Professional Documents

Culture Documents

Alesco News Energy Market Update June 2019

Alesco News Energy Market Update June 2019

Uploaded by

Kaisar DarlinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alesco News Energy Market Update June 2019

Alesco News Energy Market Update June 2019

Uploaded by

Kaisar DarlinCopyright:

Available Formats

ENERGY INSURANCE:

MARKET UPDATE

JUNE 2019

The short-term outlook in the upstream energy market remains LLOYD’S OF LONDON (LLOYD’S)

stable with oil prices at around $67 per barrel for benchmark MARKET UPDATE

Brent crude in summer 2019 ($7 per barrel lower than summer

For 2018, Lloyd’s reported another loss of GBP1bn (2017: loss

2018). The total world rig count according to Baker Hughes is 2150;

GBP2bn; 2016: profit GBP2.1bn) and a combined ratio of 105%

a 3% decrease over the past 12 months. The Energy Information

(2017: 114%). There was a slight improvement in net claims

Administration (EIA) forecasts that the United States will be a net

reduction and a reduction in major loss activity compared to 2017.

exporter of gasoline in summer 2019 for the first time since 1960.

In fact, major claims in 2017 represented 11.6% of net earned

Refining margins into Q2 2019 are continuing at a high level (the premium which is broadly in line with the ten year average 2008-

BP Global Refining Marker Margin Index $16.5 per barrel shows an 2017. Net operating expenses remained at just under 40% of

11% improvement from Q2 2018). Net Earned Premium and various initiatives are planned to try to

The overall demand for energy insurance could be viewed as reduce this significantly going forward. The Energy class again

moderately stronger in both the upstream and downstream showed an overall profit in 2018 although the accident year result

markets but there remains an oversupply of upstream capacity (106%) was again significantly improved by an 18% prior year

which is continuing to hold down rates for all but the largest reserve movement.

placements that are stretching the overall limits of market capacity.

ENERGY LOSS UPDATE

Following poor underwriting results in 2017, the downstream

It is still too early to predict 2019 loss levels, but Q1 and Q2 appear

energy market is attempting to apply double digit rate increases

to be relatively quiet in terms of Energy losses.

across the board and are paying specific attention to Business

Interruption (BI) rates and accounts with Natural Catastrophe This is in contrast to 2018 where we are still seeing adverse

(NatCat) exposure. development.

In addition many large buyers are deploying well-capitalised

captive vehicles or alternative capacity such as Oil Insurance

Limited (OIL) to manage volatility in short-term pricing. In the

past six months, OIL has added three new members, all in the

downstream energy sectors (refinery and petrochemicals).

Alesco Energy Market Update – June 2019 www.alescorms.com

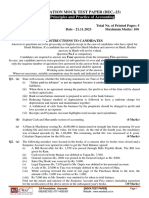

2018 ENERGY RISK LOSSES ABOVE USD250M

Date of Loss Land / Offshore Country Cause Category Total / Actual US$

April 2018 Land USA Fire/Explosion Refinery 1,205,000,000

Sept 2018 Land Germany Fire/Explosion Refinery 803,000,000

Oct 2018 Land Saudi Arabia Fire/Explosion Petrochemical 490,000,000

Oct 2018 Land Canada Fire/Explosion Refinery 405,000,000

Feb 2018 Land Papua New Guinea Earthquake LNG plant 270,000,000

UPSTREAM ENERGY CAPACITY, DOWNSTREAM ENERGY CAPACITY,

DEMAND AND OUTLOOK DEMAND AND OUTLOOK

2019 is shaping up to be another benign loss year with no Results from corporate insurers in 2018 were poor compared to

meaningful direct catastrophe impact to date. Traditional previous years largely attributed to Natural Catastrophe activity

Exploration and Production markets remain active whilst more and the continuing deterioration of some large individual losses.

recent market entrants are also pursuing new business. This negative sentiment on the sector heightened following a

series of major risk losses in 2018 (Nat Pet, Bayernoil and Irving

Underwriters are still rating new business competitively but

Oil etc.) and further deterioration on the Abu Dhabi National Oil

seeking increases up to 10% on renewal business (but generally

Company (ADNOC) loss which has seen the market achieving

accepting less on clean business). Emotionally charged

double digit rate increases. Some underwriters have withdrawn

areas for underwriters include transportation heavy risks,

from the class and others, particularly in Lloyds, are no longer

environmental issues, earthquakes and unfavourable legal

writing for income. Less attractive risks and those with Natural

venues such as Louisiana, Texas, and the Northeast USA.

