Professional Documents

Culture Documents

Midterm Q5 (A)

Midterm Q5 (A)

Uploaded by

Lina Levvenia Ratanam0 ratings0% found this document useful (0 votes)

20 views3 pagesThe document contains information on the price of semi-annual coupon bonds with varying interest rates and maturity periods of 1 year and 30 years. For 1-year bonds, the price difference between interest rates is small, but for 30-year bonds the price difference is much larger. Higher interest rates lead to lower bond prices. The time of maturity and number of periods also significantly impact the price, with longer maturities of 30 years versus 1 year showing a greater effect of interest rate on price.

Original Description:

Original Title

Midterm Q5(a)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains information on the price of semi-annual coupon bonds with varying interest rates and maturity periods of 1 year and 30 years. For 1-year bonds, the price difference between interest rates is small, but for 30-year bonds the price difference is much larger. Higher interest rates lead to lower bond prices. The time of maturity and number of periods also significantly impact the price, with longer maturities of 30 years versus 1 year showing a greater effect of interest rate on price.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views3 pagesMidterm Q5 (A)

Midterm Q5 (A)

Uploaded by

Lina Levvenia RatanamThe document contains information on the price of semi-annual coupon bonds with varying interest rates and maturity periods of 1 year and 30 years. For 1-year bonds, the price difference between interest rates is small, but for 30-year bonds the price difference is much larger. Higher interest rates lead to lower bond prices. The time of maturity and number of periods also significantly impact the price, with longer maturities of 30 years versus 1 year showing a greater effect of interest rate on price.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

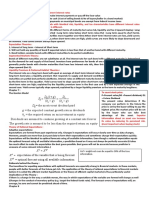

Value of a Semi-Annual Coupon Bond ( 1 Year)

Face Value 10000

Interest Rate 5%

Time of Maturity (Years) 1

Number of Period 2

Coupon Rate 7%

Price of Bond ($10,192.74)

Value of a Semi-Annual Coupon Bond ( 1 Year)

Face Value 10000

Interest Rate 8%

Time of Maturity (Years) 1

Number of Period 2

Coupon Rate 7%

Price of Bond ($9,905.70)

Value of a Semi-Annual Coupon Bond ( 1 Year)

Face Value 10000

Interest Rate 10%

Time of Maturity (Years) 1

Number of Period 2

Coupon Rate 7%

Price of Bond ($9,721.09)

Value of a Semi-Annual Coupon Bond ( 1 Year)

Face Value 10000

Interest Rate 12%

Time of Maturity (Years) 1

Number of Period 2

Coupon Rate 7%

Price of Bond ($9,541.65)

Value of a Semi-Annual Coupon Bond ( 30 Year)

Face Value 10000

Interest Rate 5%

Time of Maturity (Years) 30

Number of Period 60

Coupon Rate 7%

Price of Bond ($13,090.87)

Value of a Semi-Annual Coupon Bond ( 30 Year)

Face Value 10000

Interest Rate 8%

Time of Maturity (Years) 30

Number of Period 60

Coupon Rate 7%

Price of Bond ($8,868.83)

Value of a Semi-Annual Coupon Bond ( 30 Year)

Face Value 10000

Interest Rate 10%

Time of Maturity (Years) 30

Number of Period 60

Coupon Rate 7%

Price of Bond ($7,160.61)

Value of a Semi-Annual Coupon Bond ( 30 Year)

Face Value 10000

Interest Rate 12%

Time of Maturity (Years) 30

Number of Period 60

Coupon Rate 7%

Price of Bond ($5,959.64)

Based on the value of a one year bond, it can be observed that

the price of bond with different interest rate does not have a

large marginal difference but with the 30-year bond, the

difference between the different interest rate has a large

marginal difference. Hence, when the interest rate increases,

the price of bond decreases. A bond's price would increase if

prevailing interest rates were to drop.

