Professional Documents

Culture Documents

Explanation.-For The Purposes of This Sub-Section, The Term "Unit" Shall Have The Same Meaning As Assigned To It in Clause (ZC) of

Explanation.-For The Purposes of This Sub-Section, The Term "Unit" Shall Have The Same Meaning As Assigned To It in Clause (ZC) of

Uploaded by

ashim1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Explanation.-For The Purposes of This Sub-Section, The Term "Unit" Shall Have The Same Meaning As Assigned To It in Clause (ZC) of

Explanation.-For The Purposes of This Sub-Section, The Term "Unit" Shall Have The Same Meaning As Assigned To It in Clause (ZC) of

Uploaded by

ashim1Copyright:

Available Formats

Income Tax Department https://www.incometaxindia.gov.in/_layouts/15/dit/Pages/viewer.aspx?g...

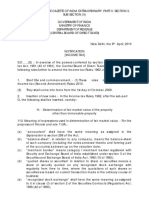

Following sections 115BAA and 115BAB shall be inserted after section 115BA by the Taxation Laws (Amendment) Act, 2019,

w.e.f. 1-4-2020:

Tax on income of certain domestic companies.

115BAA. (1) Notwithstanding anything contained in this Act but subject to the provisions of this Chapter, other than those mentioned

under section 115BA and section 115BAB, the income-tax payable in respect of the total income of a person, being a domestic

company, for any previous year relevant to the assessment year beginning on or after the 1st day of April, 2020, shall, at the option of

such person, be computed at the rate of twenty-two per cent, if the conditions contained in sub-section (2) are satisfied:

Provided that where the person fails to satisfy the conditions contained in sub-section (2) in any previous year, the option shall

become invalid in respect of the assessment year relevant to that previous year and subsequent assessment years and other provisions

of the Act shall apply, as if the option had not been exercised for the assessment year relevant to that previous year and subsequent

assessment years.

(2) For the purposes of sub-section (1), the total income of the company shall be computed,—

(i) without any deduction under the provisions of section 10AA or clause (iia) of sub-section (1) of section 32 or section 32AD or

section 33AB or section 33ABA or sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA)

or sub-section (2AB) of section 35 or section 35AD or section 35CCC or section 35CCD or under any provisions of Chapter

VI-A under the heading "C.—Deductions in respect of certain incomes" other than the provisions of section 80JJAA;

(ii) without set off of any loss carried forward or depreciation from any earlier assessment year, if such loss or depreciation is

attributable to any of the deductions referred to in clause (i);

(iii) without set off of any loss or allowance for unabsorbed depreciation deemed so under section 72A, if such loss or

depreciation is attributable to any of the deductions referred to in clause (i); and

(iv) by claiming the depreciation, if any, under any provision of section 32, except clause (iia) of sub-section (1) of the said

section, determined in such manner as may be prescribed.

(3) The loss and depreciation referred to in clause (ii) and clause (iii) of sub-section (2) shall be deemed to have been given full effect

to and no further deduction for such loss or depreciation shall be allowed for any subsequent year:

Provided that where there is a depreciation allowance in respect of a block of asset which has not been given full effect to prior to the

assessment year beginning on the 1st day of April, 2020, corresponding adjustment shall be made to the written down value of such

block of assets as on the 1st day of April, 2019 in the prescribed manner, if the option under sub-section (5) is exercised for a previous

year relevant to the assessment year beginning on the 1st day of April, 2020.

(4) In case of a person, having a Unit in the International Financial Services Centre, as referred to in sub-section (1A) of section

80LA, which has exercised option under sub-section (5), the conditions contained in sub-section (2) shall be modified to the extent that

the deduction under section 80LA shall be available to such Unit subject to fulfilment of the conditions contained in the said section.

Explanation.—For the purposes of this sub-section, the term "Unit" shall have the same meaning as assigned to it in clause (zc) of

section 2 of the Special Economic Zones Act, 2005 (28 of 2005).

