Professional Documents

Culture Documents

Format S 2: Circle: Smeccc: Branch

Format S 2: Circle: Smeccc: Branch

Uploaded by

Naresh KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format S 2: Circle: Smeccc: Branch

Format S 2: Circle: Smeccc: Branch

Uploaded by

Naresh KumarCopyright:

Available Formats

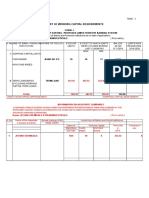

FORMAT S 2 Annexure II

(Applicable to loans Rs. 25.00 lakh to Rs. 1 crores under MSME and Indirect Agl. Segments including loans

under CGTMSE guarantee, e-DFS and other Schematic lending)

(All the figures reported in the proposal are in Rs. Lakh , unless specified otherwise)

SECTION A1

MEMORANDUM FOR Chief Manager

Circle: Hyderabad SMECCC: SME CITY CREDIT CENTER, Branch: SME CITY CREDIT CENTER,

HYDERABAD HYDERABAD

Borrower's Name: M/s. SPEAR ENGINEERING SOLUTIONS PVT LTD (MD-C S PRASAD)

Name of the Scheme: Bank's Usual Credit Dispensation Scheme

Existing CRA As on Proposed CRA As on

SB8 31/03/2017

@ Minimum mark will be NIL in cases where Collateral is not to be asked as per Bank’s norms

a)Proposal: For sanction / approval / confirmation :

i) Sanction for (i). Renewal of FBWC limits with enhancement/reduction from Rs.40 lakhs to Rs.44

lakhs and NFBWC limits of Rs.0.00 lakhs at the existing level.

ii) Approval for (i). Review of existing Term Loan/Term Loans/Corporate Loan

iii) Confirmation for (i). Action in having continued the limits beyond the validity of last sanction i.e. beyond

31/12/2017.

This proposal falls within the power of Chief Manager as

(i) FB/NFB/Total indebtedness is Rs.49.67 Lakh to Corporate

(ii) Involves policy level deviations: No

If yes, Indicate policy level deviations: NOT APPLICABLE

iii) Recommended pricing @ MCLR (%) + % = ____% p.a. falls within the discretionary powers of Not Applicable

iv) Other: NIL

b) Unit's Profile :

Location: M (Metro) Constituition : Pvt Ltd co

Line of Activity : MANFCTURING OF INDUSTRIAL FRAME WORKS IN METAL

Activity Type Manufacturing Priority Sector Yes

Industry Classification: Manufacturing Sub Industry: MANFCTURING

Date of Establishment/incorporation 04/10/2011 Commercial 04/10/2011

operation date(COD):

Value of original P&M/Equip.(Rs.) 4468254 Segment: Small Enterprise

(As per MSMED Act)

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 1 of 24

CGTMSE cover Yes Business Segment SSI MFG

New unit/Existing unit Existing Existing Connection Yes

IRAC Status of Advances Standard If Yes, Banking with 27/03/2013

us since

As on: 23/03/2018

Date of last Renewal/ Review: 31/12/2015 Renewal / Review 31/12/2017

valid upto

Whether CIBIL/ Experian/ Equifax/ Yes Date 23/03/2018

Highmarks etc check done If Yes,

their Ref No & Date

Whether unit is considered Existing

new for the purpose of CRA

calculation:

Whether Takeover involved No If Yes, Name of the NA

existing Bank

Branch NA

Conduct of account with existing NA Credit Information NA

Bank Report from existing

banker

c) Total Indebtedness (Existing and proposed): (Rs. in Lakh)

Existing Sanction Proposed Change

CC 40.00 44.00 4.00

Total FBWC 40.00 44.00 4.00

TL 5.67 5.67 0.00

Total FB(a) 45.67 49.67 4.00

Total NFBWC (b) 0.00 0.00 0.00

Derivative/Forward

Contract Limits (c)

Total NFB (b)+(c) = d 0.00 0.00 0.00

Total Indebtedness (a)+(d)

45.67 49.67 4.00

=e

d) Banking Arrangement and Sharing Pattern: (Rs. in Lakh)

Financial Arrangement: Sole Banking/ Multiple Banking

Bank’s detail FB NFB Total % Share

TL WC

SBI 5.67 44.00 0.00 49.67 100.00

Associate Banks (Total) 0.00 0.00 0.00 0.00 0.00

Other Banks ( mention name of Bank / Branch)

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 2 of 24

e) Present Position of accounts (with our Bank): Date : 29/03/2018 (Rs. in Lakh)

Account No. Facility Existing D.P. Outstanding Irregularity Irr. Since

limits

62460944839 TL 9.50 5.96 5.67 0.00

62451876164 CC 40.00 0.00 -36.31 36.31 23/03/2018

Irregularity Reports submitted upto: NIL confirmed upto: NIL

Comments on irregularity and action plan for regularization:

No irregularity observed recently in the account. As per the CGTMSE letter Branch was clearly mentioned the recent

sanction date as 31.12.2015 and the limit sanctioned is 40.00 lakhs under CGTMSE under SME Smart score scheme,

Appraisal note is not available in the file. Hence the signed copy of the CGTMSE is treated as appraisal note.

f) Credit History (with our Bank): For past two sanctions: (Rs. in Lakh)

g) Details of the Group / Associate Entities/ Companies:

Date of Net Sales Estimated /Actual CRA CRA as on Collateral Coverage

sanction (only for the relevant year) % (Excluding

FB NFB residual value)

WC TL (o/s)

Estimated Actual Year

31/12/2015 40.00 200.00 221.19 2016 UR 31/03/2015 0.00

g) Details of the Group / Associate Entities/ Companies: Not Applicable (Rs. in Lakh)

i Name of the unit

ii Names of Promoters/Directors

iii Activity

iv Credit Limits FB NFB

v IRAC Status

vi Banking with Bank

vii Branch

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 3 of 24

SECTION A2

PROFILE OF THE BORROWER

Unit Address (Full Address) Plot/Building/Flat Number : PLOY NO 36B SVCIE

Address Line 1 : PHASE II BALANAGAR

Address Line 2 : HYDERABAD

Village/ Town : Ghmc (M Corp.) (Part)

Block/Tehsil/Sub District : Secunderabad

City : Hyderabad

District : Hyderabad

State : Andhra Pradesh

Country : India

PIN/ZIP Code : 500037

Mobile No. : 8008755599

Telephone no. : 04023778999

Corporate Office Address Plot/Building/Flat Number : PLOTNO 77 WOMENS COOPERATIVE

SOCIETY

Address Line 1 : ROAD NO 7 A

Address Line 2 : JUBILEE HILLS HYDERABAD

Village/ Town : Ghmc (M Corp.) (Part)

Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

District : Hyderabad

State : TELANGANA

Country : INDIA

PIN/ZIP Code : 500033

Mobile No. : 8008755599

a) Names & Addresses of the Promoters / Directors /Partners /Proprietors:

Name: HEMALATHA KOLLI Designation: DIRECTOR

DOB: 11/08/1948 Net Worth: 25.25

Identifiers Full Address, mail id, mob. no.

