Professional Documents

Culture Documents

Financial Statement Tesco 2019 Horizontal Analysis

Financial Statement Tesco 2019 Horizontal Analysis

Uploaded by

suraj lamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Tesco 2019 Horizontal Analysis

Financial Statement Tesco 2019 Horizontal Analysis

Uploaded by

suraj lamaCopyright:

Available Formats

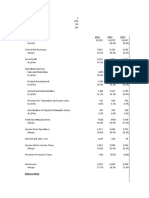

FINANCIAL STATEMENT TESCO 2019 HORIZONTAL ANALYSIS

2018/19 2017/18 %

Particulars (£) (£) Change Change Analysis

Due to sell of more inventories, lower

SP, popularity of TESCO, better

selling tactics, selling in credit as

Sales Revenue 63911 57493 6418 11.16% payables has increased

Due to buying of more inventories,

Cost of Sales 59767 54141 5626 10.39% higher production costs

Due to increase in sales revenue over

Gross Profit 4144 3352 792 23.63% cost of sales

Due to increase in gross profit and gain

Operating Profit 2153 1839 314 17.07% on property related items

Increased due to Increase in Operating

Profit and also discontinue of

Net Profit 1320 1210 110 9.09% operation of One Stop Retail Business

Increase in receivables will aid in

increasing revenues, but it might affect

Trade Receivables 1640 1504 136 9.04% liquidity

Increase in inventories has helped to

improve revenues but overstocking

might lead to loss in opportunity cost,

theft or turning the inventories

Inventory Stock 2617 2264 353 15.59% obsolete

Change in

Retained Earning 5405 4250 1155 27.18% Increased due to increase in Net Profit

Non-Current Significantly due to increase in

Assets 36379 31135 5244 16.84% investments, acquisition of Booker

Majorly due to decrease in short-term

investments and cash & cash

Current Assets 12570 13600 -1030 -7.57% equivalents

Significantly due to decrease in short

Non-Current term borrowings, post-employment

Liabilities 13533 15171 -1638 -10.80% benefit obligations

Majorly due to increase in long term

Current Liabilities 20680 19233 1447 7.52% payables & borrowings

Total Equity There has been significant change in

Equity due to shares issued for

14834 10480 4354 41.55% acquisition of Bookers Group PLC

Reference: TESCO Annual Report 2018/19 (Group Income Statement,

Balance Sheet, Statement of Change in R/E and Cash Flow Statement

You might also like

- Term ProjectDocument4 pagesTerm ProjectArslan QadirNo ratings yet

- Lululemon Form10-K AnalysisDocument7 pagesLululemon Form10-K Analysisapi-503259295No ratings yet

- 7010 - Sample AssignmnetDocument24 pages7010 - Sample AssignmnetSh Hirra Tahir100% (2)

- Creating A Business Plan: Moon ChartDocument1 pageCreating A Business Plan: Moon ChartBalazs SefferNo ratings yet

- GLDP Case Study CAN BriefingDocument14 pagesGLDP Case Study CAN BriefingAbhishekNo ratings yet

- Nguyen Duc ThinhDocument49 pagesNguyen Duc ThinhThịnh Nguyễn Đức100% (1)

- Able of Ontents: Dissertation Writing ServiceDocument62 pagesAble of Ontents: Dissertation Writing ServiceKarthick Raja100% (1)

- Uber Partnership Lockup GuidelinesDocument26 pagesUber Partnership Lockup GuidelinesPutraNo ratings yet

- VML Legoland FinalDocument172 pagesVML Legoland FinalebsNo ratings yet

- Ratio Analysis FMCG Industry FinalDocument4 pagesRatio Analysis FMCG Industry Finalnishant50% (2)

- How Social Media Impacts BusinessesDocument9 pagesHow Social Media Impacts BusinessesWilbert BaezNo ratings yet

- Apple Inc. AnalysisDocument15 pagesApple Inc. AnalysisDOWLA KHANNo ratings yet

- Clo Rex Case Study Teaching NoteDocument5 pagesClo Rex Case Study Teaching Noteismun nadhifahNo ratings yet

- Report - Srilankan AirlinesDocument30 pagesReport - Srilankan AirlineskopiNo ratings yet

- Cadbury Choki: Group MembersDocument5 pagesCadbury Choki: Group MembersAsad ShahNo ratings yet

- Week 1 Work 2210 BBDocument31 pagesWeek 1 Work 2210 BBKwanNo ratings yet

- Bairaha Annual Report 2013-14Document104 pagesBairaha Annual Report 2013-14RyazathNo ratings yet

- Business Plan - Sasha TuwachaDocument23 pagesBusiness Plan - Sasha TuwachaMunashe MuzambiNo ratings yet

