Professional Documents

Culture Documents

JD Deutsche Bank

JD Deutsche Bank

Uploaded by

compangelCopyright:

Available Formats

You might also like

- Vise Seed Pitch Deck PresentationDocument11 pagesVise Seed Pitch Deck PresentationJordan CrookNo ratings yet

- Active TRader-Marco Dion Interview Sep 2009Document5 pagesActive TRader-Marco Dion Interview Sep 2009fredtag4393No ratings yet

- Accenture Emerging Trends Model Risk Management PDFDocument16 pagesAccenture Emerging Trends Model Risk Management PDFVova KulykNo ratings yet

- JD - Credit Model ValidationsDocument2 pagesJD - Credit Model Validationssumit sinhaNo ratings yet

- SemcoDocument29 pagesSemcocompangelNo ratings yet

- WAT-PI Kit-Finance (FinvesT) PDFDocument8 pagesWAT-PI Kit-Finance (FinvesT) PDFcompangelNo ratings yet

- What Hedge Funds Really Do - An Introduction To Portfolio Management PDFDocument104 pagesWhat Hedge Funds Really Do - An Introduction To Portfolio Management PDFRutav shahNo ratings yet

- Team: Independent Model Review Work Location: Bangalore Job DescriptionDocument2 pagesTeam: Independent Model Review Work Location: Bangalore Job Descriptionsumit sinhaNo ratings yet

- JD-Wholesale - GCB 6Document2 pagesJD-Wholesale - GCB 6sumit sinhaNo ratings yet

- Job Description - Risk Analyst MRMGDocument2 pagesJob Description - Risk Analyst MRMGmanjuypNo ratings yet

- TIOB - Asset & Liability Management For Banks in Africa 2021Document7 pagesTIOB - Asset & Liability Management For Banks in Africa 2021Alex KimboiNo ratings yet

- Macquarie MRMDocument2 pagesMacquarie MRMNikita sharmaNo ratings yet

- JD - FS Risk Management (SR - Con-AM) PDFDocument3 pagesJD - FS Risk Management (SR - Con-AM) PDFAASIM AlamNo ratings yet

- JR Model ValidatorDocument2 pagesJR Model ValidatorjananiNo ratings yet

- Monte Carlo MethodologyDocument2 pagesMonte Carlo MethodologygauravroongtaNo ratings yet

- 6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredDocument102 pages6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredWubneh AlemuNo ratings yet

- Internal Validation Manager (M/F) Luxembourg Organization: Banque Internationale À Luxembourg Contract Type - Unlimited DurationDocument2 pagesInternal Validation Manager (M/F) Luxembourg Organization: Banque Internationale À Luxembourg Contract Type - Unlimited DurationshaubNo ratings yet

- Raj v. Gutta 2014Document7 pagesRaj v. Gutta 2014sundeepkumarNo ratings yet

- Key Risk Indicators: 13 - 16 December 2009, Abu Dhabi, UaeDocument6 pagesKey Risk Indicators: 13 - 16 December 2009, Abu Dhabi, UaeAneuxAgamNo ratings yet

- SAS TestDocument4 pagesSAS Testsatishreddy71No ratings yet

- Munich Re America Job Posting - Oct2012Document2 pagesMunich Re America Job Posting - Oct2012ndimuzioNo ratings yet

- 2015 Fall Erm SyllabusDocument14 pages2015 Fall Erm Syllabusgman4dx266No ratings yet

- JD - 23014382 - MRMDocument2 pagesJD - 23014382 - MRMVamsiNethalaNo ratings yet

- Deutsche Bank AG-2Document3 pagesDeutsche Bank AG-2avijeetboparaiNo ratings yet

- Quant AnalystDocument2 pagesQuant Analystd.daganeNo ratings yet

- ADB - Senior Risk Management Specialist-Liquidity MGTDocument5 pagesADB - Senior Risk Management Specialist-Liquidity MGTNathan TagayunNo ratings yet

