Professional Documents

Culture Documents

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Uploaded by

Alison JcCopyright:

Available Formats

You might also like

- FIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IDocument9 pagesFIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IAlison JcNo ratings yet

- Horizontal Analysis Narrative TescoDocument3 pagesHorizontal Analysis Narrative TescoAlison Jc100% (1)

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- Riel Corporation Comparative Statements of Financial Position December 31, 2025 Increase (Decrease) 2025 2024 Amount PercentDocument6 pagesRiel Corporation Comparative Statements of Financial Position December 31, 2025 Increase (Decrease) 2025 2024 Amount PercentKitheia Ostrava Reisenchauer100% (3)

- 06 Horniman Student F-1512xDocument5 pages06 Horniman Student F-1512xjohn galt0% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Horizontal Analysis WorksheetDocument3 pagesHorizontal Analysis WorksheetAlison JcNo ratings yet

- Accounting For Non-Accounting Students: by J. R DysonDocument2 pagesAccounting For Non-Accounting Students: by J. R DysonAlison Jc0% (1)

- Chapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionDocument41 pagesChapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionWihl Mathew ZalatarNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis SolvedAnurita PariharNo ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Soal Ujian Tengah Semester-Alk s1 2022Document4 pagesSoal Ujian Tengah Semester-Alk s1 2022malfendythNo ratings yet

- Lesson 4.2Document4 pagesLesson 4.2crisjay ramosNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Airthread Valuation Group#2Document24 pagesAirthread Valuation Group#2Himanshu AgrawalNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- Factbook-2017 0Document102 pagesFactbook-2017 0Mohamed KadriNo ratings yet

- Quarterly Update: First Half 2014 ResultsDocument4 pagesQuarterly Update: First Half 2014 ResultssapigagahNo ratings yet

- TemplateDocument8 pagesTemplateLukmanul HakimNo ratings yet

- Siemens Model3Document38 pagesSiemens Model3lalita patelNo ratings yet

- LLPW1e CH 17 Student FinalDocument17 pagesLLPW1e CH 17 Student FinaleusebiaNo ratings yet

- Requirements For Fundamentals of Accountancy, Busines S,& ManagementDocument15 pagesRequirements For Fundamentals of Accountancy, Busines S,& ManagementRichard John Ilagan DioknoNo ratings yet

- Apollo Tyres ProjectDocument10 pagesApollo Tyres ProjectChetanNo ratings yet

- 2016 Annual Financial ReportDocument247 pages2016 Annual Financial Reportpcelica77No ratings yet

- CPG Annual Report 2015Document56 pagesCPG Annual Report 2015Anonymous 2vtxh4No ratings yet

- SerwerDocument22 pagesSerwerSahand LaliNo ratings yet

- Krsnaa Diagnostics PVT LTD - v2Document67 pagesKrsnaa Diagnostics PVT LTD - v2HariharanNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. Zenderrohin gargNo ratings yet

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloNo ratings yet

- 4.1 Nature Financial Statement AnalysisDocument15 pages4.1 Nature Financial Statement AnalysisBOSS I4N TVNo ratings yet

- Dimaano CaseStudyPresentationDocument13 pagesDimaano CaseStudyPresentationRJ DimaanoNo ratings yet

- Daniel John Gabriel FarDocument9 pagesDaniel John Gabriel FarJohn Gabriel DanielNo ratings yet

- Adv Pack Historical DataDocument8 pagesAdv Pack Historical DataAnisha MathurNo ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- Unlock Assignment 05Document4 pagesUnlock Assignment 05mmakgabomnisi6No ratings yet

- Topic-3 CFAV STU Financial-Techniques 2022Document52 pagesTopic-3 CFAV STU Financial-Techniques 2022Thu BiNo ratings yet

- Horizontal and VerticalDocument9 pagesHorizontal and VerticalDianna EsmerayNo ratings yet

