets 1,048.1 1,008.4 1,092.2 1,212.2 EV / EBITDA 22.2 20.4 16.7 13.7

Creditors 223.5 246.8 290.5 335.9 EV / Revenues 6.5 6.1 5.2 4.3

Provisions 21.0 21.0 21.0 21.0 Market Cap / Revenues 6.7 6.1 5.2 4.5

Deferred tax assets 91.5 100.65 110.7 121.8 Price to Book Value 6.2 5.2 4.5 3.8

Other Current Liabilities 432.5 493.7 550.7 578.1 Solvency Ratios (x)

Total Current Liabilities 677.0 761.5 862.3 935.0 Debt / Equity 0.4 0.3 0.3 0.2

Net Current Assets 371.1 246.9 229.9 277.2 Debt / EBITDA 1.5 1.3 1.1 0.6

Application of Funds 3,026.5 3,454.9 3,853.9 4,045.4 Current Ratio 0.9 0.9 0.9 1.0

Source: ICICI Direct Research Source: ICICI Direct Research

ICICI Securities | Retail Research 8

Result Update | Syngene International ICICI Direct Research

Exhibit 16: ICICI Direct coverage universe (Healthcare)

Company I-Direct CMP TP Rating M Cap EPS (|) PE(x) RoCE (%) RoE (%)

Code (|) (|) (| cr) FY19 FY20E FY21E FY22E FY19 FY20E FY21E FY22E FY19 FY20E FY21E FY22E FY19FY20EFY21EFY22E

Ajanta Pharma AJAPHA 1176 1,180 Buy 10262 43.5 43.5 52.3 64.4 27.0 27.0 22.5 18.3 21.8 21.8 20.8 21.9 17.1 17.1 16.0 17.2

Alembic Pharma

ALEMPHA 598 620 Hold 11273 31.4 31.4 26.6 31.0 19.0 19.0 22.5 19.3 19.6 19.6 13.4 14.9 21.8 21.8 13.3 13.8

Apollo Hospitals APOHOS 1659 1,800 Buy 23076 17.0 17.0 43.7 68.1 97.8 97.8 37.9 24.3 8.8 8.8 14.8 17.5 7.1 7.1 14.9 19.6

Aurobindo Pharma

AURPHA 496 475 Hold 29080 42.1 42.1 55.4 59.5 11.8 11.8 9.0 8.3 15.9 15.9 15.7 16.1 17.7 17.7 16.7 15.4

Biocon BIOCON 295 310 Buy 35370 6.2 6.2 10.6 15.6 47.5 47.5 27.8 18.9 10.9 10.9 16.7 20.9 12.2 12.2 15.7 19.1

Cadila HealthcareCADHEA 271 260 Hold 27774 18.1 18.1 16.6 18.7 15.0 15.0 16.4 14.5 13.0 13.0 11.7 12.4 17.8 17.8 13.5 13.6

Cipla CIPLA 461 520 Hold 37139 18.6 18.6 25.3 30.0 24.8 24.8 18.2 15.4 10.9 10.9 13.6 14.8 10.0 10.0 11.2 11.9

Divi's Lab DIVLAB 1910 1,850 Hold 50699 51.0 51.0 59.1 71.2 37.5 37.5 32.3 26.8 25.5 25.5 22.1 22.8 19.4 19.4 17.0 17.6

Dr Reddy's LabsDRREDD 3039 3,000 Hold 50488 114.8 114.8 140.0 166.7 26.5 26.5 21.7 18.2 11.1 11.1 13.9 16.9 13.6 13.6 12.7 13.5

Glenmark PharmaGLEPHA 353 410 Hold 9961 26.9 26.9 36.7 46.1 13.1 13.1 9.6 7.7 15.3 15.3 15.0 17.0 13.5 13.5 14.0 15.1

Hikal HIKCHE 132 140 Buy 1255 6.3 8.4 9.7 11.7 21.1 15.8 13.6 11.4 12.2 14.3 13.0 14.2 11.5 13.6 14.2 14.8

Ipca Laboratories IPCLAB 1230 1,355 Buy 15541 35.1 35.1 60.7 75.3 35.1 35.1 20.3 16.3 15.0 15.0 19.9 21.2 14.2 14.2 18.0 18.9

Lupin LUPIN 740 810 Hold 33517 16.5 16.5 35.0 37.1 44.7 44.7 21.1 20.0 9.4 9.4 9.9 12.1 5.4 5.4 8.4 8.3

Narayana Hrudalaya

NARHRU 356 360 Buy 7276 2.9 2.9 9.8 13.3 122.6 122.6 36.4 26.7 7.7 7.7 13.9 16.5 5.5 5.5 14.5 16.7

