Professional Documents

Culture Documents

Rives Notice of Hearing 3-17-20

Rives Notice of Hearing 3-17-20

Uploaded by

K Fine0 ratings0% found this document useful (0 votes)

6K views4 pagesRives

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRives

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

6K views4 pagesRives Notice of Hearing 3-17-20

Rives Notice of Hearing 3-17-20

Uploaded by

K FineRives

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

NORTH CAROLINA BEFORE THE NORTH CAROLINA STATE BOARD OF

WAKE COUNTY CERTIFIED PUBLIC ACCOUNTANT EXAMINERS

CASE #s: 12012404-1, 12012404-3, ©2013084-2

2018297

IN THE MATTER OF:

Rives & Associates, LLP

Leon Little Rives, II, CPA, #29505 NOTICE OF HEARING

Respondents

‘The North Carolina State Board of Certified Public Accountant Examiners (“Board”) has received

evidence which if admitted at hearing would show that:

1, Rives & Associates, LLP (hereinafter “Respondent Firm”), is a registered certified

public accounting firm in North Carolina.

2. Leon Little Rives, II (hereinafter “Respondent’), is the holder of North Carolina

certificate number 29505. ‘The Respondent and Respondent Firm shall hereinafter

be collectively referred to as the “Respondents.”

3. The Respondents are subject to the provisions of Chapter 93 of the North Carolina

General Statutes and Title 21, Chapter 08 of the North Carolina Administrative

Code, including the Rules of Professional Ethics and Conduct promulgated and

adopted therein.

4, In 2010, the Respondent Firm entered into a consulting agreement with the

Yadkin County Board of Education to perform an efficiency study (“Consulting

Agreement”). Per that agreement, the fee paid by the Yadkin County Board of

Education was based upon a percentage of revenue increases and/or operating cost

decreases recognized as a result of the Consulting Agreement,

5. During the same period of time as the Consulting Agreement, the Respondent

Firm also performed the audit for the same client.

6. Per 21 NCAC 08N .0303(1)(A), a CPA shall not be prohibited from receiving a

contingent fee, except for the rendering of:

professional services for any person for whom the CPA also performs

attest services, during the period of the attest services engagement,

and the period covered by any historical financial statements

involved in such attest services...

7. Subsequently, in August 2011, the Respondents formed School Efficiency

Consultants (‘SEC’), SEC performed substantially the same functions as

previously performed by the Respondent Firm pursuant to the Consulting

‘Agreement.

Notice of Hearing -2

Rives & Associates, LLP

Leon Little Rives, II, CPA

8.

10,

iL.

12.

13.

14.

At the time that SEC was created, the Respondent Firm held a controlling interest

in SEC. Further, many of SEC's administrative functions were performed at the

Respondent Firm’s Lexington office. The Respondent was the Organizer and

Manager of SEC.

Since that time, SEC has performed consulting services for several of the

Respondent Firm's audit clients. The time periods of those consulting services

overlapped with the periods for which the Respondent Firm performed audits.

SEC is not a CPA or a CPA firm and, therefore, is not strictly prohibited from

receiving a contingent fee from the Respondent Firm's audit clients. Nevertheless,

the Respondents’ professional responsibilities may be imputed to SEC per 21

NCAC 08N .0103:

A CPA and CPA firm shall be responsible for assuring

compliance with the rules in this Subchapter by anyone who is

the CPA's partner, fellow shareholder, member, officer, director,

licensed employee, unlicensed employee or agent or unlicensed

principal, or by anyone whom the CPA supervises. A CPA or

CPA firm shall not permit others (including affiliated entities)

to carry out on the CPA's behalf, with or without compensation,

acts that if carried out by the CPA would be a violation of these

Rules.

‘The Board staff also received information indicating that the Respondent Firm

had been involved in litigation related to the performance of the audit for Telworx

Communications, LLC for the years ending December 31, 2010 and 2011.

‘The Board staff reviewed the audit workpapers for those audits and identified

potential deficiencies. Those deficiencies were primarily concerned with audit

documentation, inventory and risk assessments.

‘The Respondents subsequently disclosed that they had been sued in North

Carolina Business Court. Primarily, the lawsuit alleged that the Respondent had

acted fraudulently and in breach of his fiduciary duty as an officer and director of

Steel Tube, Inc. Other allegations contend that the Firm, through the Respondent,

acted negligently and breached its contract in the preparation of Steel Tube's tax

returns,

The lawsuit was litigated in Business Court and a jury entered a verdict against,

the Respondent based upon a breach of his fiduciary duty, conversion, and fraud.

Asa result, the Respondent was held individually liable for a total of $1,675,846,

The judge has upheld the verdict and has rendered a judgment for that amount.

‘The jury also found the Respondent Firm to be negligent and entered a $40,000

judgment against it. The jury also entered $300,000 in punitive damages against

the Respondent and $200,000 against the Respondent Firm,

Notice of Hearing -3

Rives & Associates, LLP

Leon Little Rives, Il, CPA

15.

16.

17.

18.

19,

20,

21,

22,

23,

On February 26, 2020, the Respondent was found in contempt of court. ‘The

findings of that Order on Contempt recited the following:

‘The court finds that the Defendant did have an odor of alcohol about him

when he picked up the children at the Putt-Putt and then transported them

back to Westchester Country day school.

‘The court further finds that one of the minor children smelled the odor of

alcohol and believed his Father was impaired and refused to go home with

the Defendant Father for his weekend parenting time.

The Order on Contempt imposed a 30-day jail sentence. The sentence was

suspended if the Respondent met certain conditions.

