Professional Documents

Culture Documents

Does The Number of Interlockin

Does The Number of Interlockin

Uploaded by

Ehssan SamaraCopyright:

Available Formats

You might also like

- Guzdial, Mark Ericson, Barbara - Introduction To Computing and Programming With Java - A Multimedia Approach PDFDocument384 pagesGuzdial, Mark Ericson, Barbara - Introduction To Computing and Programming With Java - A Multimedia Approach PDFWendy Do70% (10)

- Corporate Governance Mechanisms and Firm Performance A Survey of LiteratureDocument16 pagesCorporate Governance Mechanisms and Firm Performance A Survey of Literaturekamal khanNo ratings yet

- Examining The Effect of Organization Culture and Leadership Behaviors On Organizational Commitment, Job Satisfaction, and Job PerformanceDocument8 pagesExamining The Effect of Organization Culture and Leadership Behaviors On Organizational Commitment, Job Satisfaction, and Job PerformanceDrSunnyWadhwa100% (1)

- Duromax Xp10000e Generator Owners ManualDocument28 pagesDuromax Xp10000e Generator Owners Manualduromax0% (1)

- The Effect of Life Cycle Stage of A Firm On TheDocument23 pagesThe Effect of Life Cycle Stage of A Firm On TheIsmanidarNo ratings yet

- For 3rd Class - PDF - Resource Dependence Theory - A Review - Journal of ManagementDocument24 pagesFor 3rd Class - PDF - Resource Dependence Theory - A Review - Journal of ManagementRashed ShukornoNo ratings yet

- The Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectiveDocument10 pagesThe Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectivebaruthiomNo ratings yet

- Hodge Piccolo 2011Document33 pagesHodge Piccolo 2011VerperNo ratings yet

- Michel On 2010Document33 pagesMichel On 2010Tawsif HasanNo ratings yet

- Post-Restructuring Governance: An Examination of Interlocking DirectoratesDocument16 pagesPost-Restructuring Governance: An Examination of Interlocking DirectoratesEhssan SamaraNo ratings yet

- The Effect of Corporate Social Performance On Financial Performance (The Moderating Effect of Ownership Concentration)Document12 pagesThe Effect of Corporate Social Performance On Financial Performance (The Moderating Effect of Ownership Concentration)Hanan RadityaNo ratings yet

- Relationship Between Board Structure and Firm PerformanceDocument25 pagesRelationship Between Board Structure and Firm PerformanceThanh MaiNo ratings yet

- Board Size, Board Composition and Property PDFDocument16 pagesBoard Size, Board Composition and Property PDFAlifah SalwaNo ratings yet

- RutledgeRW Web18 2Document23 pagesRutledgeRW Web18 2Corolla SedanNo ratings yet

- Assenga Et Al 2018the - Impact - of - Board - Characteristics - On - The - Financial - Performance - of - Tanzanian - FirmsDocument31 pagesAssenga Et Al 2018the - Impact - of - Board - Characteristics - On - The - Financial - Performance - of - Tanzanian - FirmsSahirr SahirNo ratings yet

- Employee Retention Articles 2 PDFDocument21 pagesEmployee Retention Articles 2 PDFCharmaine ShaninaNo ratings yet

- Hillman, Withers e Collins (2009)Document24 pagesHillman, Withers e Collins (2009)Thales MardenNo ratings yet

- CEO Duality and Firm Performance: The Moderating Roles of CEO Informal Power and Board InvolvementsDocument22 pagesCEO Duality and Firm Performance: The Moderating Roles of CEO Informal Power and Board InvolvementsWihelmina DeaNo ratings yet

- Board Structure Ceo Tenure Firm Characte PDFDocument25 pagesBoard Structure Ceo Tenure Firm Characte PDFTeshaleNo ratings yet

- Sadaf SpinnerDocument7 pagesSadaf SpinnerDr-Liaqat AliNo ratings yet

- Managerial Ownership, Corporate Governance, and Voluntary DisclosureDocument19 pagesManagerial Ownership, Corporate Governance, and Voluntary Disclosure701450No ratings yet

- The Impact of Corporate Governance Performance On The Occurrence of Rpts. A Study of Indian Stock MarketDocument19 pagesThe Impact of Corporate Governance Performance On The Occurrence of Rpts. A Study of Indian Stock MarketAjazzMushtaqNo ratings yet

- Hsu 2018Document26 pagesHsu 2018Shaharyar Khan MarwatNo ratings yet

- Article 4 Corporate GovernanceDocument17 pagesArticle 4 Corporate GovernanceAayushCNo ratings yet

- JFIA/Vol 7 - 1 - 3Document21 pagesJFIA/Vol 7 - 1 - 3naseem ashrafNo ratings yet

- Corporate Governance-Assessment of The Determinants of The Effectiveness of The BoardDocument13 pagesCorporate Governance-Assessment of The Determinants of The Effectiveness of The BoardcpamutuiNo ratings yet

- Research Abstract: Effect of HR Practices On Organizational CommitmentDocument38 pagesResearch Abstract: Effect of HR Practices On Organizational Commitmentpranoy87No ratings yet

- 9910-33101-1-SMDocument8 pages9910-33101-1-SMPhương LinhNo ratings yet

- 1 PBDocument11 pages1 PBMissaoui IbtissemNo ratings yet

- Ben Amar2011Document17 pagesBen Amar2011NiaNo ratings yet

- Innocent I 2010Document15 pagesInnocent I 2010Muhammad Farrukh RanaNo ratings yet

- 11.vol 0004www - Iiste.org Call - For - Paper No 1 Pp. 40-64Document26 pages11.vol 0004www - Iiste.org Call - For - Paper No 1 Pp. 40-64Alexander DeckerNo ratings yet

- 9675-Article Text-36130-3-10-20161024Document12 pages9675-Article Text-36130-3-10-20161024mbauksupportNo ratings yet

- The Optimum Boardroom Composition and The Limitations of The Agency TheoryDocument22 pagesThe Optimum Boardroom Composition and The Limitations of The Agency TheoryMohd HapiziNo ratings yet

- NCD 18 05 2024Document22 pagesNCD 18 05 2024Dr. Nitai Chandra DebnathNo ratings yet

- 6-Saibal GhoshDocument14 pages6-Saibal GhoshDisha BaraiNo ratings yet

- Academy of ManagementDocument22 pagesAcademy of ManagementPeter KiepuszewskiNo ratings yet

- Determinan SustuinableDocument39 pagesDeterminan SustuinableArif Kenji ShinodaNo ratings yet

- Does Ownership Structure Affect Firm'S Performance? Empirical Evidence From PakistanDocument23 pagesDoes Ownership Structure Affect Firm'S Performance? Empirical Evidence From PakistanAsif SaleemNo ratings yet

- Maiga 2007Document33 pagesMaiga 2007Muhammad ArfanNo ratings yet

- Giulia Flamini and Luca GnanDocument52 pagesGiulia Flamini and Luca GnanBello AishatNo ratings yet

- Critical Perspectives On AccountingDocument13 pagesCritical Perspectives On AccountingHaroon ShafiNo ratings yet

- Literature Review On The Relationship Between Board Structure and Firm PerformanceDocument11 pagesLiterature Review On The Relationship Between Board Structure and Firm PerformanceDr Shubhi AgarwalNo ratings yet

- (KODE 05) - BI - CP (Kuantitatif) - Q1Document9 pages(KODE 05) - BI - CP (Kuantitatif) - Q1Arif Kathon SubhektiNo ratings yet

- Corporate Governance 3Document14 pagesCorporate Governance 3Sekar MuruganNo ratings yet

- Lamport M J, Latona M N, Seetanah B, Sannassee R VDocument31 pagesLamport M J, Latona M N, Seetanah B, Sannassee R VManjula AshokNo ratings yet