- Bharrel@live - Unc.edu Bdmatthe@live - Unc.edu: Assignment 9: Post-Conference AnalysisDocument14 pagesBharrel@live - Unc.edu Bdmatthe@live - Unc.edu: Assignment 9: Post-Conference AnalysisShubham UpadhyayNo ratings yet

- Kellogg's Case Study AnalysisDocument3 pagesKellogg's Case Study Analysissalil1235667% (3)

- Disaster Recovery Sample EmailsDocument3 pagesDisaster Recovery Sample EmailsTanayaNo ratings yet

- StratGroupPres Ford CompanyDocument13 pagesStratGroupPres Ford CompanyLornaPeñaNo ratings yet

- Planning Essay For LEGODocument5 pagesPlanning Essay For LEGOMarilyn WooNo ratings yet

- BUS3110M Strategic Management Individual AssignmentDocument5 pagesBUS3110M Strategic Management Individual Assignmentprojectwork185No ratings yet

- Asirius Philippines Inc.Document96 pagesAsirius Philippines Inc.Lee SuarezNo ratings yet

- Blaine Kitchenware AssignmentDocument5 pagesBlaine Kitchenware AssignmentChrisNo ratings yet

- Entrepreneurship - AssignmentDocument11 pagesEntrepreneurship - AssignmentKelas MemasakNo ratings yet

- Netflix Digital Disruption Consultancy ReportDocument20 pagesNetflix Digital Disruption Consultancy Reportcoursehero1218No ratings yet

- Autora: Estibaliz Manzaneque Corona Directora: Covadonga Aldamiz Echevarria González de DuranaDocument49 pagesAutora: Estibaliz Manzaneque Corona Directora: Covadonga Aldamiz Echevarria González de DuranaThảo KimNo ratings yet

- Global Business Strategies EldridgeDocument22 pagesGlobal Business Strategies EldridgeHassina BegumNo ratings yet

- Alam FinalDocument34 pagesAlam FinalZaheer Ahmed SwatiNo ratings yet

- KelloggsDocument5 pagesKelloggsShubham agarwalNo ratings yet

- Executive SummeryDocument18 pagesExecutive SummeryImtiaz RashidNo ratings yet

- 5 Years Marketing PlanDocument58 pages5 Years Marketing PlanhawwacoNo ratings yet

- Executive SummaryDocument18 pagesExecutive SummaryStephen FrancisNo ratings yet

- Zain CRMDocument10 pagesZain CRMabomajd100% (1)

- Urban TransportationDocument22 pagesUrban TransportationsamNo ratings yet

- Mrc2213 Strategic ManagementDocument59 pagesMrc2213 Strategic ManagementDarylGamaraNo ratings yet

- Chapter 16Document48 pagesChapter 16AudreyMae100% (1)

- Strategic Management Report: Topic: COCA-COLADocument40 pagesStrategic Management Report: Topic: COCA-COLANidhi KhoslaNo ratings yet

- CarlsbergDocument14 pagesCarlsbergRohit PantNo ratings yet

- Rendal - CSR Practices in The Philippine IndustriesDocument24 pagesRendal - CSR Practices in The Philippine IndustriesPaul Rendal100% (1)

- 602 Management Accounting v2Document4 pages602 Management Accounting v2Vandoir GoncalvesNo ratings yet

- CH 1 Introduction To Financial AccountingDocument14 pagesCH 1 Introduction To Financial AccountingMohammed Abdul MajeedNo ratings yet

- Fuel Cells: Aeronautical Engineering Propulsion IDocument7 pagesFuel Cells: Aeronautical Engineering Propulsion IMaria Clara MoralesNo ratings yet

- Research Proposal: Financial Analysis of Hospitality Sector in UKDocument13 pagesResearch Proposal: Financial Analysis of Hospitality Sector in UKRama Kedia100% (1)

- Fighting The War Against Covid-19 Through Innovation Today and TomorrowDocument42 pagesFighting The War Against Covid-19 Through Innovation Today and TomorrowKushal Sain100% (1)

- Competitive Advantage Kellogg SDocument1 pageCompetitive Advantage Kellogg SHANG NGUYEN KIMNo ratings yet

- Gujranwala Electric Power Company LTD 1 (1) .Document131 pagesGujranwala Electric Power Company LTD 1 (1) .SyedAshirBukhariNo ratings yet

- Crisis Communications HandbookDocument69 pagesCrisis Communications HandbookEverboleh ChowNo ratings yet

- CasesDocument34 pagesCasesSaket KumarNo ratings yet

- Project Introduction: Chinook DatabaseDocument42 pagesProject Introduction: Chinook DatabaseFiveer FreelancerNo ratings yet

- Marketing PlanDocument12 pagesMarketing PlanBidhan DeyNo ratings yet

- Nestle Premium Chocolate Market StrategyDocument2 pagesNestle Premium Chocolate Market Strategyjmisra71No ratings yet

