Professional Documents

Culture Documents

SMO Economies

SMO Economies

Uploaded by

tawfic noorCopyright:

Available Formats

You might also like

- Solutions PepallDocument48 pagesSolutions PepallJoseph Guen67% (6)

- Managerial Economics 8th Edition Samuelson Solutions Manual DownloadDocument18 pagesManagerial Economics 8th Edition Samuelson Solutions Manual DownloadJulie Tauscher100% (23)

- 4-The Determinants of Industry Concentration Barriers To EntryDocument57 pages4-The Determinants of Industry Concentration Barriers To Entrydivyarai12345100% (1)

- Concepts and Theories of Local Economic DevelopmentDocument46 pagesConcepts and Theories of Local Economic DevelopmentAllonah G. de GuzmanNo ratings yet

- Agglomeration Economies - A Literature ReviewDocument15 pagesAgglomeration Economies - A Literature ReviewWang XiaoNo ratings yet

- What Are External Economies of Scale?Document19 pagesWhat Are External Economies of Scale?gebeyehu kasayeNo ratings yet

- Economies of Scale & Scope: A Comprehensive AnalysisDocument5 pagesEconomies of Scale & Scope: A Comprehensive AnalysisAarti GuptaNo ratings yet

- Fin IndustryDocument10 pagesFin IndustryJudithRavelloNo ratings yet

- Determinants of Economies of Scale in Large BusineDocument7 pagesDeterminants of Economies of Scale in Large BusineRudi IryantoNo ratings yet

- 4 Managerial EconomicsDocument8 pages4 Managerial EconomicsBoSs GamingNo ratings yet

- Economies of Scale NotesDocument6 pagesEconomies of Scale NotesRadeenaNo ratings yet

- Week 3: Innovation, Enterprise and SocietyDocument23 pagesWeek 3: Innovation, Enterprise and SocietyOmar RiberiaNo ratings yet

- Kuliah Growth Pole Theory 1Document33 pagesKuliah Growth Pole Theory 1Mas SuntariNo ratings yet

- Chapter Economics of ScaleDocument4 pagesChapter Economics of ScaleRashed SifatNo ratings yet

- Economies and Diseconomies of Scale AswathyDocument8 pagesEconomies and Diseconomies of Scale AswathyAnu stephie NadarNo ratings yet

- Garments Value ChainDocument19 pagesGarments Value ChainAynul HoqNo ratings yet

- Baby Anjali Manyam Journal 4 3470312 1898071800Document5 pagesBaby Anjali Manyam Journal 4 3470312 1898071800anjaNo ratings yet

- Economies of ScaleDocument3 pagesEconomies of ScaleSujith KmNo ratings yet

- Literature Review On Vertical Integration of RetailersDocument17 pagesLiterature Review On Vertical Integration of RetailersNelum Shehzade100% (2)

- Economies of ScaleDocument15 pagesEconomies of Scalerina_angelinaNo ratings yet

- Lecture Notes Lectures 3 Why Do Firms Cluster PDFDocument4 pagesLecture Notes Lectures 3 Why Do Firms Cluster PDFminlwintheinNo ratings yet

- Economies & Diseconomies of ScaleDocument7 pagesEconomies & Diseconomies of Scalerajusrini91No ratings yet

- Economics ScaleDocument5 pagesEconomics ScaleHepsi KonathamNo ratings yet

- (CAP 2) Modern-Urban-and-Regional-EconomicsDocument24 pages(CAP 2) Modern-Urban-and-Regional-EconomicsMaria Belen Torres DiazNo ratings yet

- Internal Economies of Scale Are FirmDocument3 pagesInternal Economies of Scale Are FirmAbdelrahman DaakirNo ratings yet

- Economies of Scale - Profitability & InnovationDocument13 pagesEconomies of Scale - Profitability & InnovationAppan Kandala VasudevacharyNo ratings yet