- Organizational Restructuring Impact On Trust and Work SatisfactionDocument17 pagesOrganizational Restructuring Impact On Trust and Work SatisfactionAna Maria SimaNo ratings yet

- HRD ClimateDocument8 pagesHRD ClimatePothireddy MarreddyNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewAkanni Lateef ONo ratings yet

- Document 2Document21 pagesDocument 2Erselia TrinisaNo ratings yet

- UntitledDocument3 pagesUntitledNUR FARAH ALIAH RAMLANNo ratings yet

- Franken Cook 2Document16 pagesFranken Cook 2Cain Cyrus MonderoNo ratings yet

- Performance Measurement and Reward Systems, Trust, and Strategic ChangeDocument29 pagesPerformance Measurement and Reward Systems, Trust, and Strategic ChangeZulfaneri PutraNo ratings yet

- Gschwantner - Hiebl (JoMaC, 2016) - Management Control Systems and Organizational AmbidexterityDocument35 pagesGschwantner - Hiebl (JoMaC, 2016) - Management Control Systems and Organizational AmbidexterityHemi Fradilla TariganNo ratings yet

- Ceo DualityDocument16 pagesCeo Dualityconnie-lee06No ratings yet

- Are The 100 Best Better by Fulmer Citado Por S RobbinsDocument29 pagesAre The 100 Best Better by Fulmer Citado Por S RobbinsJONEL ANTONY MAYHUA CHUCHONNo ratings yet

- Literature Review 5Document3 pagesLiterature Review 5JasperNo ratings yet

- Reducing Employee TurnoverDocument13 pagesReducing Employee TurnoverNasir Uddin SharifNo ratings yet

- Top Management Team Process, Shared Leadership, and New Venture Performance: A Theoretical Model and Research AgendaDocument18 pagesTop Management Team Process, Shared Leadership, and New Venture Performance: A Theoretical Model and Research AgendaJuliana ChacónNo ratings yet

- 19 Top Management Team ProcessDocument18 pages19 Top Management Team ProcessGordon ClarkeNo ratings yet

- Study of leader member relationship and emotional intelligence in relation to change in preparedness among middle management personnel in the automobile sectorFrom EverandStudy of leader member relationship and emotional intelligence in relation to change in preparedness among middle management personnel in the automobile sectorNo ratings yet

- Post-Restructuring Governance: An Examination of Interlocking DirectoratesDocument16 pagesPost-Restructuring Governance: An Examination of Interlocking DirectoratesEhssan SamaraNo ratings yet

- Directors' Human Capital, Firm Strategy, and Firm PerformanceDocument31 pagesDirectors' Human Capital, Firm Strategy, and Firm PerformanceEhssan SamaraNo ratings yet

- 2018-Board Diversity, Firm Risk, and Corporate PoliciesDocument25 pages2018-Board Diversity, Firm Risk, and Corporate PoliciesEhssan SamaraNo ratings yet

- 2019-Gender Diversity in Senior Management, Strategic Change, and Firm PerformanceDocument13 pages2019-Gender Diversity in Senior Management, Strategic Change, and Firm PerformanceEhssan SamaraNo ratings yet

- Anti-Fog Product Suite: FSI Coating TechnologiesDocument2 pagesAnti-Fog Product Suite: FSI Coating TechnologiesMIGUEL ANGEL NOCUA SALAZARNo ratings yet

- Nba Sar Ug B.tech. Electrical EnggDocument161 pagesNba Sar Ug B.tech. Electrical EnggSaurabh BhiseNo ratings yet

- Numerical Descriptive Techniques (6 Hours)Document89 pagesNumerical Descriptive Techniques (6 Hours)Kato AkikoNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesGraceRasdasNo ratings yet

- Resumen Conceptos Hidrológicos Básicos 1. Distribución de Agua en El PlanetaDocument2 pagesResumen Conceptos Hidrológicos Básicos 1. Distribución de Agua en El PlanetaAnderson Bruce Sosa RaymundoNo ratings yet

- HTTP 192.168.20.28 GSP Tree Zptree Demo Lista Wo View PontajDocument1 pageHTTP 192.168.20.28 GSP Tree Zptree Demo Lista Wo View Pontajfanehhh 10No ratings yet

- Excel - Assignment - 1 (1Document16 pagesExcel - Assignment - 1 (1Ashish ChangediyaNo ratings yet

- Answer Key: Progress Tests (A) : Unit 10Document1 pageAnswer Key: Progress Tests (A) : Unit 10Сладкий ХлебушекNo ratings yet

- Pulsation Suppression Device Design For Reciprocating CompressorDocument9 pagesPulsation Suppression Device Design For Reciprocating CompressorFrancis LinNo ratings yet

- SQL Essentials PDFDocument36 pagesSQL Essentials PDFMadalina GrigoroiuNo ratings yet

- M31 Bomb Arodynamic Test - USA 1942Document18 pagesM31 Bomb Arodynamic Test - USA 1942FrancescoNo ratings yet

- Cub Cadet 1212Document44 pagesCub Cadet 1212Hayden MyersNo ratings yet

- Finals TheoriesDocument25 pagesFinals TheoriesQui Lea ChinNo ratings yet

- 315020-DOC-3483 - (V-4083 Condensate Accumulator) - RevADocument7 pages315020-DOC-3483 - (V-4083 Condensate Accumulator) - RevAAnwar SadatNo ratings yet

- Marine-Unit Description - Game - StarCraft IIDocument8 pagesMarine-Unit Description - Game - StarCraft IIcalmansoorNo ratings yet

- FINAL EXAMINATION IN STP - Analiza CentillesDocument5 pagesFINAL EXAMINATION IN STP - Analiza Centillesamiel pugatNo ratings yet

- Strategic Management MCQSDocument19 pagesStrategic Management MCQSJay Patel75% (4)

- FFT Aura Fence Operations Manual v2.0Document90 pagesFFT Aura Fence Operations Manual v2.0Usman Zouque100% (3)

- Ya 8800 10-14reDocument44 pagesYa 8800 10-14remartin_jaitmanNo ratings yet

- Indian Standard: Specification For Floor Door Stoppers (Document12 pagesIndian Standard: Specification For Floor Door Stoppers (ssaurav89No ratings yet

- En 8 160 200 R72GDocument4 pagesEn 8 160 200 R72Ggbr.moreira12No ratings yet

- EPLC User Manual Practices GuideDocument2 pagesEPLC User Manual Practices GuideHussain ElarabiNo ratings yet

- Intro Revit 9Document27 pagesIntro Revit 9Danny Anton AsanzaNo ratings yet

- Eoi RpoDocument8 pagesEoi RpoBadari Narayan PNo ratings yet

- Hyper Local Supply ChainDocument3 pagesHyper Local Supply ChainAishwarya MathurNo ratings yet

- 100 AutoCAD Commands You Should KnowDocument37 pages100 AutoCAD Commands You Should KnowAnonymous TxYttIqsPNo ratings yet

- International Economics 4th Edition Feenstra Test Bank 1Document48 pagesInternational Economics 4th Edition Feenstra Test Bank 1steven100% (42)

- 4 - RUPTURA - Simulation Code For Breakthrough, IdealDocument62 pages4 - RUPTURA - Simulation Code For Breakthrough, IdealMichail GeorgakisNo ratings yet

Does The Number of Interlockin

Does The Number of Interlockin

Uploaded by

Ehssan SamaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Does The Number of Interlockin

Does The Number of Interlockin

Uploaded by

Ehssan SamaraCopyright:

Available Formats

Does the Number of Interlocking Directors Influence a Firms Financial

Performance? An Exploratory Meta-Analysis

Nai H. Lamb

Assistant Professor of Management

University of Tennessee at Chattanooga

Many scholars suggest when a firm is connected to other firms by interlocking directors, its financial

performance should improve. However, some scholars suggest that when directors have other

commitments, this could reduce their abilities to monitor or help their companies. As expected, extant

empirical studies have produced mixed results of the relationship. An exploratory meta-analysis of 10

samples (n = 12,519) provided little evidence of a systematic estimate of interlocking directors/ financial

performance relationship. Thus, this initial meta-analysis suggests that a mere count of interlocking

directors may not have an influence on a firms financial performance.

