Professional Documents

Culture Documents

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Uploaded by

Eric AgudeloCopyright:

Available Formats

You might also like

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Section 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnDocument4 pagesSection 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnSamuel ferolinoNo ratings yet

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Chapter 4-Exercises-Managerial AccountingDocument3 pagesChapter 4-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocument9 pagesToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngNo ratings yet

- 505 - Week 4 Cont Threaded DiscussionDocument12 pages505 - Week 4 Cont Threaded DiscussionbilalNo ratings yet

- 120-Practice-Material Process StandardVariances ABCDocument36 pages120-Practice-Material Process StandardVariances ABCNovie Mea Balbes50% (2)

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Final Managerial 2016 SolutionDocument10 pagesFinal Managerial 2016 SolutionRanim HfaidhiaNo ratings yet

- Avoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainDocument6 pagesAvoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainMuhammad BilalNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sahil KumarNo ratings yet

- CosthuliDocument7 pagesCosthulikmarisseeNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Quiz Week 1 ACCT 592Document4 pagesQuiz Week 1 ACCT 592Muhammad M Bhatti100% (1)

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Cost I AssignmentDocument7 pagesCost I AssignmentibsaashekaNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Cost Accounting #2 PDFDocument3 pagesCost Accounting #2 PDFSYED ABDUL HASEEB SYED MUZZAMIL NAJEEB 13853No ratings yet

- Universidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesDocument5 pagesUniversidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesAqib LatifNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Manufacturing Costs Lecture Version 2 STUDENT VERSIONDocument15 pagesManufacturing Costs Lecture Version 2 STUDENT VERSIONLampel Louise LlandaNo ratings yet

- Cost Classification QsDocument2 pagesCost Classification QsMuhammad Istiyansyah IdrisNo ratings yet

- M Acc Mid Assessment-BDocument2 pagesM Acc Mid Assessment-BHMM HMMNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- ACC104 - Job Order Costing - For PostingDocument22 pagesACC104 - Job Order Costing - For PostingYesha SibayanNo ratings yet

- Process CostingDocument66 pagesProcess Costingarshad mNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Compute The Equivalent Units of ProductionDocument1 pageCompute The Equivalent Units of Productionsb73_817No ratings yet

- CompexamsDocument28 pagesCompexamsJoshua GibsonNo ratings yet

- Ma. Lyn Bren BS-Entrep 2B Applying Learned ConceptsDocument7 pagesMa. Lyn Bren BS-Entrep 2B Applying Learned Concepts2B Ma. Lyn BrenNo ratings yet

- Answers Homework # 14 Cost MGMT 3Document9 pagesAnswers Homework # 14 Cost MGMT 3Raman ANo ratings yet

- Prime CostsDocument9 pagesPrime Costselainemarzan09No ratings yet

- Cost Accounting ReviewerDocument8 pagesCost Accounting ReviewerMary Justine Danica OliverosNo ratings yet

- Answer Q1 Job Order CostingDocument5 pagesAnswer Q1 Job Order CostingDiane Cris Duque100% (1)

- Cost AccountingDocument4 pagesCost AccountingjungoosNo ratings yet

- Hand Out-6 - CostingDocument19 pagesHand Out-6 - CostingmuhammadNo ratings yet

- Cost SheetDocument11 pagesCost SheetPratiksha GaikwadNo ratings yet

- 5 Manufacturing Practice Set With AnswerkeyDocument6 pages5 Manufacturing Practice Set With Answerkeygiodarine0814No ratings yet

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Cost Revision Sheets For Students Chapter 1 2Document21 pagesCost Revision Sheets For Students Chapter 1 2abdelrahman redaNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- MA2 Mid TermDocument13 pagesMA2 Mid Termmaobangbang21No ratings yet

- 20ccp12-Advanced Cost Accounting Q BankDocument5 pages20ccp12-Advanced Cost Accounting Q BankgggguruNo ratings yet

- The Mid-Term ExaminationDocument4 pagesThe Mid-Term Examinationanon_355962815No ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- HGGHGHGDocument2 pagesHGGHGHGTricia MaeNo ratings yet

- Managerial AccountingDocument11 pagesManagerial Accountingmiljane perdizoNo ratings yet

- Cost Accounting ProblemsDocument4 pagesCost Accounting ProblemsShipra SinghNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Form Jurnal Khusus Dan Siklus Akt DagangDocument31 pagesForm Jurnal Khusus Dan Siklus Akt DagangIvane AngelinaNo ratings yet

