Professional Documents

Culture Documents

A Guide To Understanding Balance Sheets

A Guide To Understanding Balance Sheets

Uploaded by

slOwpOke13Copyright:

Available Formats

You might also like

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Understanding Financial Statements - Making More Authoritative BCDocument6 pagesUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Adams 2013 Training 740 WorkbookDocument458 pagesAdams 2013 Training 740 WorkbookAnonymous ZC1ld1CLm100% (1)

- What Is A Balance SheetDocument11 pagesWhat Is A Balance SheetkimringineNo ratings yet

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Document10 pagesBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanNo ratings yet

- Financial Accounting: Sir Syed Adeel Ali BukhariDocument25 pagesFinancial Accounting: Sir Syed Adeel Ali Bukhariadeelali849714No ratings yet

- Company Situation AnalysisDocument3 pagesCompany Situation AnalysisZukhruf 555No ratings yet

- Accounting BasicsDocument26 pagesAccounting BasicsAziz MalikNo ratings yet

- Glossary of Key Accounting Terms This Glossary Contains Most ofDocument20 pagesGlossary of Key Accounting Terms This Glossary Contains Most ofNguyen_nhung1105No ratings yet

- Accounting QuestionsDocument12 pagesAccounting QuestionsFLORENCE DE CASTRONo ratings yet

- Accounting ConceptsDocument95 pagesAccounting Conceptsgaurav gargNo ratings yet

- Assessing Future and Current Performance of Organisations Using Ratio AnalysisDocument11 pagesAssessing Future and Current Performance of Organisations Using Ratio AnalysisGeorge Rabar100% (1)

- Q/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingDocument4 pagesQ/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingkrstupNo ratings yet

- Reading and Understanding Financial StatementsDocument14 pagesReading and Understanding Financial StatementsSyeda100% (1)

- Economic Entity AssumptionDocument4 pagesEconomic Entity AssumptionNouman KhanNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsNaina GuptaNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsAkash ChauhanNo ratings yet

- Econ 303Document5 pagesEcon 303ali abou aliNo ratings yet

- 4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Document15 pages4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Ray Allen Uy100% (1)

- Working Capital FinanceDocument17 pagesWorking Capital FinanceAnitha GirigoudruNo ratings yet

- Chapter 3Document39 pagesChapter 3Hibaaq AxmedNo ratings yet

- Working Capital: AccountancyDocument11 pagesWorking Capital: Accountancybabumba95No ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NotesMd FahadNo ratings yet

- SCRIPTDocument5 pagesSCRIPTJohn LucaNo ratings yet

- Financial AnalysisDocument22 pagesFinancial Analysisnomaan khanNo ratings yet

- Intermediate Accounting/Preparation of Financial StatementsDocument7 pagesIntermediate Accounting/Preparation of Financial StatementsHimashu TiwariNo ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Cash Flow Statement Kotak Mahindra 2016Document80 pagesCash Flow Statement Kotak Mahindra 2016Nagireddy Kalluri100% (2)

- Account DefinationsDocument7 pagesAccount DefinationsManasa GuduruNo ratings yet

- Final Accounts LessonDocument12 pagesFinal Accounts LessonSiham KhayetNo ratings yet

- Safari - 7 Jul 2022 at 3:41 PMDocument1 pageSafari - 7 Jul 2022 at 3:41 PMKristy Veyna BautistaNo ratings yet

- Unit-Iii Fnancial Analysis Financial AppraisalDocument5 pagesUnit-Iii Fnancial Analysis Financial AppraisalumaushaNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- Finance QuestionsDocument14 pagesFinance QuestionsGeetika YadavNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- Current Assets Current LiabilitiesDocument7 pagesCurrent Assets Current LiabilitiesShubham GuptaNo ratings yet

- Accounts 1Document5 pagesAccounts 1SujithNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Task 2Document18 pagesTask 2Yashmi BhanderiNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- Accounting BasicsDocument13 pagesAccounting BasicskameshpatilNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- The Cash Flow StatementsDocument13 pagesThe Cash Flow Statementsdeo omachNo ratings yet

- Financial Management - Chapter 8Document23 pagesFinancial Management - Chapter 8rksp99999No ratings yet