- Supply Chain Control: A Theory of Vertical IntegrationDocument34 pagesSupply Chain Control: A Theory of Vertical IntegrationLuis Pablo BarragánNo ratings yet

- Shiman 2008 The Intuition Behind Suttonâ ™s Theory of Endogenous SunkDocument34 pagesShiman 2008 The Intuition Behind Suttonâ ™s Theory of Endogenous SunkCristinaNo ratings yet

- Scale of ProductionDocument9 pagesScale of ProductionOnindya MitraNo ratings yet

- Vertical IntegrationDocument25 pagesVertical IntegrationCicero CastroNo ratings yet

- SSRN Id8713Document50 pagesSSRN Id8713Joa PintoNo ratings yet

- 2022 SH1 H2 CA3 Question Suggested Answer MR Low CommentsDocument9 pages2022 SH1 H2 CA3 Question Suggested Answer MR Low CommentsShanae LeeNo ratings yet

- 3.2 Economies of Scale NotesDocument12 pages3.2 Economies of Scale NotesBAF 09 TISHA BHANSALINo ratings yet

- Economies of Scale and ExamplesDocument30 pagesEconomies of Scale and ExamplesSalman KhanNo ratings yet

- Achieving Sustainable Development Goals Through Ident - 2020 - International JouDocument13 pagesAchieving Sustainable Development Goals Through Ident - 2020 - International JouBona Christanto SiahaanNo ratings yet

- 5 UnitDocument8 pages5 UnitrealexplorerNo ratings yet

- Economies Scale Internal ExternalDocument3 pagesEconomies Scale Internal ExternalAyyaz FakharNo ratings yet

- International Trade Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFDocument28 pagesInternational Trade Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFRobinCummingsfikg100% (10)

- International Finance Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFDocument27 pagesInternational Finance Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFPamelaHillqans100% (14)

- International Finance Theory and Policy 10th Edition Krugman Solutions ManualDocument6 pagesInternational Finance Theory and Policy 10th Edition Krugman Solutions Manualkhucly5cst100% (26)

- The Risk-Reward Nexus in The Innovation-Inequality Relationship - Who Takes The Risks - Who Gets The RewardsDocument36 pagesThe Risk-Reward Nexus in The Innovation-Inequality Relationship - Who Takes The Risks - Who Gets The Rewardsbruce.cao2050No ratings yet

- The Importance of Industry StructureDocument16 pagesThe Importance of Industry StructurePriyan DsNo ratings yet

- Externalitiesv 2Document3 pagesExternalitiesv 2chidubem grace UgwuNo ratings yet

- Curs 7 BarsanDocument3 pagesCurs 7 BarsanroxxNo ratings yet

- GY300 Topic 3:4 ReadingDocument3 pagesGY300 Topic 3:4 ReadingShaista FarooqNo ratings yet

- Economies of ScopeDocument20 pagesEconomies of ScopeGirish KukrejaNo ratings yet

- 3566 Micro EconomicsDocument60 pages3566 Micro EconomicsPirya HussainNo ratings yet

- Economies of Scale - Wikipedia, The Free EncyclopediaDocument3 pagesEconomies of Scale - Wikipedia, The Free EncyclopediaPankaj SriNo ratings yet

- Financial DictionaryDocument15 pagesFinancial DictionaryMJoyce Dela CruzNo ratings yet

- Market Integration: Study Guide For Module No. 3Document8 pagesMarket Integration: Study Guide For Module No. 3Ma. Angelika MejiaNo ratings yet

- University of International Business and Economics: AssignmentDocument7 pagesUniversity of International Business and Economics: AssignmentNabeel Safdar100% (1)

- Transaction CostDocument12 pagesTransaction CostkarirkuNo ratings yet

- TCW-Module-3-Market-Integration 1Document8 pagesTCW-Module-3-Market-Integration 1Jazmine Cleobell B. LaynoNo ratings yet

