Professional Documents

Culture Documents

Agar Oh Annual Internal Audit Report 2019-20

Agar Oh Annual Internal Audit Report 2019-20

Uploaded by

api-205664725Copyright:

Available Formats

You might also like

- JDE Document Type DescriptionDocument7 pagesJDE Document Type DescriptionKelvin Tai Wei LimNo ratings yet

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDocument9 pagesQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- Problem A - SFP For UploadDocument3 pagesProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- Audit Program - Fixed AssetsDocument11 pagesAudit Program - Fixed Assetshamza dosani100% (3)

- 1 Annual Internal Audit Report NH 201819Document1 page1 Annual Internal Audit Report NH 201819api-205664725No ratings yet

- All Audit Papers 2021Document7 pagesAll Audit Papers 2021api-317438049No ratings yet

- AARS Solution Class Test 1 FinalDocument3 pagesAARS Solution Class Test 1 FinalWaseim KhanNo ratings yet

- Agar NH Annual Governance Statement 2019-20Document1 pageAgar NH Annual Governance Statement 2019-20api-205664725No ratings yet

- Quiz Quiz 1Document6 pagesQuiz Quiz 1Donna TumalaNo ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Module 3 GAM For LGUs Updated 1Document17 pagesModule 3 GAM For LGUs Updated 1Ashley salgadoNo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Week 11 Workshop SolutionsDocument9 pagesWeek 11 Workshop SolutionsAssessment Help SolutionsNo ratings yet

- Audit Programme For Audit of BanksDocument8 pagesAudit Programme For Audit of BanksGaurav AgrawalNo ratings yet

- Session 8Document12 pagesSession 8Adil AnwarNo ratings yet

- Application of Concepts SFPDocument10 pagesApplication of Concepts SFPblancocarizagioNo ratings yet

- Income Tax Internal AuditDocument3 pagesIncome Tax Internal AuditdharmakjhaNo ratings yet

- Final Audit - Reg - May 24 - MS - 7Document2 pagesFinal Audit - Reg - May 24 - MS - 7denigo3568No ratings yet

- Appraisal DrillsDocument9 pagesAppraisal DrillsLyca Morandante LamaneroNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- 06-DFA2022 Part1-Auditor's ReportDocument5 pages06-DFA2022 Part1-Auditor's ReportjoevincentgrisolaNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Rmbe FarDocument15 pagesRmbe FarMiss Fermia0% (1)

- Section 13: Fund Accounting Accounting Entries: Accounts ReceivableDocument5 pagesSection 13: Fund Accounting Accounting Entries: Accounts ReceivablethisisghostactualNo ratings yet

- Manual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesDocument4 pagesManual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesJustine Mae MoranoNo ratings yet

- ACCP305 End Chapter MCQs and Prelims PrefiDocument54 pagesACCP305 End Chapter MCQs and Prelims PrefissabinaNo ratings yet

- Management's Responsibility For The Financial ReportDocument3 pagesManagement's Responsibility For The Financial ReportNazim Uddin MahmudNo ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- SAI-LGAS MDLSGDDocument6 pagesSAI-LGAS MDLSGDlovellev.ev3No ratings yet

- P. B. C. DDocument1 pageP. B. C. DSheena DeLeonNo ratings yet

- Financial StatementsDocument35 pagesFinancial StatementsTapish GroverNo ratings yet

- Govt Acctg ReviewerDocument18 pagesGovt Acctg Reviewerdewlate abinaNo ratings yet

- Thery of AccountsDocument13 pagesThery of AccountsTerrence Von KnightNo ratings yet

- Chapter 12 - Events After The Reporting PeriodDocument3 pagesChapter 12 - Events After The Reporting PeriodFerb CruzadaNo ratings yet

- C. D. I, A. C. / Tr,. .D.: in ofDocument2 pagesC. D. I, A. C. / Tr,. .D.: in ofSheena DeLeonNo ratings yet

- Audit and Assurance - Last Year ExamsDocument17 pagesAudit and Assurance - Last Year ExamsVoice-of HopeNo ratings yet