DIN (for directors) 6540010 Plot/Building/Flat Number : PLOT NO 77 WOMEN COOP

SOCIETY

PAN No. AFCPK8495A

Address Line 1 : ROAD NO 7 A

Passport No. Address Line 2 : JUBLIEEHILLS

Village/ Town : GHMC (M Corp.) (Part)

Others (If first ID is UNIQUE IDENTIFICATION Block/Tehsil/Sub District : Ameerpet

selected other than above, NO.(UID) City : HYDERABAD

then given ID type should District : Hyderabad

be displayed) State : TELANGANA

Country : INDIA

PIN/ZIP Code : 500033

Mobile No. : 9849246020

Email Id :

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 4 of 24

Name: SRICHARAN SURAPANENI Designation: DIRECTOR

DOB: 09/10/1980 Net Worth: 47.40

Identifiers Full Address, mail id, mob. no.

DIN (for directors) 6538381 Plot/Building/Flat Number : 75-6-34,PRAKASH NAGAR

Address Line 1 : RAJAHMUNDRY

PAN No. BAHPS8527G

Address Line 2 : RAJAMUNDRY

Passport No. Village/ Town : Rajahmundry (M Corp. + OG) (Pa

Block/Tehsil/Sub District : Rajahmundry (Urban)

Others (If first ID is UNIQUE IDENTIFICATION City : SAMALKOT

selected other than above, NO.(UID) District : East Godavari

then given ID type should State : ANDHRA PRADESH

be displayed) Country : INDIA

PIN/ZIP Code : 533103

Mobile No. : 9866101256

Email Id :

Name: MANJU BIKKINA Designation: DIRECTOR

DOB: 24/12/1981 Net Worth: 50.53

Identifiers Full Address, mail id, mob. no.

DIN (for directors) 6538362 Plot/Building/Flat Number : MIG 127

Address Line 1 : BHARAT NAGAR COLONY

PAN No. AJZPB2362C

Address Line 2 : HYDERABAD

Passport No. Village/ Town : GHMC (M Corp.) (Part)

Block/Tehsil/Sub District : Secunderabad

Others (If first ID is UNIQUE IDENTIFICATION City : HYDERABAD

selected other than above, NO.(UID) District : Hyderabad

then given ID type should State : TELANGANA

be displayed) Country : INDIA

PIN/ZIP Code : 500018

Mobile No. : 9246635311

Email Id :

[* Identifiers based on KYC guidelines]

Brief Background of the borrower /company / Group & Management:

(To include competence / reputation/ corporate governance etc)

M/S SPEAR ENGINEERING SOLUTIONS PVT LTD is established in the year 2011 as a private limited

company.Initially Sri C S Prasad is Managing Director of the company. He used to manage all the operations of the

company. All other directors assist him in the operations. Recently 2 of the directors Sri C S Prasad & Smt Kolli

Chaitanaya has disqualified as directors, not due to this company but due to other companies, where they are directors.

Now 3 Directors are managing the company Smt Manju Bikkina, Sri Charan Surapaneni and Smt hemalatha Kolli.

Brief write up on the Industry/ Sector /competition and the Company’s standing:

e Indian Engineering sector has witnessed a remarkable growth over the last few years driven by increased investments

in infrastructure and industrial production. The engineering sector, being closely associated with the manufacturing and

infrastructure sectors, is of strategic importance to Indias economy.

India on its quest to become a global superpower has made significant strides towards the development of its

engineering sector. The Government of India has appointed the Engineering Export Promotion Council (EEPC) as the

apex body in charge of promotion of engineering goods, products and services from India. India exports transport

equipment, capital goods, other machinery/equipment and light engineering products such as castings, forgings and

fasteners to various countries of the world. The Indian semiconductor industry offers high growth potential areas as the

industries which source semiconductors as inputs are themselves witnessing high demand.

India became a permanent member of the Washington Accord (WA) in June 2014. The country is now a part of an

exclusive group of 17 countries who are permanent signatories of the WA, an elite international agreement on

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 5 of 24

Brief write up on the Industry/ Sector /competition and the Company’s standing:

engineering studies and mobility of engineers.

Market size

The capital goods and engineering turnover in India is expected to reach US$ 125.4 billion by FY17.

India exports its engineering goods mostly to the US and Europe, which accounts for over 60 per cent of the total

exports.

Recently, India's engineering exports to Japan and South Korea have also increased with shipments to these two

countries rising by 16 and 60 per cent respectively. Sri Lanka, Nepal and Bangladesh have also emerged as the major

destinations for India's engineering exports.

According to the India Electronics & Semiconductor Association, the Indian Electronic System Design and

Manufacturing (ESDM) market is expected to grow at a CAGR of 16-23 per cent to reach US$ 228 billion by 2020 from

$100 billion in 2016-17.

The electrical equipment industry observed a growth of 9.7 per cent during April-September 2017. Also, Growth of

Indias mining and construction equipment sector is expected at 13-17 per cent in 2017 driven by increase in

infrastructure spending.

According to a study by The Associated Chambers of Commerce of India (ASSOCHAM) and NEC Technologies, the

demand for electronic products in India is expected to grow at a Compound Annual Growth Rate (CAGR) of 41 per cent

during 2017-20 to US$ 400 billion by 2020.

According to data from the Engineering Export Promotion Council of India, engineering exports from India grew 11.33

per cent year-on-year to reach US$ 65.23 billion in FY 2016-17. Exports of electrical machinery rose to US$ 4.6 billion

in FY 2016-17 from US$ 3.7 billion in FY 2015-16.

Indias engineering exports recorded a growth of 22.75 per cent to reach US $ 56,091.89 million in April-December

2017. Exports during December 2017 grew 25.41 per cent year-on-year to US$ 7,133.93 million from US$ 5,688.32

million in the same period a year ago.

Investments

The engineering sector in India attracts immense interest from foreign players as it enjoys a comparative advantage in

terms of manufacturing costs, technology and innovation. The above, coupled with favourable regulatory policies and

growth in the manufacturing sector has enabled several foreign players to invest in India.

