Professional Documents

Culture Documents

Importance of Cost Accounting: Anu Anna Jacob

Importance of Cost Accounting: Anu Anna Jacob

Uploaded by

Muhammad Bilal0 ratings0% found this document useful (0 votes)

19 views10 pagesCost accounting aims to capture a company's costs of production by assessing input and fixed costs to aid management in measuring financial performance. It is important because it allows for (1) classification and subdivision of costs by department, product, etc., (2) determination of selling prices based on production costs, and (3) identification of profitable and unprofitable products or activities.

Original Description:

Original Title

cma-130307021256-phpapp02

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost accounting aims to capture a company's costs of production by assessing input and fixed costs to aid management in measuring financial performance. It is important because it allows for (1) classification and subdivision of costs by department, product, etc., (2) determination of selling prices based on production costs, and (3) identification of profitable and unprofitable products or activities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

19 views10 pagesImportance of Cost Accounting: Anu Anna Jacob

Importance of Cost Accounting: Anu Anna Jacob

Uploaded by

Muhammad BilalCost accounting aims to capture a company's costs of production by assessing input and fixed costs to aid management in measuring financial performance. It is important because it allows for (1) classification and subdivision of costs by department, product, etc., (2) determination of selling prices based on production costs, and (3) identification of profitable and unprofitable products or activities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

IMPORTANCE OF COST ACCOUNTING

ANU ANNA JACOB

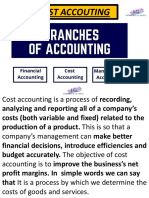

What is cost accounting?

Process that aims to capture a company's costs of

production by assessing the input costs of each step of

production, as well as fixed costs such as depreciation of

capital equipment

First measure and record these costs individually

Compare input results to output or actual results to aid

company management in measuring financial

performance.

Importance of cost accounting

1.Classification and Subdivision of Costs:

Cost accounting classifies cost and income by every

possible divisions

Data regarding costs by

departments, processes, functions, products, orders, jo

bs, contracts and services can easily computed

2.Helps in determining selling price

Since CA analyses the cost of each unit, it gives an idea

about the cost of production

This awareness helps to decide adequate selling price

High price and low price affects the company

Helps in decision making during period of

depression, competition etc.

3.Disclosure of profitable products

CA analyses each and every units, so the most

profitable unit an d unit making loses can be easily

identified

So, decision regarding which all activities are to be

promoted, which all are to be modified or avoided can

be easily taken.

This will help to improve the overall performance and

profit.

4.Control of material and supplies

In CA materials are allocated according in

terms of departments, jobs, unit of production

or service

This helps to minimize misappropriation, loses

from defective,spoiled,scrap and out of date

material supplies

5.Control of labour cost

Cost accounting analyses the time spent by each

worker, wage rate of each worker per job etc

This enables to find the cost of labour, measure

efficiency or inefficiency of labour force etc.

It also helps to assign the best suited job for each

employee.

Thus cost of labour can be controlled

6.Idleness can be detected

Cost accounting values each single unit

So it is easy to detect the idleness which result in

wastage of time, money and other resources

Proper steps can be adopted to avoid this loss

7.Reliable check on general

accounts

Cost accounting facilitates us to check the reliability of

general accounts

It identifies exact cost for the decrease/increase of

profit/loss

Thus proper measures can be adopted

CONCLUSION

The main objective of the cost accounting is to

pinpoint the efficiencies and inefficiencies, if any, in

the use of material, labour and machinery.

