Professional Documents

Culture Documents

C3 Credit Rating

C3 Credit Rating

Uploaded by

GAME OVEROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C3 Credit Rating

C3 Credit Rating

Uploaded by

GAME OVERCopyright:

Available Formats

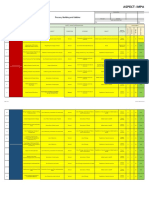

CREDIT

CREDIT RATING

RATING AGENCY

AGENCY FACTORS

FACTORS FOR

FOR SUCCESS

SUCCESS OF

OF AA RATING

RATING SYSTEM

SYSTEM RATING

RATING SYMBOLS For Long

SYMBOLS -- For Long Term

Term Debt

Debt Instruments:

Instruments:

USE

USE OF

OF CREDIT

CREDIT RATING

RATING RATING

RATING OF

OF MANUFACTURING

MANUFACTURING

Credit

Credit rating

rating can

can be

be performed

performed byby agencies

agencies called

called credit

credit Credible

Credible and

and independent

independent structure

structure and

and procedures;

procedures; AAA

AAA Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have the

the highest

highest

Credit

Credit rating

rating isis extremely

extremely important

important as

as COMPANIES

COMPANIES degree

degree ofof safety

safety regarding

regarding timely

timely servicing

servicing of

of financial

financial

rating

rating agency.

agency. Objectivity

Objectivity and

and impartiality

impartiality ofof opinions;

opinions; itit not

not only

only plays

plays aa role

role in

in investor

investor Industry

Industry Risk

Risk obligations.

obligations. Such

Such instruments

instruments carry

carry lowest

lowest credit

credit risk.

risk.

Any

Any person

person proposing

proposing toto commence

commence anyany activity

activity as

as aa credit

credit Analytical

Analytical research,

research, integrity

integrity and

and consistency;

consistency; protection

protection but but also

also benefits

benefits industry

industry as

as Company’s

Company’s industry

industry and

and AA

AA Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have high

high

rating

rating agency

agency should

should make

make an

an application

application to

to SEBI

SEBI for

for the

the Professionalism

Professionalism and and industry

industry related

related expertise;

expertise; aa whole

whole in

in terms

terms of of direct

direct mobilization

mobilization market

market position

position degree

degree ofof safety

safety regarding

regarding timely

timely servicing

servicing of

of financial

financial

grant

grant of

of aa certificate.

certificate. Confidentiality;

Confidentiality; of

of savings

savings from

from individuals.

individuals. Operating

Operating efficiencies

efficiencies obligations.

obligations. Such

Such instruments

instruments carry

carry very

very low

low credit

credit risk.

risk.

Timeliness

Timeliness of of rating

rating review

review and

and announcement

announcement of of Credit

Credit rating

rating isis useful

useful to-

to- Accounting

Accounting Quality

Quality AA Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have adequate

adequate

Promoter

Promoter of

of Credit

Credit Rating

Rating Agency

Agency changes;

changes; investors,

investors, degree

degree ofof safety

safety regarding

regarding timely

timely servicing

servicing of

of financial

financial

Financial

Financial flexibility

flexibility

SEBI

SEBI should

should not

not consider

consider an an application

application unless

unless the

the applicant

applicant isis obligations.

obligations. Such

Such instruments

instruments carry

carry low

low credit

credit risk.

risk.

Ability

Ability to

to reach

reach wide

wide range

range of

of investors

investors by

by means

means ofof issuers,

issuers, Earnings

Earnings protection

protection

promoted

promoted by by aa person

person belonging

belonging to to any

any of

of the

the following

following BBB

BBB Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have moderate

moderate

press

press reports,

reports, print

print or

or electronic

electronic media

media and

and investor

investor intermediaries

intermediaries and and Financial

Financial leverage

leverage degree

degree ofof safety

safety regarding

regarding timely

timely servicing

servicing of

of financial

financial

categories,

categories, namely:

namely:

oriented

oriented research

research services.

services. regulators

regulators Cash

Cash flow

flow adequacy

adequacy obligations.

obligations. Such

Such instruments

instruments carry

carry moderate

moderate credit

credit risk.

risk.

aa public

public financial

financial institution;

institution;

Management

Management evaluation

evaluation BB

BB Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have moderate

moderate

aa scheduled

scheduled commercial

commercial bank; bank; risk

risk of

of default

default regarding

regarding timely

timely servicing

servicing ofof financial

financial

aa foreign

foreign bankbank operating

operating in in India

India with

with the

the approval

approval of of obligations.

obligations.

the

the Reserve

Reserve BankBank of of India;

India; BB Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have high

high risk

risk of

of

aa foreign

foreign credit

credit rating

rating agency

agency recognized

recognized under

under Indian

Indian default

default regarding

regarding timely

timely servicing

servicing of

of financial

financial obligations.

obligations.

