Professional Documents

Culture Documents

Covid 19 Impact On Telecommunication PDF

Covid 19 Impact On Telecommunication PDF

Uploaded by

sanket sunthankarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Covid 19 Impact On Telecommunication PDF

Covid 19 Impact On Telecommunication PDF

Uploaded by

sanket sunthankarCopyright:

Available Formats

KARNATAK LAW SOCIETY’S

GOGTE INSTITUTE OF TECHNOLOGY

UDYAMBAG, BELAGAVI-590008

(An Autonomous Institution under Visvesvaraya Technological University, Belagavi)

(APPROVED BY AICTE, NEW DELHI)

Department of MASTER OF BUSINESS ADMINISTRATION

Project Report on

ECONOMIC IMPACT OF COVID 19 ON

TELECOMMUNICATION INDUSTRY

Submitted by

VINAY KAMAT 2GZ19MBA49

SANKET .S. SUNTHANKAR 2GZ19MBA31

VISHAL .S. KAGATI 2GZ19MBA52

VISHWANATH KENGNAL 2GZ19MBA54

DHANRAJ SUTAR 2GI19MBA24

Subject : Written Communication Division : B Subject Code : 18MBA203

Submitted to:

Prof. nupur a. veshne

Assistant Professor

Department of Master of Business Administration

2019 – 2020

Department of MBA, KLS GIT, Belagavi. Page 1

INTRODUCTION

The pandemic impacts almost every sector differently, with an opportunity

for some, albeit very few

Demand side:

India expects to witness a sharp though temporary decline in domestic

consumption. The service sector would likely suffer for a while, especially owing

to the behavioural and policy changes, as more people would prefer staying away

from cinemas, restaurants, hotels and malls. Travel restrictions would impact air

and rail traffic.

Investment side:

If the spread of the contagion is not contained, the investment activity in India

will also take a hit, as the outbreak would impact views on future business

activity. Rising global uncertainty and priorities to leverage existing capacities

would keep the investment outlook subdued. To mitigate the adverse impact on

exports, it is crucial for the Indian players to continue investing and building

capabilities, especially in the infrastructure and manufacturing space.

Employment side:

Employment, especially in urban areas is going to be significantly impacted,

especially temporary workers. Increased job uncertainty and reduced wages

would lead to lower income Growth. With investment plans slowing and funds

being redirected towards the managing crisis, job creation would take a back seat.

Supply side:

It would also take India a few months before the supply side pressures are eased,

as China and other markets recover from the aftermath of the pandemic. Supply-

side disruptions to production and trade have impacted global value chains and

India has not been immune to them either. It would be a few quarters before

production value chains come back to normal levels.

Department of MBA, KLS GIT, Belagavi. Page 2

While, at one hand India has a relative short window to avoid community spread

of the contagion from increasing exponentially. At the same time, the timeframe

to implement a coordinated response to manage the economic impact of the

Covid-19 pandemic is short and now. It is essential for the Government to

introduce a series of holistic measures in one-go. We don‘t believe, a piecemeal,

select sector approach will be able to address the economic contagion impact of

this global disaster. In fact, a piece-meal approach will be detrimental in

encouraging businesses to adopt various precautionary measures which would

slow business activity in these stressed times. To deal with a pandemic such as

Covid-19, the Government and private sector would have to look beyond the cost

and resource-intensiveness of required support. The impact of such a crisis could

be much worse if the spread of the virus is not slowed,

Department of MBA, KLS GIT, Belagavi. Page 3

EFFECT OF FALLOUT ON TELECOMMUNICATIONS SECTOR

As the global economy continues to reel from the shock and the lasting impact of

the novel corona virus (COVID-19) outbreak, “work from home” and “social

distancing” have become the buzzwords in today’s business landscape, with the

telecom sector being the invisible hand driving this shift. Remote working, video

conferencing, and telecommunications technology have quickly emerged as key

enablers for business operations during this lockdown, and streaming services

such as Netflix have become the go to source for entertainment, putting the

telecom sector in the spotlight today.