- Chief Risk Officer - KarachiDocument1 pageChief Risk Officer - KarachiAZAM WAQASNo ratings yet

- Central Bank of UAE GuidelinesDocument8 pagesCentral Bank of UAE GuidelinesAASIM AlamNo ratings yet

- Advertisement 07-08-2018Document3 pagesAdvertisement 07-08-2018Sourabh EkboteNo ratings yet

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Almb MB14Document5 pagesAlmb MB14hashximNo ratings yet

- Chap 5Document33 pagesChap 5vishalsingh9669No ratings yet

- Welcome To The CourseDocument5 pagesWelcome To The Coursetiaramaulinazhi1700No ratings yet

- Goldman Sachs - Internal Audit - Model RiskDocument2 pagesGoldman Sachs - Internal Audit - Model Riskadityaacharya44No ratings yet

- RFS PPT C5Document42 pagesRFS PPT C5shamanth shettyNo ratings yet

- Thesis Financial Risk ManagementDocument8 pagesThesis Financial Risk Managementsummeryoungnorthlasvegas100% (2)

- Risk Management in BanksDocument26 pagesRisk Management in BanksDivya Keswani0% (1)

- OTC Derivative Pricing and Risk Subject Matter Expert (SME)Document3 pagesOTC Derivative Pricing and Risk Subject Matter Expert (SME)nekougolo3064No ratings yet

- Financial Risk ManagementDocument3 pagesFinancial Risk Managementvani3826No ratings yet

- Risk ModelsDocument20 pagesRisk ModelsFarhan TariqNo ratings yet

- CPRM (Certified Project Risk Manager) SyllabusDocument4 pagesCPRM (Certified Project Risk Manager) Syllabusl4ur3ns.widiNo ratings yet

- The Evolution of Model Risk ManagementDocument8 pagesThe Evolution of Model Risk Managementbilalsununu1097No ratings yet

- Vdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsDocument2 pagesVdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsSakti AnupindiNo ratings yet

- 360 Degree Risk ManagementDocument7 pages360 Degree Risk Managementmaconny20No ratings yet

- Department Profile: Division: FID Job Title: Fixed Income Counterparty Risk Manager Location: Mumbai Job Level: VPDocument1 pageDepartment Profile: Division: FID Job Title: Fixed Income Counterparty Risk Manager Location: Mumbai Job Level: VPSahid WahabNo ratings yet

- Principles of Risk: Minimum Correct Answers For This Module: 4/8Document12 pagesPrinciples of Risk: Minimum Correct Answers For This Module: 4/8Jovan SsenkandwaNo ratings yet

- JD - CFO - EV - Risk and Compliance Consultant - 4Document3 pagesJD - CFO - EV - Risk and Compliance Consultant - 4Puneet JoshiNo ratings yet

- Unit III - BDocument30 pagesUnit III - Bscribd.fever522No ratings yet

- Head - Credit RiskDocument2 pagesHead - Credit Riskhasik.jainNo ratings yet

- Quantative Assignemtn CompleattDocument1 pageQuantative Assignemtn CompleatttimskinnynzNo ratings yet

- MFS - Risk Management in Banks MuskanDocument54 pagesMFS - Risk Management in Banks Muskansangambhardwaj64No ratings yet

- Banking & Risk Management: Business SchoolDocument2 pagesBanking & Risk Management: Business SchoolKarim AzzamNo ratings yet

- Issues in Credit Scoring: Model Development and ValidationDocument22 pagesIssues in Credit Scoring: Model Development and ValidationbusywaghNo ratings yet

- Dynamic Credit DCP - InternshipDocument1 pageDynamic Credit DCP - InternshipAli Zaigham AghaNo ratings yet

- Risk MeasurementDocument2 pagesRisk MeasurementemegersaNo ratings yet

- Modul 3 Risk ManagementDocument5 pagesModul 3 Risk ManagementLuca PappalardoNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryArin ChattopadhyayNo ratings yet

- Risk Management ProcessDocument11 pagesRisk Management ProcessDebby Taylan-HidalgoNo ratings yet

- Decision TMA2 AnswerDocument5 pagesDecision TMA2 AnswerYosef DanielNo ratings yet

- Fundamentals of Derivative Risk: Course OutlineDocument3 pagesFundamentals of Derivative Risk: Course OutlineAlexis FNo ratings yet

- 1409 Mumbai Incremental Risk Analyst 140925Document1 page1409 Mumbai Incremental Risk Analyst 140925VivekNo ratings yet

- Senior Risk Analyst - Chubb InsuranceDocument3 pagesSenior Risk Analyst - Chubb Insurancecristi.anton198No ratings yet

- Marketing Job Description - Quantitative Risk Specialist 201807Document3 pagesMarketing Job Description - Quantitative Risk Specialist 201807BerndNo ratings yet

- Adventurer's Guide to Risk Management: Fictional Tales about Risk ManagementFrom EverandAdventurer's Guide to Risk Management: Fictional Tales about Risk ManagementNo ratings yet

- Resume Gaurav KumarDocument1 pageResume Gaurav KumarcompangelNo ratings yet

- JD ZycusDocument2 pagesJD ZycuscompangelNo ratings yet

- DIAC Experienced Associate HealthcareDocument3 pagesDIAC Experienced Associate HealthcarecompangelNo ratings yet

- Role - Consultant The Team - Operational Risk Advisory TeamDocument2 pagesRole - Consultant The Team - Operational Risk Advisory TeamcompangelNo ratings yet

- Edmingle Hiring PostDocument2 pagesEdmingle Hiring PostcompangelNo ratings yet

- OB Reading NotesDocument10 pagesOB Reading NotescompangelNo ratings yet

- Sbi Scholar Loan Scheme - List of Approved InstitutionsDocument6 pagesSbi Scholar Loan Scheme - List of Approved InstitutionscompangelNo ratings yet

- CFA Institute Exam InstructionsDocument2 pagesCFA Institute Exam InstructionscompangelNo ratings yet

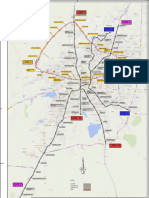

- Line 1: Network Indore Metro: Government of Madhya PradeshDocument1 pageLine 1: Network Indore Metro: Government of Madhya PradeshcompangelNo ratings yet

- Wipro Limited-An Overview: Deck Expiry by 05/15/2014Document72 pagesWipro Limited-An Overview: Deck Expiry by 05/15/2014compangelNo ratings yet

- Golden Stocks PortfolioDocument6 pagesGolden Stocks PortfoliocompangelNo ratings yet

- Cummins India Limited - AGM 9 Aug - V3-ReducedDocument29 pagesCummins India Limited - AGM 9 Aug - V3-ReducedcompangelNo ratings yet

- C11: The New C Standard by Thomas Plum: ConcurrencyDocument14 pagesC11: The New C Standard by Thomas Plum: ConcurrencycompangelNo ratings yet

- Information Systems & Their Business ValueDocument43 pagesInformation Systems & Their Business ValuecompangelNo ratings yet

- CompleteDocument18 pagesCompletecompangelNo ratings yet

- Argument and Non Argument: Abha Chatterjee IIM IndoreDocument8 pagesArgument and Non Argument: Abha Chatterjee IIM IndorecompangelNo ratings yet

- Assignment 1.0 PDFDocument6 pagesAssignment 1.0 PDFDaniyal AsifNo ratings yet

- CV EyraudDocument2 pagesCV EyraudeyraudjNo ratings yet

- Keep Up With Your Quants.Document5 pagesKeep Up With Your Quants.jisha aminNo ratings yet

- How To Write Day 1 CaseDocument37 pagesHow To Write Day 1 CaseLouis-Philippe GagnonNo ratings yet

- HKUBusinessSchool UG Brochure 2023 PDFDocument24 pagesHKUBusinessSchool UG Brochure 2023 PDFkwokchunsang6549No ratings yet