- Square Pharmaceuticals Income Statement: Gross Profit Operating ExpenseDocument33 pagesSquare Pharmaceuticals Income Statement: Gross Profit Operating ExpenseKamruzzaman khanNo ratings yet

- Prospective Analysis 2Document7 pagesProspective Analysis 2MAYANK JAINNo ratings yet

- Tarea Análisis Horizontal y Vertical StarbucksDocument4 pagesTarea Análisis Horizontal y Vertical StarbucksEmilio Nu�ez AvilesNo ratings yet

- Den FY2021 Financial Report-7Document6 pagesDen FY2021 Financial Report-7PAVANKUMAR S BNo ratings yet

- Financial - Report RTNDocument280 pagesFinancial - Report RTNShouib MehreyarNo ratings yet

- 2014 Annual Financial ReportDocument222 pages2014 Annual Financial Reportpcelica77No ratings yet

- TGT CaseDocument7 pagesTGT CaseMikael SpenceNo ratings yet

- Week 6Document8 pagesWeek 6Zsazsa100% (1)

- Case 02 FedEx UPS 2016 F1773XDocument10 pagesCase 02 FedEx UPS 2016 F1773XJosie KomiNo ratings yet

- Statements of Comprehensive IncomeDocument2 pagesStatements of Comprehensive IncomeLimarie Kris AñezNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Woof-JunctionDocument13 pagesWoof-Junctionlauvictoria29No ratings yet

- Compilation Notes Financial Statement AnalysisDocument8 pagesCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNo ratings yet

- FY24 Q1 Combined NIKE Press Release Schedules FINALDocument7 pagesFY24 Q1 Combined NIKE Press Release Schedules FINALTADIWANo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- Fm-I Chap-Ii EditedDocument55 pagesFm-I Chap-Ii Editedtibebu5420No ratings yet

- IV. Management Discussion and Analysis: 1. Note On Forward-Looking StatementsDocument14 pagesIV. Management Discussion and Analysis: 1. Note On Forward-Looking StatementsSITI MAISARAH BINTI MOHAMAD YAZIDNo ratings yet

- 2015 Annual ReportDocument184 pages2015 Annual Reportpcelica77No ratings yet

- Abbott AnalysisDocument35 pagesAbbott Analysisahmad bilal sabirNo ratings yet

- FSA CompleteDocument41 pagesFSA Completeabdul moizNo ratings yet

- Chapter No 06 Final Afs-1Document58 pagesChapter No 06 Final Afs-1salwaburiroNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2016 AccountingDocument16 pages2016 AccountingAlison JcNo ratings yet

- Accounting2 Task 7Document8 pagesAccounting2 Task 7Alison JcNo ratings yet

- Task 10 AccountingDocument1 pageTask 10 AccountingAlison JcNo ratings yet

- Job Interviews YspaceDocument6 pagesJob Interviews YspaceAlison JcNo ratings yet

- 704966Document6 pages704966Alison JcNo ratings yet

- Vertical and Horizontal AnalysisDocument3 pagesVertical and Horizontal AnalysisAlison JcNo ratings yet

- Solutions Manual: Introduction To AccountingDocument5 pagesSolutions Manual: Introduction To AccountingAlison JcNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisAlison JcNo ratings yet

- 3 2 Final Project Milestone Two Vertical and Horizontal AnalysisDocument2 pages3 2 Final Project Milestone Two Vertical and Horizontal AnalysisAlison JcNo ratings yet

- Writing Successful Essays Update 051112Document2 pagesWriting Successful Essays Update 051112Alison JcNo ratings yet

- SBUX Vertical and Horizontal AnalysisDocument1 pageSBUX Vertical and Horizontal AnalysisAlison JcNo ratings yet

- Tips On Writing An Effective EssayDocument2 pagesTips On Writing An Effective EssayAlison JcNo ratings yet