- Finman CHPT 1Document12 pagesFinman CHPT 1Rosda DhangNo ratings yet

- Tutorial 3 (Financial Management)Document2 pagesTutorial 3 (Financial Management)muthuNo ratings yet

- Learning Outcome StatementsDocument3 pagesLearning Outcome StatementsGUTIERREZ, Ronalyn Y.No ratings yet

- Every Limited Company Prepares An Annual Report On Its Accounts and State ofDocument4 pagesEvery Limited Company Prepares An Annual Report On Its Accounts and State ofSuraj SharmaNo ratings yet

- Finance Ch4Document41 pagesFinance Ch4Tofig HuseynliNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Accounting For Non-Accounting Students - Summary Chapter 4Document4 pagesAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- Accenture - 1 B Com ProfileDocument7 pagesAccenture - 1 B Com ProfileTHIMMAIAH B CNo ratings yet

- Aim 1004Document28 pagesAim 1004Emily HoeNo ratings yet

- BBB Balance Sheet 1CDocument20 pagesBBB Balance Sheet 1CPrasad NcNo ratings yet

- Task 2&4Document17 pagesTask 2&4Yashmi BhanderiNo ratings yet

- Financial Accounting and Analysis June 2022Document10 pagesFinancial Accounting and Analysis June 2022Rajni KumariNo ratings yet

- StatementsDocument72 pagesStatementswmtmtj9bpmNo ratings yet

- ICAO Document 08 - CORSIA Eligible Emisions Units - March 2022Document8 pagesICAO Document 08 - CORSIA Eligible Emisions Units - March 2022slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 1Document36 pagesNam Mang 1 Hydropower Project CDM 1slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 3Document14 pagesNam Mang 1 Hydropower Project CDM 3slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 2Document16 pagesNam Mang 1 Hydropower Project CDM 2slOwpOke13No ratings yet

- Education Sciences: Power Plants, Steam and Gas Turbines WebquestDocument10 pagesEducation Sciences: Power Plants, Steam and Gas Turbines WebquestslOwpOke13No ratings yet

- Dial IndicatorDocument10 pagesDial IndicatorslOwpOke13No ratings yet

- Non Contact Vibration Measurement of RotorDocument5 pagesNon Contact Vibration Measurement of RotorslOwpOke13No ratings yet

- Hands-On ER Training For Taxable Facilities (15 and 17 Oct 19)Document9 pagesHands-On ER Training For Taxable Facilities (15 and 17 Oct 19)slOwpOke13No ratings yet

- Greenhouse Gas (GHG) Emissions Measurement and Reporting GuidelinesDocument16 pagesGreenhouse Gas (GHG) Emissions Measurement and Reporting GuidelinesslOwpOke13No ratings yet

- NUS-ISS Short Course Opening ClosingDocument10 pagesNUS-ISS Short Course Opening ClosingslOwpOke13No ratings yet

- Data Analytics For Decision Making: Topic 1a: Introduction To Data Analytics and Big DataDocument7 pagesData Analytics For Decision Making: Topic 1a: Introduction To Data Analytics and Big DataslOwpOke13No ratings yet

- STB Standard Quick Start GuideDocument22 pagesSTB Standard Quick Start GuideslOwpOke13No ratings yet

- Level I CFA Program Formulas: Financial Reporting and AnalysisDocument1 pageLevel I CFA Program Formulas: Financial Reporting and AnalysisslOwpOke13100% (1)

- Information On Emission Factors Jan2019 PDFDocument2 pagesInformation On Emission Factors Jan2019 PDFslOwpOke13No ratings yet

- Trends in HRSG Reliability - 10 Year ReviewDocument29 pagesTrends in HRSG Reliability - 10 Year ReviewslOwpOke13100% (1)

- Summer 2015Document100 pagesSummer 2015JacksonNo ratings yet

- Airline PilotDocument3 pagesAirline PilotBtrs BtrstNo ratings yet

- Case Study TipsDocument4 pagesCase Study TipsUjjawal PandeyNo ratings yet

- Commercial LeaseDocument33 pagesCommercial LeaseEmil Mitev100% (2)

- Propeller ShaftDocument8 pagesPropeller ShaftlomejorNo ratings yet

- SVAN 956 User ManualDocument195 pagesSVAN 956 User Manualalin.butunoi865No ratings yet