- Harvard University Accounting and Finance Entry RequirementsDocument15 pagesHarvard University Accounting and Finance Entry RequirementsPaulo DaviNo ratings yet

- Quant Insight Conference Program 2020Document15 pagesQuant Insight Conference Program 2020AnalyticNo ratings yet

- CQF BrochureDocument24 pagesCQF Brochurevatsalvora1999No ratings yet

- Career Opportunities in Mathematics1Document33 pagesCareer Opportunities in Mathematics1Manoj GhagasNo ratings yet

- Resume Harsh-Bansal For HARSH BANSALDocument1 pageResume Harsh-Bansal For HARSH BANSALHarsh BansalNo ratings yet

- Artificial Intelligence For TradingDocument10 pagesArtificial Intelligence For TradingADtel TelecomunicacionesNo ratings yet

- Quant Investing 101Document8 pagesQuant Investing 101Mateus WesleyNo ratings yet

- RG QuantDocument19 pagesRG Quantsandeep222No ratings yet

- Infomineo Brochure - 2023Document4 pagesInfomineo Brochure - 2023omarmora2009No ratings yet

- Program Details: Official Partners WithDocument8 pagesProgram Details: Official Partners Withritz meshNo ratings yet

- Computer Science and Applications Brochure 23 1 24Document46 pagesComputer Science and Applications Brochure 23 1 24Gunjan RajNo ratings yet

- Quants Trading: AssignmentDocument6 pagesQuants Trading: AssignmentSudarshan TlkNo ratings yet

- Financialanalystsyllabus PDFDocument10 pagesFinancialanalystsyllabus PDFAJAY SINGH NEGINo ratings yet

- Business Climate Indices in ChinaDocument11 pagesBusiness Climate Indices in ChinaStoloNo ratings yet

- Paul Constantino: Phone: Home: EmailDocument6 pagesPaul Constantino: Phone: Home: Emailashish ojhaNo ratings yet

- Quant Finance RoadMapDocument8 pagesQuant Finance RoadMapRahul AgarwalNo ratings yet

- The CQF Careers Guide 2023Document45 pagesThe CQF Careers Guide 2023ashaik1No ratings yet

- Career in StocksDocument17 pagesCareer in StocksVamsi KrishnaNo ratings yet

- Financial Engineering A Conceptual Study: Dr. Ambrish VeernaikDocument8 pagesFinancial Engineering A Conceptual Study: Dr. Ambrish VeernaikMohammed AliNo ratings yet

- Coskun Kilic: Career SummaryDocument1 pageCoskun Kilic: Career SummaryCoskun KilicNo ratings yet

- Internship Talk by Coding ClubDocument97 pagesInternship Talk by Coding ClubRiddhiman GhatakNo ratings yet

- DataCon Africa 2019 Attendee List 18 - 02Document6 pagesDataCon Africa 2019 Attendee List 18 - 02ChristianNo ratings yet

JD Deutsche Bank

JD Deutsche Bank

Uploaded by

compangelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JD Deutsche Bank

JD Deutsche Bank

Uploaded by

compangelCopyright:

Available Formats

Job Description:

Model Risk Management's mission is to manage, independently and actively, model risk globally in line with the

bank's risk appetite with responsibility for:

o Performing robust independent model validation;

o Ensuring early and proactive identification of Model Risks;

o Designing and recommending Model Risk Appetite;

o Effectively managing and mitigating Model Risks;

o Establishing Model Risk metrics;

o Designing and implementing a strong Model Risk Management and governance framework;

o Creating bank-wide Model Risk related policies.

o Pricing Model Validation as part of MoRM is responsible for the independent review and analysis of all

derivative pricing models used for valuation and risk across the bank.

o The role is independently to review and analyse derivative models for pricing and risk management.

Position Specific Responsibilities and Accountabilities

The role is to independently review and analyse derivative models for pricing and risk management.