The foreign direct investment (FDI) inflows into India's miscellaneous mechanical and engineering industries during

April 2000 to September 2017 stood at around US$ 3.36 billion, as per data released by the Department of Industries

Policy and Promotion (DIPP). The engineering sector is a growing market. Spending on engineering services is

projected to increase to US$ 1.1 trillion by 2020. The government, in consultation with semiconductor industry, has

increased focus on the ESDM sector in last few years. Some of the initiatives outlined in the National Electronics policy

and the National Telecom policy are already in the process of implementation, such as Preferential Market Access

(PMS), Electronics Manufacturing Clusters (EMC) and Modified Special Incentive Package Scheme (M-SIPS).

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 6 of 24

PERFORMANCE DETAILS SECTION A3

(Rs. in Lakh)

a) Performance and financial indicators:

2016 2017 2018 2019

Financial Parameters Audited Audited

Estimated Projected

(Estimated) (Estimated)

221.73 223.90 246.00 271.20

Gross Domestic Sales

(0.00) (0.00)

0.00 0.00 0.00 0.00

Export Sales (if any)

(0.00) (0.00)

221.73 223.90 246.00 271.20

Net Sales

(0.00) (0.00)

Profit Before Tax 8.56 4.14 8.12 8.97

(PBT) (0.00) (0.00)

3.86 1.85 3.30 3.31

PBT/Net Sales (%)

(0.00) (0.00)

21.80 23.28 28.74 33.22

PBDIT

(0.00) (0.00)

17.73 15.89 19.74 23.72

Cash Accrual

(0.00) (0.00)

6.52 2.77 5.62 6.47

Profit after Tax (PAT)

(0.00) (0.00)

61.00 61.00 61.00 61.00

Paid Up Capital

(0.00) (0.00)

67.06 49.49 51.20 54.71

TNW

(0.00) (0.00)

45.38 33.19 36.20 39.71

Adjusted TNW

(0.00) (0.00)

2.83 4.08 4.05 3.84

TOL/TNW(times)

(0.00) (0.00)

4.18 6.09 5.72 5.29

TOL/Adjusted TNW

(0.00) (0.00)

1.05 1.18 1.21 1.32

Current Ratio

(0.00) (0.00)

Net Working Capital 5.12 22.44 26.60 41.95

(NWC) (0.00) (0.00)

0.00

DSCR - - -

@ Figures in brackets denote estimates at the time of last renewal

b) Interim

Financials

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 7 of 24

Particulars Q1/H1 current Year Q1/H1 last year

Net sales 0.00 0.00

Export 0.00 0.00

c) Comments on Performance & Financial Indicators -

i). Net Sales

Firm has achieved sales of 223.90 lakhs as on 31/03/2107 which is slightly more than the previous year. this year firm

is estimating sales of 246 lakhs as on 31/03/2018.

ii). Profitability (PBT / NS):

Profitability is low for the firm in the year 2016-17 due to increase of operational expenditure and salaries. And is

expected to be improved for the coming years after sales improvement.

iii). TNW (Rs. in Lakh)

2016 2017 2018 2019

Particulars

Audited Audited Estimated Projected

Opening TNW 60.54 67.06 49.49 51.20

Add Share Application Money 0.00 0.00 0.00 0.00

Add PAT 6.52 2.77 5.62 6.47

Add (a) Increase in equity/Capital 0.00 0.02 0.02 0.04

Add (b) Increase in share premium 0.00 0.00 0.00 0.00

Add/Subtract change in intangible assets 0.00 21.07 3.93 3.00

Adjust Prior year expenses

Less Drawings / Dividend Payment 0.00 0.00 0.00 0.00

Less DTA 0.00 -.71 0.00 0.00

Closing TNW 67.06 49.49 51.20 54.71

Less Investments in Associates/Subsidiaries 21.68 16.30 15.00 15.00

(A & S )

Less Long Term Loans to (A & S) 0.00 0.00 0.00 0.00

Adjusted TNW 45.38 33.19 36.20 39.71

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 8 of 24

Comments :

iv). TOL / TNW:

TOL/TNW is slightly above the bank bench mark level. firm has taken loans and advances from the shareholders which

resulted in increase of TOL/TNW.

v). TOL / Adj. TNW:

TOL/Adj.TNW is at 6.09 which is above the threshold level and it is expected to be improved in the coming year below

6.

vi). CURRENT RATIO & NWC:

Current Ratio is above 1 but below 1.33 and is expected to be improved slowly in the coming years as per projections &

NWC is increasing every year which is improving the firm liquidity position.

d). Compliance with takeover norms, if applicable:

Not applicable

e).Brief summary of fresh Term Loan applied: Not Applicable

f). Review of existing Term Loan : Comment on reasons for over dues (if Term Loan availed): (Rs. in Lakh)

Term Loan: Rs.5.67 Lakh

i) No of installments due: 23 ii) No of installments paid: 23

iii) No of Installments in 1 iv) Amount of interest in arrears: 0.00

arrears:

v) Comment on the Not Applicable account is regular and paid one in installment in advance.

company’s action plan

for regularizing the

account.

vi) Comments on reason No Overdue

for over dues:

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 9 of 24

SECTION A4

1. Details of Due Diligence:

Date of Pre-Sanction visit 07/03/2018

Place(s) visited Plot No 36, SVCIE, Phase II, Bala Nagar, Hyderabad 500037

Name(s) of officials, who visited B PRAVEEN KUMAR, PO & AVL NARASIMHA, CHIEF

MANAGER

Whether papers required for KYC YES

obtained (PAN/Articles/Memo etc)?

Yes/No

Date of Search Report obtained 20/03/2018

from ROC, in case of companies

Formalities regarding obtention of YES

legal opinion/valuation report

completed? (Yes/No)

Due diligence on take over NOT APPLICABLE

Other Observations, if any ROC Search Report obtained from Sri BS Hari Krishna & CO on

20/03/2018. There he pointed out that charge has not been

registered with ROC.

Immovable property has been physically

verified on

2. RMD ADVISORY :( Applicable only for manufacturing units)

RMD Guidance Industry / Present Out Threshold Level Company’s status

Note date Segment Look

For New Unit For Enhancement

31/12/2016 SSI NA NA NA Enhancement

MFG/Manufacturing

Comments : Not Applicable

(on deviation , if applicable)

3. Comments on conduct of Account:

(Rs. in Lakh)

Details Previous Year Period under review

(2016-17) (2017-18)

Credit summations 273.95 142.44

Debit summations 270.38 139.68

Gross Sales 223.90 246.00

Opening Sundry Debtors 48.39 52.26

Closing Debtors 52.26 55.22

Devolvement of LC NA NA

Devolvement of BG NA NA

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 10 of 24

Any other irregularity / non compliance

1) Firm has not filed bank charge in ROC

Comments on Summations vis-à-vis sales

Credit, Debit summations in the account are satisfactory in the year 2016-17. However in 2017-18 Credit, Debit

summations in the account are low, however firm has routed the transactions in the current account.