- Chapter 15Document25 pagesChapter 15cruzchristophertangaNo ratings yet

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocument15 pagesDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNo ratings yet

- ST ND: AC 41 - 1 Sem, A.Y. 2019-2020Document13 pagesST ND: AC 41 - 1 Sem, A.Y. 2019-2020kenn anoberNo ratings yet

- SOU 2 Md-GrimcoDocument3 pagesSOU 2 Md-GrimcoJatin ShahNo ratings yet

- Audit ManualDocument10 pagesAudit ManualSusan PascualNo ratings yet

- Iap 2Document2 pagesIap 2adammorettoNo ratings yet

- Property ProgramDocument18 pagesProperty ProgramSyarif Muhammad HikmatyarNo ratings yet

- FR 2Document8 pagesFR 2keshav000rNo ratings yet

- AUDIT REPORT-GB RevenuesDocument27 pagesAUDIT REPORT-GB RevenuesAbid KhawajaNo ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- Questioner IcsDocument19 pagesQuestioner Icsnabila dhiyaNo ratings yet

- 4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileDocument13 pages4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileSeyon HunpeganNo ratings yet

- Investment Property - BuildingDocument1 pageInvestment Property - BuildingbeeNo ratings yet

- Audit Solved Paper For CA PCC June 2009Document10 pagesAudit Solved Paper For CA PCC June 2009CAclubindiaNo ratings yet

- Audit SuggestedDocument112 pagesAudit SuggestedSushant MaskeyNo ratings yet

- Corporate Reporting November 2018Document28 pagesCorporate Reporting November 2018swarna dasNo ratings yet

- Ch14 - Audit ReportsDocument25 pagesCh14 - Audit ReportsShinny Lee G. UlaNo ratings yet

- Volume IDocument72 pagesVolume IWilliam A. Chakas Jr.No ratings yet

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- Ias 10Document12 pagesIas 10Reever RiverNo ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Unit 3 (I)Document4 pagesUnit 3 (I)Saniya HashmiNo ratings yet

- 2 Annual Governance Statement NH 201819Document1 page2 Annual Governance Statement NH 201819api-205664725No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- Agar NH Annual Governance Statement 2019-20Document1 pageAgar NH Annual Governance Statement 2019-20api-205664725No ratings yet

- Agar NH Certificate of Exemption 2019-20Document1 pageAgar NH Certificate of Exemption 2019-20api-205664725No ratings yet

- Agar Oh Certificate of Exemption 2019-20Document1 pageAgar Oh Certificate of Exemption 2019-20api-205664725No ratings yet

- Agar Oh Accounting Statements 2019-20Document1 pageAgar Oh Accounting Statements 2019-20api-205664725No ratings yet

- Opera PosterDocument1 pageOpera Posterapi-205664725No ratings yet

- 4 Certificate of Exemption NH 201819Document1 page4 Certificate of Exemption NH 201819api-205664725No ratings yet

- 3 Accounting Statements NH 201819Document1 page3 Accounting Statements NH 201819api-205664725No ratings yet

- 54744bos43877 p6 Q PDFDocument6 pages54744bos43877 p6 Q PDFShashank AgrawalNo ratings yet

- FIN 612 Notes PDFDocument34 pagesFIN 612 Notes PDFIvy Bucks WanjikuNo ratings yet

- 01QDPA10183Document9 pages01QDPA10183Sha AsyNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Amit Jaiswal-Godown Bill Format Till FebDocument6 pagesAmit Jaiswal-Godown Bill Format Till FebAnimesh TiwariNo ratings yet

- Discount Berlaku Bagi Setiap Menit Late Submission: Problem 1Document6 pagesDiscount Berlaku Bagi Setiap Menit Late Submission: Problem 1sherinaNo ratings yet

- Company Reporting Dates 2021Document1 pageCompany Reporting Dates 2021Ash LayNo ratings yet

- Application LetterDocument16 pagesApplication LetterDinda MayaNo ratings yet

- Unity University: Government and NFP AccountingDocument7 pagesUnity University: Government and NFP AccountingMike Dolla SignNo ratings yet

- 1... FMA Assignment 2Document7 pages1... FMA Assignment 2kibur amahaNo ratings yet

