Professional Documents

Culture Documents

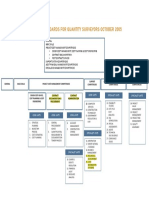

Mind Map Consolidated Funds

Mind Map Consolidated Funds

Uploaded by

Nik Nur Azmina AzharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mind Map Consolidated Funds

Mind Map Consolidated Funds

Uploaded by

Nik Nur Azmina AzharCopyright:

Available Formats

NIK NUR AZMINA BINTI AZHAR

CONSOLIDATED OBJECTIVES

- To determine the financial position and its changes in the

organisation

- To know the results of operations of the organisation

- To check its compliance with legal restrictions.

2016818082

FUND CHARACTERISTICS

Independent Accounting Entity whereby revenue, loan & trust account can stand on its own.

Has its own set of account with complete with double entry & financial statements

Self –balancing (total of assets of particular fund = total its liabilities & fund balance) & autonomous (although

government unit may be composed of several different funds, there should be focus on its general government

- It represents a system of financial record keeping that focus on how an activities & spending activities, where crucial decisions, objectives & goals can be identified.

organisation uses its finances.

- This system records source of funds & how these funds are being

spent, hence carries stewardship & accountability functions.

- Advantages:-

REGULATORY -The establishment of Consolidated Fund is governed by FC which are the Article 97(1) & Article 97(2), while FPA 1957 are the Section

7(a)-(c), & Section 16(1).

i. can track funds generated from various forms of revenue & related

expenditures, which comprise of projects or appropriations

FRAMEWORK - The Government Accounting Standard (PPKs) had been set up aiming to set accounting policies & standards as well as basis for

financial statements presentations that have been complied with the federal & state governments.

ii. easy to identify which moneys are available for specific purposes

ii. able to isolate & assign certain assets to meet a specific purpose Housing Loan Funds

- Government Housing Loan Fund Scheme -Housing Deposits

iv. it separate all finnacial account to individual funds

Loan Fund Act 1971(Act42) Miscellaneous Government Trust - Consists of General Deposits and Adjustment Deposits

- Provides housing loan facilities to members of Federal Funds - General Deposits are the monies received by the Federal Government for a

CONSOLIDATED TRUST ACCOUNT Administration, members of Parliament, members of - Sec10 FPA 1957 (Act 61)– specific specific purpose under any laws or contractual agreements & is refundable

-Sec 7 (c) of FPA 1957 stated that Consolidated State Administration and members of Legislative trust purposes in line with FC when the specific purpose has been achieved.

trust account is set up under which all receipts & Assembly, Judges, Government employees from Civil - Source of the fund is from - Adjustment deposits are temporary accounts used before payments are

payments of both government & public trust Service, Police Force and Armed Force. appropriations from the government. made or adjustments are made to specific accounts.

funds & monies received by the government for - Receipts comprises of appropriation from - 5 main categories- Clearance

Public Trust Funds

specific purposes are accounted for. Consolidated Revenue Account & Development Fund, Account, Trading Account, Loan

- Sec 9 of FPA 1957(Act61) – established this fund to account for trust

PPK No 4- Dec 2004 effective for financial year proceeds from loans raised through transfer from Loan Account, Contingency Fund and

monies entrusted to the Federal Government & Special Trust Fund

2006 Account, housing loan repayment & interest earned. Miscellanous Funds

incorporated under relevant Act.

- Until 2012 176 accounts – including

GOVERNMENT Development Funds

- Development Fund Act 1966 (Art406) with the

key aim for the economic development of the

National Trust Fund, Poor Student

Fun, National Sport Fund

- Financial source –receipts from organization or individual, placed in trust

of the government for specific purposes.

- Example; Public Finance Initiative Trust Accounts

TRUST FUNDS nation

- Consist of loans for development, contributions Market Loans Project Loans

from Consolidated Revenue Account & - Loans obtained from International Financial - Borrowing in term of money, services & technical

repayment of loan given out from this fund. Institutions,negotiated at common market rates studies, which are secured for development projects.

- Transfer from the Consolidated Loan Accounts raised for general purposes. Range from medium to long term loan.

represent the main source of finance to the - Duration – 14-20 years - Examples; Penang Bridge & East West Highway

TYPES OF Development Fund

CONSOLIDATED LOAN ACCOUNT

- Comprise of Syndicated Loan, Bond Issues &

Floating Rate Notes

- Obtained from Multilateral such as World Bank, Asia

Development Bank & Integrated Development Bank;

CONSOLIDATED - Sec 7 (b) FPA 1957 stated that Consolidated Loan - Governed by External Loan Act 1963(Act 403). & Bilateral government sources such as Malaysia &

Account established by the Federal & State Japan..

government to keep all moneys received by way of Wakala Global SUKUK

ACCOUNTS loan

- It is also established in Art 111 of the FC & the detail EXTERNAL - One form of external borrowing for Malaysia government to continue

support its prudent debt management practice

THAT RELATED

- The Wakala Global Sukuk is Malaysia’s 3rd USD denominated sovereign

about this account further explained in PPK No.5

- Sources of domestic borrowing are the local bank &

financial institution, while for external borrowing,

BORROWING sukuk issuance.