Comments on Devolvement of LC/BG and any other irregularity/non-compliance

Firm is at receive 100.00 lakhs from their debtors.

4.Whether names of promoters, directors, company, group concerns figure in defaulter/willful

defaulters list

PARTICULARS DATE POSITION

CICs defaulter List 30/09/2016 Not Found

CICs Wilful Defaulters list 31/03/2016 Not Found

PARTICULARS DATE

ECGC specific approval list 31/01/2018

Not Applicable

Deviations required for Borrower/partner for CIBIL 19/03/2018

default:

Verified CRIF reports of all the Directors and guarantors and found satisfied with the credit history.

CIBIL List(Suit filed) Rs.25 lacs and above 30/09/2017

Not Found

Other Credit Information Company(CIC) – Credit 23/03/2018

History

Verified the Commercial credit information report No 4192721 ID W-19013301 and found the no

Banned list of Promoters-SEBI 30/09/2017

Not Applicable

i-Probe Check 24/03/2018

Not Available

5. Comments on I&A and other audit reports,which have an impact on credit risk on the unit,if any:

Name of report Date Serious irregularities/ Adverse features remaining

unattended

Comments in last I&A report dated

……&its present status

Any other Audit if conducted after last

sanction :

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 11 of 24

Company's audited Balance Sheet 31/03/2017 No Major iregularities

Statutory dues/other contingent liabilities: (Rs. in Lakh)

Dues Amount quantified in Impact on financial Negative score in CRA, if

Audited B/S position (as % of TNW) any

Statutory dues 0.00

Contingent liabilities

Comments, in brief, if the impact is significant

No Such pending sundry debtors as per interview with the firm.

Critical Risk

1) 2 of the Directors were disqualified as Directors by ROC.

Mitigation

In order to mitigate the risk we advise the disqualified directors not be in the board and we advise the remaining 3

directors to submit the application for the proposed facilities. we are also taking the personal guarantee of the 3

directors and 2 disqualified directors also.

6. Comments on interchangeability (if any) :

No Interchangeability of limits

7. Recommendations and Justification:

1) Firm has initially availed cash credit facility of 40.00 lakhs on 31.12.2015. Since from the inception firm is banking

with us.

2) Firm has achieved sales of 223.14 lakhs as on 31/03/2017 which is slightly more than the previous year sales of

221.19 lakhs.

3) As per the Assessment firm is eligible for cash credit limit of 44.00 lakhs. The conduct of the account is satisfactory,

except some directors became disqualified as directors by ROC and they were no longer in the firm as directors and

they continued as shareholders. hence recommended for sanctioning renewal with enhancement of cash credit limit

from existing 40.00 lakhs to 44.00.

4) As per the ROC search we found that firm has not filed the charge of Bank, Hence It is recommended for file the

charge before release of the limits.

5) Firm is engaged in manufacturing of industrial frameworks in metal and services.

6) All the Present and founding directors are offering their personal guarantee to the company.

7) Company to adhere to the Covenants Of Sanction before release of limits.

8) And also it is observed that last sanction resolution and appraisal were not available hence the copy submitted for

CGTMSE is treated as sanction and the sanction is confirmed in SME car loan sanction done in the month of March

2016 and the same is avaialble.

Recommended for sanction / approval / confirmation on the terms and conditions asset out in

annexure-1

i) Sanction for (i). Renewal of FBWC limits with enhancement/reduction from Rs.40 lakhs to Rs.44

lakhs and NFBWC limits of Rs.0.00 lakhs at the existing level.

ii) Approval for (i). Review of existing Term Loan/Term Loans/Corporate Loan

iii) Confirmation for (i). Action in having continued the limits beyond the validity of last sanction i.e. beyond

31/12/2017.

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 12 of 24

Appraised by Assessed by

Signature

Name

Designation

PF No.

Mail ID

Date

Sanction details:

Sanctioned by: Remarks, if any.

Signature

Name

Designation

Date:

Date Chart:

1. Nature of facility (ies) applied for: Amount Format Selected is: LAKH

CC-44.00

TL-5.67

2. Date of receipt of the proposal 20/03/2018

3. Information sought on changes in the revised Business Plan

4. Reply received date

5. Discussions held with Company’s officials 27/03/2018

6. Information received on

7. Addl. Information received on

8. In Principle Note submitted, if any

9. Date of receipt of complete information

10. Date of submission to sanctioning Authority 29/03/2018

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 13 of 24

Annexure : 1

Circle: Hyderabad SMECCC: SME CITY CREDIT CENTER, Branch: SME CITY CREDIT CENTER,

HYDERABAD HYDERABAD

Borrower's Name: M/s. SPEAR ENGINEERING SOLUTIONS PVT LTD (MD-C S PRASAD)

1. Security

Primary

Realisable Date of Bank Assessed

Facility Details of Security

Value valuation Value

CC Stock Statement 64.48 23/03/2018 64.48

STOCK

The above properties have been inspected by and genuineness of title verified. We also found the valuations of the

property to be reasonable. The Certified copy of the title deeds obtained from Sub-Registrar office and compared with

the originals.

2. Personal / Third Party Guarantees:

Name SATYANARAYANA PRASAD CHERUKURI

Father's name VENKATESWAR RAO Address

Plot/Building/Flat Number : PLOT NO 77 ROAD NO 7A

Address Line 1 : JUBLIEE HILLS

PAN No. Address Line 2 : HYDERABAD

Village/ Town : GHMC (M Corp.) (Part)

Net Means 14.40 Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

As On 31/12/2017 District : Hyderabad

State : TELANGANA

Country : INDIA

Compiled on 23/03/2018

PIN/ZIP Code : 500033

Mobile No. : 8008755599

Email Id :

Name MANJU BIKKINA

Father's name RAGHAVENDRA RAO B Address

Plot/Building/Flat Number : MIG 127

Address Line 1 : BHARAT NAGAR

PAN No. Address Line 2 : HYDERABAD

Village/ Town : GHMC (M Corp.) (Part)

Net Means 50.53 Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

As On 31/12/2017 District : Hyderabad

State : TELANGANA

Country : INDIA

Compiled on 29/03/2018

PIN/ZIP Code : 500018

Mobile No. : 8008755599

Email Id :