Natco Pharma NATPHA 658 595 Hold 11974 34.9 34.9 23.7 22.0 18.8 18.8 27.8 29.9 21.3 21.3 12.2 10.5 18.5 18.5 10.0 8.6

Sun Pharma SUNPHA 452 470 Hold 108543 15.9 15.9 20.2 24.7 28.5 28.5 22.4 18.3 10.3 10.3 11.3 12.5 9.2 9.2 9.9 11.3

Syngene Int. SYNINT 306 360 Buy 12238 8.3 8.3 9.6 12.0 37.0 37.0 31.7 25.6 14.8 14.8 13.1 15.1 16.8 16.8 14.1 14.9

Torrent Pharma TORPHA 2050 2,020 Buy 34696 48.9 48.9 74.0 91.8 41.9 41.9 27.7 22.3 14.2 14.2 18.7 21.2 17.5 17.5 19.6 20.6

Source: ICICI Direct Research, Bloomberg

ICICI Securities | Retail Research 9

Result Update | Syngene International ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorises them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as

the analysts' valuation for a stock

Buy: >15%;

Hold: -5% to 15%;

Reduce: -5% to -15%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 10

Result Update | Syngene International ICICI Direct Research

ANALYST CERTIFICATION

We /I, Siddhant Khandekar, Inter CA, Mitesh Shah, CFA, Sudarshan Agarwal, PGDM(Finance), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed

in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to

the specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned

in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

CICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI

Securities Limited is a SEBI registered Research Analyst with SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI

Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance,

general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons

reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing

on a company's fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical

Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions

expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 11

You might also like

- CBS 2021Document333 pagesCBS 2021Drew Johnson100% (1)

- TSLA Q1 2022 UpdateDocument29 pagesTSLA Q1 2022 UpdateSimon Alvarez100% (1)

- The Lodging OperationsDocument23 pagesThe Lodging OperationsRofil AlbaoNo ratings yet

- Quality Statement of SpacexDocument3 pagesQuality Statement of SpacexFaisal AyazNo ratings yet

- About Syngene InternationalDocument15 pagesAbout Syngene Internationalalkanm750No ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Wipro LTD: Profitable Growth Focus of New CEODocument11 pagesWipro LTD: Profitable Growth Focus of New CEOPramod KulkarniNo ratings yet

- Bluedart Express: Strategic Investments Continue To Weigh On MarginsDocument9 pagesBluedart Express: Strategic Investments Continue To Weigh On MarginsYash AgarwalNo ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- Westlife Development: Topline Tracking ExpectationDocument6 pagesWestlife Development: Topline Tracking ExpectationADNo ratings yet

- Infosys: Digital Trajectory Intact, Revises Guidance UpwardsDocument11 pagesInfosys: Digital Trajectory Intact, Revises Guidance UpwardsanjugaduNo ratings yet

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDocument10 pagesUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalNo ratings yet

- Analytical Annexures Q2FY23Document24 pagesAnalytical Annexures Q2FY23Kdp03No ratings yet

- IDirect SundaramFin CoUpdate Feb21Document5 pagesIDirect SundaramFin CoUpdate Feb21Romelu MartialNo ratings yet

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDocument5 pages4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNo ratings yet

- HCL Technologies: Margin Pressure On Services To ContinueDocument8 pagesHCL Technologies: Margin Pressure On Services To ContinueSiddhant GNo ratings yet

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocument9 pagesAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNo ratings yet

- Divis RRDocument10 pagesDivis RRRicha P SinghalNo ratings yet

- QuarterlyUpdateReport AngelOneLtd Q4FY23Document9 pagesQuarterlyUpdateReport AngelOneLtd Q4FY23Abhishek TondeNo ratings yet

- Apollo Hospitals: Numbers Continue To StrengthenDocument13 pagesApollo Hospitals: Numbers Continue To StrengthenanjugaduNo ratings yet

- April 2022Document43 pagesApril 2022Indraneel MahantiNo ratings yet

- Nikon 2017 Financial ResultsDocument37 pagesNikon 2017 Financial ResultsMichael ZhangNo ratings yet

- Wipro LTD (WIPRO) : Growth and Margin Visibility Improving..Document13 pagesWipro LTD (WIPRO) : Growth and Margin Visibility Improving..ashok yadavNo ratings yet

- ICICI Direct Century Plyboards IndiaDocument10 pagesICICI Direct Century Plyboards IndiaTai TranNo ratings yet