The importance of having a strong telecommunications network during this

lockdown has also been acknowledged by the government in the guidelines dated

March 24, 2020, issued by the Ministry of Home Affairs (MHA), which provides

that “telecommunications, internet services, broadcasting and cable services, IT

and IT-enabled services (ITeS) only (for essential services)” are the essential

services and are exempt from the lockdown. This exemption was also provided

in the MHA notification dated April 15, 2020 (which extended the lockdown until

May 3, 2020) and in the MHA notification dated May 1, 2020 (which further

extended the lockdown for a further period of two weeks).

According to news reports, overall traffic has jumped by 10% and streaming

platforms have witnessed a 20% spike in viewership. Hence, several analysts now

believe that unlike the manufacturing and other sectors that have come to a near

standstill, the telecom industry might emerge as the golden child of this economic

slowdown. However, the increased dependency on telecom networks, and the

other restrictions on account of COVID-19, has raised a different set of challenges

for the telecom sector.

Department of MBA, KLS GIT, Belagavi. Page 4

MAJOR CHALLENGES FOR TELECOMMUNICATION INDUSTRY

A. Implementation of exemptions for the telecom industry

Although the MHA had clarified that telecommunications, IT and ITeS were

exempted from the lockdown, there were instances of local authorities asking

personnel of telecom service providers at NOCs (network operation centres) and

call centres to shut down operations. In response, the Department of

Telecommunications (DoT) had written to chief secretaries of states on March

21, urging them to allow movement of field staff of telecom companies.

It is therefore essential that appropriate instructions are received at the field level

so that the services can continue without interruption. The DoT had also written

to chief secretaries of all states on March 24, requesting them to designate a nodal

officer who can be contacted by service providers and telecom licensees in the

event of any difficulty.

This is critical given that on-ground staff need continued access to towers for

maintenance, to identify potential risks, and refuelling (for towers using diesel

genets). This move may help mitigate some of the issues seen at the local level,

in ensuring that there are no obstructions in the working of the telecom sector.

B. Rising demand and current infrastructure

While demand for services continues to spike, given India’s dependence on

wireless traffic, there is increased pressure on cellular infrastructure.

According to reports, the mean mobile and broadband download speeds in India

had fallen in March due to strain on the networks. Hence, the Cellular Operators

Association of India (COAI) has written to the Government to request streaming

service providers such as Netflix, Amazon Prime Video and Zee5 to switch to a

lower definition streaming, to reduce advertisements and pop-ups, etc., in a bid

to ease the strain on existing networks. Several service providers have already

started working on this issue.

Industry analysts have stated that as far as telecommunication networks are

concerned, fears of network choking are unfounded since there is sufficient

additional capacity. However, the switch in network usage to residential networks

Department of MBA, KLS GIT, Belagavi. Page 5

as opposed to enterprise networks (which is technologically better configured for

the high load traffic) may present another set of challenges on managing network

load. This trend may result in deeper broadband penetration for residential use.

In order to meet demand, going forward, the COAI has written, vide letter dated

March 20, 2020, to the Government to ease norms and expedite approvals for

providing services, setting up towers and to instruct state-owned firms (MTNL

and BSNL) to not terminate any interconnection points.

C. Impact of the lockdown restrictions

Admittedly, while there is increasing demand for telecom services, the telecom

sector is dependent on several other industries, which have been adversely

affected by the lockdown.

1. Impact on Manufacturing of hardware and other systems

According to reports, handset and network equipment manufacturers will be

impacted due to global disruption in supply chains, which will lead to increased

costs and lack of availability. Under the MHA order dated May 1, 2020,

manufacturing of IT hardware has been permitted even in red zones, however no

such activities can be undertaken in areas designated as containment zones.

According to industry body Indian Cellular and Electronics Association (ICEA),

manufacturers may incur losses to the tune of nearly INR 15,000 crore due to

suspension of production. Market analysts have recommended easing taxes and

levies and relaxing costs on financial aid to ease the burden on the manufacturing

sector, which will have a domino effect on the telecom industry.

2. Addition of new subscribers

Given the movement restrictions during this lockdown, there has been a sharp dip

in the number of customers purchasing new sim cards (including for migration to

4G networks).

COAI has indicated that during a regular month, the average net addition is 3

million subscribers, but due to COVID-19, the number in March may be below 1

million. We are likely to see impact on revenues only in the first quarter of FY

2020-21. COAI has stated that it takes around 30-45 days for new subscriptions

Department of MBA, KLS GIT, Belagavi. Page 6

to impact revenue and therefore the impact of a dip in new subscriptions will be

seen only around April end or early May.

