Professional Documents

Culture Documents

F.Y.B.B.A Sem 1 Financial Accounting Unit Costing

F.Y.B.B.A Sem 1 Financial Accounting Unit Costing

Uploaded by

Samir Parekh0 ratings0% found this document useful (0 votes)

35 views3 pages1. The document provides information from 5 different case studies to prepare cost statements and calculate costs and profits. The case studies include information on opening and closing stock amounts, expenses like wages, overhead, materials purchased, and sales amounts. Students are asked to use the data to calculate items like cost of materials, prime cost, factory cost, cost of production, cost of sales, and net profit percentage.

2. The case studies provide detailed financial data including stock amounts, expenses, purchases, and sales. Students are to use this data to prepare cost statements and calculate financial metrics like net profit amounts and percentages.

3. Cost accounting concepts like prime cost, factory cost, cost of production, and cost of sales are to

Original Description:

Original Title

UNIT COSTING

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides information from 5 different case studies to prepare cost statements and calculate costs and profits. The case studies include information on opening and closing stock amounts, expenses like wages, overhead, materials purchased, and sales amounts. Students are asked to use the data to calculate items like cost of materials, prime cost, factory cost, cost of production, cost of sales, and net profit percentage.

2. The case studies provide detailed financial data including stock amounts, expenses, purchases, and sales. Students are to use this data to prepare cost statements and calculate financial metrics like net profit amounts and percentages.

3. Cost accounting concepts like prime cost, factory cost, cost of production, and cost of sales are to

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

35 views3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit Costing

F.Y.B.B.A Sem 1 Financial Accounting Unit Costing

Uploaded by

Samir Parekh1. The document provides information from 5 different case studies to prepare cost statements and calculate costs and profits. The case studies include information on opening and closing stock amounts, expenses like wages, overhead, materials purchased, and sales amounts. Students are asked to use the data to calculate items like cost of materials, prime cost, factory cost, cost of production, cost of sales, and net profit percentage.

2. The case studies provide detailed financial data including stock amounts, expenses, purchases, and sales. Students are to use this data to prepare cost statements and calculate financial metrics like net profit amounts and percentages.

3. Cost accounting concepts like prime cost, factory cost, cost of production, and cost of sales are to

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

F.Y.B.B.

A SEM 1 FINANCIAL ACCOUNTING UNIT COSTING

1. From the following information, prepare a statement of cost Showing (a) the cost of material used. (b) the

prime cost (c) the works cost, (d) the cost of production (e) the cost of sales and (f) the net profit.

Stock of finished goods on 31-3-2005 56,000

Stock of raw materials on 31-3-2005 25,600

Purchase of raw materials 5,84,000

Sale of finished goods 11,84,000

Stock of finished goods on 31-3-2006 60,000

Stock of raw materials on 31-3-2006 27,200

ProductiVe Wages 3,97,600

Works overhead 87,000 Ans: Total cost: Rs. 11,44,0000

Administrative overhead 71,000 Profit: Rs.40,000

Selling and distribution overhead 10,000

2. From the following information relating to Chetan Machine Manufacturing Company, you are required to prepare

statement of cost and find out percentage of net profit to sales .

1-4-05 31-3-06

Stock of Raw Materials 30,000 25,000

Cost of Works-in-Progress 12,000 16,000

Cost of Stock of Finished Goods 60,000 55,000

During the year, particulars about expenses and sales were as under :

Purchase of Raw Materials 4,50,000

Direct wages 2,30,000

Factory overheads 92,000 Ans : Cost of Sales Rs.8,28,000 Net Profit Rs.

Administration overheads 30,000 72,000, Percentage of Net Profit on sales 8%

Selling and distribution overheads 20,000

Sales 9,00,000

Work-in-Progress is to be valued on the basis of Prime Cost.

3. The following are the cost details of ABC limited. You are required to prepare a Cost Sheet showing the

Prime Cost, Factory Cost, Cost of Production, Cost of Sales and Profit .

Particulars Rs.

Sales 7,80,000

Materials

Raw Materials 4,00,000

Stationery 4,000

Packing Materials 2,500

Direct Wages 50,000

Salaries

Factory Staff 50,000

Administrative staff 40,000

Sales staff 20,000

Rent .