By entering into the Consulting Agreement with the Yadkin County Board of

‘Education at the same time that the Respondent Firm performed the audit for that

same client, the Respondents have potentially violated 21 NCAC 08N .0303.

By auditing clients during the same time period that SEC was providing

consulting agreements on a contingency basis, the Respondents have potentially

violation 21 NCAC 08N .0303.

‘The subsequent consulting services rendered by SEC for clients that had their

audits performed by the Respondent Firm created a real or apparent lack of

independence in potential violation of 21 NCAC 08N .042(a).

‘The audit deficiencies identified through a review of the workpapers for the

Telworx Communications, LLC audits constitute potential violations of 21 NCAC

O8N .0403.

The jury verdict and resulting judge's order show that the plaintiff, by a

preponderance of the evidence, proved that the Respondent engaged in fraudulent

behavior, converted Steel Tube, Inc. property, and breached his fiduciary duties.

That conduct constitutes potential violations of 21 NCAC 08N .0201 (Integrity),

.0202 (Deceptive Conduct) and .0203 Discreditable Conduct).

‘The jury's award of punitive damages and resulting judge's order show that the

plaintiff, by clear and convincing evidence, that the Respondent engaged in fraud

or willful or wanton conduct. That conduct constitutes potential violations of 21

NCAC 08N .0201 (Integrity), .0202 (Deceptive Conduct) and .0203 (Discreditable

Conduct),

The jury also found that the Respondents negligently failed to correctly file Steel

Tube Inc’ tax returns. That failure could constitute a violation of 21 NCAC 08N

.0212 (Competence).

Notice of Hearing - 4

Rives & Associates, LLP

Leon Little Rives, II, CPA

24. The Respondent's actions resulting in the Order on Contempt potentially

constitute violations of 21 NCAC 08N .0201 (Integrity) and .0203 (Discreditable

Conduct),

‘The discipline which the Board may impose on the Respondents for violation of the aforementioned

statutes and rules includes censure, revocation of license for a period of time, or permanent

revocation. In addition, the Board may impose civil penalties of up to $1,000 per infraction.

Pursuant to N. C. Gen. Stat. § 150B-38, the Respondents are entitled to a public hearing on this

matter. This notice is to advise Respondents Rives & Associates, LLP, and Leon Little Rives, II,

CPA, that, unless this matter is resolved by consent, the Board will hear this matter in the Board

offices at 1101 Oberlin Road in Raleigh on July 20, 2020. If the Respondents are not present, a

decision may be reached in their absonce, and the Respondents may be deemed to have waived

their right to a hearing.

Pursuant to N. C. Gen. Stat. § 150B-40(d), the Respondents may not communicate regarding this

matter, directly or indirectly, with any individual member of the Board.

This notice is issued the _'7 day of MARCH , 2020.

NORTH CAROLINA STATE BOARD OF CERTIFIED

PUBLIC ACCOUNTANT EXAMINERS

BY: 4 Suk Maast.

airman, Professional Standards Committee

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Summer YouthDocument17 pagesSummer YouthK FineNo ratings yet

- Goldsboro Mayoral HopefulsDocument51 pagesGoldsboro Mayoral HopefulsK FineNo ratings yet

- ROD ComplaintDocument15 pagesROD ComplaintK FineNo ratings yet

- Mayor ApplicationsDocument57 pagesMayor ApplicationsK FineNo ratings yet

- SEC WebsiteDocument2 pagesSEC WebsiteK FineNo ratings yet

- Traditional Calendar PDFDocument2 pagesTraditional Calendar PDFK FineNo ratings yet

- Wayne BOE Communications LetterDocument2 pagesWayne BOE Communications LetterK FineNo ratings yet

- Dunsmore ApplicationDocument16 pagesDunsmore ApplicationK FineNo ratings yet

- City Proposed BudgetDocument629 pagesCity Proposed BudgetK FineNo ratings yet

- School Operating Specialists, LLC - ContractDocument3 pagesSchool Operating Specialists, LLC - ContractK FineNo ratings yet

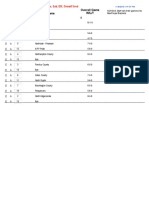

- Total Local Supplement To The Salaries of The Superintendent, His Cabinet and Key AdministratorsDocument1 pageTotal Local Supplement To The Salaries of The Superintendent, His Cabinet and Key AdministratorsK FineNo ratings yet

- Members of The Wayne County Board of Education Are Paid $11,700 Annually. Board Chairman Chris West Is Paid $12,900Document1 pageMembers of The Wayne County Board of Education Are Paid $11,700 Annually. Board Chairman Chris West Is Paid $12,900K FineNo ratings yet

- HurricaneDocument11 pagesHurricaneK FineNo ratings yet

- Thought Exchange Comments 9-16-19Document103 pagesThought Exchange Comments 9-16-19K FineNo ratings yet

- Total Local Supplement To The Salaries of The Superintendent, His Cabinet and Key AdministratorsDocument1 pageTotal Local Supplement To The Salaries of The Superintendent, His Cabinet and Key AdministratorsK FineNo ratings yet

- April 2018: Residency Controversy (Exhibit 13)Document3 pagesApril 2018: Residency Controversy (Exhibit 13)K FineNo ratings yet

- Final 2019 FootballSeedingDocument16 pagesFinal 2019 FootballSeedingK FineNo ratings yet

- 1rental: E-Mail: Avnhotels@Yahoo. ComDocument4 pages1rental: E-Mail: Avnhotels@Yahoo. ComK FineNo ratings yet