Professional Documents

Culture Documents

31 thU9V8pZIEoijGbRNn7OXQ0e

31 thU9V8pZIEoijGbRNn7OXQ0e

Uploaded by

Avinash Kumar0 ratings0% found this document useful (0 votes)

17 views1 page1) This is an application by a banking company for a certificate under section 195(3) of the Income Tax Act to receive interest and other sums without deduction of tax.

2) The banking company declares that it is neither an Indian company nor one that has made arrangements to declare and pay dividends in India, and operates in India through branches.

3) The banking company fulfills all conditions of rule 29B and requests a certificate authorizing it to receive specified interest and other sums without tax deduction under section 195(1) during the given financial year.

Original Description:

Original Title

31.thU9V8pZIEoijGbRNn7OXQ0e

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) This is an application by a banking company for a certificate under section 195(3) of the Income Tax Act to receive interest and other sums without deduction of tax.

2) The banking company declares that it is neither an Indian company nor one that has made arrangements to declare and pay dividends in India, and operates in India through branches.

3) The banking company fulfills all conditions of rule 29B and requests a certificate authorizing it to receive specified interest and other sums without tax deduction under section 195(1) during the given financial year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 page31 thU9V8pZIEoijGbRNn7OXQ0e

31 thU9V8pZIEoijGbRNn7OXQ0e

Uploaded by

Avinash Kumar1) This is an application by a banking company for a certificate under section 195(3) of the Income Tax Act to receive interest and other sums without deduction of tax.

2) The banking company declares that it is neither an Indian company nor one that has made arrangements to declare and pay dividends in India, and operates in India through branches.

3) The banking company fulfills all conditions of rule 29B and requests a certificate authorizing it to receive specified interest and other sums without tax deduction under section 195(1) during the given financial year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

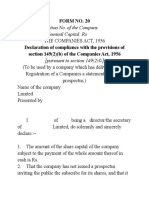

FORM NO 15C

[See rule 29B]

Application by a banking company for a certificate under section 195(3) of the Income -

tax Act,

1961, for receipt of interest and other sums without deduction of tax

To

The Assessing Officer,

Sir,

I, , being the principal officer of [name of the

banking company] hereby declare :

(a) that is a banking company which is neither an Indian company nor a

company which has made the prescribe d arrangements for the declaration and payment of dividends within

India and which is operating in India through a branch(es) at ;

(b) that the head office of the said company is situated at

[name of the place and country];

(c) that the said company is entitled to receive interest (other than 'Interest on securities') and other sums not

being dividends, chargeable under the provisions of the Income -tax Act, 1961, during the financial year

;

(d) that the company fulfils all the conditions laid down in rule 29B of the Income-tax Rules, 1962.

I, therefore, request that a certificate may be issued authorising the said company to receive interest other than

interest on securities (other than interest payable on securities referred to in proviso

to section 193) and other sums not being dividends, without deduction of tax under sub-section (1) of

section 195 of the Income-tax Act, 1961, during the financial year . I hereby

declare that what is stated in this application is correct.

Date .

Signature

Address

You might also like

- Declaration No PE in India.175145431Document3 pagesDeclaration No PE in India.175145431Pallavi MaggonNo ratings yet

- Notification 88 2023Document4 pagesNotification 88 2023sarvagya.mishra448No ratings yet

- SPktTyfOn2q9UeZKwQ1ER8gs PDFDocument1 pageSPktTyfOn2q9UeZKwQ1ER8gs PDFAvinash KumarNo ratings yet

- Itr 62 Form 15 CDocument1 pageItr 62 Form 15 Cad2avNo ratings yet

- Form No. 15DDocument1 pageForm No. 15DDeep SanjayNo ratings yet

- Agreement To Adopt The Preliminary Agreement1 PDFDocument9 pagesAgreement To Adopt The Preliminary Agreement1 PDFVipul ShahNo ratings yet

- Form No. 39: Form of Application For Registration As Authorised Income - Tax PractitionerDocument1 pageForm No. 39: Form of Application For Registration As Authorised Income - Tax PractitionerGanesh GollaNo ratings yet

- Statutory Declaration On Entitlement To Commence Business - Section 19034Document1 pageStatutory Declaration On Entitlement To Commence Business - Section 19034AmirulHafisNo ratings yet

- Form 12BBDocument6 pagesForm 12BBmoin.m.baigNo ratings yet

- 2024 07 1 13 10 18 15GH - AcknowledgeDocument2 pages2024 07 1 13 10 18 15GH - AcknowledgeKajal SamaniNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- 02 Manila Banking Corporation v. CIRDocument2 pages02 Manila Banking Corporation v. CIRCheska VergaraNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)D. Nanda KishoreNo ratings yet

- Form F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessDocument2 pagesForm F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessBhava SharmaNo ratings yet

- Procedure For BODocument6 pagesProcedure For BOmsn_testNo ratings yet

- Tata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership DeclarationDocument2 pagesTata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership DeclarationAnbarasu MookiahpandianNo ratings yet

- US Internal Revenue Service: f2439 - 1996Document6 pagesUS Internal Revenue Service: f2439 - 1996IRSNo ratings yet

- Pursuant To The Practice Note No 4Document4 pagesPursuant To The Practice Note No 4ahchee88No ratings yet

- Unit 2Document22 pagesUnit 2Jannat ZaidiNo ratings yet

- 15 G Form (Pre-Filled) PDFDocument8 pages15 G Form (Pre-Filled) PDFAkshay SinghNo ratings yet

- A Report On Procedure of Registration of Partnership Firm Under Partnership Act 1932Document3 pagesA Report On Procedure of Registration of Partnership Firm Under Partnership Act 1932sampras199767% (21)