Catastrophe exposure are more of a challenge to attract

For rig accounts, flat renewals have been challenging due to competitively priced supporting capacity. There are a number

losses across the book but despite this, incumbent markets of high profile examples in the marketplace where brokers

are containing rises to reflect increasing activity levels. The have become distressed to complete placements, and required

rating environment is more challenging for equipment or ‘frac’ substantially higher terms to finish off programmes.

compared to conventional onshore drillers.

Overall total market capacity remains largely intact at over

USD7bn but this is largely a theoretical number and actual

working capacity for most placements could be considered to

be no more than 50% of this level - taking into account regional

players and markets averse to some coverages. Despite this, the

short-term outlook still remains favourable for buyers with rates

close to the historical low point.

POWER INSURANCE MARKET OIL RECENT DEVELOPMENTS

Following Lloyd’s review of the PG risk code, most business At 31st December 2018, the Total Shareholders’ Equity was

plans were signed off but at reduced premium income levels USD3.2bn (2017: USD4.4bn) with written premiums for 2019

and there were some market withdrawals. Swiss Re, Allianz, totalling USD464m compared to USD354m in 2018. This reflects

Aviva, Axa and other European company markets are removing the average 30% premium for most members following a poor

or restricting support for coal fired generators who are unable to 2018 loss year of USD783M which resulted in an underwriting

demonstrate commitment towards feedstock diversification. loss of USD405m compounded by a loss of USD250m on

investment income. However OIL declared at the shareholders

The general Property market, in recent years ever more

AGM in March 2019 that a further dividend of USD250m would be

prominent in broker’s Power Gen schematics, are pulling back

paid in 2019. The OIL pool is likely to remain volatile for those

from this sector following directive from managing agents to

members with high pool shares.

focus on their core business. Accounts with attrition are coming

under particular scrutiny, with even apparently profitable Overall membership has increased to 56 members.

high rate on line primary offerings being rejected. Even clean

renewals are being disproportionately penalised by the Property

market, with the most severe treatment being imposed in

developing economies with high Nat Cat exposure.

Despite another challenging year in terms of results for the

traditional Power Generation underwriting community, business

continues with clean renewals anywhere between flat and 10%

up. There remains significant overall capacity and some new

options for lead markets, despite some attempts by follower

markets to hide behind the decision-making of certain leaders.

ALESCO’S RECOMMENDATIONS AND

CONSIDERATIONS OUR TEAM

Energy insurance buyers are continuing to trade in a fragile Alesco’s Energy division has one of the largest teams in

insurance market. The broker’s role in maintaining a strong London which has continued to grow despite the volatility

relationship with key lead underwriters in the commercial market in the energy industry, helping our clients of all sizes to

coupled with an understanding of all the alternatives available recognise that we offer a high level of strategic advice and

service. With over 400 clients spread across 6 continents, our

seems to be fundamental to steering clients through these choppy

team of over 65 experts works across the globe on projects

waters as we hit the 2019 mid-point.

throughout the industry, covering; Upstream, Downstream,

Midstream, Power and Renewables.

IF YOU WOULD LIKE TO DISCUSS ANY OF THE ABOVE PLEASE CONTACT:

JON SMITH

@AlescoRMS

Direct: +44 (0)20 7204 6186 LinkedIn/Alesco

UKART-362515476

Email: Jon_Smith@alescorms.com www.alescorms.com

Alesco Risk Management Services Limited is an appointed representative of Arthur J. Gallagher (UK) Limited which is authorised and regulated by the Financial Conduct Authority. Registered Office:

The Walbrook Building, 25 Walbrook, London EC4N 8AW. Registered in England and Wales. Company Number: 1193013. www.alescorms.com. FP599-2019 Exp. 29/5/2020.