Since cost accounting analyses each possible units it is

beneficial to management as well as the employees

You might also like

- Chapter 10 (Issues Between Organizations and Individuals)Document25 pagesChapter 10 (Issues Between Organizations and Individuals)Sabbir100% (1)

- Introduction To Cost AccountingDocument4 pagesIntroduction To Cost AccountingNeelabh KumarNo ratings yet

- Share 'IMPORTANCE of Cost Accounting - PPT'Document11 pagesShare 'IMPORTANCE of Cost Accounting - PPT'Y KNo ratings yet

- Cost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingDocument37 pagesCost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingShubashPoojariNo ratings yet

- B.B.A (Bachelor of Business Administration) - Semester I Course Name-COST ACCOUNTING Topic-Objectives of Cost AccountingDocument3 pagesB.B.A (Bachelor of Business Administration) - Semester I Course Name-COST ACCOUNTING Topic-Objectives of Cost Accountinggaming tuberNo ratings yet

- Integrated and Non Integrated System of AccountingDocument46 pagesIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)

- Cost Accounting Final ReportDocument15 pagesCost Accounting Final ReportMurtaza MoizNo ratings yet

- Meaning and Classification of CostDocument13 pagesMeaning and Classification of Costpooja456No ratings yet

- Mba Cost and Management Accounting NotesDocument24 pagesMba Cost and Management Accounting Notesshanu rockNo ratings yet

- Definition of CostingDocument22 pagesDefinition of CostingmichuttyNo ratings yet

- Anand Pandey COSTINGDocument8 pagesAnand Pandey COSTINGAnand PandeyNo ratings yet

- Cost Accounting - Theory QuestionsDocument16 pagesCost Accounting - Theory Questionsaryanmittal595No ratings yet

- Meaningof Cost AccountingDocument13 pagesMeaningof Cost AccountingEthereal DNo ratings yet

- BBA M&CA 301A UNIT II NotesDocument46 pagesBBA M&CA 301A UNIT II Notesrahmanakhtar28No ratings yet

- ACCT303Document9 pagesACCT303Karan KhannaNo ratings yet

- Cost Concept Uses and ClasificationsDocument8 pagesCost Concept Uses and ClasificationsSameel Ur RehmanNo ratings yet

- Accountancy SectionDocument124 pagesAccountancy Sections7k1994No ratings yet

- Cost AccountingDocument23 pagesCost AccountingSEEMANo ratings yet

- Cost AccountingDocument22 pagesCost AccountingSiddharth KakaniNo ratings yet

- Chapter 2Document20 pagesChapter 2siddeshNo ratings yet

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- Cost A:c & BankingDocument130 pagesCost A:c & BankingAbu anas100% (1)

- Cost Accounting PresentationsDocument13 pagesCost Accounting PresentationsAdityaNo ratings yet

- Defination of Cost AccountingDocument5 pagesDefination of Cost AccountingYaseen Saleem100% (1)

- Cost Accounting1Document134 pagesCost Accounting1Ryan Brown100% (1)

- Cost AccountingDocument4 pagesCost AccountingKazeem modinatNo ratings yet

- Cost AccountingDocument26 pagesCost AccountingJanvi JagtapNo ratings yet

- Cost SheetDocument14 pagesCost Sheettanbir singhNo ratings yet

- Cost Accounting NotesDocument17 pagesCost Accounting NotesAyushi Dwivedi0% (1)

- CST Accounting by Ig ClassesDocument39 pagesCST Accounting by Ig Classesraman sharma100% (1)

- Course Title: Cost & Management Accounting Course Code:ACC 205Document37 pagesCourse Title: Cost & Management Accounting Course Code:ACC 205Ishita GuptaNo ratings yet

- Cost AccountingDocument59 pagesCost AccountingDitto SabuNo ratings yet

- Cost AccountingDocument44 pagesCost Accountingknowledge informationNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingyaqoob008No ratings yet

- Abc SummaryDocument2 pagesAbc SummaryJana RaoNo ratings yet

- Advantages of Cost AccountingDocument3 pagesAdvantages of Cost AccountingKirti_jadhav2014No ratings yet

- Cost AccountingDocument4 pagesCost AccountingAnunobi JaneNo ratings yet

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- Hospital Cost AccountingDocument39 pagesHospital Cost AccountingIndu Randhawa Gill100% (1)

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Costing An Overview of Cost and Management Accounting 1 PDFDocument6 pagesCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- B Com Core Cost AccountingDocument116 pagesB Com Core Cost AccountingPRIYANKA H MEHTA100% (1)

- Cost AccountingDocument25 pagesCost Accountingmahendrabpatel100% (1)