INTRODUCTION

When two firms share a common director, the director is often referred as an interlocking director; the

tie or connection that he/she creates is also referred as a board interlock (Burt, 1980; Mizruchi, 1996).

Interlocking directors are an important topic in organizational studies. They are found to be meaningful

mechanisms, and rather than random activities (Hallock, 1997). Many scholars argue that interlocking

directors are a creditable and relatively low-cost source for firms to manage environmental uncertainty

(Useem, 1984), can gain access to diverse and unique information (Beckman & Haunschild, 2002;

Haunschild & Beckman, 1998), learn new corporate practices (Davis, 1991; Palmer, Jennings, & Zhou,

1993), and serve as a signal of the quality of the firm (Certo, 2003; Higgins & Gulati, 2003; Kang, 2008).

In the U.S., many large firms are connected with one another through interlocking directors (Spencer

Stuart Board Index, 2015).

Interlocking directors, as expected, have been one of the most often used measures of interfirm

networks. Researchers in general suggest that interlocks can influence a firms strategies, structures, and

performance. Despite its prominence, earlier studies provide only mixed support for its influence (Palmer,

Barber, & Zhou, 1995; Fligstein, 1995; Mizruchi, 1996). One of the biggest criticisms is that interlocking

directors fail to predict corporate financial performance. Many researchers propose that interlocks help

firms secure resource and thus improve financial performance (Casciaro & Piskorski, 2005; Westphal,

Boivie, & Chng, 2006). Based on resource dependence theory, a firm with interlocks should have access

to information otherwise not available to them. This should translate to higher financial performance.

Results have been inconsistent. Some found positive effects on financial performance (Pennings, 1980;

Burt, 1983), while others found negative effects (Fligstein and Brantley, 1992).

In related reviews, relationships between board composition and financial performance are described

as conflicting (Finkelstein & Hambrick, 1996; Johnson, Daily, & Ellstrand, 1996). Prior meta-analyses

such as Dalton, Johnson, and Ellstrands (1998) found that there are no substantive relationships between

American Journal of Management Vol. 17(2) 2017 47

board composition and financial performance. In a later publication, they did find a positive relationship

between number of directors and financial performance (Dalton, Johnson, & Ellstrand, 1999).

Since there has been no consensus regarding the direction of the relationship between interlocking

directors and financial performance, I seek to provide meta-analyses to reconcile the mixed findings. A

meta-analysis can account for sampling errors and provides more reliability in concluding prior studies

(Hunter & Schmidt, 2004). I identified 10 relevant empirical studies with 10 unique samples (n = 12,519)

to conduct a systematic review of the relationship.

INTERLOCKING DIRECTORS AND FINANCIAL PERFORMANCE

Early studies indicated that interlocks are a result of corporate control, inter-corporate cohesion, and

resource dependence (Mizruchi, 1980). Schoorman, Bazerman, and Atkin (1981) suggested interlocking

directors are fairly common because they provide horizontal coordination among competitors, vertical

coordination among suppliers and customers, expertise, and enhancement of reputation. However, a very

important question for strategy researchers is: So what? Do interlocks affect organizational strategy and

ultimately, organizational performance? As Mizruchi (1996) put it, If interlocks are to be worth

studying, it is essential that they be shown to have consequences for the behavior of firms (p. 280). I

provide a brief review of some rational for both perspectives on the board interlock-financial performance

link.

Arguments for the Positive Effect of Interlocks on Financial Performance

Different theories have been applied to explain the relationships between interlocking directors and

financial performance. Resource dependence theory has been the primary basis for the perspective that

interlocking directors are associated with better financial performance. The core thesis is that interlocks

help organizations obtain needed resources and information to improve their corporate performance

(Pfeffer & Salancick, 1978; Casciaro & Piskorski, 2005; Westphal, Boivie, & Chng, 2006). In this vein, a

board interlock is a measure of a firms ability to secure critical resources. For instance, Lang and

Lockhart (1990) found firms interlocked with financial institutions increased with financial dependence.

Hillman, Cannella, and Paetzold (2000) found that firms are more likely to appoint resourceful outside

directors during times of environmental uncertainty. Carpenter and Westphal (2001) showed that outside

directors can contribute to the decision process if they are connected to strategic related firms.

Interlocking directors can facilitate a firms borrowing (Mizsuchi, 1996), alliance formation (Gulati &

Westphal, 1999), and have been associated with effective capital acquisition (Stearns & Mizruchi, 1993).

Resource dependency theory also posits that interlocking directorates serve as carrier of information

(Useem, 1984). Directors that also sit on other firms boards are more likely to have access to diverse

strategies and insider information that is otherwise not accessible to outsiders. They are likely to provide

better counsel and advice. Westphal (1999) showed a positive relation between advice provided by

outside directors and the firms financial performance. This perspective is consistent with the survey

results from the 2012 Spencer Stuart Board Index that board directors consider their role in discussing

corporate strategy one of their top priorities in governance issues.

In summary, based on resource dependency theory, interlocking directors facilitate coordination

between organizations and reduce environmental uncertainty (Pfeffer & Salancick, 1978). Thus,

interlocking directors are a mean of transferring critical information and best practices (Hillman &

Dalziel, 2003). Interlocks also serve to reduce opportunism by increasing the flow of information between

organizations (Phan, Lee, & Lau, 2003).

Social network theory also has been applied in studies on interlocking directors. It proposes that firms

that are embedded in the director network can leverage social relations and in return, facilitate economic

exchanges, resulting in better firm performance (Granovetter, 1985). In this view, interlocks serve as a

mechanism for firms to connect with one another. Firms that are embedded in the director network can

reap the benefits of social capital that are not available to firms outside of the network. Studies have

48 American Journal of Management Vol. 17(2) 2017

found that interlocking directors are associated with a firms future performance (Horton, Millo &

Serafeim, 2012).

Another perspective is from market for directors. A director that sits on multiple boards can signal

his/her quality, such as monitoring and advising (Ferris, Jagannathan, & Pritchard, 2003; Kaplan &

Reishus, 1990). Thus, as the number of interlocking directors increases in a firm, it can be viewed as the

quality of the board also increases. In this vein, the positive board quality should lead to a better financial

performance. In conclusion, there are many studies that advocate for the benefits of interlocking directors.

Arguments for the Negative Effect of Interlocks on Financial Performance

As previously mentioned, scholars have not yet reached a consensus on the positive relationship

between interlocking directors and financial performance. Meeusen and Cuyvers (1985) and Fligstein and

Brantley (1992) both found interlocks associated with reduced financial performance. One argument is

that costs are associated with directors serving on multiple boards, and they are referred as busy directors

(Core, Holthausen, & Larcker, 1999). The view is that busy directors have limited time and attention for

the boards they serve (Li & Ang, 2000). Researchers found that firms that have outside directors with

multiple directorships are associated with weak governance (Fich & Shivdasani, 2006). This view

predicts that busy directors can have a negative influence on firm performance (Core et al., 1999;

Jiraporn, Singh, & Lee, 2008).