- Dynamizing Innovation Systems Through Induced Innovation Networks: A Conceptual Framework and The Case of The Oil Industry in BrazilDocument4 pagesDynamizing Innovation Systems Through Induced Innovation Networks: A Conceptual Framework and The Case of The Oil Industry in Brazilhendry wardiNo ratings yet

- Corporate StrategyDocument52 pagesCorporate Strategytomstor9No ratings yet

- Clusters and Economic Policy White PaperDocument10 pagesClusters and Economic Policy White PaperShahzod QuchkorovNo ratings yet

- MERIT-Infonomics Research Memorandum SeriesDocument54 pagesMERIT-Infonomics Research Memorandum SeriesBrendon HoNo ratings yet

- 5 Dunning's OLI and Porter's Diamond, Global Sourcing and ProductionDocument9 pages5 Dunning's OLI and Porter's Diamond, Global Sourcing and ProductionOlga LiNo ratings yet

- A Technological and Organisational Explanation For The Size Distribution of FirmsDocument14 pagesA Technological and Organisational Explanation For The Size Distribution of FirmsCore ResearchNo ratings yet

- Basic Economic Ideas and Resource Allocation: Ideas For Answers To Progress QuestionsDocument4 pagesBasic Economic Ideas and Resource Allocation: Ideas For Answers To Progress QuestionsChristy NyenesNo ratings yet

- Env 313.2 Biodiversity and Conservation of Species Assignment 1Document7 pagesEnv 313.2 Biodiversity and Conservation of Species Assignment 1tawfic noorNo ratings yet

- ENV 373 Sec3 Groups 2020Document2 pagesENV 373 Sec3 Groups 2020tawfic noorNo ratings yet

- Analysis of Threatened Species: Smooth-Coated Indian Otter: Faculty: MsoDocument15 pagesAnalysis of Threatened Species: Smooth-Coated Indian Otter: Faculty: Msotawfic noorNo ratings yet

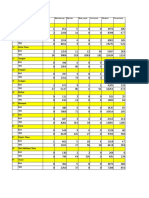

- Rajshahi Economic Cencus 2013, Table 18Document24 pagesRajshahi Economic Cencus 2013, Table 18tawfic noorNo ratings yet

- Mining Manufacturing Elecricity Water - Supply Construction Wholesale Transportation Geo CodeDocument3 pagesMining Manufacturing Elecricity Water - Supply Construction Wholesale Transportation Geo Codetawfic noorNo ratings yet

- To Whomever It May ConcernDocument1 pageTo Whomever It May Concerntawfic noorNo ratings yet

- Production and Cost Analysis 1Document39 pagesProduction and Cost Analysis 1walsonsanaani3rdNo ratings yet

- 6 - More Differentiation PDFDocument20 pages6 - More Differentiation PDFDan EnzerNo ratings yet

- Tpoc 6 - Cost TheoryDocument47 pagesTpoc 6 - Cost TheoryPatricia Ann TamposNo ratings yet

- Industrial EconomicsDocument26 pagesIndustrial Economicskissaraj0% (1)

- Intro To Eco Chapter FiveDocument36 pagesIntro To Eco Chapter Fivegetasew muluyeNo ratings yet

- ECO401 Finalterm Solved Paper 1Document14 pagesECO401 Finalterm Solved Paper 1s9a4q7cNo ratings yet

- Assignment# 3 CompleteDocument13 pagesAssignment# 3 CompleteASAD ULLAHNo ratings yet

- Chapter 5 Theory of Production UpdateDocument35 pagesChapter 5 Theory of Production Updatehidayatul raihanNo ratings yet

- Unit 7 Notes Core Economy Textbook CompressDocument6 pagesUnit 7 Notes Core Economy Textbook CompressaliffmcrNo ratings yet

- Managerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020Document27 pagesManagerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020SZANo ratings yet

- The Industry - Printing (Reference)Document9 pagesThe Industry - Printing (Reference)Nguyệt HồngNo ratings yet

- Economics 500: Microeconomic TheoryDocument5 pagesEconomics 500: Microeconomic TheoryKey OnNo ratings yet

