Professional Documents

Culture Documents

Introduction To Accounting Basics

Introduction To Accounting Basics

Uploaded by

AnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Accounting Basics

Introduction To Accounting Basics

Uploaded by

AnaCopyright:

Available Formats

Introduction to Accounting Basics

This explanation of accounting basics will introduce you to some basic accounting principles,

accounting concepts, and accounting terminology. Once you become familiar with some of these

terms and concepts, you will feel comfortable navigating through the explanations, quizzes, quick

tests, and other features of AccountingCoach.com.

Some of the basic accounting terms that you will learn include revenues, expenses, assets,

liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar

with accounting debits and credits as we show you how to record transactions. You will also see why

two basic accounting principles, the revenue recognition principle and the matching principle, assure

that a company's income statement reports a company's profitability.

In this explanation of accounting basics, and throughout all of the free materials and the PRO

materials—we will often omit some accounting details and complexities in order to present clear and

concise explanations. This means that you should always seek professional advice for your specific

circumstances.

Did you know? To make accounting even easier to understand, we created a collection of premium materials

called AccountingCoach PRO. Our PRO users get lifetime access to our visual tutorials, seminar videos,

cheat sheets, flashcards, quick tests, quick tests with coaching, business forms, and more.

Confused? Send Feedback

A Story for Relating to Accounting

Basics

We will present the basics of accounting through a story of a person starting a new business. The

person is Joe Perez—a savvy man who sees the need for a parcel delivery service in his

community. Joe has researched his idea and has prepared a business plan that documents the

viability of his new business.

Joe has also met with an attorney to discuss the form of business he should use. Given his specific

situation, they concluded that a corporation will be best. Joe decides that the name for his

corporation will be Direct Delivery, Inc. The attorney also advises Joe on the various permits and

government identification numbers that will be needed for the new corporation.

Joe is a hard worker and a smart man, but admits he is not comfortable with matters of accounting.

He assumes he will use some accounting software, but wants to meet with a professional

accountant before making his selection. He asks his banker to recommend a professional

accountant who is also skilled in explaining accounting to someone without an accounting

background. Joe wants to understand the financial statements and wants to keep on top of his new

business. His banker recommends Marilyn, an accountant who has helped many of the bank's small

business customers.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Peregrine Powerpoint 2Document36 pagesPeregrine Powerpoint 2api-253241169No ratings yet

- Bar Questions and Answers For CredtransDocument120 pagesBar Questions and Answers For CredtransGreggy LawNo ratings yet

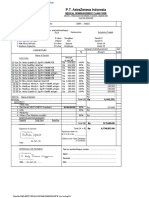

- P.T. Astrazeneca Indonesia: Medical Reimbursement Claim FormDocument15 pagesP.T. Astrazeneca Indonesia: Medical Reimbursement Claim FormPono PonoNo ratings yet

- Roadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Document17 pagesRoadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Gc DmNo ratings yet

- Fannie Special Exam May 2006Document348 pagesFannie Special Exam May 2006ny1davidNo ratings yet

- OVGU IBE Program HandbookDocument52 pagesOVGU IBE Program HandbookFilip JuncuNo ratings yet

- Ugc Net Commerce: Unit SnapshotDocument59 pagesUgc Net Commerce: Unit SnapshotPeer SheebaNo ratings yet

- 2 Tos 1S1920Document18 pages2 Tos 1S1920NikkiNo ratings yet

- Define Progressive, Regressive and Proportional TaxesDocument3 pagesDefine Progressive, Regressive and Proportional TaxesSyedShahmeerRazaNo ratings yet

- Ramo 4-86Document3 pagesRamo 4-86RB BalanayNo ratings yet

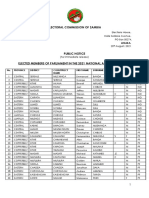

- Electoral Commission of Zambia: Elections House, Haile Selassie Avenue, PO Box 50274, 20 August, 2021Document4 pagesElectoral Commission of Zambia: Elections House, Haile Selassie Avenue, PO Box 50274, 20 August, 2021joseph katongoNo ratings yet

- Servicewide Specialists, Inc Vs CADocument10 pagesServicewide Specialists, Inc Vs CAchrisNo ratings yet

- Shrinking To Grow: Evolving Trends in Corporate Spin-OffsDocument12 pagesShrinking To Grow: Evolving Trends in Corporate Spin-OffsmdorneanuNo ratings yet

- Axis Bank Reinventing BankingDocument46 pagesAxis Bank Reinventing Bankingswati singhaniaNo ratings yet

- Equity Research Interview Questions PDFDocument5 pagesEquity Research Interview Questions PDFAkanksha Ajit DarvatkarNo ratings yet

- 5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesDocument74 pages5.1 Learning Objective 5-1: Chapter 5 Short-Term Investments & ReceivablesSeanNo ratings yet

- Financial Statement Analysis Financial Statement AnalysisDocument70 pagesFinancial Statement Analysis Financial Statement AnalysisFaiza AslamNo ratings yet

- Assignment - Banking & InsuranceDocument4 pagesAssignment - Banking & Insurancesandeep_kadam_7No ratings yet

- AdidasDocument46 pagesAdidasLiby Santos0% (1)

- Form HA-4632Document2 pagesForm HA-4632GARY SELLSNo ratings yet

- Self-Managed Super: Factsheet June 2013Document2 pagesSelf-Managed Super: Factsheet June 2013RomeoNo ratings yet

- Exercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionDocument5 pagesExercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionjorwitzNo ratings yet

- Balance of Payments Textbook NotesDocument4 pagesBalance of Payments Textbook Notesalina lorenaNo ratings yet

- Current Macroeconomic and Financial SItuation. Tables Based On Annual Data of 2019.20. 1Document89 pagesCurrent Macroeconomic and Financial SItuation. Tables Based On Annual Data of 2019.20. 1hello worldNo ratings yet

- Local Government Finance NotesDocument23 pagesLocal Government Finance NotesBa NyaNo ratings yet

- Wifi 2Document2 pagesWifi 2VENKATA KARTEEKNo ratings yet

- Aerospace Defense Outlook Dawn of New DayDocument32 pagesAerospace Defense Outlook Dawn of New Dayvigneshkumar rajanNo ratings yet

- Ateneo 2007 Commercial Law (Negotiable Instruments Law)Document16 pagesAteneo 2007 Commercial Law (Negotiable Instruments Law)Maria Jessica Franco Balancio100% (2)

- Monetary Policy in A Small Open Economy. The Case of Paraguay - BCP - Portal GuaraniDocument22 pagesMonetary Policy in A Small Open Economy. The Case of Paraguay - BCP - Portal GuaraniportalguaraniNo ratings yet

- Cfas - Journal EntriesDocument3 pagesCfas - Journal EntriesJefferson SarmientoNo ratings yet