Additionally, the lockdown is also likely to delay 5G spectrum auctions and its

consequent rollout as network operators are currently focused on meeting

increased demand without a dip in service quality. Due to restrictions on

manufacturing and movement of goods, this will also limit the ability to roll out

5G enabled handsets.

3. Impact on tariffs

Even after the last round of tariff hikes late last year, India continues to have the

lowest tariff rates in the world.

The lower tariffs, as a result of increased competition due to new entrants in the

market, led to a situation where the revenues of the incumbent Telcos were

considered almost unsustainable for their balance sheets.

Reports indicate that a second round of tariff hikes had been planned in the April-

June quarter of 2020, however, given

(i) the impact of COVID-19 on spending ability (especially of low income

subscribers),

(ii) the benefits required to be extended by Telcos (as stated above)

(iii) the dip in subscriptions, the planned tariff hikes may be delayed to the

second half of 2020.

TRAI had floated a consultation paper on the need to set floor price (so as to

ensure reasonable return on capital) and the COAI had written to TRAI,

requesting that an open house be conducted digitally to fix floor pricing. This

would, while being within the authority of TRAI, be a departure from the existing

regulatory forbearance maintained by TRAI in relation to tariff fixation. The

proposed discussions on setting up the floor tariff have been deferred until the

current situation eases.

4. Subscriber Retention

Market share is one of the most important performance metric held closest to the

chest by Telcos. Given the challenges of increasing market share in such times,

Department of MBA, KLS GIT, Belagavi. Page 7

focus would automatically move towards preserving the existing subscriber base.

This is most challenging with respect to low ARPU (Average Revenue per User)

subscribers. During this lockdown period, there are reports that Telcos have

granted dispensations to their subscribers – like extended validity, additional talk

time benefits, etc., as attractions to continue service. TRAI, raising concerns

around price discrimination, has, on April 7, 2020, written to Telcos, alleging that

they were selectively increasing validity of prepaid users during the lockdown.

However, the Telcos have written back to the regulator, contending that they have

provided benefits worth at least INR 600 crores to subscribers who are at the

bottom of the pyramid to ensure connectivity during this time. These initiatives

would be towards reducing drop-outs for low ARPU subscribers, who otherwise

would not necessarily have be in a position to make timely recharges, either due

to monetary reasons or access to online recharging facilities. This initiative also

helps towards ensuring connectivity of larger masses and for widespread

information dissemination, which is critical at this point. This is consistent with

the representation by the Telcos to TRAI, where they have stated that if these

benefits were offered to an extended pool, this would amount to “an unjustified

subsidy” to the customers who can afford these services and cause a steep loss to

the industry. Subsequently, TRAI has undertaken a detailed review and has

decided not to issue any further directives at present.

5. Power tariffs

Given the increased burden on the existing telecom infrastructure, the Tower and

Infrastructure Providers Association (TAIPA), which includes Bharti Infratel,

and Indus Towers as its members, has written to various states, seeking relief in

power tariffs. The Maharashtra State Electricity Regulatory Commission

(MSERC) has proposed to reduce tariffs in the state by up to 10-15 percent.

TAIPA has stated that similar relief from other state authorities would support

telecom infrastructure providers in the present situation.

Department of MBA, KLS GIT, Belagavi. Page 8

D. Adjusted Gross Revenue (AGR) and other existing issues in the telecom

sector

The COVID-19 outbreak and the resultant lockdown have come at a time when

the telecommunications sector was already grappling with the issue of payment

of Adjusted Gross Revenue (AGR). The Supreme Court had recently rejected the

self-assessments of AGR dues undertaken by a few Telcos and had refused to

take up the Centre’s submission to allow telecom companies an extended period

of 20 years to pay the AGR dues, stating that the matter will be listed in two

weeks.

Now, due to COVID-19, there is uncertainty around the listing of the matter in

the Supreme Court. However, reports state that as of now, no notices have been

sent to the Telcos for AGR dues and the focus of DoT is to ensure smooth

operations during the pandemic.