- Economies Diseconomies of ScaleDocument37 pagesEconomies Diseconomies of Scalebhakti_kumariNo ratings yet

- Monopolistic CompetitionDocument4 pagesMonopolistic CompetitionSneha SureshNo ratings yet

- Sadia Saeed EconomicsDocument15 pagesSadia Saeed Economicssadia saeedNo ratings yet

- Solution: ECO 100Y Introduction To Economics Term Test # 3Document14 pagesSolution: ECO 100Y Introduction To Economics Term Test # 3examkillerNo ratings yet

- UOP E Assignments - ECO 561 Final Exam Answers FreeDocument15 pagesUOP E Assignments - ECO 561 Final Exam Answers Freeuopeassignments100% (1)

- BB 107 (Spring) Tutorial 6(s)Document4 pagesBB 107 (Spring) Tutorial 6(s)高雯蕙No ratings yet

- 2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulyDocument67 pages2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulysiyandankosiyekhayaNo ratings yet

- Maha MicroDocument3 pagesMaha MicroDanish KhanNo ratings yet

- Managerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionDocument24 pagesManagerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionArif DarmawanNo ratings yet

- Benefits of MergersDocument3 pagesBenefits of MergerssadhinNo ratings yet

- First Trial Exam-IB2Document16 pagesFirst Trial Exam-IB2Rita ChandranNo ratings yet

- Managerial EconomicsDocument14 pagesManagerial Economicsmssharma500475% (4)

- By: Mohammed Faisal Bari. - Roll No.:28. - Course:Bba LLBDocument22 pagesBy: Mohammed Faisal Bari. - Roll No.:28. - Course:Bba LLBThe paths We chooseNo ratings yet

- Full Download Ebook Ebook PDF Microeconomics Principles Applications Tools 9th PDFDocument41 pagesFull Download Ebook Ebook PDF Microeconomics Principles Applications Tools 9th PDFleo.delacruz139100% (43)

- Untitled 1Document25 pagesUntitled 1Juncheng Wu0% (1)

- The Theory and Estimation of CostDocument38 pagesThe Theory and Estimation of Costde essensioNo ratings yet

SMO Economies

SMO Economies

Uploaded by

tawfic noorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMO Economies

SMO Economies

Uploaded by

tawfic noorCopyright:

Available Formats

1.

(Internal) Economies of Scale

Economies of scale appear when total average cost of production decreases as the level of

production increases. The reverse relationship holds when diseconomies of scale are

present. Determinants of the precise nature of this relationship may be the technology of

production, the organizational structure of a firm, or possibly the level of expertise in

producing a certain product or service.

Manolis Athanassiou, Wiley Encyclopedia of Management

[Internal] Economy of scale, in economics, the relationship between the size of a plant or

industry and the lowest possible cost of a product. When a factory increases output, a

reduction in the average cost of a product is usually obtained. This reduction is known as

economy of scale. Increased labour supply, better specialization, improved technology, and

discovery of new resources or better implementation of existing ones all can increase

output and lead to economy of scale. Conversely, diseconomy of scale can result when an

increase in output causes the average cost to increase.

https://www.britannica.com/topic/economy-of-scale

2. External Economies of Scale (also known as agglomeration economies)

When the sources of the savings are outside the scope or size of the firm, they are called

external economies of scale. Alfred Marshall (1920) identified three sources of external

economies of scale: input sharing, labor market pooling, and knowledge spillovers.

Terminologies differ, but Marshall’s external economies of scale later also came to be known

as “economies of agglomeration”.

He identified two types of external/agglomeration economies: (a) locational economies, and

(b) urbanization economies.

“localisation economies are benefits because of close localisation of firms belonging

to the same industry in a given area leading to savings on the basis of greater

cooperation in research, lower transportation rates as well as consumption of

special inputs or services.”

