Professional Documents

Culture Documents

Question 3-FS

Question 3-FS

Uploaded by

Rax-Nguajandja KapuireOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 3-FS

Question 3-FS

Uploaded by

Rax-Nguajandja KapuireCopyright:

Available Formats

Question 2

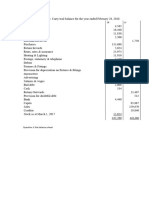

Mr Zambezi has been trading for some years as a wine merchant. The following list of

balances has been extracted from his ledger as at 30 April 2007, the end of his most recent

financial year.

N$

Bad debts recovered 900

Capital 83 887

Sales 259 870

Trade Creditors 19 840

Returns out 13 407

Provision for bad debts 512

Discount allowed 2 306

Discount received 1 750

Purchases 135 680

Returns inwards 5 624

Carriage outwards 4 562

Drawings 18 440

Carriage inwards 11 830

Rent, rates and insurance 25 973

Heating and Lighting 11 010

Postage, stationery and telephone 2 410

Advertising 5 980

Salaries and wages 38 521

Bad debts 2 008

Cash in hand 1 434

Cash in bank 4 440

Inventory as at 1 May 2006 15 654

Trade Debtors 24 500

Fixtures and Fittings – at cost 120 740

Accumulated depreciation on fixtures and fittings – 30 April 2007 63 020

Depreciation 12 074

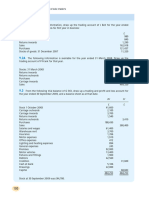

The following additional information as at 30 April 2007 is available:

a) Additional bad debts to be written off N$ 500.

b) Inventory at the close of business was valued at N$ 17 750.

c) Insurances have been prepaid by N$1 120

d) Heating and lighting is accrued by N$1 360

e) Rates have been prepaid by N$5 435

f) The provision for bad debts is to be adjusted so that it is 3% of trade debtors.

Required:

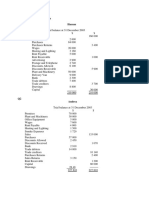

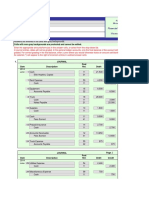

2.1 Prepare journal entries for adjustments. Narrations are not required. (12

marks)

2.2 Prepare a Statement of profit or loss (Show workings separately). (19 marks)

2.3 Prepare a Statement of financial position (19 marks)

You might also like

- Question 8 - Preparation of FSDocument4 pagesQuestion 8 - Preparation of FSRax-Nguajandja Kapuire100% (1)

- Horngrens Financial and Managerial Accounting 6th Edition Nobles Test BankDocument85 pagesHorngrens Financial and Managerial Accounting 6th Edition Nobles Test Bankmatthewavilawpkrnztjxs100% (33)

- NYIF Accounting Module 5 QuizDocument4 pagesNYIF Accounting Module 5 QuizShahd OkashaNo ratings yet

- Unit 05 Accounting Principles Jan 2022Document6 pagesUnit 05 Accounting Principles Jan 2022Takassar AliNo ratings yet

- 4.0 Curly KaleDocument2 pages4.0 Curly KaleAkik HasanNo ratings yet

- Review Questions Volume 1 - Chapter 9Document4 pagesReview Questions Volume 1 - Chapter 9YelenochkaNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Answer To Sample Question 3Document3 pagesAnswer To Sample Question 3Farid Abbasov0% (1)

- Financial StatementsDocument3 pagesFinancial StatementsSoumendra RoyNo ratings yet

- INCOMPLETEDocument13 pagesINCOMPLETEOwen Bawlor ManozNo ratings yet

- Review Questions Volume 1 - Chapter 7Document3 pagesReview Questions Volume 1 - Chapter 7YelenochkaNo ratings yet

- 6sgp 2005 Dec QDocument7 pages6sgp 2005 Dec Qapi-19836745No ratings yet

- (Problems) - Audit of ReceivablesDocument16 pages(Problems) - Audit of Receivablesapatos80% (5)

- Frankwood 361-361Document1 pageFrankwood 361-361saiimbutt525No ratings yet

- Incomplete RecordsDocument5 pagesIncomplete RecordsTarmak LyonNo ratings yet

- Quiz 1 AccountingDocument2 pagesQuiz 1 AccountingNayab ShamsiNo ratings yet

- Question 1 Trail BalanceDocument1 pageQuestion 1 Trail Balancehamsmith1876No ratings yet

- Financial Statements Q - StudentDocument1 pageFinancial Statements Q - StudentSun PujunNo ratings yet