The role as a Quantitative Analyst in Mumbai will work closely with the pricing validation team in London to

produce, analyse and document validation testing.

Reviews and analysis require a good understanding of the mathematical models used, implementation methods,

products traded in these markets, and the associated risks.

In addition to theoretical analysis and review it is required (where appropriate) that model/products are

independently implemented in a managed C++ library.

The outcome of review and analysis and independent implementation will form the basis of discussion with key

model stakeholders including: Front Office Trading; Front Office Quants; Market Risk Managers; and Finance

Controllers.

People Management

Experience/ Exposure

Excellent mathematical ability with an understanding of Stochastic Calculus, Partial Differential Equations,

Monte-Carlo Methods, Finite Difference Methods, and Numerical Algorithms.

Strong interest in financial markets (especially derivative pricing) demonstrated by qualifications and/or

experience.

Experience coding in C++ an advantage.

Excellent communication skills – both written and oral.

Education/ Qualifications

PhD qualification in numerate subject such as Mathematics, Financial Mathematics, Physics.

Strong candidates with other post-graduate qualifications may also be considered.

You might also like

- Vise Seed Pitch Deck PresentationDocument11 pagesVise Seed Pitch Deck PresentationJordan CrookNo ratings yet

- Active TRader-Marco Dion Interview Sep 2009Document5 pagesActive TRader-Marco Dion Interview Sep 2009fredtag4393No ratings yet

- Accenture Emerging Trends Model Risk Management PDFDocument16 pagesAccenture Emerging Trends Model Risk Management PDFVova KulykNo ratings yet

- JD - Credit Model ValidationsDocument2 pagesJD - Credit Model Validationssumit sinhaNo ratings yet

- SemcoDocument29 pagesSemcocompangelNo ratings yet

- WAT-PI Kit-Finance (FinvesT) PDFDocument8 pagesWAT-PI Kit-Finance (FinvesT) PDFcompangelNo ratings yet

- What Hedge Funds Really Do - An Introduction To Portfolio Management PDFDocument104 pagesWhat Hedge Funds Really Do - An Introduction To Portfolio Management PDFRutav shahNo ratings yet

- Team: Independent Model Review Work Location: Bangalore Job DescriptionDocument2 pagesTeam: Independent Model Review Work Location: Bangalore Job Descriptionsumit sinhaNo ratings yet

- JD-Wholesale - GCB 6Document2 pagesJD-Wholesale - GCB 6sumit sinhaNo ratings yet

- Job Description - Risk Analyst MRMGDocument2 pagesJob Description - Risk Analyst MRMGmanjuypNo ratings yet

- TIOB - Asset & Liability Management For Banks in Africa 2021Document7 pagesTIOB - Asset & Liability Management For Banks in Africa 2021Alex KimboiNo ratings yet

- Macquarie MRMDocument2 pagesMacquarie MRMNikita sharmaNo ratings yet

- JD - FS Risk Management (SR - Con-AM) PDFDocument3 pagesJD - FS Risk Management (SR - Con-AM) PDFAASIM AlamNo ratings yet

- JR Model ValidatorDocument2 pagesJR Model ValidatorjananiNo ratings yet

- Monte Carlo MethodologyDocument2 pagesMonte Carlo MethodologygauravroongtaNo ratings yet

- 6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredDocument102 pages6 Figure Jobs in Risk and Compliance Management and What It Takes To Get HiredWubneh AlemuNo ratings yet

- Internal Validation Manager (M/F) Luxembourg Organization: Banque Internationale À Luxembourg Contract Type - Unlimited DurationDocument2 pagesInternal Validation Manager (M/F) Luxembourg Organization: Banque Internationale À Luxembourg Contract Type - Unlimited DurationshaubNo ratings yet

- Raj v. Gutta 2014Document7 pagesRaj v. Gutta 2014sundeepkumarNo ratings yet

- Key Risk Indicators: 13 - 16 December 2009, Abu Dhabi, UaeDocument6 pagesKey Risk Indicators: 13 - 16 December 2009, Abu Dhabi, UaeAneuxAgamNo ratings yet