- New benchmark for in Islamic capital market

TO THE PKK the source are the foreign banks, financial

institution, IMF & World Bank

Treasury Bills

- Short term loan instruments to finance redemption cost of matured bills

- All receipts & disbursements are accounted for the

INTERNAL

- Major Subscriber are the Commercial Banks & Discount Houses

purpose of repayment of outstanding loans &

- Maturity period not exceeding one year (Short term nature)- 91-365 day

transfer to other funds

- Governed by Treasury Bills Act 1946 (Revised 1977).

PCONSOLIDATED

A R I S I A N . CREVENUE

O ACCOUNT

- Sec 7 (a) FPA 1957 stated that all types of money or revenue received BORROWING SUKUK

- Arabic name for financial certificates.

Equivalent to bonds

Government Investment Issues

except for loan & trusts are the sources to Consolidated Revenue - Aims to meet the government

Account (except Islamic religious revenue). - Sukuk securities are structure to comply

papers based on Islamic principles

- The money are used to maintain operating expenditure; namely Malaysian Government Securities with the Islamic law and its investment

as well as to complement measures

charged expenditure (Art 98 FC) & supply / operating expenditure (Art - Bond issued by the government on a long term basis to finance principles, which prohibit the charging

in controlling excess liquidity in

100 FC). Federal Government expenditure especially development payment of interest.

the financial system

PPK No.3 – May 2004 effective 2005 onwards expenditure - Government Funding Act 1983 with the

- Medium-term loan instruments

- Performance of Federal Government Revenue & Expenditure - Registered stock which are made available to market by tender aim to enable the issuance of instruments

- Maturity period 1-8 years

- There are 4 types of revenue, which are the tax revenue; non-tax and managed by Central Bank of Malaysia that could serve as liquidity management

- Main subscriber are Bank Islam &

revenue; other receipts; and revenue from Federal Territories (Kuala - Maturity period range from 5 to 20 years tools for the Islamic banks through

Islamic Financial Institutions

Lumpur, Labuan, & Putrajaya). -Primary issues and redemption of MGS on maturity are issuance of Shariah-compliance

offering interest-free banking

- It is used to pay for two types of operating expenditure, which are the managed by Central Bank of Malaysia under the Registrar of Government Investment Certificates

services in fulfilling their liquidity

charged expenditure (Article 98, FC) & the supply expenditure (Articles Public Debt- - Murabahah is the certificates of

& investment requirement

100 and 101, FC) - Major subscriber – EPF, Petronas, Central Bank of Malaysia, intedebtness arising from a deffered mark

- Governed by Act 275/83.

- Any excess will be contributed to the Consolidated Trust Account. Pension Trust Fund and BSN up sale transaction of an asset

You might also like

- CFAS Qualifying Exam ReviewerDocument20 pagesCFAS Qualifying Exam ReviewerCher Na100% (5)

- PAD370 NotaDocument12 pagesPAD370 Notanurulfahizah67% (3)

- Chapter 2Document10 pagesChapter 2mengistuNo ratings yet

- Unit 2 Principles of Accounting and Financial Reporting For State and Local Governmental UnitsDocument19 pagesUnit 2 Principles of Accounting and Financial Reporting For State and Local Governmental Unitsayele gebremichaelNo ratings yet

- Financial Accounting and Reporting: Consolidated FundDocument42 pagesFinancial Accounting and Reporting: Consolidated FundHAFIZAH BINTI MAT NAWINo ratings yet

- Unit 2Document18 pagesUnit 2YonasNo ratings yet

- 08 MF NBFC - UnlockedDocument23 pages08 MF NBFC - UnlockedBittu SharmaNo ratings yet

- Basic AccountingDocument14 pagesBasic AccountingRufina B VerdeNo ratings yet

- UNIT 2 NEW GoverntDocument14 pagesUNIT 2 NEW GoverntYosef Mitiku100% (1)

- UACS NotesDocument5 pagesUACS NotesJamila Zarsuelo100% (1)

- Government and Non Profit AccountingDocument9 pagesGovernment and Non Profit AccountingMesay Adane100% (1)

- Governmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andDocument14 pagesGovernmental Accounting: Accountability: Term Used by GASB To Describe A Government's Duty To Justify The Raising andAbdul Hakim MambuayNo ratings yet

- Acccob 2 ReviewerDocument14 pagesAcccob 2 Revieweranika bordaNo ratings yet

- FARE PP GobiernoDocument51 pagesFARE PP GobiernojorgeNo ratings yet

- Course Module - Chapter 2 - Budget ProcessDocument20 pagesCourse Module - Chapter 2 - Budget Processssslll2No ratings yet

- Handbook (PN)Document116 pagesHandbook (PN)Baisharwaine A. PandaNo ratings yet

- Intricacies of Corporate Bs and FsDocument33 pagesIntricacies of Corporate Bs and FsR.K.GUPTANo ratings yet

- Lecture Notes: Afar - Not For Profit OrganizationsDocument5 pagesLecture Notes: Afar - Not For Profit OrganizationsJem Valmonte100% (1)

- Accbp100 FMDocument3 pagesAccbp100 FMeri keiNo ratings yet

- Government Accounting: (Unified Account Code Structure)Document13 pagesGovernment Accounting: (Unified Account Code Structure)Mariella AngobNo ratings yet

- Chapters 4 6 SummaryDocument7 pagesChapters 4 6 SummaryAnna Katrina AlabaNo ratings yet

- CFAS Part 1Document3 pagesCFAS Part 1AINAH SALEHA MIMBALAWAGNo ratings yet

- A Case Study On Equity Linked Tax Saving Schemes in Mutual Funds and Risk and Return Analysis With Reference To Private Sector, KeralaDocument43 pagesA Case Study On Equity Linked Tax Saving Schemes in Mutual Funds and Risk and Return Analysis With Reference To Private Sector, Keralasachin mohanNo ratings yet

- Afar 3215-NpoDocument5 pagesAfar 3215-Npoj.galagar.127531.tcNo ratings yet

- Sarfaesi Act PPT-1Document21 pagesSarfaesi Act PPT-1Vironika Reddy100% (1)

- Lecture Notes: Afar G/N/E de Leon 3015 - Not For Profit Organizations M A Y 2 0 2 1Document6 pagesLecture Notes: Afar G/N/E de Leon 3015 - Not For Profit Organizations M A Y 2 0 2 1TatianaNo ratings yet

- Midterm-Reviewer-On-Government-Accounting 2Document5 pagesMidterm-Reviewer-On-Government-Accounting 2Sharmaine JoyceNo ratings yet

- CFAS Qualifying Exam ReviewerDocument15 pagesCFAS Qualifying Exam ReviewerJoyceNo ratings yet

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotesGan JessieNo ratings yet

- Conceptual Framework and Accounting Standards CompressDocument7 pagesConceptual Framework and Accounting Standards CompresslazarjiacinthjillNo ratings yet

- CFASDocument3 pagesCFAScaryljoycemaceda3No ratings yet

- Generally Accepted Accounting Principles For Governments Et by The Governmental Accounting Standards Board, Government AccountingDocument10 pagesGenerally Accepted Accounting Principles For Governments Et by The Governmental Accounting Standards Board, Government AccountingnicahNo ratings yet

- GAM-govacco Notes Part 2Document3 pagesGAM-govacco Notes Part 2hoxhiiNo ratings yet

- Branches of AccountingDocument2 pagesBranches of AccountingKanekio ShinNo ratings yet

- Note 1-Government AccountingDocument5 pagesNote 1-Government AccountingAngelica RubiosNo ratings yet

- Finance Notes (M1 M6 John) MinDocument10 pagesFinance Notes (M1 M6 John) Minlalla.lilli026No ratings yet

- ACC2001 Lecture 7 Business Combinations IDocument53 pagesACC2001 Lecture 7 Business Combinations Imichael krueseiNo ratings yet

- 44473bos34356sm Mod3 cp8Document80 pages44473bos34356sm Mod3 cp8MBaralNo ratings yet

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)

- Kalayni JoshiDocument16 pagesKalayni JoshiNarendra PatilNo ratings yet

- Conceptual Framework For Financial Reporting ReviewerDocument7 pagesConceptual Framework For Financial Reporting ReviewerPearl Jade YecyecNo ratings yet

- Gov. CH 1PDFDocument10 pagesGov. CH 1PDFTilahun TesemaNo ratings yet

- Chapter 1 - Overview of Corporate FinanceDocument26 pagesChapter 1 - Overview of Corporate Finance21124014No ratings yet

- Special Purpose FrameworkDocument5 pagesSpecial Purpose Frameworkanishcholkar5No ratings yet