Factory 2,700

Office 1,400

Advertising 4,700

Telephone Expenses 3,000

Travelling Expenses

Office staff 3,000

Selling staff 4,500

Prof.BIJAL MODI(M.COM.NET,SLET) Page 1

General Expenses

Office 16,500

Selling 8,500 Ans : Cost of sales Rs.7,40,800, Net

Depreciation Profi Rs, 39,200

Plant & Machinery 90,000

Office Equipment 30,000

Sales Department vehicles 10,000

4. From the following details of K.B. Manu. co. Ltd., prepare a Cost Sheet showing stepwise costs and

determine the profit:

Particulars Rs.

Raw Materials

Opening stock 20,000

Purchases 1,24,000

Closing stock 24,000

Expenses for purchase of raw materials 2,000

Direct wages (paid) 36,000

Direct wages (outstanding-to be paid) 4,000

Factory supervisor's salary 24,000

Other expenses for factory 10,000

Rent (Factory 2/5 and Office 3/5) 4,000

Purchase of office stationery (Balance stock 1 ,000) 3,000

Salesmen commission 10,000

Depreciation

Machinery 6,000 Ans:cost of sales: Rs.2,26,000

Typewriter 2,000 Profit: Rs.16,000

Office Air-conditioner 8,000

Sales of wastage at the stage of prime cost 2,000

sales 2,42,000

5.

6.

7.

8.

9.

10

.

11

.

12

.

13

.

14

.

15

16

.

Prof.BIJAL MODI(M.COM.NET,SLET) Page 2

Prof.BIJAL MODI(M.COM.NET,SLET) Page 3

You might also like

- 7 CMA FormatDocument22 pages7 CMA Formatzahoor80100% (2)

- Cost and Management Accounting NOTESDocument72 pagesCost and Management Accounting NOTESAnshul BajajNo ratings yet

- Chapter 01 Test BankDocument5 pagesChapter 01 Test BankMlndsamoraNo ratings yet

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- Marginal Costing Numericals PDFDocument7 pagesMarginal Costing Numericals PDFSubham PalNo ratings yet

- Mms AssignDocument3 pagesMms AssigndarekarroshanNo ratings yet

- Javier Danna Assignment 2.3 &3.5Document4 pagesJavier Danna Assignment 2.3 &3.5Danna ClaireNo ratings yet

- NIKEDocument8 pagesNIKEMarryam Majeed75% (4)

- Asme Viii QC ManualDocument70 pagesAsme Viii QC Manualneurolepsia3790No ratings yet

- CH 11 Quiz KeyDocument7 pagesCH 11 Quiz KeyMatt ManiscalcoNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Cost SheetDocument5 pagesCost Sheetpooja45650% (2)

- Unit and Output Costing QuestionDocument14 pagesUnit and Output Costing QuestionSilver TricksNo ratings yet

- 04 Activity Based Costing PDFDocument11 pages04 Activity Based Costing PDFPappu LalNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- MAE - Pratice - Cost Sheet. - QuestionDocument6 pagesMAE - Pratice - Cost Sheet. - QuestionDhairya Mudgal0% (1)

- SM Notes by Om TrivediDocument18 pagesSM Notes by Om TrivedibabyNo ratings yet

- TYBCOM - Sem 6 - Cost AccountingDocument40 pagesTYBCOM - Sem 6 - Cost AccountingKhushi PrajapatiNo ratings yet

- Cost Sheet ProblemsDocument11 pagesCost Sheet ProblemsPrem RajNo ratings yet

- Assignment Cost Sheet SumsDocument3 pagesAssignment Cost Sheet SumsMamta PrajapatiNo ratings yet

- JKSC TB Nov 23Document258 pagesJKSC TB Nov 23Narayan choudharyNo ratings yet

- Material Cost Variance ProblemsDocument3 pagesMaterial Cost Variance ProblemsHarsh RanaNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Ratio Problems 1Document6 pagesRatio Problems 1Vivek MathiNo ratings yet

- Cost Accounting Notes Fall 19-1Document11 pagesCost Accounting Notes Fall 19-1AnoshiaNo ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- Cost Sheet: Solutions To Assignment ProblemsDocument3 pagesCost Sheet: Solutions To Assignment ProblemsNidaNo ratings yet