In the event the sought relief is not granted by the Supreme Court, and the Telcos

would be required to pay the AGR in full or without any deferment, the financial

impact on Telcos could be severe. If the revenues and available cash are not

sufficient to pay the license fees (based on the revised interpretation of AGR),

Telecos may be forced to consider increasing debt to meet demand. But, given

the precarious financial conditions, lenders willing to extend financial assistance

will be scarce and cost of borrowing will be higher (as compared to the pre-

COVID situation), given the impact on the sector, creating a vicious cycle.

To help the industry and the economy, the RBI has issued certain relaxations to

ease repayment and access to working capital, such as a moratorium of three

months on payments of all instalments falling due between March 1, 2020 and

May 31, 2020.

A recent report by ICRA also indicates that the debt levels in the industry, which

moderated to around Rs 4.4 lakh crore as of March 31, 2020, may rise further on

account of the AGR dues to almost Rs 4.6 lakh crore.

Other ongoing issues include exemption of GST on license fee and payment for

spectrum acquired in auctions, and exemption from service tax on amount of

license fee payable pursuant to the order of the Supreme Court. While these were

ongoing discussions (with the government), the lockdown and the pandemic will

lead to a delay in outcome.

Department of MBA, KLS GIT, Belagavi. Page 9

E. Outlook and way forward

The general outlook, globally as well as in India, considers the telecom sector to

be one of the few that may escape unscathed from the pandemic and the resultant

lockdown. The government and all stakeholders are also cognizant of the

importance of these services, given the current scenario. We are seeing steps

being taken to address short-term issues as and when they come to light. Despite

the issues, the increased demand for services may help offset any dip in revenues,

especially the high-end subscribers and other people who have been working

from home and those who need strong and reliable network to continue

functioning.

An additional area where Telcos may be able to help is in assisting the

government with outreach and analytics to spread awareness about COVID-19,

and to provide anonymized data to the government for analytics, which could be

used for developing plans for combating the pandemic. The DoT and mobile

phone operators are working to track location details of calls to closely track

movement of COVID-19 patients as well as to monitor migrant laborers to help

them with food and employment. Several Telcos have already started taking steps

in this direction. Further dialogue between regulators and service providers would

go a long way towards, firstly, resolving some of the issues highlighted above,

especially considering the importance of the telecom sector today, and secondly,

toward developing effective strategies against the pandemic.

Department of MBA, KLS GIT, Belagavi. Page 10

STRATEGIES TO REVIVE TELECOMMUNICATION SECTOR

We are witnessing new normal after lockdown in the country. Remote working,

Home entertainment, video streaming, Remote Education, use of collaborative

platform and accelerated use of digital payments have quickly become the life

blood of modern society.

Many analysts believe once we’re through the worse of this virus, Telecom will

be one of the few still standing and, in many aspects become part of normal life.

While this new normal have opened up new horizon of opportunities for

communication service providers, they will also be challenged to meet up the

requirements of consistent demand for High Speed Broad Band connection, High

quality service experience, Quick resolution time, Customer segmentation based

on their usage habits and preferences, Retention of customers,

5G and Fiber to Home

These global opportunities will present itself in different forms in different parts

of the world. Roll out of 5G which was expected to take off in 2020 onwards in

developed countries will only get delayed as CSPs will be extremely careful in

massive capex investment until global economy is coming out of recession.

Emerging countries like India and other South East Asian countries will delay

their investment in 5G and would rather leverage the investment made in 4G

Fixed Broad Band was gaining momentum for providing high speed internet

connectivity along with triple play and Quad play services and current scenarios

have presented accelerated opportunities to meet up the sudden need of high-

speed connectivity.

There will be need of supporting multiple services like High speed Internet (HSI),

OTT services like You tube, Netflix, Amazon prime, collaborative platforms like

WebEx, Microsoft Team, Zoom etc for remote working and also remote

education simultaneously.

In countries where 5G roll out is stunted due to Capex constraints arising out of

onslaught of Covid -19, High speed internet connectivity through fiber will open

up new opportunities for ISPs. They will be able to leverage the current Home

pass assets for connecting end users.