Another argument is that an interlocking directorate that is embedded in the director network may

become more committed to his/her elite network than to his/her boards (Burris, 1992). In this view,

directors that are connected to different boards can be influenced by the norms and values of the network

(Koenig & Gogel, 1981; Windolf & Beyer, 1996). This may lead to the tendency that the directors are

more concerned with the social cohesion, rather than their director duties.

Third, assuming interlocking directors transmit information and practices, it is not only the good

practices that are diffused, but also the bad practices. For instance, interlocking directors have been shown

to spread options backdating (Armstrong & Larcker, 2009; Bizjak, Lemmon, & Whitby, 2009). When bad

practices are spread, firm performance will eventually suffer. Finally, firms that are interlocked with firms

that are accused of questionable practices may suffer from reputational penalties as well. Kang (2008)

showed that firms that are interlocked with firms that are accused of financial reporting fraud are more

likely to experience a decline in reputation. In this vein, interlocks may not necessarily diffuse the

practice, but rather, they diffuse the perception of reputations.

Based on the above arguments, it is not surprising that scholars still cannot reach an agreement on the

direction of the relation between board interlock and financial performance.

Measures of Financial Performance and Time as Moderators

Different studies have used different measure of a firms financial performance. Some studies used

accounting based measure (e.g. return on assets and return on sales), while others used market-based

measure (e.g. market-to-book value). It is possible that depending on the measure a study used, the result

can be different. Thus, I use the measure of financial performance as a moderator, separating my studies

into two groups: accounting based and market-based measure. In addition, time can influence the result.

Studies are either cross-sectional or longitudinal in nature. It may be possible that depending on how the

study is conducted over time or at a given time point, the result can be influenced. Thus, I also used time

as a moderator, splitting my studies into two groups, cross sectional or longitudinal.

METHODS

Sample

For meta-analyses, it was unnecessary that the study focuses on interlocking directors and financial

performance; we only need a correlation between these two variables. Thus, I used several search

techniques to identify useful studies. First, I searched different database (e.g. ABI/Inform, EBSCO,

JSTORE) and Google Scholar using different keywords (e.g. interlocking directors, interlocking

American Journal of Management Vol. 17(2) 2017 49

directorates, overlapping directors, multiple directorship) to conduct a comprehensive review of extant

literature. Second, I used the same keywords to search unpublished dissertations and theses on ProQuest

Dissertation and Theses. Third, I manually reviewed references from review articles related to

interlocking directors to identify any missing articles from the computerized search. Finally, I identified

studies that have correlation coefficient for interlocking directors and financial performance. As there are

different ways to measure interlocking directors, I made a decision to capture interlocking directors as the

number of interlocking directors (a count variable, instead of a dummy variable, for instance). The

number of interlocks as a count variable is essentially a measure of degree centrality as well.

This process resulted in 10 studies with a total of 10 samples (n = 12,519). My studies are listed in

Appendix A. The coding menu is shown in Appendix B.

Meta-Analytic Procedures

I estimated the average correlations among variables weighted by sample size as suggested by Hunter

and Schmidt (1990). I obtained these statistics from correlation coefficients reported between the number

of board interlocks and a firm financial performance. Hunter and Schmidts (1990) procedures provide

simple estimates of the true population correlation between any two measures (i.e., r ) as well as the

2

proportion of observed variance in r ( sr ), due to random sampling error ( se ) versus residual variation (

2

se2 ).

RESULTS

The results are reported in Table 1. The overall r between number of board interlocks and financial

performance is positive but relatively small (0.0285).

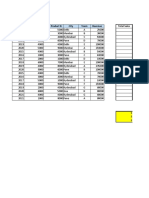

TABLE 1

RESULTS OF META-ANALYSIS

UNCORRECTED CORRECTED

r-mean 0.0285 0.0285

SD-true 0.0183 0.0183

10%CV 0.0051 0.0051

90%CV 0.0518 0.0518

%-acc 70.63% 70.63%

SD-corr 0.0337 0.0337

SD-artifact 0.0283 0.0283

var-obs/total 0.0011 0.0011

var-error 0.0008 0.0008

var-true 0.0003 0.0003

Q-statistic 14.1583 Number of Correlations (K) 10

Combined N 12,519

For the homogeneity analysis, as we can see in the table above, Q statistics is 14.1583. The critical

value for 9 degree of freedom (K-1) at P=0.05 is 16.9. Therefore, I cannot reject the null hypothesis. It

shows that the observed variance in effect size is not statistically significant from those expected by

sampling errors.

50 American Journal of Management Vol. 17(2) 2017

I further conducted moderator analyses. For my first moderator, I divided my 10 studies into two

groups: studies that used accounting based measure (e.g. return on assets or return on sales) for financial

performance and studies that used market-based measure (e.g. book-to-market value) for financial

performance. There are 6 studies that used accounting measure and 4 studies used market-based measure.

After I ran the analysis, QB=2.4599 (df=1) and p(QB)=0.1168. This means that the difference is not

statistically significant at P=0.1. QW=0.0949 and P(QW)> 0.05, meaning that homogeneous variances

overall.

I then used time as my moderator. My studies are divided into 2 groups: cross-sectional or

longitudinal studies. There are 6 longitudinal studies and 4 cross-sectional studies. After I ran the

analysis, QB=1.6355 (df=1) and p(QB)=0.2009. This means that the difference is not statistically

significant at P=0.1. QW=2.3041 and P(QW)> 0.05, meaning that homogeneous variances overall.

The results for interlocking directors and financial performance show little evidence of a systematic

estimate of the relationship. The moderator analyses relying on different indicators are also invariant.

DISCUSSION

A Meta-analysis is an effective method to estimate a relationship between two variables in a true

population. It is achieved by examining multiple studies across different contexts. In this case, the meta-

analysis indicates that there is little relationship between interlocking directors and financial performance.

Mizruchi (1996) suggested that interlocks may be both a predictor and an outcome of firm

performance. Thus, the conflicting results are likely due to causal ordering. In my meta-analysis, I did not

find a substantive relationship between interlocking directors and financial performance. The moderators

did not yield statistical significant results either. This may indicate that the number of board interlocks do

not influence a firms financial performance.

Limitations of the Study

My meta-analysis has several limitations. First, a meta-analysis, unlike an experiment, cannot

establish a cause and effect relationship. Thus, I cannot explicitly state that interlocking directors do/do

not influence financial performance. I can only say that I cannot show a systematic relationship in my

analysis. Thus, causality should not be inferred. A cause and effect relationship can only be identified in a

controlled experiment. Second, I decided to use the number of interlocks as a measure of degree of

connectedness. There are other ways to measure interlocks, for instance, the presence of interlock

(dummy variable) and centrality measures (betweenness, closeness, and eigenvector). It is possible that

other ways of measuring interlocks can yield a different result. Third, though data examined in my meta-

analysis were obtained from multiple primary studies, I cannot assure that every study measures the

construct accurately. In other words, I have no control over the completeness of the studies. However, I

have examined each single article in detail and made sure that the construct and measurements are clear

and comparable. Finally, I have only examined 10 studies. If more studies are included in the meta-

analysis, the result may be different.

Future Research

One direction for future investigations is to determine the interlock-financial performance relation in

a dyad level. Simply putting the number of interlocks overlooks the relationship between specific two

parties. In other words, interlocks are essentially a two-way relation, so it should be treated at a dyad

level. Researchers should not treat interlocks in isolation. For instance, the current practice is to count the

number of interlocks on a board and investigate its influence on financial performance (or diffusion of

strategy). I propose, that researchers treat an interlock at the dyad level. When one firm (ego) is

interlocked with another firm (alter), does its financial performance improve as a result of connecting to

that specific alter? For instance, Haunschild and Beckman (1998) showed that information from similar

interlocked firms is more influential than from dissimilar ones. Connelly and his colleagues (Connelly,

Johnson, Tihanyi, & Ellstrand, 2011) were able to show that firms interlocked with different alters

American Journal of Management Vol. 17(2) 2017 51

resulted in different strategic decisions. For the future research, scholars should look into whether alter-

specific attributes lead to different level of financial performance.

