Professional Documents

Culture Documents

Gillete Deal

Gillete Deal

Uploaded by

Manjunathan Mohan0 ratings0% found this document useful (0 votes)

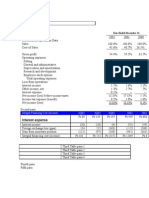

37 views2 pagesThe document provides financial details regarding Procter & Gamble's proposed acquisition of Gillette. Some key figures include:

- P&G is offering $54.05 per Gillette share, valuing Gillette at $57.7 billion including Gillette's $2.3 billion in debt.

- Gillette has over 1 billion shares outstanding and generates $10.4 billion in annual revenues and $3 billion in EBITDA.

- The acquisition price represents a P/E ratio of 30.37 based on Gillette's 2005 earnings estimate, higher than Gillette's current P/E of 25.28.

Original Description:

Original Title

Gillete deal

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial details regarding Procter & Gamble's proposed acquisition of Gillette. Some key figures include:

- P&G is offering $54.05 per Gillette share, valuing Gillette at $57.7 billion including Gillette's $2.3 billion in debt.

- Gillette has over 1 billion shares outstanding and generates $10.4 billion in annual revenues and $3 billion in EBITDA.

- The acquisition price represents a P/E ratio of 30.37 based on Gillette's 2005 earnings estimate, higher than Gillette's current P/E of 25.28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

37 views2 pagesGillete Deal

Gillete Deal

Uploaded by

Manjunathan MohanThe document provides financial details regarding Procter & Gamble's proposed acquisition of Gillette. Some key figures include:

- P&G is offering $54.05 per Gillette share, valuing Gillette at $57.7 billion including Gillette's $2.3 billion in debt.

- Gillette has over 1 billion shares outstanding and generates $10.4 billion in annual revenues and $3 billion in EBITDA.

- The acquisition price represents a P/E ratio of 30.37 based on Gillette's 2005 earnings estimate, higher than Gillette's current P/E of 25.28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

Gillette

No.of Outstanding Shares (miilion) 1068.379

No.of P&G Share to be given for Gillette sha 1041.67

45 Net Income (2005 Estimate) (US$

Market Share Price (Current) miilion)

Offered Share Price 54.05

Market Capitalisation (US$ miilion) 48077.06

Gross Offer Value (US$ miilion) 57745.9

Debt of Gillette (US$ miilion) 2321

Revenues (Current) (US$ miilion) 10366

Revenue Per Share 9.70

EBITDA (Current) (US$ miilion) 3013 P&G Share price

Earnings Per Share (2005 Estimate) 1.78 P&G EPS

Earnings Per Share (2006 Estimate) 2.01

P/E (2005 Estimate) based on Current 25.28

Share Price

P/E (2006 Estimate) based on Current 22.39

Share Price

P/E (2005 Estimate) based on Offer Share 30.37

Price

P/E (2006 Estimate) based on OfferShare

Price 26.89

Annual EPS Growth Rate 12.92% EV/EBITDA Method

PEG Ratio 1.96 No.of Outstanding Shares (miilion)

Enterprise Value (US$ miilion) 50398.06 Market Share Price (Current in $)

EV/EBITDA 16.73 Market Capitalisation (US$ miilion)

4.64

Price-Sales Ratio Debt of Gillette (US$ miilion)

Enterprise Value (US$ miilion)

Price-Sales Ratio EBITDA (Current) (US$ miilion)

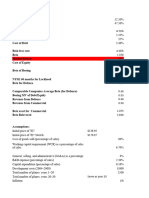

No.of Outstanding Shares (miilion) 1068.38 EV/EBITDA

Market Share Price (Current in $) 45.00

Revenues (Current) (US$ miilion) 10366.00

Revenue Per Share 9.70

Price-Sales Ratio 4.64

1901.71462

Ferrari EV/EBDITA Calculation

Share Price 50

Outstanding Shares 188.9

55.44 Market Cap (Million $) 9445

2.60 Debt (Million $) 2267

Cash (Million $) 258

Enterprise Value 11454

EBDITA 678

EV/EBDITA 16.89

A Method

1068.379

45

48077.055 PEG Ratio

2321 P/E (2005 Estimate) based on

Current Share Price 25.2809

Earnings Per Share (2005 1.78

50398.055 Estimate)

Earnings Per Share (2006

3013 Estimate) 2.01

16.73 Annual EPS Growth Rate 12.92%

PEG Ratio 1.96

You might also like

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Gulf Oil ExhibitsDocument20 pagesGulf Oil Exhibitsaskpeeves1No ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- Jagannath University: Submitted ForDocument13 pagesJagannath University: Submitted Formd samirNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Total 50: Vocabulary 1 Match The Pictures To The WordsDocument5 pagesTotal 50: Vocabulary 1 Match The Pictures To The WordsDamirNo ratings yet