- SAS TestDocument4 pagesSAS Testsatishreddy71No ratings yet

- Munich Re America Job Posting - Oct2012Document2 pagesMunich Re America Job Posting - Oct2012ndimuzioNo ratings yet

- 2015 Fall Erm SyllabusDocument14 pages2015 Fall Erm Syllabusgman4dx266No ratings yet

- JD - 23014382 - MRMDocument2 pagesJD - 23014382 - MRMVamsiNethalaNo ratings yet

- Deutsche Bank AG-2Document3 pagesDeutsche Bank AG-2avijeetboparaiNo ratings yet

- Quant AnalystDocument2 pagesQuant Analystd.daganeNo ratings yet

- ADB - Senior Risk Management Specialist-Liquidity MGTDocument5 pagesADB - Senior Risk Management Specialist-Liquidity MGTNathan TagayunNo ratings yet

- Chief Risk Officer - KarachiDocument1 pageChief Risk Officer - KarachiAZAM WAQASNo ratings yet

- Central Bank of UAE GuidelinesDocument8 pagesCentral Bank of UAE GuidelinesAASIM AlamNo ratings yet

- Advertisement 07-08-2018Document3 pagesAdvertisement 07-08-2018Sourabh EkboteNo ratings yet

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Almb MB14Document5 pagesAlmb MB14hashximNo ratings yet

- Chap 5Document33 pagesChap 5vishalsingh9669No ratings yet

- Welcome To The CourseDocument5 pagesWelcome To The Coursetiaramaulinazhi1700No ratings yet

- Goldman Sachs - Internal Audit - Model RiskDocument2 pagesGoldman Sachs - Internal Audit - Model Riskadityaacharya44No ratings yet

- RFS PPT C5Document42 pagesRFS PPT C5shamanth shettyNo ratings yet

- Thesis Financial Risk ManagementDocument8 pagesThesis Financial Risk Managementsummeryoungnorthlasvegas100% (2)

- Risk Management in BanksDocument26 pagesRisk Management in BanksDivya Keswani0% (1)

- OTC Derivative Pricing and Risk Subject Matter Expert (SME)Document3 pagesOTC Derivative Pricing and Risk Subject Matter Expert (SME)nekougolo3064No ratings yet

- Financial Risk ManagementDocument3 pagesFinancial Risk Managementvani3826No ratings yet

- Risk ModelsDocument20 pagesRisk ModelsFarhan TariqNo ratings yet

- CPRM (Certified Project Risk Manager) SyllabusDocument4 pagesCPRM (Certified Project Risk Manager) Syllabusl4ur3ns.widiNo ratings yet

- The Evolution of Model Risk ManagementDocument8 pagesThe Evolution of Model Risk Managementbilalsununu1097No ratings yet

- Vdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsDocument2 pagesVdocuments - MX - VN Chief Credit Risk Officer Eng African Development Bank Chiefonly ApplicantsSakti AnupindiNo ratings yet

- 360 Degree Risk ManagementDocument7 pages360 Degree Risk Managementmaconny20No ratings yet

- Department Profile: Division: FID Job Title: Fixed Income Counterparty Risk Manager Location: Mumbai Job Level: VPDocument1 pageDepartment Profile: Division: FID Job Title: Fixed Income Counterparty Risk Manager Location: Mumbai Job Level: VPSahid WahabNo ratings yet

- Principles of Risk: Minimum Correct Answers For This Module: 4/8Document12 pagesPrinciples of Risk: Minimum Correct Answers For This Module: 4/8Jovan SsenkandwaNo ratings yet

- JD - CFO - EV - Risk and Compliance Consultant - 4Document3 pagesJD - CFO - EV - Risk and Compliance Consultant - 4Puneet JoshiNo ratings yet