- Essay Writing TipsDocument1 pageEssay Writing TipsAlison JcNo ratings yet

- Basic Ideas of Financial Mathematics: 1 PercentageDocument11 pagesBasic Ideas of Financial Mathematics: 1 PercentageAlison JcNo ratings yet

- Intermediate Maths MaterialDocument187 pagesIntermediate Maths MaterialAlison JcNo ratings yet

- Financial Mathematics: I-Liang ChernDocument135 pagesFinancial Mathematics: I-Liang ChernAlison JcNo ratings yet

- IPO Critical DisclosuresDocument93 pagesIPO Critical DisclosuresFarhin MaldarNo ratings yet

- Scoggin Capital On BloombergDocument2 pagesScoggin Capital On BloombergExcessCapitalNo ratings yet

- Chapter 8Document39 pagesChapter 8heqingNo ratings yet

- EDHEC Position Paper Risks European ETFsDocument70 pagesEDHEC Position Paper Risks European ETFsgohchuansin100% (1)

- BMC Topaz UsDocument6 pagesBMC Topaz UsHamza Mouhamed AmineNo ratings yet

- Utility, Indifference Curves Portfolio Theory - Investing in OneDocument38 pagesUtility, Indifference Curves Portfolio Theory - Investing in Oneisteaq ahamedNo ratings yet

- AltaVista's Clients Speak Out (Part 3 of 3) - Growth Capitalist March 9 2017Document3 pagesAltaVista's Clients Speak Out (Part 3 of 3) - Growth Capitalist March 9 2017Teri BuhlNo ratings yet

- Module 22 Liabilities and EquityDocument63 pagesModule 22 Liabilities and EquityCaptain ObviousNo ratings yet

- Another Stupid Letter From Larry FinkDocument2 pagesAnother Stupid Letter From Larry FinkCODEPINKNo ratings yet

- Robo Advisory FintecDocument12 pagesRobo Advisory FintecUtkarsh SharmaNo ratings yet

- Cash BudgetDocument7 pagesCash BudgetabyNo ratings yet

- Principles of Marketing 16Th Edition Kotler Test Bank Full Chapter PDFDocument68 pagesPrinciples of Marketing 16Th Edition Kotler Test Bank Full Chapter PDFSaraSmithdgyj100% (12)

- Assignment 7Document2 pagesAssignment 7Isabel RiveroNo ratings yet

- Module 9 - Statement of Cash Flows Part 2Document14 pagesModule 9 - Statement of Cash Flows Part 2Geneen LouiseNo ratings yet

- Moving Average: 130 140 Actual ForecastDocument12 pagesMoving Average: 130 140 Actual ForecastFaith MateoNo ratings yet

- HW1Document4 pagesHW1Annie JuliaNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet

- BAJFINANCE 26042023174914 BFL SEFiling ConsolidatedDocument50 pagesBAJFINANCE 26042023174914 BFL SEFiling ConsolidatedMajor LoonyNo ratings yet

- Banana Leaf Catering FSDocument2 pagesBanana Leaf Catering FSLeslie CastilloNo ratings yet

- CH 3Document35 pagesCH 3alicia darwinNo ratings yet

- Crude Trading PlanDocument19 pagesCrude Trading PlanGopagani DharshanNo ratings yet

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet

- Pengurusan Kewangan (Kumpulan 6)Document42 pagesPengurusan Kewangan (Kumpulan 6)Wai ChongNo ratings yet

- Brief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMDocument13 pagesBrief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMĐức NghĩaNo ratings yet

- Pinguin Prospectus 18.10.2007 - UkDocument254 pagesPinguin Prospectus 18.10.2007 - UkMikeElNo ratings yet

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- Red Flags of Enron's of Revenue and Key Financial MeasuresDocument24 pagesRed Flags of Enron's of Revenue and Key Financial MeasuresJoshua BailonNo ratings yet

- Options Trading GuideDocument57 pagesOptions Trading Guidecallmetarantula85% (13)