- Cost Accounting: Is A Form of Managerial Accounting That Aims To Capture A Company'sDocument6 pagesCost Accounting: Is A Form of Managerial Accounting That Aims To Capture A Company'sZ the officerNo ratings yet

- Costing SystemsDocument4 pagesCosting SystemsNeriza PonceNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Assingment 1Document5 pagesAssingment 1sunnysisodiaNo ratings yet

- Unit 6Document36 pagesUnit 6BHUSHAN KALAMBENo ratings yet

- AIOU8408 Assignment 1 0000603169Document18 pagesAIOU8408 Assignment 1 0000603169Farhan ShakilNo ratings yet

- ESSAY: This Will Help You Express Your Understanding of The Concept. Answer Each Item Briefly in Complete SentencesDocument6 pagesESSAY: This Will Help You Express Your Understanding of The Concept. Answer Each Item Briefly in Complete Sentencesjustin morenoNo ratings yet

- Cost Accounting: Made by Prakhar Agarwal Mba 2 SemDocument29 pagesCost Accounting: Made by Prakhar Agarwal Mba 2 SemPrakhar AgarwalNo ratings yet

- New Management Accounting-1Document264 pagesNew Management Accounting-1leaky100% (1)

- Introduction To Cost AccountingDocument9 pagesIntroduction To Cost AccountingShohidul Islam SaykatNo ratings yet

- Advantages of Cost AccountingDocument3 pagesAdvantages of Cost AccountingMehwish PervaizNo ratings yet

- ABC Method NoteDocument3 pagesABC Method NoteMahima SheromiNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Manufacturing Secret : Product Development and Intelligent Manufacturing For Flexible Automation With Odoo 17: odoo consultations, #1.1From EverandManufacturing Secret : Product Development and Intelligent Manufacturing For Flexible Automation With Odoo 17: odoo consultations, #1.1No ratings yet

- Cost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelFrom EverandCost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelNo ratings yet

- Avoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainDocument6 pagesAvoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainMuhammad BilalNo ratings yet

- Cost Accounting As A Subject in BBADocument2 pagesCost Accounting As A Subject in BBAMuhammad BilalNo ratings yet

- Introduction To DerivativesDocument4 pagesIntroduction To DerivativesMuhammad BilalNo ratings yet

- Brands and Brand Management: Mansoor Waqas Askaree Lecturer SBBU Sanghar Campus EmailDocument50 pagesBrands and Brand Management: Mansoor Waqas Askaree Lecturer SBBU Sanghar Campus EmailMuhammad BilalNo ratings yet

- Course Outline Course: Brand Management Class: BBA (2013) Instructor: Mr. Mansoor Waqas Askaree E.mail: Mansoorwaqas@sbbusba - Edu.pkDocument5 pagesCourse Outline Course: Brand Management Class: BBA (2013) Instructor: Mr. Mansoor Waqas Askaree E.mail: Mansoorwaqas@sbbusba - Edu.pkMuhammad BilalNo ratings yet

- Themes in Information System DevelopmentDocument14 pagesThemes in Information System DevelopmentMuhammad BilalNo ratings yet

- Three Stages of Strategic Management ProcessDocument3 pagesThree Stages of Strategic Management ProcessMuhammad BilalNo ratings yet

- Logic: Credit Assignment by Muhammad Bilal 18 Bba 001Document3 pagesLogic: Credit Assignment by Muhammad Bilal 18 Bba 001Muhammad BilalNo ratings yet

- Marketing 1 PDFDocument14 pagesMarketing 1 PDFMuhammad BilalNo ratings yet

- The Analysis of Financial Reports Automobile Assembler Industry in PakistanDocument55 pagesThe Analysis of Financial Reports Automobile Assembler Industry in PakistanMuhammad BilalNo ratings yet

- Consumer Behavior and Marketing StrategyDocument2 pagesConsumer Behavior and Marketing StrategyMuhammad BilalNo ratings yet

- Chapter No 1 SummaryDocument7 pagesChapter No 1 SummaryMuhammad BilalNo ratings yet