(5) Nothing contained in this section shall apply unless the option is exercised by the person in the prescribed manner on or before the

due date specified under sub-section (1) of section 139 for furnishing the returns of income for any previous year relevant to the

assessment year commencing on or after the 1st day of April, 2020 and such option once exercised shall apply to subsequent

assessment years:

Provided that in case of a person, where the option exercised by it under section 115BAB has been rendered invalid due to violation of

conditions contained in sub-clause (ii) or sub-clause (iii) of clause (a), or clause (b) of sub-section (2) of said section, such person

may exercise option under this section:

Provided further that once the option has been exercised for any previous year, it cannot be subsequently withdrawn for the same or

any other previous year.

1 of 1 25-05-2020, 16:07

You might also like

- Aws A2.4 1Document83 pagesAws A2.4 1Ярослав Дорошенко100% (3)

- Gabby Petito/Brian Laundrie Amended Civil ComplaintDocument38 pagesGabby Petito/Brian Laundrie Amended Civil ComplaintLeigh EganNo ratings yet

- LTFRB Franchise RequirementsDocument2 pagesLTFRB Franchise RequirementsRojen Yuri71% (7)

- Resa Afar 2205 Quiz 1Document16 pagesResa Afar 2205 Quiz 1Rafael BautistaNo ratings yet

- Al-Mabadi Al - Asharah Li Ilm Usul Al-Fiqh: 1. Al-Hadd / The Definition of This ScienceDocument5 pagesAl-Mabadi Al - Asharah Li Ilm Usul Al-Fiqh: 1. Al-Hadd / The Definition of This Sciencealb 348No ratings yet

- Section 10BDocument5 pagesSection 10BShreya JainNo ratings yet

- SchedulefileDocument6 pagesSchedulefile27-Deekshitha Preeth JayaramNo ratings yet

- Home Previous: Customs Chapter 10-BDocument5 pagesHome Previous: Customs Chapter 10-Bశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Amendments For May 2021 09.02.2021Document34 pagesAmendments For May 2021 09.02.2021Hari MNo ratings yet

- 16 Deductions Under Chapter ViaDocument89 pages16 Deductions Under Chapter ViabinoygnairNo ratings yet

- Chapter 2Document9 pagesChapter 2Paym entNo ratings yet

- Section 10ADocument6 pagesSection 10Apratapnirbhay0551No ratings yet

- Salary. 192.: B.-Deduction at SourceDocument3 pagesSalary. 192.: B.-Deduction at SourceJeremy RemlalfakaNo ratings yet

- Declaration 206AA 206ABDocument2 pagesDeclaration 206AA 206ABskikhtiarNo ratings yet

- 44ad 2019Document2 pages44ad 2019dipak300pawarNo ratings yet

- Section - 44ADDocument2 pagesSection - 44ADSANJAY PRASADNo ratings yet

- 29 Deductions GenerallyDocument17 pages29 Deductions GenerallyMasitala PhiriNo ratings yet

- Section 115JC - Special Provisions For Payment of Tax by Certain Persons Other Than A Company.Document1 pageSection 115JC - Special Provisions For Payment of Tax by Certain Persons Other Than A Company.Anand LakraNo ratings yet

- Sec 201 - Failure To Deduct or Pay TDS - Amendment On 1 July 2010 - Circular No. 1 2010Document1 pageSec 201 - Failure To Deduct or Pay TDS - Amendment On 1 July 2010 - Circular No. 1 2010Mohan ReddyNo ratings yet

- TDS Not DeductDocument6 pagesTDS Not DeductAnil WayanadNo ratings yet

- Restriction On ITC in Case of Diffrence’ GTR 3B Is A Return - CBIC Notifies - Taxguru - inDocument7 pagesRestriction On ITC in Case of Diffrence’ GTR 3B Is A Return - CBIC Notifies - Taxguru - indhananjay12031978No ratings yet

- Input Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.Document22 pagesInput Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.KaranNo ratings yet

- Circular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Document3 pagesCircular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Vivek AgarwalNo ratings yet

- Finance Bill 2013Document45 pagesFinance Bill 2013hit2011No ratings yet

- The Finance Bill, 2013Document5 pagesThe Finance Bill, 2013vickytatkareNo ratings yet