- GPB Capital: Massachusetts ComplaintDocument47 pagesGPB Capital: Massachusetts ComplaintTony OrtegaNo ratings yet

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Uploaded by

Alison JcOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Discuss The Basics of Horizontal Analysis or Vertical Analysis

Uploaded by

Alison JcCopyright:

Available Formats

The horizontal analysis is a comparison of the historical financial information for a company over

a series of reporting periods, or of the ratios derived from this financial information (Accounting Tools,

n.d.). This can be performed on revenues, cost of sales, expenses assets cash, equity and

liabilities. Additionally, it can be performed on ratios. The best quick description of a horizontal analysis

is that when you hear a person say that revenues have increased by 15% in this past quarter, that person

is using a horizontal analysis. The ease of use comes from the fact that it can be used on any item in the

company’s financial statements. There are two ways in which the comparison can be made. The first way

is the absolute comparison which compares the absolute currency amounts of the items over a period of

time (Ready Ratios, n.d.).

The second way is the percentage comparison, in which percentages are compared over a

certain period of time, and more simply, so that an easy increase or decrease rate can be

determined. (Ready Ratios, n.d.). The percentage comparison is most useful when

comparing companies that are of different size and scale. The fact that the accounting periods can be

two period or more than two periods, a month, a quarter or a year, it is the analyst’s discretion when

choosing which data they'd like to interpret and perform the analysis on.

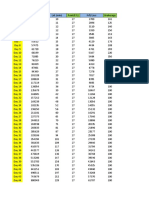

The company I chose to perform the horizontal analysis on was Best Buy’s consolidated balance sheet for

the 2014-2015 comparative years.

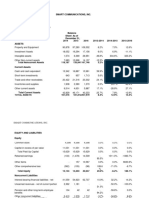

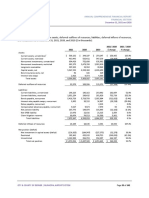

Assets

Current Assets 2015 2014 Increase or (Decrease)

Amount percent

Cash and cash equivalents $ 2,432 $ 2,678 (246) (9.1)%

Short-term investments 1,456 223 1233 529.2%

Receivables, net 1,280 1,308 (28) (2.1)%

Merchandise inventories 5,174 5,376 (202) (15.4)%

Other current assets 703 900 (197) (21.9)%

Current assets held for sale 684 — (684) 100%

Total current assets 11,729 10,485 1244 11.9%

Property and Equipment

Land and buildings 611 758 (147) (1.9)%

Leasehold improvements 2,201 2,182 19 .87%

Fixtures and equipment 4,729 4,515 214 4.7%

Property under capital lease 119 120 (1) (.8)%

7,660 7,575 85 1.1%

Less accumulated depreciation 5,365 4,977 388 7.8%

Net property and equipment 2,295 2,598 (303) (11.7)%

Goodwill 425 425 - 0

Intangibles, Net 57 101 (44) (43.6)%

Other Assets 583 404 179 44.3%

Non-current assets held for sale 167 - 167 100%

Total Assets $ 15,256 $ 14,013 1243 8.9%

The end analysis shows that while many negative numbers are seen here throughout this portion of the

consolidated balance sheet, the end result is that the company’s total sets grew by 8.9%, which is an

overall gain for the company.

References

Accounting Tools. (n.d.). Horizontal Analysis. Retrieved on February 1, 2016

from http://www.accountingtools.com/horizontal-analysis

Ready Ratios. (n.d.). Horizontal Analysis of Financial Statements. Retrieved on February 1, 2016

from http://www.readyratios.com/reference/analysis/horizontal_analysis_of_financial_stateme

nts.html

You might also like

- FIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IDocument9 pagesFIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IAlison JcNo ratings yet

- Horizontal Analysis Narrative TescoDocument3 pagesHorizontal Analysis Narrative TescoAlison Jc100% (1)