- Project Report On Ulip & Mutual FundDocument55 pagesProject Report On Ulip & Mutual FundGovind BhakuniNo ratings yet

- Astm f2164 PDFDocument5 pagesAstm f2164 PDFLuis J Villa Roel Bullon100% (1)

- Eu Law ExamDocument14 pagesEu Law ExamOla PietruszewskaNo ratings yet

- NutruentsDocument7 pagesNutruentsPEDRO INFANTE AGUILARNo ratings yet

- BillPayment FormDocument2 pagesBillPayment FormThúy An Nguyễn100% (1)

- SEM and STMDocument25 pagesSEM and STMZhanarNo ratings yet

- Ptc08 Camera ModuleDocument9 pagesPtc08 Camera ModuleAndre ZakharianNo ratings yet

- FP 247 03 Sand Cast BronzesDocument4 pagesFP 247 03 Sand Cast BronzesnfcastingsNo ratings yet

- IBA Question SolutionDocument343 pagesIBA Question SolutionTushar Mahmud Sizan80% (10)

- Thru-Tubing Retriveable PackerDocument9 pagesThru-Tubing Retriveable PackerilkerkozturkNo ratings yet

- 7steps For Organizing Restaurant and Kitchen CleaningDocument2 pages7steps For Organizing Restaurant and Kitchen CleaningAlpha HospitalityNo ratings yet

- Understanding What A CDP DoesDocument5 pagesUnderstanding What A CDP DoesVISHAL GUPTANo ratings yet

- GenDocument46 pagesGenChowdhury SujayNo ratings yet

- Welding Procedure Specification: Company Dodsal Pte Ltd. Approved by KBRT Signature Name DateDocument1 pageWelding Procedure Specification: Company Dodsal Pte Ltd. Approved by KBRT Signature Name DateS GoudaNo ratings yet

- Sands of TimeDocument211 pagesSands of TimebetutzNo ratings yet

- Module 1Document140 pagesModule 1naitik S TNo ratings yet

- OpenDesign Specification For .DWG FilesDocument246 pagesOpenDesign Specification For .DWG FilesPhilip Jeffrey TroweNo ratings yet

- An Order Constituting The Barangay Tourism Development Council of Barangay Puro, Aroroy, MasbateDocument2 pagesAn Order Constituting The Barangay Tourism Development Council of Barangay Puro, Aroroy, MasbateJohn Paul M. Morado0% (1)

- Code of Ethics in Management Accounting and Financial ManagementDocument2 pagesCode of Ethics in Management Accounting and Financial ManagementSyed Mahwish QadriNo ratings yet

- Web D Worksheet 3Document19 pagesWeb D Worksheet 3aditya polNo ratings yet

- Wealth Management ModuleDocument127 pagesWealth Management ModuleVAIBHAV BUNTY100% (3)

- Smart Money? The Forecasting Ability of CFTC Large Traders: by Dwight R. Sanders, Scott H. Irwin, and Robert MerrinDocument21 pagesSmart Money? The Forecasting Ability of CFTC Large Traders: by Dwight R. Sanders, Scott H. Irwin, and Robert MerrinPerfect SebokeNo ratings yet

- Final Chapter 4Document19 pagesFinal Chapter 4Jhanelyn V. InopiaNo ratings yet

A Guide To Understanding Balance Sheets

A Guide To Understanding Balance Sheets

Uploaded by

slOwpOke13Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Guide To Understanding Balance Sheets

A Guide To Understanding Balance Sheets

Uploaded by

slOwpOke13Copyright:

Available Formats

A Guide to Understanding Balance

Sheets

Business Information Factsheet

BIF007 · August 2016

Introduction

The financial position of any business can be determined from three key financial statements: the

balance sheet, the profit and loss account, and the cash flow statement.

A balance sheet is a financial 'snapshot' that summarises the value of a business (the assets of

the business less its liabilities) at a specific point in time. All limited companies have to prepare

a balance sheet as part of the annual accounts they submit to Companies House, but a balance

sheet can be prepared at any time.

This factsheet explains the main features of a balance sheet, what kind of information it should

contain and provides definitions of the key terms that are used on a balance sheet.