- NN 14 2022 EnglishDocument13 pagesNN 14 2022 EnglishManish sharmaNo ratings yet

- in Section 2 of The Income-Tax Act, With Effect From The 1st Day of April, 2014Document20 pagesin Section 2 of The Income-Tax Act, With Effect From The 1st Day of April, 2014vickytatkareNo ratings yet

- Deduction Under Section 80 CCD of Income TaxDocument2 pagesDeduction Under Section 80 CCD of Income Taxnahar_sv1366No ratings yet

- Gala - Business 43B and 43D - V3Document7 pagesGala - Business 43B and 43D - V3Priyank GalaNo ratings yet

- VLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr: JFTLV H Lañ MHÑ, Yñ - (,U) 04@0007@2003-16Document8 pagesVLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr: JFTLV H Lañ MHÑ, Yñ - (,U) 04@0007@2003-16Shrikanth SKNo ratings yet

- Notification No. 35-2021 - Central TaxDocument4 pagesNotification No. 35-2021 - Central TaxSIR GNo ratings yet

- Section 40Document4 pagesSection 40Anil MathewNo ratings yet

- 43B Certain Deductions To Be Only On Actual PaymentDocument2 pages43B Certain Deductions To Be Only On Actual PaymentNISHANTH JOSENo ratings yet

- Circular 17 2020Document4 pagesCircular 17 2020Moneylife FoundationNo ratings yet

- Reduction in TaxDocument3 pagesReduction in Taxsmyns.bwNo ratings yet

- ct26 2022Document18 pagesct26 2022cadeepaksingh4No ratings yet

- ZAKAT Tax ComplicationsDocument1 pageZAKAT Tax Complicationssaif RashidNo ratings yet

- Income-Tax Rules, 1962: Form No.29BDocument5 pagesIncome-Tax Rules, 1962: Form No.29Bjack sonNo ratings yet

- Amendment in TDS Rules - Notification 41-2010Document15 pagesAmendment in TDS Rules - Notification 41-2010Nidhi MalhotraNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- Finance Act 1956 15 - 1956 - Eng - LS PDFDocument38 pagesFinance Act 1956 15 - 1956 - Eng - LS PDFkamatchinmayNo ratings yet

- MRL Form 3cdDocument11 pagesMRL Form 3cdPARITOSH SHAHNo ratings yet

- Income Tax Cia 2 Differences in Financial Bill of 2009 and 2011Document7 pagesIncome Tax Cia 2 Differences in Financial Bill of 2009 and 2011karandutt69No ratings yet

- circular-CBDT Clarifies Provisions RelatingDocument6 pagescircular-CBDT Clarifies Provisions RelatingYogesh KanojiyaNo ratings yet

- Annex-A: Further To Amend Certain Tax LawsDocument7 pagesAnnex-A: Further To Amend Certain Tax LawsAfreen MirzaNo ratings yet

- Law - May 2020Document18 pagesLaw - May 2020Princy ManglaNo ratings yet

- Section 139Document9 pagesSection 139Mkv Downloader2No ratings yet

- Agenda Item 2 (2) - ITC RulesDocument9 pagesAgenda Item 2 (2) - ITC Rulesfintech ConsultancyNo ratings yet

- Microsoft Word - CIRCULAR-NO-2-2020-F-NODocument1 pageMicrosoft Word - CIRCULAR-NO-2-2020-F-NOarunjain022No ratings yet

- Budget 2022-Indirect Tax - FinalDocument45 pagesBudget 2022-Indirect Tax - Finalahjchogle2No ratings yet

- Notfctn 40 Central Tax English 2021Document12 pagesNotfctn 40 Central Tax English 2021sridharanNo ratings yet

- Elective Ourse in Commerce ECO-11 Elements of Income TaxDocument12 pagesElective Ourse in Commerce ECO-11 Elements of Income TaxJai GorakhNo ratings yet