Law

Law and

and having

having atat least

least five

five years

years experience

experience inin rating

rating CC Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have very

very high

high

securities;

securities; risk

risk of

of default

default regarding

regarding timely

timely servicing

servicing ofof financial

financial

obligations.

obligations.

any

any company

company or or aa body

body corporate,

corporate, having

having continuous

continuous

DD Instruments

Instruments with

with this

this rating

rating are

are in

in default

default or

or are

are expected

expected to to

net

net worth

worth of of minimum

minimum rupeesrupees oneone hundred

hundred crores

crores asas be

be in

in default

default soon.

soon.

per

per its

its audited

audited annual

annual accounts

accounts for for the

the previous

previous five

five

years

years in in relation

relation toto the

the date

date on on which

which application

application to to RATING

RATING SYMBOLS For Short

SYMBOLS -- For Short Term

Term Debt

Debt Instruments:

Instruments:

SEBI

SEBI isis made

made seeking

seeking registration.

registration. A1

A1 Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have very

very strong

strong

degree

degree of

of safety

safety regarding

regarding timely

timely payment

payment of of financial

financial

Agreement

Agreement with

with the

the Client

Client obligations.

obligations. Such

Such instruments

instruments carry

carry lowest

lowest credit

credit risk.

risk.

CREDIT

Every

Every credit

credit rating

rating agency

agency isis required

required to to enter

enter into

into aa written

written A2

A2 Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have strong

strong

agreement

agreement with

with each

each client

client whose

whose securities

securities itit proposes

proposes to to degree

degree of

of safety

safety regarding

regarding timely

timely payment

payment of of financial

financial

rate,

rate, and

and every

every such

such agreement

agreement should

should include

include the the following

following obligations.

obligations. Such

Such instruments

instruments carry

carry low

low credit

credit risk.

risk.

provisions,

provisions, namely:

namely: A3

A3 Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have moderate

moderate

degree

degree of

of safety

safety regarding

regarding timely

timely payment

payment of of financial

financial

the

the rights

rights and

and liabilities

liabilities of

of each

each party

party in in respect

respect of

of the

the

obligations.

obligations. Such

Such instruments

instruments carry

carry higher

higher credit

credit risk

risk as

as

rating

rating of

of securities

securities shall

shall be

be defined;

defined; compared

compared to to instruments

instruments rated

rated in

in the

the two

two higher

higher categories.

categories.

RATING

the

the fee

fee to

to be

be charged

charged by by the

the credit

credit rating

rating agency

agency shall

shall A4

A4 Instruments

Instruments with

with this

this rating

rating are

are considered

considered to to have

have minimal

minimal

be

be specified;

specified; degree

degree of

of safety

safety regarding

regarding timely

timely payment

payment of of financial

financial

the

the client

client shall

shall agree

agree toto aa periodic

periodic review,

review, obligations.

obligations. Such

Such instruments

instruments carry

carry very

very high

high credit

credit risk

risk and

and are

are

the

the credit

credit rating

rating agency

agency shall

shall disclose

disclose to to the

the client

client the

the susceptible

susceptible to

to default.

default.

DD Instruments

Instruments with

with this

this rating

rating are

are in

in default

default or

or expected

expected to to be

be in

in

rating

rating assigned,

assigned,

default

default on

on maturity.

maturity.

the

the client

client shall

shall agree

agree toto disclose

disclose the

the rating

rating assigned.

assigned.

Credit

Credit rating,

rating, in

in general

general sense,

sense, isis the

the evaluation

evaluation of

of the

the credit

credit worthiness

worthiness of of an

an individual

individual or

or of

of aa business

business

RATING

RATING OF

OF FINANCIAL

FINANCIAL SERVICES

SERVICES COMPANIES

COMPANIES

concern

concern or

or of

obligations

of an

obligations as

an instrument

as well

instrument of

well as

as net

of aa business

net worth.

worth.

business based

based on

on relevant

relevant factors

factors indicating

indicating ability

ability and

and willingness

willingness to

to pay

pay

INSPIRE ACADEMY (888888 1719)