Based on the value obtained, it can be said that the time of

maturity and number of periods play a big role on the price of

bond. Comparing the one-year bond and the 30-year bond, it

can be said that in the one-year bond, with the time of

maturity as 1 year and number of periods as 2 does inflict a

slight changes on the price of bond with the different interest

rate. But with the 30-year bond, the time of maturity is 30

years and number of period is 60 gives a significantly large

difference between the interest rates.

The price of bond between the different interest rate and

constant coupon rate shows that the interest rate, time of

maturity and number of periods does have a significant

impact over the price of bond.

You might also like

- Arnott Marketing PlanDocument58 pagesArnott Marketing PlanLina Levvenia Ratanam75% (4)

- Ebb6123 Corporate Finance - Mid-TermDocument2 pagesEbb6123 Corporate Finance - Mid-TermLina Levvenia Ratanam0% (1)

- XLSXDocument2 pagesXLSXchristiewijaya100% (1)

- A 10 Year 8 % Coupon (Semiannual) Bond Sells For $1,100, What Is The Bond Holder's YTM?Document4 pagesA 10 Year 8 % Coupon (Semiannual) Bond Sells For $1,100, What Is The Bond Holder's YTM?mobinil1No ratings yet

- Bond Immunization Using Solver Exercise - EmptyDocument14 pagesBond Immunization Using Solver Exercise - EmptyAdarsh JalanNo ratings yet

- M2 - Assessments SolutionsDocument46 pagesM2 - Assessments SolutionsSmita100% (1)

- Fmi 5 432Document6 pagesFmi 5 432Aditi RawatNo ratings yet

- Individual Assignment Financial ManagementDocument17 pagesIndividual Assignment Financial ManagementUtheu Budhi Susetyo100% (1)

- Deferred AnnuityDocument1 pageDeferred Annuityjaine ylevrebNo ratings yet

- Deferred AnnuityDocument1 pageDeferred Annuityjaine ylevrebNo ratings yet

- Financial Functions PMTDocument10 pagesFinancial Functions PMTkareena shahNo ratings yet

- Class Problems Chapter 6 - Haryo IndraDocument3 pagesClass Problems Chapter 6 - Haryo IndraHaryo HartoyoNo ratings yet

- Case 3 What If Analysis DataDocument7 pagesCase 3 What If Analysis Dataconcortecha2No ratings yet

- Question Set TVMDocument17 pagesQuestion Set TVMAnju VijayNo ratings yet

- Adobe Scan 16 Oct 2023 1hDocument8 pagesAdobe Scan 16 Oct 2023 1htajnaharpNo ratings yet

- Value of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedDocument5 pagesValue of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedJAYRAJ AGRAWALNo ratings yet

- Fin101 Bonds ValuationDocument6 pagesFin101 Bonds ValuationXYZNo ratings yet

- Chapter - 06 DurationDocument10 pagesChapter - 06 DurationRim RimNo ratings yet

- Assignment 2 BondsDocument6 pagesAssignment 2 BondsLalit SaraswatNo ratings yet

- Webinar 2Document134 pagesWebinar 2Hélio Julião NgoveNo ratings yet

- Required Rate of Return 8% Required Rate of Return 11%Document3 pagesRequired Rate of Return 8% Required Rate of Return 11%Krishele G. GotejerNo ratings yet

- Bond Price CalculationDocument8 pagesBond Price CalculationСветка СоханичNo ratings yet

- 2.2 TERM STRUCTURE OF INTEREST RATE RISK - Leysa, Diane C.Document11 pages2.2 TERM STRUCTURE OF INTEREST RATE RISK - Leysa, Diane C.Ryna Miguel MasaNo ratings yet

- Assignment 3Document88 pagesAssignment 3Manjing WangNo ratings yet

- Bonds UploadDocument11 pagesBonds UploadZiHan ZhangNo ratings yet

- Price Calculator For Bonds.Document29 pagesPrice Calculator For Bonds.Farjad Rehman100% (1)