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 14 of 24

Name SRI CHARAN SURAPANENI

Father's name VARA PRASAD RAO Address

Plot/Building/Flat Number : E43 FLAT NO 203 DEVI ELITE

Address Line 1 : MADHURA NAGAR SR NAGAR

PAN No. BAHPS8527G Address Line 2 : HYDERABAD

Village/ Town : GHMC (M Corp.) (Part)

Net Means 47.40 Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

As On 31/12/2017 District : Hyderabad

State : TELANGANA

Country : INDIA

Compiled on 23/03/2018

PIN/ZIP Code : 500038

Mobile No. : 9849246020

Email Id :

Name CHAITANYA CHERUKURI

Father's name SATYANARAYANA PRASAD Address

Plot/Building/Flat Number : PLOT NO 77 ROAD NO 7A

Address Line 1 : JUBLIEE HILLS

PAN No. AHMPK8904E Address Line 2 : HYDERABAD

Village/ Town : GHMC (M Corp.) (Part)

Net Means 25.70 Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

As On 31/12/2017 District : Hyderabad

State : TELANGANA

Country : INDIA

Compiled on 23/03/2018

PIN/ZIP Code : 500033

Mobile No. : 8008755599

Email Id :

Name HEMALATHA KOLLI

Father's name VENKAT DURGA PRASAD RAO Address

Plot/Building/Flat Number : PLOT NO 77 ROAD NO 7A

Address Line 1 : WOMEN COOPERATIVE SOCIETY

PAN No. AFCPK8495A Address Line 2 : JUBLIEEHILLS

Village/ Town : GHMC (M Corp.) (Part)

Net Means 25.25 Block/Tehsil/Sub District : Secunderabad

City : HYDERABAD

As On 31/12/2017 District : Hyderabad

State : TELANGANA

Country : INDIA

Compiled on 29/03/2018

PIN/ZIP Code : 500033

Mobile No. : 8008755599

Email Id :

3. Interest Rate : MCLR(8.15%)+3.50% = 11.65% p.a. at monthly rests.

CC(HYP):

Concession : Not Applicable

TL: NOT APPLICABLE

SLC: NOT APPLICABLE

Not Applicable

EPC :

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 15 of 24

4. Margin (%) Stocks:-- 25.00

Receivables:-- 50.00

Cover Period (Days):-- 60.00

BG :-- NA

LC :-- NA

Term loan:-- NA

5. Repayment CC(Hyp) : Repayable on demand, Renewable after one year

TL: Not Applicable

6. (i) Validity of Sanction(in Sanction valid for 12 Months.

months)

(ii) Review/Renewal (in 12

months)

7. Inspection Stocks and books of the Firm shall be inspected once in quarter at irregular

intervals by one or more representatives of the Bank. The firm shall extend all

assistance to the aforesaid representatives in conducting and completing such

inspection smoothly and shall take steps to carry out such remedial measures as

necessitated due to shortcomings, if any pointed out by

the inspections shall be born by the firm.

8. Stock Statement Monthly

9. Insurance Entire assets financed by the Bank should be insured against all risks. Insurance

of stocks / mortgaged property should be arranged. In the case of immovable

properties mortgaged to the Bank whether as primary or collateral security,

besides such properties being insured against usual risks such as fire, riot, strike,

breakage and breakdown, nsurance against flood, earthquake and cyclone

should also be arranged where the place of the unit is susceptible to such natural

calamities.

10. Processing fee WC 0.30% of loan amount.Maximum of Rs 30 Lac + Applicable GST

SLC Fees NA

Upfront fee for TL Not applicable

CGTMSE fees As per the CGTMSE fee changed time to time

11. Inspection charges 275/- per lac p.a Min. Rs 600/- p.a Max. Rs. 15000/- p.a

12. Branch Allocation Not applicable

13. EM Charges Not Applicable

14. Commitment Charges If the average utilization is more than 75% - No charges. If the average utilization

is between 50-75% - 0.25% p.a to be recovered on entire unutilized portion on a

quarterly basis. If the average utilization is less than 50% - 0.50% p.a to be

recovered on entire unutilized portion on a quarterly basis.

15. Other Charges Nil

16. Pre Payment Penalty Nil

17. Penal Interest 5.00 % per annum on the irregular portion for the period of irregularity.

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 16 of 24

18. Documents SME Documentation

19. Others Nil

20. Other Stipulations, if any. NA

21. Covenants of sanction : Before Release of the limits company to provide/comply the following

1) CIF of the firm need to be updated by the firm

2) Cash credit Account mandate to be updated by the firm suitably as per

present board.

3) ABS to be signed by all the present directors.

4) Notarized Assets and Liabilities to be submitted.

5) Internal resolution exiting the 2 disqualified directors and present directors

who are on the table should provide resolution for availing the credit limits to be

provided.

6) ROC charge for the existing limits to be created

7) Company to Submit up to date GST Returns.

8) Recent Statutory approvals.

9) Application for limits in Bank standard format.

10) Latest Work orders and Debtors list to be provided.

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 17 of 24

ANNEXURE-2

Circle: Hyderabad SMECCC: SME CITY CREDIT CENTER, Branch: SME CITY CREDIT CENTER,

HYDERABAD HYDERABAD

Borrower's Name: M/s. SPEAR ENGINEERING SOLUTIONS PVT LTD (MD-C S PRASAD)

Assessment for Working Capital facilities:

(If the assessment of the WC limits is based on any other parameters, like Cash Budget method, Nayak Committee-

Turnover Method, please specify them along with an explanation)

a) Inventory & receivable levels: Amount Rs. in Lakh (Days):

Inventory/Payments Previous Actuals Average as per Now Estimated Projected

Estimated Mthly. Review

2017 2017 2017 2018 2019

Raw material

(i)Imported (days) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0)

(ii)Indigenous (days) 0.00 (0) 73.86 (813) 0.00 (0) 80.00 (746) 88.00 (743)

SIP Amount (days) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0)

FG Amount (days) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0) 0.00 (0)

Receivables Amount (days) 0.00 (0) 52.26 (85) 0.00 (0) 55.22 (82) 65.00 (87)

S Creditors Amount (days) 0.00 (0) 53.66 (591) 0.00 (0) 54.22 (506) 55.25 (466)

b) Projected Turnover Method (Nayak Committee Method) and Traditional Method (Upto credit limits Rs. 5.00

crores)

(Rs. in Lakh)