- Symbiosis Center For Management & HRDDocument3 pagesSymbiosis Center For Management & HRDKUMAR ABHISHEKNo ratings yet

- 02 CAS-4-FormatDocument1 page02 CAS-4-FormatMOORTHY.KENo ratings yet

- Assertion MCQ of Lit XiDocument7 pagesAssertion MCQ of Lit Xikrish mehtaNo ratings yet

- 03 Overhead CostingDocument9 pages03 Overhead CostingPappu LalNo ratings yet

- Accounting For OverheadsDocument9 pagesAccounting For OverheadsAnimashaun Hassan Olamide100% (1)

- Standard Costing Ex QuestionsDocument20 pagesStandard Costing Ex QuestionsKaruna ChakinalaNo ratings yet

- Cost II AssignmentDocument4 pagesCost II AssignmentmeazadgafuNo ratings yet

- Chap 5 PDFDocument22 pagesChap 5 PDFHiren ChauhanNo ratings yet

- Cost AccountingDocument21 pagesCost Accountingabdullah_0o0No ratings yet

- Paper - 4: Cost Accounting andDocument56 pagesPaper - 4: Cost Accounting andemmanuel JohnyNo ratings yet

- Assignment 1111Document8 pagesAssignment 1111SAAD HUSSAINNo ratings yet

- Assignment 04Document8 pagesAssignment 04John MilanNo ratings yet

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- Labour Cost ProblemsDocument5 pagesLabour Cost ProblemsM211110 ANVATHA.MNo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingJonathan Smoko100% (1)

- Overheads Revision PDFDocument9 pagesOverheads Revision PDFSurajNo ratings yet

- Contract Costing (Unsolved)Document6 pagesContract Costing (Unsolved)ArnavNo ratings yet

- Marginal Costing and Break-Even AnalysisDocument6 pagesMarginal Costing and Break-Even AnalysisPrasanna SharmaNo ratings yet

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- Job Costing QuestionsDocument5 pagesJob Costing Questionsfaith olaNo ratings yet

- Business Statistics Cases Unit 2 Tri 3 BBA (Hon.) With ResearchDocument68 pagesBusiness Statistics Cases Unit 2 Tri 3 BBA (Hon.) With ResearchPrathamesh DivekarNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Bba Chapter 3 Revenue and Cost AnalysisDocument17 pagesBba Chapter 3 Revenue and Cost AnalysisDr-Abu Hasan Sonai SheikhNo ratings yet

- Ipcc Cost Accounting RTP Nov2011Document209 pagesIpcc Cost Accounting RTP Nov2011Rakesh VermaNo ratings yet

- Fifo and LifoDocument4 pagesFifo and LifoShaik. Nazhath SulthanaNo ratings yet

- Bep Problems Unit 2Document29 pagesBep Problems Unit 2CHENNAKESAVA MAMILLANo ratings yet

- Unit - V Budget and Budgetary Control ProblemsDocument2 pagesUnit - V Budget and Budgetary Control ProblemsalexanderNo ratings yet

- Assignment 1558529449 Sms PDFDocument16 pagesAssignment 1558529449 Sms PDFNextGen GamingNo ratings yet

- Cost Analysis of Coca-Cola Company - by HakimzadDocument18 pagesCost Analysis of Coca-Cola Company - by HakimzadHakimzad9001 Faisal9001100% (1)

- Special QuestionsDocument42 pagesSpecial QuestionsSaloni BansalNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- Standard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDocument7 pagesStandard Costing - Solutions To Home Work Problems: Question No: 19 Reconciliation With Finished Goods InventoryDevi ParameshNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- Cost Sheet ProblemsDocument2 pagesCost Sheet ProblemsPridhvi Raj ReddyNo ratings yet

- Ca - Unit 2 - WamDocument4 pagesCa - Unit 2 - WamGovindNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- S. S. Agrawal College of Commerce & Management, Navsari: Written & Spoken CommunicationDocument16 pagesS. S. Agrawal College of Commerce & Management, Navsari: Written & Spoken CommunicationSamir ParekhNo ratings yet