Capital

Capital Adequacy

Adequacy

Asset

Asset Quality

Quality

Management

Management

Earnings

Earnings

Liquidity

Liquidity

Systems

Systems and

and Control

Control

IPO

IPO GRADING

GRADING

IPO

IPO grading

grading (Initial

(Initial Public

Public Offering

Offering Grading)

Grading) isis aa service

service

aimed

aimed at at facilitating

facilitating thethe assessment

assessment of of equity

equity issues

issues offered

offered

to

to public.

public. The

The grade

grade assigned

assigned toto any

any individual

individual issue

issue

represents

represents aa relative

relative assessment

assessment of of the

the ‘fundamentals’

‘fundamentals’ of of

that

that issue

issue in

in relation

relation toto the

the universe

universe of of other

other listed

listed equity

equity

securities

securities inin India.

India. Such

Such grading

grading isis assigned

assigned onon aa five-point

five-point

scale

scale with

with aa higher

higher score

score indicating

indicating stronger

stronger fundamentals.

fundamentals.

Procedure

Procedure for

for IPO

IPO Grading

Grading

The

The company

company needs

needs to

to first

first contact

contact one

one of

of the

the grading

grading

agencies

agencies and

and mandate

mandate itit for

for the

the grading

grading exercise.

exercise. The

The agency

agency

would

would then

then follow

follow the

the process

process outlined

outlined below.

below.

Seek

Seek information

information required

required for

for the

the grading

grading from

from the

the company.

company.

On On receipt

receipt of

of required

required information,

information, havehave discussions

discussions

with

with the

the company’s

company’s management

management and and visit

visit the

the

company’s

company’s operating

operating locations,

locations, ifif required.

required.

Prepare

Prepare anan analytical

analytical assessment

assessment report.

report.

Present

Present the

the analysis

analysis to

to aa committee

committee comprising

comprising

senior

senior executives

executives of

of the

the concerned

concerned grading

grading agency.

agency.

This

This committee

committee would

would discuss

discuss all

all relevant

relevant issues

issues and

and

assign

assign aa grade.

grade.

Communicate

Communicate the the grade

grade to to the

the company

company alongalong with

with

an

an assessment

assessment report

report outlining

outlining the

the rationale

rationale for

for the

the

grade

grade assigned.

assigned.

Shubhamm Sukhlecha (CA, CS, BSL LLB) (sukhlecha.shubham@gmail.com)

You might also like

- Price Comparisson - Bored Piling JCDC, Rev.02Document2 pagesPrice Comparisson - Bored Piling JCDC, Rev.02Zain AbidiNo ratings yet

- Lecture+Notes (Upgrad)Document5 pagesLecture+Notes (Upgrad)GAME OVERNo ratings yet

- Alexander Cooley, Jack Snyder-Ranking The World - Grading States As A Tool of Global Governance-Cambridge University Press (2015) PDFDocument258 pagesAlexander Cooley, Jack Snyder-Ranking The World - Grading States As A Tool of Global Governance-Cambridge University Press (2015) PDFVitor VelosoNo ratings yet

- Lampiran 1 Critical Line List - DDocument5 pagesLampiran 1 Critical Line List - DAfif FadhliNo ratings yet

- Fourth Periodical Test S.Y. 2019-2020 Computer System Servicing - Grade 11 Table of SpecificationsDocument1 pageFourth Periodical Test S.Y. 2019-2020 Computer System Servicing - Grade 11 Table of SpecificationsKay Tracey UrbiztondoNo ratings yet

- 16 17 V Plus Factor 5 OkDocument3 pages16 17 V Plus Factor 5 OkPeter Benedict NapolesNo ratings yet

- Skill MatrixDocument1 pageSkill Matrixvinod kumarNo ratings yet

- Reinforcement Details Section A-A: MSRDCDocument1 pageReinforcement Details Section A-A: MSRDCaryaNo ratings yet

- Elastomeric Bearing Design20mDocument10 pagesElastomeric Bearing Design20mamirNo ratings yet

- Sm-Control Examenes Ingreso y Periodicos 2023Document22 pagesSm-Control Examenes Ingreso y Periodicos 2023Raymundo VargasNo ratings yet

- Wine-Processing-Technology EN 2017Document2 pagesWine-Processing-Technology EN 2017casillarodrigoNo ratings yet

- Summary Sheet: Project Name: Project Manager: Date of EvaluationDocument3 pagesSummary Sheet: Project Name: Project Manager: Date of Evaluationphuc haNo ratings yet