Department of MBA, KLS GIT, Belagavi. Page 11

Technology as major Business Enabler:

Investment in technology platforms will be critically vital to track the new needs,

spot the opportunities ahead of others and fulfil those demands quickly.

Traditional practice of increasing number of foot soldiers for Network Operation

and Maintenance, collecting data from many desperate applications for customer

insights, despatch of truck roll for home broad band and ordinary call centre have

to be substituted by new technology platform like Real time analytics for network

performance and Customer Analytics powered by Artificial intelligence and

Machine Learning.

It would be imperative to capture customer experience insights in advance and

cross relate experience index with other network performance parameters to

identify the problems pro-actively and initiate actions. Traditional Network

Operation Centres (NOC) has been built to capture network alarms and faults at

only Network element level.

Capability of capturing and fusing multiple inputs can be effectively delivered by

Network analytics Solution powered by sophisticated algorithms and Artificial

Intelligence.

CONCLUSION

As the world continues to cope with the effects of Covid-19, the

telecommunication companies and tech sector has undoubtedly come to the

forefront as the golden child of the global economy. But telecom companies with

clear vision of deploying technology driven approach to deliver best in class

service will get differentiated from those with traditional approach.

Deployment of Analytics solution, Artificial Intelligence and Machine learning

for getting insights of customer behaviour, determining their emerging needs and

fulfilling those in most efficient manner will be incredibly important now and

also in future.

Department of MBA, KLS GIT, Belagavi. Page 12

You might also like

- Occupational Safety Health and Working Conditions Code 2020Document3 pagesOccupational Safety Health and Working Conditions Code 2020Avil HarshNo ratings yet

- Bess Price LectureDocument7 pagesBess Price Lectureundeliverableau3870No ratings yet

- Tax AssignmentDocument7 pagesTax AssignmentNaiha AbidNo ratings yet

- Cross Border Investment Internal 1 Adrianna Lillyan Thangkhiew 17010125260Document8 pagesCross Border Investment Internal 1 Adrianna Lillyan Thangkhiew 17010125260lillyanNo ratings yet

- FM ProjectDocument9 pagesFM Projectkhyati agrawalNo ratings yet

- Historical Development of Trade Union in IndiaDocument7 pagesHistorical Development of Trade Union in Indiashiv161No ratings yet

- The Path Forward For Digital Asset Adoption in India PDFDocument36 pagesThe Path Forward For Digital Asset Adoption in India PDFAman ShahNo ratings yet

- International Double Taxation AgreementsDocument22 pagesInternational Double Taxation AgreementsMithlesh YadavNo ratings yet

- Role of Banks in The Development of EconomyDocument25 pagesRole of Banks in The Development of EconomyZabed HossenNo ratings yet

- MUN WTO Intellectual Property Rights Backgoround GuideDocument16 pagesMUN WTO Intellectual Property Rights Backgoround Guideshireen95No ratings yet

- Assessment & Procedure & Other Concepts: Dr. Shakuntala Misra National Rehabilitation UniversityDocument14 pagesAssessment & Procedure & Other Concepts: Dr. Shakuntala Misra National Rehabilitation UniversityShubham PathakNo ratings yet

- Fdi in India PDFDocument12 pagesFdi in India PDFpnjhub legalNo ratings yet

- Depository System in IndiaDocument22 pagesDepository System in Indiamishra_shashishekhar97No ratings yet

- NATIONAL LAW INSTITUTE UNIVERSITY Equity FinalDocument20 pagesNATIONAL LAW INSTITUTE UNIVERSITY Equity FinalHrishikeshNo ratings yet

- Bank GuaranteeDocument11 pagesBank GuaranteeAnanya ChoudharyNo ratings yet

- Intellectual Property Rights and BlockchainDocument3 pagesIntellectual Property Rights and BlockchainRoss DennyNo ratings yet

- Ibc 2016 MDocument11 pagesIbc 2016 MMayank SenNo ratings yet

- Humanitarian and Refugee LawDocument13 pagesHumanitarian and Refugee Lawvaibhav bangarNo ratings yet

- From (Abiha Zaidi (Abihazaidi - Nliu@gmail - Com) ) - ID (27) - My Digital Signatures - FinalDocument21 pagesFrom (Abiha Zaidi (Abihazaidi - Nliu@gmail - Com) ) - ID (27) - My Digital Signatures - FinalAnonymous eXiWtAnNo ratings yet