Understanding a balance sheet

A balance sheet is a good indicator of whether a business is solvent (meaning it can meet its

financial obligations) and is able to trade on a continuing basis. It shows how a business is

financed, how much capital is employed in the business and how quickly the assets of the

business can be turned into cash.

A balance sheet shows all the assets of a business (anything owned by the business or owed to

the business) less its liabilities (all the money owed by the business to its creditors). The resulting

'net asset value' will always be equal to the sum of the capital and reserves of the business, which

includes any investments in the business plus the net profit the business has accumulated from

its trading activities.

It is important to remember:

• A balance sheet does not show the profitability of a business. This is shown by the profit

and loss account (see BIF 8, A Guide to Understanding Profit and Loss Accounts, for more

information). If you have balance sheets from two consecutive years, you may be able to

calculate the level of profit a business has achieved by comparing the change in value of the

profit and loss reserve. However, this can understate the profit achieved if a business pays

dividends to shareholders.

• A balance sheet does not reflect the true market value of a business' assets. It is necessary to

put a value on any assets listed on a balance sheet, but the true value may be more or less

than the figures given on the balance sheet.

• A balance sheet does not show the market value of a business. The market value of a

business depends on past and potential future profitability and the current value (as

opposed to cost) of any assets.

BIF007 · Balance Sheets - A Guide to Understanding Page 1 of 6

© Cobweb Information Ltd, 2016

A balance sheet is different from, but complementary to, the profit and loss account, and is

critical to understanding the financial strength of a business.

A business can generate good profits but be regarded as being financially vulnerable if it has a

weak balance sheet due to its low net asset value. On the other hand, a business can potentially

sustain a period of poor profitability when it has a strong balance sheet, due to its high net asset

value.

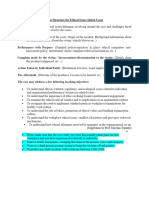

The following example of a balance sheet demonstrates how the net assets of the business

(assets minus liabilities) are equal to the net worth (capital plus reserves):

BIF007 · Balance Sheets - A Guide to Understanding Page 2 of 6

© Cobweb Information Ltd, 2016

Key balance sheet terms

Fixed assets

Fixed assets usually have a useful life of more than one year. Fixed assets can be 'tangible'

assets which physically exist, such as buildings and equipment, or 'intangible' assets that have a

subjective value, such as intellectual property or goodwill.

The cost of tangible fixed assets, such as equipment, is depreciated over their expected lifetimes.

This allows for the loss in value of those assets over time and it is this depreciated value (the 'net

book value') that appears in the balance sheet. In the example balance sheet, the 'net book value'

of the tangible fixed assets is £140,000.

If a business spends a large amount of money developing a new product, this expenditure can

be capitalised (turned into an asset) and shown on the balance sheet as an intangible asset. If a

business buys another business for more than its net worth, the difference in value is classed as

'goodwill', which represents the likelihood that existing customers will continue to buy. Since it is

difficult to value both intellectual property and goodwill, except when they come to be sold, it is

considered good practice to depreciate the value of intangible assets over a short period of time

so that they can be 'written off' in the balance sheet ('amortised') as quickly as possible.

See BIF 41, Understanding and Calculating Depreciation, for more information.

Current assets

These are assets that can be turned into cash within one year and typically include:

• Stock and work in progress. Stock is usually valued at cost rather than its market value.

However, old stock may be written down to its 'net realisable value'; that is, the price that it

might attract if sold. Work in progress is the value of raw materials and components that are

in the production process, but are not yet finished goods.

• Trade debtors. The value of trade debtors is the amount of money owed to a business by its

customers. This figure includes value added tax (VAT) if a business is registered for VAT and

charges VAT on its invoices.

• Cash at bank. This is the value of any money the business has that is deposited in bank

accounts on the date the balance sheet is created. This figure may be adjusted for any

cheques that have been issued to pay suppliers, but which are still waiting to be cashed.

In the example balance sheet, the value of the current assets is £35,000.

Current liabilities

Current liabilities are the total value of any money owed by the business that is due to be repaid

within a year. They typically include:

• Trade creditors. The total amount of money that is owed to suppliers. This figure will include

VAT if the business is VAT registered and has charged VAT to its customers.