Particulars Actual Estimated Projected

2017 2018 2019

a. Estimated Sales for the Current year 223.90 246.00 271.20

b.Working capital required (31.25% of ‘a’) or (18.75% of

‘a’) 69.97 76.88 84.75

Eligible Bank Finance (80% of ‘b’) 55.98 61.50 67.80

Bank finance Required (A) 55.98 61.50 67.80

2. Assessment as per Traditional Method

Estimated Purchases in the current Year 33.14 39.13 43.23

Estimated Average Raw Material Holding at any time

(Calculated at cost of Purchases) 73.86 80.00 88.00

Estimated Average holding of Stock in process and

Finished goods at any one time

0.00 0.00 0.00

(calculated at cost of Production)

Estimated Average Receivable outstanding at any one

time 52.26 55.22 65.00

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 18 of 24

Total Requirement 126.12 135.22 153.00

Less Estimated average credit enjoyed on purchases

53.66 54.22 55.25

Less Other Sources like unsecured loans, plough back of

profits etc 0.00 0.00 0.00

Bank Finance Required (B) 72.46 81.00 97.75

Working Capital Assessed/recommended 44.00 44.00 44.00

(A or B which ever is higher) i.e. 72.46 81.00 97.75

Comments

c. For Self Employed and Professionals Not Applicable

d. Assessment of EPC/FBD limits: Not Applicable

f. Assessment of other facilities:

(i) Assessment of Stand by Line Of Credit (SLC) : Not Applicable

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 19 of 24

(ii) Assessment of SME Credit plus: Not Applicable

(iii) Assessment of SME Care/SME Help: Not Applicable

(iv) Assessment of Open Term Loan: Not Applicable

(v) Assessment of SME Car Loan: Not Applicable

(vi) Assessment under Exporters Gold Card: Not Applicable

g.Assessment of Non fund based limits:

i) Assessment of LC limits: Not Applicable

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 20 of 24

ANNEXURE-3

Assessment of Term Loan: Not Applicable

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 21 of 24

Annexure 4

Circle: Hyderabad SMECCC: SME CITY CREDIT CENTER, Branch: SME CITY CREDIT CENTER,

HYDERABAD HYDERABAD

Borrower's Name: M/s. SPEAR ENGINEERING SOLUTIONS PVT LTD (MD-C S PRASAD)

Details of the approvals, sanctions and misc. details of the Firm / Company:

(Rs. in Lakh)

Details Particulars Remarks

1. CIF No(s) 72133456092

2. Trade Tax Registration. u74900tg2011ptc07628

3. TAN No. of the unit

4. IT Pan No. of the unit AAQCS4904C PAN

5. Company Registration No. U74900TG2011PTC076828

6. SSI/SME Registration Yes YES

7. Pollution Control Board clearances No

8. Whether covered under CGTMSE Yes CG20160013509WC

guarantee

9. Guarantee cover CGTMSE for

WC :(Amt)Rs. 44.00 CC

TL :(Amt)Rs 5.67 SME CAR

10. CGTMSE Guarantee valid upto

WC : 31/03/2018 CC

TL : 31/03/2018 NOT APPLICABLE

11. Charge in ROC registered /modified 29/03/2018 NOT DONE

on

12. Last ROC Search done on 20/03/2018 OBTAINED

13. Security Documents valid upto 01/01/2019 VALID

14. Insurance details

Company

Policy No POLICY

Amount

15. Date of last TIR

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 22 of 24

16. Date of last NEC

17. Date of last valuation

18. Mention any other, if any

Cross Selling and access to Alternate Channels: (Rs. in Lakh)

a. CINB facility extended No

b. Insta Deposit Card Issued No

c. Cash Pick-up required No

d. Cross Selling details :

Corporate Salary Package

P Segment Loans (Nos)

(a) Housing

(b) Auto Loans

(c) Personal Loans

SBI Credit Card (No.)

Point Of Sale Terminals

SBI Life Business : (Premium )

SBI General Insurance (Premium)

SBI Mutual Funds (Gross investment) 0 0

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 23 of 24

CUE Rating Annexure

CUE Rating Applicable Not Applicable

PAN Number AAQCS4904C

Current Proposal Previous Sanction

CUE Application # NA NA

CUE Customer Name NA NA

CUE Rating NA NA

Date of CUE Validation NA NA

CUE PD(%) NA NA

Deposit Module PD(%) NA NA

Cash Credit Module PD(%) NA NA

Customer Info Module PD(%) NA NA

QCA Module PD(%) NA NA

Bureau Module PD(%) NA NA

Financial Module PD(%) NA NA

Remarks Not Applicable

Scheme: Bank's Usual Credit Dispensation Scheme Application No: 180070501510757

Page 24 of 24

You might also like

- Model Business Plan Mango Pineapple Banana 1 1 1Document86 pagesModel Business Plan Mango Pineapple Banana 1 1 1ebubec92% (13)

- Sample Project Report For Commercial Vehicle LoanDocument18 pagesSample Project Report For Commercial Vehicle LoanRajveer Mahajan40% (5)

- Ca Inter Advanced Accounts Imp Questions BookletDocument112 pagesCa Inter Advanced Accounts Imp Questions BookletUdaykiran BheemaganiNo ratings yet

- Used Auto Sales Business PlanDocument59 pagesUsed Auto Sales Business PlanFaisal Nawaz100% (1)

- Numericals On Financial ManagementDocument4 pagesNumericals On Financial ManagementDhruv100% (1)

- Gym Project AppraisalDocument15 pagesGym Project AppraisalDanish Khan100% (1)

- EMW QuizDocument7 pagesEMW QuizNaresh Kumar100% (3)

- Firm Ka CR OM MEDICAL BOARD NOTE AND CONFIDENTIAL REPORT 1Document19 pagesFirm Ka CR OM MEDICAL BOARD NOTE AND CONFIDENTIAL REPORT 1apurva adviserNo ratings yet

- UCO Bank Revised - Simplified - GECL - Process - NoteDocument2 pagesUCO Bank Revised - Simplified - GECL - Process - NoteNitish KumarNo ratings yet

- Project Report - UMW Dongshin MotechDocument22 pagesProject Report - UMW Dongshin MotechGAURAV NIGAM0% (1)

- Final ExaminationDocument2 pagesFinal Examinationashikur rahmanNo ratings yet

- Executive MSC in Project Management: Finance - Final ExaminationDocument6 pagesExecutive MSC in Project Management: Finance - Final ExaminationSamantha Meril PandithaNo ratings yet

- Executive MSC in Project Management: Finance - Final ExaminationDocument6 pagesExecutive MSC in Project Management: Finance - Final ExaminationSamantha Meril PandithaNo ratings yet

- Mahamaya Project V2Document6 pagesMahamaya Project V2Sumit AhujaNo ratings yet

- Advanced Corporate AccountingDocument2 pagesAdvanced Corporate AccountingVanshika JainNo ratings yet