- 26 Usc 460 - Special Rules For Long-Term Contracts: USC Prelim 112-143 112-141 Public Laws For The Current CongressDocument8 pages26 Usc 460 - Special Rules For Long-Term Contracts: USC Prelim 112-143 112-141 Public Laws For The Current CongressBhava Nath DahalNo ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Income Tax Amendment Draft Bill 2016Document10 pagesIncome Tax Amendment Draft Bill 2016Muhammad KashifNo ratings yet

- Section - 36Document5 pagesSection - 36adipawar2824No ratings yet

- Taxation Assignment Budget Proposal 2020Document20 pagesTaxation Assignment Budget Proposal 2020Shivani DuttNo ratings yet

- ST THDocument3 pagesST THDhananjaya MnNo ratings yet

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Nikhil KumarNo ratings yet

- Chapter - Composition Rules 1. Intimation For Composition LevyDocument4 pagesChapter - Composition Rules 1. Intimation For Composition LevyGuru SankarNo ratings yet

- Finance Bill 2024Document45 pagesFinance Bill 2024Ankur ShahNo ratings yet

- It 2Document1 pageIt 2Babu GupthaNo ratings yet

- Gala - Business 35D and 28 (Iv)Document5 pagesGala - Business 35D and 28 (Iv)Priyank GalaNo ratings yet

- Carry ForwardDocument16 pagesCarry Forwardpabloescobar11yNo ratings yet

- 32ACDocument1 page32ACashim1No ratings yet

- Form 9C Clarification 3.7.19Document2 pagesForm 9C Clarification 3.7.19ashim1No ratings yet

- 32 Additional DepDocument2 pages32 Additional Depashim1No ratings yet

- 40ADocument3 pages40Aashim1No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- Notification5-IGST (Restriction of ITC Refund)Document2 pagesNotification5-IGST (Restriction of ITC Refund)ashim1No ratings yet

- RCM - Motor Vehicle IDocument2 pagesRCM - Motor Vehicle Iashim1No ratings yet

- Notice Pay - An EnigmaDocument5 pagesNotice Pay - An Enigmaashim1No ratings yet

- Notice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-GujratDocument7 pagesNotice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-Gujratashim1No ratings yet

- Write Back Amount Vs GSTDocument8 pagesWrite Back Amount Vs GSTashim1No ratings yet

- RCM Wef 1.10.19Document14 pagesRCM Wef 1.10.19ashim1No ratings yet

- Circular No.: Government India Department Revenue Board Direct Division)Document2 pagesCircular No.: Government India Department Revenue Board Direct Division)ashim1No ratings yet

- Section 372A Co Act IIDocument4 pagesSection 372A Co Act IIashim1No ratings yet

- IDEA TutorialDocument142 pagesIDEA Tutorialashim1No ratings yet

- Section 372A Co Act III GoodDocument21 pagesSection 372A Co Act III Goodashim1No ratings yet

- Diff Between AS and TASDocument2 pagesDiff Between AS and TASashim1No ratings yet

- Section 370 Co ActDocument18 pagesSection 370 Co Actashim1No ratings yet

- Relationship Accounting Vs TaxationDocument24 pagesRelationship Accounting Vs Taxationashim1No ratings yet

- Section 372A Co Act IVDocument11 pagesSection 372A Co Act IVashim1No ratings yet

- SFT - FAQ Refer Page 5 For Nil ResponseDocument80 pagesSFT - FAQ Refer Page 5 For Nil Responseashim1No ratings yet

- RSPCB - Textiles Case StudyDocument111 pagesRSPCB - Textiles Case Studyashim1100% (2)

- AY 20-21 Tax RatesDocument4 pagesAY 20-21 Tax Ratesashim1No ratings yet

- CBDT - FV Unquoted EquityDocument4 pagesCBDT - FV Unquoted Equityashim1No ratings yet

- Payment of BonusDocument2 pagesPayment of Bonusashim1No ratings yet

- GBI Scheme - ClarificationsDocument1 pageGBI Scheme - Clarificationsashim1No ratings yet