- 70.Tủ Điện Mp p b2c SpDocument7 pages70.Tủ Điện Mp p b2c Spthanh sang đinhNo ratings yet

- PERSAN - CatalogoCompleto 16-17Document168 pagesPERSAN - CatalogoCompleto 16-17renatoeliegeNo ratings yet

- Project Procedure: Saudi Arabian Oil CompanyDocument21 pagesProject Procedure: Saudi Arabian Oil Companyomar omarNo ratings yet

- 69.Tủ Điện Mp p b2b SpDocument7 pages69.Tủ Điện Mp p b2b Spthanh sang đinhNo ratings yet

- EMS Aspect Impact - Novasys Production LineDocument3 pagesEMS Aspect Impact - Novasys Production LinedebashismondalNo ratings yet

- Material Approval Request (MAR) Monitoring Matrix: Posco E&C GCRDocument4 pagesMaterial Approval Request (MAR) Monitoring Matrix: Posco E&C GCRResearcherNo ratings yet

- Engracia L. Valdomar NationalHigh School-Model PDFDocument1 pageEngracia L. Valdomar NationalHigh School-Model PDFAnthony ChanNo ratings yet

- Tupa Unat 2018Document5 pagesTupa Unat 2018Gustavo Allende Llaveria GallNo ratings yet

- 17051790-D-M-2146 (24-FG-FG-081A-B-300#-ASME B31.8-P) - Layout1Document1 page17051790-D-M-2146 (24-FG-FG-081A-B-300#-ASME B31.8-P) - Layout1Er Md AamirNo ratings yet

- PERSAN Volkswagen PDFDocument4 pagesPERSAN Volkswagen PDFIsmael GalvezNo ratings yet

- PersanDocument2 pagesPersanparicio leibaNo ratings yet

- Lexis Practice Advisor Journal Fall 2018 ProspectingDocument45 pagesLexis Practice Advisor Journal Fall 2018 ProspectingLivros juridicosNo ratings yet

- Salary Sheet 22 23Document65 pagesSalary Sheet 22 23Manojit GamingNo ratings yet

- SDG MGM M PL02 Partition LayoutDocument1 pageSDG MGM M PL02 Partition LayoutAbdul RahumanNo ratings yet

- 63.Tủ Điện MP-P-B2C-FAFDocument11 pages63.Tủ Điện MP-P-B2C-FAFthanh sang đinhNo ratings yet

- 2-Stone MasonaryDocument1 page2-Stone MasonaryMunawarNo ratings yet

- MS Adj 001Document1 pageMS Adj 001Manish ChandNo ratings yet

- 62.Tủ Điện MP-P-B2B-FAFDocument11 pages62.Tủ Điện MP-P-B2B-FAFthanh sang đinhNo ratings yet

- E Tech TOS 2022 23 - 1stQDocument4 pagesE Tech TOS 2022 23 - 1stQJessica RusellNo ratings yet

- Technical Note-ExtradosedDocument4 pagesTechnical Note-ExtradosedShaileshRastogiNo ratings yet

- Adobe Scan 23-Feb-2024Document5 pagesAdobe Scan 23-Feb-2024Bhargav BhatNo ratings yet

- Aspect-Impact Rating Sheet (Airs) : Department/ Section/ Unit: Process, Building and UtilitiesDocument4 pagesAspect-Impact Rating Sheet (Airs) : Department/ Section/ Unit: Process, Building and UtilitiesSir ZenNo ratings yet

- 68.Tủ Điện Mp p b2a SpDocument7 pages68.Tủ Điện Mp p b2a Spthanh sang đinhNo ratings yet

- Sprint ReinhartDocument60 pagesSprint Reinhartdeni rytmheNo ratings yet

- 72.Tủ Điện MP-P-B2E-SPDocument7 pages72.Tủ Điện MP-P-B2E-SPthanh sang đinhNo ratings yet

- Ymms: Jun 1, 2022 Engine: 3.0L Eng License: Vin: 2B4GP2531YR564389 Odometer: 2000 Dodge Caravan SEDocument1 pageYmms: Jun 1, 2022 Engine: 3.0L Eng License: Vin: 2B4GP2531YR564389 Odometer: 2000 Dodge Caravan SEDianely CoralNo ratings yet

- 71.Tủ Điện Mp p b2d SpDocument7 pages71.Tủ Điện Mp p b2d Spthanh sang đinhNo ratings yet