• Other creditors. This is the value of any money that the business owes for taxes, including

VAT, Pay As You Earn (PAYE) and corporation tax liabilities. It can also include provisions for

costs that the business has incurred for products or services that have not yet been invoiced

by suppliers.

BIF007 · Balance Sheets - A Guide to Understanding Page 3 of 6

© Cobweb Information Ltd, 2016

• Loans. This is the value of any loan or hire purchase repayments that are due to be repaid

within the next 12 months and will also include any overdraft balance (if the business has

an overdraft).This figure is likely to be only a portion of the total loan or hire purchase

repayments that are outstanding at the balance sheet date. Any repayments that are due

after 12 months are included in the balance sheet as long-term liabilities.

In the example balance sheet, the value of the current liabilities is £32,000.

Net current assets

This is simply the difference between current assets and current liabilities. In the example, net

current assets are £3,000. This figure should be positive to indicate that the business is able to

meet its current cash needs. A negative net current asset figure indicates that a business may not

be able to meet its debts as they fall due. If this is the case, the business may be insolvent.

Long-term liabilities

Long-term liabilities include the balance of any bank loans and hire purchase payments that fall

due later than 12 months after the balance sheet date. In the example balance sheet, long-term

liabilities are £100,000.

Net assets

The net asset value of a business is the total assets (both tangible and intangible) less the total

liabilities (both current and long-term). In the example balance sheet, net assets are £43,000.

Net worth

The net worth of a business is the sum of any capital and reserves.

• Capital is any money invested by the business owner or shareholders.

• Reserves are the retained profits of the business.

The capital and reserves are sometimes referred to as the 'equity' in the business and in the

example the total net worth of the business is £43,000.

It is important to remember that reserves are not the same as cash: they simply show where the

money in the business has come from. A business should seek to build up its reserves (profit) as

this is the best source of working capital.

The net worth of a business will always be equal to the net assets, and therefore the balance

sheet will 'balance'.

In the example balance sheet, the total net assets of £43,000 balances with the total net worth of

£43,000.

Hints and tips

• Balance sheets can be compared over time - for example, current year against previous year -

to identify changes in the strength and performance of a business.

• An accountant or business adviser can help in the preparation of balance sheets.

BIF007 · Balance Sheets - A Guide to Understanding Page 4 of 6

© Cobweb Information Ltd, 2016

• Computerised accounting packages can generate a balance sheet quickly, although it may

need to be adjusted to allow for depreciation.

• Being able to read and understand a balance sheet is important for exercising effective

financial control of a business, and for assessing the financial position of competitors.

• Balance sheets can be used to calculate a number of useful financial ratios that help

to benchmark a business against its competitors and to measure changes in financial

performance over time. See BIF 9, An Introduction to Understanding Financial Ratios, for

more information.

Further information

BIF 8 A Guide to Understanding Profit and Loss Accounts

BIF 9 An Introduction to Understanding Financial Ratios

BIF 30 How to Keep a Manual Cash Book

BIF 38 Choosing and Using an Accountant

BIF 40 A Summary of Sources of Finance for Starting a Business

BIF 41 Understanding and Calculating Depreciation

BIF 54 A Guide to Costing and Pricing a Product or Service

BIF 58 How to Forecast Cash Flow

BIF 69 A Guide to Preparing and Submitting Company Accounts to Companies House

BIF 260 An Introduction to Preparing a Budget

BIF 264 An Introduction to Tax Self-Assessment

Books

'Accounting and Finance for Non-Specialists' (9th edition)

Peter Atrill and Eddie McLaney

2014

Pearson

'FT Guide to Finance for Non Financial Managers: The Numbers Game and How to Win It'

Jo Haigh

2011

Financial Times/Prentice Hall

'Understanding Your Business Finances'

Johnny Martin

2014

Essential Business

Useful contacts

The Institute of Chartered Accountants in England and Wales (ICAEW) is a membership

organisation for accountants. There is a searchable directory of accountants on its website.

Tel: (01908) 248250

Website: www.icaew.co.uk

The Institute of Chartered Accountants of Scotland (ICAS) is a membership organisation for

accountants in Scotland.

Tel: (0131) 347 0100

BIF007 · Balance Sheets - A Guide to Understanding Page 5 of 6

© Cobweb Information Ltd, 2016

Website: www.icas.com

Chartered Accountants Ireland represents accountants in Ireland and offers a 'find a member/

firm' facility on its website.