Conversely, future research can also consider the boundary condition of interlocks on firm

performance. It is plausible that the relation between interlocking directors and financial performance is a

function of a firms degree of resource dependence (resource constraints). For instance, interlocks may

improve firm performance when the firm is dependent on other organizations and have little excess

resources. When a firm is more independent and have plenty of excess resources, interlocks may have a

negative influence on firm performance. In this view, a combined resource dependence- contingency

theory may be worth exploring.

REFERENCES

Armstrong, C.S. & Larcker, D.F. (2009). Discussion of The impact of the options backdating scandal on

shareholders and Taxes and the backdating of stock option exercise dates. Journal of

Accounting and Economics, 47, (12), 50-58.

Beckman, C. M. & Haunschild, P.R. (2002). Network learning: The effects of partners' heterogeneity of

experience on corporate acquisitions. Administrative Science Quarterly, 47, (1), 92-124.

Bizjak, J., Lemmon, M., & Whitby, R. (2009). Option backdating and interlocking directors. Review of

Financial Studies, 22, (11), 4821-4847.

Bums, V. (1992). Elite policy-planning networks in the united states. Research in Politics and Society, 4,

(1), 111-134.

Burt, R.S. (1980). Cooptive corporate actor networks: A reconsideration of interlocking directorates

involving American manufacturing. Administrative Science Quarterly, 25, (4), 557-582.

Burt, R.S. (1983). Corporate profits and cooptation: Networks of market constraints and directorate ties

in the American economy. New York: Academic Press.

Casciaro, T. & Piskorski, M.J. (2005). Power imbalance, mutual dependence, and constraint absorption:

A closer look at resource dependence theory. Administrative Science Quarterly, 50, (2), 167-199.

Certo, S.T. (2003). Influencing initial public offering investors with prestige: Signaling with board

structures. The Academy of Management Review, 28, (3), 432-446.

Connelly, B.L., Johnson, J.L., Tihanyi, L., & Ellstrand, A.E. (2011). More than adopters: Competing

influences in the interlocking directorate. Organization Science, 22, (3), 688-703.

Core, J.E., Holthausen, R.W., & Larcker, D.F. (1999). Corporate governance, chief executive officer

compensation, and firm performance. Journal of Financial Economics, 51, (3), 371-406.

Dalton, D.R., Daily, C.M., Ellstrand, A.E., & Johnson, J.L. (1998). Meta-analytic reviews of board

composition, leadership structure, and financial performance. Strategic Management Journal, 19,

(3), 269-290.

Dalton, D.R., Daily, C.M., Johnson, J.L., & Ellstrand, A.E. (1999). Number of directors and financial

performance: A meta-analysis. The Academy of Management Journal, 42, (6), 674-686.

Davis, G.F. (1991). Agents without principles? the spread of the poison pill through the intercorporate

network. Administrative Science Quarterly, 36, (4), 583-613.

Ferris, S.P., Jagannathan, M., & Pritchard, A.C. (2003). Too busy to mind the business? monitoring by

directors with multiple board appointments. The Journal of Finance, 58, (3), 1087-1112.

Fich, E.M. & Shivdasani, A. (2006). Are busy boards effective monitors? The Journal of Finance, 61, (2),

689-724.

Finkelstein, S. & Hambrick, D.C. (1996). Strategic leadership: Top executives and their effects on

organizations. Minneapolis/ St. Paul: West.

Fligstein, N. (1995). Networks of power or the finance conception of control? comment on Palmer,

Barber, Zhou, and Soysal. American Sociological Review, 60, (4), 500-503.

Fligstein, N. & Brantley, P. (1992). Bank control, owner control, or organizational dynamics: Who

controls the large modern corporation? American Journal of Sociology, 98, (2), 280-307.

52 American Journal of Management Vol. 17(2) 2017

Granovetter, M. (1985). Economic action and social structure: The problem of embeddedness. American

Journal of Sociology, 9, (3), 481-510.

Gulati, R. & Westphal, J.D. (1999). Cooperative or controlling? the effects of CEO-board relations and

the content of interlocks on the formation of joint ventures. Administrative Science Quarterly, 44,

(3), 473-506.

Hallock, K.F. (1997). Reciprocally interlocking boards of directors and executive compensation. The

Journal of Financial and Quantitative Analysis, 32, (3), 331-344.

Haunschild, P.R. & Beckman, C.M. (1998). When do interlocks matter?: Alternate sources of information

and interlock influence. Administrative Science Quarterly, 43, (4), 815-844.

Higgins, M.C. & Gulati, R. (2003). Getting off to a good start: The effects of upper echelon affiliations on

underwriter prestige. Organization Science, 14, (3), 244-263.

Hillman, A.J., Cannella, A.A., & Paetzold, R.L. (2000). The resource dependence role of corporate

directors: Strategic adaptation of board composition in response to environmental change.

Journal of Management Studies, 37, (2), 235-256.

Hillman, A.J. & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and

resource dependence perspectives. Academy of Management Review, 28, (3), 383-396.

Horton, J., Millo, Y., & Serafeim, G. (2012). Resources or power? implications of social networks on

compensation and firm performance. Journal of Business Finance & Accounting, 39, (3-4), 399-

426.

Hunter J.E. & Schmidt F.L. (1990). Methods of meta-analysis: Correcting errors and bias in research

findings. Newbury Park: Sage.

Jiraporn, P., Singh, M., & Lee, C.I. (2009). Ineffective corporate governance: Director busyness and

board committee memberships. Journal of Banking & Finance, 33, (5), 819-828.

Johnson, J.L., Ellstrand, A.E., & Daily, C.M. (1996). Boards of directors: A review and research agenda.

Journal of Management, 22, (3), 409-438.

Kang, E. (2008). Director interlocks and spillover effects of reputational penalties from financial

reporting fraud. Academy of Management Journal, 51, (3), 537-555.

Kaplan, S.N. & Reishus, D. (1990). Outside directorships and corporate performance. Journal of

FinancialEconomics, 27, (2), 389-410.

Koenig, T. & Gogel, R. (1981). Interlocking corporate directorships as a social network. American

Journal of Economics and Sociology, 40, (1), 37-50.

Landis, J.R. & Koch, G.G. (1977). An application of hierarchical kappa-type statistics in the assessment

of majority agreement among multiple observers. Biometrics, 33, (2), 363-374.

Lang, J.R. & Lockhart, D.E. (1990). Increased environmental uncertainty and changes in board linkage

patterns. Academy of Management Journal, 33, (1), 106-128.

Li, J. & Ang, J.S. (2000). Quantity versus quality of directors time: The effectiveness of directors and

number of outside directorships. Managerial Finance, 26, (10), 1-21.

Carpenter, M.A. & Westphal, J.D. (2001). The strategic context of external network ties: Examining the

impact of director appointments on board involvement in strategic decision making. Academy of

Management Journal, 44,(4), 639-660.

Meeusen, W. & Cuyvers, L. (1985). The interaction between interlocking directorships and the economic

behaviour of companies. In FN Stokman, R Ziegler, J Scott, (Ed.), Networks of corporate power:

45-72. Cambridge: Polity.

Mizruchi, M.S. (1996). What do interlocks do? An analysis, critique, and assessment of research on

interlocking directorates. Annual Review of Sociology, 22, (1), 271-298.

Mizruchi, M.S. (1980). The structure of the American corporate network: 1904-1974 (Ph.D. ed.). United

States -- New York: State University of New York at Stony Brook.

Palmer, D.A., Jennings, P.D., & Zhou, X. (1993). Late adoption of the multidivisional form by large US

corporations: Institutional, political, and economic accounts. Administrative Science Quarterly,

38, (1), 100-131.

American Journal of Management Vol. 17(2) 2017 53

Palmer, D., Barber, B.M., & Zhou, X. (1995). The finance conception of control--"the theory that ate

New York?" reply to Fligstein. American Sociological Review, 60,(4), 504-508.

Pennings, J. (1980). Interlocking directorates. San Francisco: Jossey-Bass. Pfeffer, J., & Salancik, G.R.

(1978). The external control of organizations: A resource dependence perspective. New York:

Stanford University Press.

Phan, P.H., Lee, S.H., & Lau, S.C. (2003). The performance impact of interlocking directorates: The case

of Singapore. Journal of Managerial Issues, 15, (3), 338-352.

Schmidt, F.L., & Hunter, J.E. (2004). Methods of meta-analysis: Correcting error and bias in research

findings. Newbury Park: Sage.

Schoorman, F.D., Bazerman, M.H., & Atkin, R.S. (1981). Interlocking directorates: A strategy for

reducing environmental uncertainty. Academy of Management Review, 6, (2), 243-251.

Stearns, L.B. & Mizruchi, M.S. (1993). Board composition and corporate financing: The impact of

financial institution representation on borrowing. Academy of Management Journal, 36, (3), 603-

618.

Stuart, S. (2015). Spencer Stuart board index 2015. New York: SpencerStuart. Useem, M. (1984). The

inner circle: Large corporations and the rise of business political activity in the US and UK. New

York: Oxford University Press.

Westphal, J.D. (1999). Collaboration in the boardroom: Behavioral and performance consequences of

CEO-board social ties. Academy of Management Journal, 42,(1), 7-24.

Westphal, J.D., Boivie, S., & Chng, D.H.M. (2006). The strategic impetus for social network ties:

Reconstituting broken CEO friendship ties. Strategic Management Journal, 27, (5), 425-445.

Windolf, P. & Beyer, J. (1996). Co-operative capitalism: Corporate networks in Germany and Britain.

The British Journal of Sociology, 47, (2), 205-231.

54 American Journal of Management Vol. 17(2) 2017

APPENDIX A

STUDIES USED IN META-ANALYSIS LISTED BY PUBLICATION YEAR

Phan, P.H., Lee, S.H., & Lau, S.C. (2003). The performance impact of interlocking directorates: The case

of Singapore, Journal of Managerial Issues, 15, (3), 338-352.

Seidel, M. L. & Westphal, J.D. (2004). Research impact: How seemingly innocuous social cues in a CEO

survey can lead to change in board of director network ties, Strategic Organization, 2, (3), 227-

270.

Young, C.S. (2005). Top management teams social capital in Taiwan: The impact on firm value in an

emerging economy, Journal of Intellectual Capital, 6, (2), 177-190.

Ruigrok, W., Peck, S.I., & Keller, H. (2006). Board Characteristics and Involvement in Strategic Decision

Making: Evidence from Swiss Companies, Journal of Management Studies, 43, (5), 1201-1226.

Kiel, G.C. & Nicholson, G.J. (2006). Multiple Directorships and Corporate Performance in Australian

Listed Companies, Corporate Governance: An International Review, 14, (6), 530-546.

Kang, E. (2008). Director interlocks and spillover effects of reputational penalties from financial

reporting

fraud, Academy of Management Journal, 51, (3), 537-555.

Liang, F.M. (2009). Ownership Structure and Firm Performance in an Emerging Market: the Moderating

Role of Social Networks, Contemporary Management Research, 5, (2), 201-212.

Haynes, K.T. & Hillman, A. (2010). The effect of board capital and CEO power on strategic change,

Strategic Management Journal, 31, (11), 1145-1163.

Conyon, M.J., Peck, S.I., & Sadler, G.V. (2011). New perspectives on the governance of executive

compensation: An examination of the role and effect of compensation consultants. Journal of

Management & Governance, 15, (1), 29-58.

Cannella, A.A., Jones, C.D., & Withers, M.C. (2015). Family-versus lone-founder-controlled public

corporations: Social identity theory and boards of directors, Academy of Management Journal, 58, (2),

436-459.

American Journal of Management Vol. 17(2) 2017 55

APPENDIX B

CODING MENU

Codebook for Interlock Meta-Analysis

Hierarchy Description and coding rules

First Level No coding needed

1. The Paper The characteristics of the paper

2. The Setting & Sample The setting in which the study took place and characteristics of the

Characteristics sample

3. Moderators These are used to split the sample

4. Statistical Outcome/ Effect r and n

Sizes

Second Level

1. The Paper The characteristics of the paper

1.1 The title of the paper No abbreviation please

1.2 The last name of the first Only the last name of the first author

author

1.3 The name of the journal No abbreviation please (unless it's a commonly known journal, e.g.

AMJ, AMR, SMJ, ASQ)

1.4 The year of the publication/ Enter the year or 0=unknown;

writing

1.5 Type of the paper 0= working paper; 1= journal article; 2=book/book chapter;

3=dissertation; 4=MA thesis; 5=conference paper; 6= others

(specify); 7= can't tell;

1.6 Published paper 0= unpublished; 1=Published;

2. The Setting & Sample The setting in which the study took place and characteristics of

Characteristics the sample

2.1 Study number Give numbers to your study if there is more than 1 study in your

paper. Use (first author's last name)1, (first author's last name)2 so on

(e.g. Tihanyi1). 0= only 1 study;

2.2 Year(s) the study take place Example: 1990-1992

2.3 Longitudinal study 0= cross-sectional; 1=longitudinal study;

2.4 Type of study 0=archival; 1=survey; 2=both archival and survey; 3=others

(specify);

2.5 Data source Please specify

2.6 Companies 0=public/ non business; 1= business (firms); 2= individuals

(directors); 3= others (specify)

2.7 Level of analysis 0= focus on each individual company (egocentric); 1= focus on the

dyad relations between companies; 2= focus on individual director

(egocentric); 3= focus on dyad relations between 2 director; 4=others

(specify)

56 American Journal of Management Vol. 17(2) 2017

3. Moderators These are used to split the sample

3.1 Financial performance Not sure=0; Accounting-based ( ROA, ROE, or ROS)=1; Market-

based (like Jensen's alpha, Treynor measure, or Sharpe

measure)=2;

3.2 Country Name of the country/ countries/ region(s)

3.3 Board size Mean of the sample (raw number and specify unit)

3.4 Outside directors Mean of the sample (raw number and specify unit)

3.5 Firm size Mean of the sample (raw number and specify unit)

3.6 Firm age Mean of the sample (raw number and specify unit)

3.7 CEO also a chair Mean of the sample (raw number and specify unit)

3.8 Managers ownership Mean of the sample (raw number and specify unit)

3.9 Ownership concentration Mean of the sample (raw number and specify unit)

3.10 Blockholder ownership Mean of the sample (raw number and specify unit)

(institutional owners, family

owners etc.)

3.11 Director ownership Mean of the sample (raw number and specify unit)

4. Statistical Outcome/ Effect r and n

Sizes

4.1 Size (n) Sample size

4.2 r for FP and presence of r for financial performance and interlock measures

interlock

4.3 r for FP and number of r for financial performance and interlock measures

interlocks

ABOUT THE AUTHOR

Nai H. Lamb (PhD, Texas A&M University) is an Assistant Professor of Management at the University

of Tennessee at Chattanooga, College of Business. Her research interests focus on topics such as

corporate social responsibility, corporate governance, board interlocks, and social networks. Her research

has been published or accepted in Business & Society, Journal of Accounting and Finance, Journal of

Economics and Finance Education, Management Research and Review, and the Oxford Handbook of

Corporate Governance.

Mailing Information for Contact Author:

Nai H. Lamb

College of Business (Dept. 6156)

University of Tennessee at Chattanooga

Chattanooga, TN 37403

(423) 425-4047

American Journal of Management Vol. 17(2) 2017 57

Reproduced with permission of copyright owner.

Further reproduction prohibited without permission.

You might also like

- Guzdial, Mark Ericson, Barbara - Introduction To Computing and Programming With Java - A Multimedia Approach PDFDocument384 pagesGuzdial, Mark Ericson, Barbara - Introduction To Computing and Programming With Java - A Multimedia Approach PDFWendy Do70% (10)

- Corporate Governance Mechanisms and Firm Performance A Survey of LiteratureDocument16 pagesCorporate Governance Mechanisms and Firm Performance A Survey of Literaturekamal khanNo ratings yet

- Examining The Effect of Organization Culture and Leadership Behaviors On Organizational Commitment, Job Satisfaction, and Job PerformanceDocument8 pagesExamining The Effect of Organization Culture and Leadership Behaviors On Organizational Commitment, Job Satisfaction, and Job PerformanceDrSunnyWadhwa100% (1)

- Duromax Xp10000e Generator Owners ManualDocument28 pagesDuromax Xp10000e Generator Owners Manualduromax0% (1)

- The Effect of Life Cycle Stage of A Firm On TheDocument23 pagesThe Effect of Life Cycle Stage of A Firm On TheIsmanidarNo ratings yet

- For 3rd Class - PDF - Resource Dependence Theory - A Review - Journal of ManagementDocument24 pagesFor 3rd Class - PDF - Resource Dependence Theory - A Review - Journal of ManagementRashed ShukornoNo ratings yet

- The Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectiveDocument10 pagesThe Moderating Effect of Large Shareholders On Board Structure-Firm Performance Relationship: An Agency PerspectivebaruthiomNo ratings yet

- Hodge Piccolo 2011Document33 pagesHodge Piccolo 2011VerperNo ratings yet

- Michel On 2010Document33 pagesMichel On 2010Tawsif HasanNo ratings yet

- Post-Restructuring Governance: An Examination of Interlocking DirectoratesDocument16 pagesPost-Restructuring Governance: An Examination of Interlocking DirectoratesEhssan SamaraNo ratings yet

- The Effect of Corporate Social Performance On Financial Performance (The Moderating Effect of Ownership Concentration)Document12 pagesThe Effect of Corporate Social Performance On Financial Performance (The Moderating Effect of Ownership Concentration)Hanan RadityaNo ratings yet

- Relationship Between Board Structure and Firm PerformanceDocument25 pagesRelationship Between Board Structure and Firm PerformanceThanh MaiNo ratings yet

- Board Size, Board Composition and Property PDFDocument16 pagesBoard Size, Board Composition and Property PDFAlifah SalwaNo ratings yet

- RutledgeRW Web18 2Document23 pagesRutledgeRW Web18 2Corolla SedanNo ratings yet

- Assenga Et Al 2018the - Impact - of - Board - Characteristics - On - The - Financial - Performance - of - Tanzanian - FirmsDocument31 pagesAssenga Et Al 2018the - Impact - of - Board - Characteristics - On - The - Financial - Performance - of - Tanzanian - FirmsSahirr SahirNo ratings yet

- Employee Retention Articles 2 PDFDocument21 pagesEmployee Retention Articles 2 PDFCharmaine ShaninaNo ratings yet

- Hillman, Withers e Collins (2009)Document24 pagesHillman, Withers e Collins (2009)Thales MardenNo ratings yet

- CEO Duality and Firm Performance: The Moderating Roles of CEO Informal Power and Board InvolvementsDocument22 pagesCEO Duality and Firm Performance: The Moderating Roles of CEO Informal Power and Board InvolvementsWihelmina DeaNo ratings yet

- Board Structure Ceo Tenure Firm Characte PDFDocument25 pagesBoard Structure Ceo Tenure Firm Characte PDFTeshaleNo ratings yet

- Sadaf SpinnerDocument7 pagesSadaf SpinnerDr-Liaqat AliNo ratings yet

- Managerial Ownership, Corporate Governance, and Voluntary DisclosureDocument19 pagesManagerial Ownership, Corporate Governance, and Voluntary Disclosure701450No ratings yet

- The Impact of Corporate Governance Performance On The Occurrence of Rpts. A Study of Indian Stock MarketDocument19 pagesThe Impact of Corporate Governance Performance On The Occurrence of Rpts. A Study of Indian Stock MarketAjazzMushtaqNo ratings yet

- Hsu 2018Document26 pagesHsu 2018Shaharyar Khan MarwatNo ratings yet

- Article 4 Corporate GovernanceDocument17 pagesArticle 4 Corporate GovernanceAayushCNo ratings yet

- JFIA/Vol 7 - 1 - 3Document21 pagesJFIA/Vol 7 - 1 - 3naseem ashrafNo ratings yet

- Corporate Governance-Assessment of The Determinants of The Effectiveness of The BoardDocument13 pagesCorporate Governance-Assessment of The Determinants of The Effectiveness of The BoardcpamutuiNo ratings yet

- Research Abstract: Effect of HR Practices On Organizational CommitmentDocument38 pagesResearch Abstract: Effect of HR Practices On Organizational Commitmentpranoy87No ratings yet

- 9910-33101-1-SMDocument8 pages9910-33101-1-SMPhương LinhNo ratings yet

- 1 PBDocument11 pages1 PBMissaoui IbtissemNo ratings yet

- Ben Amar2011Document17 pagesBen Amar2011NiaNo ratings yet

- Innocent I 2010Document15 pagesInnocent I 2010Muhammad Farrukh RanaNo ratings yet

- 11.vol 0004www - Iiste.org Call - For - Paper No 1 Pp. 40-64Document26 pages11.vol 0004www - Iiste.org Call - For - Paper No 1 Pp. 40-64Alexander DeckerNo ratings yet

- 9675-Article Text-36130-3-10-20161024Document12 pages9675-Article Text-36130-3-10-20161024mbauksupportNo ratings yet

- The Optimum Boardroom Composition and The Limitations of The Agency TheoryDocument22 pagesThe Optimum Boardroom Composition and The Limitations of The Agency TheoryMohd HapiziNo ratings yet

- NCD 18 05 2024Document22 pagesNCD 18 05 2024Dr. Nitai Chandra DebnathNo ratings yet

- 6-Saibal GhoshDocument14 pages6-Saibal GhoshDisha BaraiNo ratings yet

- Academy of ManagementDocument22 pagesAcademy of ManagementPeter KiepuszewskiNo ratings yet

- Determinan SustuinableDocument39 pagesDeterminan SustuinableArif Kenji ShinodaNo ratings yet

- Does Ownership Structure Affect Firm'S Performance? Empirical Evidence From PakistanDocument23 pagesDoes Ownership Structure Affect Firm'S Performance? Empirical Evidence From PakistanAsif SaleemNo ratings yet

- Maiga 2007Document33 pagesMaiga 2007Muhammad ArfanNo ratings yet

- Giulia Flamini and Luca GnanDocument52 pagesGiulia Flamini and Luca GnanBello AishatNo ratings yet

- Critical Perspectives On AccountingDocument13 pagesCritical Perspectives On AccountingHaroon ShafiNo ratings yet

- Literature Review On The Relationship Between Board Structure and Firm PerformanceDocument11 pagesLiterature Review On The Relationship Between Board Structure and Firm PerformanceDr Shubhi AgarwalNo ratings yet

- (KODE 05) - BI - CP (Kuantitatif) - Q1Document9 pages(KODE 05) - BI - CP (Kuantitatif) - Q1Arif Kathon SubhektiNo ratings yet

- Corporate Governance 3Document14 pagesCorporate Governance 3Sekar MuruganNo ratings yet

- Lamport M J, Latona M N, Seetanah B, Sannassee R VDocument31 pagesLamport M J, Latona M N, Seetanah B, Sannassee R VManjula AshokNo ratings yet

- Organizational Restructuring Impact On Trust and Work SatisfactionDocument17 pagesOrganizational Restructuring Impact On Trust and Work SatisfactionAna Maria SimaNo ratings yet

- HRD ClimateDocument8 pagesHRD ClimatePothireddy MarreddyNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewAkanni Lateef ONo ratings yet

- Document 2Document21 pagesDocument 2Erselia TrinisaNo ratings yet

- UntitledDocument3 pagesUntitledNUR FARAH ALIAH RAMLANNo ratings yet

- Franken Cook 2Document16 pagesFranken Cook 2Cain Cyrus MonderoNo ratings yet

- Performance Measurement and Reward Systems, Trust, and Strategic ChangeDocument29 pagesPerformance Measurement and Reward Systems, Trust, and Strategic ChangeZulfaneri PutraNo ratings yet

- Gschwantner - Hiebl (JoMaC, 2016) - Management Control Systems and Organizational AmbidexterityDocument35 pagesGschwantner - Hiebl (JoMaC, 2016) - Management Control Systems and Organizational AmbidexterityHemi Fradilla TariganNo ratings yet

- Ceo DualityDocument16 pagesCeo Dualityconnie-lee06No ratings yet

- Are The 100 Best Better by Fulmer Citado Por S RobbinsDocument29 pagesAre The 100 Best Better by Fulmer Citado Por S RobbinsJONEL ANTONY MAYHUA CHUCHONNo ratings yet

- Literature Review 5Document3 pagesLiterature Review 5JasperNo ratings yet

- Reducing Employee TurnoverDocument13 pagesReducing Employee TurnoverNasir Uddin SharifNo ratings yet

- Top Management Team Process, Shared Leadership, and New Venture Performance: A Theoretical Model and Research AgendaDocument18 pagesTop Management Team Process, Shared Leadership, and New Venture Performance: A Theoretical Model and Research AgendaJuliana ChacónNo ratings yet

- 19 Top Management Team ProcessDocument18 pages19 Top Management Team ProcessGordon ClarkeNo ratings yet

- Study of leader member relationship and emotional intelligence in relation to change in preparedness among middle management personnel in the automobile sectorFrom EverandStudy of leader member relationship and emotional intelligence in relation to change in preparedness among middle management personnel in the automobile sectorNo ratings yet

- Post-Restructuring Governance: An Examination of Interlocking DirectoratesDocument16 pagesPost-Restructuring Governance: An Examination of Interlocking DirectoratesEhssan SamaraNo ratings yet

- Directors' Human Capital, Firm Strategy, and Firm PerformanceDocument31 pagesDirectors' Human Capital, Firm Strategy, and Firm PerformanceEhssan SamaraNo ratings yet

- 2018-Board Diversity, Firm Risk, and Corporate PoliciesDocument25 pages2018-Board Diversity, Firm Risk, and Corporate PoliciesEhssan SamaraNo ratings yet

- 2019-Gender Diversity in Senior Management, Strategic Change, and Firm PerformanceDocument13 pages2019-Gender Diversity in Senior Management, Strategic Change, and Firm PerformanceEhssan SamaraNo ratings yet

- Anti-Fog Product Suite: FSI Coating TechnologiesDocument2 pagesAnti-Fog Product Suite: FSI Coating TechnologiesMIGUEL ANGEL NOCUA SALAZARNo ratings yet

- Nba Sar Ug B.tech. Electrical EnggDocument161 pagesNba Sar Ug B.tech. Electrical EnggSaurabh BhiseNo ratings yet

- Numerical Descriptive Techniques (6 Hours)Document89 pagesNumerical Descriptive Techniques (6 Hours)Kato AkikoNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesGraceRasdasNo ratings yet

- Resumen Conceptos Hidrológicos Básicos 1. Distribución de Agua en El PlanetaDocument2 pagesResumen Conceptos Hidrológicos Básicos 1. Distribución de Agua en El PlanetaAnderson Bruce Sosa RaymundoNo ratings yet

- HTTP 192.168.20.28 GSP Tree Zptree Demo Lista Wo View PontajDocument1 pageHTTP 192.168.20.28 GSP Tree Zptree Demo Lista Wo View Pontajfanehhh 10No ratings yet

- Excel - Assignment - 1 (1Document16 pagesExcel - Assignment - 1 (1Ashish ChangediyaNo ratings yet

- Answer Key: Progress Tests (A) : Unit 10Document1 pageAnswer Key: Progress Tests (A) : Unit 10Сладкий ХлебушекNo ratings yet

- Pulsation Suppression Device Design For Reciprocating CompressorDocument9 pagesPulsation Suppression Device Design For Reciprocating CompressorFrancis LinNo ratings yet

- SQL Essentials PDFDocument36 pagesSQL Essentials PDFMadalina GrigoroiuNo ratings yet

- M31 Bomb Arodynamic Test - USA 1942Document18 pagesM31 Bomb Arodynamic Test - USA 1942FrancescoNo ratings yet

- Cub Cadet 1212Document44 pagesCub Cadet 1212Hayden MyersNo ratings yet

- Finals TheoriesDocument25 pagesFinals TheoriesQui Lea ChinNo ratings yet

- 315020-DOC-3483 - (V-4083 Condensate Accumulator) - RevADocument7 pages315020-DOC-3483 - (V-4083 Condensate Accumulator) - RevAAnwar SadatNo ratings yet

- Marine-Unit Description - Game - StarCraft IIDocument8 pagesMarine-Unit Description - Game - StarCraft IIcalmansoorNo ratings yet

- FINAL EXAMINATION IN STP - Analiza CentillesDocument5 pagesFINAL EXAMINATION IN STP - Analiza Centillesamiel pugatNo ratings yet

- Strategic Management MCQSDocument19 pagesStrategic Management MCQSJay Patel75% (4)

- FFT Aura Fence Operations Manual v2.0Document90 pagesFFT Aura Fence Operations Manual v2.0Usman Zouque100% (3)

- Ya 8800 10-14reDocument44 pagesYa 8800 10-14remartin_jaitmanNo ratings yet

- Indian Standard: Specification For Floor Door Stoppers (Document12 pagesIndian Standard: Specification For Floor Door Stoppers (ssaurav89No ratings yet

- En 8 160 200 R72GDocument4 pagesEn 8 160 200 R72Ggbr.moreira12No ratings yet

- EPLC User Manual Practices GuideDocument2 pagesEPLC User Manual Practices GuideHussain ElarabiNo ratings yet

- Intro Revit 9Document27 pagesIntro Revit 9Danny Anton AsanzaNo ratings yet

- Eoi RpoDocument8 pagesEoi RpoBadari Narayan PNo ratings yet

- Hyper Local Supply ChainDocument3 pagesHyper Local Supply ChainAishwarya MathurNo ratings yet

- 100 AutoCAD Commands You Should KnowDocument37 pages100 AutoCAD Commands You Should KnowAnonymous TxYttIqsPNo ratings yet

- International Economics 4th Edition Feenstra Test Bank 1Document48 pagesInternational Economics 4th Edition Feenstra Test Bank 1steven100% (42)

- 4 - RUPTURA - Simulation Code For Breakthrough, IdealDocument62 pages4 - RUPTURA - Simulation Code For Breakthrough, IdealMichail GeorgakisNo ratings yet