- Paf-Mdf Control 01Document33 pagesPaf-Mdf Control 01thanh sang đinhNo ratings yet

- Circuit Map V12Document1 pageCircuit Map V12Senseu MasterNo ratings yet

- Larsen & Toubro Limited: Distribution Transformer Sizing CalculationDocument33 pagesLarsen & Toubro Limited: Distribution Transformer Sizing CalculationEngr. Nabid Rayhan KhalequeNo ratings yet

- Larsen & Toubro Limited: ECC Division - EDRCDocument13 pagesLarsen & Toubro Limited: ECC Division - EDRCEngr. Nabid Rayhan KhalequeNo ratings yet

- Mech Control Sequen 3Document1 pageMech Control Sequen 3ARUL SANKARANNo ratings yet

- Project Philosophy: Saudi Arabian Oil CompanyDocument16 pagesProject Philosophy: Saudi Arabian Oil Companyomar omarNo ratings yet

- MJB 16+785 DC 201 AbutDocument63 pagesMJB 16+785 DC 201 AbutChandra BabuNo ratings yet

- House of Quality - CarDocument1 pageHouse of Quality - CarJessica YulianiNo ratings yet

- Bulk Carrier - Training MatrixDocument1 pageBulk Carrier - Training MatrixTaner AkciğerNo ratings yet

- Ifs Banks 2015Document192 pagesIfs Banks 2015Justine991No ratings yet

- 208418M506-Smoke Extra FanDocument1 page208418M506-Smoke Extra FanFuji Electric SMBENo ratings yet

- Police Homebuyer Asst (Pshbap) MapDocument1 pagePolice Homebuyer Asst (Pshbap) MapThe Daily LineNo ratings yet

- DN - 28+757 - MNB - Box TypeDocument17 pagesDN - 28+757 - MNB - Box Typeravi kumarNo ratings yet

- Consultant Evaluation SummaryDocument2 pagesConsultant Evaluation SummaryHussain ElarabiNo ratings yet

- 3058-Neyveli Design Report For ReclaimerDocument88 pages3058-Neyveli Design Report For ReclaimerJigarNo ratings yet

- 95. Tủ điện FP-A2-TF-SPKDocument7 pages95. Tủ điện FP-A2-TF-SPKthanh sang đinhNo ratings yet

- Persan RenaultDocument9 pagesPersan RenaultGerman AngueraNo ratings yet

- Date Rev. No. Description 21-Aug-2019 R0 First Submission MLP ANS TRB RevisionsDocument1 pageDate Rev. No. Description 21-Aug-2019 R0 First Submission MLP ANS TRB Revisionsnaveen srinivasNo ratings yet

- 61.Tủ Điện MP-P-B2A-FAFDocument11 pages61.Tủ Điện MP-P-B2A-FAFthanh sang đinhNo ratings yet

- Misc-008 Ret. Wall R0 - RCC Above 3m SR EdgeDocument1 pageMisc-008 Ret. Wall R0 - RCC Above 3m SR EdgeBIKASHNo ratings yet

- 96. Tủ Điện DB-P-GFC-PLDocument12 pages96. Tủ Điện DB-P-GFC-PLthanh sang đinhNo ratings yet

- 4M Change Summary Sheet - PRFDocument4 pages4M Change Summary Sheet - PRFkumar QANo ratings yet

- Colorful Chalkboard Classroom Labels and OrganizersFrom EverandColorful Chalkboard Classroom Labels and OrganizersNo ratings yet

- Aayushi Jain Sakshi Verma Arushi Singh Juhi RajwaniDocument12 pagesAayushi Jain Sakshi Verma Arushi Singh Juhi RajwaniGAME OVER0% (1)

- Operating System: Hari RaghavaDocument26 pagesOperating System: Hari RaghavaGAME OVERNo ratings yet

- EcommerceDocument162 pagesEcommerceGAME OVERNo ratings yet

- CFM FinalDocument13 pagesCFM FinalGAME OVERNo ratings yet

- Basic Competitive Analysis TemplateDocument3 pagesBasic Competitive Analysis TemplateGAME OVERNo ratings yet

- MAYKAA: A Tribute To The Women of TodayDocument2 pagesMAYKAA: A Tribute To The Women of TodayGAME OVERNo ratings yet

- CMSL Amendments For June 2019 PART 3 (ICDR) - Executive-RevisionDocument40 pagesCMSL Amendments For June 2019 PART 3 (ICDR) - Executive-RevisionGAME OVERNo ratings yet