Tel: (028) 9043 5840 (Northern Ireland office)

Website: www.charteredaccountants.ie

The Association of Chartered Certified Accountants (ACCA) is a membership association for

accountants.

Tel: (0141) 582 2000

Website: www.acca.org.uk

DISCLAIMER While all reasonable efforts have been made, the publisher makes no warranties that this

information is accurate and up-to-date and will not be responsible for any errors or omissions in the information

nor any consequences of any errors or omissions. Professional advice should be sought where appropriate.

Cobweb Information Ltd, Unit 9 Bankside, The Watermark, Gateshead, NE11 9SY.

Tel: 0191 461 8000 Website: www.cobwebinfo.com

BIF007 · Balance Sheets - A Guide to Understanding Page 6 of 6

© Cobweb Information Ltd, 2016

You might also like

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Understanding Financial Statements - Making More Authoritative BCDocument6 pagesUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Adams 2013 Training 740 WorkbookDocument458 pagesAdams 2013 Training 740 WorkbookAnonymous ZC1ld1CLm100% (1)

- What Is A Balance SheetDocument11 pagesWhat Is A Balance SheetkimringineNo ratings yet

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Document10 pagesBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanNo ratings yet

- Financial Accounting: Sir Syed Adeel Ali BukhariDocument25 pagesFinancial Accounting: Sir Syed Adeel Ali Bukhariadeelali849714No ratings yet

- Company Situation AnalysisDocument3 pagesCompany Situation AnalysisZukhruf 555No ratings yet

- Accounting BasicsDocument26 pagesAccounting BasicsAziz MalikNo ratings yet

- Glossary of Key Accounting Terms This Glossary Contains Most ofDocument20 pagesGlossary of Key Accounting Terms This Glossary Contains Most ofNguyen_nhung1105No ratings yet

- Accounting QuestionsDocument12 pagesAccounting QuestionsFLORENCE DE CASTRONo ratings yet

- Accounting ConceptsDocument95 pagesAccounting Conceptsgaurav gargNo ratings yet

- Assessing Future and Current Performance of Organisations Using Ratio AnalysisDocument11 pagesAssessing Future and Current Performance of Organisations Using Ratio AnalysisGeorge Rabar100% (1)

- Q/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingDocument4 pagesQ/A: 4 Ways Investment Firms Make Money: Investment Banking Investing and Lending Client Services Investment Management 1. What Is Investment BankingkrstupNo ratings yet

- Reading and Understanding Financial StatementsDocument14 pagesReading and Understanding Financial StatementsSyeda100% (1)

- Economic Entity AssumptionDocument4 pagesEconomic Entity AssumptionNouman KhanNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsNaina GuptaNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsAkash ChauhanNo ratings yet

- Econ 303Document5 pagesEcon 303ali abou aliNo ratings yet

- 4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Document15 pages4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Ray Allen Uy100% (1)

- Working Capital FinanceDocument17 pagesWorking Capital FinanceAnitha GirigoudruNo ratings yet

- Chapter 3Document39 pagesChapter 3Hibaaq AxmedNo ratings yet

- Working Capital: AccountancyDocument11 pagesWorking Capital: Accountancybabumba95No ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NotesMd FahadNo ratings yet

- SCRIPTDocument5 pagesSCRIPTJohn LucaNo ratings yet

- Financial AnalysisDocument22 pagesFinancial Analysisnomaan khanNo ratings yet

- Intermediate Accounting/Preparation of Financial StatementsDocument7 pagesIntermediate Accounting/Preparation of Financial StatementsHimashu TiwariNo ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Cash Flow Statement Kotak Mahindra 2016Document80 pagesCash Flow Statement Kotak Mahindra 2016Nagireddy Kalluri100% (2)

- Account DefinationsDocument7 pagesAccount DefinationsManasa GuduruNo ratings yet

- Final Accounts LessonDocument12 pagesFinal Accounts LessonSiham KhayetNo ratings yet

- Safari - 7 Jul 2022 at 3:41 PMDocument1 pageSafari - 7 Jul 2022 at 3:41 PMKristy Veyna BautistaNo ratings yet