- Form No. 20Document3 pagesForm No. 20Pratik MuchandikarNo ratings yet

- 15 H Form (Pre-Filled)Document2 pages15 H Form (Pre-Filled)pareshrankaNo ratings yet

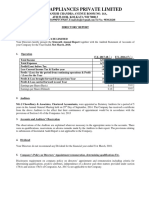

- Cosmos Appliances FY 2018Document23 pagesCosmos Appliances FY 2018Bhavin SagarNo ratings yet

- Declaration FormatsDocument5 pagesDeclaration Formatskirubkanchan96No ratings yet

- Commerce LabDocument116 pagesCommerce LabStanley RoyNo ratings yet

- Form 15 HDocument2 pagesForm 15 Hsumeet khannaNo ratings yet

- F 12 CDocument1 pageF 12 Cpremkumar.bathalaNo ratings yet

- Form 15 GDocument2 pagesForm 15 GSiddharthNo ratings yet

- BSE SB Cancellation New FormatDocument4 pagesBSE SB Cancellation New FormatabcNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitluthfi musthofaNo ratings yet

- Guidance For Companies Incorporated in Pakistan Regarding Statutory Activities and Related Compliance With The Provisions of Companies Act, 2017Document5 pagesGuidance For Companies Incorporated in Pakistan Regarding Statutory Activities and Related Compliance With The Provisions of Companies Act, 2017syasir85No ratings yet

- PARTNERSHIP DEED 7-11-2017 WrittenDocument4 pagesPARTNERSHIP DEED 7-11-2017 WrittenMohd AsifNo ratings yet

- Form STK-3Document2 pagesForm STK-3jaiNo ratings yet

- Ae 524617Document28 pagesAe 524617thhduyen30No ratings yet

- Illegal Partnership Illegal Partnership: Section 24 of The Indian Contract Act % &$Document7 pagesIllegal Partnership Illegal Partnership: Section 24 of The Indian Contract Act % &$Kazia Shamoon AhmedNo ratings yet

- Procedure For Registration of A Partnership FirmDocument4 pagesProcedure For Registration of A Partnership FirmjasujunkNo ratings yet

- UntitledDocument1 pageUntitledGeethu KadariNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitcesc festNo ratings yet

- Empanelment Form IIDocument15 pagesEmpanelment Form IIANKESH SHRIVASTAVANo ratings yet

- Abb FZ LLC - Bangalore ItatDocument23 pagesAbb FZ LLC - Bangalore Itatbharath289No ratings yet

- Form No. 15G: Declaration/VerificationDocument2 pagesForm No. 15G: Declaration/VerificationMadhu MohanNo ratings yet

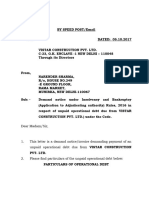

- Demand NoticeDocument5 pagesDemand Noticeg95jyt8hg2No ratings yet

- In Re - Dinshaw Maneckjee Petit ... Vs Unknown On 29 November, 1926Document16 pagesIn Re - Dinshaw Maneckjee Petit ... Vs Unknown On 29 November, 1926Ravi RanjanNo ratings yet

- No PE DeclarationDocument1 pageNo PE DeclarationDebasisNo ratings yet

- BusinessLicenceAct 1Document27 pagesBusinessLicenceAct 1Leonardo DorsettNo ratings yet

- Legal Notice AnimeshDocument7 pagesLegal Notice AnimeshKalyan Dutt100% (1)

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Taxi Cab Company (PDF) - 202112271209329631Document38 pagesTaxi Cab Company (PDF) - 202112271209329631Salah MohammedNo ratings yet

- Board Resolution For GST Registration in Word FormatDocument1 pageBoard Resolution For GST Registration in Word FormatKartik Jain ASCO, NoidaNo ratings yet

- Incorporation of A Company and Matters IncidentalDocument80 pagesIncorporation of A Company and Matters Incidentalprithviraj yadavNo ratings yet

- Procedure For Registration of A Partnership FirmDocument6 pagesProcedure For Registration of A Partnership FirmMuhammad Nisar KhattakNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument6 pagesPetitioner Vs Vs Respondent: Second DivisionPatty PerezNo ratings yet

- Equipme Plant Hire CREDIT APPDocument12 pagesEquipme Plant Hire CREDIT APPtapiwanaishe maunduNo ratings yet

- Vision Realcon RejoinderDocument8 pagesVision Realcon RejoinderSonali AggarwalNo ratings yet

- Application For Company IncorporationDocument5 pagesApplication For Company IncorporationHassam AhmadNo ratings yet

- ITC Notes PDFDocument44 pagesITC Notes PDFAvinash KumarNo ratings yet

- rf9RgWUoLMY58namXBIiNpED PDFDocument2 pagesrf9RgWUoLMY58namXBIiNpED PDFAvinash KumarNo ratings yet

- SPktTyfOn2q9UeZKwQ1ER8gs PDFDocument1 pageSPktTyfOn2q9UeZKwQ1ER8gs PDFAvinash KumarNo ratings yet

- Bank Account Number Name and Address of The DeductorDocument2 pagesBank Account Number Name and Address of The DeductorAvinash KumarNo ratings yet

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash KumarNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash Kumar100% (1)

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- Good Evening To AllDocument2 pagesGood Evening To AllAvinash KumarNo ratings yet

- Rural Market Plan: - (Akash Kumar) (Shani Jha)Document1 pageRural Market Plan: - (Akash Kumar) (Shani Jha)Avinash KumarNo ratings yet

- Meaning and Importance of Financial Services 1&2 UNITDocument11 pagesMeaning and Importance of Financial Services 1&2 UNITAvinash KumarNo ratings yet