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- Riel Corporation Comparative Statements of Financial Position December 31, 2025 Increase (Decrease) 2025 2024 Amount PercentDocument6 pagesRiel Corporation Comparative Statements of Financial Position December 31, 2025 Increase (Decrease) 2025 2024 Amount PercentKitheia Ostrava Reisenchauer100% (3)

- 06 Horniman Student F-1512xDocument5 pages06 Horniman Student F-1512xjohn galt0% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Horizontal Analysis WorksheetDocument3 pagesHorizontal Analysis WorksheetAlison JcNo ratings yet

- Accounting For Non-Accounting Students: by J. R DysonDocument2 pagesAccounting For Non-Accounting Students: by J. R DysonAlison Jc0% (1)

- Chapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionDocument41 pagesChapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionWihl Mathew ZalatarNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis SolvedAnurita PariharNo ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Soal Ujian Tengah Semester-Alk s1 2022Document4 pagesSoal Ujian Tengah Semester-Alk s1 2022malfendythNo ratings yet

- Lesson 4.2Document4 pagesLesson 4.2crisjay ramosNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Airthread Valuation Group#2Document24 pagesAirthread Valuation Group#2Himanshu AgrawalNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- Factbook-2017 0Document102 pagesFactbook-2017 0Mohamed KadriNo ratings yet

- Quarterly Update: First Half 2014 ResultsDocument4 pagesQuarterly Update: First Half 2014 ResultssapigagahNo ratings yet

- TemplateDocument8 pagesTemplateLukmanul HakimNo ratings yet

- Siemens Model3Document38 pagesSiemens Model3lalita patelNo ratings yet

- LLPW1e CH 17 Student FinalDocument17 pagesLLPW1e CH 17 Student FinaleusebiaNo ratings yet

- Requirements For Fundamentals of Accountancy, Busines S,& ManagementDocument15 pagesRequirements For Fundamentals of Accountancy, Busines S,& ManagementRichard John Ilagan DioknoNo ratings yet

- Apollo Tyres ProjectDocument10 pagesApollo Tyres ProjectChetanNo ratings yet

- 2016 Annual Financial ReportDocument247 pages2016 Annual Financial Reportpcelica77No ratings yet

- CPG Annual Report 2015Document56 pagesCPG Annual Report 2015Anonymous 2vtxh4No ratings yet

- SerwerDocument22 pagesSerwerSahand LaliNo ratings yet

- Krsnaa Diagnostics PVT LTD - v2Document67 pagesKrsnaa Diagnostics PVT LTD - v2HariharanNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- Fima Midterm ActsDocument4 pagesFima Midterm ActsKatrina PaquizNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. Zenderrohin gargNo ratings yet

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloNo ratings yet

- 4.1 Nature Financial Statement AnalysisDocument15 pages4.1 Nature Financial Statement AnalysisBOSS I4N TVNo ratings yet

- Dimaano CaseStudyPresentationDocument13 pagesDimaano CaseStudyPresentationRJ DimaanoNo ratings yet

- Daniel John Gabriel FarDocument9 pagesDaniel John Gabriel FarJohn Gabriel DanielNo ratings yet

- Adv Pack Historical DataDocument8 pagesAdv Pack Historical DataAnisha MathurNo ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- Unlock Assignment 05Document4 pagesUnlock Assignment 05mmakgabomnisi6No ratings yet

- Topic-3 CFAV STU Financial-Techniques 2022Document52 pagesTopic-3 CFAV STU Financial-Techniques 2022Thu BiNo ratings yet

- Horizontal and VerticalDocument9 pagesHorizontal and VerticalDianna EsmerayNo ratings yet

- Square Pharmaceuticals Income Statement: Gross Profit Operating ExpenseDocument33 pagesSquare Pharmaceuticals Income Statement: Gross Profit Operating ExpenseKamruzzaman khanNo ratings yet

- Prospective Analysis 2Document7 pagesProspective Analysis 2MAYANK JAINNo ratings yet