- Duration ExampDocument10 pagesDuration ExampMuhammad Ali MeerNo ratings yet

- Effective Interest Rate CalculatorDocument2 pagesEffective Interest Rate CalculatormmahaliNo ratings yet

- Interest Rate CalculatorDocument2 pagesInterest Rate CalculatorBlera007No ratings yet

- M2 Assessments Activity MOOCDocument46 pagesM2 Assessments Activity MOOCSmitaNo ratings yet

- Solutions To Numerical Mcqs of Quiz1Document3 pagesSolutions To Numerical Mcqs of Quiz1Nadiya IftekharNo ratings yet

- Bond PracticeDocument3 pagesBond PracticeЯсмина ХалидоваNo ratings yet

- Principles of Managerial Finance: Bond & Stock ValuationDocument68 pagesPrinciples of Managerial Finance: Bond & Stock ValuationJoshNo ratings yet

- The Passive and Active Stances: Bond Portfolio ManagementDocument41 pagesThe Passive and Active Stances: Bond Portfolio ManagementvaibhavNo ratings yet

- Bonds: Formulas & ExamplesDocument12 pagesBonds: Formulas & ExamplesAayush sunejaNo ratings yet

- Zero-Coupon Bond Bonos de Descuento Puro: Ley Del Precio ÚnicoDocument11 pagesZero-Coupon Bond Bonos de Descuento Puro: Ley Del Precio ÚnicoSebastian MejiaNo ratings yet

- Lecture 7 BH CH 7 Bond and ValuationDocument41 pagesLecture 7 BH CH 7 Bond and ValuationAydin GaniyevNo ratings yet

- IM PandeyDocument45 pagesIM PandeyRahul KhannaNo ratings yet

- Debt Market: A Market For Long Term SecuritiesDocument32 pagesDebt Market: A Market For Long Term SecuritiesPoonam SoniNo ratings yet

- CF 4 2016Document43 pagesCF 4 2016Siddhartha PatraNo ratings yet

- FM Homework4Document30 pagesFM Homework4subinamehtaNo ratings yet

- Lect7-2023Document94 pagesLect7-2023vitordias347No ratings yet

- 2.2) APR and EARDocument4 pages2.2) APR and EARCody Alan SmithNo ratings yet

- Bond Valuations 26 AprilDocument9 pagesBond Valuations 26 AprilMuhammad IrfanNo ratings yet

- Actividad Capítulo 8Document25 pagesActividad Capítulo 8Naomi NaranjoNo ratings yet

- Bond ValuationDocument52 pagesBond ValuationDevi MuthiahNo ratings yet

- F Bond Valuation Workings in Class and Solutions 1sGM0gfKLuDocument34 pagesF Bond Valuation Workings in Class and Solutions 1sGM0gfKLudffdf fdfgNo ratings yet

- Bond ValuationDocument29 pagesBond ValuationNur Al AhadNo ratings yet

- Homework For 9 October - Nino KvaratskheliaDocument8 pagesHomework For 9 October - Nino KvaratskheliaKvaratskhelia NinoNo ratings yet

- Chapter 10 NotesDocument9 pagesChapter 10 NotesashibhallauNo ratings yet

- UntitledDocument7 pagesUntitledtranvanchonNo ratings yet

- Investment Analysis & Portfolio Management: Bond Valuation: That Holding Period IsDocument5 pagesInvestment Analysis & Portfolio Management: Bond Valuation: That Holding Period IsNitesh KirarNo ratings yet

- Finance Management HW Week 4Document7 pagesFinance Management HW Week 4arwa_mukadam03100% (1)

- Financial Institutions Management,: by Anthony SaundersDocument17 pagesFinancial Institutions Management,: by Anthony SaundersDexter ShahNo ratings yet

- Assignment No 6 - FM Actual Summer 2020 Furqan Farooq-18292Document37 pagesAssignment No 6 - FM Actual Summer 2020 Furqan Farooq-18292Furqan Farooq Vadharia100% (1)