- Quitclaim and Release FormDocument4 pagesQuitclaim and Release FormAlemie Blase TuaNo ratings yet

- Caltex (Philippines), Inc. vs. Sulpicio Lines, IncDocument20 pagesCaltex (Philippines), Inc. vs. Sulpicio Lines, IncJesha GCNo ratings yet

- GRADE 3 - Filipino & Kinaray-A Teacher Administration Guide: Guidance NotesDocument10 pagesGRADE 3 - Filipino & Kinaray-A Teacher Administration Guide: Guidance NotesMar StoneNo ratings yet

- Omnibus AffidavitDocument2 pagesOmnibus AffidavitPatrick RodriguezNo ratings yet

- PI of Street Lamp - YekalonDocument2 pagesPI of Street Lamp - YekalonHarold de MesaNo ratings yet

- Inheriting in Spain Brochure - E&G SolicitorsDocument18 pagesInheriting in Spain Brochure - E&G Solicitorscarinaulander59No ratings yet

- City of Grapevine v. Muns, No. 22-0044 (Tex. Jun 16, 2023) (Young, J., and Blacklock, J., Concurring in The Denial of The Petition For Review)Document5 pagesCity of Grapevine v. Muns, No. 22-0044 (Tex. Jun 16, 2023) (Young, J., and Blacklock, J., Concurring in The Denial of The Petition For Review)RHTNo ratings yet

- Lju PortfolioDocument16 pagesLju Portfolionyararai gombaNo ratings yet

- RFQ Airport Terminal Planning ServicesDocument18 pagesRFQ Airport Terminal Planning ServicesAndrew TanNo ratings yet

- APCC PUB - Professional Indemnity Insurance GuidelinesDocument14 pagesAPCC PUB - Professional Indemnity Insurance GuidelinesSrinivasa MadhusudhanaNo ratings yet

- The Telangana Societies Registration Act, 2001.act - 35 - of - 2001Document19 pagesThe Telangana Societies Registration Act, 2001.act - 35 - of - 2001Sridhar NimmagaddaNo ratings yet

- Q4 - Applied - Empowerment Technology11-12 - Week2Document6 pagesQ4 - Applied - Empowerment Technology11-12 - Week2JEWEL LUCKY LYN GUINTONo ratings yet

- Mathematics of Finance Canadian 8th Edition Brown Kopp Solution ManualDocument41 pagesMathematics of Finance Canadian 8th Edition Brown Kopp Solution Manualflorence100% (34)

- Audio FG-730 - Installation - MNDocument2 pagesAudio FG-730 - Installation - MNgarrigan12No ratings yet

- Legaspi V. City of CebuDocument1 pageLegaspi V. City of CebuNico RavilasNo ratings yet

- Busn 9th Edition Kelly Test BankDocument10 pagesBusn 9th Edition Kelly Test BankDarinFreemantqjn100% (73)

- Cases 1-3 (Torts)Document15 pagesCases 1-3 (Torts)RacsNo ratings yet

- Inter-School I.I.M.U.N.Document4 pagesInter-School I.I.M.U.N.deeptanshuranjansharmaNo ratings yet

- Seattle Protest Photo and Video SubpoenaDocument21 pagesSeattle Protest Photo and Video SubpoenaMichael Zhang100% (1)

- 20 07 21 Letter To Indra For Phoolbagan TOC Ver 2 - R1Document3 pages20 07 21 Letter To Indra For Phoolbagan TOC Ver 2 - R1Arindam HaldarNo ratings yet

- Paypal StatementDocument11 pagesPaypal StatementZhor RealzonNo ratings yet

- French Flip FX @falcon - BooksDocument8 pagesFrench Flip FX @falcon - BooksJabir JabirNo ratings yet

- Oblicon FInals 2021Document5 pagesOblicon FInals 2021yusepNo ratings yet

- Functions of FBRDocument14 pagesFunctions of FBRAsdaf AliNo ratings yet

- Sevilla v. Cardenas, July 31, 2006Document12 pagesSevilla v. Cardenas, July 31, 2006Jennilyn Gulfan YaseNo ratings yet