- Unit III - BDocument30 pagesUnit III - Bscribd.fever522No ratings yet

- Head - Credit RiskDocument2 pagesHead - Credit Riskhasik.jainNo ratings yet

- Quantative Assignemtn CompleattDocument1 pageQuantative Assignemtn CompleatttimskinnynzNo ratings yet

- MFS - Risk Management in Banks MuskanDocument54 pagesMFS - Risk Management in Banks Muskansangambhardwaj64No ratings yet

- Banking & Risk Management: Business SchoolDocument2 pagesBanking & Risk Management: Business SchoolKarim AzzamNo ratings yet

- Issues in Credit Scoring: Model Development and ValidationDocument22 pagesIssues in Credit Scoring: Model Development and ValidationbusywaghNo ratings yet

- Dynamic Credit DCP - InternshipDocument1 pageDynamic Credit DCP - InternshipAli Zaigham AghaNo ratings yet

- Risk MeasurementDocument2 pagesRisk MeasurementemegersaNo ratings yet

- Modul 3 Risk ManagementDocument5 pagesModul 3 Risk ManagementLuca PappalardoNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryArin ChattopadhyayNo ratings yet

- Risk Management ProcessDocument11 pagesRisk Management ProcessDebby Taylan-HidalgoNo ratings yet

- Decision TMA2 AnswerDocument5 pagesDecision TMA2 AnswerYosef DanielNo ratings yet

- Fundamentals of Derivative Risk: Course OutlineDocument3 pagesFundamentals of Derivative Risk: Course OutlineAlexis FNo ratings yet

- 1409 Mumbai Incremental Risk Analyst 140925Document1 page1409 Mumbai Incremental Risk Analyst 140925VivekNo ratings yet

- Senior Risk Analyst - Chubb InsuranceDocument3 pagesSenior Risk Analyst - Chubb Insurancecristi.anton198No ratings yet

- Marketing Job Description - Quantitative Risk Specialist 201807Document3 pagesMarketing Job Description - Quantitative Risk Specialist 201807BerndNo ratings yet

- Adventurer's Guide to Risk Management: Fictional Tales about Risk ManagementFrom EverandAdventurer's Guide to Risk Management: Fictional Tales about Risk ManagementNo ratings yet

- Resume Gaurav KumarDocument1 pageResume Gaurav KumarcompangelNo ratings yet

- JD ZycusDocument2 pagesJD ZycuscompangelNo ratings yet

- DIAC Experienced Associate HealthcareDocument3 pagesDIAC Experienced Associate HealthcarecompangelNo ratings yet

- Role - Consultant The Team - Operational Risk Advisory TeamDocument2 pagesRole - Consultant The Team - Operational Risk Advisory TeamcompangelNo ratings yet

- Edmingle Hiring PostDocument2 pagesEdmingle Hiring PostcompangelNo ratings yet

- OB Reading NotesDocument10 pagesOB Reading NotescompangelNo ratings yet

- Sbi Scholar Loan Scheme - List of Approved InstitutionsDocument6 pagesSbi Scholar Loan Scheme - List of Approved InstitutionscompangelNo ratings yet

- CFA Institute Exam InstructionsDocument2 pagesCFA Institute Exam InstructionscompangelNo ratings yet

- Line 1: Network Indore Metro: Government of Madhya PradeshDocument1 pageLine 1: Network Indore Metro: Government of Madhya PradeshcompangelNo ratings yet

- Wipro Limited-An Overview: Deck Expiry by 05/15/2014Document72 pagesWipro Limited-An Overview: Deck Expiry by 05/15/2014compangelNo ratings yet

- Golden Stocks PortfolioDocument6 pagesGolden Stocks PortfoliocompangelNo ratings yet

- Cummins India Limited - AGM 9 Aug - V3-ReducedDocument29 pagesCummins India Limited - AGM 9 Aug - V3-ReducedcompangelNo ratings yet

- C11: The New C Standard by Thomas Plum: ConcurrencyDocument14 pagesC11: The New C Standard by Thomas Plum: ConcurrencycompangelNo ratings yet