- Lect 2Document15 pagesLect 2GBMS gorakhnagarNo ratings yet

- Bond Valuation Week 7 Unit 7.3Document8 pagesBond Valuation Week 7 Unit 7.3BUSHRA ZAINABNo ratings yet

- Session 2 EMBA Interest Rate RiskDocument24 pagesSession 2 EMBA Interest Rate Risksatu tanvirNo ratings yet

- Session 2 EMBA Interest Rate RiskDocument24 pagesSession 2 EMBA Interest Rate Risksatu tanvirNo ratings yet

- Cs2-United States Steel Industry-LevveniaDocument5 pagesCs2-United States Steel Industry-LevveniaLina Levvenia RatanamNo ratings yet

- Ebb6133 - Case Study 1 LEVVENIA A/P RATANAM (19030076)Document4 pagesEbb6133 - Case Study 1 LEVVENIA A/P RATANAM (19030076)Lina Levvenia RatanamNo ratings yet

- Chapter 6Document2 pagesChapter 6Lina Levvenia RatanamNo ratings yet

- Design and Development PlanDocument7 pagesDesign and Development PlanLina Levvenia RatanamNo ratings yet

- Cash Flow Accumulated Cash Flow Year Undiscounted Discounted Undiscounted Discounted 50 50 40 90 40 130 15Document1 pageCash Flow Accumulated Cash Flow Year Undiscounted Discounted Undiscounted Discounted 50 50 40 90 40 130 15Lina Levvenia RatanamNo ratings yet

- LU 12 Digital Business Service Implementation, Optimisation & ChallengesDocument61 pagesLU 12 Digital Business Service Implementation, Optimisation & ChallengesLina Levvenia RatanamNo ratings yet

- CHPT5 5.1-5.6Document7 pagesCHPT5 5.1-5.6Lina Levvenia RatanamNo ratings yet

- Key Partners Key Activities Value Proposition Customer Relationship Customer SegmentDocument5 pagesKey Partners Key Activities Value Proposition Customer Relationship Customer SegmentLina Levvenia RatanamNo ratings yet

- Question 8 (B) Investment A Year Cash Flow PV of Cash FlowDocument4 pagesQuestion 8 (B) Investment A Year Cash Flow PV of Cash FlowLina Levvenia RatanamNo ratings yet

- Income Statement Company A Percent Company B Percent RevenueDocument4 pagesIncome Statement Company A Percent Company B Percent RevenueLina Levvenia RatanamNo ratings yet

- Capital Budgeting ProblemDocument2 pagesCapital Budgeting ProblemLina Levvenia RatanamNo ratings yet

- 3.1 Wildhack Croporation Common Size Balance Sheet of December 31,2002 and 2003 Asset 2002 2003 Current AssetDocument5 pages3.1 Wildhack Croporation Common Size Balance Sheet of December 31,2002 and 2003 Asset 2002 2003 Current AssetLina Levvenia RatanamNo ratings yet

- Ipoh - Feb 2019 Cmba Class ScheduleDocument2 pagesIpoh - Feb 2019 Cmba Class ScheduleLina Levvenia RatanamNo ratings yet

- ABC CostingDocument47 pagesABC CostingLina Levvenia RatanamNo ratings yet

- Technosales Multimedia Technologies PVT LTD - 36Document1 pageTechnosales Multimedia Technologies PVT LTD - 36Fbsix ApNo ratings yet

- The Board of Directors of Ogle Construction Company Is MeetingDocument1 pageThe Board of Directors of Ogle Construction Company Is MeetingAmit PandeyNo ratings yet

- (Dis) Honesty - The Truth About Lies: A Companion Film Discussion & Activity GuideDocument3 pages(Dis) Honesty - The Truth About Lies: A Companion Film Discussion & Activity GuideKevin MalloryNo ratings yet

- Total Quality ManagementDocument55 pagesTotal Quality Managementss100% (2)