- Heintz & Perry 21 Ed. College Accounting, Chapter 10 Problem 10B SolutionDocument4 pagesHeintz & Perry 21 Ed. College Accounting, Chapter 10 Problem 10B SolutionCrystal WangNo ratings yet

- Toa Interim ReportingDocument17 pagesToa Interim ReportingSam100% (1)

- Bill Berry Is The Lead Audit Partner and The ManagingDocument1 pageBill Berry Is The Lead Audit Partner and The ManagingMuhammad ShahidNo ratings yet

- Airthread Connections Work Sheet SelfDocument65 pagesAirthread Connections Work Sheet SelfkjhathiNo ratings yet

- Chapter 14Document27 pagesChapter 14IstikharohNo ratings yet

- ACN202-Lesson PlanDocument26 pagesACN202-Lesson PlanMaher Neger AneyNo ratings yet

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Document748 pagesDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Proposal - Vlad's Emporium LimitedDocument6 pagesProposal - Vlad's Emporium LimitedNatali DavydenkoNo ratings yet

- ACCT3103 SyllabusDocument10 pagesACCT3103 SyllabuschrislmcNo ratings yet

- Application Form Admission Advanced Level Exam 2021Document5 pagesApplication Form Admission Advanced Level Exam 2021Shakir Ul HaqueNo ratings yet

- Jahangirnagar University (IBA-JU) : Institute of Business AdministrationDocument9 pagesJahangirnagar University (IBA-JU) : Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument11 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsKrizzia DizonNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- ASSIGNMENT 2 Group 9Document6 pagesASSIGNMENT 2 Group 9Haroon Z. ChoudhryNo ratings yet

- Sr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountDocument8 pagesSr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit Amountaktaruzzaman bethuNo ratings yet

- SAP FICO Transaction CodesDocument17 pagesSAP FICO Transaction CodesandrefumianNo ratings yet

- MM Configuration DocumentDocument34 pagesMM Configuration DocumentVishnu Kumar SNo ratings yet

- Imp. A.O MCQDocument19 pagesImp. A.O MCQNadir AhmedNo ratings yet

- Simple and Compound EntryDocument4 pagesSimple and Compound EntryJezeil DimasNo ratings yet

- General Ledger 4 ColmDocument2 pagesGeneral Ledger 4 ColmMaryNo ratings yet

- HCLDocument10 pagesHCLaakritiNo ratings yet

- Motivation LetterDocument2 pagesMotivation LetterBabar MehmoodNo ratings yet

- AJE - Royal (Copia-Prov)Document4 pagesAJE - Royal (Copia-Prov)Luis CarrascoNo ratings yet

- Revenue Recognition For Service Contracts in Sap CRM: Configuration GuideDocument32 pagesRevenue Recognition For Service Contracts in Sap CRM: Configuration Guidenalini KNo ratings yet

- Course Outline - Audit 2Document5 pagesCourse Outline - Audit 2Lini RosliNo ratings yet

- Chapter 04Document39 pagesChapter 04LouiseNo ratings yet

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Uploaded by

Eric AgudeloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Midterm No. One Review: The Equivalent Units of Production For Conversion Costs Were

Uploaded by

Eric AgudeloCopyright:

Available Formats

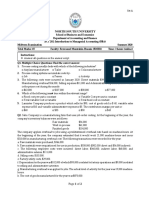

Midterm No.

One Review

CHAPTERS 1-4

Extra credit points awarded: 5 Dr. Seyedin

The purpose of this extra credit assignment is to prepare you for the first midterm. You must

show your work as it relates to each problem-solving question. Please complete the review

using pen (not pencil) or MS Word. Turn in the review at the beginning of the class

on Thursday, January 28.

SOLUTIONS

Watson Company uses the weighted-average method in its process costing system. The

following information pertains to Processing Department B for the month of May:

Number Cost of

of units materials

Beginning work in process 25,000 $10,000

Started in May 70,000 $40,000

Units completed 65,000

Ending work in process 30,000

All materials are added at the beginning of the process. The cost per equivalent unit for

materials is closest to:

% of completion, % of completion,

Units Materials Conversion

Transferred out* 65000 100% *65000=65000

Ending Inventory 30000 100% *30000=30000

Equivalent Units of 95,0000

Production

*Please note transferred out (TO) units are also called units completed.