- Tarea Análisis Horizontal y Vertical StarbucksDocument4 pagesTarea Análisis Horizontal y Vertical StarbucksEmilio Nu�ez AvilesNo ratings yet

- Den FY2021 Financial Report-7Document6 pagesDen FY2021 Financial Report-7PAVANKUMAR S BNo ratings yet

- Financial - Report RTNDocument280 pagesFinancial - Report RTNShouib MehreyarNo ratings yet

- 2014 Annual Financial ReportDocument222 pages2014 Annual Financial Reportpcelica77No ratings yet

- TGT CaseDocument7 pagesTGT CaseMikael SpenceNo ratings yet

- Week 6Document8 pagesWeek 6Zsazsa100% (1)

- Case 02 FedEx UPS 2016 F1773XDocument10 pagesCase 02 FedEx UPS 2016 F1773XJosie KomiNo ratings yet

- Statements of Comprehensive IncomeDocument2 pagesStatements of Comprehensive IncomeLimarie Kris AñezNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Woof-JunctionDocument13 pagesWoof-Junctionlauvictoria29No ratings yet

- Compilation Notes Financial Statement AnalysisDocument8 pagesCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNo ratings yet

- FY24 Q1 Combined NIKE Press Release Schedules FINALDocument7 pagesFY24 Q1 Combined NIKE Press Release Schedules FINALTADIWANo ratings yet

- Factbook 2021 Version XLSXDocument108 pagesFactbook 2021 Version XLSXMohamed KadriNo ratings yet

- Fm-I Chap-Ii EditedDocument55 pagesFm-I Chap-Ii Editedtibebu5420No ratings yet

- IV. Management Discussion and Analysis: 1. Note On Forward-Looking StatementsDocument14 pagesIV. Management Discussion and Analysis: 1. Note On Forward-Looking StatementsSITI MAISARAH BINTI MOHAMAD YAZIDNo ratings yet

- 2015 Annual ReportDocument184 pages2015 Annual Reportpcelica77No ratings yet

- Abbott AnalysisDocument35 pagesAbbott Analysisahmad bilal sabirNo ratings yet

- FSA CompleteDocument41 pagesFSA Completeabdul moizNo ratings yet

- Chapter No 06 Final Afs-1Document58 pagesChapter No 06 Final Afs-1salwaburiroNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2016 AccountingDocument16 pages2016 AccountingAlison JcNo ratings yet

- Accounting2 Task 7Document8 pagesAccounting2 Task 7Alison JcNo ratings yet

- Task 10 AccountingDocument1 pageTask 10 AccountingAlison JcNo ratings yet

- Job Interviews YspaceDocument6 pagesJob Interviews YspaceAlison JcNo ratings yet

- 704966Document6 pages704966Alison JcNo ratings yet

- Vertical and Horizontal AnalysisDocument3 pagesVertical and Horizontal AnalysisAlison JcNo ratings yet

- Solutions Manual: Introduction To AccountingDocument5 pagesSolutions Manual: Introduction To AccountingAlison JcNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisAlison JcNo ratings yet

- 3 2 Final Project Milestone Two Vertical and Horizontal AnalysisDocument2 pages3 2 Final Project Milestone Two Vertical and Horizontal AnalysisAlison JcNo ratings yet

- Writing Successful Essays Update 051112Document2 pagesWriting Successful Essays Update 051112Alison JcNo ratings yet

- SBUX Vertical and Horizontal AnalysisDocument1 pageSBUX Vertical and Horizontal AnalysisAlison JcNo ratings yet

- Tips On Writing An Effective EssayDocument2 pagesTips On Writing An Effective EssayAlison JcNo ratings yet

- Essay Writing TipsDocument1 pageEssay Writing TipsAlison JcNo ratings yet

- Basic Ideas of Financial Mathematics: 1 PercentageDocument11 pagesBasic Ideas of Financial Mathematics: 1 PercentageAlison JcNo ratings yet