- Information Systems & Their Business ValueDocument43 pagesInformation Systems & Their Business ValuecompangelNo ratings yet

- CompleteDocument18 pagesCompletecompangelNo ratings yet

- Argument and Non Argument: Abha Chatterjee IIM IndoreDocument8 pagesArgument and Non Argument: Abha Chatterjee IIM IndorecompangelNo ratings yet

- Assignment 1.0 PDFDocument6 pagesAssignment 1.0 PDFDaniyal AsifNo ratings yet

- CV EyraudDocument2 pagesCV EyraudeyraudjNo ratings yet

- Keep Up With Your Quants.Document5 pagesKeep Up With Your Quants.jisha aminNo ratings yet

- How To Write Day 1 CaseDocument37 pagesHow To Write Day 1 CaseLouis-Philippe GagnonNo ratings yet

- HKUBusinessSchool UG Brochure 2023 PDFDocument24 pagesHKUBusinessSchool UG Brochure 2023 PDFkwokchunsang6549No ratings yet

- Harvard University Accounting and Finance Entry RequirementsDocument15 pagesHarvard University Accounting and Finance Entry RequirementsPaulo DaviNo ratings yet

- Quant Insight Conference Program 2020Document15 pagesQuant Insight Conference Program 2020AnalyticNo ratings yet

- CQF BrochureDocument24 pagesCQF Brochurevatsalvora1999No ratings yet

- Career Opportunities in Mathematics1Document33 pagesCareer Opportunities in Mathematics1Manoj GhagasNo ratings yet

- Resume Harsh-Bansal For HARSH BANSALDocument1 pageResume Harsh-Bansal For HARSH BANSALHarsh BansalNo ratings yet

- Artificial Intelligence For TradingDocument10 pagesArtificial Intelligence For TradingADtel TelecomunicacionesNo ratings yet

- Quant Investing 101Document8 pagesQuant Investing 101Mateus WesleyNo ratings yet

- RG QuantDocument19 pagesRG Quantsandeep222No ratings yet

- Infomineo Brochure - 2023Document4 pagesInfomineo Brochure - 2023omarmora2009No ratings yet

- Program Details: Official Partners WithDocument8 pagesProgram Details: Official Partners Withritz meshNo ratings yet

- Computer Science and Applications Brochure 23 1 24Document46 pagesComputer Science and Applications Brochure 23 1 24Gunjan RajNo ratings yet

- Quants Trading: AssignmentDocument6 pagesQuants Trading: AssignmentSudarshan TlkNo ratings yet

- Financialanalystsyllabus PDFDocument10 pagesFinancialanalystsyllabus PDFAJAY SINGH NEGINo ratings yet

- Business Climate Indices in ChinaDocument11 pagesBusiness Climate Indices in ChinaStoloNo ratings yet

- Paul Constantino: Phone: Home: EmailDocument6 pagesPaul Constantino: Phone: Home: Emailashish ojhaNo ratings yet

- Quant Finance RoadMapDocument8 pagesQuant Finance RoadMapRahul AgarwalNo ratings yet

- The CQF Careers Guide 2023Document45 pagesThe CQF Careers Guide 2023ashaik1No ratings yet

- Career in StocksDocument17 pagesCareer in StocksVamsi KrishnaNo ratings yet

- Financial Engineering A Conceptual Study: Dr. Ambrish VeernaikDocument8 pagesFinancial Engineering A Conceptual Study: Dr. Ambrish VeernaikMohammed AliNo ratings yet

- Coskun Kilic: Career SummaryDocument1 pageCoskun Kilic: Career SummaryCoskun KilicNo ratings yet

- Internship Talk by Coding ClubDocument97 pagesInternship Talk by Coding ClubRiddhiman GhatakNo ratings yet

- DataCon Africa 2019 Attendee List 18 - 02Document6 pagesDataCon Africa 2019 Attendee List 18 - 02ChristianNo ratings yet