(10,000 + 40,000)/950000 =0.5263157

1. The following data were taken from the accounting records of the Hazel Corporation

which uses the weighted-average method in its process costing system:

Beginning work in process inventory, 30,000 units

(100% complete as to materials; 60% complete as to conversion)

Started in process during the period, 70,000 units

Ending work in process inventory, 40,000 units

(100% complete as to materials; 50% complete as to conversion)

The equivalent units of production for conversion costs were:

Beg. WIP Units + Started Units = TO + Ending WIP Units

30000 + 70000 = TO + 40000

TO = 60000

% of completion, % of completion,

Units Materials Conversion

Transferred out* 60000 100% *60000=60000

Ending Inventory 40000 50% *40000=20000

Equivalent Units 80000

of Production

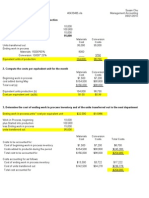

2. The Bears Company's cost of goods manufactured was $180,000 when its sales were

$500,000 and its gross margin was $220,000. If the ending inventory of finished goods

was $20,000, the beginning inventory of finished goods must have been:

Cost of goods sold = Sales – Gross margin

Cost of goods sold = 500,000 – 220,000 = 280,000

*Beg. Inv. of FG + CGM- End. Inv. FG = CGS

Beg. Inv. of FG + 180,000 – 20,000 = 280,000

Beg. Inv. of FG = 120,000

*Beginning Inventory of Finished Goods+ Cost of Goods Manufactured –Ending

Inventory of Finished Goods = Cost of Goods Sold

3. Carlo Company uses a predetermined overhead rate based on direct labor hours to apply

manufacturing overhead to jobs. The company estimated manufacturing overhead at

$400,000 for the year and direct labor-hours at 100,000 hours. Actual manufacturing

overhead costs incurred during the year totaled $440,000. Actual direct labor hours were

105,000. What was the overapplied or underapplied overhead for the year?

Estimated MOH $400,000

Estimated DLH 100,000 hours

Actual MOH $440,000

Actual DLH 105,000 hours

Predetermined overhead rate: 400,000 / 100,000 = $4.00

Total MOH applied: 105,000 x $4.00 = $420,000

The Underapplied overhead for the year: 440,000 – 420,000= $20,000

4. Amarillo Company's costs for the month of August were as follows: direct materials,

$37,000; direct labor, $30,000; sales salaries, $11,000; indirect labor, $11,000; indirect

materials, $15,000; general corporate administrative cost, $10,000; taxes on

manufacturing facility, $2,000; and rent on factory, $20,000. The beginning work in

process inventory was $16,000 and the ending work in process inventory was $9,000.

What was the cost of goods manufactured for the month?

DM 37,000

DL 30,000

MOH 48,000 (11,000+15,000+2,000+20,000)

TMC 115,000

Add: begin. WIP 16,000

131,000

Deduct end. WIP 9,000

CGM 122,000

5. Mifflin Company has the following estimated costs for next year:

Direct materials $15,000

Direct labor 60,000

Sales commissions 75,000

Salary of production supervisor 50,000

Indirect materials 5,000

Advertising expense 11,000

Rent on factory equipment 20,000

Mifflin estimates that 10,000 direct labor and 25,000 machine hours will be worked

during the year. If overhead is applied on the basis of machine hours, the overhead rate

per hour will be:

Estimated MOH =50,000 + 5,000 + 20,000 = 75,500

Overhead rate per hour = 75,000 / 25,000 = $3

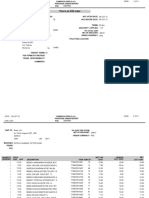

6. The Ying Manufacturing Company uses a job-order costing system and applies overhead

to jobs using a predetermined overhead rate. The company closes any balance in the

Manufacturing Overhead account to Cost of Goods Sold. During the year the company's

Finished Goods inventory account was debited for $125,000 and credited for $110,000.

The ending balance in the Finished Goods inventory account was $28,000. At the end of

the year, manufacturing overhead was overapplied by $3,000. If the estimated

manufacturing overhead for the year was $24,000, and the applied overhead was

$30,000, the actual manufacturing overhead cost for the year was:

Overapplied MOH = Applied MOH - Actual MOH

3000= 30000- Actual MOH

Actual MOH = 30000 –3000

Actual MOH = 27000

7. Underline the correct answer

DL cost is:

a. Conversion cost, Manufacturing Cost, Period cost

b. Conversion cost, Manufacturing Cost, Prime cost

c. Fixed cost, Manufacturing Cost, Prime cost

d. Conversion cost, Manufacturing Cost, Mixed cost

8. Underline the correct answer

Direct material cost:

a. Variable cost, Manufacturing Cost, Prime cost

b. Conversion cost, Manufacturing Cost, Prime cost

c. Conversion cost, Manufacturing Cost, Product cost

d. Fixed cost, Manufacturing Cost, Prime cost

9. Determine cost of goods manufactured below:

• DM $42,000

• DL 24,000

• MOH 16,000

• Beginning WIP 10,000

• Ending 11,500

• Cost of GM ?