For example, it made sense for a new entrepreneur in light engineering firm to

locate in Dholai khal area. Or, new IT firms keep moving to Silicon Valley area in

California (expensive land value the is offset by other savings an IT firm can obtain)

“Urbanisation economies are based on the size or presence of firms of other

industries and/or the city's size and diversity which allows them to share specialised

inputs but also to share public utilities, transportation services and infrastructure.

In fact, the city can offer access to big markets of both products and labour and

provide to the firms located in big cities the advantage of provision of public utilities

and public infrastructure suggesting that there are increasing returns to scale,

according to the city's size.”

3. A collection of definitions of Economies of Agglomeration (along the same theme

as the previous description)

Economies of agglomeration are where a firm gains an advantage from the common

location of other firms (Parr, 2002), such as through knowledge spillovers or producer

linkages (Puga, 2010).

Knowledge spill-over is said to happen when firms can learn from other firms without having

to pay for it.

While intuitively it makes sense that there are savings and advantages to firms from siting

close by, econometric measurement of such savings is not straightforward. For our

purposes (Env 307), we do not need to delve into such analysis.

Another definition:

Agglomeration economies are external economies that stem from the location of firms

belonging to the same or related industrial sectors. It is widely known that firms can fully

take advantage of benefits from industrial agglomerations if they locate close to each other.

-Akihiro Otsuka, Mika Goto, Toshiyuki Sueyoshi

4. Diseconomies of agglomeration

The increase in costs due to density (such as land value, pollution, congestion and crime, phenomena

that frequently are related to overcrowding) are collectively referred to as diseconomies of scale.

This idea makes intuitive sense. It is empirically observable as well (e.g. Dhaka’s

urban core is attracting increasingly fewer number of new firms, and many firms

are moving away).

However, just like economies of agglomeration, diseconomies are hard to measure

econometrically.

You might also like

- Solutions PepallDocument48 pagesSolutions PepallJoseph Guen67% (6)

- Managerial Economics 8th Edition Samuelson Solutions Manual DownloadDocument18 pagesManagerial Economics 8th Edition Samuelson Solutions Manual DownloadJulie Tauscher100% (23)

- 4-The Determinants of Industry Concentration Barriers To EntryDocument57 pages4-The Determinants of Industry Concentration Barriers To Entrydivyarai12345100% (1)

- Concepts and Theories of Local Economic DevelopmentDocument46 pagesConcepts and Theories of Local Economic DevelopmentAllonah G. de GuzmanNo ratings yet

- Agglomeration Economies - A Literature ReviewDocument15 pagesAgglomeration Economies - A Literature ReviewWang XiaoNo ratings yet

- What Are External Economies of Scale?Document19 pagesWhat Are External Economies of Scale?gebeyehu kasayeNo ratings yet

- Economies of Scale & Scope: A Comprehensive AnalysisDocument5 pagesEconomies of Scale & Scope: A Comprehensive AnalysisAarti GuptaNo ratings yet

- Fin IndustryDocument10 pagesFin IndustryJudithRavelloNo ratings yet

- Determinants of Economies of Scale in Large BusineDocument7 pagesDeterminants of Economies of Scale in Large BusineRudi IryantoNo ratings yet

- 4 Managerial EconomicsDocument8 pages4 Managerial EconomicsBoSs GamingNo ratings yet

- Economies of Scale NotesDocument6 pagesEconomies of Scale NotesRadeenaNo ratings yet

- Week 3: Innovation, Enterprise and SocietyDocument23 pagesWeek 3: Innovation, Enterprise and SocietyOmar RiberiaNo ratings yet

- Kuliah Growth Pole Theory 1Document33 pagesKuliah Growth Pole Theory 1Mas SuntariNo ratings yet

- Chapter Economics of ScaleDocument4 pagesChapter Economics of ScaleRashed SifatNo ratings yet

- Economies and Diseconomies of Scale AswathyDocument8 pagesEconomies and Diseconomies of Scale AswathyAnu stephie NadarNo ratings yet