- Accounting and ASC FrameworkDocument10 pagesAccounting and ASC FrameworkGwen Cabarse PansoyNo ratings yet

- Sreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsDocument10 pagesSreview of Financial Accounting Theory and Practice: Framework For The Preparation and Presentation of FsGwen Cabarse PansoyNo ratings yet

- End Sem Notes - Securities (Kohli)Document53 pagesEnd Sem Notes - Securities (Kohli)Kumar VaibhavNo ratings yet

- PAS 1 Presentation of Financial StatementsDocument5 pagesPAS 1 Presentation of Financial StatementsRNo ratings yet

- Chapter Two Principles & Basis of Accounting For Government & NFP EntitiesDocument10 pagesChapter Two Principles & Basis of Accounting For Government & NFP Entitiesmeron fitsum100% (1)

- CFAS Qualifying Exam ReviewerDocument14 pagesCFAS Qualifying Exam Reviewercaryljoycemaceda3No ratings yet

- Chapter Two FundDocument7 pagesChapter Two FundTesfaye KebebawNo ratings yet

- Ia3 CH1Document3 pagesIa3 CH1Reen DomingoNo ratings yet

- Financial Management - Module 1 - 3Document5 pagesFinancial Management - Module 1 - 322-54470No ratings yet

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualDocument30 pagesGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualJessicaHardysrbxd100% (14)

- 1.1 PAS 1 Chapter 2 Summary (SFP)Document2 pages1.1 PAS 1 Chapter 2 Summary (SFP)Deviane CalabriaNo ratings yet

- (Self-Study) Topic 7Document13 pages(Self-Study) Topic 7voanh1346No ratings yet

- Introduction To Accounting JGF - July 31 and Aug 1Document16 pagesIntroduction To Accounting JGF - July 31 and Aug 1LARINGO IanNo ratings yet

- Actgnp Rev.Document11 pagesActgnp Rev.Krizah Marie CaballeroNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chapter 9 & 10: Is Controls For System Reliabilities: - Confidentiality, Privacy, Processing Integrity & AvaiabilityDocument7 pagesChapter 9 & 10: Is Controls For System Reliabilities: - Confidentiality, Privacy, Processing Integrity & AvaiabilityNik Nur Azmina AzharNo ratings yet

- Chapter 7Document49 pagesChapter 7Nik Nur Azmina AzharNo ratings yet

- Chapter 2Document21 pagesChapter 2Nik Nur Azmina AzharNo ratings yet

- Learning Objectives: Accounting Information Systems: An OverviewDocument16 pagesLearning Objectives: Accounting Information Systems: An OverviewNik Nur Azmina AzharNo ratings yet

- Chapter 5Document16 pagesChapter 5Nik Nur Azmina AzharNo ratings yet

- MARSHALL-WS2 Problem Document Chapters 5 6 7Document18 pagesMARSHALL-WS2 Problem Document Chapters 5 6 7Nik Nur Azmina AzharNo ratings yet

- Chapter 4 Audit Evidence: Learning ObjectivesDocument20 pagesChapter 4 Audit Evidence: Learning ObjectivesNik Nur Azmina AzharNo ratings yet

- Tutorial 4 - Transportation and Assignment Problem: (A-R, B-Q, C-P, D-S, 92)Document4 pagesTutorial 4 - Transportation and Assignment Problem: (A-R, B-Q, C-P, D-S, 92)Nik Nur Azmina AzharNo ratings yet

- Tutorial 7Document4 pagesTutorial 7Nik Nur Azmina AzharNo ratings yet

- Uitm Terengganu Tutorial 6/Qmt425Document3 pagesUitm Terengganu Tutorial 6/Qmt425Nik Nur Azmina AzharNo ratings yet

- Assignment 1 - Classification of CompaniesDocument14 pagesAssignment 1 - Classification of CompaniesNik Nur Azmina Azhar100% (1)

- Tutorial 5 - Inventory Control: (Order Quantity 100 Units, TC RM5137.50)Document2 pagesTutorial 5 - Inventory Control: (Order Quantity 100 Units, TC RM5137.50)Nik Nur Azmina AzharNo ratings yet

- Mind Map Government MachineryDocument1 pageMind Map Government MachineryNik Nur Azmina AzharNo ratings yet

- Residence Status For IndividualDocument2 pagesResidence Status For IndividualNik Nur Azmina AzharNo ratings yet

- Whether ZarilaDocument4 pagesWhether ZarilaNik Nur Azmina AzharNo ratings yet

- FAR410Document8 pagesFAR410Nik Nur Azmina AzharNo ratings yet

- Mind Map Objective of MacroeconomicsDocument1 pageMind Map Objective of MacroeconomicsNik Nur Azmina Azhar100% (1)