- Income Statement: General Selling and Administration ExpensesDocument8 pagesIncome Statement: General Selling and Administration ExpensesShehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Resume - Vikas ThikDocument4 pagesResume - Vikas ThikVikas ThikNo ratings yet

- Chapter 2 Smart BookDocument60 pagesChapter 2 Smart BookEmi NguyenNo ratings yet

- Chemalite Transaction Analysis: Assets, Liabilities & Owners' EquityDocument6 pagesChemalite Transaction Analysis: Assets, Liabilities & Owners' EquityFarhad KabirNo ratings yet

- Advanced Financial Accounting and ReportingDocument15 pagesAdvanced Financial Accounting and ReportingAcain RolienNo ratings yet

- Ched CmoDocument222 pagesChed CmoJake Altiyen0% (1)

- Chapter (2) Accounting Transactions Analysis and Recording: February 2019Document29 pagesChapter (2) Accounting Transactions Analysis and Recording: February 2019Klyndzu SandraNo ratings yet

- Turtle Diagram - Internal AuditDocument1 pageTurtle Diagram - Internal Auditsyahir etNo ratings yet

- Chapter 2 - Branches of AccountingDocument17 pagesChapter 2 - Branches of Accountingairam cabadduNo ratings yet

- Techniques of Financial AppraisalDocument35 pagesTechniques of Financial AppraisalUtsav DubeyNo ratings yet

- Auditing and Assurance Services Learning ObjectivesDocument15 pagesAuditing and Assurance Services Learning Objectiveshuma1208No ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel Tolentino100% (1)

- ErrorsDocument31 pagesErrorsmoNo ratings yet

- Ethical Issues Facing Tax ProfessionDocument25 pagesEthical Issues Facing Tax ProfessionNur AsniNo ratings yet

- 0462Document277 pages0462Tahseen Raza100% (1)

- Mooe AttachmentsDocument1 pageMooe AttachmentsPASCUALNo ratings yet

- Acknowledgement Receipt - BARMMDocument2 pagesAcknowledgement Receipt - BARMMShiemi OkumuraNo ratings yet

- WSBP LK TW I 2018Document85 pagesWSBP LK TW I 2018Nela NavidaNo ratings yet

Agar Oh Annual Internal Audit Report 2019-20

Agar Oh Annual Internal Audit Report 2019-20

Uploaded by

api-205664725Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agar Oh Annual Internal Audit Report 2019-20

Agar Oh Annual Internal Audit Report 2019-20

Uploaded by

api-205664725Copyright:

Available Formats

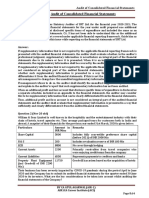

Annual lnternal Audit Report 2A19l2O

OLD HUTTON & HOLMESCALES PARISH COUNCIL. CUMBRIA

This authority's internal auditor, acting independently and on the basis of an assessment of risk,

carried out a selective assessment of compliance with relevant procedures and controls to be in

operation during the financial year ended 31 fVarch ?A2A.

The internal audit for 2019120 has been carried out in aceordance with this authority's needs

and planned coverage. On the basis of the findings in the areas examined, the internal audit

conclusions are sumrnarised in this table. Set out below are the objectives of internal control

and alongside are the internal audit conclusicns on whether, in al! significant respects, the control

objectives were being achieved throughout the financial year to a standard adequate io meet the

needs of this authority.

,t,. Appropriate accountir.ig records have been properly kert throi;ghout the financial yeai-.

B. This authority complied with its financial regulations, payments were supported by invoices, all

expenditure was approved and VAT was appropriately accounted for.

C. This authority assessed the significant risks to achieving its objectives and reviewed the adequacy

of arrangements to manage these.

B. The precept or rates requirement resulted from an adequate budgetary process; progress against

the budget was regularly monitored; and reserves were appropriate.

::r Expected income was fully- received, based on correct prices. oroperiy recorded and promptiy

banked; and VAT was apprcpriately accounted for.

F. Petty cash payments were properly supported by receipts, all petty cash expenditure was

approved and VAT appropriately accounted for.