DM 42,000

DL 24,000

MOH 16,000

TMC 82,000

Add: begin. WIP 10,000

92,000

Deduct end. WIP 11,500

CGM 80,500

10. Name two types of Manufacturing Cost that are variable. Direct Materials and

Direct labor

11. Underline the correct answer (s)

The corporate controller salary would be classified as:

a. Product

• Direct Labor (DL)

• Manufacturing overhead (MOH)

b. Period

• Selling expense

• Administrative expense

12. What is the entry to record the purchase of raw materials on account?

Raw Materials xxx

Accounts Payable xxx

13. What is the entry to record depreciation on manufacturing equipment?

Manufacturing Overhead xxx

Accumulated Depreciation xxx

14. What is the entry to transfer the cost of goods manufactured for the period?

Finished Goods xxx

WIP xxx

15. Name the two categories of cost comprising conversion costs. Direct Labor and

Manufacturing Overhead

You might also like

- Exercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingDocument4 pagesExercises: Job Order Costing: Q1: Lamonda Corp. Uses A Job Order Cost System. On April 1, The Accounts Had The FollowingCynthia WongNo ratings yet

- Section 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnDocument4 pagesSection 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnSamuel ferolinoNo ratings yet

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Chapter 4-Exercises-Managerial AccountingDocument3 pagesChapter 4-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDocument9 pagesToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngNo ratings yet

- 505 - Week 4 Cont Threaded DiscussionDocument12 pages505 - Week 4 Cont Threaded DiscussionbilalNo ratings yet

- 120-Practice-Material Process StandardVariances ABCDocument36 pages120-Practice-Material Process StandardVariances ABCNovie Mea Balbes50% (2)

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Final Managerial 2016 SolutionDocument10 pagesFinal Managerial 2016 SolutionRanim HfaidhiaNo ratings yet

- Avoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainDocument6 pagesAvoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainMuhammad BilalNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sahil KumarNo ratings yet

- CosthuliDocument7 pagesCosthulikmarisseeNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Quiz Week 1 ACCT 592Document4 pagesQuiz Week 1 ACCT 592Muhammad M Bhatti100% (1)

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Cost I AssignmentDocument7 pagesCost I AssignmentibsaashekaNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Cost Accounting #2 PDFDocument3 pagesCost Accounting #2 PDFSYED ABDUL HASEEB SYED MUZZAMIL NAJEEB 13853No ratings yet

- Universidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesDocument5 pagesUniversidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesAqib LatifNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Manufacturing Costs Lecture Version 2 STUDENT VERSIONDocument15 pagesManufacturing Costs Lecture Version 2 STUDENT VERSIONLampel Louise LlandaNo ratings yet

- Cost Classification QsDocument2 pagesCost Classification QsMuhammad Istiyansyah IdrisNo ratings yet

- M Acc Mid Assessment-BDocument2 pagesM Acc Mid Assessment-BHMM HMMNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- ACC104 - Job Order Costing - For PostingDocument22 pagesACC104 - Job Order Costing - For PostingYesha SibayanNo ratings yet

- Process CostingDocument66 pagesProcess Costingarshad mNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Compute The Equivalent Units of ProductionDocument1 pageCompute The Equivalent Units of Productionsb73_817No ratings yet

- CompexamsDocument28 pagesCompexamsJoshua GibsonNo ratings yet

- Ma. Lyn Bren BS-Entrep 2B Applying Learned ConceptsDocument7 pagesMa. Lyn Bren BS-Entrep 2B Applying Learned Concepts2B Ma. Lyn BrenNo ratings yet

- Answers Homework # 14 Cost MGMT 3Document9 pagesAnswers Homework # 14 Cost MGMT 3Raman ANo ratings yet

- Prime CostsDocument9 pagesPrime Costselainemarzan09No ratings yet

- Cost Accounting ReviewerDocument8 pagesCost Accounting ReviewerMary Justine Danica OliverosNo ratings yet

- Answer Q1 Job Order CostingDocument5 pagesAnswer Q1 Job Order CostingDiane Cris Duque100% (1)