- Ratio Decendi Obiter Dicta Stare DecisesDocument2 pagesRatio Decendi Obiter Dicta Stare DecisesSatyam PathakNo ratings yet

- Banking TanayaDocument17 pagesBanking TanayaAbhishek PratapNo ratings yet

- Social Security Agreementsfdsmsfngmfnsfv G FM VXC VV XCVXVN FNG, FBG, FG, Nxcv,,xcvbnxcvbsfgjsflkagksbgnfgm, Asn FM, NdsaggmfdgDocument12 pagesSocial Security Agreementsfdsmsfngmfnsfv G FM VXC VV XCVXVN FNG, FBG, FG, Nxcv,,xcvbnxcvbsfgjsflkagksbgnfgm, Asn FM, NdsaggmfdgVishal VnNo ratings yet

- Clubbing of IncomeDocument17 pagesClubbing of IncomeAnonymous K0ZhcHT2iuNo ratings yet

- Intellectual Property RightsDocument7 pagesIntellectual Property RightsShreyas SinghNo ratings yet

- Labour FDDocument36 pagesLabour FDSushrut ShekharNo ratings yet

- Banking Law (Final Draft) ON Islamic Banking: Changing Views of Banking in IndiaDocument12 pagesBanking Law (Final Draft) ON Islamic Banking: Changing Views of Banking in IndiaAnonymous Rds6k7No ratings yet

- Term Paper: Dr. R.Anita RaoDocument26 pagesTerm Paper: Dr. R.Anita Raosuchanda87No ratings yet

- Abhuday Investment and Securities Law ProjectDocument14 pagesAbhuday Investment and Securities Law ProjectRahul TiwariNo ratings yet

- IBC Project. MonikaDocument30 pagesIBC Project. MonikaIayushsingh SinghNo ratings yet

- F4eng 2010 AnsDocument12 pagesF4eng 2010 AnssigninnNo ratings yet

- Copyright Filing IndiaDocument2 pagesCopyright Filing IndiaBalaji NNo ratings yet

- Taxation - Income TaxDocument158 pagesTaxation - Income Taxnaren197667% (6)

- A Study of Secured and Unsecured Debenture With ExamplesDocument15 pagesA Study of Secured and Unsecured Debenture With ExamplesankitNo ratings yet

- Exceptions To Doctrince of Indoor MGT, Prospectus, Etc.Document3 pagesExceptions To Doctrince of Indoor MGT, Prospectus, Etc.Maduka CollinsNo ratings yet

- Charitable or Religious Trusts and Institutions, Political Parties and Electoral TrustsDocument71 pagesCharitable or Religious Trusts and Institutions, Political Parties and Electoral TrustsShreyash SinghNo ratings yet

- Rent Control Act 1Document16 pagesRent Control Act 1krishna garg100% (1)

- Lot FDDocument16 pagesLot FDShikhar TandonNo ratings yet

- Jamia Millia Islamia University Faculty of LawDocument13 pagesJamia Millia Islamia University Faculty of LawShimran ZamanNo ratings yet

- E-Commerce Laws and Regulations in India: Issues and ChallengesDocument10 pagesE-Commerce Laws and Regulations in India: Issues and ChallengesRaju KumarNo ratings yet

- Pradhan Mantri Mudra Yojana: EconomicsDocument16 pagesPradhan Mantri Mudra Yojana: EconomicsAJIT SHARMANo ratings yet

- Cyber LawDocument16 pagesCyber LawPrateethi SinghviNo ratings yet

- 86806-RBI Comm PolicyDocument5 pages86806-RBI Comm PolicyrbrNo ratings yet

- Child Aduction: Conflict of LawsDocument36 pagesChild Aduction: Conflict of LawsAnirudh AroraNo ratings yet

- Amity Law School Amity University, LucknowDocument15 pagesAmity Law School Amity University, LucknowROHIT SINGH RajputNo ratings yet

- Khong - The Economic Justifications For Intellectual Poperty RightsDocument8 pagesKhong - The Economic Justifications For Intellectual Poperty RightsSelvantheranNo ratings yet