- Test 1 (QP)Document2 pagesTest 1 (QP)Bushra AsgharNo ratings yet

- CHAPTER9-NEWDocument27 pagesCHAPTER9-NEWredegeneratedNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- Final Accounts QuesDocument2 pagesFinal Accounts QuesJiller GgNo ratings yet

- Extra Exercises Adjustmen SPACEDocument6 pagesExtra Exercises Adjustmen SPACEMohd Rafi JasmanNo ratings yet

- Tutorial 7 QADocument4 pagesTutorial 7 QAJin HueyNo ratings yet

- Final Accounts - Igcse - Yr 10.Document3 pagesFinal Accounts - Igcse - Yr 10.MUSTHARI KHANNo ratings yet

- Ac108 May2017Document5 pagesAc108 May2017Sahid Afrid AnwahNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- M2 Academy - Income StatementsDocument2 pagesM2 Academy - Income StatementsDesire Mthungameli DubeNo ratings yet

- Acc Section 4 B - Trial Balance QuestionsDocument3 pagesAcc Section 4 B - Trial Balance QuestionsNathefa LayneNo ratings yet

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- Classwork:: 1) (Q. 5.3 of RISE Book) Draw Up Amir's Balance Sheet From The Following Information As at 31Document4 pagesClasswork:: 1) (Q. 5.3 of RISE Book) Draw Up Amir's Balance Sheet From The Following Information As at 31Ahmad HasnainNo ratings yet

- SWAZI+ONE Accounting ExerciseDocument2 pagesSWAZI+ONE Accounting Exercisekj98mcqc5zNo ratings yet

- DR CR Le LeDocument7 pagesDR CR Le LeKANGOMA FODIE MansarayNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- Frankwood 359-359Document1 pageFrankwood 359-359saiimbutt525No ratings yet

- Randall AnswersDocument83 pagesRandall Answersmunashe shawnNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- Chapter 6 The Trial Balance Q1 HassanDocument1 pageChapter 6 The Trial Balance Q1 HassanAmyNo ratings yet

- Financial Statement - Yr 10Document1 pageFinancial Statement - Yr 10MUSTHARI KHANNo ratings yet

- Trial Balance and Final Accounts ProblemsDocument6 pagesTrial Balance and Final Accounts Problemsbhanu.chandu100% (1)

- Applications TD-1Document6 pagesApplications TD-1babyNo ratings yet

- Acc AssignmentDocument4 pagesAcc AssignmentBianca BenNo ratings yet

- Rivera and Santos PartnershipDocument31 pagesRivera and Santos PartnershipDaneca GallardoNo ratings yet

- Exercises On Financial StatementDocument10 pagesExercises On Financial Statementzuraidiroslan game100% (1)

- POA Online Final Revion - Paper 2Document13 pagesPOA Online Final Revion - Paper 2ricardogibbs9o9No ratings yet

- Additional Class Tutorial Basic Sopl SofpDocument2 pagesAdditional Class Tutorial Basic Sopl Sofpazra balqisNo ratings yet

- Delicious Desserts AdjustmentsDocument1 pageDelicious Desserts Adjustmentsmaxribeiro@yahoo.comNo ratings yet

- IS & SFP PracticeDocument3 pagesIS & SFP PracticesubachaluNo ratings yet

- Trade Receivables Control AccountDocument3 pagesTrade Receivables Control AccountChen Shu YingNo ratings yet

- Accounting Questions PracticesDocument2 pagesAccounting Questions PracticesSusanna Ng50% (2)

- BUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Document2 pagesBUS10250 Financial Accounting Semester B 2019/2020 Written Assignment 1Y KNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsBhuvaneshwari Palani0% (2)

- Tutorial 4 - QDocument3 pagesTutorial 4 - Qyingxean tanNo ratings yet

- ACP314 Competency PracticeDocument1 pageACP314 Competency PracticeJastine Rose CañeteNo ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- PracticeDocument1 pagePracticeNana CatNo ratings yet

- Project Guidelines TYBAF Sem 6 FA 7 5Document5 pagesProject Guidelines TYBAF Sem 6 FA 7 5Sanskar PankajNo ratings yet

- Unit 2Document15 pagesUnit 2neharajt06061No ratings yet

- Four Sons EnterpriseDocument2 pagesFour Sons EnterpriseNur Aqilah Fatonah Binti Ahmad RasidiNo ratings yet

- Problem 2-3A: Name: Section: 041911535049Document5 pagesProblem 2-3A: Name: Section: 041911535049Tyasa PutriNo ratings yet

- Pilot Test Solution Official (NLKT)Document36 pagesPilot Test Solution Official (NLKT)an27504No ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Question 2 (22 Marks)Document1 pageQuestion 2 (22 Marks)Rax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- Quadratic EquationsDocument1 pageQuadratic EquationsRax-Nguajandja KapuireNo ratings yet