- Garments Value ChainDocument19 pagesGarments Value ChainAynul HoqNo ratings yet

- Baby Anjali Manyam Journal 4 3470312 1898071800Document5 pagesBaby Anjali Manyam Journal 4 3470312 1898071800anjaNo ratings yet

- Economies of ScaleDocument3 pagesEconomies of ScaleSujith KmNo ratings yet

- Literature Review On Vertical Integration of RetailersDocument17 pagesLiterature Review On Vertical Integration of RetailersNelum Shehzade100% (2)

- Economies of ScaleDocument15 pagesEconomies of Scalerina_angelinaNo ratings yet

- Lecture Notes Lectures 3 Why Do Firms Cluster PDFDocument4 pagesLecture Notes Lectures 3 Why Do Firms Cluster PDFminlwintheinNo ratings yet

- Economies & Diseconomies of ScaleDocument7 pagesEconomies & Diseconomies of Scalerajusrini91No ratings yet

- Economics ScaleDocument5 pagesEconomics ScaleHepsi KonathamNo ratings yet

- (CAP 2) Modern-Urban-and-Regional-EconomicsDocument24 pages(CAP 2) Modern-Urban-and-Regional-EconomicsMaria Belen Torres DiazNo ratings yet

- Internal Economies of Scale Are FirmDocument3 pagesInternal Economies of Scale Are FirmAbdelrahman DaakirNo ratings yet

- Economies of Scale - Profitability & InnovationDocument13 pagesEconomies of Scale - Profitability & InnovationAppan Kandala VasudevacharyNo ratings yet

- Supply Chain Control: A Theory of Vertical IntegrationDocument34 pagesSupply Chain Control: A Theory of Vertical IntegrationLuis Pablo BarragánNo ratings yet

- Shiman 2008 The Intuition Behind Suttonâ ™s Theory of Endogenous SunkDocument34 pagesShiman 2008 The Intuition Behind Suttonâ ™s Theory of Endogenous SunkCristinaNo ratings yet

- Scale of ProductionDocument9 pagesScale of ProductionOnindya MitraNo ratings yet

- Vertical IntegrationDocument25 pagesVertical IntegrationCicero CastroNo ratings yet

- SSRN Id8713Document50 pagesSSRN Id8713Joa PintoNo ratings yet

- 2022 SH1 H2 CA3 Question Suggested Answer MR Low CommentsDocument9 pages2022 SH1 H2 CA3 Question Suggested Answer MR Low CommentsShanae LeeNo ratings yet

- 3.2 Economies of Scale NotesDocument12 pages3.2 Economies of Scale NotesBAF 09 TISHA BHANSALINo ratings yet

- Economies of Scale and ExamplesDocument30 pagesEconomies of Scale and ExamplesSalman KhanNo ratings yet

- Achieving Sustainable Development Goals Through Ident - 2020 - International JouDocument13 pagesAchieving Sustainable Development Goals Through Ident - 2020 - International JouBona Christanto SiahaanNo ratings yet

- 5 UnitDocument8 pages5 UnitrealexplorerNo ratings yet

- Economies Scale Internal ExternalDocument3 pagesEconomies Scale Internal ExternalAyyaz FakharNo ratings yet

- International Trade Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFDocument28 pagesInternational Trade Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFRobinCummingsfikg100% (10)

- International Finance Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFDocument27 pagesInternational Finance Theory and Policy 10Th Edition Krugman Solutions Manual Full Chapter PDFPamelaHillqans100% (14)

- International Finance Theory and Policy 10th Edition Krugman Solutions ManualDocument6 pagesInternational Finance Theory and Policy 10th Edition Krugman Solutions Manualkhucly5cst100% (26)

- The Risk-Reward Nexus in The Innovation-Inequality Relationship - Who Takes The Risks - Who Gets The RewardsDocument36 pagesThe Risk-Reward Nexus in The Innovation-Inequality Relationship - Who Takes The Risks - Who Gets The Rewardsbruce.cao2050No ratings yet