- Health Law LTP Final SubmissionDocument14 pagesHealth Law LTP Final SubmissionSAINATH ASORENo ratings yet

- Inter State Migrant WorkersDocument13 pagesInter State Migrant WorkersSmitha DavidNo ratings yet

- Damodaram Sanjivayya National Law University Sabbavaram, Visakhapatnam, A.P., India Project TitleDocument10 pagesDamodaram Sanjivayya National Law University Sabbavaram, Visakhapatnam, A.P., India Project Titlesarayu alluNo ratings yet

- Rajneesh DPC FDDocument26 pagesRajneesh DPC FDUdit KapoorNo ratings yet

- Digital Banking Challenges and Opportunities in in PDFDocument5 pagesDigital Banking Challenges and Opportunities in in PDFHafsa HamidNo ratings yet

- Law of DesignDocument24 pagesLaw of DesignSanjeev ChaswalNo ratings yet

- Cyber Law ProjectDocument13 pagesCyber Law ProjectPapiya DasguptaNo ratings yet

- Business EnvironmentDocument29 pagesBusiness EnvironmentShreyaNo ratings yet

- Cyber PDFDocument14 pagesCyber PDFHimanshumalikNo ratings yet

- Banking LawDocument17 pagesBanking LawpermanikaNo ratings yet

- Jurisdiction On CyberspaceDocument21 pagesJurisdiction On CyberspaceAntarik DawnNo ratings yet

- Need For Enlargement of Security Council International LawDocument25 pagesNeed For Enlargement of Security Council International LawNidhi NavneetNo ratings yet

- The Challenges of The Goods and Service Tax GST Implementation in IndiaDocument9 pagesThe Challenges of The Goods and Service Tax GST Implementation in Indiasatnam_25No ratings yet

- Manveen 1020161751 Energy LawDocument12 pagesManveen 1020161751 Energy LawAngel SharmaNo ratings yet

- Reflection of The Movie Informant - RevisedDocument3 pagesReflection of The Movie Informant - RevisedBhavika BhatiaNo ratings yet

- The International Telecommunications Regime: Domestic Preferences And Regime ChangeFrom EverandThe International Telecommunications Regime: Domestic Preferences And Regime ChangeNo ratings yet

- Find The Error PDFDocument7 pagesFind The Error PDFsanket sunthankarNo ratings yet

- Industrial Relationship: Presented by Vishal Kagati Vishwanath K NazimDocument14 pagesIndustrial Relationship: Presented by Vishal Kagati Vishwanath K Nazimsanket sunthankarNo ratings yet

- Aura Schedule 2019Document4 pagesAura Schedule 2019sanket sunthankarNo ratings yet

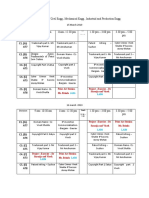

- Students of Civil Engg., Mechanical Engg., Industrial and Production EnggDocument3 pagesStudents of Civil Engg., Mechanical Engg., Industrial and Production Enggsanket sunthankarNo ratings yet

- Pgcet Syllabus 12345Document3 pagesPgcet Syllabus 12345sanket sunthankarNo ratings yet

- How Venture Capital Firms WorkDocument8 pagesHow Venture Capital Firms Worksanket sunthankarNo ratings yet

- Schedule and Details For VTU Resume EntryDocument2 pagesSchedule and Details For VTU Resume Entrysanket sunthankarNo ratings yet

- SPJAT SAMPLE PAPER No 1 PDFDocument15 pagesSPJAT SAMPLE PAPER No 1 PDFsanket sunthankarNo ratings yet

- Assignment Ed 555Document10 pagesAssignment Ed 555sanket sunthankarNo ratings yet

- Project Report Employee EngagementDocument10 pagesProject Report Employee Engagementsanket sunthankarNo ratings yet

- Anmol FinalDocument4 pagesAnmol Finalsanket sunthankar100% (1)

- Mba GitDocument1 pageMba Gitsanket sunthankarNo ratings yet

- Calendar of Events 19.12.2018 2Document3 pagesCalendar of Events 19.12.2018 2sanket sunthankarNo ratings yet

- Gender and Society LESSON 9: Representation of Women in Media and Masculinity and FemininityDocument6 pagesGender and Society LESSON 9: Representation of Women in Media and Masculinity and FemininityCamille AdarnaNo ratings yet