- Unit-IV, Cmos Operational AmplifiersDocument45 pagesUnit-IV, Cmos Operational AmplifiersTejaswini KonetiNo ratings yet

- Synaptris (Intelliview Reporting Tool and Dashboard)Document6 pagesSynaptris (Intelliview Reporting Tool and Dashboard)Richa Gupta JainNo ratings yet

- Chapter No 7: Data Collection Multiple Choice Questions SUBJECT:Business Research Methods PREPARED BY:Maryum SaleemDocument4 pagesChapter No 7: Data Collection Multiple Choice Questions SUBJECT:Business Research Methods PREPARED BY:Maryum SaleemZara KhanNo ratings yet

- Mta1 Can, M1 10P Can, At1 Can, At1 CF Can, M1, At1, AT1 CF, RA 12, RA 23, RA T1, FS 002 CAN, FS 002, T1 Foot CAN, ER 1, ER 1FDocument16 pagesMta1 Can, M1 10P Can, At1 Can, At1 CF Can, M1, At1, AT1 CF, RA 12, RA 23, RA T1, FS 002 CAN, FS 002, T1 Foot CAN, ER 1, ER 1Fmacguyver66No ratings yet

- Case Study of The Marubay Rural Renewable Energy TechnologyDocument30 pagesCase Study of The Marubay Rural Renewable Energy TechnologyCollen Sita100% (1)

- Seminar ReportDocument29 pagesSeminar ReportUrja DhabardeNo ratings yet

- Hiệu part3Document4 pagesHiệu part3Đỗ Đại HọcNo ratings yet

- Application For ParoleDocument2 pagesApplication For ParoleChristian Rivera100% (3)

- 3 Internal Quality AuditDocument12 pages3 Internal Quality AuditJeaneth Dela Pena CarnicerNo ratings yet

- People's Dome Cad File-A1Document1 pagePeople's Dome Cad File-A1Macoy CarandangNo ratings yet

- Module 1Document35 pagesModule 1anjuNo ratings yet

- Share Go Director Raftaar Training Module Jan 2023Document64 pagesShare Go Director Raftaar Training Module Jan 2023Shravan Khilledar100% (1)

- Manual Instruction For Shutle Kiln-To NetDocument75 pagesManual Instruction For Shutle Kiln-To NetlonungNo ratings yet

- Ankit JainDocument2 pagesAnkit JainRahul TiwariNo ratings yet

- Preparing Your Pathway To AustraliaDocument14 pagesPreparing Your Pathway To AustraliaKRISTIANTONo ratings yet

- Digital Electronics: Course Description and ObjectivesDocument3 pagesDigital Electronics: Course Description and ObjectivesMaxNo ratings yet

- Case 3-2017 Waste ManagementDocument18 pagesCase 3-2017 Waste ManagementShaameswary AnnadoraiNo ratings yet

- Metode Data Mining SomDocument22 pagesMetode Data Mining SomAnonymous N22g3i4No ratings yet

- Target Date Investment OptionsDocument11 pagesTarget Date Investment OptionsEdward CobbNo ratings yet

- Mousa 2015Document16 pagesMousa 2015Mohammed YahyaNo ratings yet

- First Aid Android ApplicationDuc - Chapter 1 4Document26 pagesFirst Aid Android ApplicationDuc - Chapter 1 4paul francoNo ratings yet

- MINI PROJECT REPORT DoucmentDocument78 pagesMINI PROJECT REPORT DoucmentVarshini VuraNo ratings yet

- Taxation Management AssignmentDocument11 pagesTaxation Management AssignmentniraliNo ratings yet

- The Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesDocument12 pagesThe Optimal Petroleum Fiscal Regime For Ghana: An Analysis of Available AlternativesIbrahim SalahudinNo ratings yet

- EB 06 LightingDocument45 pagesEB 06 LightingTamNo ratings yet

- A Study of Consumer Preferences Towards FrootiDocument11 pagesA Study of Consumer Preferences Towards Frootisidyans12No ratings yet