- Unit-Iii Fnancial Analysis Financial AppraisalDocument5 pagesUnit-Iii Fnancial Analysis Financial AppraisalumaushaNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- Finance QuestionsDocument14 pagesFinance QuestionsGeetika YadavNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- Current Assets Current LiabilitiesDocument7 pagesCurrent Assets Current LiabilitiesShubham GuptaNo ratings yet

- Accounts 1Document5 pagesAccounts 1SujithNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Task 2Document18 pagesTask 2Yashmi BhanderiNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- Accounting BasicsDocument13 pagesAccounting BasicskameshpatilNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- The Cash Flow StatementsDocument13 pagesThe Cash Flow Statementsdeo omachNo ratings yet

- Financial Management - Chapter 8Document23 pagesFinancial Management - Chapter 8rksp99999No ratings yet

- Finman CHPT 1Document12 pagesFinman CHPT 1Rosda DhangNo ratings yet

- Tutorial 3 (Financial Management)Document2 pagesTutorial 3 (Financial Management)muthuNo ratings yet

- Learning Outcome StatementsDocument3 pagesLearning Outcome StatementsGUTIERREZ, Ronalyn Y.No ratings yet

- Every Limited Company Prepares An Annual Report On Its Accounts and State ofDocument4 pagesEvery Limited Company Prepares An Annual Report On Its Accounts and State ofSuraj SharmaNo ratings yet

- Finance Ch4Document41 pagesFinance Ch4Tofig HuseynliNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Accounting For Non-Accounting Students - Summary Chapter 4Document4 pagesAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- Accenture - 1 B Com ProfileDocument7 pagesAccenture - 1 B Com ProfileTHIMMAIAH B CNo ratings yet

- Aim 1004Document28 pagesAim 1004Emily HoeNo ratings yet

- BBB Balance Sheet 1CDocument20 pagesBBB Balance Sheet 1CPrasad NcNo ratings yet

- Task 2&4Document17 pagesTask 2&4Yashmi BhanderiNo ratings yet

- Financial Accounting and Analysis June 2022Document10 pagesFinancial Accounting and Analysis June 2022Rajni KumariNo ratings yet

- StatementsDocument72 pagesStatementswmtmtj9bpmNo ratings yet

- ICAO Document 08 - CORSIA Eligible Emisions Units - March 2022Document8 pagesICAO Document 08 - CORSIA Eligible Emisions Units - March 2022slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 1Document36 pagesNam Mang 1 Hydropower Project CDM 1slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 3Document14 pagesNam Mang 1 Hydropower Project CDM 3slOwpOke13No ratings yet

- Nam Mang 1 Hydropower Project CDM 2Document16 pagesNam Mang 1 Hydropower Project CDM 2slOwpOke13No ratings yet

- Education Sciences: Power Plants, Steam and Gas Turbines WebquestDocument10 pagesEducation Sciences: Power Plants, Steam and Gas Turbines WebquestslOwpOke13No ratings yet

- Dial IndicatorDocument10 pagesDial IndicatorslOwpOke13No ratings yet

- Non Contact Vibration Measurement of RotorDocument5 pagesNon Contact Vibration Measurement of RotorslOwpOke13No ratings yet

- Hands-On ER Training For Taxable Facilities (15 and 17 Oct 19)Document9 pagesHands-On ER Training For Taxable Facilities (15 and 17 Oct 19)slOwpOke13No ratings yet

- Greenhouse Gas (GHG) Emissions Measurement and Reporting GuidelinesDocument16 pagesGreenhouse Gas (GHG) Emissions Measurement and Reporting GuidelinesslOwpOke13No ratings yet

- NUS-ISS Short Course Opening ClosingDocument10 pagesNUS-ISS Short Course Opening ClosingslOwpOke13No ratings yet

- Data Analytics For Decision Making: Topic 1a: Introduction To Data Analytics and Big DataDocument7 pagesData Analytics For Decision Making: Topic 1a: Introduction To Data Analytics and Big DataslOwpOke13No ratings yet

- STB Standard Quick Start GuideDocument22 pagesSTB Standard Quick Start GuideslOwpOke13No ratings yet

- Level I CFA Program Formulas: Financial Reporting and AnalysisDocument1 pageLevel I CFA Program Formulas: Financial Reporting and AnalysisslOwpOke13100% (1)