- Module 7 Price EscalationDocument16 pagesModule 7 Price EscalationkatherineNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- Lenovo Intergration Plan Annual 2004 PresentationDocument26 pagesLenovo Intergration Plan Annual 2004 PresentationKelvin Lim Wei LiangNo ratings yet

- Creating Winning Event Proposals SecretsDocument16 pagesCreating Winning Event Proposals SecretsAnonymous 5z7ZOpNo ratings yet

- Inputs: FCFF Stable Growth ModelDocument12 pagesInputs: FCFF Stable Growth ModelKojiro FuumaNo ratings yet

- LS India Cements Q1FY11Document2 pagesLS India Cements Q1FY11prateepnigam355No ratings yet

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepNo ratings yet

- Explain (Simply and in Your Own Words) What The Company DoesDocument8 pagesExplain (Simply and in Your Own Words) What The Company DoesShreyas LakshminarayanNo ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Fin 465 Case 45Document10 pagesFin 465 Case 45MuyeedulIslamNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- BPCL Analyst Report (2008)Document5 pagesBPCL Analyst Report (2008)ankit_r_bhagat201No ratings yet

- Ongc - 1qfy15 - HDFC SecDocument8 pagesOngc - 1qfy15 - HDFC Secsatish_xpNo ratings yet

- Trent LTD - 2023.06.03Document34 pagesTrent LTD - 2023.06.03pulkitnarang1606No ratings yet

- Reliance Relative ValuationDocument15 pagesReliance Relative ValuationHEM BANSALNo ratings yet

- Trent LTD - 2023.07.01Document34 pagesTrent LTD - 2023.07.01pulkitnarang1606No ratings yet

- Trent - Q4FY22 Result - DAMDocument6 pagesTrent - Q4FY22 Result - DAMRajiv BharatiNo ratings yet

- Etihad Etisalat Company (Mobily) Defining A League... July 22, 2008Document36 pagesEtihad Etisalat Company (Mobily) Defining A League... July 22, 2008AliNo ratings yet

- Keyratio 2009Document1 pageKeyratio 2009Kishore SinghNo ratings yet

- 2023.08.31 KMX Historical Financial STMT Info For AnalystsDocument33 pages2023.08.31 KMX Historical Financial STMT Info For AnalystsjohnsolarpanelsNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Prabhudas Lilladher Apar Industries Q3DY24 Results ReviewDocument7 pagesPrabhudas Lilladher Apar Industries Q3DY24 Results ReviewvenkyniyerNo ratings yet

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaNo ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Alcoa 3Q09 Earnings PresentationDocument45 pagesAlcoa 3Q09 Earnings PresentationychartsNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Netscape Valuation For IPO... PV of FCFsDocument1 pageNetscape Valuation For IPO... PV of FCFsJunaid EliasNo ratings yet

- Monmouth Student Template UpdatedDocument14 pagesMonmouth Student Template Updatedhao pengNo ratings yet

- Cash Return On Invested CapitalDocument2 pagesCash Return On Invested CapitalMichael JacopinoNo ratings yet

- CH 6 Model 14 Free Cash Flow CalculationDocument12 pagesCH 6 Model 14 Free Cash Flow CalculationrealitNo ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Selected Financial Information (Consolidate ($ Millions) )Document2 pagesSelected Financial Information (Consolidate ($ Millions) )KshitishNo ratings yet

- Final PharmaDocument40 pagesFinal PharmakunalprasherNo ratings yet

- Firm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearDocument9 pagesFirm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearKshitishNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Adidas Group Consolidated Income Statement (IFRS) : Net SalesDocument4 pagesAdidas Group Consolidated Income Statement (IFRS) : Net SalesPranit ShahNo ratings yet

- Nyse FFG 2010Document5 pagesNyse FFG 2010Bijoy AhmedNo ratings yet

- J.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8Document9 pagesJ.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8MayTepper100% (1)

- Long Question 4: Table: Data On Performance of Molla Salt Company in 2014 and 2018Document2 pagesLong Question 4: Table: Data On Performance of Molla Salt Company in 2014 and 2018Tanim RezaNo ratings yet

- IPL Profit Report Half Year 2016Document13 pagesIPL Profit Report Half Year 2016Victor VazquezNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- Risk Free Rate 0.97% Market Risk Premium 7.50% Beta 1.45 Terminal Growth Rate 1.00%Document17 pagesRisk Free Rate 0.97% Market Risk Premium 7.50% Beta 1.45 Terminal Growth Rate 1.00%HAMMADHRNo ratings yet

- V Guard IndustriDocument93 pagesV Guard IndustriAshley KamalasanNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- TSN 2023 Q3 Earnings Release FINALDocument12 pagesTSN 2023 Q3 Earnings Release FINALCory DewayneNo ratings yet

- Grasim Q3FY09 PresentationDocument47 pagesGrasim Q3FY09 PresentationJasmine NayakNo ratings yet

- 2020 - Midland - Student SpreadsheetDocument14 pages2020 - Midland - Student Spreadsheetvasu goswamiNo ratings yet

- Active Gear Historical Income Statement Operating Results Revenue Gross ProfitDocument20 pagesActive Gear Historical Income Statement Operating Results Revenue Gross ProfitJoan Alejandro MéndezNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Unit - 3 EEFMDocument32 pagesUnit - 3 EEFMAppasani Manishankar100% (1)

- Annotated BB2023 A IAS02 PartA PDFDocument20 pagesAnnotated BB2023 A IAS02 PartA PDFKhutso MabalaNo ratings yet

- Some Important Viva QusetionsDocument21 pagesSome Important Viva QusetionsLakshmi NairNo ratings yet

- Principles of Microeconomics: Powerpoint Presentations ForDocument48 pagesPrinciples of Microeconomics: Powerpoint Presentations Forsamantha davidsonNo ratings yet

- 3 ElasticitiesDocument9 pages3 ElasticitiesshriyaNo ratings yet

- ECONOMICS HOLIDAY HOMEWORK - Term 2Document3 pagesECONOMICS HOLIDAY HOMEWORK - Term 2Adhith MuthurajNo ratings yet

- MM 2ND AssignmentDocument1 pageMM 2ND AssignmentPradeep BiradarNo ratings yet

- Natural Resource Economics: An Overview: (Chapter 6)Document16 pagesNatural Resource Economics: An Overview: (Chapter 6)ii muNo ratings yet

- Option Strategies PDFDocument5 pagesOption Strategies PDFdhanabal sNo ratings yet

- Philippine Ports Authority AO 002-2018 Revised Methodology and Formula For Adjustment of Cargo Handling CH TariffDocument5 pagesPhilippine Ports Authority AO 002-2018 Revised Methodology and Formula For Adjustment of Cargo Handling CH TariffPortCallsNo ratings yet

- Q3 W6 Ethics Suba, DarenDocument2 pagesQ3 W6 Ethics Suba, DarenAida SubaNo ratings yet

- Dealing With Competition: Ap Te r4Document25 pagesDealing With Competition: Ap Te r4Md Mozaddedul KarimNo ratings yet

- Topic 1 MT LectureDocument147 pagesTopic 1 MT LectureIssacNo ratings yet

- PM Quiz 2Document9 pagesPM Quiz 2rajeshNo ratings yet

- Decision Making in Flexible Mine Production System Design Using Real OptionsDocument13 pagesDecision Making in Flexible Mine Production System Design Using Real OptionsWilme NareaNo ratings yet

- PDF TN BILL EDITDocument8 pagesPDF TN BILL EDITJaram JohnsonNo ratings yet

- Name: Eman Zafar FA18-BBA-036 Assignment # 02 Bba 6 CRM Submitted To: Sir Abid Saeed 4/14/21Document7 pagesName: Eman Zafar FA18-BBA-036 Assignment # 02 Bba 6 CRM Submitted To: Sir Abid Saeed 4/14/21Reeja BaigNo ratings yet

- Divergence (BraveFx Academy)Document12 pagesDivergence (BraveFx Academy)Mikail AdedejiNo ratings yet

- Financial Accounting and Reporting PartDocument6 pagesFinancial Accounting and Reporting PartLalaine De JesusNo ratings yet

- Debre Markos University College of Business and Economics Department of EconomicsDocument484 pagesDebre Markos University College of Business and Economics Department of EconomicsYeshiwas EwinetuNo ratings yet

- Demand and Supply of Bikes: Govind Verma Firoz Chowki Ruturaj JamdarDocument8 pagesDemand and Supply of Bikes: Govind Verma Firoz Chowki Ruturaj JamdarFirozNo ratings yet

- Syllabus - Economics - IDocument8 pagesSyllabus - Economics - IBoiled PotatoNo ratings yet

- Revenue Analysis and Pricing PoliciesDocument22 pagesRevenue Analysis and Pricing PoliciesMirabel VidalNo ratings yet

- ECON1193-ASSIGNMENT 1 - Nguyen The Nam An-S3926614Document13 pagesECON1193-ASSIGNMENT 1 - Nguyen The Nam An-S3926614An NguyenthenamNo ratings yet

- Managerial Decisions For Firms With Market Power: Essential ConceptsDocument8 pagesManagerial Decisions For Firms With Market Power: Essential ConceptsRohit SinhaNo ratings yet

- CF Berk DeMarzo Harford Chapter 13 Problem AnswerDocument9 pagesCF Berk DeMarzo Harford Chapter 13 Problem AnswerRachel Cheng0% (1)

- Why Do Diffrent Places Have Different CurrenceysDocument20 pagesWhy Do Diffrent Places Have Different CurrenceysDani JainNo ratings yet