- SALOMA - On Being A Scientist in One's Home CountryDocument5 pagesSALOMA - On Being A Scientist in One's Home CountryCarylNo ratings yet

- Passage About English and RubberDocument6 pagesPassage About English and RubberEman Mohamed AminNo ratings yet

- English 6 WorkbookDocument212 pagesEnglish 6 WorkbookRodel Agcaoili100% (1)

- Agents of SocializationDocument18 pagesAgents of SocializationGodofredo HermosuraNo ratings yet

- Arc Gallery Presentation FinalDocument25 pagesArc Gallery Presentation Finalapi-644709614No ratings yet

- January 30, 2023: University DentistDocument4 pagesJanuary 30, 2023: University DentistDeneene VillarinNo ratings yet

- Ibm Project Concept NoteDocument6 pagesIbm Project Concept Notesana08shaikNo ratings yet

- IRCA Seminar Info Material SWISSDocument5 pagesIRCA Seminar Info Material SWISSTouraj ANo ratings yet

- Functions of Bar Council & CommitteesDocument2 pagesFunctions of Bar Council & CommitteesBhargav Shorthand ClassesNo ratings yet

- Second Round Call For IPSF Team 2016-17Document11 pagesSecond Round Call For IPSF Team 2016-17International Pharmaceutical Students' Federation (IPSF)No ratings yet

- JUMP Math AP Book 3-1 Sample OA3-10 To 14 - 2Document15 pagesJUMP Math AP Book 3-1 Sample OA3-10 To 14 - 2Sónia RodriguesNo ratings yet

- 9234 Holiday Postcards PDFDocument3 pages9234 Holiday Postcards PDFCoordinación Académica IEST CúcutaNo ratings yet

- Role of Government in Organizing EdpsDocument22 pagesRole of Government in Organizing EdpsNaveen NNo ratings yet

- Educ 102Document6 pagesEduc 102Christian GonzalesNo ratings yet

- Inyada, Aladi EvelynDocument93 pagesInyada, Aladi EvelynJames Daniel Agbo100% (1)

- D Epartment of Education: R Epublic of The P HilippinesDocument3 pagesD Epartment of Education: R Epublic of The P HilippinesNIMFA PADILLANo ratings yet

- Certificate of Participation: Sta. Lucia Elementary SchoolDocument4 pagesCertificate of Participation: Sta. Lucia Elementary SchoolPRINCESS EUNICE LANDAYANNo ratings yet

- Xii l.1 PPT of The Last LessonDocument15 pagesXii l.1 PPT of The Last Lessonriya RiyaNo ratings yet

- Nisha ValviDocument11 pagesNisha ValviAnonymous CwJeBCAXpNo ratings yet

- Participatory DevelopmentDocument20 pagesParticipatory DevelopmentFranditya UtomoNo ratings yet

- Principles Of: Course Instructor: MS ATIYADocument39 pagesPrinciples Of: Course Instructor: MS ATIYABOSS HASHMINo ratings yet

- Cornwell 308148002 HPSC 3023 Major EssayDocument12 pagesCornwell 308148002 HPSC 3023 Major EssayBenjamin GordonNo ratings yet

- Type Appearance CauseDocument18 pagesType Appearance CauseTasbir AbirNo ratings yet

- EAD 523 - Clinical Field Experience B - Improving New Teacher Induction StrategiesDocument4 pagesEAD 523 - Clinical Field Experience B - Improving New Teacher Induction Strategiesshirley moligaNo ratings yet

- 9 Box + Chart TemplateDocument2 pages9 Box + Chart TemplateIqrä QurëshìNo ratings yet

- Career Ready StudentsDocument6 pagesCareer Ready StudentsIulia PetrescuNo ratings yet

- DHANANJAY SINGH-Model2Document1 pageDHANANJAY SINGH-Model2Ar Jitendra KumarNo ratings yet

- Perception About Gender Equality of Senior High School Students in General de Jesus College S.Y. 2019 - 2020Document48 pagesPerception About Gender Equality of Senior High School Students in General de Jesus College S.Y. 2019 - 2020Kaira Jeen PangilinanNo ratings yet