- Cost AccountingDocument4 pagesCost AccountingjungoosNo ratings yet

- Hand Out-6 - CostingDocument19 pagesHand Out-6 - CostingmuhammadNo ratings yet

- Cost SheetDocument11 pagesCost SheetPratiksha GaikwadNo ratings yet

- 5 Manufacturing Practice Set With AnswerkeyDocument6 pages5 Manufacturing Practice Set With Answerkeygiodarine0814No ratings yet

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Cost Revision Sheets For Students Chapter 1 2Document21 pagesCost Revision Sheets For Students Chapter 1 2abdelrahman redaNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- MA2 Mid TermDocument13 pagesMA2 Mid Termmaobangbang21No ratings yet

- 20ccp12-Advanced Cost Accounting Q BankDocument5 pages20ccp12-Advanced Cost Accounting Q BankgggguruNo ratings yet

- The Mid-Term ExaminationDocument4 pagesThe Mid-Term Examinationanon_355962815No ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- HGGHGHGDocument2 pagesHGGHGHGTricia MaeNo ratings yet

- Managerial AccountingDocument11 pagesManagerial Accountingmiljane perdizoNo ratings yet

- Cost Accounting ProblemsDocument4 pagesCost Accounting ProblemsShipra SinghNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Form Jurnal Khusus Dan Siklus Akt DagangDocument31 pagesForm Jurnal Khusus Dan Siklus Akt DagangIvane AngelinaNo ratings yet

- Heintz & Perry 21 Ed. College Accounting, Chapter 10 Problem 10B SolutionDocument4 pagesHeintz & Perry 21 Ed. College Accounting, Chapter 10 Problem 10B SolutionCrystal WangNo ratings yet

- Toa Interim ReportingDocument17 pagesToa Interim ReportingSam100% (1)

- Bill Berry Is The Lead Audit Partner and The ManagingDocument1 pageBill Berry Is The Lead Audit Partner and The ManagingMuhammad ShahidNo ratings yet

- Airthread Connections Work Sheet SelfDocument65 pagesAirthread Connections Work Sheet SelfkjhathiNo ratings yet

- Chapter 14Document27 pagesChapter 14IstikharohNo ratings yet

- ACN202-Lesson PlanDocument26 pagesACN202-Lesson PlanMaher Neger AneyNo ratings yet

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Document748 pagesDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Proposal - Vlad's Emporium LimitedDocument6 pagesProposal - Vlad's Emporium LimitedNatali DavydenkoNo ratings yet

- ACCT3103 SyllabusDocument10 pagesACCT3103 SyllabuschrislmcNo ratings yet

- Application Form Admission Advanced Level Exam 2021Document5 pagesApplication Form Admission Advanced Level Exam 2021Shakir Ul HaqueNo ratings yet

- Jahangirnagar University (IBA-JU) : Institute of Business AdministrationDocument9 pagesJahangirnagar University (IBA-JU) : Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument11 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsKrizzia DizonNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- ASSIGNMENT 2 Group 9Document6 pagesASSIGNMENT 2 Group 9Haroon Z. ChoudhryNo ratings yet

- Sr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit AmountDocument8 pagesSr. No Date Trans. Code / CHQ No. Particulars Balanced Amount Credit Amount Debit Amountaktaruzzaman bethuNo ratings yet

- SAP FICO Transaction CodesDocument17 pagesSAP FICO Transaction CodesandrefumianNo ratings yet

- MM Configuration DocumentDocument34 pagesMM Configuration DocumentVishnu Kumar SNo ratings yet

- Imp. A.O MCQDocument19 pagesImp. A.O MCQNadir AhmedNo ratings yet

- Simple and Compound EntryDocument4 pagesSimple and Compound EntryJezeil DimasNo ratings yet

- General Ledger 4 ColmDocument2 pagesGeneral Ledger 4 ColmMaryNo ratings yet

- HCLDocument10 pagesHCLaakritiNo ratings yet

- Motivation LetterDocument2 pagesMotivation LetterBabar MehmoodNo ratings yet

- AJE - Royal (Copia-Prov)Document4 pagesAJE - Royal (Copia-Prov)Luis CarrascoNo ratings yet

- Revenue Recognition For Service Contracts in Sap CRM: Configuration GuideDocument32 pagesRevenue Recognition For Service Contracts in Sap CRM: Configuration Guidenalini KNo ratings yet

- Course Outline - Audit 2Document5 pagesCourse Outline - Audit 2Lini RosliNo ratings yet

- Chapter 04Document39 pagesChapter 04LouiseNo ratings yet