- Scope and Aims of Engineering EthicsDocument5 pagesScope and Aims of Engineering EthicsSamir ParekhNo ratings yet

- Academic Calender BCA-2020-21 - Final - 8-6-2020Document2 pagesAcademic Calender BCA-2020-21 - Final - 8-6-2020Samir ParekhNo ratings yet

- Academic Calendar of BCOM (2020-2021) : Academic Session 1,3 and 5 Semester 2,4 and 6 SemesterDocument1 pageAcademic Calendar of BCOM (2020-2021) : Academic Session 1,3 and 5 Semester 2,4 and 6 SemesterSamir ParekhNo ratings yet

- BCA Sem 6 - Allocation Details Project FinalDocument4 pagesBCA Sem 6 - Allocation Details Project FinalSamir ParekhNo ratings yet

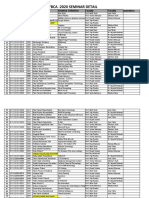

- BCA Sem - 6 Allocation Details Seminar - FinalDocument2 pagesBCA Sem - 6 Allocation Details Seminar - FinalSamir ParekhNo ratings yet

- Rural AdvertisingDocument18 pagesRural Advertisingdhruv vashisthNo ratings yet

- Schweppes Case StudyDocument10 pagesSchweppes Case StudyPam UrsolinoNo ratings yet

- Report IKEA BodyDocument15 pagesReport IKEA BodyDennis SmitsNo ratings yet

- Conversations With MillionairesDocument227 pagesConversations With MillionairesPhạm An Viên100% (5)

- Customer Relationship Management On Shoppers StopDocument13 pagesCustomer Relationship Management On Shoppers StopSoumya Das100% (1)

- Japaneese Cinema IndustryDocument9 pagesJapaneese Cinema Industrypraneeth kukatlaNo ratings yet

- IKEA Case StudyDocument13 pagesIKEA Case StudySabrina HuotNo ratings yet

- SAP MM Module Resume With 3 Years ExperienceDocument5 pagesSAP MM Module Resume With 3 Years ExperienceTamil Ka Amutharasan0% (1)

- Letters of Credit, TRL and NILDocument11 pagesLetters of Credit, TRL and NILOna DlanorNo ratings yet

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFbharti khandelwalNo ratings yet

- Costco Annual ReportDocument80 pagesCostco Annual ReportVarun GuptaNo ratings yet

- Working Capital Case StudyDocument4 pagesWorking Capital Case StudyRahul SinghNo ratings yet

- All The Questions From Part B Are Compulsory (5marks Each)Document2 pagesAll The Questions From Part B Are Compulsory (5marks Each)PuneetKaushik33% (3)

- Sales Organization StructureDocument27 pagesSales Organization Structurefantasticvarun67% (3)

- COMP255 Question Bank Chapter 8Document8 pagesCOMP255 Question Bank Chapter 8Ferdous RahmanNo ratings yet

- Ali CorpDocument11 pagesAli CorpANTONY0% (1)

- Tests of ControlsDocument6 pagesTests of ControlsEvan RoymanNo ratings yet

- CapSim Demonstration Student Notes SP13Document8 pagesCapSim Demonstration Student Notes SP13NRLDCNo ratings yet

- Why-Engage in InternationalBusinessDocument2 pagesWhy-Engage in InternationalBusinessShaharyar Khan Marwat100% (1)

- Delivery ChallanDocument8 pagesDelivery ChallanBALWINDER SINGHNo ratings yet

- PARLE PRODUCTS (P) LTD (Appellant) vs. J. P. Co., MYSORE (Respondent)Document12 pagesPARLE PRODUCTS (P) LTD (Appellant) vs. J. P. Co., MYSORE (Respondent)Rohit DongreNo ratings yet

- Keisha D. KubishDocument2 pagesKeisha D. KubishLee GriffinNo ratings yet

- Supply Chain ManagementDocument5 pagesSupply Chain Management버니 모지코No ratings yet

- MQP - MCQsDocument4 pagesMQP - MCQsazam49No ratings yet

- Chgh1 New PrintDocument69 pagesChgh1 New PrintChetan GhodeswarNo ratings yet