G. Salaries to employees and allowances to members were paid in accordance with this authority's

approvals, and PAYE and Nl requirements were properly applied. ir/fi

i Asset and rnvestmenls registers were complete and accurate and properly marntained. "/.,

i. Periodic and year-end bank account reconciliations were properly carried out.

Accaunting statements prepared during the year were prepared on the correct accounting basis

ireceipts and payrnents or income and expenditure), agreed to the casir book, supported by an

adequate audit trail from underlying records and where aporonriate debtors and ci"editors were

K. lf the authority ceilified itself as exempt from a limited assurance review in 2018119, it met the

exemption criteria and correctly declared itself exempt. (lf the authority had a limited assurance

review of its 2018/19 AGAR tick "not covered")

The authority has demonstrated that during summer 2019 it correctly provided for the exercise

of public rights as required by the Accounts and Audit Regulations.

M. {For local councils only}

Trust funds (including charitable) - The council met its responsibilities as a trustee-

For any other risk areas ideniified by this authority aeiequate controls existed (lisi any other risk areas on separate sheets if needed).

Daieis) internaI audit undertaken Name of person who carried out the internal audit

Mathew Ellwood

10t03t2020

Signature of person rvho 1 , I -.

carried outthe internal audit Date )_L l5lz*

*lf the response is 'no' please state the in'rpllcations and action being taken to acjdress any weakness in control identified

(add separate sheets if neededi.

**Note: lf the response is 'not covered' please state when the most recent iniernal audit work was done in this area and when it is

next planned; or. if coverage is not required, the annuai internal audit repon rnust explain wh'y not (add separate sheets if needed).

ffi

Annual Governance arid Accountabiiity Return 2A19l2A Part.2 Page 4 of 6

Local Cot"rncils lnternal Drainage Boards and other SmallerAutho;'lties

You might also like

- JDE Document Type DescriptionDocument7 pagesJDE Document Type DescriptionKelvin Tai Wei LimNo ratings yet

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDocument9 pagesQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- Problem A - SFP For UploadDocument3 pagesProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- Audit Program - Fixed AssetsDocument11 pagesAudit Program - Fixed Assetshamza dosani100% (3)

- 1 Annual Internal Audit Report NH 201819Document1 page1 Annual Internal Audit Report NH 201819api-205664725No ratings yet

- All Audit Papers 2021Document7 pagesAll Audit Papers 2021api-317438049No ratings yet

- AARS Solution Class Test 1 FinalDocument3 pagesAARS Solution Class Test 1 FinalWaseim KhanNo ratings yet

- Agar NH Annual Governance Statement 2019-20Document1 pageAgar NH Annual Governance Statement 2019-20api-205664725No ratings yet

- Quiz Quiz 1Document6 pagesQuiz Quiz 1Donna TumalaNo ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Module 3 GAM For LGUs Updated 1Document17 pagesModule 3 GAM For LGUs Updated 1Ashley salgadoNo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Week 11 Workshop SolutionsDocument9 pagesWeek 11 Workshop SolutionsAssessment Help SolutionsNo ratings yet

- Audit Programme For Audit of BanksDocument8 pagesAudit Programme For Audit of BanksGaurav AgrawalNo ratings yet

- Session 8Document12 pagesSession 8Adil AnwarNo ratings yet

- Application of Concepts SFPDocument10 pagesApplication of Concepts SFPblancocarizagioNo ratings yet

- Income Tax Internal AuditDocument3 pagesIncome Tax Internal AuditdharmakjhaNo ratings yet

- Final Audit - Reg - May 24 - MS - 7Document2 pagesFinal Audit - Reg - May 24 - MS - 7denigo3568No ratings yet

- Appraisal DrillsDocument9 pagesAppraisal DrillsLyca Morandante LamaneroNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- 06-DFA2022 Part1-Auditor's ReportDocument5 pages06-DFA2022 Part1-Auditor's ReportjoevincentgrisolaNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Rmbe FarDocument15 pagesRmbe FarMiss Fermia0% (1)

- Section 13: Fund Accounting Accounting Entries: Accounts ReceivableDocument5 pagesSection 13: Fund Accounting Accounting Entries: Accounts ReceivablethisisghostactualNo ratings yet

- Manual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesDocument4 pagesManual On The New Government Accounting System For National Government Agencies Accounting Policies Chapter 2. Basic Features and PoliciesJustine Mae MoranoNo ratings yet

- ACCP305 End Chapter MCQs and Prelims PrefiDocument54 pagesACCP305 End Chapter MCQs and Prelims PrefissabinaNo ratings yet

- Management's Responsibility For The Financial ReportDocument3 pagesManagement's Responsibility For The Financial ReportNazim Uddin MahmudNo ratings yet

- BADVAC3X MOD 5 Financial StatementsDocument9 pagesBADVAC3X MOD 5 Financial StatementsEouj Oliver DonatoNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- SAI-LGAS MDLSGDDocument6 pagesSAI-LGAS MDLSGDlovellev.ev3No ratings yet

- P. B. C. DDocument1 pageP. B. C. DSheena DeLeonNo ratings yet

- Financial StatementsDocument35 pagesFinancial StatementsTapish GroverNo ratings yet

- Govt Acctg ReviewerDocument18 pagesGovt Acctg Reviewerdewlate abinaNo ratings yet

- Thery of AccountsDocument13 pagesThery of AccountsTerrence Von KnightNo ratings yet

- Chapter 12 - Events After The Reporting PeriodDocument3 pagesChapter 12 - Events After The Reporting PeriodFerb CruzadaNo ratings yet

- C. D. I, A. C. / Tr,. .D.: in ofDocument2 pagesC. D. I, A. C. / Tr,. .D.: in ofSheena DeLeonNo ratings yet

- Audit and Assurance - Last Year ExamsDocument17 pagesAudit and Assurance - Last Year ExamsVoice-of HopeNo ratings yet

- Chapter 15Document25 pagesChapter 15cruzchristophertangaNo ratings yet

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocument15 pagesDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNo ratings yet

- ST ND: AC 41 - 1 Sem, A.Y. 2019-2020Document13 pagesST ND: AC 41 - 1 Sem, A.Y. 2019-2020kenn anoberNo ratings yet

- SOU 2 Md-GrimcoDocument3 pagesSOU 2 Md-GrimcoJatin ShahNo ratings yet

- Audit ManualDocument10 pagesAudit ManualSusan PascualNo ratings yet

- Iap 2Document2 pagesIap 2adammorettoNo ratings yet

- Property ProgramDocument18 pagesProperty ProgramSyarif Muhammad HikmatyarNo ratings yet

- FR 2Document8 pagesFR 2keshav000rNo ratings yet

- AUDIT REPORT-GB RevenuesDocument27 pagesAUDIT REPORT-GB RevenuesAbid KhawajaNo ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- Questioner IcsDocument19 pagesQuestioner Icsnabila dhiyaNo ratings yet

- 4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileDocument13 pages4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileSeyon HunpeganNo ratings yet

- Investment Property - BuildingDocument1 pageInvestment Property - BuildingbeeNo ratings yet

- Audit Solved Paper For CA PCC June 2009Document10 pagesAudit Solved Paper For CA PCC June 2009CAclubindiaNo ratings yet

- Audit SuggestedDocument112 pagesAudit SuggestedSushant MaskeyNo ratings yet

- Corporate Reporting November 2018Document28 pagesCorporate Reporting November 2018swarna dasNo ratings yet

- Ch14 - Audit ReportsDocument25 pagesCh14 - Audit ReportsShinny Lee G. UlaNo ratings yet

- Volume IDocument72 pagesVolume IWilliam A. Chakas Jr.No ratings yet

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- Ias 10Document12 pagesIas 10Reever RiverNo ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Unit 3 (I)Document4 pagesUnit 3 (I)Saniya HashmiNo ratings yet

- 2 Annual Governance Statement NH 201819Document1 page2 Annual Governance Statement NH 201819api-205664725No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- Agar NH Annual Governance Statement 2019-20Document1 pageAgar NH Annual Governance Statement 2019-20api-205664725No ratings yet