- HDFC Amc: Earnings in Higher OrbitDocument9 pagesHDFC Amc: Earnings in Higher OrbitNiruNo ratings yet

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- HCL Technologies: Digital & Product Business Drove MarginsDocument11 pagesHCL Technologies: Digital & Product Business Drove MarginsSiddhant GNo ratings yet

- Press Release and Inv. PresentationDocument16 pagesPress Release and Inv. Presentationankur parekhNo ratings yet

- FY2024AnalystPresL&T Q1FY24 Analyst PresentationDocument32 pagesFY2024AnalystPresL&T Q1FY24 Analyst PresentationSHREYA NAIRNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Nestlé India: Upbeat Volume Growth, Tax Cuts Aid ProfitabilityDocument9 pagesNestlé India: Upbeat Volume Growth, Tax Cuts Aid ProfitabilityVishakha RathodNo ratings yet

- ABB Q3 2022 Press Release EnglishDocument13 pagesABB Q3 2022 Press Release EnglishMATHU MOHANNo ratings yet

- SBI Life Insurance: Business Gains Traction To Continue AheadDocument8 pagesSBI Life Insurance: Business Gains Traction To Continue Aheadmayank98108No ratings yet

- CMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeDocument14 pagesCMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeSameer MaradiaNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- IDBI Capital Sees 9% UPSIDE in Supreme Industries Robust VolumeDocument13 pagesIDBI Capital Sees 9% UPSIDE in Supreme Industries Robust Volumehitesh.tradingviewNo ratings yet

- Hikal LTD: Crop Protection Propels Growth But Margins MissDocument10 pagesHikal LTD: Crop Protection Propels Growth But Margins MissRakesh KumarNo ratings yet

- Shareholder Deck Q1 2023 FINALDocument34 pagesShareholder Deck Q1 2023 FINALBrandon Gonzalez cNo ratings yet

- Quarterly Update Report VBL Q1 CY23Document7 pagesQuarterly Update Report VBL Q1 CY23Jyotishman SahaNo ratings yet

- Hampered by Tightening PPKM: Mitra Adiperkasa TBK (MAPI IJ)Document6 pagesHampered by Tightening PPKM: Mitra Adiperkasa TBK (MAPI IJ)Putu Chantika Putri DhammayantiNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Cyient 2023Document426 pagesCyient 2023Vishwas ChaturvediNo ratings yet

- CPP Investor Factsheet 2023Document2 pagesCPP Investor Factsheet 2023tdhNo ratings yet

- Infosys: Strong Revenue, Margin Resilience Is KeyDocument8 pagesInfosys: Strong Revenue, Margin Resilience Is KeyKrish JNo ratings yet

- IDirect Polycab CoUpdate Jun20 PDFDocument10 pagesIDirect Polycab CoUpdate Jun20 PDFkishore13No ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- ITC Limited: Strategy Refresh To Build Investor ConfidenceDocument15 pagesITC Limited: Strategy Refresh To Build Investor Confidenceaathi sakthiNo ratings yet

- ICICI Securities LTD ResultDocument8 pagesICICI Securities LTD Resultchandan_93No ratings yet

- Cox & Kings (CNKLIM) : Weak Performance Debt Concerns AddressedDocument9 pagesCox & Kings (CNKLIM) : Weak Performance Debt Concerns Addressedsaran21No ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- Results Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyDocument1 pageResults Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyMeharwal TradersNo ratings yet

- CyientDocument367 pagesCyientReTHINK INDIANo ratings yet

- Just Group Research Report 05.15.21 - v2Document4 pagesJust Group Research Report 05.15.21 - v2Ralph SuarezNo ratings yet

- IDirect SKFIndia Q2FY20Document10 pagesIDirect SKFIndia Q2FY20praveensingh77No ratings yet

- Task 3 Sec A Group 12Document4 pagesTask 3 Sec A Group 12Pulkit AggarwalNo ratings yet

- Prabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDocument8 pagesPrabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDhaval MailNo ratings yet

- 2022 05 25 ALS Full Year Results FY22Document5 pages2022 05 25 ALS Full Year Results FY22Johan orlando Castro BeltranNo ratings yet

- Q2'20 UpdateDocument26 pagesQ2'20 UpdateFred Lamert100% (2)

- Boosting Productivity in Kazakhstan with Micro-Level Tools: Analysis and Policy LessonsFrom EverandBoosting Productivity in Kazakhstan with Micro-Level Tools: Analysis and Policy LessonsNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- List The Steps in The Accounting CycleDocument10 pagesList The Steps in The Accounting Cyclesanketsabale26No ratings yet