You might also like

- Integrated Accounting Fundamentals: Nu LagunaDocument12 pagesIntegrated Accounting Fundamentals: Nu Lagunaalthea nicole velezNo ratings yet

- Deloitte Oil Gas and Chemicals Industry OutlookDocument8 pagesDeloitte Oil Gas and Chemicals Industry OutlookNasrul SalmanNo ratings yet

- Facts and Figures Press Release 6135c4977c393Document5 pagesFacts and Figures Press Release 6135c4977c393aa4e11No ratings yet

- National GridDocument2 pagesNational GridPranav BahlNo ratings yet

- Willis Energy Market Review 2013 PDFDocument92 pagesWillis Energy Market Review 2013 PDFsushilk28No ratings yet

- Weekly Recap: Let The Bodies Hit The FloorDocument7 pagesWeekly Recap: Let The Bodies Hit The FloorsirdquantsNo ratings yet

- CERI Crude Oil Report - January 2023Document6 pagesCERI Crude Oil Report - January 2023avinash mohantyNo ratings yet

- Covid 19 Can 50 Oil Prices Turn Around Energy SectorDocument4 pagesCovid 19 Can 50 Oil Prices Turn Around Energy SectorSallam BakeerNo ratings yet

- J Focat 2019 09 010Document1 pageJ Focat 2019 09 010Toni TanNo ratings yet

- Energy Newsletter Oct 2019Document32 pagesEnergy Newsletter Oct 2019bobyNo ratings yet

- DI Exploration and ProductionDocument7 pagesDI Exploration and ProductiontataxpNo ratings yet

- Mena Insurance Market Update United Arab EmiratesDocument16 pagesMena Insurance Market Update United Arab EmiratesLatika ParasharNo ratings yet

- Industrial Goods Sector - Mid-Year Outlook 2023Document17 pagesIndustrial Goods Sector - Mid-Year Outlook 2023Carl MacaulayNo ratings yet

- AGL Energy LimitedDocument14 pagesAGL Energy LimitedRupesh MaharjanNo ratings yet

- 2019 Marine Insurance Facts & FiguresDocument5 pages2019 Marine Insurance Facts & FiguresAkash MishraNo ratings yet

- Effects of Covid-19 On Energy InvestmentDocument4 pagesEffects of Covid-19 On Energy InvestmentSaagar SenniNo ratings yet

- Oil and Gas After COVID 19 v4Document11 pagesOil and Gas After COVID 19 v4Cedie Rogel De Torres100% (1)

- Renewable Volume ObligationDocument9 pagesRenewable Volume ObligationHieu NgoNo ratings yet

- Qatar Economy Watch 2021Document11 pagesQatar Economy Watch 2021rishardh mNo ratings yet

- U.S. Fracking Sector Disappoints Yet Again - IEEFA August 2019Document8 pagesU.S. Fracking Sector Disappoints Yet Again - IEEFA August 2019CliffhangerNo ratings yet

- April262019 Airline Economic Analysis 2018-2019vfwebDocument62 pagesApril262019 Airline Economic Analysis 2018-2019vfwebapi-548139140No ratings yet

- See RefiningDocument21 pagesSee RefiningTRIFMAKNo ratings yet

- PHP MPPD ObDocument5 pagesPHP MPPD Obfred607No ratings yet

- More IdeasDocument13 pagesMore IdeasRohaan KapurNo ratings yet

- Release 1Q18 ENGDocument27 pagesRelease 1Q18 ENGPaolo SNo ratings yet

- AMPOL Annual Report ASX 2020Document136 pagesAMPOL Annual Report ASX 2020Zakee QasimNo ratings yet

- Us Oil and Gas Outlook 2018Document8 pagesUs Oil and Gas Outlook 2018DebasishNo ratings yet

- Rystad Energy Commentary - 3539361 - Australasia 2020 ReviewDocument9 pagesRystad Energy Commentary - 3539361 - Australasia 2020 ReviewRaam WilliamsNo ratings yet

- Us Eri Ogc Report 2021Document11 pagesUs Eri Ogc Report 2021Truman LauNo ratings yet

- Financial Analysis - Covestro 1128 1445Document2 pagesFinancial Analysis - Covestro 1128 1445ouattara dabilaNo ratings yet

- Ongc Ar 2019-20 PDFDocument630 pagesOngc Ar 2019-20 PDFAkashdeep MukherjeeNo ratings yet