- C18, 19 Listing and DelistingDocument2 pagesC18, 19 Listing and DelistingGAME OVERNo ratings yet

- Reading Material - Competitor ResearchDocument6 pagesReading Material - Competitor ResearchGAME OVERNo ratings yet

- Assignment 01 - FMDocument2 pagesAssignment 01 - FMGAME OVERNo ratings yet

- Assignment 01 - BEDocument1 pageAssignment 01 - BEGAME OVERNo ratings yet

- Khaadi Annual Report 22Document5 pagesKhaadi Annual Report 22hussainahmadkhan89No ratings yet

- Developing A Scoring Credit Model Based On The Methodology of International Credit Rating AgenciesDocument13 pagesDeveloping A Scoring Credit Model Based On The Methodology of International Credit Rating AgenciesHeber A.No ratings yet

- India Ratings Assigns Kanchi Karpooram IND BB-' Outlook StableDocument4 pagesIndia Ratings Assigns Kanchi Karpooram IND BB-' Outlook StableoceanapolloNo ratings yet

- Banking Awareness-Live - Credit Rating AgenciesDocument2 pagesBanking Awareness-Live - Credit Rating AgenciesyugandharNo ratings yet

- Vault Guide To The Top Financial Services EmployersDocument385 pagesVault Guide To The Top Financial Services EmployersDerek WangNo ratings yet

- Charles A. Gargano: Eagle Building Technologies Inc.Document127 pagesCharles A. Gargano: Eagle Building Technologies Inc.jpeppardNo ratings yet

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocument7 pagesEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNo ratings yet

- SWOT Analysis of BangladeshDocument31 pagesSWOT Analysis of BangladeshRifa TasfiaNo ratings yet

- Credit Rating Agencies (1 FinalDocument88 pagesCredit Rating Agencies (1 FinalAvtaar SinghNo ratings yet

- Business Terms and GlossaryDocument31 pagesBusiness Terms and GlossaryRavi ManiyarNo ratings yet

- FINM3006 Notes On Past Exams: 2016 Test 1Document77 pagesFINM3006 Notes On Past Exams: 2016 Test 1Navya VinnyNo ratings yet

- Creditmetrics TechdocDocument213 pagesCreditmetrics TechdocnormanNo ratings yet

- Roll Number - 15 To 21 - Credit Rating AgencyDocument26 pagesRoll Number - 15 To 21 - Credit Rating AgencyHIMANSHU DUTTANo ratings yet

- (Download PDF) Essentials of Investments 11th Edition Bodie Test Bank Full ChapterDocument70 pages(Download PDF) Essentials of Investments 11th Edition Bodie Test Bank Full Chapteraivilorejnok100% (5)

- Credit Rating AgencyDocument9 pagesCredit Rating AgencyChuks MadukaNo ratings yet

- Moodys Sovereign Methodology 2015Document35 pagesMoodys Sovereign Methodology 2015hsr1708No ratings yet

- Measuring Country Risk: Executive SummaryDocument5 pagesMeasuring Country Risk: Executive SummarytinhoiNo ratings yet

- Public Debt 2014eDocument73 pagesPublic Debt 2014elankaCnewsNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Banco Regional S.A.E.C.A.: Update To Credit AnalysisDocument8 pagesBanco Regional S.A.E.C.A.: Update To Credit AnalysisPradeep J DsouzaNo ratings yet

- Credit Risk Executive SummaryDocument16 pagesCredit Risk Executive SummaryReeza SeedatNo ratings yet

- Russia Infrastructure Report - Q1 2023Document44 pagesRussia Infrastructure Report - Q1 2023saim siamNo ratings yet

- Fidelity Asian Bonds Fact Sheet PDFDocument3 pagesFidelity Asian Bonds Fact Sheet PDFSebastian BauschNo ratings yet

- Credit Rating: Prof - Bijoy GuptaDocument21 pagesCredit Rating: Prof - Bijoy GuptaManash GopeNo ratings yet

- Corporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoDocument28 pagesCorporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoMaryam MalikNo ratings yet

- Capital Market and Security AnalysisDocument154 pagesCapital Market and Security AnalysisAbhinav SharmaNo ratings yet

- CFA Level 1 FundamentalsDocument5 pagesCFA Level 1 Fundamentalskazimeister1No ratings yet

- Bank of America Class Action SuitDocument146 pagesBank of America Class Action Suitjohn94404No ratings yet