- Labor Law ReviewerDocument11 pagesLabor Law Reviewerbreezy bonesNo ratings yet

- Soft Skills: Emotional Intelligence Problem SolvingDocument4 pagesSoft Skills: Emotional Intelligence Problem SolvingAnissa Livnglife Golden FowlesNo ratings yet

- Christian CorporationDocument14 pagesChristian CorporationKissel Jade Barsalote SarnoNo ratings yet

- Management PrerogativesDocument1 pageManagement PrerogativesJohanne LariosaNo ratings yet

- Class Suit Filed by Bus Drivers Against CYM Recruitment Et AlDocument1 pageClass Suit Filed by Bus Drivers Against CYM Recruitment Et AlNoemi Lardizabal-DadoNo ratings yet

- I Pio, Sikap Dan PerilakuDocument29 pagesI Pio, Sikap Dan PerilakuJordan LdzNo ratings yet

- Resigning From A Nursing PositionDocument15 pagesResigning From A Nursing PositionLouise NicoleNo ratings yet

- Youth Entrepreneurship FINAL ReportDocument41 pagesYouth Entrepreneurship FINAL ReportRama subediNo ratings yet

- Organizing and Staffing VTU NotesDocument100 pagesOrganizing and Staffing VTU NotesJoyson PereiraNo ratings yet

- Supplier Risk Assessment: 3 - Leading Questions 0 Poor 1 Average 2 - GoodDocument2 pagesSupplier Risk Assessment: 3 - Leading Questions 0 Poor 1 Average 2 - GoodAnthonyNo ratings yet

- Final Exam - Performance and Compensation ManagementDocument16 pagesFinal Exam - Performance and Compensation ManagementTaha JavaidNo ratings yet

- Fatal Flaws in The Theory of Comparative AdvantageDocument4 pagesFatal Flaws in The Theory of Comparative AdvantageClaudia Necula100% (1)

- CBC - Front Office NC2Document89 pagesCBC - Front Office NC2mercylaure100% (1)

- Lecture 2 IHRMDocument26 pagesLecture 2 IHRMPriya AggarwalNo ratings yet

- Culminating Task: NameDocument2 pagesCulminating Task: Nameangeli deganNo ratings yet

- Industrial Management-27.12.2023Document48 pagesIndustrial Management-27.12.2023Al-AMIN ajNo ratings yet

- Performance ApprisalDocument4 pagesPerformance Apprisalrajalakshmi m100% (1)

- Journal of Politics and International Affairs - Fall 2016Document77 pagesJournal of Politics and International Affairs - Fall 2016Gabe GiddensNo ratings yet

- Happy Father's Day Po Dadi! Thank You Po Sa Lahat! Love You Po!Document2 pagesHappy Father's Day Po Dadi! Thank You Po Sa Lahat! Love You Po!Mary Shaynah JungwirthNo ratings yet

- Presented By: Suraj Parkash: Rights Reserved. 1-1Document49 pagesPresented By: Suraj Parkash: Rights Reserved. 1-1Honey GuptaNo ratings yet

- 13.) JAKA V NLRCDocument2 pages13.) JAKA V NLRCMartin RegalaNo ratings yet

- Senior Human Resources Manager in Los Angeles CA Resume Richard DawsonDocument2 pagesSenior Human Resources Manager in Los Angeles CA Resume Richard DawsonRichardDawson2No ratings yet

- Mygov - 16593418061 (1) ZaDocument8 pagesMygov - 16593418061 (1) Zaसुरेश चंद Suresh ChandNo ratings yet

- CV Diego Dominguez enDocument2 pagesCV Diego Dominguez enDiego Miguel Dominguez DomenechNo ratings yet

- S2S HR Forum Brochure 3Document2 pagesS2S HR Forum Brochure 3rocketramesh3No ratings yet

- OshaDocument42 pagesOshaImran DDzNo ratings yet

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1No ratings yet

- Payroll Enabling HRDocument212 pagesPayroll Enabling HRsagarthegame50% (2)

- Waterford Directory 2Document44 pagesWaterford Directory 2api-299374327No ratings yet