- Motorcycle LoanDocument10 pagesMotorcycle Loanrowilson reyNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementssantosh kumarNo ratings yet

- TermLoanASBProductDisclosureSheet IDocument8 pagesTermLoanASBProductDisclosureSheet IamirulNo ratings yet

- WorkingCapitalFinanceForNBFC AxisFinance C014 23 24 26 33 43 66Document18 pagesWorkingCapitalFinanceForNBFC AxisFinance C014 23 24 26 33 43 66Raunak BothraNo ratings yet

- StatementDocument10 pagesStatementchefrinkuNo ratings yet

- HBT LiftDocument3 pagesHBT Liftakcabhay9No ratings yet

- Jun 232021 Smespd 06 eDocument83 pagesJun 232021 Smespd 06 emahmudul hasanNo ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Case Study 1Document4 pagesCase Study 1Boopathi thangarajNo ratings yet

- T09759191021024401 SoadDocument8 pagesT09759191021024401 Soadkaushikajay.officialNo ratings yet

- PMEGPDocument26 pagesPMEGPadhyan kashyapNo ratings yet

- Andhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsDocument6 pagesAndhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsAbhishek OjhaNo ratings yet

- 58804bos47896finalnew p2 PDFDocument21 pages58804bos47896finalnew p2 PDFSatyam ThakurNo ratings yet

- Truck Proposal TLDocument10 pagesTruck Proposal TLwamiqhasanNo ratings yet

- Double S PLC-Annex - OD-Renw-Apr-2023Document7 pagesDouble S PLC-Annex - OD-Renw-Apr-2023nigussieabagazNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- Team Computers Private - R - 09102020Document8 pagesTeam Computers Private - R - 09102020DarshanNo ratings yet

- ASL Industries 18th Oct 2023 V2.2Document23 pagesASL Industries 18th Oct 2023 V2.2Shubham KothawadeNo ratings yet

- Rajesh Exports 20may2021Document6 pagesRajesh Exports 20may2021adhyan kashyapNo ratings yet

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDocument4 pagesSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNo ratings yet

- MC CMD Ed Others: Annexure Sanctioning AuthorityDocument26 pagesMC CMD Ed Others: Annexure Sanctioning AuthoritydanishsamdaniNo ratings yet

- IMF and RomaniaDocument1 pageIMF and RomaniaARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNo ratings yet

- Short Review Mohd IsmailDocument5 pagesShort Review Mohd IsmailVaibhav KumarNo ratings yet

- End Term - Corporate FinanceDocument3 pagesEnd Term - Corporate FinanceDEBAPRIYA SARKARNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Topic 4 To 6Document9 pagesTopic 4 To 6srocky2000No ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- Credit Appraisal Format For Limits Above Rs.2 Crore (For MSME Above Rs.5 Crore)Document34 pagesCredit Appraisal Format For Limits Above Rs.2 Crore (For MSME Above Rs.5 Crore)SAWAN KUMARNo ratings yet

- Loans and AdvancesDocument9 pagesLoans and AdvanceshasithapaletiNo ratings yet

- Statement ReportDocument7 pagesStatement ReportStevenNo ratings yet

- Altum Credo - New CAM Format For NBFC Clean VersionDocument19 pagesAltum Credo - New CAM Format For NBFC Clean VersionSwarna SinghNo ratings yet

- Factors Aaffecting NPAs - f1-1Document6 pagesFactors Aaffecting NPAs - f1-1Rashmi RajNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Loan Account Detail As On 12/04/2022: Issue Date: 12/04/2022 Page 1 of 15Document15 pagesLoan Account Detail As On 12/04/2022: Issue Date: 12/04/2022 Page 1 of 15Shamim ShaikhNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- DoshiDocument6 pagesDoshirasik890No ratings yet

- Hii Full Fill To ToDocument3 pagesHii Full Fill To ToNagasai PraveenNo ratings yet

- Annexure IIDocument9 pagesAnnexure IIPratik RajNo ratings yet

- BilledStatements 5332 16-02-24 21.30Document2 pagesBilledStatements 5332 16-02-24 21.30Sonali SutarNo ratings yet

- A Comparative Analysis of The Financial Performance Commercial BankDocument13 pagesA Comparative Analysis of The Financial Performance Commercial Bankssscribd46No ratings yet

- MBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021Document6 pagesMBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021subhasis mahapatraNo ratings yet

- 1066 RHBBANK TA 2024-01-09 HOLD 5.70 RHBBankBerhadBoostBankSettoGoLive - 496911287Document3 pages1066 RHBBANK TA 2024-01-09 HOLD 5.70 RHBBankBerhadBoostBankSettoGoLive - 496911287steven yapNo ratings yet

- Twoinstallments PDFDocument1 pageTwoinstallments PDFAlender TongiNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Scada Systems and ApplicationsDocument2 pagesScada Systems and ApplicationsNaresh KumarNo ratings yet

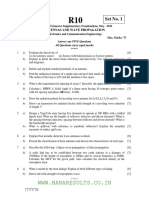

- WWW Manaresults Co inDocument2 pagesWWW Manaresults Co inNaresh KumarNo ratings yet

- WWW - Manaresults.Co - In: Answer Any FIVE Questions All Questions Carry Equal MarksDocument2 pagesWWW - Manaresults.Co - In: Answer Any FIVE Questions All Questions Carry Equal MarksNaresh KumarNo ratings yet

- JNTU Kakinada - M.Tech - EMBEDDED REAL TIME OPERATING SYSTEMSDocument7 pagesJNTU Kakinada - M.Tech - EMBEDDED REAL TIME OPERATING SYSTEMSNaresh KumarNo ratings yet

- HAVANA Brochure 1 FinalDocument12 pagesHAVANA Brochure 1 FinalNaresh KumarNo ratings yet

- Scada Systems and Its Applications: Instructions To CandidatesDocument1 pageScada Systems and Its Applications: Instructions To CandidatesNaresh KumarNo ratings yet

- Scheme - I Sample Question PaperDocument4 pagesScheme - I Sample Question PaperNaresh KumarNo ratings yet

- 19ecs431 - Embedded SystemsDocument18 pages19ecs431 - Embedded SystemsNaresh KumarNo ratings yet

- Memory TechnologiesDocument1 pageMemory TechnologiesNaresh KumarNo ratings yet

- CV 2 MarksDocument9 pagesCV 2 MarksNaresh KumarNo ratings yet

- JNTUK - M Tech - 2017 - 2nd Semester-H6810052017 SEMICONDUCTOR MEMORY DESIGN AND TESTINGDocument1 pageJNTUK - M Tech - 2017 - 2nd Semester-H6810052017 SEMICONDUCTOR MEMORY DESIGN AND TESTINGNaresh KumarNo ratings yet