- Intermediate Maths MaterialDocument187 pagesIntermediate Maths MaterialAlison JcNo ratings yet

- Financial Mathematics: I-Liang ChernDocument135 pagesFinancial Mathematics: I-Liang ChernAlison JcNo ratings yet

- IPO Critical DisclosuresDocument93 pagesIPO Critical DisclosuresFarhin MaldarNo ratings yet

- Scoggin Capital On BloombergDocument2 pagesScoggin Capital On BloombergExcessCapitalNo ratings yet

- Chapter 8Document39 pagesChapter 8heqingNo ratings yet

- EDHEC Position Paper Risks European ETFsDocument70 pagesEDHEC Position Paper Risks European ETFsgohchuansin100% (1)

- BMC Topaz UsDocument6 pagesBMC Topaz UsHamza Mouhamed AmineNo ratings yet

- Utility, Indifference Curves Portfolio Theory - Investing in OneDocument38 pagesUtility, Indifference Curves Portfolio Theory - Investing in Oneisteaq ahamedNo ratings yet

- AltaVista's Clients Speak Out (Part 3 of 3) - Growth Capitalist March 9 2017Document3 pagesAltaVista's Clients Speak Out (Part 3 of 3) - Growth Capitalist March 9 2017Teri BuhlNo ratings yet

- Module 22 Liabilities and EquityDocument63 pagesModule 22 Liabilities and EquityCaptain ObviousNo ratings yet

- Another Stupid Letter From Larry FinkDocument2 pagesAnother Stupid Letter From Larry FinkCODEPINKNo ratings yet

- Robo Advisory FintecDocument12 pagesRobo Advisory FintecUtkarsh SharmaNo ratings yet

- Cash BudgetDocument7 pagesCash BudgetabyNo ratings yet

- Principles of Marketing 16Th Edition Kotler Test Bank Full Chapter PDFDocument68 pagesPrinciples of Marketing 16Th Edition Kotler Test Bank Full Chapter PDFSaraSmithdgyj100% (12)

- Assignment 7Document2 pagesAssignment 7Isabel RiveroNo ratings yet

- Module 9 - Statement of Cash Flows Part 2Document14 pagesModule 9 - Statement of Cash Flows Part 2Geneen LouiseNo ratings yet

- Moving Average: 130 140 Actual ForecastDocument12 pagesMoving Average: 130 140 Actual ForecastFaith MateoNo ratings yet

- HW1Document4 pagesHW1Annie JuliaNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet

- BAJFINANCE 26042023174914 BFL SEFiling ConsolidatedDocument50 pagesBAJFINANCE 26042023174914 BFL SEFiling ConsolidatedMajor LoonyNo ratings yet

- Banana Leaf Catering FSDocument2 pagesBanana Leaf Catering FSLeslie CastilloNo ratings yet

- CH 3Document35 pagesCH 3alicia darwinNo ratings yet

- Crude Trading PlanDocument19 pagesCrude Trading PlanGopagani DharshanNo ratings yet

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet

- Pengurusan Kewangan (Kumpulan 6)Document42 pagesPengurusan Kewangan (Kumpulan 6)Wai ChongNo ratings yet

- Brief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMDocument13 pagesBrief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMĐức NghĩaNo ratings yet

- Pinguin Prospectus 18.10.2007 - UkDocument254 pagesPinguin Prospectus 18.10.2007 - UkMikeElNo ratings yet

- Topic 5 Types of RisksDocument11 pagesTopic 5 Types of Riskskenedy simwingaNo ratings yet

- Red Flags of Enron's of Revenue and Key Financial MeasuresDocument24 pagesRed Flags of Enron's of Revenue and Key Financial MeasuresJoshua BailonNo ratings yet

- Options Trading GuideDocument57 pagesOptions Trading Guidecallmetarantula85% (13)

- GPB Capital: Massachusetts ComplaintDocument47 pagesGPB Capital: Massachusetts ComplaintTony OrtegaNo ratings yet