- Pesopay: Merchant User GuideDocument59 pagesPesopay: Merchant User GuideHexene Jenine Desembrana DayaNo ratings yet

- A.M. No. 02-8-13-SCDocument1 pageA.M. No. 02-8-13-SCMichelle SulitNo ratings yet

- Present: Nilanjana Chatterjee Additional District Judge, 10 Court, Alipore (WB00811)Document3 pagesPresent: Nilanjana Chatterjee Additional District Judge, 10 Court, Alipore (WB00811)Suman RoyNo ratings yet

- Precedents As A Source of LawDocument63 pagesPrecedents As A Source of LawVida travel SolutionsNo ratings yet

- Notes On CasesDocument19 pagesNotes On CasesHelga LukuNo ratings yet

- A Brief History of Kolehiyo NG SubicDocument14 pagesA Brief History of Kolehiyo NG SubicBart JavillonarNo ratings yet

- TrendMicro Hosted Email SecurityDocument122 pagesTrendMicro Hosted Email Securitymarcianocalvi4611No ratings yet

- Reception of English Law in The Borneo StatesDocument9 pagesReception of English Law in The Borneo StatesWong Kai XinNo ratings yet

- Reading 02 PDFDocument4 pagesReading 02 PDFPhương NguyễnNo ratings yet

- CCJ Review Schedule 2019Document3 pagesCCJ Review Schedule 2019Mark ErvinNo ratings yet

- Aiqs Competency Standards For Quantity SurveyorsDocument1 pageAiqs Competency Standards For Quantity SurveyorsTobyNo ratings yet

- Nutrimix Vs CADocument2 pagesNutrimix Vs CAFranco David BaratetaNo ratings yet

- PMC - Scope of ServicesDocument8 pagesPMC - Scope of ServicesAr Kajal GangilNo ratings yet

- Labour Law Notes by Nayan Prakash GandhiDocument63 pagesLabour Law Notes by Nayan Prakash GandhiGandhi_P_NayanNo ratings yet

- 4-Badac Data Capture Forms - Badac Form 1-1Document3 pages4-Badac Data Capture Forms - Badac Form 1-1Dona JojuicoNo ratings yet

- OEO106030 LTE ERAN3.0 Power Control Feature ISSUE1.00Document31 pagesOEO106030 LTE ERAN3.0 Power Control Feature ISSUE1.00Muhammad Turi100% (1)

- Dayang Norita Binti Awang Bujang Lorong 2C Lorong 2C 7 Lorong 2C, JLN Tung Yee 96100, SARIKEI, SARDocument3 pagesDayang Norita Binti Awang Bujang Lorong 2C Lorong 2C 7 Lorong 2C, JLN Tung Yee 96100, SARIKEI, SARgoku sonNo ratings yet

- Solutions Manual: An Introduction To TaxDocument21 pagesSolutions Manual: An Introduction To Taxyea okayNo ratings yet

- Beirnes - The Law Is An AssDocument20 pagesBeirnes - The Law Is An AssRafael NunesNo ratings yet

- Creating A Function Block Using The Structured Text Editor - LAB1 - 2Document8 pagesCreating A Function Block Using The Structured Text Editor - LAB1 - 2Anandhu KumarNo ratings yet

- Question 1Document4 pagesQuestion 1Khadijah MisfanNo ratings yet

- More Evidence in Proof of Murder Committed by Nandikadal Kamal Gunaratne When He Was DepDocument5 pagesMore Evidence in Proof of Murder Committed by Nandikadal Kamal Gunaratne When He Was DepThavam RatnaNo ratings yet

- Indian Patents Act 1970 and Recent AmendmentsDocument7 pagesIndian Patents Act 1970 and Recent AmendmentsHarneet Kaur Kansal0% (1)

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghNo ratings yet

- 01 Internal Auditing Technique Rev. 05 12 09 2018Document40 pages01 Internal Auditing Technique Rev. 05 12 09 2018Syed Maroof AliNo ratings yet

- Čedomilj Mijatović PDFDocument28 pagesČedomilj Mijatović PDFRTK401RTK401No ratings yet

- Simulation and Design ToolsDocument63 pagesSimulation and Design ToolsJainamNo ratings yet

- Calo Vs DegamoDocument1 pageCalo Vs Degamoaudreydql5No ratings yet

- EyhicsDocument4 pagesEyhicsTasnuva MahjabinNo ratings yet

- Self AssessmentDocument4 pagesSelf AssessmentPaul CowartNo ratings yet