- Criterion 3 UG NBADocument39 pagesCriterion 3 UG NBANaresh KumarNo ratings yet

- Scada Systems and Applications Jun 2020Document1 pageScada Systems and Applications Jun 2020Naresh KumarNo ratings yet

- IoT Lesson PlanDocument2 pagesIoT Lesson PlanNaresh KumarNo ratings yet

- Triple DES Using 3 Key MethodDocument3 pagesTriple DES Using 3 Key MethodNaresh KumarNo ratings yet

- School of Technology GITAM Deemed To Be UniversityDocument3 pagesSchool of Technology GITAM Deemed To Be UniversityNaresh KumarNo ratings yet

- JNTU ANANTAPUR - 2016 - 9A04701 Embedded Real Time Operating SystemsDocument1 pageJNTU ANANTAPUR - 2016 - 9A04701 Embedded Real Time Operating SystemsNaresh KumarNo ratings yet

- Malla Reddy Engineering College: B. Tech. Iv Semester (Mr15) Regular End ExaminationsDocument2 pagesMalla Reddy Engineering College: B. Tech. Iv Semester (Mr15) Regular End ExaminationsNaresh KumarNo ratings yet

- M.Tech. Degree Examination Embedded Systems: (EPRES 233)Document2 pagesM.Tech. Degree Examination Embedded Systems: (EPRES 233)Naresh KumarNo ratings yet

- Project Expo PosterDocument1 pageProject Expo PosterNaresh KumarNo ratings yet

- Malla Reddy Engineering College: B. Tech. Iv Semester (Mr15) Regular End ExaminationsDocument2 pagesMalla Reddy Engineering College: B. Tech. Iv Semester (Mr15) Regular End ExaminationsNaresh KumarNo ratings yet

- Eec207: Electromagnetic Waves L T P C 3 1 0 4Document2 pagesEec207: Electromagnetic Waves L T P C 3 1 0 4Naresh KumarNo ratings yet

- AWP Question Paper2 2016Document1 pageAWP Question Paper2 2016Naresh KumarNo ratings yet

- AWP Question Paper 2016Document1 pageAWP Question Paper 2016Naresh KumarNo ratings yet

- AWP Question Paper 2015Document4 pagesAWP Question Paper 2015Naresh KumarNo ratings yet

- Teacher Course FeedbackDocument1 pageTeacher Course FeedbackNaresh KumarNo ratings yet

- B.Tech. DEGREE Examination Electronics & Communication EngineeringDocument2 pagesB.Tech. DEGREE Examination Electronics & Communication EngineeringNaresh KumarNo ratings yet

- 6438nr-Digital System DesignDocument2 pages6438nr-Digital System DesignNaresh KumarNo ratings yet

- Eec403: Microwave EngineeringDocument1 pageEec403: Microwave EngineeringNaresh KumarNo ratings yet

- PGAS - Annual Report - 2015 - Versi Eng PDFDocument540 pagesPGAS - Annual Report - 2015 - Versi Eng PDFAal AlgebraNo ratings yet

- Almeda v. CA, 256 SCRA 292 (1996)Document7 pagesAlmeda v. CA, 256 SCRA 292 (1996)Fides DamascoNo ratings yet

- Relative Strength Index PDFDocument3 pagesRelative Strength Index PDFAnton Husen PurboyoNo ratings yet

- TEAM06 Lufthansa Ver.08.25Document33 pagesTEAM06 Lufthansa Ver.08.25Adonis SardiñasNo ratings yet

- ACCT 102 Lecture Notes Chapter 13 SPR 2018Document5 pagesACCT 102 Lecture Notes Chapter 13 SPR 2018Sophia Varias CruzNo ratings yet

- ACCT5432-17 S2 Seminar Week 3Document26 pagesACCT5432-17 S2 Seminar Week 3杨子偏No ratings yet

- Test 7 - IND AS 102, 19 - QuestionsDocument3 pagesTest 7 - IND AS 102, 19 - QuestionskrishbafanaNo ratings yet

- Central Bank Digital Currencies: Preliminary Legal ObservationsDocument30 pagesCentral Bank Digital Currencies: Preliminary Legal Observationsprabin ghimireNo ratings yet

- Control Accounts NotesDocument8 pagesControl Accounts NotesMehereen AubdoollahNo ratings yet

- 07 - Online Monetary TransactionsDocument20 pages07 - Online Monetary TransactionsELTSPDNo ratings yet

- Islamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMDocument7 pagesIslamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMTaha Wael QandeelNo ratings yet

- Lecture 31 Credit+Analysis+-+Credit+Ratings+and+Ratings+AgenciesDocument19 pagesLecture 31 Credit+Analysis+-+Credit+Ratings+and+Ratings+AgenciesTaanNo ratings yet

- SMEGuideBook EnglishDocument87 pagesSMEGuideBook EnglishDininduUdanaNawarathnaNo ratings yet

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajNo ratings yet

- Index PDFDocument2 pagesIndex PDFamanNo ratings yet

- QS Invoice-Rev.1Document1 pageQS Invoice-Rev.1Lusac EIRLNo ratings yet

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions ManualDocument45 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions Manualsmiletadynamia7iu4100% (24)

- Crypto Quantum LeapDocument28 pagesCrypto Quantum LeapManish VermaNo ratings yet

- Far ExercisesDocument34 pagesFar ExercisesTrisha Mae CorpuzNo ratings yet

- IAS-16 (Property, Plant & Equipment)Document20 pagesIAS-16 (Property, Plant & Equipment)Nazmul HaqueNo ratings yet

- Blackstone 3 Q21 Supplemental Financial DataDocument20 pagesBlackstone 3 Q21 Supplemental Financial DataW.Derail McClendonNo ratings yet

- Chapter 2 - ICF11e - ch03 - International Financial MarketsDocument30 pagesChapter 2 - ICF11e - ch03 - International Financial MarketsKhang Nguyễn Lâm ThếNo ratings yet

- Tai Tong v. Insurance Commission, GR. 55397, 29 Feb. 1988Document6 pagesTai Tong v. Insurance Commission, GR. 55397, 29 Feb. 1988Homer SimpsonNo ratings yet

- Income Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Document2 pagesIncome Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Jasmine ActaNo ratings yet

- How To Use BDO Nomura Online Trading Platform PDFDocument20 pagesHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNo ratings yet

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet