Professional Documents

Culture Documents

Bank Account Number Name and Address of The Deductor

Bank Account Number Name and Address of The Deductor

Uploaded by

Avinash Kumar0 ratings0% found this document useful (0 votes)

12 views2 pagesThis document contains Form 26B which is used to claim a refund of tax paid under Chapter XVII-B of the Income Tax Act of 1961. The form requires the deductor to provide details such as their name, address, bank account and TAN. It also requires the deductor to provide details of the tax paid in column I, including the challan identification number, BSR code, date deposited and amount. Column II requires details of the tax paid for which credit has been claimed in statements filed under section 200 or 206C, including the statement form number and amount of credit claimed. The deductor must verify the details provided and certify that the amount has not been claimed for credit in any other statement

Original Description:

Original Title

0UbWq9hJ5lZPsLYMIpS4QcGd

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains Form 26B which is used to claim a refund of tax paid under Chapter XVII-B of the Income Tax Act of 1961. The form requires the deductor to provide details such as their name, address, bank account and TAN. It also requires the deductor to provide details of the tax paid in column I, including the challan identification number, BSR code, date deposited and amount. Column II requires details of the tax paid for which credit has been claimed in statements filed under section 200 or 206C, including the statement form number and amount of credit claimed. The deductor must verify the details provided and certify that the amount has not been claimed for credit in any other statement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesBank Account Number Name and Address of The Deductor

Bank Account Number Name and Address of The Deductor

Uploaded by

Avinash KumarThis document contains Form 26B which is used to claim a refund of tax paid under Chapter XVII-B of the Income Tax Act of 1961. The form requires the deductor to provide details such as their name, address, bank account and TAN. It also requires the deductor to provide details of the tax paid in column I, including the challan identification number, BSR code, date deposited and amount. Column II requires details of the tax paid for which credit has been claimed in statements filed under section 200 or 206C, including the statement form number and amount of credit claimed. The deductor must verify the details provided and certify that the amount has not been claimed for credit in any other statement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

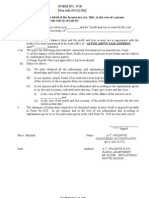

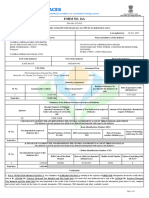

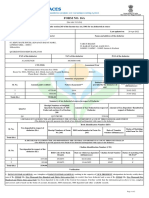

INCOME-TAX RULES, 1962

FORM NO. 26B

[See rule 31A(3A)]

Form to be filed by the deductor, if he claims refund of sum paid under Chapter XVII-B of the Income-tax Act, 1961

Name and address of the Bank Account Number

deductor

MICR Code

Tax Deduction and Collection Type of account (as applicable)

Account Number (TAN)

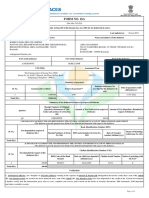

I. Details of sum paid in the Central Government account through II. Detail of sum paid under Chapter XVII-B by the deductor for which

challans out of which refund is being claimed. credit has been claimed in the statement furnished under sub-section (3)

of section 200 or the proviso to sub-section (3) of section 206C (out of

amount mentioned in column 3 below).

Sl. Challan Identification number (CIN) Form No. of Amount of Amount of

No (2) Amount F.Y. Period statement in which Receipt number of credit claimed refund

BSR Code of the Date on which tax Challan Serial tax credit claimed relevant statement (Rs.) claimed

Bank Branch deposited (dd/mm/yyyy) Number (Rs.)

(1) (3) (4) (5) (6) (7) (8) (9)

1

Total (Rs.) Total (Rs.)

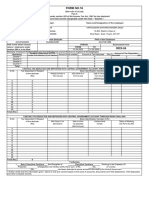

Verification

I, _______________________________ son/daughter of __________________________________working in the capacity of _______________________________________

________________________________________________(designation) do hereby certify that a total sum of rupees_____________________________________(in words)

[mentioned in column (9) above] has been deducted and deposited to the credit of the Central Government and the same has not been claimed and shall not be claimed in any

of the statement to be furnished under sub-section (3) of section 200 or the proviso to sub-section (3) of section 206C. This is also to certify that there is no demand outstanding

under the provisions of Chapter XVII-B or Chapter XVII-BB of Income-tax Act, 1961. I further certify that the information given above is true, complete and correct and is

based on the books of account, documents, relevant statements, tax deposited and other available records.

Place

Date (Signature of person responsible for deduction of tax)

Full Name:- _______________________________.”;

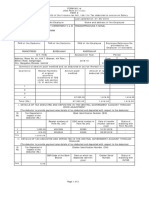

Notes : In case of refund related to tax deducted under section 194-IA of the Act for which Form No.26QB has been filed by the

deductor,—

(a) Permanent Account Number may be furnished in place of Tax Deductions and Collection Account Number;

(b) in column II, in sub-column (5) relating to the 'period', may be left blank;

(c) in column II, in sub-column (7) relating to the 'Receipt number of relevant statement', furnish acknowledgement number of Form

No.26QB.

You might also like

- Module Title: Combinational and Sequential Logic Topic Title: Sequential Logic Tutor Marked Assignment 3 (V1.1)Document11 pagesModule Title: Combinational and Sequential Logic Topic Title: Sequential Logic Tutor Marked Assignment 3 (V1.1)Khadija YasirNo ratings yet

- Handbook For Installation of Medium Voltage LinesDocument106 pagesHandbook For Installation of Medium Voltage Linesajayi micheal sunday100% (1)

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Renr1367 11 01 All PDFDocument412 pagesRenr1367 11 01 All PDFJonathan Luiz PolezaNo ratings yet

- rf9RgWUoLMY58namXBIiNpED PDFDocument2 pagesrf9RgWUoLMY58namXBIiNpED PDFAvinash KumarNo ratings yet

- Ministry of Finance (Department of Revenue)Document24 pagesMinistry of Finance (Department of Revenue)grameshchandraNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CNo ratings yet

- Notification No 73 2022Document2 pagesNotification No 73 2022uslls visNo ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Form 16 2019 20Document4 pagesForm 16 2019 20Kishan SinghNo ratings yet

- Form 16 2020 21Document6 pagesForm 16 2020 21Manoj MahimkarNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) )Document12 pagesForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- CBDT Notifies Forms For Accumulation of Income by A TrustDocument4 pagesCBDT Notifies Forms For Accumulation of Income by A TrustBibhuChhotrayNo ratings yet

- 75 - 1 - 1 - Advt. No6.2018Document6 pages75 - 1 - 1 - Advt. No6.2018Umesh GuptaNo ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Excel Form16 Ay 2017 18Document6 pagesExcel Form16 Ay 2017 18Tulsiram KumawatNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Qwertabacb PDFDocument3 pagesQwertabacb PDFNDKKMDBNo ratings yet

- Form 3CDDocument8 pagesForm 3CDmahi jainNo ratings yet

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocument16 pagesForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- Form 16Document4 pagesForm 16Kirtikumar ModiNo ratings yet

- Form 16 in Excel Format For Ay 2021 22 Fy 2020 21Document9 pagesForm 16 in Excel Format For Ay 2021 22 Fy 2020 21Tapas GhoshNo ratings yet

- Form27d Applicable From 01.04Document2 pagesForm27d Applicable From 01.04sudhrengeNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Notification-49 Central TaxDocument5 pagesNotification-49 Central TaxYatrik GandhiNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Tax Audit ReportDocument18 pagesTax Audit ReportNeha DenglaNo ratings yet

- Income Tax NotificationDocument5 pagesIncome Tax NotificationjaksandcoNo ratings yet

- Vaasant G - Resume Seniour LevelDocument3 pagesVaasant G - Resume Seniour LevelanikagiriNo ratings yet

- Form 16 NikitaDocument3 pagesForm 16 Nikitaravinder singhalNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- Payment of Bonus Act FormsDocument5 pagesPayment of Bonus Act Formspratik06No ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Todaleep sharmaNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 31 thU9V8pZIEoijGbRNn7OXQ0eDocument1 page31 thU9V8pZIEoijGbRNn7OXQ0eAvinash KumarNo ratings yet

- ITC Notes PDFDocument44 pagesITC Notes PDFAvinash KumarNo ratings yet

- rf9RgWUoLMY58namXBIiNpED PDFDocument2 pagesrf9RgWUoLMY58namXBIiNpED PDFAvinash KumarNo ratings yet

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- SPktTyfOn2q9UeZKwQ1ER8gs PDFDocument1 pageSPktTyfOn2q9UeZKwQ1ER8gs PDFAvinash KumarNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash KumarNo ratings yet

- Good Evening To AllDocument2 pagesGood Evening To AllAvinash KumarNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash Kumar100% (1)

- Meaning and Importance of Financial Services 1&2 UNITDocument11 pagesMeaning and Importance of Financial Services 1&2 UNITAvinash KumarNo ratings yet

- Rural Market Plan: - (Akash Kumar) (Shani Jha)Document1 pageRural Market Plan: - (Akash Kumar) (Shani Jha)Avinash KumarNo ratings yet

- Final MKTDocument34 pagesFinal MKTHong Anh VuNo ratings yet

- 2008 05 HUB The Computer Paper TCPDocument40 pages2008 05 HUB The Computer Paper TCPthecomputerpaperNo ratings yet

- Raccon BookmarkDocument2 pagesRaccon BookmarkLinda YiusNo ratings yet

- Submitted JTOIDocument10 pagesSubmitted JTOIFAHIRA RAHMA NATHANIANo ratings yet

- Unit 9: Joint Products, Cost Allocation and by Products ContentDocument20 pagesUnit 9: Joint Products, Cost Allocation and by Products Contentዝምታ ተሻለNo ratings yet

- Calligraphy Fonts - Calligraphy Font Generator 2Document1 pageCalligraphy Fonts - Calligraphy Font Generator 2STANCIUC ALEXANDRA-ALESIANo ratings yet

- Paper1 1Document119 pagesPaper1 1Damián VillegasNo ratings yet

- Drum HandlingDocument18 pagesDrum Handlinganshu_60No ratings yet

- Complex AnalysisDocument144 pagesComplex AnalysisMiliyon Tilahun100% (4)

- X-Plane Installer LogDocument3 pagesX-Plane Installer LogMarsala NistoNo ratings yet

- Awaring Presentation On Ethiopian Standards ES 3961 2 June 2017Document36 pagesAwaring Presentation On Ethiopian Standards ES 3961 2 June 2017berekajimma100% (4)

- Davidson Et Al-2019-Journal of Applied Behavior AnalysisDocument14 pagesDavidson Et Al-2019-Journal of Applied Behavior Analysisnermal93No ratings yet

- Biology Science For Life 4th Edition Belk Test BankDocument38 pagesBiology Science For Life 4th Edition Belk Test Bankapodaawlwortn3ae100% (13)

- Key Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartDocument6 pagesKey Differences Between Sole Proprietorship and Joint Hindu Family Firm - A Comparison ChartVarun KocharNo ratings yet

- For Health Week2Document23 pagesFor Health Week2Mary Grace CatubiganNo ratings yet

- SCD Define Plant LocationDocument535 pagesSCD Define Plant LocationSantosh YadavNo ratings yet

- SAES-L-460 PDF Download - Pipeline Crossings Under Roads - PDFYARDocument7 pagesSAES-L-460 PDF Download - Pipeline Crossings Under Roads - PDFYARZahidRafiqueNo ratings yet

- Drug Discovery Complete NotesDocument5 pagesDrug Discovery Complete NotesSadiqa ForensicNo ratings yet

- Thread & FastenerDocument35 pagesThread & Fastenermani317No ratings yet

- Lecture 6 Interpersonal RelationshipsDocument36 pagesLecture 6 Interpersonal RelationshipsZimi EnduranceNo ratings yet

- Atmel 42738 TCPIP Server Client With CycloneTCP - AT16287 - ApplicationNote PDFDocument45 pagesAtmel 42738 TCPIP Server Client With CycloneTCP - AT16287 - ApplicationNote PDFIvan IvanovNo ratings yet

- Conquest of Manila: Asynchronous Activities Before Session 1Document4 pagesConquest of Manila: Asynchronous Activities Before Session 1Marbie Ann SimbahanNo ratings yet

- Java 8 - Functional InterfacesDocument3 pagesJava 8 - Functional InterfacesNahom DiresNo ratings yet

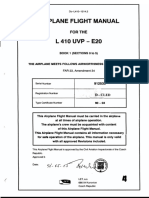

- L410 Flight ManualDocument722 pagesL410 Flight ManualTim Lin100% (1)

- Kiln Performance - Efficiency FormulasDocument12 pagesKiln Performance - Efficiency FormulasMohamed ZayedNo ratings yet

- ISO 9001 2015 Quality Manual Template For Service IndustryDocument21 pagesISO 9001 2015 Quality Manual Template For Service IndustryJose Luis Zimic100% (1)

- June 2017 (v2) QP - Paper 2 CIE Maths IGCSE PDFDocument12 pagesJune 2017 (v2) QP - Paper 2 CIE Maths IGCSE PDFgrayNo ratings yet