- BAV Assignment-1 Group8Document18 pagesBAV Assignment-1 Group8Aakash SinghalNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Fugro NV Accounting Review 0311 2013Document3 pagesFugro NV Accounting Review 0311 2013Jean-Louis ThiemeleNo ratings yet

- Financial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019Document30 pagesFinancial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019choiand1No ratings yet

- Business Writing BasicsDocument26 pagesBusiness Writing Basicssuraj lamaNo ratings yet

- Opportunities and Challenges of Communication in A Diverse WorldDocument14 pagesOpportunities and Challenges of Communication in A Diverse Worldsuraj lamaNo ratings yet

- Business EtiquettesDocument16 pagesBusiness Etiquettessuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument28 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument23 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument29 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument27 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument26 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument31 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument26 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument37 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument25 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument31 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- ChairmanStatement and Independent Auditors ReportDocument3 pagesChairmanStatement and Independent Auditors Reportsuraj lamaNo ratings yet

- Human Resource Management: Fifteenth EditionDocument22 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Recommendation Tesco 2019Document2 pagesRecommendation Tesco 2019suraj lamaNo ratings yet

- Business Review and Future DevelopmentsDocument4 pagesBusiness Review and Future Developmentssuraj lamaNo ratings yet

- TESCO 2019 FindingsDocument4 pagesTESCO 2019 Findingssuraj lamaNo ratings yet

- Bri OktoberDocument3 pagesBri OktoberMobilkamu JakartaNo ratings yet

- Funding of AcquisitionsDocument41 pagesFunding of AcquisitionssandipNo ratings yet

- Exam Code 1 ObDocument4 pagesExam Code 1 ObHuỳnh Lê Yến VyNo ratings yet

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- Unit 6.Document18 pagesUnit 6.iDeo StudiosNo ratings yet

- Chapter 10. Tests of ControlsDocument25 pagesChapter 10. Tests of Controlsreeem312477No ratings yet

- Fundamentals of Cost Accounting 5Th Edition Lanen Test Bank Full Chapter PDFDocument60 pagesFundamentals of Cost Accounting 5Th Edition Lanen Test Bank Full Chapter PDFmarrowscandentyzch4c100% (12)

- Rose Hudgins Bank Management and FinanciDocument42 pagesRose Hudgins Bank Management and FinancisaadNo ratings yet

- AfmDocument15 pagesAfmabcd dcbaNo ratings yet

- ECN4001 - Tutorial 4 - QuestionsDocument6 pagesECN4001 - Tutorial 4 - QuestionsShann BevNo ratings yet

- Full Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions ManualDocument36 pagesFull Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manualcolagiovannibeckah100% (33)

- Aishwarya Precision Works GECLSDocument7 pagesAishwarya Precision Works GECLSchandan bhatiNo ratings yet

- Silabi3-52 Sore (14x Pertemuan) PDFDocument16 pagesSilabi3-52 Sore (14x Pertemuan) PDFAnugrah Mirae Asset SekuritasNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- QTTCDocument21 pagesQTTCHuong LanNo ratings yet

- Acc AssignmentDocument5 pagesAcc AssignmentBlen tesfayeNo ratings yet

- Introduction To IFRSDocument42 pagesIntroduction To IFRSstiftriteNo ratings yet

- CreditReport Piramal - Mahendra Jain - 2023 - 05 - 12 - 11 - 43 - 04.pdf 12-May-2023 PDFDocument7 pagesCreditReport Piramal - Mahendra Jain - 2023 - 05 - 12 - 11 - 43 - 04.pdf 12-May-2023 PDFGamer SinghNo ratings yet

- MCQ Cma Inter-P8 CostingDocument58 pagesMCQ Cma Inter-P8 Costingsekhee1011No ratings yet

- Caplin Point LabDocument76 pagesCaplin Point Lab40 Sai VenkatNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30sumonNo ratings yet

- Partnership Dissolution IllustrationsDocument12 pagesPartnership Dissolution IllustrationsKayla Sophia PatioNo ratings yet

- FNCE 545 Managerial Finance MBADocument417 pagesFNCE 545 Managerial Finance MBATarusengaNo ratings yet

- IAS 21 - Effects of Changes in Foreign Exchange PDFDocument22 pagesIAS 21 - Effects of Changes in Foreign Exchange PDFJanelle SentinaNo ratings yet

- RCH ResultsDocument16 pagesRCH Resultsichikuro9No ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJelwin Enchong BautistaNo ratings yet

- ENT Update Notes s1Document46 pagesENT Update Notes s1nanastase41No ratings yet

- RFM Notes-Commercial and SMEDocument8 pagesRFM Notes-Commercial and SMEmuneebmateen01No ratings yet

- Retail Math FormulasDocument6 pagesRetail Math FormulasMurat AnlıNo ratings yet