- Information On Emission Factors Jan2019 PDFDocument2 pagesInformation On Emission Factors Jan2019 PDFslOwpOke13No ratings yet

- Trends in HRSG Reliability - 10 Year ReviewDocument29 pagesTrends in HRSG Reliability - 10 Year ReviewslOwpOke13100% (1)

- Summer 2015Document100 pagesSummer 2015JacksonNo ratings yet

- Airline PilotDocument3 pagesAirline PilotBtrs BtrstNo ratings yet

- Case Study TipsDocument4 pagesCase Study TipsUjjawal PandeyNo ratings yet

- Commercial LeaseDocument33 pagesCommercial LeaseEmil Mitev100% (2)

- Propeller ShaftDocument8 pagesPropeller ShaftlomejorNo ratings yet

- SVAN 956 User ManualDocument195 pagesSVAN 956 User Manualalin.butunoi865No ratings yet

- Project Report On Ulip & Mutual FundDocument55 pagesProject Report On Ulip & Mutual FundGovind BhakuniNo ratings yet

- Astm f2164 PDFDocument5 pagesAstm f2164 PDFLuis J Villa Roel Bullon100% (1)

- Eu Law ExamDocument14 pagesEu Law ExamOla PietruszewskaNo ratings yet

- NutruentsDocument7 pagesNutruentsPEDRO INFANTE AGUILARNo ratings yet

- BillPayment FormDocument2 pagesBillPayment FormThúy An Nguyễn100% (1)

- SEM and STMDocument25 pagesSEM and STMZhanarNo ratings yet

- Ptc08 Camera ModuleDocument9 pagesPtc08 Camera ModuleAndre ZakharianNo ratings yet

- FP 247 03 Sand Cast BronzesDocument4 pagesFP 247 03 Sand Cast BronzesnfcastingsNo ratings yet

- IBA Question SolutionDocument343 pagesIBA Question SolutionTushar Mahmud Sizan80% (10)

- Thru-Tubing Retriveable PackerDocument9 pagesThru-Tubing Retriveable PackerilkerkozturkNo ratings yet

- 7steps For Organizing Restaurant and Kitchen CleaningDocument2 pages7steps For Organizing Restaurant and Kitchen CleaningAlpha HospitalityNo ratings yet

- Understanding What A CDP DoesDocument5 pagesUnderstanding What A CDP DoesVISHAL GUPTANo ratings yet

- GenDocument46 pagesGenChowdhury SujayNo ratings yet

- Welding Procedure Specification: Company Dodsal Pte Ltd. Approved by KBRT Signature Name DateDocument1 pageWelding Procedure Specification: Company Dodsal Pte Ltd. Approved by KBRT Signature Name DateS GoudaNo ratings yet

- Sands of TimeDocument211 pagesSands of TimebetutzNo ratings yet

- Module 1Document140 pagesModule 1naitik S TNo ratings yet

- OpenDesign Specification For .DWG FilesDocument246 pagesOpenDesign Specification For .DWG FilesPhilip Jeffrey TroweNo ratings yet

- An Order Constituting The Barangay Tourism Development Council of Barangay Puro, Aroroy, MasbateDocument2 pagesAn Order Constituting The Barangay Tourism Development Council of Barangay Puro, Aroroy, MasbateJohn Paul M. Morado0% (1)

- Code of Ethics in Management Accounting and Financial ManagementDocument2 pagesCode of Ethics in Management Accounting and Financial ManagementSyed Mahwish QadriNo ratings yet

- Web D Worksheet 3Document19 pagesWeb D Worksheet 3aditya polNo ratings yet

- Wealth Management ModuleDocument127 pagesWealth Management ModuleVAIBHAV BUNTY100% (3)

- Smart Money? The Forecasting Ability of CFTC Large Traders: by Dwight R. Sanders, Scott H. Irwin, and Robert MerrinDocument21 pagesSmart Money? The Forecasting Ability of CFTC Large Traders: by Dwight R. Sanders, Scott H. Irwin, and Robert MerrinPerfect SebokeNo ratings yet

- Final Chapter 4Document19 pagesFinal Chapter 4Jhanelyn V. InopiaNo ratings yet