- APA Referencing SummaryDocument16 pagesAPA Referencing SummaryRax-Nguajandja KapuireNo ratings yet

- APA Style - North West UniversityDocument19 pagesAPA Style - North West UniversityRax-Nguajandja KapuireNo ratings yet

- Principles of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaDocument10 pagesPrinciples of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaRax-Nguajandja KapuireNo ratings yet

- Unit 7 - Cost and ProductionDocument25 pagesUnit 7 - Cost and ProductionRax-Nguajandja KapuireNo ratings yet

- Unit 8 - Perfect CompetitionDocument20 pagesUnit 8 - Perfect CompetitionRax-Nguajandja KapuireNo ratings yet

- A Summary of The Design ProcessDocument11 pagesA Summary of The Design ProcessRax-Nguajandja KapuireNo ratings yet

- The Chartered Quantity SurveyorDocument23 pagesThe Chartered Quantity SurveyorRax-Nguajandja KapuireNo ratings yet

- Unit 6 - Consumer Equilibrium - 2019Document9 pagesUnit 6 - Consumer Equilibrium - 2019Rax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 2Document34 pagesSustainable Design Principles 2Rax-Nguajandja KapuireNo ratings yet

- MOCK AssignmentDocument1 pageMOCK AssignmentRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 6Document52 pagesSustainable Design Principles 6Rax-Nguajandja KapuireNo ratings yet

- Site Visit Memorandum of UnderstandingDocument1 pageSite Visit Memorandum of UnderstandingRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 5Document51 pagesSustainable Design Principles 5Rax-Nguajandja KapuireNo ratings yet

- Reviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Document7 pagesReviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Rosevilla AbneNo ratings yet

- All MCQ For Thompson 5eDocument47 pagesAll MCQ For Thompson 5eLindaLindyNo ratings yet

- Chapter-4 Admission of A Partner - Questions - Edit PDFDocument29 pagesChapter-4 Admission of A Partner - Questions - Edit PDFRahul AgarwalNo ratings yet

- CH 6 Control AccountDocument10 pagesCH 6 Control AccountPawan PoynauthNo ratings yet

- Final ExamDocument13 pagesFinal ExamLAGUN ROVELYNNo ratings yet

- Assignment On JournalDocument4 pagesAssignment On JournalNIKHIL GUPTANo ratings yet

- IAS 12 - Income TaxesDocument55 pagesIAS 12 - Income Taxesrafid aliNo ratings yet

- AP 5906Q ReceivablesDocument3 pagesAP 5906Q Receivablesxxxxxxxxx100% (2)

- Intermediate Aactg.1Document5 pagesIntermediate Aactg.1Charmane MatiasNo ratings yet

- Accountancy: Financial AccountingDocument12 pagesAccountancy: Financial AccountingRajan BhagatNo ratings yet

- Final AccountsDocument61 pagesFinal AccountsvimalaNo ratings yet

- Question Sheet AFMDocument48 pagesQuestion Sheet AFMGoku SayienNo ratings yet

- Markov Problem SetDocument8 pagesMarkov Problem SetChristian TanNo ratings yet

- Extra Exercises Adjustmen SPACEDocument6 pagesExtra Exercises Adjustmen SPACEMohd Rafi JasmanNo ratings yet

- MSDocument23 pagesMSWaqas PirzadaNo ratings yet

- 93-A China Banking Corporation v. Court of AppealsDocument2 pages93-A China Banking Corporation v. Court of AppealsAdi CruzNo ratings yet

- FA Sem 1 Concepts Booklet Merged 25.02.21Document114 pagesFA Sem 1 Concepts Booklet Merged 25.02.21Hardik MistryNo ratings yet

- CTPDocument53 pagesCTPsuraj nairNo ratings yet

- 9706 s09 QP 2Document33 pages9706 s09 QP 2roukaiya_peerkhanNo ratings yet

- BIR Ruling (C-168) 519-08Document12 pagesBIR Ruling (C-168) 519-08mifajNo ratings yet

- Assignment 2.2Document6 pagesAssignment 2.2GLEN JORDAN ANTONIONo ratings yet

- FAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019Document3 pagesFAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019ChjxksjsgskNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- Adjusting Entries - Uncollectible AccountsDocument2 pagesAdjusting Entries - Uncollectible AccountsCharish ImaysayNo ratings yet

- CH 07 WebDocument62 pagesCH 07 WebAireeseNo ratings yet

- Chapter 5 2023Document10 pagesChapter 5 202334Hoàng ThơNo ratings yet