- Agar NH Certificate of Exemption 2019-20Document1 pageAgar NH Certificate of Exemption 2019-20api-205664725No ratings yet

- Agar Oh Certificate of Exemption 2019-20Document1 pageAgar Oh Certificate of Exemption 2019-20api-205664725No ratings yet

- Agar Oh Accounting Statements 2019-20Document1 pageAgar Oh Accounting Statements 2019-20api-205664725No ratings yet

- Opera PosterDocument1 pageOpera Posterapi-205664725No ratings yet

- 4 Certificate of Exemption NH 201819Document1 page4 Certificate of Exemption NH 201819api-205664725No ratings yet

- 3 Accounting Statements NH 201819Document1 page3 Accounting Statements NH 201819api-205664725No ratings yet

- 54744bos43877 p6 Q PDFDocument6 pages54744bos43877 p6 Q PDFShashank AgrawalNo ratings yet

- FIN 612 Notes PDFDocument34 pagesFIN 612 Notes PDFIvy Bucks WanjikuNo ratings yet

- 01QDPA10183Document9 pages01QDPA10183Sha AsyNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Amit Jaiswal-Godown Bill Format Till FebDocument6 pagesAmit Jaiswal-Godown Bill Format Till FebAnimesh TiwariNo ratings yet

- Discount Berlaku Bagi Setiap Menit Late Submission: Problem 1Document6 pagesDiscount Berlaku Bagi Setiap Menit Late Submission: Problem 1sherinaNo ratings yet

- Company Reporting Dates 2021Document1 pageCompany Reporting Dates 2021Ash LayNo ratings yet

- Application LetterDocument16 pagesApplication LetterDinda MayaNo ratings yet

- Unity University: Government and NFP AccountingDocument7 pagesUnity University: Government and NFP AccountingMike Dolla SignNo ratings yet

- 1... FMA Assignment 2Document7 pages1... FMA Assignment 2kibur amahaNo ratings yet

- Income Statement: General Selling and Administration ExpensesDocument8 pagesIncome Statement: General Selling and Administration ExpensesShehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Resume - Vikas ThikDocument4 pagesResume - Vikas ThikVikas ThikNo ratings yet

- Chapter 2 Smart BookDocument60 pagesChapter 2 Smart BookEmi NguyenNo ratings yet

- Chemalite Transaction Analysis: Assets, Liabilities & Owners' EquityDocument6 pagesChemalite Transaction Analysis: Assets, Liabilities & Owners' EquityFarhad KabirNo ratings yet

- Advanced Financial Accounting and ReportingDocument15 pagesAdvanced Financial Accounting and ReportingAcain RolienNo ratings yet

- Ched CmoDocument222 pagesChed CmoJake Altiyen0% (1)

- Chapter (2) Accounting Transactions Analysis and Recording: February 2019Document29 pagesChapter (2) Accounting Transactions Analysis and Recording: February 2019Klyndzu SandraNo ratings yet

- Turtle Diagram - Internal AuditDocument1 pageTurtle Diagram - Internal Auditsyahir etNo ratings yet

- Chapter 2 - Branches of AccountingDocument17 pagesChapter 2 - Branches of Accountingairam cabadduNo ratings yet

- Techniques of Financial AppraisalDocument35 pagesTechniques of Financial AppraisalUtsav DubeyNo ratings yet

- Auditing and Assurance Services Learning ObjectivesDocument15 pagesAuditing and Assurance Services Learning Objectiveshuma1208No ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel Tolentino100% (1)

- ErrorsDocument31 pagesErrorsmoNo ratings yet

- Ethical Issues Facing Tax ProfessionDocument25 pagesEthical Issues Facing Tax ProfessionNur AsniNo ratings yet

- 0462Document277 pages0462Tahseen Raza100% (1)

- Mooe AttachmentsDocument1 pageMooe AttachmentsPASCUALNo ratings yet

- Acknowledgement Receipt - BARMMDocument2 pagesAcknowledgement Receipt - BARMMShiemi OkumuraNo ratings yet

- WSBP LK TW I 2018Document85 pagesWSBP LK TW I 2018Nela NavidaNo ratings yet