- Atul Industries Limited-IC PDFDocument23 pagesAtul Industries Limited-IC PDFSanjayNo ratings yet

- Reporte Final CFADocument29 pagesReporte Final CFAAndres FelipeNo ratings yet

- 2022-09-09-sri-sigma5-maintenance-resilience-enDocument40 pages2022-09-09-sri-sigma5-maintenance-resilience-enWilson ManyongaNo ratings yet

- New Zealand Insurance Market UpdateDocument36 pagesNew Zealand Insurance Market UpdateDave ReesNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Balmoral Newsletter Chemicals 2019 Q2Document9 pagesBalmoral Newsletter Chemicals 2019 Q2CDI Global IndiaNo ratings yet

- IPAA-Response July2017 PDFDocument8 pagesIPAA-Response July2017 PDFState Senator Liz KruegerNo ratings yet

- Pinnacle - Economics of Reliability - Global Refining 2022Document26 pagesPinnacle - Economics of Reliability - Global Refining 2022Bruno ZindyNo ratings yet

- Environ Defence Federal FossilFuelSubsidies April 2021Document14 pagesEnviron Defence Federal FossilFuelSubsidies April 2021LUNo ratings yet

- Airline Industry Economic Performance Jun19 Report PDFDocument6 pagesAirline Industry Economic Performance Jun19 Report PDFFahad MohamedNo ratings yet

- Pija Doc 1581907800Document8 pagesPija Doc 1581907800lamp vicNo ratings yet

- MH5 PDFDocument55 pagesMH5 PDFHammadNo ratings yet

- Case StudyDocument7 pagesCase StudyKrizzel ValerosNo ratings yet

- ENMPOOCT19 KuwaitDocument2 pagesENMPOOCT19 KuwaitfdsfdsaNo ratings yet

- Decommissioning of Oil and Gas Assets 2021 Article Science DirectDocument14 pagesDecommissioning of Oil and Gas Assets 2021 Article Science DirectlawzammNo ratings yet

- Third Point Q3 2020 Investor Letter TPOIDocument12 pagesThird Point Q3 2020 Investor Letter TPOIMichael LoNo ratings yet

- Us 2022 Outlook Oil and GasDocument11 pagesUs 2022 Outlook Oil and GasChib DavidNo ratings yet

- Us 2022 Outlook Oil and GasDocument11 pagesUs 2022 Outlook Oil and GasChib DavidNo ratings yet

- Insights Bullish Near Term OutlookDocument62 pagesInsights Bullish Near Term OutlookHandy HarisNo ratings yet

- Hiscox Interim Statement 2019Document18 pagesHiscox Interim Statement 2019saxobobNo ratings yet

- GX Global Chemical 2017 ReportDocument20 pagesGX Global Chemical 2017 ReportarrivaNo ratings yet

- ETF Newsletter - May - 20Document21 pagesETF Newsletter - May - 20Chuck CookNo ratings yet

- Us 2023 Outlook ChemicalDocument12 pagesUs 2023 Outlook ChemicalrajjjjjkumarNo ratings yet

- 2017-18 Third Quarter Report Fiscal UpdateDocument18 pages2017-18 Third Quarter Report Fiscal UpdateCTV CalgaryNo ratings yet

- Ril Half Year Ended 2019Document16 pagesRil Half Year Ended 2019Pragya Singh BaghelNo ratings yet

- BERYLLS Study Top 100 Supplier-2019 ENDocument16 pagesBERYLLS Study Top 100 Supplier-2019 ENJorge Navarro BeckerNo ratings yet

- Roland Berger Global Automotive Supplier Study 2020Document59 pagesRoland Berger Global Automotive Supplier Study 2020spam.recycler1048No ratings yet

- Cement Sector Report - 201204Document44 pagesCement Sector Report - 201204Chayan JainNo ratings yet

- Renewable energy finance: Sovereign guaranteesFrom EverandRenewable energy finance: Sovereign guaranteesNo ratings yet

- Emergency Response Simulation - RiotDocument7 pagesEmergency Response Simulation - RiotKaisar DarlinNo ratings yet

- CV - Salahuddin MuhammadDocument2 pagesCV - Salahuddin MuhammadKaisar DarlinNo ratings yet