- The Importance of Industry StructureDocument16 pagesThe Importance of Industry StructurePriyan DsNo ratings yet

- Externalitiesv 2Document3 pagesExternalitiesv 2chidubem grace UgwuNo ratings yet

- Curs 7 BarsanDocument3 pagesCurs 7 BarsanroxxNo ratings yet

- GY300 Topic 3:4 ReadingDocument3 pagesGY300 Topic 3:4 ReadingShaista FarooqNo ratings yet

- Economies of ScopeDocument20 pagesEconomies of ScopeGirish KukrejaNo ratings yet

- 3566 Micro EconomicsDocument60 pages3566 Micro EconomicsPirya HussainNo ratings yet

- Economies of Scale - Wikipedia, The Free EncyclopediaDocument3 pagesEconomies of Scale - Wikipedia, The Free EncyclopediaPankaj SriNo ratings yet

- Financial DictionaryDocument15 pagesFinancial DictionaryMJoyce Dela CruzNo ratings yet

- Market Integration: Study Guide For Module No. 3Document8 pagesMarket Integration: Study Guide For Module No. 3Ma. Angelika MejiaNo ratings yet

- University of International Business and Economics: AssignmentDocument7 pagesUniversity of International Business and Economics: AssignmentNabeel Safdar100% (1)

- Transaction CostDocument12 pagesTransaction CostkarirkuNo ratings yet

- TCW-Module-3-Market-Integration 1Document8 pagesTCW-Module-3-Market-Integration 1Jazmine Cleobell B. LaynoNo ratings yet

- Dynamizing Innovation Systems Through Induced Innovation Networks: A Conceptual Framework and The Case of The Oil Industry in BrazilDocument4 pagesDynamizing Innovation Systems Through Induced Innovation Networks: A Conceptual Framework and The Case of The Oil Industry in Brazilhendry wardiNo ratings yet

- Corporate StrategyDocument52 pagesCorporate Strategytomstor9No ratings yet

- Clusters and Economic Policy White PaperDocument10 pagesClusters and Economic Policy White PaperShahzod QuchkorovNo ratings yet

- MERIT-Infonomics Research Memorandum SeriesDocument54 pagesMERIT-Infonomics Research Memorandum SeriesBrendon HoNo ratings yet

- 5 Dunning's OLI and Porter's Diamond, Global Sourcing and ProductionDocument9 pages5 Dunning's OLI and Porter's Diamond, Global Sourcing and ProductionOlga LiNo ratings yet

- A Technological and Organisational Explanation For The Size Distribution of FirmsDocument14 pagesA Technological and Organisational Explanation For The Size Distribution of FirmsCore ResearchNo ratings yet

- Basic Economic Ideas and Resource Allocation: Ideas For Answers To Progress QuestionsDocument4 pagesBasic Economic Ideas and Resource Allocation: Ideas For Answers To Progress QuestionsChristy NyenesNo ratings yet

- Env 313.2 Biodiversity and Conservation of Species Assignment 1Document7 pagesEnv 313.2 Biodiversity and Conservation of Species Assignment 1tawfic noorNo ratings yet

- ENV 373 Sec3 Groups 2020Document2 pagesENV 373 Sec3 Groups 2020tawfic noorNo ratings yet

- Analysis of Threatened Species: Smooth-Coated Indian Otter: Faculty: MsoDocument15 pagesAnalysis of Threatened Species: Smooth-Coated Indian Otter: Faculty: Msotawfic noorNo ratings yet

- Rajshahi Economic Cencus 2013, Table 18Document24 pagesRajshahi Economic Cencus 2013, Table 18tawfic noorNo ratings yet

- Mining Manufacturing Elecricity Water - Supply Construction Wholesale Transportation Geo CodeDocument3 pagesMining Manufacturing Elecricity Water - Supply Construction Wholesale Transportation Geo Codetawfic noorNo ratings yet