- Debt:: Balance SheetDocument2 pagesDebt:: Balance Sheetsanketsabale26No ratings yet

- Personal SWOT Analysis of A Student PDFDocument1 pagePersonal SWOT Analysis of A Student PDFsanketsabale26No ratings yet

- Pja 2Document14 pagesPja 2sanketsabale26No ratings yet

- III. The Balance of Payments: QuestionsDocument7 pagesIII. The Balance of Payments: Questionssanketsabale26No ratings yet

- 3d Virtual Trial Room IJERTCONV6IS13159 PDFDocument4 pages3d Virtual Trial Room IJERTCONV6IS13159 PDFsanketsabale26No ratings yet

- Slide03 (Fin4400) YuanDocument9 pagesSlide03 (Fin4400) Yuansanketsabale26No ratings yet

- Roll No - 18-S-106: My LearningsDocument1 pageRoll No - 18-S-106: My Learningssanketsabale26No ratings yet

- Nfpa 12 2018 14Document1 pageNfpa 12 2018 14Sundar RzNo ratings yet

- Domino's PizzaDocument14 pagesDomino's PizzaWyatt ThomasNo ratings yet

- Naveen Kumar YadavDocument2 pagesNaveen Kumar Yadavnaveen yadavNo ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- KE51, KE52, KE53 - Profit Center Create, Change, DisplayDocument5 pagesKE51, KE52, KE53 - Profit Center Create, Change, DisplayElboy Son DecanoNo ratings yet

- C2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Document3 pagesC2000-002 - Acctg Guidelines On The Use of Income of SUC Pursuant To RA8292Alquin ColladoNo ratings yet

- Fmea Sfe47.005 WeldingDocument8 pagesFmea Sfe47.005 Weldingkumaraswamy.kNo ratings yet

- Essay NetflixDocument10 pagesEssay NetflixCarlosNo ratings yet

- Machine Hour Cost Sheet Mechanical Ventilation BoxDocument10 pagesMachine Hour Cost Sheet Mechanical Ventilation BoxLAURA VANESSA MENDIVELSO SANCHEZNo ratings yet

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- The Following Are 10 Technical Accounting Terms Introduced or EmphasizedDocument1 pageThe Following Are 10 Technical Accounting Terms Introduced or Emphasizedamit raajNo ratings yet

- IC Onboarding Process Template1Document1 pageIC Onboarding Process Template1Kishen RaghunathNo ratings yet

- The Best of Tyre RecyclingDocument4 pagesThe Best of Tyre RecyclingMihai Basarab100% (1)

- 3 Year - Work in Poland 2024-3Document11 pages3 Year - Work in Poland 2024-3bini kinduNo ratings yet

- Organization and Regulation of Rail Industry in JapanDocument23 pagesOrganization and Regulation of Rail Industry in JapanWilliam LauNo ratings yet

- Sindh Building Control Authority: Stamp Paper)Document5 pagesSindh Building Control Authority: Stamp Paper)Syed IrtazaNo ratings yet

- Curriculum Vitae Latest Kaustubh ArolkarDocument3 pagesCurriculum Vitae Latest Kaustubh ArolkarPraney MalhotraNo ratings yet

- Accountancy Preparatory ExaminationDocument6 pagesAccountancy Preparatory Examinationclown clNo ratings yet

- 2332 - Muhammad Ali - ResumeDocument1 page2332 - Muhammad Ali - ResumeAli AgralNo ratings yet

- Johnny Doc Criminal Complaint 2021Document8 pagesJohnny Doc Criminal Complaint 2021philly victorNo ratings yet

- Web Development Quotation: What About It?Document4 pagesWeb Development Quotation: What About It?Gathy BrayohNo ratings yet

- Yanata Reylend CA1 ASSIGNMENTDocument7 pagesYanata Reylend CA1 ASSIGNMENTReylend YanataNo ratings yet

- Voidable Contract ARTICLE 1390-1402Document20 pagesVoidable Contract ARTICLE 1390-1402Joseph VegaNo ratings yet

- MA 3103 - Valuation Methods (Financial Analysis)Document9 pagesMA 3103 - Valuation Methods (Financial Analysis)Jacinta Fatima ChingNo ratings yet

- Transport Policy 1Document3 pagesTransport Policy 1mandi bahauddin associatesNo ratings yet

- MAZARS MODEL FS (MPERS) 2016 - External (Final)Document56 pagesMAZARS MODEL FS (MPERS) 2016 - External (Final)Ann YeoNo ratings yet

- Circuit Board Case Operations ManagementDocument5 pagesCircuit Board Case Operations ManagementdonmathewsgeorgNo ratings yet