- Marine Intermediate, 31st August Until 9th September 2022: Date Time Subject Lecturer VenueDocument2 pagesMarine Intermediate, 31st August Until 9th September 2022: Date Time Subject Lecturer VenueKaisar DarlinNo ratings yet

- m97 Reinsurance Examination SyllabusDocument4 pagesm97 Reinsurance Examination SyllabusKaisar Darlin0% (1)

- m97 Reinsurance Examination SyllabusDocument4 pagesm97 Reinsurance Examination SyllabusKaisar Darlin0% (1)

- Rfa 2018 en nl0000349488Document184 pagesRfa 2018 en nl0000349488hoiruNo ratings yet

- Case Study - 1Document5 pagesCase Study - 1Jordan BimandamaNo ratings yet

- Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsDocument4 pagesJimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsAngel Kaye Nacionales JimenezNo ratings yet

- Grade11 Fabm1 Q2 Week6Document19 pagesGrade11 Fabm1 Q2 Week6Mickaela MonterolaNo ratings yet

- PLDT vs. NTCDocument2 pagesPLDT vs. NTCI took her to my penthouse and i freaked itNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Statement of FactsDocument2 pagesStatement of FactsNitin RautNo ratings yet

- 14 - Karan Singh - BHELDocument12 pages14 - Karan Singh - BHELrajat_singlaNo ratings yet

- Different Methods of Ranking Investment ProposalsDocument3 pagesDifferent Methods of Ranking Investment ProposalsPratibha Nagvekar100% (1)

- Solution of 16 &17Document15 pagesSolution of 16 &17Jabed GuruNo ratings yet

- BUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course HeroDocument6 pagesBUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course Herowriter topNo ratings yet

- Cost Sheet Analysis: Dabur India Limited.: Submitted byDocument15 pagesCost Sheet Analysis: Dabur India Limited.: Submitted byVipul BhagatNo ratings yet

- Papat All SubjectsDocument104 pagesPapat All SubjectsChester Jericho RamosNo ratings yet

- Borussia Dortmund ENGL GB2022 RZ-sDocument244 pagesBorussia Dortmund ENGL GB2022 RZ-sNirmalNo ratings yet

- Ratio Analysis of Coca ColaDocument16 pagesRatio Analysis of Coca ColaAlwina100% (1)

- Premidterm ExaminationDocument5 pagesPremidterm ExaminationAnne Camille AlfonsoNo ratings yet

- Income Statement - Apple Traveling Salesperson "Income Statement"Document2 pagesIncome Statement - Apple Traveling Salesperson "Income Statement"jitenNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFanandNo ratings yet

- Paper - Investing in Indonesian Pharmaceutical Companies in The Middle of Pandemic UncertaintyDocument9 pagesPaper - Investing in Indonesian Pharmaceutical Companies in The Middle of Pandemic UncertaintyZuchrizal WinataNo ratings yet

- INCOME TAX VALUE ADDED TAX ACTIVITY SolutionDocument6 pagesINCOME TAX VALUE ADDED TAX ACTIVITY SolutionMarco Alejandro IbayNo ratings yet

- Question - Mid Term Parallel Quiz 2324Document4 pagesQuestion - Mid Term Parallel Quiz 2324haikal.abiyu.w41No ratings yet

- Liabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasDocument158 pagesLiabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasErika Mae LegaspiNo ratings yet

- Accrual & Prepaid HW QDocument4 pagesAccrual & Prepaid HW Q小仙女哈哈哈No ratings yet

- Salary SlipDocument1 pageSalary SlipSanjay SolankiNo ratings yet

- FACTS OF CASE EnronDocument8 pagesFACTS OF CASE EnronChincel G. ANINo ratings yet

- Activity 7Document16 pagesActivity 7JEWELL ANN PENARANDANo ratings yet

- Case Study - Tata SteelDocument44 pagesCase Study - Tata SteelMohammad Abubakar SiddiqNo ratings yet

- Annual Report PDFDocument237 pagesAnnual Report PDFnahid hasanNo ratings yet

- In January 2014 The Management of Kinzie Company Concludes ThatDocument1 pageIn January 2014 The Management of Kinzie Company Concludes Thattrilocksp SinghNo ratings yet