- To Whomever It May ConcernDocument1 pageTo Whomever It May Concerntawfic noorNo ratings yet

- Production and Cost Analysis 1Document39 pagesProduction and Cost Analysis 1walsonsanaani3rdNo ratings yet

- 6 - More Differentiation PDFDocument20 pages6 - More Differentiation PDFDan EnzerNo ratings yet

- Tpoc 6 - Cost TheoryDocument47 pagesTpoc 6 - Cost TheoryPatricia Ann TamposNo ratings yet

- Industrial EconomicsDocument26 pagesIndustrial Economicskissaraj0% (1)

- Intro To Eco Chapter FiveDocument36 pagesIntro To Eco Chapter Fivegetasew muluyeNo ratings yet

- ECO401 Finalterm Solved Paper 1Document14 pagesECO401 Finalterm Solved Paper 1s9a4q7cNo ratings yet

- Assignment# 3 CompleteDocument13 pagesAssignment# 3 CompleteASAD ULLAHNo ratings yet

- Chapter 5 Theory of Production UpdateDocument35 pagesChapter 5 Theory of Production Updatehidayatul raihanNo ratings yet

- Unit 7 Notes Core Economy Textbook CompressDocument6 pagesUnit 7 Notes Core Economy Textbook CompressaliffmcrNo ratings yet

- Managerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020Document27 pagesManagerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020SZANo ratings yet

- The Industry - Printing (Reference)Document9 pagesThe Industry - Printing (Reference)Nguyệt HồngNo ratings yet

- Economics 500: Microeconomic TheoryDocument5 pagesEconomics 500: Microeconomic TheoryKey OnNo ratings yet

- Economies Diseconomies of ScaleDocument37 pagesEconomies Diseconomies of Scalebhakti_kumariNo ratings yet

- Monopolistic CompetitionDocument4 pagesMonopolistic CompetitionSneha SureshNo ratings yet

- Sadia Saeed EconomicsDocument15 pagesSadia Saeed Economicssadia saeedNo ratings yet

- Solution: ECO 100Y Introduction To Economics Term Test # 3Document14 pagesSolution: ECO 100Y Introduction To Economics Term Test # 3examkillerNo ratings yet

- UOP E Assignments - ECO 561 Final Exam Answers FreeDocument15 pagesUOP E Assignments - ECO 561 Final Exam Answers Freeuopeassignments100% (1)

- BB 107 (Spring) Tutorial 6(s)Document4 pagesBB 107 (Spring) Tutorial 6(s)高雯蕙No ratings yet

- 2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulyDocument67 pages2023 Economics Grade 11 Step Ahead Learner Document Final 10 JulysiyandankosiyekhayaNo ratings yet

- Maha MicroDocument3 pagesMaha MicroDanish KhanNo ratings yet

- Managerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionDocument24 pagesManagerial Economics in A Global Economy: Market Structure: Perfect Competition, Monopoly and Monopolistic CompetitionArif DarmawanNo ratings yet

- Benefits of MergersDocument3 pagesBenefits of MergerssadhinNo ratings yet

- First Trial Exam-IB2Document16 pagesFirst Trial Exam-IB2Rita ChandranNo ratings yet

- Managerial EconomicsDocument14 pagesManagerial Economicsmssharma500475% (4)

- By: Mohammed Faisal Bari. - Roll No.:28. - Course:Bba LLBDocument22 pagesBy: Mohammed Faisal Bari. - Roll No.:28. - Course:Bba LLBThe paths We chooseNo ratings yet

- Full Download Ebook Ebook PDF Microeconomics Principles Applications Tools 9th PDFDocument41 pagesFull Download Ebook Ebook PDF Microeconomics Principles Applications Tools 9th PDFleo.delacruz139100% (43)

- Untitled 1Document25 pagesUntitled 1Juncheng Wu0% (1)

- The Theory and Estimation of CostDocument38 pagesThe Theory and Estimation of Costde essensioNo ratings yet